Market Overview:

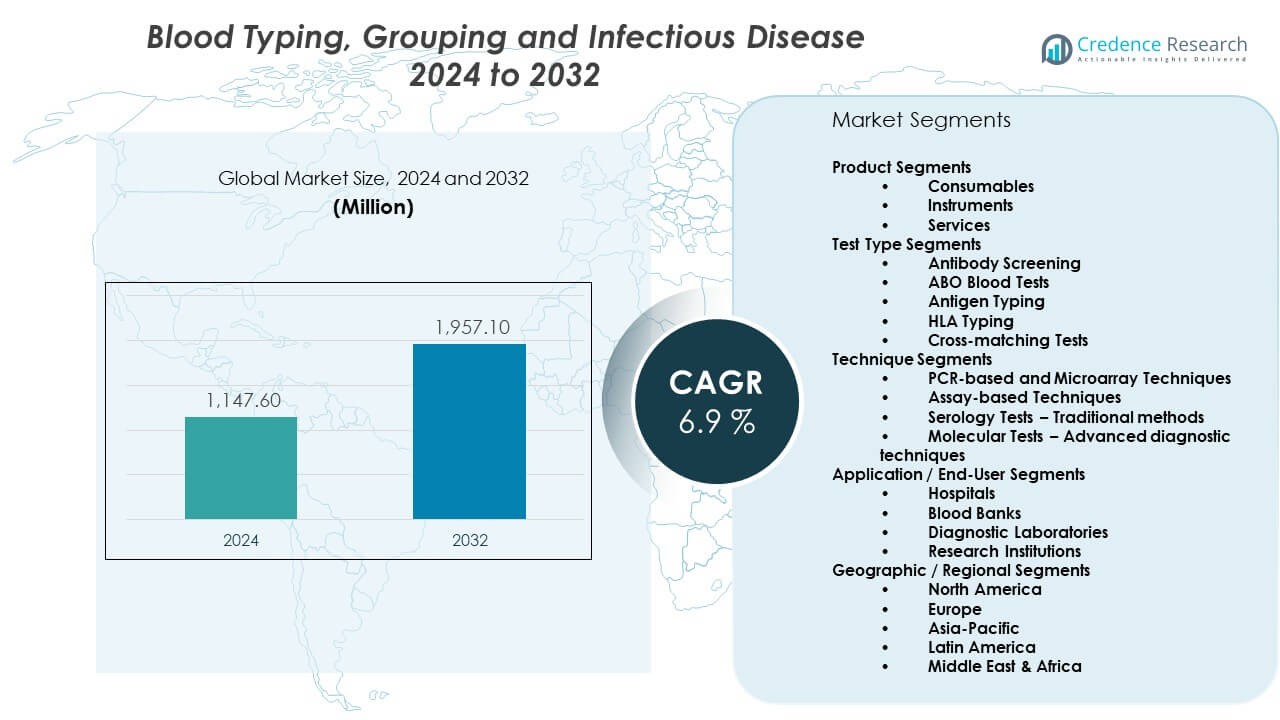

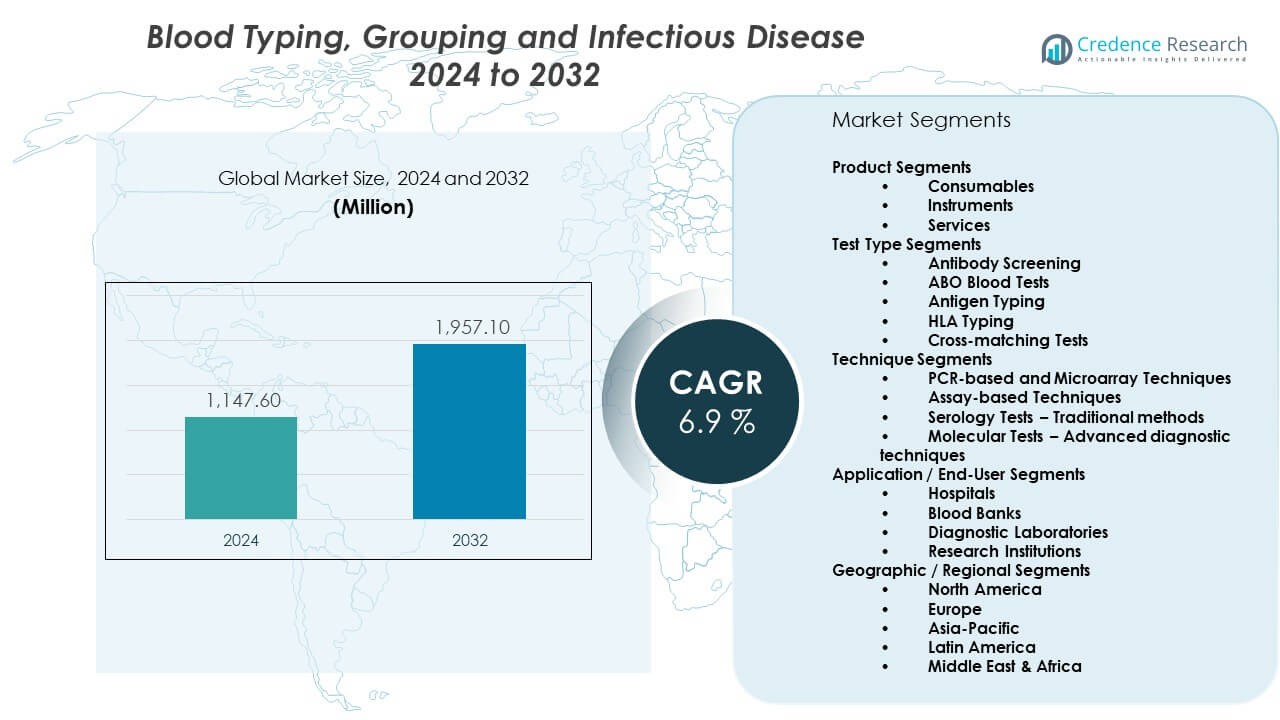

The Blood Typing, Grouping And Infectious Disease Market is projected to grow from USD 1,147.6 million in 2024 to USD 1,957.1 million by 2032, with a 6.9% CAGR. Growth reflects rising diagnostic demand across hospitals, labs, and blood banks. Broader screening needs support steady adoption of advanced testing systems.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blood Typing, Grouping And Infectious Disease Market Size 2024 |

USD 1,147.6 Million |

| Blood Typing, Grouping And Infectious Disease Market, CAGR |

6.9% |

| Blood Typing, Grouping And Infectious Disease Market Size 2032 |

USD 1,957.1 Million |

Demand rises due to higher screening volumes in modern care systems. Clinicians rely on rapid assays to improve transfusion safety and infection control. Automation boosts testing accuracy across high-throughput labs. Broader disease surveillance increases procurement of advanced kits. Rising surgical loads expand the need for reliable pre-transfusion checks. Public health programs also raise awareness of early pathogen detection. These factors strengthen long-term market growth.

North America leads due to strong lab automation and strict transfusion rules. Europe follows with wide adoption of molecular tools across national health networks. Asia Pacific emerges quickly as hospitals modernize diagnostic platforms and expand donor screening. China and India increase testing capacity driven by rising healthcare investment. Latin America and the Middle East show steady growth as countries upgrade laboratory infrastructure and improve infectious disease tracking systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Blood Typing, Grouping and Infectious Disease market grows from USD 1,147.6 million in 2024 to USD 1,957.1 million by 2032, supported by a 9% CAGR, driven by rising diagnostic demand across hospitals, labs, and blood banks.

- North America (33–36%), Europe (second largest), and Asia-Pacific (fastest expanding) dominate due to strong automation, molecular adoption, and large-scale modernization of diagnostic systems.

- Asia-Pacific, holding a rising share supported by China and India, records the fastest growth due to healthcare investment, expanded donor screening, and rapid diagnostic infrastructure upgrades.

- Consumables lead the segment structure with 46–57.4% share, driven by high-volume use of reagents and kits in routine screening workflows across clinical settings.

- Hospitals hold the largest end-user share at 8%, supported by higher procedure loads, wider transfusion testing, and stronger integration of automated diagnostic platforms.

Market Drivers:

Market Drivers:

Strong Adoption of Advanced Diagnostic Platforms Strengthening Testing Accuracy

The Blood Typing, Grouping and Infectious Disease market gains momentum through rapid integration of new diagnostic tools. Labs upgrade platforms to improve precision during high-volume screening. Automated systems reduce manual errors and help clinicians maintain safe transfusion practices. It builds greater trust across hospitals that depend on consistent results under tight timelines. Demand rises due to growing emphasis on standardized workflows. Public health programs support broader use of molecular kits for infection detection. Blood banks rely on fast methods to improve donor evaluation. These factors reinforce the steady growth path.

- For instance, the Ortho Vision Analyzer by Ortho Clinical Diagnostics significantly streamlines workflow through automation, with the newer ORTHO VISION Swift model automating over 99% of the daily workload and delivering results for 95% of tests in under 40 minutes with high reproducibility.

Rising Global Focus on Transfusion Safety Across Healthcare Facilities

Healthcare facilities expand testing frameworks to improve transfusion safety protocols. Clinical teams invest in efficient typing solutions to avoid mismatch risks. Growing awareness supports wider adoption across surgical centers. It encourages hospitals to upgrade legacy tools to improve safety performance. Infection control teams depend on reliable assays during complex medical procedures. Strong governance programs push regular screening across donor pools. Emergency units prioritize faster tools that reduce decision pressure. These elements strengthen long-term confidence in modern diagnostic systems.

- For instance, Immucor’s Echo Lumena platform delivers type and screen results with onboard capacity for 20 samples and reduces manual intervention through fully automated serologic workflows.

Increasing Infectious Disease Surveillance Driving Higher Testing Volumes

Heightened disease surveillance expands testing demand across public and private labs. Health authorities push wider screening to control pathogen spread. Investments support new platforms designed for rapid detection workflows. It helps labs maintain stable performance during peak load periods. Screening needs grow across travel hubs and emergency departments. Hospitals widen pathogen panels to improve early diagnosis. Diagnostic teams seek tools with stronger sensitivity to improve accuracy. These factors support sustainable market expansion.

Continuous Automation Improving Speed, Throughput and Operational Control

High-throughput automation improves workflow speed across large laboratories. Automated liquid handling reduces manual variability and improves reproducibility. It supports wider screening during emergency preparedness cycles. Manufacturers introduce scalable tools tailored for diverse test menus. Hospitals use automation to improve compliance with strict regulatory standards. Blood banks benefit from faster turnaround times during donor drives. Clinical units value tools that simplify operator training needs. These drivers boost overall adoption across the diagnostic landscape.

Market Trends:

Shift Toward Digital Connectivity and Remote Quality Monitoring in Diagnostics

The Blood Typing, Grouping and Infectious Disease market observes strong movement toward digital health integration. Labs deploy systems that link instruments with centralized data platforms. Cloud-based dashboards support real-time performance evaluation. It improves workflow transparency and lowers reporting delays. Remote access tools support quality audits across multisite networks. Laboratories integrate digital alerts to guide corrective steps. Data-driven insights refine testing pathways in critical settings. These developments reshape operational standards.

- For instance, Roche’s cobas® 6800/8800 systems feature remote diagnostics and automated workflow controls capable of processing up to 960 results every eight hours while transmitting performance data to centralized monitoring platforms.

Growing Preference for Compact, Point-of-Care Systems in Decentralized Testing Environments

Demand rises for compact platforms supporting bedside and field diagnostics. Emergency units turn to portable analyzers for quick decision support. It helps medical teams manage critical cases without long delays. Rural centers rely on easy-to-use devices with low training needs. Clinics adopt small-format systems that maintain reliable performance. Mobile health programs expand point-of-care deployment for screening drives. Diagnostic teams value rapid interpretation during high-stress procedures. These trends redefine accessibility across regions.

- For instance, Abbott’s i-STAT Alinity handheld analyzer delivers results in under two minutes and supports more than 20 test cartridges, enabling point-of-care teams to manage urgent diagnostic needs.

Expanded Use of Multiplex Assay Panels to Improve Clinical Efficiency

Multiplex technologies gain popularity for detecting multiple parameters in a single run. Hospitals adopt panels that combine blood grouping and pathogen screening. It reduces workflow complexity and improves patient management. Labs benefit from fewer consumables during peak activity. Actionable insights help clinicians make quicker therapeutic decisions. Multiplex kits support structured surveillance programs. Blood banks value integrated test menus for donor screening. These shifts reinforce efficiency-focused upgrades.

Stronger Role of AI-Assisted Analysis Supporting Automated Interpretation

AI tools support pattern recognition during complex diagnostic evaluations. Algorithms reduce interpretive errors during high-volume workflows. It enables faster screening without compromising accuracy. Predictive insights help teams refine testing priorities. Automated alerts highlight unusual patterns requiring review. Hospitals value decision-support engines during emergency loads. Vendors integrate AI modules into new-generation instruments. These technology gains shape the next phase of diagnostic modernization.

Market Challenges Analysis:

Operational Constraints Limiting Standardization Across Diverse Healthcare Systems

The Blood Typing, Grouping and Infectious Disease market faces challenges linked to inconsistent infrastructure across regions. Labs struggle to align workflows due to varied automation maturity. It complicates integration of advanced platforms that require stable resources. Rural hospitals deal with limited operator training, slowing adoption. Supply delays disrupt reagent availability in peak seasons. Regulatory variations create uncertainty for manufacturers planning expansions. Some centers manage high workloads with outdated tools, reducing accuracy potential. These factors restrict full-scale modernization.

High Technology Costs and Skilled Workforce Gaps Slowing Adoption Pace

Upfront investment needs create barriers for smaller facilities. Complex molecular systems demand specialized training that many centers lack. It forces slow transitions from legacy kits to advanced platforms. Maintenance requirements strain limited budgets across emerging regions. Frequent calibration needs prolong downtime in resource-constrained environments. Workforce shortages limit smooth operation of new technologies. Compliance requirements increase documentation pressure on diagnostic teams. These issues hinder adoption across cost-sensitive markets.

Market Opportunities:

Expansion of Automated, Integrated Platforms Supporting Scalable Diagnostic Growth

The Blood Typing, Grouping and Infectious Disease market gains new opportunities from expanding automation. Integrated workflows support higher throughput for large hospitals. It enables facilities to manage broader testing menus with fewer manual steps. Vendors design modular systems that scale with rising demand. Clinics adopt upgraded tools that improve screening consistency. Public health agencies encourage stronger automation to support surveillance goals. These areas offer strong growth prospects for new solutions.

Growing Investments in Emerging Regions Supporting Diagnostic Capacity Building

Emerging countries improve lab infrastructure to strengthen healthcare readiness. It drives demand for modern diagnostic systems with higher reliability. Hospitals expand donor screening units to support rising surgical needs. Governments fund training programs to build specialized talent pools. New labs open in semi-urban areas to reduce testing delays. Diagnostic firms gain access to large customer bases seeking upgrades. These developments create wide opportunities for future market expansion.

Market Segmentation Analysis:

Product Segments

Consumables lead the Blood Typing, Grouping and Infectious Disease market with strong use in routine testing due to constant replenishment needs. Reagents and kits support high-volume workflows across hospitals and labs. Instruments show steady growth through automated analyzers that improve accuracy and speed. Services expand with rising reliance on outsourced diagnostic support.

- For instance, Bio-Rad’s ID-System gel cards support batch processing of up to 48 samples per run and maintain controlled centrifugation parameters that ensure consistent antigen–antibody reaction quality.

Test Type Segments

Antibody screening holds the dominant position due to its role in early detection and transfusion preparation. ABO blood tests follow with essential use in every clinical setting. Antigen typing remains important for complex transfusion therapies. HLA typing supports transplant compatibility, while cross-matching tests ensure safe pre-transfusion checks.

- For instance, Thermo Fisher’s One Lambda HLA typing kits deliver high-resolution sequencing with accuracy above 99% using next-generation sequencing workflows validated in global transplant centers.

Technique Segments

PCR-based and microarray techniques capture the largest share with strong accuracy and sensitivity. Assay-based methods support mid-volume testing across diverse facilities. Serology tests remain valuable due to ease of use in basic screening. Molecular tests gain traction through advanced diagnostic capability and stronger pathogen detection.

Application / End-User Segments

Hospitals lead with the highest share due to large patient loads and continuous screening needs. Blood banks depend on rapid screening tools to ensure donor safety. Diagnostic laboratories expand testing capacity through advanced platforms. Research institutions contribute through studies focused on antigen expression and genetic markers that support development within the field.

Segmentation:

Product Segments

- Consumables

- Instruments

- Services

Test Type Segments

- Antibody Screening

- ABO Blood Tests

- Antigen Typing

- HLA Typing

- Cross-matching Tests

Technique Segments

- PCR-based and Microarray Techniques

- Assay-based Techniques

- Serology Tests – Traditional methods

- Molecular Tests – Advanced diagnostic techniques

Application / End-User Segments

- Hospitals

- Blood Banks

- Diagnostic Laboratories

- Research Institutions

Geographic / Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leading With Strong Diagnostic Adoption

North America holds the largest share of the Blood Typing, Grouping and Infectious Disease market at nearly 33–36%. Strong healthcare infrastructure supports wide use of automated testing systems across hospitals and donor centers. High procedure volume improves demand for rapid assays and molecular tools. It benefits from strict regulatory frameworks that guide blood safety and infectious disease monitoring. Large research programs drive innovation and early adoption of advanced technologies. Continuous upgrades across U.S. and Canadian labs strengthen leadership in the global landscape.

Europe Maintaining Second Position With Robust Regulatory Support

Europe secures the second-largest share with a stable and mature diagnostic ecosystem. Strong policies guide standardized testing across blood banks and clinical labs. It benefits from long-standing expertise in serology, antigen typing, and high-throughput platforms. Germany, the U.K., and France lead with strong investment in transfusion safety and infectious disease surveillance. Growing modernization in Southern and Eastern Europe increases adoption of molecular techniques. Collaboration across health agencies fuels consistency in test quality and reporting standards.

Asia-Pacific Emerging as the Fastest Growing Regional Market

Asia-Pacific records the fastest growth with rapid expansion across China, India, and Japan. Rising chronic disease burden strengthens demand for reliable blood screening tools. It gains traction through large-scale healthcare reforms and new diagnostic capacity. Hospitals increase procurement of automated systems to match rising procedure volumes. Growing awareness improves uptake of molecular and PCR-based tests. Expanding lab networks help the region progress from an emerging base to a leading future contributor in this global market.

Key Player Analysis:

- Abbott

- Bio-Rad Laboratories, Inc.

- Danaher Corporation / Beckman Coulter

- Grifols, S.A.

- Thermo Fisher Scientific Inc.

- Immucor, Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Quotient Limited

- DIAGAST

- Hoffmann-La Roche Ltd.

- bioMérieux

- Becton, Dickinson and Company

- Siemens Healthineers AG

- Hologic, Inc.

- Ortho Clinical Diagnostics, Inc.

- Agena Bioscience, Inc. / Mesa Laboratories, Inc.

- QIAGEN N.V.

- Seegene Inc.

- AXO Science

- BAG Diagnostics GmbH

- Novacyt Group

Competitive Analysis:

The Blood Typing, Grouping and Infectious Disease market shows strong competition among global diagnostics leaders and specialized transfusion testing companies. Major firms expand portfolios with automated platforms, molecular tools, and high-sensitivity assays. It gains competitive strength through continuous advancements in serology, PCR, and microarray technologies. Established players focus on precision, workflow speed, and regulatory compliance to maintain market position. New entrants target niche areas such as HLA typing and multiplex pathogen detection. Strategic partnerships support wider geographical reach and integrated product lines. Companies also invest in R&D to improve reagent stability, automation capability, and test accuracy. This competition strengthens innovation across the diagnostic landscape.

Recent Developments:

- Danaher Corporation / Beckman Coulter made its debut at the ESCMID Global 2025 conference, held in Vienna in April 2025, under a joint Danaher booth, showcasing integrated molecular diagnostics, phenotypical susceptibility testing, and immunodiagnostics capabilities. On September 17, 2024, Beckman Coulter expanded its partnership with Scopio Labs to include global distribution of Scopio’s Full-Field Bone Marrow Aspirate (FF-BMA) Application. Additionally, on July 30, 2024, Biogen, Beckman Coulter, and Fujirebio announced a collaboration on blood-based biomarkers and tests for tau pathology in Alzheimer’s disease.

- Bio-Rad Laboratories announced a binding offer to acquire Stilla Technologies on February 12, 2025, with the acquisition completed in July 2025. The strategic acquisition expanded Bio-Rad’s digital PCR portfolio with plans to launch the QX Continuum system and QX700 series for molecular diagnostics applications including infectious disease testing.

- Grifols announced its subsidiary Biotest received FDA approval for Yimmugo, an intravenous immunoglobulin therapeutic for treating primary immunodeficiencies, with the FDA approval letter dated June 13, 2024. The company subsequently officially launched Yimmugo in the United States on October 9, 2025, following successful introduction in Europe at the end of 2022.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Segments, Test Type Segments, Technique Segments, Application / End-User Segments, and Geographic / Regional Segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage].

Future Outlook:

- Growing demand for automated typing platforms will strengthen adoption across large hospitals.

- Wider use of molecular tools will improve accuracy in infection detection.

- Rising awareness of transfusion safety will increase testing volumes in blood banks.

- Expansion of donor screening programs will support higher reagent consumption.

- Integration of AI analytics will refine interpretation of complex diagnostic results.

- Growth in decentralized care will boost use of portable testing devices.

- Strengthening regulatory emphasis on quality control will accelerate instrument upgrades.

- Emerging markets will expand diagnostic infrastructure to improve blood safety.

- New microarray and multiplex platforms will support broader test menus.

- Industry collaborations will increase global access to advanced diagnostic systems.

Market Drivers:

Market Drivers: