Market Overview

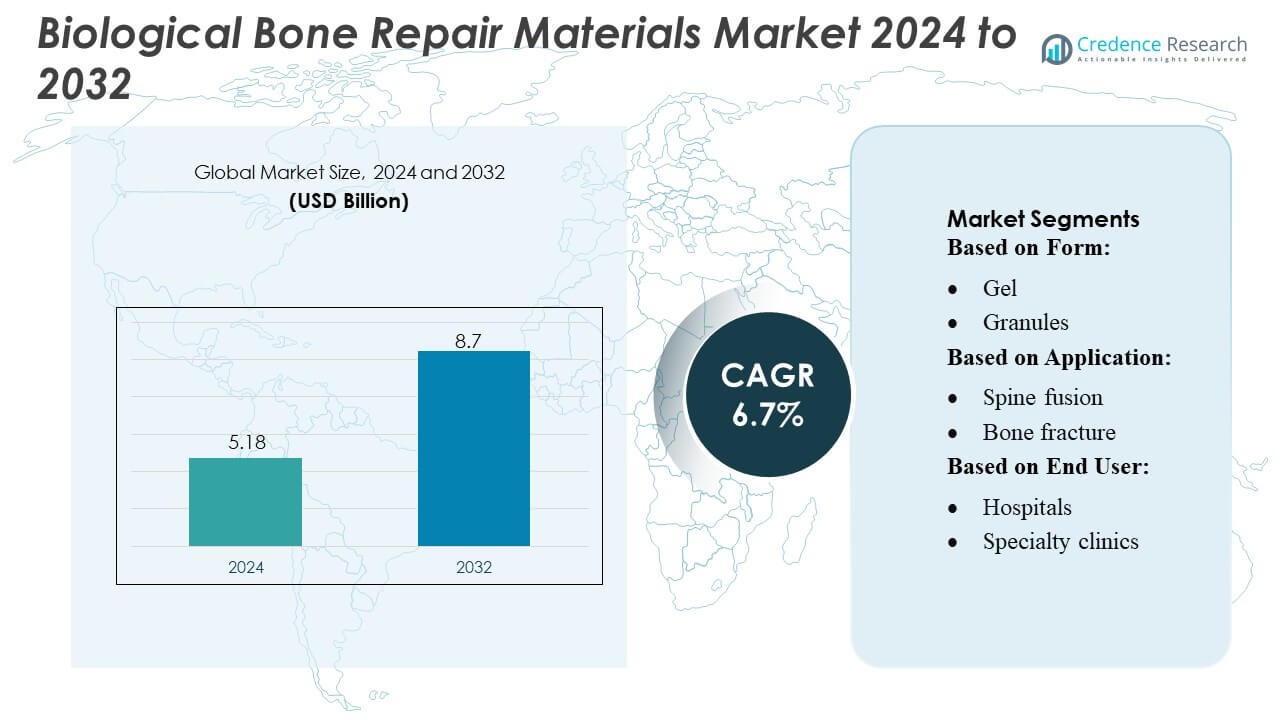

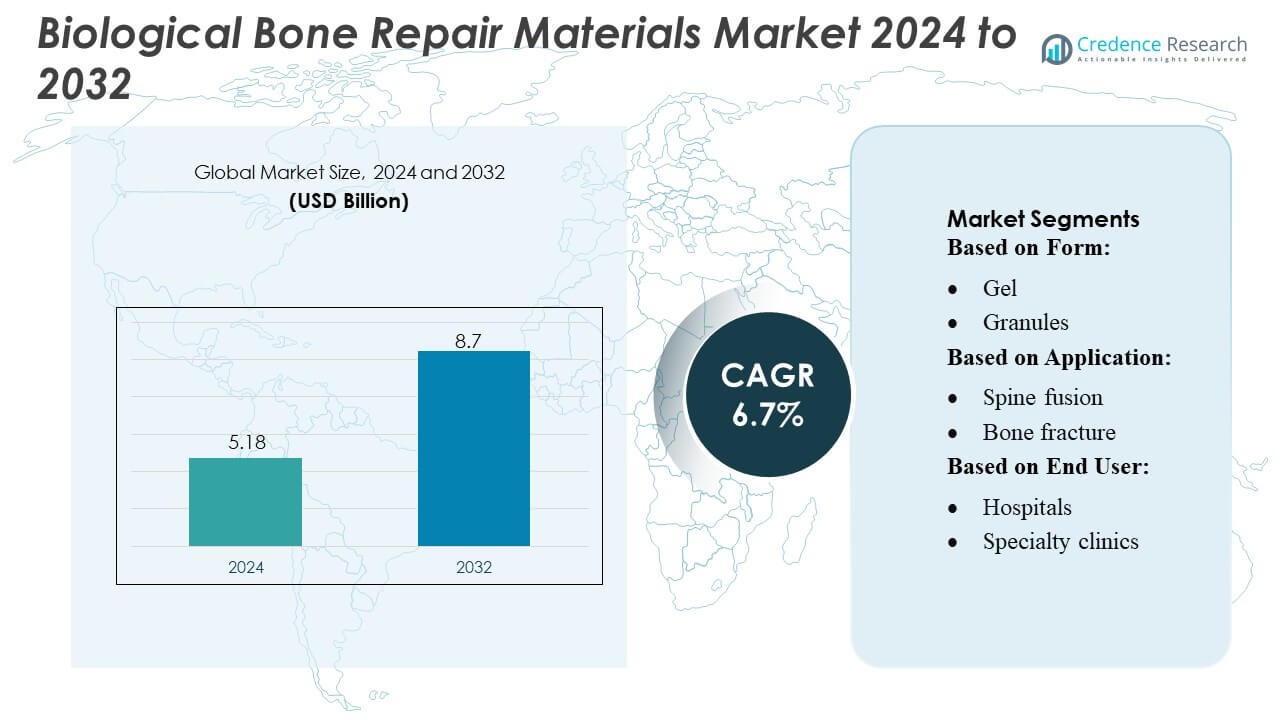

Biological Bone Repair Materials Market size was valued USD 5.18 billion in 2024 and is anticipated to reach USD 8.7 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biological Bone Repair Materials Market Size 2024 |

USD 5.18 Billion |

| Biological Bone Repair Materials Market, CAGR |

6.7% |

| Biological Bone Repair Materials Market Size 2032 |

USD 8.7 Billion |

The Biological Bone Repair Materials Market is driven by strong participation from top players, including Invibo Ltd., Zimmer Biomet, AdvanSource, Matexcel, Globus Medical, Evonik Industries AG, Exactech Inc., Stryker Corp, DSM Biomedical, and Depuy Synthes Inc., each contributing to advancements in biologics, synthetic grafts, and regenerative technologies. These companies compete through expanded product portfolios, clinical evidence generation, and strategic collaborations that enhance adoption across orthopedic and trauma settings. North America leads the global market with approximately 36–38% share, supported by advanced healthcare infrastructure, high orthopedic procedural volume, and strong penetration of next-generation biologic repair materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Biological Bone Repair Materials Market was valued at USD 5.18 billion in 2024 and is projected to reach USD 8.7 billion by 2032, registering a CAGR of 6.7% during the forecast period.

- Rising demand for advanced biologics, increased orthopedic surgeries, and strong adoption of injectable and putty-based grafts drive market expansion across trauma, spine fusion, and joint reconstruction procedures.

- Growing preference for synthetic and bioactive substitutes, along with advancements in regenerative scaffolds and minimally invasive treatment techniques, shapes emerging market trends.

- Intense competition prevails as leading companies expand portfolios, form collaborations, and strengthen clinical validation, while cost constraints and limited reimbursement in developing regions act as key restraints.

- North America leads with 36–38% share, followed by Europe at around 28–30% and Asia-Pacific at 24–26%, while the spine fusion segment holds the dominant share across applications due to high procedural volume and growing use of biologically enhanced repair materials.

Market Segmentation Analysis:

By Form

Gel dominates the Biological Bone Repair Materials Market with an estimated 32–34% share, driven by its excellent moldability, rapid cell adhesion, and suitability for minimally invasive orthopedic and dental procedures. Its ease of application and strong regenerative efficacy support broad clinical usage across fracture care and spine interventions. Granules follow closely due to their high osteoconductivity and long-standing acceptance in trauma and reconstructive surgeries. Paste/injectable formats continue gaining traction with rising demand for precise delivery in complex defects, while putty and other forms serve niche cases requiring tailored viscosity and structural support.

- For instance, Bioactive glass granules based on formulations such as Bioactive glass S53P4 have been shown to inhibit the growth of up to 50 clinically relevant bacterial strains while promoting osteostimulation and bone bonding — underlining why granular forms remain a trusted choice for bone defect filling and reconstructive use.

By Application

Bone fracture repair remains the leading application segment, capturing 35–38% share, supported by the global rise in trauma cases, sports injuries, and age-related fragility fractures. Surgeons prefer biological materials in this segment due to their ability to accelerate healing while reducing revision surgery rates. Spine fusion represents another rapidly expanding area, driven by escalating degenerative spine disorders and wider adoption of bioactive graft substitutes. Joint reconstruction and dental/CMF surgery segments benefit from expanding procedural volumes, improved biomaterial integration, and increasing preference for natural bone regeneration over synthetic implants across elective and reconstructive interventions.

- For instance, Zimmer Biomet’s genex® Bone Graft Substitute — distributed globally — is delivered via a closed-mixing system that is reported to prepare 2 times faster than traditional open-mix methods, and becomes drillable just 15 minutes after mixing; this speed and convenience help surgeons respond promptly in fracture-repair settings.

By End User

Hospitals dominate the end-user landscape with 40–42% share, driven by high patient inflow, advanced surgical infrastructure, and greater access to complex orthopedic, trauma, and spine procedures requiring biological repair materials. Their ability to integrate imaging, diagnostics, and multidisciplinary teams strengthens adoption across major surgeries. Specialty clinics show growing demand as outpatient orthopedic and dental reconstruction procedures rise. Ambulatory surgical centers expand steadily with increasing preference for minimally invasive, same-day surgeries using injectable and gel-based biomaterials, while other end users contribute through emerging point-of-care orthopedic and maxillofacial services.

Key Growth Drivers

1. Rising Global Burden of Orthopedic Injuries and Degenerative Disorders

Growing incidence of fractures, trauma cases, osteoporosis, and age-related degenerative bone conditions significantly drives demand for biological bone repair materials. As elderly populations expand globally, the need for advanced bone regeneration solutions increases across trauma, spine, and joint reconstruction procedures. Surgeons increasingly prefer biologically active substitutes that shorten healing time and reduce revision rates. This surge in orthopedic interventions, combined with enhanced access to advanced care in emerging economies, positions biological grafts and biomaterials as essential components within modern musculoskeletal treatment pathways.

- For instance, AdvanSource’s worldwide there are an estimated 2.2 million bone graft procedures annually, which underscores the global scale of demand for bone repair materials.

2. Advancements in Regenerative Medicine and Tissue Engineering

Rapid improvements in bioactive materials, stem cell–based constructs, and growth factor–enhanced grafts strengthen market adoption by improving fusion success, osteointegration, and recovery outcomes. Manufacturers invest heavily in next-generation biomimetic scaffolds that replicate natural bone behavior, offering superior healing performance over synthetic alternatives. These advancements support complex reconstructive procedures and help clinicians manage large bone defects more efficiently. As clinical evidence validating regenerative approaches grows, healthcare providers increasingly integrate biologically enriched graft substitutes into standard orthopedic, dental, and spine fusion protocols.

- For instance, Matexcel’s natural-polymer hydrogel platform supports creation of scaffolds based on materials such as collagen, gelatin, hyaluronic acid, alginate, or chitosan — allowing flexible tuning of scaffold mechanical stiffness from soft tissue-like values (< 1 kPa) up to pre-bone tissue stiffness (> 30 kPa), thus enabling design of hydrogels across a wide biomechanical range.

3. Shift Toward Minimally Invasive and Outpatient Orthopedic Procedures

The market benefits from the global shift toward minimally invasive surgeries that require injectable, moldable, and fast-setting biological bone repair materials. Hospitals and ambulatory surgical centers prefer these formats because they reduce operating time, minimize complications, and support quicker patient recovery. Rising adoption of outpatient orthopedic and dental reconstruction procedures amplifies demand for easy-to-use biomaterials compatible with small-incision techniques. This trend is reinforced by technological innovations that enhance handling properties, promote targeted regeneration, and expand the use of biological substitutes in day-care surgical environments.

Key Trends & Opportunities

1. Growing Integration of 3D-Printed and Customized Bone Graft Solutions

3D printing enables patient-specific graft designs that match anatomical defects with high precision, creating strong opportunities for personalized bone regeneration. Manufacturers increasingly explore bioresorbable and hybrid scaffolds that support vascularization and cell proliferation, improving long-term outcomes in trauma, CMF, and orthopedic reconstruction. As regulatory pathways become clearer and additive manufacturing technologies mature, customized biological grafts are expected to become a core offering, particularly in complex cases where standard graft shapes are insufficient.

- For instance, Evonik has recently partnered with BellaSeno to commercialize 3D-printed, fully resorbable scaffolds for bone regeneration — manufactured using Evonik’s RESOMER® polymers — tailored to patient-specific bone defects.

2. Increasing Use of Allografts and Xenografts in High-Volume Procedures

The expansion of bone banks, improved sterilization technologies, and enhanced biomaterial processing techniques have strengthened confidence in allografts and xenografts. Their availability, cost efficiency, and consistent performance create opportunities, especially in markets facing limited autograft supply. Demand rises across spine fusion, hip revision, and dental reconstruction procedures where biologically active, ready-to-use materials reduce surgical burden. The scalability of donor-derived biomaterials positions them as a strategic growth segment in both developed and emerging healthcare systems.

- For instance, Globus Medical’s 3D-printed titanium interbody spacer system — HEDRON IA — was used in a minimally invasive anterior lumbar interbody fusion (ALIF) procedure as the first commercially available 3D-printed ALIF spacer with integrated anchor technology.

3. Expansion of Biological Repair Materials in Dental and CMF Applications

Rapid growth in implant dentistry, orthodontic corrections, and cranio-maxillofacial reconstruction presents strong opportunities for biological bone repair materials. Surgeons prefer bioactive substitutes for socket preservation, sinus lifts, and jaw defect reconstruction due to their superior osteoconductivity and ease of shaping. Rising cosmetic dentistry demand, combined with growing procedural volumes across Asia and Latin America, accelerates adoption. Continuous development of small-defect grafts and specialized dental biomaterials reinforces market penetration in this high-potential segment.

Key Challenges

1. High Cost and Limited Reimbursement Coverage

Biological bone repair materials often carry higher costs than synthetic grafts, making them less accessible in cost-sensitive markets and underfunded healthcare systems. Reimbursement policies remain inconsistent across countries, particularly for advanced regenerative solutions incorporating growth factors or stem cell technologies. Hospitals and clinics face financial pressure when adopting premium products, slowing wider penetration. This economic barrier particularly impacts outpatient and dental settings where out-of-pocket expenditure is high, restraining uptake despite strong clinical effectiveness.

2. Regulatory Complexities and Quality Variability Across Biomaterials

Strict regulatory requirements for biological products, donor-derived materials, and growth factor–enhanced grafts create long approval timelines and increase development costs. Quality and performance variability across allografts, xenografts, and bioengineered substitutes can affect surgeon confidence, especially in markets with less robust certification frameworks. Ensuring sterility, biocompatibility, and long-term safety adds operational challenges for manufacturers. These complexities slow product innovation cycles and limit rapid commercialization of new-generation regenerative materials.

Regional Analysis

North America

North America holds the largest share of approximately 36–38%, supported by advanced orthopedic care infrastructure, strong reimbursement frameworks, and high adoption of biologics across spinal fusion, trauma repair, and joint reconstruction procedures. The region benefits from a high prevalence of osteoporosis and sports-related fractures, along with strong penetration of allografts, demineralized bone matrices, and cellular bone matrices. Continuous product innovation by domestic manufacturers and rising investments in next-generation regenerative materials support sustained demand. Hospitals and specialty orthopedic centers drive most of the consumption, reinforced by early regulatory approvals and robust clinical evidence for biologically enhanced bone repair solutions.

Europe

Europe accounts for roughly 28–30% of the market, driven by its established clinical protocols for biologics, expanding geriatric population, and strong orthopedic procedural volume across Germany, the U.K., France, and Italy. Adoption improves as public health systems increasingly integrate bioactive grafts and synthetic bone substitutes to reduce revision surgeries and accelerate recovery outcomes. High research activity in biomaterials, supported by EU-funded regenerative medicine programs, strengthens the regional ecosystem. Hospitals remain the primary end users, with growing demand for advanced granules, putty, and injectable formulations aligned with minimally invasive surgical approaches across fracture repair and musculoskeletal reconstruction.

Asia-Pacific

Asia-Pacific captures around 24–26% of the global market and represents the fastest-growing region due to rising trauma incidence, expanding healthcare infrastructure, and increasing access to specialized orthopedic care in China, India, Japan, and South Korea. The region’s demand strengthens as aging populations and active lifestyle injuries fuel surgical interventions requiring biologic grafts and substitutes. International manufacturers expand their presence through partnerships and localized production, making cost-effective regenerative materials more accessible. Advancements in spine surgery volumes, rising medical tourism, and improving clinician awareness of biologically enhanced repair techniques accelerate the adoption of granules, putty, and injectable formats across hospitals and specialty clinics.

Latin America

Latin America holds nearly 6–7% share, supported by steady improvements in trauma care, growing private hospital investments, and rising surgical volumes in Brazil, Mexico, and Argentina. Although budget constraints limit widespread access to premium biologics, the market gradually expands through cost-optimized allografts and synthetic bone substitutes that reduce dependence on autografts. Increased orthopedic training programs and collaboration with global suppliers improve the adoption of advanced injectable and putty-based bone repair materials. As healthcare modernization accelerates, the region shows growing interest in regenerative therapies that shorten recovery time, particularly within private orthopedic and sports medicine facilities.

Middle East & Africa

The Middle East & Africa region represents approximately 4–5% of the market, driven by expanding specialty orthopedic centers, higher investment in trauma care, and growing medical tourism in the Gulf countries. Adoption of biologic grafts and substitutes increases as hospitals upgrade capabilities for complex fracture repair and spine procedures. However, limited reimbursement coverage and cost sensitivity constrain rapid penetration of advanced cellular bone matrices. Growth remains strongest in the UAE, Saudi Arabia, and South Africa, where private healthcare providers prioritize modern biomaterials that deliver faster healing outcomes and support minimally invasive surgical workflows.

Market Segmentations:

By Form:

By Application:

- Spine fusion

- Bone fracture

By End User:

- Hospitals

- Specialty clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Biological Bone Repair Materials Market remains moderately consolidated, with leading companies such as Invibo Ltd., Zimmer Biomet, AdvanSource, Matexcel, Globus Medical, Evonik Industries AG, Exactech Inc., Stryker Corp, DSM Biomedical, and Depuy Synthes Inc. the Biological Bone Repair Materials Market is defined by continuous innovation in biomaterials, strong clinical research activity, and expanding product portfolios focused on faster healing outcomes and reduced complications. Companies increasingly invest in advanced regenerative technologies such as bioactive ceramics, demineralized bone matrices, and highly engineered injectable grafts to meet rising demand in orthopedic trauma, spine fusion, and joint reconstruction. Competition intensifies as manufacturers enhance manufacturing capabilities, pursue regulatory approvals across multiple regions, and strengthen surgeon training programs to support adoption. Strategic collaborations, mergers, and targeted R&D pipelines remain central to improving product differentiation, clinical efficacy, and global market reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Invibo Ltd.

- Zimmer Biomet

- AdvanSource

- Matexcel

- Globus Medical

- Evonik Industries AG

- Exactech, Inc.

- Stryker Corp

- DSM Biomedical

- Depuy Synthes Inc.

Recent Developments

- In January 2025, UPL Corp announced the U.S. EPA’s registration of ATROFORCE™ bionematicide, a new seed treatment for cotton. This treatment uses a patented strain of Trichoderma atroviride to protect against nematodes, which can damage plant roots, cause yield loss, and make crops more vulnerable to other stresses.

- In September 2024, Indigo Ag’s CLIPS™ device, launched, is an automatic, hands-free system for applying dry powder biologicals directly into a seed box, simplifying the seed treatment process and making it more efficient.

- In February 2024, TETROUS, INC., a regenerative medicine company, launched EnFix TAC to its product portfolio of EnFix demineralized bone allograft implants designed specifically for rotator cuff repair surgeries.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biologically advanced grafts will rise as orthopedic procedures increase across aging and active populations.

- Adoption of minimally invasive surgeries will accelerate the use of injectable and moldable bone repair formulations.

- Synthetic and bioactive substitutes will gain stronger penetration as healthcare systems reduce reliance on autografts and allografts.

- Regenerative technologies using growth factors and stem-cell–based scaffolds will expand clinical applications.

- Hospitals and specialty orthopedic centers will continue to drive procurement of next-generation bone repair materials.

- Surgeons will increasingly prefer materials offering faster osteointegration and reduced recovery timelines.

- Technological advancements will enhance customization of bone graft substitutes for complex defects.

- Emerging markets will show rapid adoption due to improved healthcare infrastructure and rising trauma cases.

- Strategic partnerships between biomaterial developers and orthopedic device companies will intensify.

- Regulatory approvals and supportive clinical evidence will strengthen global market expansion.