Market Overview:

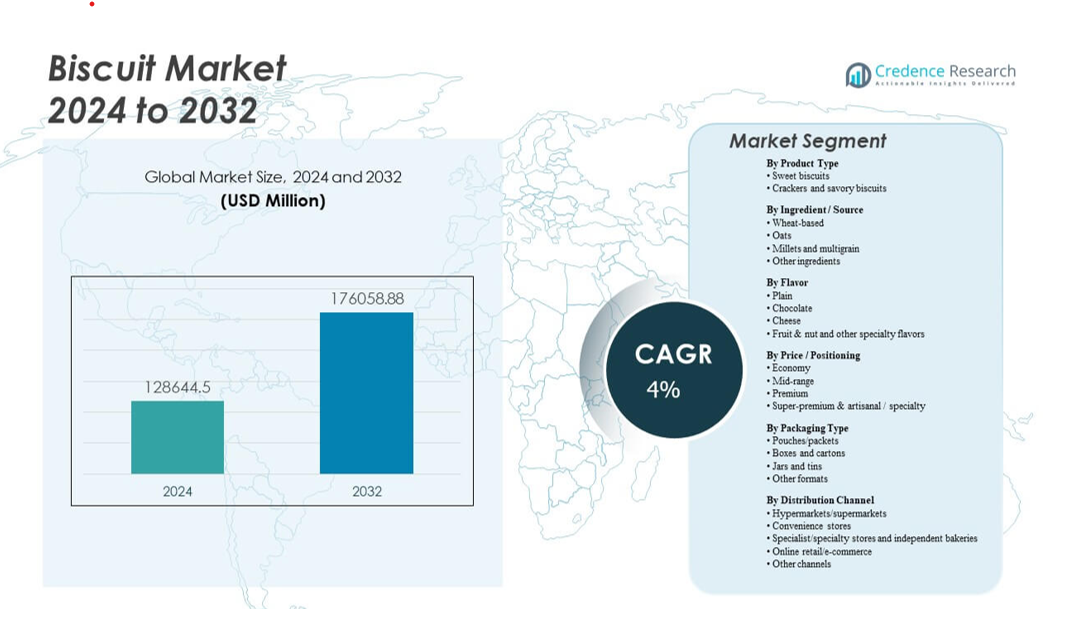

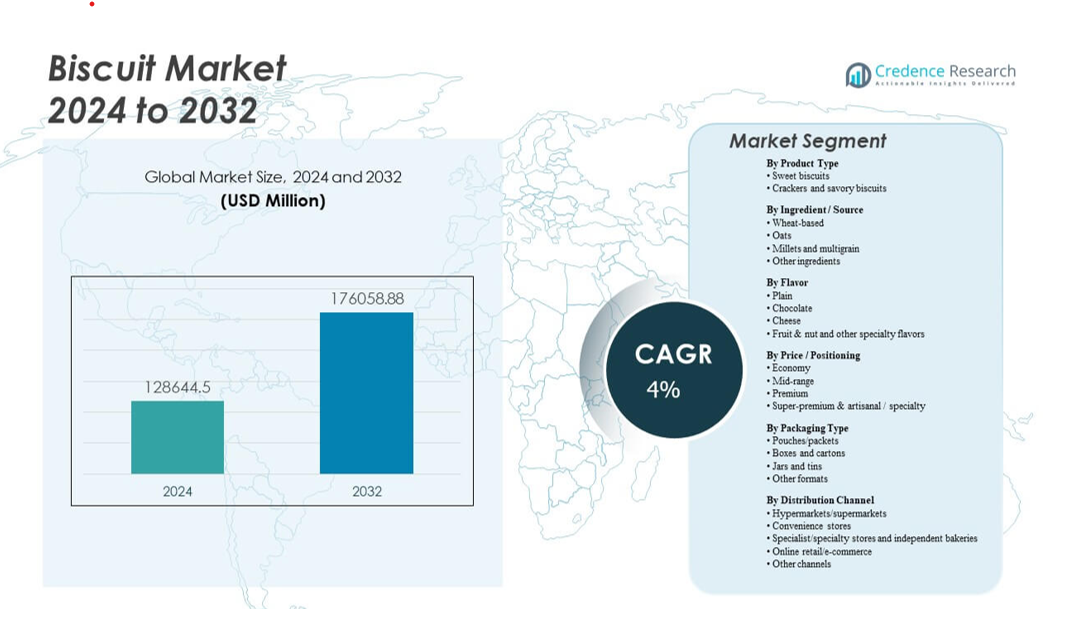

The Biscuit Market is projected to grow from USD 128,644.5 million in 2024 to an estimated USD 176,058.88 million by 2032, with a compound annual growth rate (CAGR) of 4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biscuit Market Size 2024 |

USD 128,644.5 million |

| Biscuit Market, CAGR |

4% |

| Biscuit Market Size 2032 |

USD 176,058.88 million |

Market drivers reflect evolving consumer habits, stronger retail infrastructure and rising interest in convenient, ready-to-eat bakery products. Busy lifestyles support steady demand for sweet biscuits, crackers and healthier variants such as multigrain and high-fiber options. Brands develop new flavors to attract younger buyers who prefer indulgent, innovative and seasonal offerings. Health-conscious consumers create momentum for reduced-sugar, plant-based and clean-label biscuits. Packaging upgrades improve shelf life and convenience for daily use, while e-commerce strengthens access to premium and niche formats. Rising urban incomes in developing nations reinforce long-term consumption patterns.

Regional growth reflects diverse consumption structures across global markets. Europe leads due to established bakery traditions and wide acceptance of premium biscuits with refined flavors. Asia Pacific emerges as the fastest-growing region driven by large populations, expanding retail networks and strong demand for both affordable packs and premium variants in urban centers. North America maintains steady growth supported by innovation, health-oriented formulations and strong snacking culture. Latin America progresses through broader retail penetration and cultural affinity for sweet biscuits. The Middle East and Africa continue expanding demand as packaged snack adoption increases and global brands strengthen distribution presence.

Market Insights:

- The Biscuit Market is projected to grow from USD 128,644.5 million in 2024 to USD 176,058.88 million by 2032 at a 4% CAGR, supported by steady global demand.

- Rising preference for convenient packaged snacks drives consistent adoption across diverse age groups and lifestyles.

- Strong interest in healthier variants, including multigrain, high-fiber and reduced-sugar biscuits, strengthens product innovation.

- Ingredient cost fluctuations and supply chain instability remain key restraints affecting production efficiency.

- Europe leads consumption due to long-established bakery traditions and high demand for premium formats.

- Asia Pacific shows the fastest expansion driven by urban growth, evolving retail systems and flavor adaptation.

- North America maintains stable growth with strong product innovation and wide acceptance of sweet and savory categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Convenient Snack Products

The Biscuit Market benefits from stronger demand for quick snack options across urban and rural households. Consumers prefer packaged bakery items that offer long shelf life and stable flavor. Brands focus on improving formulations that support health and taste. New variants reach younger buyers who value novelty in everyday snacks. Organized retail boosts visibility across supermarkets and hypermarkets. Online channels help small manufacturers reach wider audiences. Product promotion through seasonal themes drives higher sales. It strengthens its position through consistent product upgrades.

- For instance, Britannia Industries reported strong momentum in its biscuit portfolio in FY2024, supported by launches such as Good Day Fruit & Nut, Cake Rusk, and the Bourbon Milk Shake variant, as noted in Sharekhan’s May 2024 research report. The company highlighted that its focus states grew at 2.4 times the pace of the rest of India, reinforcing distribution-led gains across key markets. This performance helped Britannia widen its competitive lead within the Biscuit Market.

Shift Toward Health-Focused Biscuit Formulations

Health-oriented products drive strong interest as buyers look for guilt-free snack choices. Whole grain and high-fiber variants appeal to consumers seeking balanced diets. Companies reduce salt and sugar to align with wellness goals. Functional ingredients such as seeds and oats enhance product appeal. Packaging highlights clean-label claims to improve trust. Regulatory encouragement for healthier processed foods supports product reformulation. Wider awareness of nutrition encourages trial of premium biscuits. The Biscuit Market adapts to wellness trends through targeted innovation.

Growing Influence of Flavor Innovation and Premiumization

New flavor profiles attract consumers searching for variety in everyday snacks. Premium biscuits gain acceptance due to rising disposable incomes. Global tastes influence local innovation across many categories. Chocolate-filled and fruit-based options perform well in competitive shelves. Limited-edition runs create excitement among young buyers. Stronger branding ensures repeat purchases across many regions. International players introduce global recipes that increase competition. It expands its reach by elevating flavor diversity.

- For instance, Oreo (Mondelēz International) introduced its Cherry Blossom Matcha Oreo Thins flavor to the U.S. in April 2025 via an exclusive limited-edition sweepstakes, bringing a fan-favorite international variant originally launched in Japan (and Hong Kong) to American consumers.

Expansion of Retail Infrastructure and Digital Commerce

Rapid retail modernization improves access to packaged biscuits across emerging markets. Supermarket expansion increases shelf visibility for branded and private-label formats. Small stores stock more affordable packs to serve daily buyers. E-commerce platforms support premium biscuit distribution in urban centers. Targeted ads boost online engagement for new launches. Delivery apps help quick replenishment during peak demand seasons. Regional players use digital tools to build brand recall. The Biscuit Market gains scale through broader retail coverage.

Market Trends

Rising Popularity of Portion-Controlled and On-the-Go Packs

Smaller pack formats attract buyers seeking controlled daily consumption. Single-serve biscuits help manage calorie intake for health-conscious consumers. Compact packs support travel use across busy households. Retailers promote multi-pack deals that support budget buyers. Packaging innovation improves product safety and transport ease. Higher focus on convenience strengthens buying patterns across cities. Kids’ snack packs grow with school and travel needs. The Biscuit Market benefits from rising acceptance of quick-grab packs.

- For instance, Syntegon Technology offers the Pack 403 as a high-performance horizontal flow wrapper designed for packaged food applications, including biscuits, with officially documented capabilities for high-speed wrapping and improved sealing precision.

Growing Use of Sustainable Packaging Solutions

Manufacturers explore recyclable and biodegradable materials to meet green expectations. Consumers show strong interest in environment-friendly brands. Paper-based packs replace older multi-layer structures across many lines. Retailers highlight sustainable options on shelves to guide conscious buyers. Government pressure drives compliance with packaging norms. Supply chains integrate eco-safe printing and labeling. Brands communicate sustainability goals through clear pack messaging. It responds to rising demand for low-impact packaging formats.

Rise in Fusion Flavors Inspired by Global Cuisine

Global culinary ideas influence biscuit makers exploring bold combinations. Sweet-savory blends attract young consumers seeking new tastes. Regional spices appear in fusion formats that appeal to local palates. International brands introduce popular global recipes in emerging markets. Co-branding with confectionery firms boosts flavor experimentation. Social media trends inspire limited-edition flavor drops. Influencer reviews increase trial among niche consumers. The Biscuit Market experiments with fusion lines to keep buyers engaged.

Increasing Adoption of Plant-Based and Vegan Recipes

Plant-based biscuits attract buyers who follow ethical food choices. Dairy-free variants appeal to lactose-intolerant consumers. Vegan labels strengthen brand credibility in health-focused segments. Plant oils replace traditional fats across many recipes. Retailers dedicate shelf space to clean and vegan bakery products. Ingredient suppliers expand options for natural flavor enhancers. Consumers welcome cruelty-free processes in processed foods. It aligns with ethical trends through wider plant-based offerings.

- For instance, Parle Products is the manufacturer of India’s iconic Parle-G biscuit, one of the world’s largest-selling biscuit brands, as documented by industry reports and company disclosures. The company also produces well-known lines such as Monaco and Krackjack, which hold strong nationwide distribution across both urban and rural markets. These established brands support Parle’s long-standing leadership in the Biscuit Market.

Market Challenges Analysis

Volatility in Raw Material Supply and Pricing Pressures

Ingredient price swings pose challenges for large and small manufacturers. Wheat, sugar and edible oil fluctuations affect production planning. Higher input costs limit the ability to maintain stable pricing. Supply chain disruptions delay timely manufacturing across regions. Weather risks reduce consistent crop availability. Packaging material shortages add further strain on margins. Buyers resist frequent price changes in competitive shelves. The Biscuit Market manages these pressures with improved sourcing strategies.

Growing Health Scrutiny and Rising Competition Across Categories

Health concerns shape buyer perception of processed biscuits. Regulators tighten labeling norms to protect consumers. Brands redesign recipes to limit negative ingredients like trans fats. Competing snack categories reduce footfall for traditional biscuits. Marketing noise makes differentiation harder for smaller brands. Premium chocolate and cereal snacks create pressure on shelf space. Digital-native brands attract younger consumers with niche offerings. It faces stronger competition while adapting to new wellness standards.

Market Opportunities

Expansion Into High-Protein, Functional and Specialty Biscuit Lines

High-protein biscuits appeal to fitness-oriented adults across urban markets. Functional biscuits with probiotics attract health-seeking families. Gluten-free and allergen-free options open niche demand pockets. Natural sweeteners create cleaner formulations for wellness buyers. Specialty biscuits succeed in premium retail channels. Ingredient diversity supports creative product development for brands. Export opportunities grow for unique regional formulations. The Biscuit Market uses specialty trends to increase category value.

Growth Potential Across Emerging Economies With Untapped Demand

Urbanization expands distribution networks across developing regions. Rising incomes increase acceptance of premium bakery products. Local manufacturers use affordable packs to target mass buyers. Festive-season gifting boosts demand in culturally active markets. Tourism expands exposure to international biscuit formats. Retail digitization improves reach in smaller towns and rural belts. Youth-driven snack culture increases long-term category adoption. It gains new growth avenues across fast-expanding economies.

Market Segmentation Analysis:

By Product Type

The Biscuit Market shows strong demand for sweet biscuits, driven by wider flavor choice and steady household use. Crackers and savory biscuits grow through interest in light snacks with balanced seasoning. Brands refresh core lines to meet taste shifts. It gains depth by serving varied consumption needs.

By Ingredient / Source

Wheat-based biscuits lead due to stable supply and familiar taste. Oats gain traction from health-focused buyers who value fiber-rich snacks. Millets and multigrain options attract consumers seeking natural ingredients. Other bases support gluten-free and functional claims. The Biscuit Market adapts through flexible ingredient strategies.

- For instance, Parle-G continues to be one of India’s most widely distributed wheat-based biscuits, supported by its long-standing national retail reach. Britannia’s NutriChoice 5 Grain Digestive is confirmed on the company’s official product listings as a multigrain biscuit made with oats, ragi, wheat, corn and rice, reinforcing its position in the health-focused segment.

By Flavor

Plain biscuits hold loyal demand from everyday snack users. Chocolate formats succeed with younger buyers who seek indulgent choices. Cheese variants grow through rising interest in savory snacks. Fruit, nut and specialty flavors build traction among premium consumers. It expands flavor lines to maintain category relevance.

- For instance, Britannia’s Pure Magic Choco Lush is a documented center-filled chocolate biscuit positioned in the company’s premium indulgence range. Britannia also offers fruit-and-nut variants under its Good Day portfolio, which broadens its flavor presence within the premium biscuit segment.

By Price / Positioning

Economy biscuits support mass consumption through affordable packs. Mid-range products balance quality with value-driven pricing. Premium lines attract buyers seeking refined taste and better textures. Super-premium and artisanal biscuits grow in niche channels. The Biscuit Market strengthens reach through layered price tiers.

By Packaging Type

Pouches and packets dominate due to low cost and broad retail fit. Boxes and cartons serve premium and gift-friendly formats. Jars and tins support long shelf life in family use. Other formats serve travel, bulk and HoReCa needs. It benefits from adaptable packaging choices.

By Distribution Channel

Hypermarkets and supermarkets drive visibility for major brands. Convenience stores support impulse buying near residential zones. Specialist bakeries push premium and artisanal lines. Online retail expands reach for niche products. Other channels include foodservice and vending. The Biscuit Market gains scale through multi-channel access.

Segmentation:

By Product Type

- Sweet biscuits

- Crackers and savory biscuits

By Ingredient / Source

- Wheat-based

- Oats

- Millets and multigrain

- Other ingredients

By Flavor

- Plain

- Chocolate

- Cheese

- Fruit & nut and other specialty flavors

By Price / Positioning

- Economy

- Mid-range

- Premium

- Super-premium & artisanal / specialty

By Packaging Type

- Pouches/packets

- Boxes and cartons

- Jars and tins

- Other formats

By Distribution Channel

- Hypermarkets/supermarkets

- Convenience stores

- Specialist/specialty stores and independent bakeries

- Online retail/e-commerce

- Other channels

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds close to 24% share of the global Biscuit Market due to strong packaged snack adoption and steady demand from households. The region benefits from high product innovation and strong retail penetration across major cities. Consumers prefer value-added formats with diverse flavors and clean-label claims. Brands invest in premium and functional biscuits that target wellness-focused buyers. Distribution strength across supermarkets and club stores supports consistent volume. The Biscuit Market grows in North America through strong brand loyalty and expanding premium ranges.

Europe accounts for roughly 30% share, making it the leading regional contributor with deep bakery traditions and refined biscuit preferences. The region supports high consumption of sweet and savory formats driven by long-standing snacking culture. Strong regulations guide ingredient quality and encourage healthier formulations. Private-label penetration is high across retail chains, increasing competitive pressure. Demand for artisanal, organic and high-fiber biscuits grows across Western Europe. It maintains strong demand through continuous flavor innovation and premium craftsmanship.

Asia Pacific holds about 32% share, making it the fastest-growing region with rising urban incomes and wider packaged food adoption. Large population centers in China and India drive strong biscuit penetration across rural and urban markets. Smaller pack sizes help reach cost-sensitive consumers, while premium formats gain momentum in metros. Regional brands compete with global manufacturers through flavor adaptation and price flexibility. E-commerce platforms expand reach for niche biscuit lines. The Biscuit Market accelerates growth in Asia Pacific through scale advantages and expanding retail networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nestlé

- Parle Products Pvt. Ltd.

- Britannia Industries Ltd.

- ITC Limited (ITC Sunfeast)

- Mondelez International

- Ferrero Group

- Kellogg’s

- General Mills

- PepsiCo

- Lotus Bakeries

- United Biscuits

- Pladis Global

- Bahlsen GmbH

- Walkers Shortbread Ltd.

- Yıldız Holding

Competitive Analysis:

The Biscuit Market features a mix of multinational manufacturers and strong regional brands that shape competitive dynamics through product quality, pricing and distribution reach. Global players focus on extensive flavor portfolios, active marketing and efficient manufacturing systems to secure widespread visibility. They strengthen category leadership through investments in automation and cleaner formulations that support shifting consumer expectations. Regional firms compete through localized flavors, flexible pack sizes and competitive price points that appeal to mass-market buyers. Digital commerce allows smaller brands to scale faster by targeting niche consumer groups. Leading companies expand premium and healthy biscuit lines to differentiate in crowded shelves. It maintains competitive intensity through continuous innovation in packaging, taste and ingredient profiles while focusing on strengthening brand identity across key markets.

Recent Developments:

- In November 2025, CavinKare unveiled its Orange Cream Biscuit Milkshake and Premium Malt Milkshake variants under the Cavin’s beverages division in India. The launch builds on a nostalgia theme, infusing the much-loved orange cream biscuit taste into a ready-to-drink milkshake and further diversifying CavinKare’s dairy portfolio in the country.

- In October 2025, Nigerian Bottling Company made a significant entry into the biscuit market with the formal launch of the Plazma biscuit brand in Nigeria. This event, held in Lagos, showcased NBC’s first foray into the biscuit sector, marking a strategic move to diversify its product offerings beyond beverages and reach a broader consumer base.

- In September 2025, Ferrero completed the acquisition of WK Kellogg Co. This deal expands Ferrero’s strategic presence and product portfolio particularly in North America’s biscuits and cereals markets by integrating Kellogg’s iconic brands under its umbrella. Ferrero’s ongoing M&A activity reflects its continued commitment to strengthening its confectionery and biscuit lines.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient / Source, Flavor, Price / Positioning, Packaging Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Stronger demand for convenient packaged snacks will support broader household adoption across major regions.

- Product innovation will center on healthier formulations that target fiber-rich, clean-label and low-sugar preferences.

- Premium biscuits will gain traction through refined textures, global flavors and artisanal positioning.

- Portion-controlled and on-the-go packs will expand due to growing interest in mobility-focused snacking.

- Sustainable packaging will evolve with recyclable films, paper-based formats and lower-impact materials.

- Digital retail will accelerate growth through targeted promotions and wider access to niche biscuit lines.

- Local flavor adaptation will strengthen competitiveness across emerging economies with diverse taste profiles.

- Ingredient diversification will increase demand for oats, millets and functional blends across new launches.

- Retail modernization will enhance visibility for both global brands and value-focused regional players.

- Innovation in savory and fusion categories will help broaden category appeal among young consumers.