Market Overview:

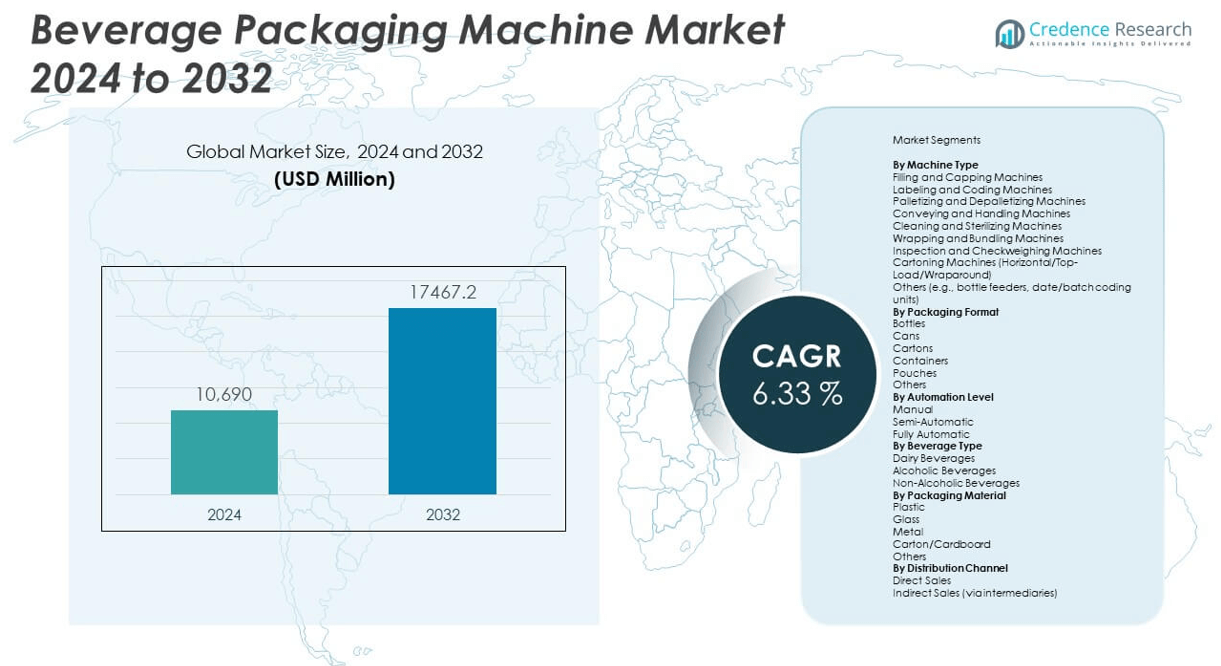

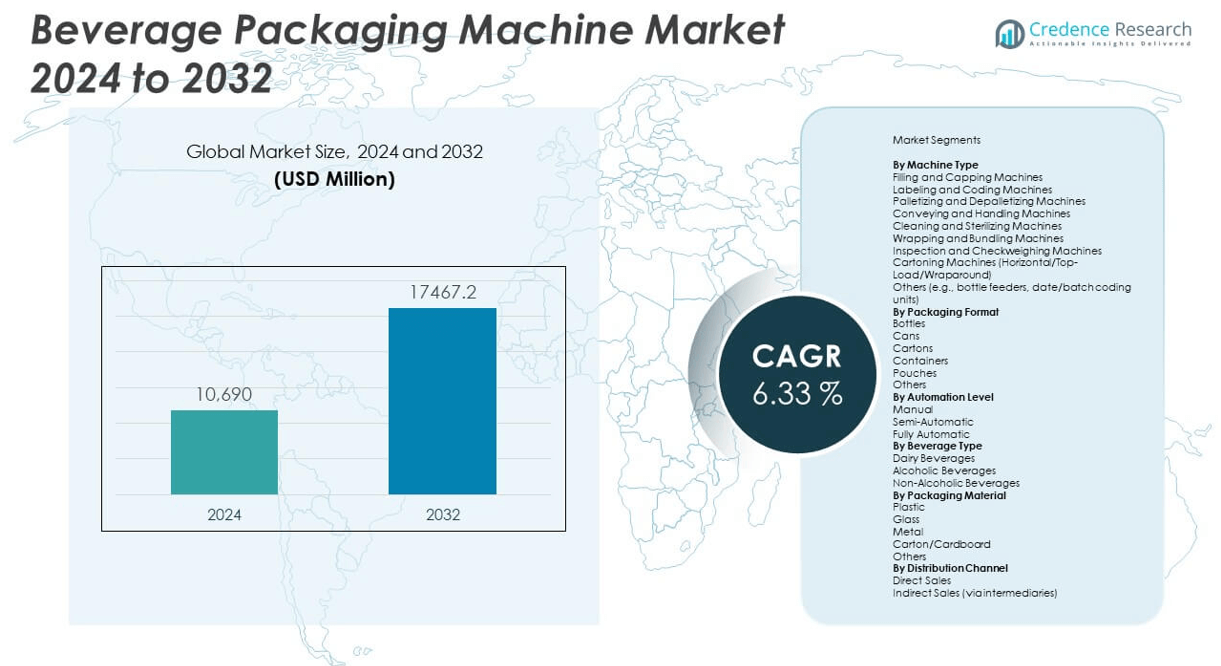

The Beverage Packaging Machine Market is projected to grow from USD 10,690 million in 2024 to an estimated USD 17,467.2 million by 2032, with a compound annual growth rate (CAGR) of 6.33% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Beverage Packaging Machine Market Size 2024 |

USD 10,690 million |

| Beverage Packaging Machine Market, CAGR |

6.33% |

| Beverage Packaging Machine Market Size 2032 |

USD 17,467.2 million |

Market growth is primarily driven by the increasing global consumption of packaged beverages and the rising demand for automation in production lines. As manufacturers aim to improve efficiency, reduce waste, and enhance product shelf life, the adoption of advanced packaging machinery is expanding. Innovations such as smart packaging, integration of IoT technologies, and increased demand for sustainable and eco-friendly packaging materials further contribute to the growing adoption of these machines across various beverage categories, including bottled water, carbonated drinks, juices, and alcoholic beverages.

Regionally, North America and Europe are leading the market due to established beverage industries, high adoption of automation, and stringent packaging standards. Asia Pacific is emerging as a high-growth region, driven by increasing urbanization, rising disposable incomes, and expanding beverage consumption in countries like China, India, and Indonesia. Latin America and the Middle East & Africa are also witnessing gradual growth due to rising investments in beverage production infrastructure and growing consumer preference for packaged drinks.

Market Insights:

- The Beverage Packaging Machine Market was valued at USD 10,690 million in 2024 and is projected to reach USD 17,467.2 million by 2032, growing at a CAGR of 6.33%.

- Rising global demand for packaged beverages and the need for automation are major growth drivers in both developed and emerging economies.

- Increasing preference for sustainable packaging materials is encouraging the adoption of eco-compatible machinery across beverage manufacturers.

- High capital investment and maintenance costs pose a challenge for small and medium-sized enterprises to adopt advanced packaging systems.

- Compatibility issues with legacy machinery and limited flexibility in handling new materials restrict operational efficiency for some manufacturers.

- North America leads the market due to technological advancements and automation readiness, holding 32% of the global share.

- Asia Pacific is the fastest-growing region, supported by rising beverage consumption and industrial growth in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Beverage Consumption Encourages Automation and Efficiency Investments

The surge in demand for packaged beverages is pushing manufacturers to upgrade their production capabilities. The Beverage Packaging Machine Market is benefiting from this shift, as producers seek faster, more reliable packaging equipment. Companies are moving toward high-speed, automated machines to meet volume expectations and maintain product quality. Evolving consumer lifestyles and growing demand for on-the-go beverages are pushing for compact and portable packaging formats. These preferences require advanced packaging solutions that support multiple product configurations. Beverage producers are also striving to reduce manual labor and operational costs by investing in smart machinery. With competition intensifying, manufacturers are placing greater emphasis on consistency and shelf appeal.

- For instance, Krones AG developed its Contiform 3 Speed blow-molding system, which achieves up to 2,750 bottles per hour per cavity, enabling beverage manufacturers to significantly boost throughput while reducing energy consumption by 15% compared to previous models.

Sustainability Goals are Driving the Need for Eco-Friendly Packaging Machinery

Environmental concerns are encouraging beverage producers to switch to sustainable packaging formats. The Beverage Packaging Machine Market is witnessing a shift toward equipment compatible with recyclable, biodegradable, or compostable materials. Brands want machines that handle eco-conscious materials without sacrificing efficiency. Governments are imposing strict regulations on plastic waste, which further motivates companies to explore greener alternatives. To comply, manufacturers need machines capable of adapting to newer packaging substrates. Flexible machinery designs allow quick changes in material handling, improving operational agility. Companies are increasingly evaluating carbon footprints at the machinery level to align with sustainability metrics. These factors collectively fuel the adoption of next-generation eco-compatible packaging machines.

- For instance, Tetra Pak introduced its Plant-Based Carton Packaging, which uses sugarcane-derived polymers and has helped reduce CO₂ emissions by 20% per package. Their A3/Speed aseptic filling system also supports fully recyclable cartons and maintains sterile conditions for up to 24 months without refrigeration.

Increased Focus on Hygiene and Shelf-Life Extension Accelerates Equipment Modernization

Growing health awareness among consumers compels beverage companies to prioritize hygiene in production. The Beverage Packaging Machine Market is advancing with equipment that minimizes contamination risks. Machines with enclosed systems, touchless operation, and sterilization features are gaining traction. Enhanced sealing technologies preserve product integrity and extend shelf life. This is particularly critical for dairy, juices, and health beverages. High-speed machines that maintain sanitation standards support both efficiency and safety goals. Equipment manufacturers now integrate easy-clean mechanisms and stainless-steel components to meet industry standards. These developments elevate both product quality and consumer confidence.

Customization and Packaging Versatility Support Market Expansion Across SKUs

Consumer preferences are shifting toward variety and personalization in beverage offerings. The Beverage Packaging Machine Market supports this demand by enabling flexibility in packaging designs. Machines that handle multiple bottle shapes, sizes, and materials enhance production capabilities. Brands often introduce limited-edition products that require rapid changeovers. Versatile packaging equipment allows quick adaptation to different labels, caps, or volumes. Operators seek systems that reduce downtime during format transitions. Machines with modular designs facilitate easy upgrades and expansion without large investments. This capability supports growth across small, medium, and large-scale production lines.

Market Trends

Integration of IoT and Industry 4.0 Features in Beverage Packaging Machinery

Manufacturers are integrating IoT-enabled sensors and cloud connectivity into packaging lines. The Beverage Packaging Machine Market reflects this transformation through intelligent systems offering real-time performance insights. Operators gain access to predictive maintenance alerts, reducing unplanned downtime. Digital dashboards provide analytics for optimizing throughput and quality control. Remote monitoring capabilities allow centralized oversight across plants. These technologies increase overall equipment effectiveness and decision-making accuracy. Brands demand visibility into each stage of packaging to comply with traceability requirements. Equipment providers are embedding smart modules to meet evolving automation goals.

Adoption of Robotics Enhances Precision and Speed Across Packaging Lines

Robotic arms and automated material handling systems are transforming packaging workflows. The Beverage Packaging Machine Market incorporates robotics to improve precision, especially in bottling, capping, and labeling operations. Robots reduce human intervention, ensuring consistent output with minimal error rates. Pick-and-place technology optimizes handling of delicate or irregularly shaped containers. Multi-axis robotic platforms facilitate greater line flexibility. Robotics reduce fatigue-related issues, increasing output during long production runs. High-speed robotic integration is now standard in premium beverage packaging lines. This trend accelerates the push toward fully autonomous operations.

- For example, Sidel’s CoboAccess™_Pal robotic palletizer integrates a FANUC collaborative robot and operates at speeds of up to 6 cycles per minute. It features precise box placement, supports pallet heights up to 1,900 mm, and is designed for 24/7 operation within a compact, fenceless, and mobile configuration suitable for secondary packaging environments.

Emergence of Compact and Space-Saving Packaging Equipment Designs

Space constraints in manufacturing environments prompt the demand for compact machinery. The Beverage Packaging Machine Market offers solutions that minimize footprint without compromising output. Compact lines enable small and mid-sized businesses to scale operations efficiently. Integrated systems combine filling, sealing, and labeling in a single unit. These designs reduce conveyor lengths and power consumption. Mobility features like wheels or stackable modules simplify installation and maintenance. Space-saving formats appeal to producers in urban facilities or portable production units. Manufacturers are focusing on user-friendly interfaces within smaller control panels.

- For instance, Sidel’s EvoFILL Can Compact integrates filling and seaming into a single block, reducing footprint by up to 30%. It supports up to 40,000 cans per hour and achieves 5% monoblock efficiency, making it ideal for urban or space-constrained facilities.

Focus on Aesthetic Appeal and Branding Boosts Demand for Advanced Labeling Capabilities

Visual branding plays a critical role in beverage sales across retail and e-commerce channels. The Beverage Packaging Machine Market supports this need by offering advanced labeling and printing functions. Equipment now supports 360-degree labels, heat shrink sleeves, and digital printing. Machines with integrated vision systems ensure label alignment and defect detection. Customization software allows brands to switch label formats based on marketing campaigns. These enhancements increase shelf impact and customer recall. Augmented reality (AR) and QR code support also elevate packaging engagement. Labeling machines are becoming a central component of packaging innovation.

Market Challenges Analysis

High Capital Investment and Maintenance Costs Restrain Market Access for Small Manufacturers

Acquiring modern packaging equipment involves significant upfront costs. The Beverage Packaging Machine Market often presents a financial barrier to small and medium-sized beverage producers. High initial investment in advanced machinery deters businesses with limited capital reserves. In many cases, maintenance costs and frequent servicing requirements add to the financial burden. Specialized labor is often needed to operate or maintain complex systems, increasing overheads. Rapid technological advancements also make existing equipment obsolete quickly. Companies hesitate to invest without assurance of long-term returns. These constraints limit automation in small-scale beverage operations and slow down industry-wide transformation.

Limited Material Compatibility and Customization Options in Legacy Systems Create Bottlenecks

Older packaging machines struggle with adapting to modern, eco-friendly, or multi-format packaging. The Beverage Packaging Machine Market faces challenges when legacy systems cannot accommodate new substrates or design flexibility. Machines not built for modular adjustments limit product variation and output. Transitioning from plastic to paper or bio-based materials often requires machine recalibration or full replacement. This lack of compatibility results in production inefficiencies and product damage. High customization requirements from retailers or D2C platforms add complexity. Without upgradeable architecture, older systems become bottlenecks in dynamic supply chains.

Market Opportunities

Growing Demand for Flexible Packaging Formats Creates New Equipment Opportunities

Flexible pouches, cartons, and squeezable packaging formats are gaining popularity. The Beverage Packaging Machine Market has the opportunity to serve this rising demand by introducing machines capable of handling these new formats. Consumers seek convenience, portability, and resealability, all of which flexible packaging offers. Manufacturers are looking for solutions that support faster pouch filling and sealing without compromising quality. Equipment vendors can capitalize by developing adaptive systems tailored for these emerging trends.

Expansion of Beverage Manufacturing in Emerging Markets Spurs Equipment Demand

Emerging economies in Asia Pacific, Latin America, and Africa are investing in local beverage production. The Beverage Packaging Machine Market can benefit from this shift by offering cost-effective, scalable machinery. Regional beverage companies seek localized packaging solutions to serve fast-growing populations. Equipment that combines automation with affordability will see strong uptake. This opportunity encourages partnerships between global equipment suppliers and regional beverage brands.

Market Segmentation Analysis:

By machine type, includes a wide range of systems essential for efficient beverage production lines. Filling and capping machines hold a dominant position, forming the backbone of most packaging processes. Labeling and coding machines are growing in demand due to the need for traceability and branding. Palletizing and depalletizing machines enhance end-of-line automation, while conveying and handling systems improve line integration. Cleaning and sterilizing machines are essential for hygiene in dairy and bottled water production. Wrapping, bundling, inspection, and cartoning machines support packaging versatility, with modular units offering cost-effective upgrades. Specialized equipment like bottle feeders and date/batch coding units fill specific operational gaps.

- For instance, Coca-Cola bottling plants use high-speed rotary filling and capping systems capable of processing over 1,200 bottles per minute to maintain production efficiency.

By packaging format, bottles remain the most widely used due to their adaptability and consumer familiarity. Cans are popular in carbonated beverages and alcoholic drinks, offering convenience and durability. Cartons see extensive use in dairy and juice segments for their stackability and sustainability. Containers, pouches, and other innovative formats are gaining traction with product diversification and branding efforts. Machines designed for flexible changeovers between formats are in high demand, particularly among producers managing multiple SKUs.

- For example, AFA Systems provides cartoning machines with quick-change tooling to switch between bottle and pouch formats for multi-SKU operations.

By automation level, fully automatic machines lead the market due to their efficiency, accuracy, and low reliance on manual labor. Large-scale beverage manufacturers prioritize these systems to achieve high throughput and consistent quality. Semi-automatic machines serve mid-sized operations requiring partial automation without high capital expenditure. Manual systems continue to support small and niche producers that prioritize cost control over speed, although their adoption is decreasing with increased automation trends.

By beverage type segment, non-alcoholic beverages such as soft drinks, juices, bottled water, and energy drinks drive substantial demand for packaging machines. Their high production volumes and frequent new product launches require scalable and flexible packaging systems. Dairy beverages demand hygienic and precise filling solutions, while alcoholic beverages prioritize safety, branding, and premium presentation. Equipment designed for viscosity control, carbonation handling, and temperature regulation supports diverse beverage types effectively.

By packaging material, plastic continues to dominate due to its low cost and versatility. However, glass and metal remain essential for specific categories like alcohol and premium juices, where product protection and aesthetics are critical. Carton and cardboard materials are gaining favor in the context of sustainability, especially in dairy and juice applications. Machines compatible with these varying materials enable producers to meet shifting consumer expectations and regulatory standards.

By distribution channel, direct sales dominate the Beverage Packaging Machine Market, especially among large manufacturers who seek customized solutions and long-term service agreements. Indirect sales through intermediaries cater to small and medium enterprises, offering cost-effective procurement and localized support. Equipment providers utilize both channels strategically to maximize market reach across developed and emerging economies.

Segmentation:

By Machine Type

- Filling and Capping Machines

- Labeling and Coding Machines

- Palletizing and Depalletizing Machines

- Conveying and Handling Machines

- Cleaning and Sterilizing Machines

- Wrapping and Bundling Machines

- Inspection and Checkweighing Machines

- Cartoning Machines (Horizontal/Top-Load/Wraparound)

- Others (e.g., bottle feeders, date/batch coding units)

By Packaging Format

- Bottles

- Cans

- Cartons

- Containers

- Pouches

- Others

By Automation Level

- Manual

- Semi-Automatic

- Fully Automatic

By Beverage Type

- Dairy Beverages

- Alcoholic Beverages

- Non-Alcoholic Beverages

By Packaging Material

- Plastic

- Glass

- Metal

- Carton/Cardboard

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales (via intermediaries)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds a significant share of the Beverage Packaging Machine Market, accounting for 32% of the global revenue in 2024. The region benefits from advanced manufacturing infrastructure and high adoption of automation technologies. Major beverage producers in the U.S. and Canada continue to invest in efficient, high-speed packaging systems to meet rising consumer demand. Stringent regulations on food safety and sustainability drive the adoption of innovative, compliant packaging equipment. Growth in functional beverages and ready-to-drink product segments fuels further investment in flexible and multi-format machinery. The presence of leading equipment manufacturers strengthens the region’s competitive position.

Europe represents the second-largest regional market, contributing 28% to the global Beverage Packaging Machine Market share. Countries such as Germany, Italy, and France lead the regional demand due to their strong engineering base and advanced beverage sectors. Regulatory emphasis on sustainable packaging drives the shift toward machines compatible with recyclable and biodegradable materials. The alcoholic and non-alcoholic beverage industries demand highly customized packaging systems, supporting innovation in machinery design. Equipment manufacturers in the region focus on modularity and energy efficiency to align with environmental targets. Export-oriented strategies among European machine builders further enhance market penetration worldwide.

Asia Pacific emerges as the fastest-growing region, capturing 25% of the Beverage Packaging Machine Market share in 2024. Rapid urbanization, rising disposable incomes, and expanding middle-class populations in China, India, and Southeast Asia accelerate beverage consumption. Local manufacturers are investing in modern packaging systems to improve output and reduce operational costs. Multinational beverage companies are also increasing their footprint in the region, creating demand for scalable, automated packaging solutions. Government initiatives supporting industrial automation and smart manufacturing further stimulate market development. It is expected to witness continued growth driven by rising domestic demand and manufacturing expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Barry-Wehmiller Companies

- Bosch Packaging Technology (now Syntegon Technology GmbH)

- Bradman Lake Group Ltd

- Cariba S.r.l

- Coesia S.p.A.

- Douglas Machine Inc.

- EconoCorp Inc.

- GEA Group

- Jacob White Packaging Ltd.

- KHS Group

- Krones AG

- Mpac Group plc

- A. Jones

- Sacmi

- Sidel Group

- SIG Combibloc Group

- Tetra Laval / Tetra Pak

- Tishma Technologies

Competitive Analysis:

Market leaders in the Beverage Packaging Machine Market maintain strong positions through continuous innovation and broad product portfolios. Companies compete on automation capabilities, modular designs, and compatibility with sustainable materials. It emphasizes integration of smart sensors and IoT features to deliver real-time performance metrics to clients. Strategic partnerships with beverage brands help providers tailor equipment to specific production requirements. Firms often invest in global service networks to ensure timely support and minimize downtime for clients. Price competitiveness remains critical, prompting vendors to offer scalable solutions for small and large producers. It leverages strong R&D pipelines to stay ahead in technology adoption.

Recent Developments:

- In June 2025, KHS Group announced new turnkey line solutions at drinktec, including the launch of the InnoPET FreshSafe QuadBlock, a compact system combining stretch blow molding, coating, filling, and labeling for PET bottles. KHS also highlighted an ultralight 0.25-liter rPET bottle and a new bottle washer for glass containers to improve sustainability and efficiency.

- In June 2025, Tetra Pak opened a new Technology Development Centre in Karlshamn, Sweden, to accelerate the commercial scale-up of fermentation-derived foods. This investment is their largest yet in the “new food” sector, providing support for startups and established manufacturers working on novel, sustainable food sources.

- In July 2025, Sidel revealed plans to introduce an industry-first rPET origami-like packaging solution at drinktec 2025. This innovative packaging is expected to set new standards in efficiency and sustainability. Sidel will also present Qual-IS™ Aseptic Intelligence and a new line optimization portfolio aiming at 100% recycled PET packaging.

Market Concentration & Characteristics:

The Beverage Packaging Machine Market features a moderately consolidated structure, with several leading firms capturing major shares and a range of regional and niche players addressing specialized needs. It shows high barriers to entry due to capital-intensive manufacturing and technical expertise required to develop advanced, automated systems. Customers prefer established brands that provide reliable support and durability, reinforcing incumbent positions. Smaller vendors differentiate through customization, local servicing, and flexible pricing for small and medium enterprises. Market dynamics reflect a balance between dominant global players and growing regional manufacturers that cater to emerging markets and specific material handling requirements.

Report Coverage:

The research report offers an in-depth analysis based on Machine Type, Packaging Format, Automation Level, Beverage Type, Packaging Material and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will see rising adoption of automated, high-speed machinery as beverage companies aim to boost throughput and maintain consistent packaging quality across large production volumes.

- Integration of AI, IoT, and smart control systems will enhance remote monitoring, predictive maintenance, and real-time process optimization across packaging lines.

- Increasing demand for sustainable packaging will drive innovation in machines that handle recyclable, compostable, and biodegradable materials with high precision.

- Flexible and modular machine configurations will gain popularity due to the growing need for rapid changeovers, multiple SKUs, and personalized beverage formats.

- The Asia Pacific region will experience strong market expansion, supported by rising consumption, industrial investments, and government automation initiatives.

- Compact and energy-efficient machines will appeal to urban and mid-sized beverage producers, where space and utility resources are limited.

- Advanced labeling, printing, and tamper-evident sealing systems will support branding, traceability, and regulatory compliance in competitive retail environments.

- Greater adoption of robotics in material handling, sorting, and packaging will improve speed, reduce errors, and limit human intervention in hygienic zones.

- Regulatory bodies will continue to influence machinery upgrades through evolving safety and sustainability mandates.

- Partnerships between equipment manufacturers and beverage brands will foster product-specific innovations and expand the scope of customized packaging solutions.