Market Overview:

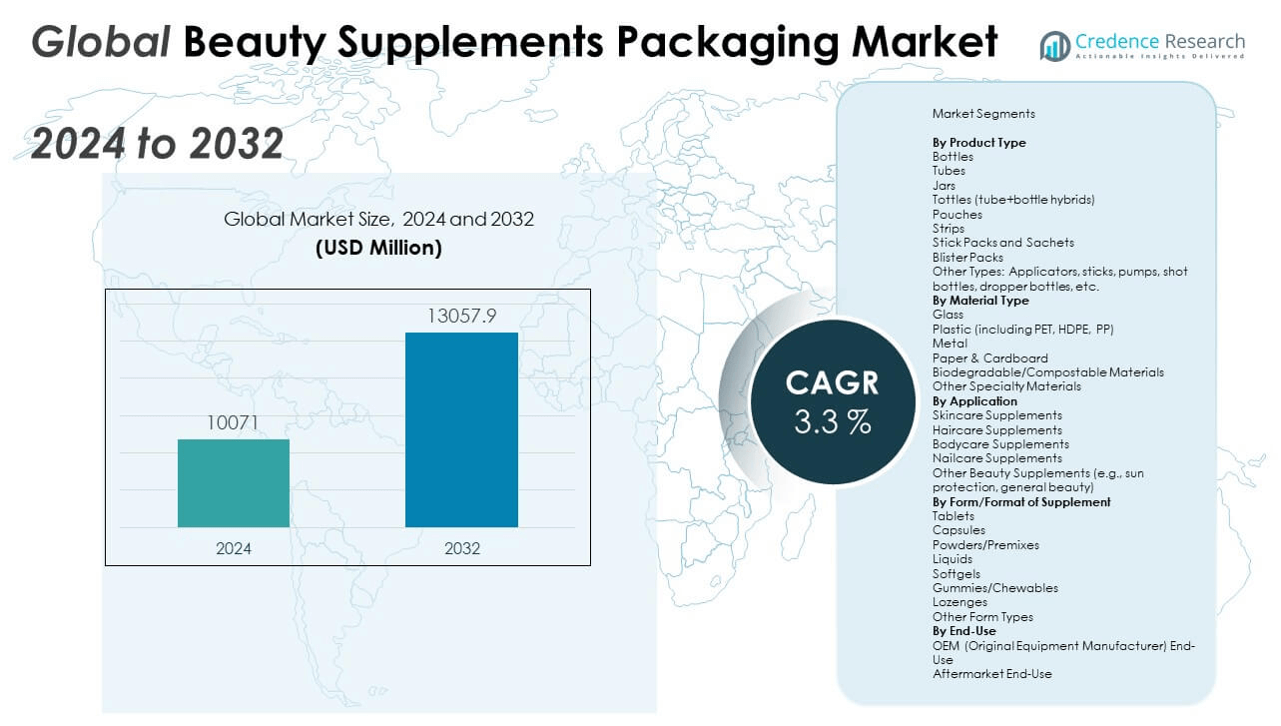

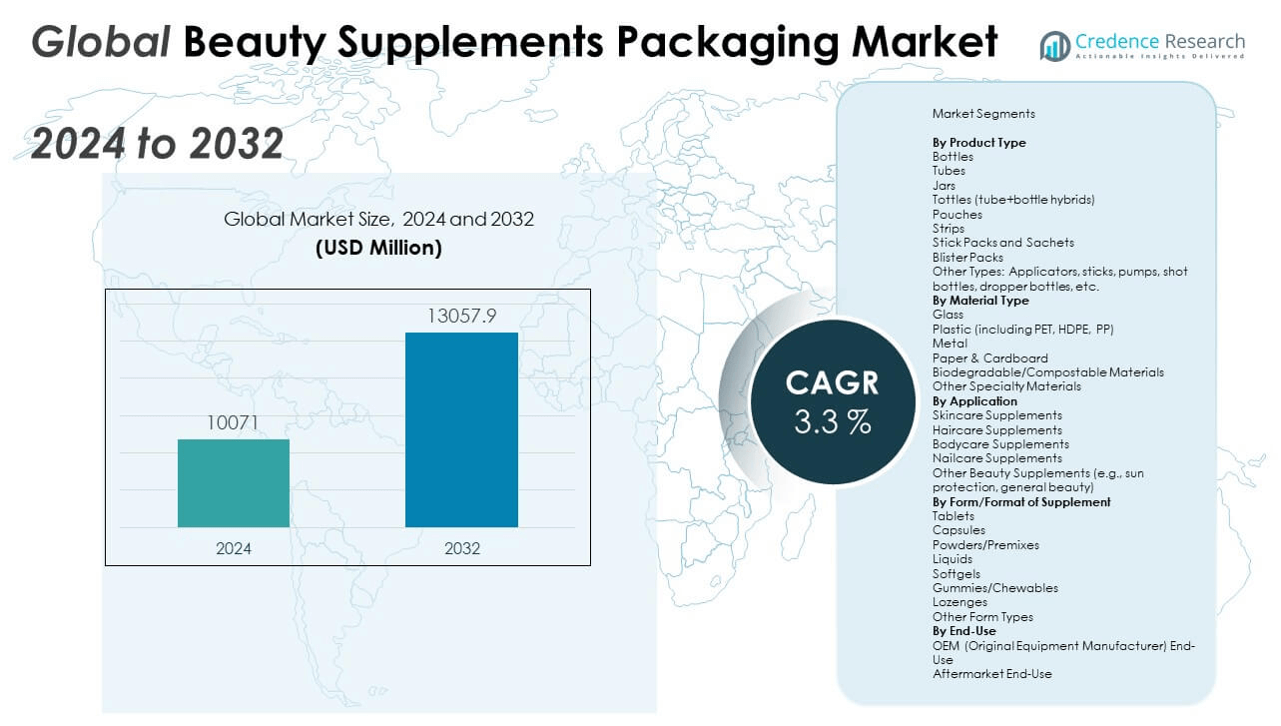

The Beauty Supplements Packaging Market is projected to grow from USD 10,071 million in 2024 to an estimated USD 13,057.9 million by 2032, with a compound annual growth rate (CAGR) of 3.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Beauty Supplements Packaging Market Size 2024 |

USD 10,071 million |

| Beauty Supplements Packaging Market, CAGR |

3.3% |

| Beauty Supplements Packaging Market Size 2032 |

USD 13,057.9 million |

The market is driven by the rising consumer focus on wellness and beauty from within, which has spurred demand for supplements targeting hair, skin, and nails. This trend has led to increased innovation in packaging formats that are not only functional but also visually appealing, aligning with brand identity and consumer lifestyle. Brands are actively investing in sustainable and compact packaging solutions that enhance product shelf life and consumer convenience, especially in e-commerce-driven channels.

Regionally, North America leads the beauty supplements packaging market due to a high adoption rate of wellness products and strong brand presence. Europe follows closely, driven by consumer awareness and eco-friendly packaging regulations. Asia Pacific is emerging as a high-growth region, especially in countries like South Korea, Japan, and China, where beauty-conscious consumers and growing disposable incomes support market expansion. The cultural emphasis on beauty and the growing influence of K-beauty and J-beauty trends further boost regional demand for innovative packaging in these markets.

Market Insights:

- The Beauty Supplements Packaging Market is projected to grow from USD 10,071 million in 2024 to USD 13,057.9 million by 2032, at a CAGR of 3.3%.

- Rising demand for wellness and aesthetic-focused supplements is accelerating the need for innovative and functional packaging formats.

- Increasing focus on sustainability is driving the shift toward recyclable, biodegradable, and low-impact packaging materials.

- High production costs and regulatory compliance requirements are restraining the widespread adoption of eco-friendly packaging solutions.

- North America holds the largest market share at 34%, supported by strong consumer demand and advanced packaging infrastructure.

- Asia Pacific is emerging as the fastest-growing region, driven by rising disposable incomes and increasing health awareness.

- Regional customization, eco-design integration, and smart packaging innovations are reshaping the competitive landscape across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Preference for Wellness and Nutritional Aesthetics Drives Packaging Innovation

Consumers are increasingly prioritizing wellness and internal beauty, fueling demand for supplements that improve skin, hair, and nails. This behavior drives companies to develop packaging that reflects health-conscious branding and functionality. Packaging must ensure freshness, promote convenience, and comply with hygiene standards. The Beauty Supplements Packaging Market leverages this shift by offering formats like stick packs, blister packs, and single-serve sachets. Functional packaging supports busy lifestyles and enhances portability. Brands focus on labeling that communicates ingredient transparency and safety. This trend aligns with growing self-care routines among all age groups. It reinforces the need for packaging that merges clinical efficacy with lifestyle appeal.

- For example, TOSLA Nutricosmetics, a leader in liquid nutricosmetics, uses multilayered stick packs that preserve active ingredients for up to 15 months, maintaining product integrity during shelf life.

Sustainability Requirements Reshape Packaging Material Choices Across the Industry

Environmental concerns are compelling manufacturers to switch to recyclable, biodegradable, and compostable packaging. The Beauty Supplements Packaging Market is evolving as regulatory pressure and consumer awareness intensify. It supports the adoption of paper-based solutions, bio-resins, and refill systems. Companies are reducing plastic content and exploring post-consumer recycled materials. Sustainable design plays a vital role in influencing consumer decisions, especially among younger demographics. Packaging that balances aesthetics with ecological value becomes a competitive differentiator. Brands investing in clean-label messaging are gaining consumer trust. It encourages packaging formats that reduce waste and align with zero-waste goals.

- RMS Beauty, for instance, transitioned to 100% post-consumer recycled (PCR) plastic lids across its core products in 2022, cutting annual virgin plastic consumption by 52 metric tons.

E-Commerce Growth Increases Demand for Durable and Informative Packaging Formats

Online retail is driving the need for packaging that offers protection during transit and improves unboxing experience. The Beauty Supplements Packaging Market addresses this with tamper-evident seals, protective coatings, and impact-resistant formats. E-commerce-ready packaging includes QR codes for authentication and usage instructions. Packaging design also plays a key role in brand recognition and consumer loyalty. It integrates storytelling elements that resonate across digital channels. Retailers and brands aim to reduce damage rates and optimize space during logistics. Smart packaging formats enhance product traceability and safety. It fosters loyalty by ensuring secure delivery and superior user experience.

Customization and Premiumization Create Strong Demand for Aesthetic and Functional Packaging

Consumer expectations are shifting toward personalized experiences, driving demand for premium, tailored packaging. The Beauty Supplements Packaging Market reflects this through high-end finishes, minimalistic designs, and customizable labeling. It offers packaging tailored to different age groups, lifestyles, and aesthetic preferences. Luxury brands use embossed logos, metallic foils, and UV coatings to convey exclusivity. Consumers associate premium packaging with higher product value and efficacy. Brands combine functional features with upscale designs to differentiate themselves. Limited edition and seasonal packaging strategies stimulate repeat purchases. Packaging thus plays a role in conveying brand promise and consumer lifestyle alignment.

Market Trends:

Integration of Smart Packaging Technology Enhances User Engagement and Brand Transparency

Smart packaging is emerging as a major trend, integrating QR codes, NFC chips, and augmented reality features. The Beauty Supplements Packaging Market embraces this to offer product traceability and interactive experiences. Consumers scan packaging to access ingredient information, certifications, and tutorials. Smart features allow brands to educate users on dosage, routines, and benefits. It improves customer engagement and builds trust. Retailers use smart packaging to manage inventory and detect counterfeit products. Real-time interaction helps brands monitor usage trends and personalize marketing efforts. It turns traditional packaging into a communication tool that drives loyalty.

Minimalist and Transparent Designs Shape Branding Strategies and Consumer Trust

Clean and minimalist packaging styles are gaining traction as they reflect purity and authenticity. The Beauty Supplements Packaging Market responds with clear containers, simple fonts, and neutral palettes. Transparent packaging helps consumers verify contents, improving trust in product quality. Minimal designs convey sophistication and allow key details to stand out. Brands focus on reducing clutter to improve legibility and shelf appeal. Consumers increasingly value packaging that highlights active ingredients without distractions. It supports the wellness trend by emphasizing clarity and honesty. Packaging design thus influences first impressions and buying decisions at retail shelves.

Rise of Travel-Friendly and On-the-Go Packaging Formats Supports Active Lifestyles

With consumers seeking convenience in everyday routines, demand for portable formats is growing. The Beauty Supplements Packaging Market introduces compact, single-use sachets, pouches, and blister packs. These formats cater to frequent travelers, gym-goers, and busy professionals. Packaging ensures ease of use without compromising hygiene or efficacy. Brands focus on resealable options to support longer shelf life. Lightweight and space-efficient packaging also reduces shipping costs. Consumers prefer small doses that fit seamlessly into their daily bags or skincare kits. This trend promotes consumption consistency and builds customer retention. It aligns with changing lifestyles and health routines.

- For example, TOSLA’s VELIOUS™ technology is designed to mask unpleasant tastes in liquid collagen and other active ingredients.

Eco-Designs and Functional Aesthetics Dominate Packaging Innovation Goals

Eco-designs that merge sustainability with functionality are reshaping packaging innovation. The Beauty Supplements Packaging Market adopts formats that use biodegradable inks, refill systems, and compostable materials. Functional packaging now includes moisture barriers and UV protection to preserve active ingredients. Design choices prioritize ergonomic handling and easy dispensing. Brands invest in mono-material structures to improve recyclability. Color schemes and shapes reflect the brand’s ecological commitment. Consumers recognize and reward packaging that aligns with their environmental values. Packaging design influences both brand loyalty and regulatory compliance. It strengthens positioning in a sustainability-driven market landscape.

- For example, Quadpack’s Regula Airless Refill system combines eco-design with performance by offering a mono-material, airless pump bottle made entirely of PET, allowing full recyclability without disassembly.

Market Challenges Analysis:

High Material and Compliance Costs Limit Adoption of Sustainable Packaging Solutions

The transition toward eco-friendly packaging introduces significant cost burdens for manufacturers. The Beauty Supplements Packaging Market faces challenges in balancing affordability with sustainability goals. Biodegradable and recyclable materials remain more expensive than conventional plastic. Small and mid-sized brands struggle to scale due to limited budgets and inconsistent material availability. Regulatory standards vary across regions, complicating global packaging strategies. Certification and compliance audits further add to operational costs. Developing high-barrier properties in sustainable formats poses technical difficulties. Brands risk compromising product stability when shifting to greener materials. It delays innovation and restricts mass adoption in cost-sensitive markets.

Counterfeit Risks and Packaging Authentication Continue to Threaten Consumer Safety

The rising popularity of beauty supplements has attracted counterfeiters, putting consumer safety at risk. The Beauty Supplements Packaging Market must integrate anti-counterfeiting technologies to protect brand reputation. Traditional packaging often lacks authentication features that enable verification. Counterfeits can mislead consumers, erode trust, and lead to harmful side effects. Brands must invest in smart packaging with serialization or digital watermarks. However, adoption of such technologies requires infrastructure upgrades and training. Supply chain complexity further increases vulnerability to tampering and diversion. Consumer education on identifying authentic products remains limited. These factors hinder full-scale implementation of protective solutions.

Market Opportunities:

Expansion in Emerging Markets Opens New Avenues for Localized Packaging Solutions

Emerging markets in Asia Pacific, Latin America, and the Middle East offer strong growth potential. The Beauty Supplements Packaging Market can expand by catering to local cultural preferences and packaging needs. Regional customization in language, design, and dosage form can enhance appeal. Rising disposable incomes and wellness awareness drive market penetration. Brands can partner with regional packaging firms for cost-effective solutions. Regulatory support in some markets eases entry barriers. Sustainable and affordable packaging options are key differentiators. It allows global brands to gain foothold in high-growth regions with long-term demand prospects.

Innovation in Biodegradable and Functional Packaging Drives Competitive Edge

New developments in bio-based materials and refillable formats provide a platform for differentiation. The Beauty Supplements Packaging Market can benefit from innovations that combine visual appeal with functionality. Patented closures, moisture-resistant layers, and minimal waste formats boost performance. Companies can use design thinking to deliver unique unboxing experiences. Sustainable packaging creates alignment with consumer values. It enhances storytelling and promotes brand loyalty. Packaging innovation opens doors for limited edition offerings and co-branding partnerships. It drives product visibility in a competitive and saturated market landscape.

Market Segmentation Analysis:

By product types, the beauty supplements packaging market includes a wide range of product types to accommodate diverse supplement delivery methods. Bottles, tubes, jars, and tottles are widely used for powders, liquids, and capsules due to their practicality and consumer familiarity. Stick packs, sachets, pouches, and strips cater to on-the-go usage, favored for portability and ease of dosing. Blister packs are common for tablets and capsules, offering both protection and portion control. Other types such as applicators, pumps, shot bottles, and dropper bottles support specialized formulations, enhancing product differentiation and user convenience.

- For example, Catalyst Nutraceuticals explicitly states they produce stick packs for “hydration blends, greens, reds, and collagen” with high-speed packaging equipment that runs “up to 25K sticks per hour” using 12-lane and 6–8 lane machines.

By material type, plastic remains dominant owing to its cost-efficiency, flexibility, and suitability for mass production. Variants like PET, HDPE, and PP offer durability and barrier protection. Glass is preferred for premium liquid supplements, offering inertness and a premium appearance. Paper and cardboard appeal to eco-conscious brands, while metal supports niche applications. Biodegradable and compostable materials are gaining interest due to regulatory pressure and rising consumer demand for sustainable alternatives. Other specialty materials enable advanced protection and aesthetic customization.

- For example, APC Packaging offers a 60 ml airless pump jar made from PMMA/ABS with customizable hot-stamp, UV-metallized, embossing/debossing, or anodized finishes. It ensures preservation of sensitive beauty supplements while delivering a premium look.

By application, skincare supplements account for the largest share, driven by demand for collagen, anti-aging, and hydration-enhancing products. Haircare and nailcare supplements follow, with growing interest in strengthening and revitalizing solutions. Bodycare formulations address tone, elasticity, and detox support. Other applications include sun protection and general beauty boosters. Each segment influences packaging format, labeling, and dosage design to match the functional positioning of the product.

By supplement form, the market includes tablets, capsules, powders/premixes, liquids, softgels, gummies/chewables, and lozenges. Each format has distinct packaging needs—blisters for tablets, bottles for liquids, sachets for powders, and pouches for gummies. The choice of packaging aligns with consumer preferences, dosage stability, and retail presentation. Packaging also plays a key role in protecting active ingredients and ensuring shelf life across these formats.

By end-use, OEMs represent a major share by supplying packaging solutions directly to supplement manufacturers and beauty brands. These solutions support large-scale production and customized branding. The aftermarket end-use includes refill packaging, subscription formats, and e-commerce-ready designs. The beauty supplements packaging market supports both segments by offering scalable, efficient, and visually compelling packaging tailored to retail and direct-to-consumer channels.

Segmentation:

By Product Type

- Bottles

- Tubes

- Jars

- Tottles (tube+bottle hybrids)

- Pouches

- Strips

- Stick Packs and Sachets

- Blister Packs

- Other Types: Applicators, sticks, pumps, shot bottles, dropper bottles, etc.

By Material Type

- Glass

- Plastic (including PET, HDPE, PP)

- Metal

- Paper & Cardboard

- Biodegradable/Compostable Materials

- Other Specialty Materials

By Application

- Skincare Supplements

- Haircare Supplements

- Bodycare Supplements

- Nailcare Supplements

- Other Beauty Supplements (e.g., sun protection, general beauty)

By Form/Format of Supplement

- Tablets

- Capsules

- Powders/Premixes

- Liquids

- Softgels

- Gummies/Chewables

- Lozenges

- Other Form Types

By End-Use

- OEM (Original Equipment Manufacturer) End-Use

- Aftermarket End-Use

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share in the beauty supplements packaging market, accounting for 34% of the global revenue. Strong consumer demand for wellness and aesthetic products, coupled with a robust e-commerce infrastructure, drives growth in the region. Brands in the U.S. and Canada focus on premium, eco-friendly packaging that supports product safety and brand storytelling. Regulatory bodies emphasize ingredient transparency and packaging compliance, influencing material selection and labeling practices. The high purchasing power and health-conscious demographic further stimulate demand for high-end, functional packaging. It positions North America as the most mature and competitive region in the global market.

Europe captures 27% of the beauty supplements packaging market and benefits from strong environmental regulations and consumer preferences for sustainable products. Countries such as Germany, France, and the U.K. lead in adopting recyclable and biodegradable packaging materials. Regional manufacturers invest in compliance-driven packaging solutions that meet strict EU guidelines. The market supports innovation through bio-based materials and minimalistic design principles. Clean-label trends and functional packaging formats gain popularity among European consumers. It creates opportunities for local and global players to differentiate through innovation and sustainability.

The Asia Pacific region represents 24% of the beauty supplements packaging market and shows the fastest growth rate. Rising disposable incomes, expanding middle-class population, and increasing health awareness fuel demand across countries like China, Japan, South Korea, and India. The region benefits from strong manufacturing capabilities and evolving consumer behavior toward self-care and wellness. Local players and international brands invest in region-specific packaging tailored to cultural preferences and climate considerations. Compact, cost-efficient, and visually appealing packaging formats dominate in urban centers. It enhances market expansion across both developed and emerging economies within Asia Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Albéa Group

- Amcor plc

- AptarGroup, Inc.

- Berry Global Inc.

- HCP Packaging

- APC Packaging

- Libo Cosmetics

- Quadpack Industries

- Pretium Packaging

- TricorBraun

Competitive Analysis:

The beauty supplements packaging market features moderate to high competition with a mix of global and regional players. Companies compete on design innovation, sustainability, material quality, and regulatory compliance. Key participants include Amcor, AptarGroup, Gerresheimer AG, Berry Global, and WestRock. These players invest in recyclable packaging, smart labeling technologies, and customized formats to meet brand and consumer demands. The market rewards innovation in tamper-evident packaging, refillable systems, and visually impactful formats. It is shaped by continuous R&D and collaboration with beauty supplement brands to deliver aesthetic, protective, and sustainable packaging solutions that differentiate products on crowded retail shelves.

Recent Developments:

- In March 2025, Albéa Group debuted an innovative range of packaging solutions at the MakeUp in Los Angeles show. The launches focused on sustainability, with highlights such as the Metamorphosis paper-based tube made of up to 50% paper and produced locally, and the Ecofusion top.

- In March 2025, APC Packaging unveiled the Adapté Collection, featuring 3D-printed interchangeable caps, pumps, sprayers, and droppers that fit onto the same bottle. This allows brands in the beauty supplement market to experiment with dispensing options while maintaining consistent brand aesthetics.

- In April 2025, Amcor plc completed an all-stock combination with Berry Global, creating a global leader in consumer and healthcare packaging. This strategic merger enhances Amcor’s capabilities, combining innovation, R&D, and sustainability with a broader product offering for consumer categories, including beauty supplements.

Market Concentration & Characteristics:

The beauty supplements packaging market shows moderate concentration with a strong presence of established global players and growing participation from niche regional firms. It is characterized by rapid innovation, high customization, and a strong emphasis on sustainability and regulatory compliance. Packaging acts as a key differentiator in a saturated market, influencing both consumer choice and brand positioning. Companies focus on offering functional, travel-ready, and premium-looking solutions that appeal to wellness-conscious buyers. The market evolves with changing beauty standards, online shopping behaviors, and preference for traceable and eco-friendly materials. It remains dynamic, innovation-driven, and brand-sensitive across all regions.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material Type, Application, Form/Format of Supplement and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable materials will drive innovations in biodegradable and recyclable packaging.

- Growth in e-commerce will increase the need for durable, lightweight, and tamper-proof packaging formats.

- Smart packaging technologies will expand, offering traceability, authentication, and interactive features.

- Personalization and customization will influence design strategies to enhance consumer engagement.

- Travel-ready and single-dose packaging formats will gain popularity with mobile consumers.

- Clean-label packaging with transparent material and simplified text will shape brand loyalty.

- Emerging markets will present new opportunities with rising wellness awareness and regional adaptation.

- Advanced manufacturing techniques will support low-cost, scalable, and eco-conscious production.

- Regulatory pressures will accelerate the transition toward compliant and sustainable packaging practices.

- Partnerships between packaging firms and beauty brands will foster tailored, functional packaging solutions.