Market Overview

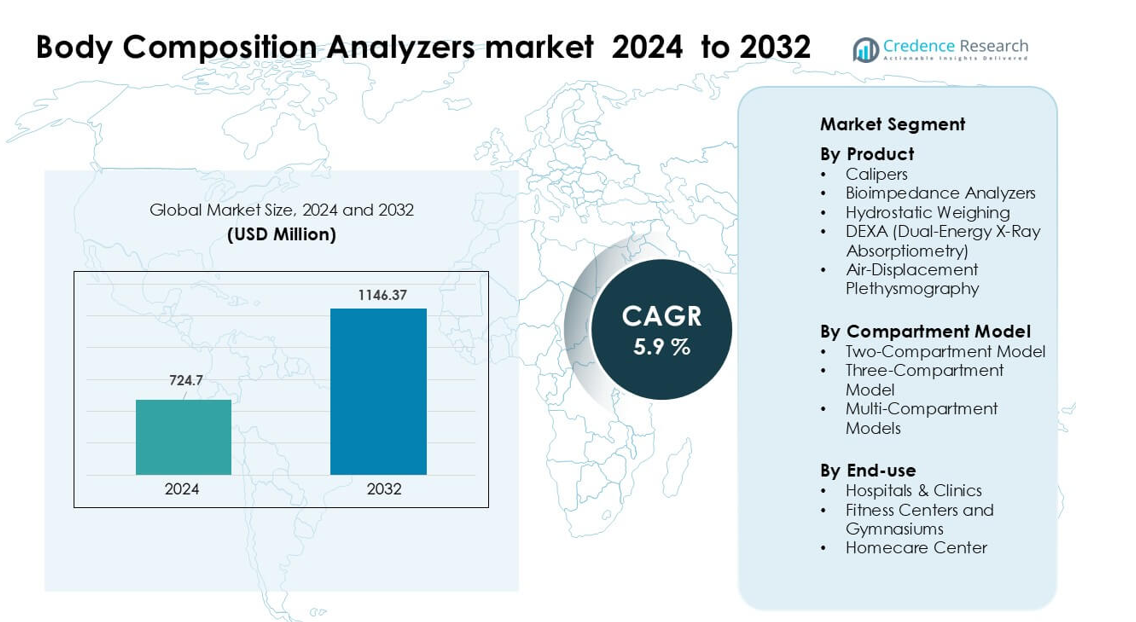

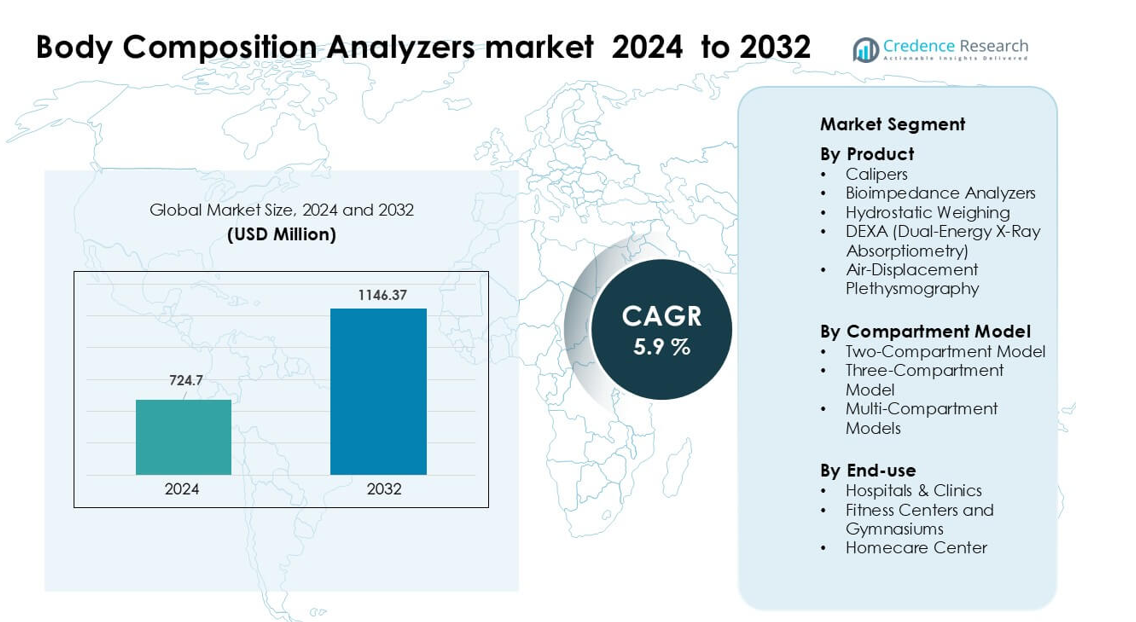

Body Composition Analyzers market was valued at USD 724.7 million in 2024 and is anticipated to reach USD 1146.37 million by 2032, growing at a CAGR of 5.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Body Composition Analyzers Market Size 2024 |

USD 724.7 million |

| Body Composition Analyzers Market, CAGR |

5.9% |

| Body Composition Analyzers Market Size 2032 |

USD 1146.37 million |

Top players in the global body composition analyzers market include Hologic Inc., GE Healthcare, InBody Co. Ltd, Omron Corporation, Tanita Corporation, SECA GmbH, Bodystat Ltd, COSMED Srl, Maltron International and Charder Electronic Co. Ltd. These firms compete on innovation, algorithm accuracy, multi-frequency bioimpedance and connectivity features. The leading region in the market is North America, which held approximately 39.4 % of global revenue in 2024.

Market Insights

- The body composition analyzers market reached about USD 724.7 million in 2024 and is projected to surpass USD 1146.37 million by 2032, growing at a CAGR near 5.9 %.

- Demand grew as clinics, fitness centers, and wellness programs increased adoption of BIA and DEXA devices for obesity care, sports evaluation, and preventive diagnostics.

- Trends focused on multi-frequency analyzers, cloud dashboards, and smart-scale ecosystems that support remote health tracking and personalized nutrition plans.

- Competition intensified among InBody, GE Healthcare, Hologic, Tanita, Omron, SECA, COSMED, Maltron, Bodystat, and Charder as companies improved algorithm accuracy and expanded portable and professional-grade systems; premium DEXA held strong traction with about 31 % segment share.

- North America led the market with roughly 39 % share in 2024 due to strong clinical infrastructure and rapid digital-health adoption, while Asia Pacific showed fast growth as hospitals and gyms expanded diagnostic and body-monitoring services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Bioimpedance analyzers led the product segment in 2024 with about 54% share. Brands favored this system because the method offers fast readings, low operating cost, and broad use in medical and fitness settings. The technology gained stronger adoption as clinics and gyms needed quick body-fat checks and hydration tracking for routine assessments. DEXA and air-displacement tools grew in specialized fields due to higher accuracy, while calipers and hydrostatic weighing saw limited use. Growth in the leading bioimpedance category came from portable designs and rising wellness programs across urban regions.

- For instance, InBody’s BWA 2.0 uses an advanced 3 MHz bioimpedance technology performing 40 impedance measurements across 8 frequencies, including ultra‑high frequency enabling precise fluid analysis even in edema patients.

By Compartment Model

The two-compartment model dominated this segment in 2024 with nearly 58% share. Users preferred this approach because it divides the body into fat mass and fat-free mass, which supports easy interpretation for routine health checks. The model gained strong traction in hospitals, gyms, and research setups due to simple operation and compatibility with BIA devices. Multi-compartment and three-compartment systems expanded in sports science and clinical research where deeper accuracy is required. The leading two-compartment model grew as wellness platforms increased large-scale screening programs.

- For instance, InBody’s multi‑frequency BIA devices (such as the InBody 770) measure impedance at 15 points across 5 body segments using six frequencies (1 kHz, 5 kHz, 50 kHz, 250 kHz, 500 kHz, and 1000 kHz) to estimate total body water and derive fat‑free mass and fat mass without relying on empirical estimation.

By End-use

Hospitals and clinics held the top share in 2024 with around 46% share. Medical centers adopted analyzers to support nutrition counseling, obesity management, and pre-surgical evaluations. The demand rose because care providers needed fast and non-invasive tracking tools for chronic disease management. Fitness centers showed strong momentum due to rising membership and personalized training plans, while homecare devices gained users seeking remote health monitoring. Growth in the hospital segment came from higher patient load, rising metabolic disorders, and broader integration of diagnostic body-composition tools.

Key Growth Drivers

Rising Focus on Obesity and Metabolic Disorders

Global obesity rates increased sharply, and this trend pushed stronger demand for accurate body-composition screening. Hospitals used analyzers to track fat mass, muscle loss, and metabolic risk in routine care. Patients received faster guidance because clinicians relied on clear biomarker data during consultations. Insurance programs in several regions also encouraged early detection, which improved adoption. Fitness chains added body-composition checks to membership plans and wellness packages. Consumers became more aware after major health bodies highlighted rising lifestyle diseases. Governments also promoted screening drives for early diagnosis. These factors created sustained growth for clinical-grade analyzers across advanced and emerging markets.

- For instance, a retrospective study of 2,404 adults with type 2 diabetes using the InBody 770 (multi‑frequency BIA) found that 71.5% of participants were obese when body‑fat percentage (PBF) was used far higher than the 32.4% obesity rate estimated via BMI highlighting how body‑composition screening reveals metabolic risk that BMI misses

Expansion of Fitness, Sports, and Preventive-Health Ecosystems

Gyms, athletic centers, and sports-training setups rapidly adopted measurement devices to support performance goals. Trainers used these systems to design personalized routines based on fat-free mass and hydration values. Young adults showed higher interest due to rising fitness engagement worldwide. Wearable devices also increased awareness about body tracking, pushing users toward more accurate hardware. Corporate wellness programs added composition testing for employee health checks. Many premium gyms integrated smart analyzers with mobile dashboards, which boosted engagement. Growing participation in weight-management and body-recomposition programs added further momentum. These combined forces expanded demand across non-clinical environments.

- For instance, InBody’s 770 device, used in elite sports‑training environments, takes 30 impedance measurements across 6 frequencies (1, 5, 50, 250, 500, and 1000 kHz) across five body segments, allowing trainers to precisely monitor intracellular and extracellular water shifts that are critical for hydration and recovery.

Technological Advancements in Smart and Connected Analyzers

Manufacturers introduced advanced multi-frequency and segmental bioimpedance systems with stronger accuracy. Cloud connectivity supported long-term monitoring and trend analysis for medical teams and trainers. AI-supported prediction models improved early detection of health risks. Portable analyzers gained traction due to compact size and easy setup. Mobile apps enabled users to compare results, set goals, and track progress over time. Smart DEXA and 3D scanning tools also became more accessible for high-precision clinics. These improvements drove rapid modernization and encouraged wider adoption across hospitals, gyms, and home settings.

Key Trends & Opportunities

Shift Toward Remote and Home-Based Wellness Solutions

Remote-care adoption increased after digital-health platforms expanded their services. Home users preferred compact analyzers because the devices offered frequent checks without clinic visits. Several brands launched Bluetooth-enabled systems that synced directly with mobile dashboards. Telehealth providers used this data to guide patients through weight-loss and nutrition plans. Growth in smart homes and consumer IoT improved device penetration. These factors created new opportunities for companies targeting at-home wellness, chronic-disease support, and lifestyle-management markets.

- For instance, InBody’s H20N (InBodyDial) scale takes 10 impedance measurements (20 kHz & 100 kHz) across five body segments in about 8 seconds, and transmits data to the InBody App over Bluetooth, enabling users to track metrics such as skeletal muscle mass, body-fat percentage, and visceral fat from their phones.

Growing Use of Advanced Multi-Compartment Models

Sports-science labs and specialist clinics shifted toward high-accuracy models for detailed research. These models measured bone mass, body water, and tissue density with better precision. Expanding research in sarcopenia, aging, and athlete performance pushed demand. Academic institutes also upgraded labs with new equipment for training programs. These trends created opportunities for brands offering multi-compartment and hybrid systems with enhanced accuracy.

- For instance, a validation study of the InBody 770 bioelectrical impedance device against a four‑compartment (4C) gold‑standard model reported a total error of 2.4 kg for both fat mass and fat‑free mass.

Key Challenges

High Equipment Cost and Limited Access in Emerging Regions

Advanced DEXA and multi-frequency analyzers required high capital investment. Many smaller clinics and gyms avoided these systems due to limited budgets. Replacement parts and calibration added further cost pressure. Several emerging regions faced infrastructure gaps that slowed adoption. The lack of skilled technicians also restricted use in remote locations. These barriers reduced market penetration for premium systems.

Accuracy Variability Across Different Technologies

Bioimpedance results sometimes changed due to hydration levels or measuring conditions. This created trust issues among medical professionals and users seeking precise data. Clinics preferred standardized systems, but many consumer devices lacked strict accuracy guidelines. Manufacturers needed strong calibration and quality-control processes to maintain reliability. These accuracy concerns slowed adoption in some medical and research environments.

Regional Analysis

North America

North America led the body composition analyzers market in 2024 with about 37% share. Hospitals boosted adoption due to rising obesity cases, expanding bariatric programs, and strong insurance support for diagnostic assessments. Fitness chains added smart analyzers to membership plans, which increased commercial demand. High awareness of preventive health encouraged home users to buy connected devices. Strong presence of leading manufacturers and advanced clinical infrastructure supported continuous upgrades. Research institutes also used multi-compartment systems for sports science and aging studies. These factors kept North America ahead in both clinical and non-clinical deployments.

Europe

Europe held nearly 29% share in 2024, supported by strong public-health programs and rising focus on metabolic screening. Clinics used analyzers to support nutrition counseling, chronic-disease monitoring, and rehabilitation services. Gyms and sports academies expanded usage as fitness engagement increased across major countries. Regulatory support for medical-grade accuracy strengthened demand for premium analyzers. Aging populations in Germany, Italy, and France created higher need for muscle-mass assessment tools. Digital-health expansion, combined with rising adoption of segmental systems, kept Europe a strong secondary market with stable long-term demand.

Asia Pacific

Asia Pacific accounted for around 25% share in 2024 and recorded the fastest expansion. Rapid urbanization and rising lifestyle diseases drove strong installation rates in hospitals and diagnostic chains. Gyms and wellness studios gained popularity among young populations, increasing commercial demand. Local manufacturers introduced affordable bioimpedance systems, boosting access in India, China, and Southeast Asia. Growing interest in sports performance and preventive health supported adoption in academic and athletic centers. Government awareness programs on obesity and diabetes further accelerated market penetration across the region.

Latin America

Latin America captured close to 6% share in 2024 as hospitals and fitness centers improved diagnostic and wellness capabilities. Rising obesity rates, particularly in Mexico and Brazil, encouraged adoption of body-composition tools for routine health checks. Gyms incorporated analyzers into personalized training plans, while private clinics offered nutrition and weight-management programs. Economic constraints limited uptake of high-end DEXA systems, but affordable BIA devices gained traction. Growing investment in medical infrastructure and digital health improved long-term growth prospects across the region.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024, with growth led by higher investment in private healthcare and wellness centers. Gulf countries adopted advanced analyzers in hospitals to support chronic-disease management programs. Fitness clubs expanded in major cities, driving commercial demand for BIA devices. Limited awareness and cost barriers slowed adoption in several African countries, but urban hubs showed rising interest in preventive health. Government initiatives promoting early screening and lifestyle management supported gradual market expansion across the region.

Market Segmentations:

By Product

- Calipers

- Bioimpedance Analyzers

- Hydrostatic Weighing

- DEXA (Dual-Energy X-Ray Absorptiometry)

- Air-Displacement Plethysmography

By Compartment Model

- Two-Compartment Model

- Three-Compartment Model

- Multi-Compartment Models

By End-use

- Hospitals & Clinics

- Fitness Centers and Gymnasiums

- Homecare Center

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the body composition analyzers market features strong activity from global players that focus on accuracy, medical reliability, and multi-segment adoption. Companies such as InBody, GE Healthcare, Hologic Inc., Tanita Corporation, Omron Corporation, COSMED Srl, Seca GmbH, Bodystat Ltd, Maltron International, and Charder Electronic Co. Ltd compete by advancing measurement precision, improving multi-frequency BIA systems, and expanding integration with digital health platforms. Leading brands invest in advanced algorithms, cloud-linked dashboards, and clinical-grade sensors to support hospitals, fitness centers, and wellness programs. Many manufacturers also strengthen their portfolios through portable analyzers, connected smart scales, and professional devices for research and medical diagnostics. Product launches align with rising demand for obesity management, sports performance evaluation, and chronic-disease monitoring. Strategic partnerships with clinics and gyms help expand distribution channels across North America, Europe, and Asia Pacific. Continuous R&D spending and regulatory compliance shape long-term competitiveness across key regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- InBody Co. Ltd

- Bodystat Ltd

- Maltron International

- GE Healthcare

- COSMED Srl

- Omron Corporation

- Tanita Corporation

- Hologic Inc.

- Seca GmbH

- Charder Electronic Co. Ltd

Recent Developments

- In May 2025, Seca GmbH launched its mBCA Alpha scanner for body composition screening in primary care settings, completing an assessment in just 24 seconds.

- In March 2025, Seca introduced its Treatment Tracker, an AI-powered platform that links a patient’s treatment plan with their body composition data, enabling real-time monitoring and adjustment.

- In 2024, Charder Electronic Co., Ltd. presented its MA801 Body Composition Analyzer at the Healthcare+ Expo in Taiwan, emphasising advanced metrics like phase angle and muscle-quality evaluation.

Report Coverage

The research report offers an in-depth analysis based on Product, Compartment Model, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will rise as hospitals expand metabolic and obesity-management services.

- Multi-frequency BIA systems will gain traction for higher clinical accuracy.

- AI-driven analytics will support personalized nutrition and fitness programs.

- Cloud-linked devices will strengthen long-term patient monitoring.

- DEXA systems will see wider use in sports science and bone-health tracking.

- Portable analyzers will grow as gyms and wellness centers increase testing demand.

- Integration with digital health records will improve diagnostic workflows.

- Manufacturers will focus on lower-radiation and faster-scan technologies.

- Emerging markets in Asia Pacific will invest heavily in advanced diagnostic tools.

- Corporate wellness programs will boost adoption across large workforce groups.