Market Overview

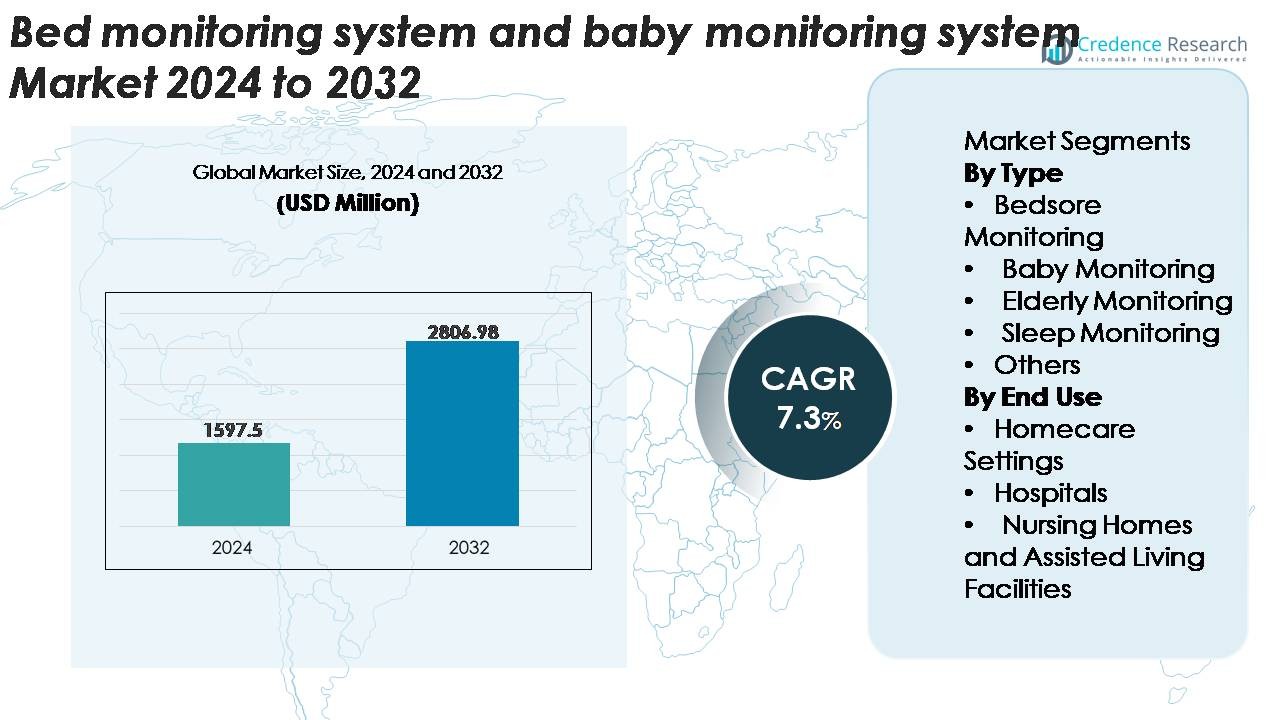

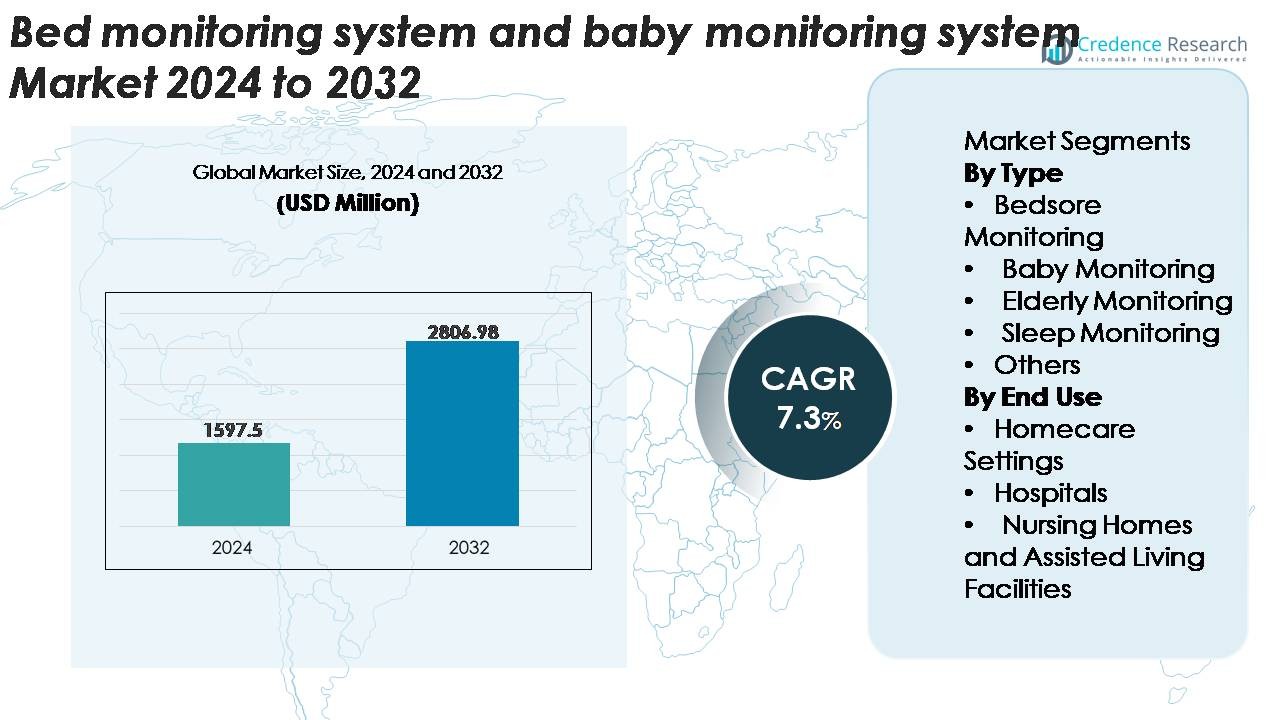

The global Bed Monitoring System And Baby Monitoring System Market was valued at USD 1,597.5 million in 2024 and is anticipated to reach USD 2,806.98 million by 2032, registering a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bed Monitoring System And Baby Monitoring System Market Size 2024 |

USD 1,597.5 Million |

| Bed Monitoring System And Baby Monitoring System Market, CAGR |

7.3% |

| Bed Monitoring System And Baby Monitoring System Market Size 2032 |

USD 2,806.98 Million |

The market for bed monitoring and baby monitoring systems is shaped by strong competition among leading players such as Sleep Number Corporation, Lenovo Group, Wellsense, EMFIT, Smart Caregiver Corporation, Eight Sleep, Artemis S.A (Tekscan), and EarlySense. These companies focus on advanced sensing technologies, AI-driven analytics, and connected platforms to enhance sleep tracking, fall detection, and continuous patient or infant monitoring. Their strategic emphasis on non-contact sensors, pressure-mapping grids, and cloud-enabled remote monitoring strengthens product differentiation across healthcare and homecare environments. North America remains the leading region with approximately 38% market share, driven by high technology adoption, strong digital health infrastructure, and significant consumer investment in smart safety devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global bed monitoring system and baby monitoring system market was valued at USD 1,597.5 million in 2024 and is projected to reach USD 2,806.98 million by 2032, registering a CAGR of 7.3% over the forecast period.

- Demand accelerates due to rising focus on infant safety, growth in elderly care needs, and increasing adoption of smart, sensor-based beds capable of detecting movement, pressure, and physiological changes in real time.

- AI-enabled predictive analytics, non-contact sensing, and IoT-integrated sleep tracking represent major trends, with the Baby Monitoring segment holding the largest share, driven by high consumer adoption and continuous product innovation.

- Competition intensifies among key players offering cloud-connected monitoring solutions, though challenges such as data privacy concerns and high installation costs in clinical environments restrain broader adoption.

- Regionally, North America leads with about 38% share, followed by Europe at 28% and Asia-Pacific at 24%, supported by strong healthcare digitalization and rising homecare usage across key markets.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

The Baby Monitoring segment represents the dominant portion of the market, supported by rising parental focus on continuous infant safety, expanding adoption of smart camera-equipped devices, and integration of real-time alerts for motion, breathing, and temperature variations. Advancements such as AI-enabled anomaly detection, remote mobile connectivity, and wearable sensors further enhance segment leadership. Bedsore monitoring and elderly monitoring solutions continue to gain traction as healthcare systems prioritize preventive care, while sleep monitoring expands steadily due to demand for integrated sleep-tracking mattresses and non-contact sensor technologies tailored for wellness applications.

- For instance, EarlySense’s Contact-Free Continuous Monitoring platform commercialized in baby-monitor configurations uses a piezoelectric sensor capable of capturing over 100 motion micro-vibrations per second to detect subtle respiratory changes in infants.

By End Use

Homecare Settings remain the dominant end-use segment, driven by the rapid shift toward remote patient management, aging-in-place trends, and increased reliance on smart home medical devices for continuous monitoring. Consumers value ease of installation, wireless operation, and mobile app integration, supporting widespread adoption across infant care and eldercare applications. Hospitals maintain steady demand for advanced bedsore and critical-care monitoring systems, while nursing homes and assisted living facilities expand usage to enhance resident safety, reduce manual supervision burdens, and support early detection of mobility- or behavior-related risks.

- For instance, EMFIT’s QS Monitoring System adapted for home sleep and movement tracking uses a thin ferroelectret sensor sheet capable of measuring micro-movements at a sampling frequency of 100 Hz, enabling high-resolution detection of respiration and nighttime activity without body contact.

Key Growth Drivers

Rising Prevalence of Chronic Illnesses and Mobility-Related Conditions

The escalating incidence of chronic illnesses, age-related mobility impairments, and post-operative recovery needs strongly accelerates adoption of bed monitoring and baby monitoring systems. Hospitals and long-term care facilities increasingly rely on sensor-embedded beds, pressure-mapping pads, and automated alert systems to manage high-risk patients susceptible to falls, pressure ulcers, or respiratory irregularities. At the household level, families caring for elderly members or infants demand continuous monitoring solutions that provide real-time alerts, non-contact sensing, and remote oversight. The push toward early detection, preventive care, and patient-centric monitoring further expands deployment across homecare settings. As health systems prioritize reduced hospital readmissions and improved compliance with safety standards, digitally integrated monitoring systems become essential for mitigating risk, minimizing manual supervision burdens, and enhancing clinical workflow efficiency.

· For instance, Owlet’s clinically validated Dream Sock uses medical-grade pulse oximetry to measure heart rates between 0–220 bpm and SpO₂ with an accuracy of ±2% in the 70–100% range, enabling continuous infant monitoring during sleep.

Expansion of Smart Homes and Connected Healthcare Ecosystems

Rapid digitalization of homes and healthcare environments fuels strong uptake of intelligent bed and baby monitoring devices. Smart home platforms increasingly integrate Wi-Fi-enabled cameras, AI-assisted sleep trackers, and mattress-embedded biometric sensors, allowing users to access real-time health metrics and alerts through smartphones or voice assistants. This expansion aligns closely with remote patient monitoring initiatives, enabling families and clinicians to monitor physiological changes from anywhere. IoT interoperability also supports automation of environmental conditions such as temperature, lighting, and infant sleep cycles. As consumers shift toward holistic health and wellness ecosystems, manufacturers enhance interoperability with wearables and telehealth services, creating unified monitoring environments. The demand for predictive insights, behavior analytics, and continuous data flow strengthens the role of connected monitoring systems across both consumer and clinical applications.

· For example, Eight Sleep’s Pod 3 smart mattress features dual-zone thermoregulation with a temperature operating span ranging roughly from 55°F to 110°F, managed through active water-based heating and cooling. The system uses embedded biometric sensors that collect millions of nightly data points related to movement, heart rate, respiratory rate, and sleep trends.

Increasing Focus on Safety, Early Detection, and Preventive Care

Growing awareness of infant safety, fall prevention in seniors, and early detection of health anomalies significantly drives market expansion. Baby monitoring systems with advanced features such as breathing analysis, movement detection, room-condition tracking, and two-way communication are becoming standard in infant care routines. For elderly individuals, automated bed exit alerts, heart-rate tracking, and sleep-quality assessment support proactive intervention and reduce emergency events. Clinical guidelines increasingly emphasize early identification of pressure ulcer risk, sleep disorders, and respiratory issues, strengthening demand for smart beds equipped with pressure-sensing grids and cloud-connected analytics platforms. Preventive care initiatives in hospitals and nursing homes further promote adoption of monitoring solutions to reduce liability, improve patient outcomes, and maintain regulatory compliance regarding safety protocols and quality-of-care benchmarks.

Key Trends & Opportunities

Emergence of AI-Enabled Predictive Monitoring and Behavioral Analytics

AI-driven algorithms are transforming bed and baby monitoring systems from passive alert tools into predictive, insight-rich intelligence platforms. Machine learning models can now interpret disturbances in sleep patterns, movement irregularities, breathing deviations, and pressure variations to forecast potential risks before they escalate. For infants, AI-assisted anomaly detection enhances identification of unsafe postures or environmental hazards. In eldercare, predictive analytics support early detection of deteriorating mobility, nocturnal wandering, or early-stage pressure ulcer formation. This shift creates strong opportunities for device manufacturers to integrate advanced neural models, edge computing, and autonomous decision-support tools. The growing availability of AI-as-a-service platforms also shortens development cycles, enabling vendors to launch more sophisticated and interoperable monitoring solutions that appeal to hospitals, caregivers, and tech-forward households.

· For instance, Withings’ Sleep Analyzer uses a clinically validated ballistocardiography sensor placed under the mattress to track heart rate, breathing disturbances, and sleep stages. The device is medically certified for sleep apnea detection under EU MDR and demonstrates high correlation with clinical polysomnography for respiratory event identification.

Growth of Non-Contact and Wearable Sensor Innovations

Non-contact sensing technologies such as radar-based motion tracking, fiber-optic pressure sensing, and capacitive monitoring are gaining prominence as consumers and healthcare providers seek accurate yet unobtrusive systems. These innovations eliminate reliance on adhesive electrodes or wearable straps, improving comfort for infants, seniors, and bedridden patients. At the same time, wearable devices equipped with respiration bands, sleep patches, and accelerometer-based motion sensors offer complementary capabilities for real-time physiological monitoring. Manufacturers see strong opportunities to combine non-contact platforms with wearable solutions to create hybrid multi-sensing ecosystems. As sensor miniaturization, battery efficiency, and wireless protocols continue to improve, next-generation monitoring devices will offer higher precision, longer operating cycles, and broader clinical and consumer applications.

· For instance, Xandar Kardian’s FDA-cleared XK300 uses impulse-radio UWB radar capable of detecting sub-millimeter chest micro-motions to measure respiratory rate and heart rate continuously. The sensor operates without wearables or body contact and delivers respiration accuracy within ±2.5 breaths per minute in clinical validation studies.

Increasing Integration with Telehealth and Remote Care Management Platforms

The expansion of telehealth services creates new opportunities for bed and baby monitoring systems to become essential components of remote patient management. Seamless integration with electronic health records, caregiver dashboards, and virtual consultation platforms enables continuous data sharing between patients, clinicians, and family members. Healthcare providers benefit from longitudinal trend analysis, remote vital tracking, and automated alert escalation workflows, reducing in-person visits and improving care continuity. Homecare agencies leverage these systems to monitor compliance, mobility issues, and behavioral deviations across dispersed patients. As reimbursement models increasingly support remote monitoring, demand will continue rising for devices that offer secure data transmission, multi-stakeholder visibility, and regulatory-grade analytics.

Key Challenges

Data Privacy Concerns and Regulatory Compliance Requirements

Data security remains one of the most pressing challenges, particularly for systems capturing continuous infant imaging, sleep behavior analytics, or health-related data from vulnerable populations. Vendors must comply with complex regulatory frameworks governing data storage, transmission, and consent management, including HIPAA and equivalent international standards. Ensuring encrypted communication, secure cloud platforms, and robust user authentication adds technical and cost burdens for manufacturers. Privacy concerns also influence consumer adoption, especially for camera-based baby monitoring systems. Any breach or misuse of sensitive data can rapidly erode trust, expose companies to litigation, and hinder market expansion. Meeting evolving data governance expectations requires substantial investment in cybersecurity, compliance audits, and transparent data-handling protocols.

High Implementation Costs and Integration Complexities in Clinical Settings

Hospitals, nursing homes, and rehabilitation centers face significant challenges related to upfront costs, infrastructure upgrades, and interoperability requirements when adopting advanced bed monitoring systems. Integrating sensor-embedded beds, cloud platforms, and wireless networks into existing clinical workflows often requires specialized IT support, network reinforcement, and staff training. Many facilities operate with legacy infrastructure that limits seamless connectivity, creating barriers to full-scale deployment. Budget constraints in long-term care facilities further slow adoption despite strong clinical benefits. Additionally, device fragmentation across vendors can lead to compatibility issues, complicating centralized monitoring dashboards or unified data ecosystems. Overcoming these challenges demands improved standardization, cost-effective system designs, and broader reimbursement alignment.

Regional Analysis

North America

North America holds the largest share of the bed monitoring system and baby monitoring system market at around 38%, driven by strong adoption of smart home technologies, advanced hospital infrastructure, and high consumer spending on infant safety products. The region benefits from rapid integration of AI-powered monitoring, pressure-mapping beds, and remote patient management platforms across homecare and long-term care settings. Growing prevalence of chronic diseases and rising demand for fall-prevention technologies among seniors further strengthen uptake. Government support for digital health and strong penetration of connected IoT ecosystems continue to make North America the leading regional contributor.

Europe

Europe accounts for roughly 28% of global market share, supported by its well-established healthcare systems, rapid expansion of aging-in-place programs, and strong regulatory emphasis on patient safety. Hospitals and elderly-care facilities increasingly adopt pressure-ulcer prevention beds, bed-exit alarms, and non-contact sleep monitoring technologies. High consumer awareness and rising preference for wearable and contactless baby monitoring solutions also contribute to regional growth. Countries such as Germany, the U.K., France, and the Nordics lead adoption due to their digital health readiness. Demand continues to rise as remote care models gain acceptance and long-term care expenditure expands across the region.

Asia-Pacific

Asia-Pacific represents approximately 24% of the market, emerging as the fastest-growing region due to expanding urban populations, rising birth rates, and increasing investment in smart healthcare infrastructure. Rapid adoption of IoT-enabled baby monitors, AI-based sleep trackers, and smart beds in China, Japan, South Korea, and India drives demand. Hospitals are modernizing with fall-prevention and vital-tracking beds as governments prioritize digital health initiatives. Growing middle-class spending on infant safety products and eldercare technologies further accelerates growth. As home healthcare adoption rises and telemedicine platforms expand, Asia-Pacific continues gaining momentum in both consumer and institutional segments.

Latin America

Latin America holds around 6% of global market share, with growing adoption of infant monitoring products and gradual digitalization of healthcare facilities. Countries such as Brazil, Mexico, and Chile are investing in remote patient monitoring systems to enhance care delivery in underserved regions. Homecare adoption is rising as families increasingly seek affordable, easy-to-use baby and elderly monitoring solutions. However, limited hospital budgets and slow infrastructure modernization constrain widespread deployment of advanced sensor-enabled beds. Partnerships with international medical device manufacturers and the expansion of private healthcare networks are expected to accelerate technology penetration over the coming years.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4% of the market, with growth primarily concentrated in Gulf Cooperation Council countries where healthcare modernization and smart hospital investments are accelerating. Adoption of fall-prevention solutions, sleep monitoring systems, and connected infant monitors is rising across premium hospital chains and high-income households. In contrast, many African nations experience slower uptake due to budgetary constraints and limited access to advanced monitoring technologies. Ongoing investments in digital health infrastructure, expanding private healthcare sectors, and increasing awareness of early-detection tools are expected to gradually expand market penetration across the region.

Market Segmentations:

By Type

- Bedsore Monitoring

- Baby Monitoring

- Elderly Monitoring

- Sleep Monitoring

- Others

By End Use

- Homecare Settings

- Hospitals

- Nursing Homes and Assisted Living Facilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the bed monitoring system and baby monitoring system market is characterized by a mix of established medical device manufacturers, smart home technology companies, and specialized monitoring solution providers. Leading players compete through advancements in AI-driven analytics, non-contact sensing technologies, wireless connectivity, and inte gration with telehealth platforms. Companies increasingly focus on developing pressure-mapping beds, radar-based motion sensors, and camera-enabled baby monitors with enhanced biometric tracking to strengthen product differentiation. Strategic initiatives include collaborations with hospitals, long-term care facilities, and homecare providers to accelerate adoption of real-time monitoring ecosystems. Many manufacturers also expand cloud-based platforms to enable remote oversight and predictive risk detection across infants, seniors, and bedridden patients. Continuous innovation in IoT architectures, cybersecurity features, and interoperability with digital health platforms shapes competitive positioning, while pricing strategies and regulatory compliance remain critical factors influencing market penetration and customer retention.

Key Player Analysis

Recent Developments

- In December 2024, the company Lenexa Medical announced deployment of its fabric-based sensors under the name LenexaCARE, integrated into patient beds to continuously monitor and prevent pressure injuries in hospitalized or bedridden patients.

- In June 2024, Sleep Number Corporation Introduced the new “c1” smart bed at a value price point (~US$999 queen), which offers the brand’s signature dual-adjustable comfort, breathable technology, and personalized digital sleep health insights.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven predictive monitoring will increase, enabling earlier detection of movement, sleep, and health anomalies.

- Non-contact sensing technologies will expand, improving comfort and compliance for infants, seniors, and bedridden patients.

- Integration with telehealth and remote care platforms will strengthen, supporting continuous monitoring beyond clinical settings.

- Demand for smart home–compatible baby and bed monitoring devices will rise as connected living ecosystems evolve.

- Healthcare facilities will increasingly deploy automated fall-prevention and pressure-ulcer detection systems to enhance patient safety.

- Wearable and hybrid multi-sensor solutions will gain traction for comprehensive monitoring across age groups.

- Cloud-based analytics platforms will grow, offering real-time insights and multi-stakeholder visibility for caregivers and clinicians.

- Product innovation will accelerate through partnerships between medical device companies and digital health technology firms.

- Regulatory focus on data security and device interoperability will intensify, shaping product development priorities.

- Emerging markets will see faster adoption as homecare demand rises and healthcare digitalization accelerates.

Market Segmentation Analysis:

Market Segmentation Analysis: