Market Overview

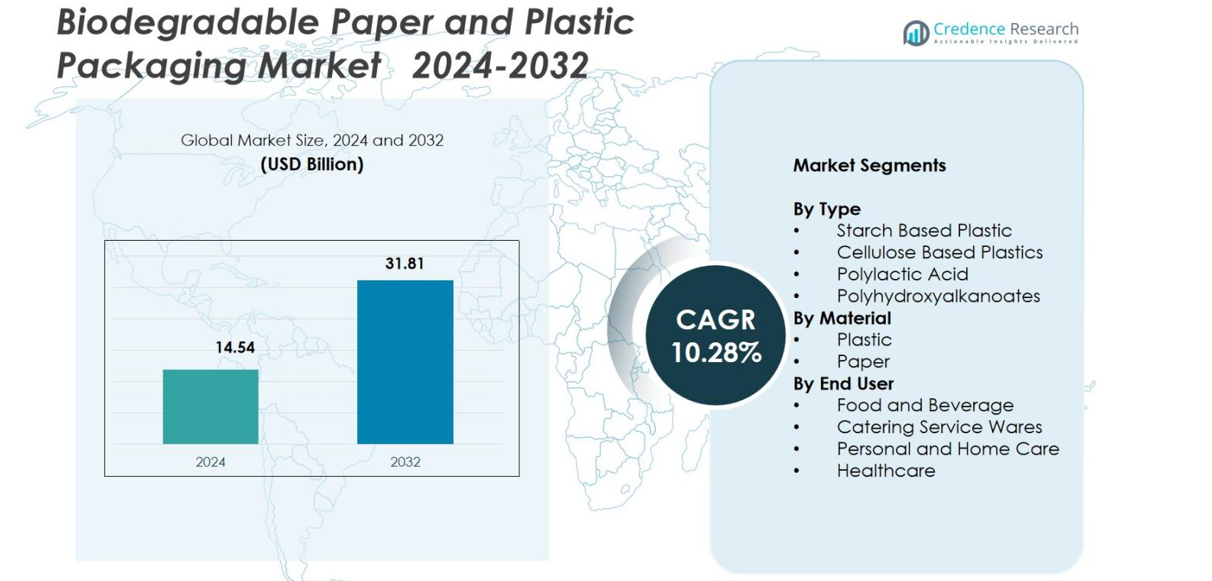

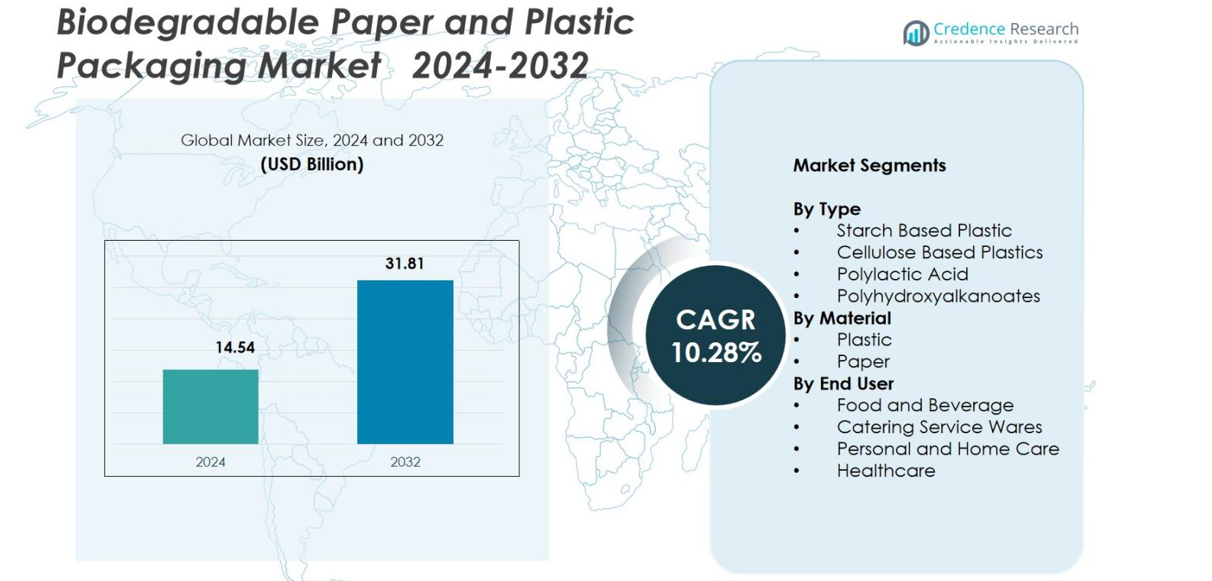

Biodegradable Paper and Plastic Packaging Market size was valued at USD 14.54 Billion in 2024 and is anticipated to reach USD 31.81 Billion by 2032, at a CAGR of 10.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biodegradable Paper and Plastic Packaging Market Size 2024 |

USD 14.54 Billion |

| Biodegradable Paper and Plastic Packaging Market, CAGR |

10.28% |

| Biodegradable Paper and Plastic Packaging Market Size 2032 |

USD 31.81 Billion |

Biodegradable Paper and Plastic Packaging Market features strong participation from global sustainability-focused packaging manufacturers, with Amcor plc, Mondi Group, Tetra Pak International SA, Kruger Inc., SmartSolve Industries, Ultra Green Sustainable Packaging, Eurocell S.r.l., and Hosgör Plastik emerging as prominent players driving innovation in fiber-based and compostable materials. Europe led the market in 2024 with a 35.7% share, supported by stringent environmental regulations and advanced recycling and composting infrastructure. North America followed with a 28.4% share, driven by expanding foodservice and e-commerce demand, while Asia-Pacific accounted for 27.1% due to rapid regulatory reforms and rising consumer interest in sustainable packaging.

Market Insights

- The Biodegradable Paper and Plastic Packaging Market was valued at USD 14.54 Billion in 2024 and is projected to reach USD 31.81 Billion by 2032, advancing at a CAGR of 10.28%.

- Growing regulatory pressure to phase out single-use plastics and rising adoption across food and beverage applications, which held the largest segment share at 44.9% in 2024, strongly drive market expansion.

- Increasing demand for compostable and fiber-based materials, along with innovations in PLA, PHA, and coated paper technologies, shapes key market trends as brands prioritize sustainability-focused packaging formats.

- Key players, including Amcor plc, Mondi Group, Tetra Pak, Kruger Inc., and SmartSolve Industries, enhance market competitiveness by investing in biodegradable polymers, molded fiber solutions, and recyclable paper packaging developments.

- Europe led the market with a 35.7% regional share in 2024, followed by North America at 28.4% and Asia-Pacific at 27.1%, reflecting strong regulatory support, advanced infrastructure, and rising consumer preference for sustainable packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

In the Biodegradable Paper and Plastic Packaging market, starch-based plastic dominated the segment with a 38.2% share in 2024, driven by its low cost, easy processability, and strong alignment with compostability regulations. Its adoption accelerates across single-use items, flexible packaging, and food-contact applications. Polylactic acid (PLA) and cellulose-based plastics are also gaining traction due to renewable sourcing and improved performance characteristics, while polyhydroxyalkanoates (PHA) expands in premium niches requiring high biodegradability, particularly in marine and medical environments.

- For instance, NatureWorks’ Ingeo PLA portfolio, produced at 150,000 metric tons per year with an additional 75,000-ton PLA plant under construction in Thailand, is widely deployed in compostable coffee capsules, flexible films, and food-service packaging, including new grades such as Ingeo Extend 4950D for coffee capsules and single-portion packets.

By Material

Paper remained the leading material category with a 56.7% market share in 2024, supported by expanding demand for recyclable, fiber-based packaging and global restrictions on single-use plastics. Its cost efficiency, strong printability, and suitability for foodservice, e-commerce, and retail applications reinforce its dominance. Biodegradable plastics continue to grow but face higher production costs and performance trade-offs, prompting innovation in coated paper, high-barrier fiber materials, and molded pulp solutions that further enhance uptake across major industries.

- For instance, Mondi introduced its FunctionalBarrier paper range, a recyclable high-barrier paper designed for dry foods, frozen items, and consumer goods.

By End User

The food and beverage sector led the end-user segment with a 44.9% share in 2024, driven by rising adoption of compostable trays, wrappers, containers, and takeaway packaging aligned with sustainability mandates. Catering service wares also show strong momentum as restaurants and cloud kitchens transition to eco-conscious disposables. Personal and home care brands increasingly adopt biodegradable pouches and fiber-based bottles, while healthcare applications expand with sterile, bio-based packaging formats that reduce medical waste, collectively strengthening demand across diverse end-use industries.

Key Growth Drivers

Rapid Regulatory Enforcement and Phase-Out of Single-Use Plastics

Governments worldwide are accelerating bans, taxes, and extended producer responsibility (EPR) mandates that restrict traditional petroleum-based plastics, significantly boosting adoption of biodegradable paper and plastic packaging. These policies push manufacturers, retailers, and foodservice operators to transition toward compostable, recyclable, and fiber-based alternatives. The EU Single-Use Plastics Directive, India’s single-use plastic ban, and U.S. state-level compostability rules drive large-scale packaging redesigns. Companies invest in certified materials, eco-labeling, and sustainable sourcing to remain compliant. As countries strengthen circular-economy frameworks and carbon-reduction targets, stringent regulatory pressure continues to anchor long-term demand for biodegradable packaging across FMCG, food delivery, e-commerce, and retail ecosystems.

- For instance, India’s nationwide ban on selects single-use plastics in July 2022, FMCG players and quick-service restaurants switched to molded fiber trays, paper cups, and compostable bags, with several states enforcing strict compliance checks on manufacturers and distributors.

Rising Consumer Demand for Sustainable and Eco-Conscious Packaging

Growing environmental awareness among consumers remains a decisive driver for biodegradable packaging adoption. Shoppers increasingly link sustainable packaging to brand responsibility, product quality, and environmental stewardship, compelling FMCG and retail companies to replace conventional plastics with biodegradable alternatives. Younger demographics especially millennials and Gen Z prefer packaging made from renewable sources such as PLA, starch blends, cellulose fibers, and recycled paper. This shift is most visible in food delivery, organic foods, cosmetics, and premium personal care segments where sustainability strongly influences purchase decisions. Brands enhance customer loyalty by promoting compostable, recyclable, and bio-based packaging. As ESG-aligned purchasing behavior expands globally, consumer-driven demand significantly strengthens market growth.

- For instance, L’Oréal introduced its paper-based cosmetic tubes developed with Albéa, replacing a significant portion of plastic with responsibly sourced fiber material directly responding to rising consumer preference for low-carbon, bio-based packaging.

Technological Advancements in Biodegradable Materials and Processing

Innovations in material science and processing technologies are drastically improving the performance, durability, and commercial viability of biodegradable packaging. Breakthroughs in coated paper barriers, multilayer compostable films, nanocellulose coatings, enhanced PLA blends, and PHA fermentation systems are enabling biodegradable materials to replace petroleum-based plastics in high-barrier applications. These advancements enhance moisture resistance, heat stability, and mechanical strength, expanding use in refrigerated items, foodservice wares, healthcare disposables, and personal care packaging. Upgraded manufacturing processes reduce costs, increase throughput, and support mass adoption. Certification systems, lifecycle assessment tools, and eco-design guidelines streamline regulatory compliance. As R&D investments accelerate, technological progress continues unlocking new market opportunities.

Key Trends & Opportunities

Acceleration of Circular Economy Integration and Composting Infrastructure

A major trend reshaping the biodegradable packaging market is the rapid expansion of circular economy frameworks that emphasize material recovery, composting, and renewable feedstock adoption. Governments and private companies are investing in municipal composting plants, organic waste collection, and closed-loop recycling systems, making biodegradable packaging more practical and scalable. Foodservice chains and retailers increasingly deploy compostable service ware, molded fiber trays, and collection programs for in-store waste. Collaborations among waste-management firms, polymer producers, and sustainability initiatives accelerate infrastructure growth. As circular systems mature, biodegradable packaging becomes more accessible, cost-efficient, and aligned with global sustainability goals, creating major long-term opportunities.

- For instance, Starbucks expanded its circular pilot programs by introducing compostable cups and establishing in-store cup-collection systems in select North American and European cities, working with local composters to ensure certified materials enter proper processing facilities.

Expansion of Premium Fiber-Based and High-Barrier Biodegradable Solutions

The market presents strong opportunities in advanced biodegradable solutions that match or exceed the barrier properties of traditional plastics. High-performance coated papers, plant-based laminates, nanocellulose films, and hybrid bio-polymers support oxygen, grease, and moisture resistance, enabling adoption in premium food items, beverages, cosmetics, and pharmaceuticals. Molded fiber packaging is replacing rigid plastics in electronics, luxury goods, and personal care due to its premium aesthetics and strong sustainability appeal. As brands seek visually distinctive, high-barrier packaging that enhances eco-conscious branding, suppliers developing specialty fibers, coated paper technologies, and compostable laminates are positioned to capitalize on these emerging opportunities.

- For instance, Stora Enso commercialized MFC (microfibrillated cellulose) barrier papers that provide enhanced grease and oxygen resistance, supporting applications in confectionery, snack packaging, and dry foods previously dominated by plastic laminates.

Key Challenges

High Production Costs and Limited Economies of Scale

Despite rising demand, biodegradable packaging materials remain significantly more expensive to produce than conventional plastics. Biopolymers like PLA and PHA require specialized fermentation or polymerization processes, while high-barrier coated papers incur additional processing costs. Limited large-scale manufacturing capacity prevents economies of scale, making biodegradable options challenging for low-margin industries and small businesses. Rising raw material prices, energy usage in processing, and certification requirements further elevate costs. These pricing constraints slow adoption in mass foodservice and in developing markets. Until manufacturing capacity expands and production costs decline, affordability will remain a major barrier to widespread deployment.

Inadequate Composting and Recycling Infrastructure in Many Regions

A critical challenge hindering the full potential of biodegradable packaging is the lack of adequate industrial composting, material segregation systems, and standardized disposal pathways. Many biodegradable and compostable materials require controlled conditions to degrade efficiently, yet several regions lack certified composting facilities or municipal organic-waste programs. Misclassification of materials such as confusion between biodegradable, recyclable, and compostable formats leads to improper disposal, contamination of recycling streams, and reduced environmental benefit. Without stronger waste-management reforms, consumer education, and infrastructure investment, biodegradable packaging cannot achieve optimal performance, limiting adoption across global markets.

Regional Analysis

North America

North America held a 28.4% share in 2024, driven by strong regulatory actions, rising consumer preference for sustainable packaging, and rapid adoption across foodservice, e-commerce, and personal care industries. The U.S. market leads due to state-level compostability mandates, brand commitments to plastic reduction, and expanding biopolymer manufacturing capacity. Growth is further supported by corporate ESG initiatives and increasing availability of certified compostable packaging. Canada’s national waste-reduction policies also accelerate adoption, while expanding municipal composting infrastructure enhances feasibility for large-scale biodegradable packaging deployment across multiple sectors.

Europe

Europe dominated the global market with a 35.7% share in 2024, supported by stringent EU regulations, advanced recycling systems, and widespread consumer acceptance of sustainable materials. The region’s leadership stems from the Single-Use Plastics Directive, circular-economy initiatives, and strong demand from food and beverage brands shifting to fiber-based and compostable formats. Countries such as Germany, France, Italy, and the Netherlands exhibit high adoption rates due to well-developed composting networks and industry collaborations. Continuous investment in bio-based polymers and coated paper technologies reinforces Europe’s position as the primary hub for biodegradable packaging innovation.

Asia-Pacific

Asia-Pacific accounted for a 27.1% share in 2024, driven by rapid urbanization, government bans on single-use plastics, and expanding food delivery and retail sectors. China, India, Japan, and South Korea are key markets adopting biodegradable packaging to address waste-management pressures and environmental concerns. India’s nationwide plastic ban and China’s aggressive phase-out policies significantly accelerate market growth. Strong manufacturing capabilities, rising consumer awareness, and increasing foreign investments in biopolymer production support regional expansion. The booming e-commerce ecosystem further increases demand for biodegradable alternatives in flexible packaging, molded fiber solutions, and foodservice disposables.

Latin America

Latin America captured a 5.8% market share in 2024, with growth driven by rising sustainability awareness, expanding foodservice industries, and government-led restrictions on single-use plastic items. Brazil, Mexico, and Chile lead adoption as retailers and FMCG companies transition toward compostable bags, molded fiber containers, and paper-based packaging. Infrastructure limitations slow large-scale deployment, yet increasing investment in recycling and composting facilities helps unlock future opportunities. Regional consumers increasingly prefer eco-friendly products, prompting manufacturers to explore cost-effective biodegradable materials suited to local markets and environmental regulations.

Middle East & Africa

The Middle East & Africa region held a 3.0% share in 2024, characterized by evolving regulatory frameworks, emerging sustainability initiatives, and growing interest in reducing plastic pollution. The UAE, Saudi Arabia, and South Africa spearhead adoption through bans on non-biodegradable bags and initiatives promoting compostable and recyclable packaging. While infrastructure gaps remain, rising environmental concerns and national waste-reduction strategies stimulate demand. The retail, hospitality, and foodservice sectors increasingly integrate biodegradable packaging, while partnerships with international material suppliers help expand availability of premium fiber-based and bio-based plastics across the region.

Market Segmentations

By Type

- Starch Based Plastic

- Cellulose Based Plastics

- Polylactic Acid

- Polyhydroxyalkanoates

By Material

By End User

- Food and Beverage

- Catering Service Wares

- Personal and Home Care

- Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Biodegradable Paper and Plastic Packaging market is characterized by strong participation from global packaging manufacturers, biopolymer producers, and fiber-based material innovators focused on expanding sustainable product portfolios. Key players such as Amcor plc, Mondi Group, Tetra Pak International SA, Kruger Inc., SmartSolve Industries, Ultra Green Sustainable Packaging, Eurocell S.r.l., and Hosgör Plastik actively invest in advanced biodegradable materials, coated paper technologies, and high-barrier compostable films to meet rising regulatory and consumer demands. Companies prioritize R&D to enhance performance attributes, reduce production costs, and offer scalable, eco-friendly alternatives for foodservice, e-commerce, personal care, and retail sectors. Strategic partnerships, capacity expansions, and certifications such as industrial compostability and recyclable fiber-grade validation strengthen market positioning. Growing competition encourages innovation in starch-based plastics, PLA, PHA, molded fiber solutions, and recyclable paper formats, enabling suppliers to address diverse application requirements and differentiate through sustainability-driven value propositions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SmartSolve Industries

- Mondi

- Eurocell S.r.l

- Amcor PLC

- Riverside Paper Co. Inc.

- Ultra Green Sustainable Packaging

- Özsoy Plastik

- Kruger Inc.

- Hosgör Plastik

- Tetra Pak International SA

Recent Developments

- In September 2025, Xampla (UK) raised USD 14 million to scale its plant-protein-derived biodegradable alternatives to single-use plastics including packaging linings, films and sachets.

- In August 2025, BioPak acquired Queensland-based eco-friendly packaging supplier Bygreen, expanding its sustainable packaging offerings including biodegradable paper straws and compostable packaging.

- In March 2025, Green Lab a Southeast Asia based sustainable packaging company officially entered the U.S. market with its FSC-certified 100% recycled paper bags and biodegradable food packaging.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as global policies increasingly restrict single-use plastics and promote sustainable packaging adoption.

- Advances in PLA, PHA, and high-barrier coated paper technologies will broaden functional applications across industries.

- Food and beverage, e-commerce, and personal care sectors will intensify their shift toward biodegradable packaging solutions.

- Larger production capacities and process optimization will help reduce manufacturing costs over time.

- Expansion of composting and recycling infrastructure will improve end-of-life management and market feasibility.

- Companies will focus on eco-design, lightweight materials, and circular packaging strategies to meet ESG goals.

- Strategic collaborations among material developers, converters, and FMCG brands will accelerate innovation and adoption.

- Consumer demand for compostable, fiber-based, and renewable packaging formats will influence packaging choices.

- Asia-Pacific will record strong growth due to regulatory reforms, sustainability programs, and urban consumption patterns.

- Emerging hybrid bio-materials and premium molded fiber solutions will create new opportunities in high-value packaging segments.