Market Overview:

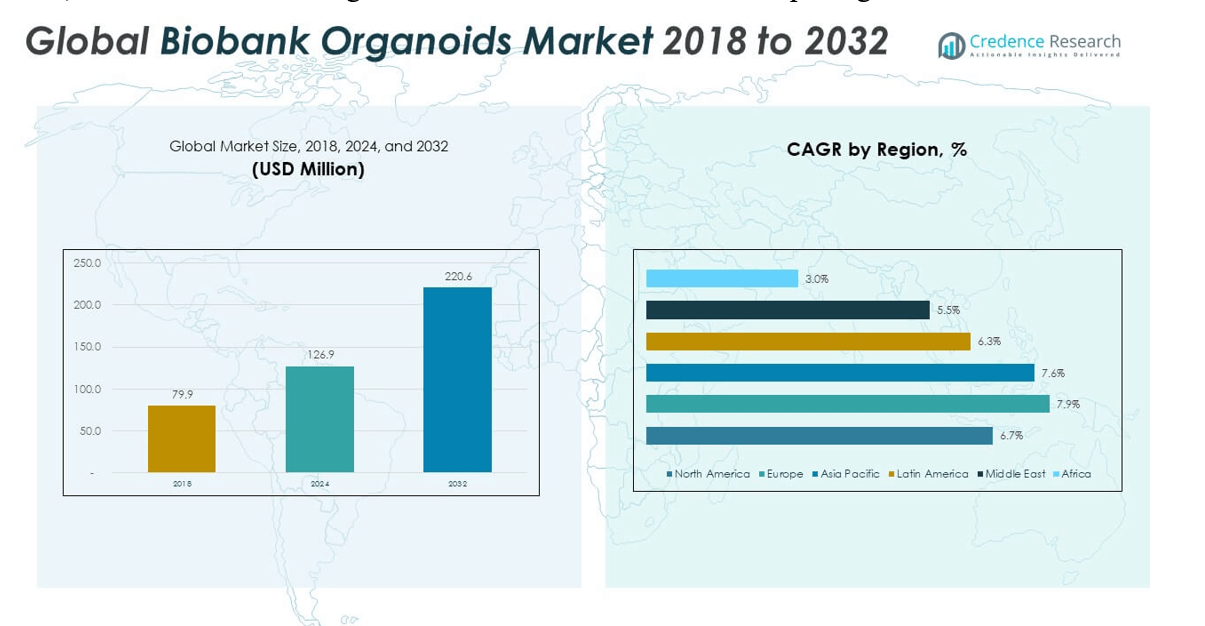

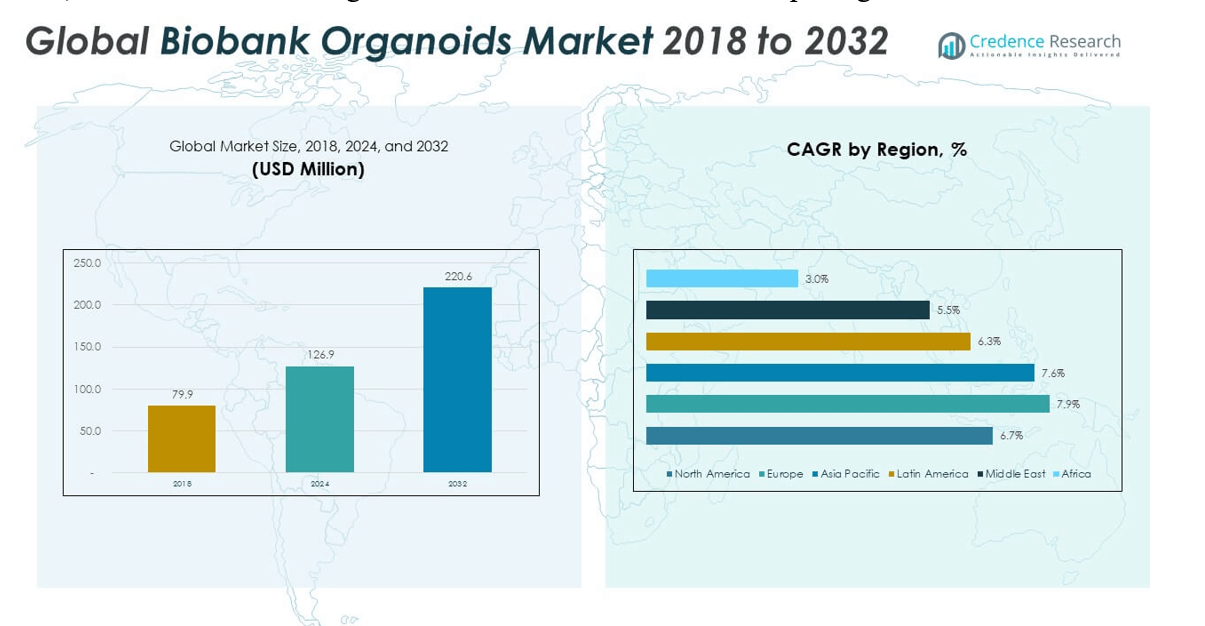

The Biobank Organoids Market size was valued at USD 79.9 million in 2018 to USD 126.9 million in 2024 and is anticipated to reach USD 220.6 million by 2032, at a CAGR of 7.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biobank Organoids Market Size 2024 |

USD 126.9 million |

| Biobank Organoids Market, CAGR |

7.13% |

| Biobank Organoids Market Size 2032 |

USD 220.6 million |

The Biobank Organoids Market is experiencing robust growth due to rising demand for personalized medicine, increasing investments in regenerative medicine research, and the expanding use of organoid models in drug discovery and toxicology testing. Researchers are adopting organoids to closely replicate human organ physiology, enabling more accurate disease modeling and therapeutic screening. Pharmaceutical companies are also leveraging organoid biobanks to streamline preclinical trials and reduce failure rates. Government funding and collaborations between biobanks and academic institutions further drive the advancement and accessibility of these innovative biological models.

North America leads the Biobank Organoids Market due to its advanced research infrastructure, strong presence of pharmaceutical companies, and active government support for biomedical research. Europe follows closely, driven by high research activity and regulatory support for organoid-based applications. Asia Pacific is emerging as a significant region, with countries like China, Japan, and South Korea investing in biotechnology and precision medicine. These nations are expanding their biobank capacities and promoting innovation through public-private partnerships. The market is also witnessing gradual growth in Latin America and the Middle East, where research funding and healthcare modernization are opening new avenues.

Market Insights:

- The Biobank Organoids Market was valued at USD 126.9 million in 2024 and is projected to reach USD 220.6 million by 2032, growing at a CAGR of 7.13%.

- Rising demand for personalized medicine and disease-specific modeling is driving organoid biobanking applications.

- Pharmaceutical companies are increasingly adopting organoid models to improve preclinical drug screening efficiency.

- High costs and lack of standardization in organoid storage and processing continue to restrain broader market adoption.

- North America leads the market due to its strong research ecosystem and established biobanking infrastructure.

- Europe shows accelerated growth with supportive regulation, public funding, and collaborative research networks.

- Asia Pacific is emerging as a key region driven by biotechnology investments and expanding precision medicine programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Emphasis on Personalized Medicine Across Research and Clinical Applications

The growing focus on personalized medicine remains a major driver in the Biobank Organoids Market. Organoids offer close replication of human tissue, enabling more accurate therapeutic modeling. Researchers and clinicians use these models to understand patient-specific disease mechanisms. It enhances drug efficacy screening and reduces trial-and-error approaches in treatment. Pharmaceutical firms invest in organoid-based biobanking to support targeted therapies. Tailored drug development pipelines increasingly incorporate biobanked organoids to predict individual patient responses. The trend toward patient-specific healthcare continues to strengthen the need for robust biobank organoid infrastructure.

- For instance, researchers at the Hubrecht Institute, via Hubrecht Organoid Technology (HUB), established a living biobank of colorectal cancer organoids sourced from 20 consecutive patients. These patient‑derived organoid lines mirrored molecular subtypes and maintained the genetic diversity of the original tumors, validating their representativeness in preclinical models.

Expanding Use of Organoids in Drug Discovery and Toxicity Testing

Pharmaceutical companies are integrating organoids into drug screening pipelines to improve preclinical predictability. The Biobank Organoids Market benefits from this shift toward 3D models that simulate organ-level functions. Organoids enable the identification of adverse effects before clinical trials begin. They allow early elimination of ineffective or toxic compounds, saving costs and development time. Biobanked organoids standardize model availability and improve test reproducibility. Regulatory bodies also encourage safer drug testing approaches, driving interest in these systems. It enhances the overall drug development timeline and market success rates.

- For instance, Emulate, Inc.’s Liver-Chip technology demonstrated 87% sensitivity in detecting drug-induced liver injury (DILI) and 100% specificity for non-toxic drugs, according to a 2022 study published in Nature Communications Medicine. The study involved testing 870 Liver-Chips across 27 compounds and confirmed the platform’s superior accuracy compared to traditional liver spheroid models, which showed only 47% sensitivity. This validation positioned Liver-Chip as a more reliable tool for preclinical liver toxicity assessment.

Increasing Investment in Regenerative Medicine and Disease Modeling

Academic institutions and private investors channel significant funding into regenerative medicine using organoid technologies. The Biobank Organoids Market gains traction through its application in disease modeling and tissue regeneration studies. These organoids assist in simulating complex pathologies, including neurological, gastrointestinal, and hepatic conditions. Biobanked organoids ensure availability of disease-specific models for advanced R&D. It supports exploration of gene expression patterns and treatment response profiles. Medical researchers rely on organoid banks to test regenerative therapies efficiently. Such capabilities expand the translational value of these platforms.

Government and Institutional Support for Biobanking Infrastructure Development

Public agencies and consortia worldwide promote the standardization and expansion of biobanking systems. The Biobank Organoids Market is benefiting from strategic funding programs and research alliances. Institutional biobanks partner with biotech startups to widen access to rare disease organoid models. Initiatives such as the Human Cell Atlas accelerate organoid collection and categorization. It enhances global collaborations, data sharing, and ethical oversight. Regulatory frameworks increasingly support the use of biobanked human-derived organoids in compliant research. This support underpins future scalability and integration into clinical applications.

Market Trends:

Integration of Artificial Intelligence for Enhanced Data Analysis and Predictive Modeling

The adoption of AI and machine learning is transforming how organoid data are processed and interpreted. The Biobank Organoids Market benefits from AI-enhanced imaging, classification, and pattern recognition. Researchers use these tools to assess organoid morphology, growth, and response to compounds. It streamlines large-scale analysis across diverse organoid types in the biobank. Predictive modeling supports early-stage drug development and toxicity prediction. AI facilitates cross-comparison of patient-derived models to discover biomarkers. These capabilities improve clinical relevance and scalability in organoid-based research.

Shifting Preference Toward Automation and Standardized Storage Platforms

Automation technologies are becoming central to organoid harvesting, processing, and storage protocols. The Biobank Organoids Market is witnessing strong demand for robotic systems that enable high-throughput organoid handling. Standardized cryopreservation tools improve viability and reproducibility across multiple organoid lines. It addresses long-standing concerns related to sample variability and manual error. Automated systems ensure traceability, scalability, and quality control. Integration with laboratory information systems enhances biobank accessibility and data transparency. This shift reduces operational inefficiencies in academic and commercial biobanks.

Increased Collaboration Between Industry Stakeholders and Research Institutions

Strategic partnerships between biotechnology firms, pharmaceutical companies, and academic centers are fueling innovation. The Biobank Organoids Market is evolving through joint ventures aimed at expanding disease-specific organoid libraries. Research institutions contribute patient-derived samples and clinical insights, while companies provide technological infrastructure. These collaborations accelerate clinical translation of organoid models into diagnostic and therapeutic workflows. It supports co-development of customized organoid platforms for oncology, virology, and rare diseases. Such cross-sector engagement enhances knowledge exchange and model availability.

- For instance, the Organoid Program led by Hans Clevers at the Hubrecht Institute partnered with companies like AstraZeneca and Roche to share over 150 patient-derived tumor organoid lines for preclinical drug testing. These collaborations demonstrated strong clinical translatability, supporting personalized drug screening based on tumor-specific responses.

Growing Focus on Ethical, Regulatory, and Donor Consent Frameworks

The use of human-derived biological materials in organoids has raised attention to ethical and legal compliance. The Biobank Organoids Market is adapting to evolving governance structures around patient consent and data privacy. Organizations adopt transparent practices for sample collection, anonymization, and use. It strengthens public trust and encourages donor participation in research. Regulatory agencies worldwide are formulating guidelines for ethical organoid utilization in clinical trials. Standardized consent procedures promote responsible biobank expansion and international collaborations.

- For instance, BBMRI-ERIC, Europe’s leading biobank consortium, publishes GDPR-compliant standardized consent protocols and ELSI (Ethical, Legal, and Social Issues) guidance for organoid biobanking. Member biobanks such as THL Biobank (Finland) have implemented these standards and earned BBMRI-ERIC Quality Labels after successful compliance assessments, ensuring transparent and ethical use of donor samples.

Market Challenges Analysis:

Limited Standardization and Scalability Across Organoid Models and Storage Protocols

The absence of uniform protocols for organoid cultivation and biobanking creates inconsistencies in sample quality. The Biobank Organoids Market struggles with challenges in reproducibility across institutions and research centers. Variations in donor tissue, media composition, and growth conditions affect organoid morphology. Lack of consensus around preservation and thawing protocols further hinders sample viability. It impedes widespread adoption across pharmaceutical and clinical applications. Laboratories face difficulties in maintaining batch consistency and quality assurance. The challenge limits scalability, reducing market potential for broader applications.

High Operational Costs and Technical Complexity for Widespread Adoption

Maintaining viable, high-quality organoid biobanks involves substantial infrastructure and expertise. The Biobank Organoids Market contends with financial barriers linked to facility maintenance, labor, and storage technologies. Advanced imaging systems, cryopreservation units, and data management platforms require capital-intensive investment. Skilled personnel are necessary to manage organoid handling, culture monitoring, and quality control. It restricts entry for small institutions and low-resource regions. Commercial scaling is further complicated by technical challenges in long-term organoid preservation. These factors delay market penetration and global adoption.

Market Opportunities:

Emerging Demand for Rare Disease Models and Precision Oncology Applications

The Biobank Organoids Market holds strong growth potential in areas underserved by conventional models. Rare disease research and personalized oncology require accurate in vitro systems. Biobanked organoids derived from patient tumors offer valuable tools for precision drug screening. It enables clinicians to identify the most effective therapeutic options for individual cases. The niche demand for such applications drives market expansion and research investment. Companies exploring personalized oncology pipelines are key stakeholders in leveraging these models.

Potential Growth in Developing Economies with Biotech Infrastructure Development

Developing regions are building biotechnology capabilities through public-private initiatives and government incentives. The Biobank Organoids Market can capitalize on this momentum to expand geographically. Infrastructure development in Asia Pacific, Latin America, and parts of Africa creates new supply and demand chains. It supports regional disease research aligned with local healthcare priorities. Collaborations between global firms and local research hubs open biobank deployment opportunities. It offers a pathway to diversified organoid libraries and broader healthcare impact.

Market Segmentation Analysis:

The Biobank Organoids Market is segmented

By type into tissue derived organoids and pluripotent stem cell-derived organoids. Tissue derived organoids hold a prominent share due to their high biological relevance and close resemblance to native tissue architecture. These models are widely used for disease modeling, drug screening, and regenerative studies. Pluripotent stem cell-derived organoids are gaining traction for their versatility and potential to model early developmental stages and complex diseases. Their application in neuroscience, liver, and cardiac research is expanding, supported by advances in stem cell technology and differentiation protocols.

- For instance,a team at the Institute of Molecular Biotechnology (IMBA, Vienna) led by Jürgen Knoblich generated cerebral organoids from human pluripotent stem cells to model microcephaly, as reported in Nature (Lancaster et al., 2013). Their protocol enabled the formation of 3D brain-like structures from induced pluripotent stem cells, effectively replicating aspects of early human brain development and disease phenotypes.

By end user, the Biobank Organoids Market serves biopharmaceutical companies, contract research organizations (CROs), and academic and research institutes. Biopharmaceutical companies dominate the segment due to their investment in preclinical testing and precision medicine pipelines. CROs leverage organoid biobanks for high-throughput screening and customized research services, catering to a wide range of sponsors. Academic and research institutes contribute significantly through innovation, disease-specific organoid development, and collaborations with industry stakeholders. The market benefits from the complementary roles of these end users in accelerating organoid adoption.

- For instance,Crown Bioscience, a global CRO, has developed a large-scale organoid biobank including over 500 patient-derived tumor organoid models, which it employs for high-throughput drug screening and contract research services on behalf of major pharmaceutical sponsors.

Segmentation:

By Type

- Tissue Derived Organoids

- Pluripotent Stem Cell-derived Organoids

By End User

- Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Academics and Research Institutes

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Biobank Organoids Market size was valued at USD 29.39 million in 2018 to USD 45.70 million in 2024 and is anticipated to reach USD 77.20 million by 2032, at a CAGR of 6.7% during the forecast period. North America accounted for 36.02% of the global market in 2024. The region leads due to its strong biotechnology and pharmaceutical industry presence, along with established biobanking infrastructure. It benefits from extensive funding support, research collaborations, and the early adoption of organoid-based technologies. The United States contributes significantly through its high-volume clinical trials and advanced precision medicine programs. Academic institutions and research hospitals collaborate with private firms to expand disease-specific organoid libraries. Regulatory support from agencies like the FDA encourages the use of innovative biological models in drug development. High awareness among healthcare professionals and access to skilled personnel further enhance market performance. The region continues to innovate in organoid storage, cryopreservation, and data integration.

Europe

The Europe Biobank Organoids Market size was valued at USD 23.00 million in 2018 to USD 38.09 million in 2024 and is anticipated to reach USD 69.86 million by 2032, at a CAGR of 7.9% during the forecast period. Europe represented 30.01% of the global market in 2024. It shows strong growth supported by government-backed research programs, particularly in countries like Germany, the UK, and the Netherlands. The region emphasizes ethical biobanking practices, transparent donor consent, and regulatory harmonization. Public health institutions and universities play a key role in establishing organoid biobanks for disease modeling. Pharmaceutical and biotech firms collaborate with EU-funded projects to develop standardized organoid systems. Europe’s rising focus on rare diseases and oncology research contributes to market demand. Infrastructure investments and technological upgrades support high-throughput organoid production. The region continues to expand its footprint in both academic and commercial applications.

Asia Pacific

The Asia Pacific Biobank Organoids Market size was valued at USD 17.12 million in 2018 to USD 27.87 million in 2024 and is anticipated to reach USD 50.00 million by 2032, at a CAGR of 7.6% during the forecast period. Asia Pacific accounted for 21.96% of the global market in 2024. The region is emerging rapidly due to growing investments in biotechnology, healthcare digitization, and life sciences R&D. China, Japan, and South Korea are the key contributors, driven by national initiatives in precision medicine. Public-private partnerships foster innovation and expand biobanking capabilities. Academic institutions are aligning with global research networks to promote standardization. Infrastructure development and international collaborations help integrate organoid models into diagnostic and therapeutic workflows. Pharmaceutical companies are increasingly exploring organoids for local disease modeling. It offers a favorable environment for customized solutions and regional disease studies.

Latin America

The Latin America Biobank Organoids Market size was valued at USD 5.42 million in 2018 to USD 8.23 million in 2024 and is anticipated to reach USD 13.46 million by 2032, at a CAGR of 6.3% during the forecast period. The region held a 6.49% share of the global market in 2024. It is witnessing gradual progress, supported by increased awareness and research initiatives in Brazil, Mexico, and Argentina. Biomedical institutions in the region are adopting organoid technologies for disease modeling and drug efficacy testing. Growth remains constrained by limited infrastructure and funding but is supported by international aid and academic partnerships. Research collaborations with North American and European institutions help build local expertise. It benefits from regional focus on infectious diseases and oncology, where organoids provide unique modeling capabilities. Regulatory reforms are slowly enabling ethical tissue collection and biobanking. Latin America is creating opportunities for long-term market growth through focused investment.

Middle East

The Middle East Biobank Organoids Market size was valued at USD 2.93 million in 2018 to USD 4.29 million in 2024 and is anticipated to reach USD 6.62 million by 2032, at a CAGR of 5.5% during the forecast period. The region represented 3.38% of the global market in 2024. It is gradually adopting biobanking and organoid technologies, supported by healthcare modernization programs in countries like the UAE and Saudi Arabia. Governments are investing in research parks and innovation hubs that foster life sciences growth. Medical universities are initiating biobank collaborations with international stakeholders. It shows potential in rare disease and genetic disorder research, given the region’s unique population genetics. Limited technical expertise and regulatory clarity remain challenges for broader adoption. However, partnerships with global biotech companies and academic exchanges are helping overcome capability gaps. The market is expected to grow with targeted initiatives and long-term policy planning.

Africa

The Africa Biobank Organoids Market size was valued at USD 2.05 million in 2018 to USD 2.70 million in 2024 and is anticipated to reach USD 3.44 million by 2032, at a CAGR of 3.0% during the forecast period. Africa accounted for 2.13% of the global market in 2024. The region is at a nascent stage, with limited infrastructure for organoid biobanking. It is gradually integrating organoid technologies through academic partnerships and donor-funded programs. South Africa remains the key hub due to its strong research base and international collaborations. Regional universities are exploring organoid models for infectious diseases and public health studies. It faces challenges in resource availability, training, and standardization. Policy frameworks for ethical biobanking are under development in several countries. International agencies play a pivotal role in capacity building. Africa holds long-term potential as biotechnology capabilities expand and regional research priorities evolve.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- HUB Organoids

- Central Máxima Organoid Bank

- Frankfurt Cancer Institute Organoid Biobank

- BiolVT

- Crown Bioscience

- Samsung Biologics

- Other Key Players

Competitive Analysis:

The Biobank Organoids Market exhibits a competitive landscape characterized by strategic acquisitions, technological advancements, and expanding service portfolios. Major players such as Merck KGaA, Crown Bioscience, and Thermo Fisher Scientific have strengthened their market positions through acquisitions and research collaborations. Merck KGaA expanded its capabilities by acquiring a leading organoid technology provider, while Crown Bioscience enhanced its clinical biospecimen access through the acquisition of a prominent biobank network. HUB Organoids has gained industry recognition for its innovation in patient-derived organoid platforms. Companies are focusing on expanding preclinical and personalized medicine applications by investing in organoid modeling and data integration. Academic institutions and contract research organizations also play a vital role in driving specialized research services. The Biobank Organoids Market continues to evolve through licensing deals, partnerships, and new service launches, creating a dynamic environment for both established players and emerging entrants seeking to differentiate through innovation and domain expertise.

Recent Developments:

- In January 2025, Merck KGaA completed the acquisition of HUB Organoids Holding B.V., strengthening its life science portfolio with proprietary organoid technology. The transaction closed on December 23, 2024 and grants Merck access to HUB’s patented platforms and service offerings, including new model generation, assay development, and high‑throughput screening.

Market Concentration & Characteristics:

The Biobank Organoids Market demonstrates a moderately consolidated structure dominated by a core group of multinational companies and specialized service providers. Leading firms hold significant market share by leveraging patented organoid technologies, global distribution networks, and advanced R&D capabilities. High entry barriers—stemming from technical complexity, regulatory standards, and capital intensity—limit widespread competition. The market favors players with proprietary organoid models and standardized biobanking protocols. It is shaped by strategic licensing agreements, collaborative research initiatives, and selective acquisitions aimed at expanding model diversity and application range. Service differentiation, intellectual property, and regulatory compliance define competitive advantage. While innovation remains a key growth factor, trust, quality, and scalability are critical to market leadership. The Biobank Organoids Market maintains a balance between academic innovation and commercial scalability.

Report Coverage:

The research report offers an in-depth analysis based on Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for patient-derived organoids is expected to rise with the expansion of precision medicine programs.

- Technological advancements will improve organoid scalability, viability, and storage protocols.

- Pharmaceutical companies will increasingly integrate organoid biobanks into drug discovery workflows.

- Regulatory bodies may introduce more defined frameworks to standardize biobanking practices.

- Strategic collaborations between academic institutions and biotech firms will accelerate innovation.

- Emerging economies are likely to invest in localized organoid research and infrastructure.

- AI integration will enhance organoid data analysis, improving predictive modeling capabilities.

- Rare disease and oncology research will drive niche applications and customized model development.

- Commercial biobanks are expected to expand their service portfolios to include high-throughput organoid production.

- Ethical sourcing, donor consent, and transparency will remain essential for market credibility and expansion.