Market Overview

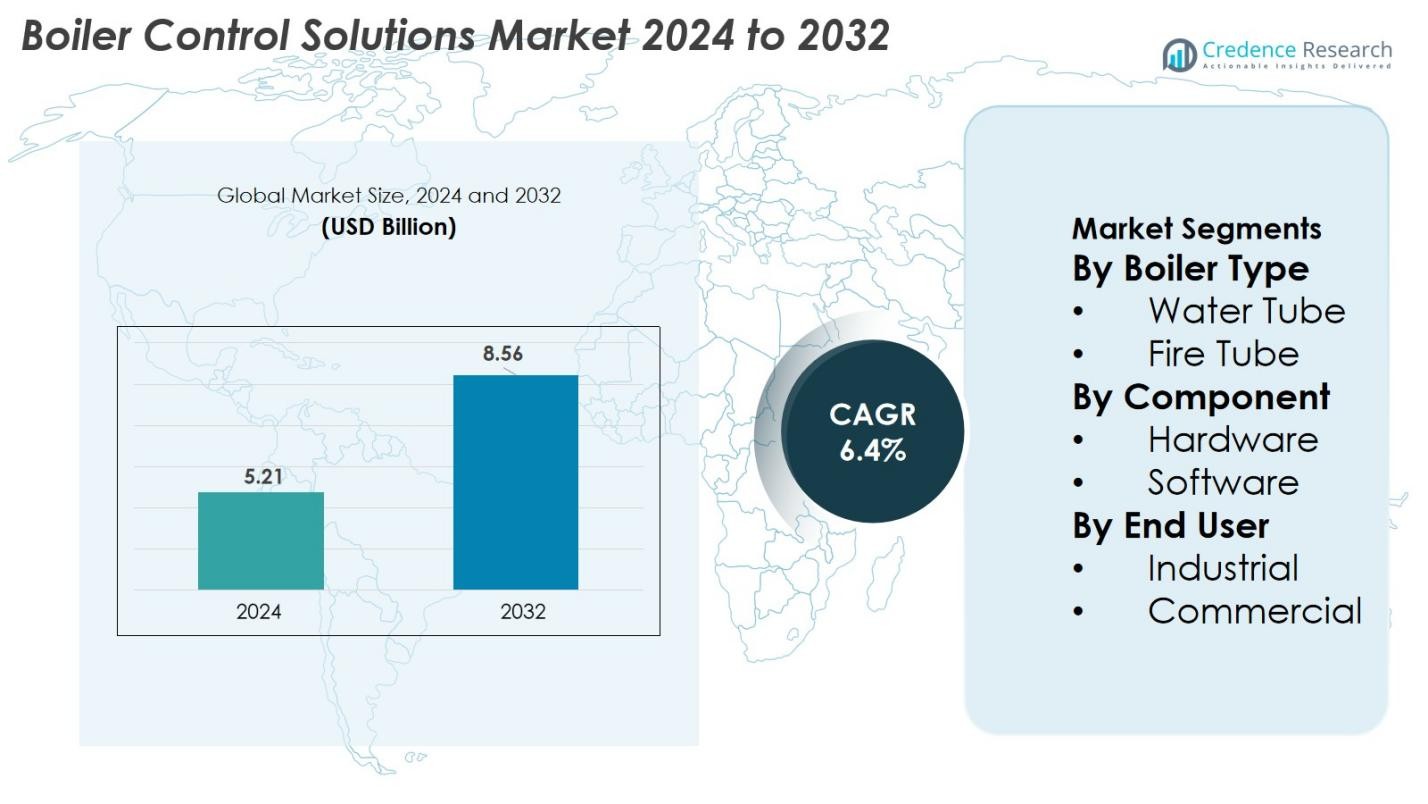

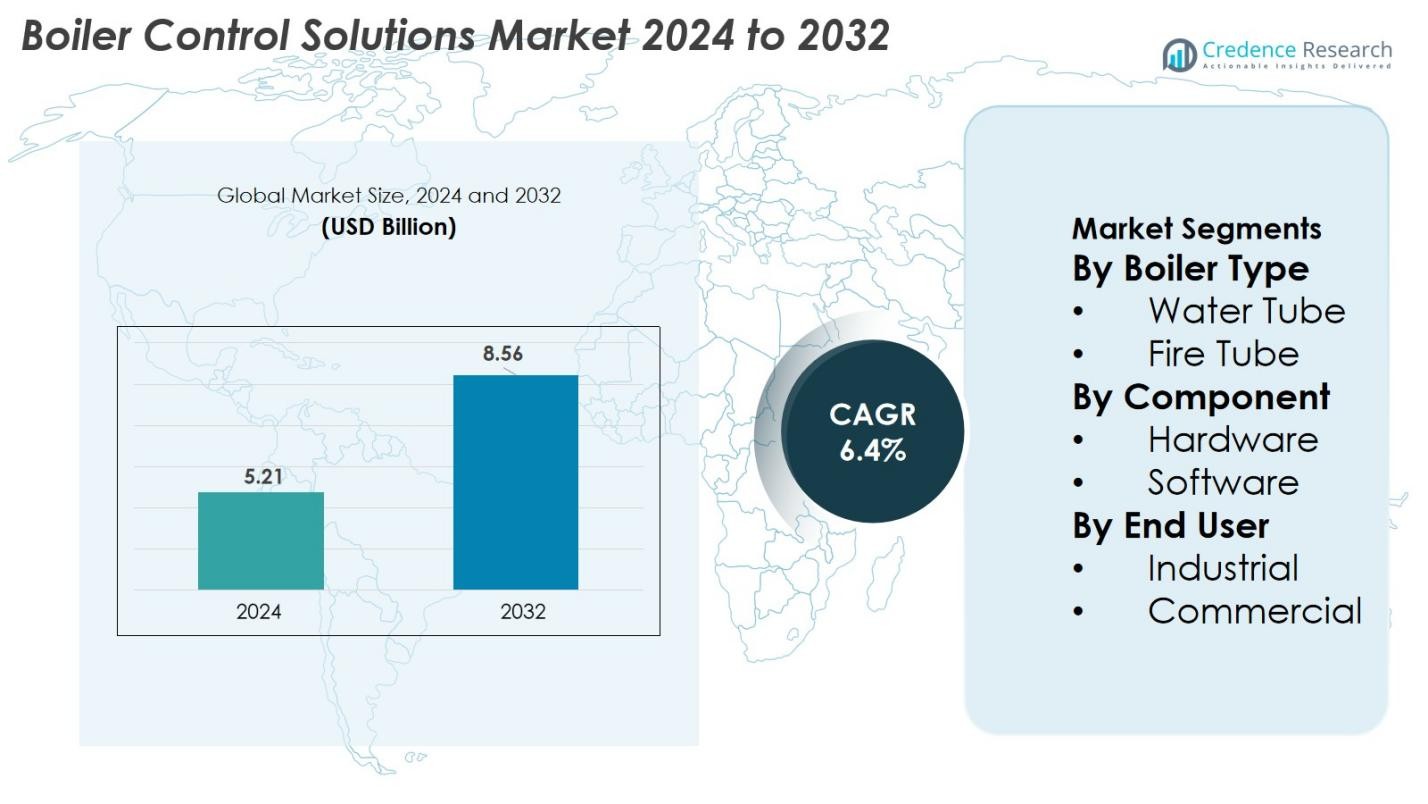

Boiler Control Solutions market size was valued at USD 5.21 Billion in 2024 and is anticipated to reach USD 8.56 Billion by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Boiler Control Solutions Market Size 2024 |

USD 5.21 Billion |

| Boiler Control Solutions Market, CAGR |

6.4% |

| Boiler Control Solutions Market Size 2032 |

USD 8.56 Billion |

Boiler Control Solutions market is shaped by the presence of global automation and boiler technology leaders, including Siemens AG, ABB, Schneider Electric, Emerson Electric Co., Yokogawa Electric Corporation, Honeywell International Inc., Cleaver-Brooks Company, Inc., Burnham Commercial Boilers, Spirax Sarco Limited, and HBX Control Systems. These companies strengthen the market through advanced combustion control, smart monitoring systems, IoT-enabled sensors, and integrated automation platforms designed to improve efficiency and safety. Regionally, Asia Pacific leads the market with a 38.9% share in 2024, driven by rapid industrialization and strong demand from manufacturing and power sectors, followed by North America and Europe with robust modernization and emission-compliance initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Boiler Control Solutions market reached USD 5.21 Billion in 2024 and is projected to grow at a CAGR of 6.4% through 2032, supported by increasing automation adoption.

- Market growth is driven by rising demand for energy-efficient boiler operations, stringent emission-compliance requirements, and modernization of industrial heating systems across key sectors.

- Key trends include rapid integration of IoT, AI-based monitoring, predictive maintenance, and the shift toward low-NOx, sustainable combustion technologies enhancing operational reliability.

- Leading players such as Siemens AG, ABB, Schneider Electric, Emerson, Honeywell, Yokogawa, Spirax Sarco, and Cleaver-Brooks strengthen the market through digital control platforms and smart hardware solutions.

- Asia Pacific leads with 38.9% share, followed by North America at 32.6% and Europe at 27.4%, while the water tube boiler segment dominates with 62.4% share, supported by strong industrial adoption.

Market Segmentation Analysis

By Boiler Type

The Water Tube segment dominates the Boiler Control Solutions market, accounting for 62.4% of the market share in 2024. Water tube boilers lead due to their higher efficiency, superior heat transfer rates, and suitability for high-pressure industrial operations. Industries such as power generation, oil and gas, and chemicals increasingly favor water tube systems for their reliability and ability to support automation-driven control architectures. The rising integration of advanced monitoring sensors, fuel-optimization technologies, and real-time performance analytics further accelerates adoption over fire tube configurations.

- For instance, Babcock & Wilcox (B&W) has delivered more than 5,000 water-tube package and industrial boilers worldwide a testament to their reliability and ability to meet diverse capacity, fuel and emissions-control requirements.

By Component

The Hardware segment held the largest share in 2024, commanding 68.7% of the Boiler Control Solutions market. This dominance is driven by widespread deployment of controllers, sensors, actuators, and automation modules essential for real-time boiler operation, safety, and combustion efficiency. Industries rely heavily on robust hardware infrastructure to ensure stable performance, reduce energy consumption, and meet stringent emission norms. Continuous advancements in digital control panels, smart valves, and IoT-enabled sensing devices further strengthen hardware uptake, while software continues to expand through cloud-based monitoring and predictive analytics.

- For instance, Siemens’ SIPART PS2 smart positioner installed in over 10 million valve applications globally enhances combustion control stability through precise valve actuation in industrial boiler systems.

By End User

The Industrial segment led the Boiler Control Solutions market with 71.5% share in 2024, supported by extensive use across power plants, refineries, chemical processing, food and beverage, and metals manufacturing facilities. Industrial users demand advanced automation, high-efficiency combustion systems, and strict adherence to energy-efficiency regulations, driving strong adoption of modern control platforms. Increasing focus on process optimization, operational safety, and fuel-cost reduction further accelerates the shift toward integrated control solutions. Meanwhile, the commercial segment records steady growth as buildings adopt smart boiler controls for energy management and sustainability goals.

Key Growth Drivers

Rising Focus on Energy Efficiency and Fuel Optimization

The Boiler Control Solutions market is primarily driven by industries’ increasing focus on enhancing energy efficiency and reducing fuel consumption. Industrial facilities across chemicals, power generation, pharmaceuticals, and food processing rely heavily on boilers, making fuel savings a critical operational priority. Advanced control systems equipped with precise combustion management, automated modulation, and oxygen-trim technologies significantly improve thermal efficiency while minimizing wastage. Growing pressure from global energy-efficiency regulations, carbon-tax policies, and sustainability mandates further accelerates adoption. Real-time monitoring and predictive maintenance also help reduce downtimes and operational losses, enhancing overall process reliability. As energy costs continue escalating globally, industries increasingly deploy modern boiler control platforms to optimize load management and reduce lifecycle operating expenses. This cost-saving potential remains a major growth catalyst for the market.

- For instance, Yokogawa’s Oxygen Analyzer ZR402G/ZR802G widely deployed in refinery and utility boilers supports oxygen-trim control that reduces excess air levels and enhances combustion efficiency, helping facilities cut fuel use and emissions simultaneously

Expansion of Industrial Automation and Industry 4.0 Adoption

The demand for boiler control solutions continues to strengthen due to rapid expansion of industrial automation and Industry 4.0 adoption. Modern manufacturing environments require highly precise, digitally integrated boiler operations to maintain production continuity and ensure thermal stability. Smart controls enable remote monitoring, automated fault detection, and seamless integration with plant-wide SCADA or DCS systems, supporting fully connected industrial ecosystems. IoT-enabled sensors, cloud analytics, and advanced control algorithms improve accuracy and responsiveness, reducing the risk of thermal imbalance or equipment failure. As industries pursue digital transformation, automated control mechanisms become essential for meeting quality, safety, and performance benchmarks. The shift toward autonomous operations in sectors such as petrochemicals, power plants, and food processing further amplifies the need for intelligent boiler control infrastructures. The increasing convergence of automation and digitization remains a powerful driver shaping the market’s growth trajectory.

- For instance, Emerson’s DeltaV™ control system supports embedded advanced control algorithms and real-time asset health monitoring, enabling early detection of boiler inefficiencies or burner issues and reducing operational risks in continuous-process facilities.

Stringent Safety Regulations and Emission Compliance Requirements

Stringent industrial safety standards and emission-control regulations are major drivers compelling industries to adopt advanced boiler control systems. Boilers operate under high pressure and temperature conditions, making safety-critical controls essential for preventing hazardous failures, explosions, or thermal runaways. Regulatory bodies mandate real-time monitoring of combustion quality, pressure levels, steam output, and NOx emissions to ensure safe and sustainable operations. Modern control solutions incorporate automated shutdown protocols, fault alarms, and continuous emissions monitoring systems to meet these requirements. Governments worldwide continue implementing tougher industrial emission standards, particularly for coal and gas-fired boilers, pushing facilities toward digitalized control platforms capable of maintaining compliance. The increasing emphasis on workplace safety, environmental responsibility, and audit-ready reporting systems continues to fuel adoption of advanced boiler control technologies across both industrial and commercial sectors.

Key Trends & Opportunities

Growing Integration of IoT, AI, and Predictive Analytics

A major trend shaping the Boiler Control Solutions market is the rapid integration of IoT, AI, and predictive analytics to enhance operational reliability and decision-making. Modern boiler systems are increasingly equipped with interconnected sensors that capture real-time data on temperature, pressure, fuel characteristics, and component wear. AI-driven predictive analytics help identify early signs of malfunction, allowing operators to schedule maintenance before failures occur. This shift from reactive to proactive maintenance significantly reduces downtime and extends equipment life. Cloud-based dashboards also offer remote accessibility and automated reporting, enabling multi-site monitoring. As industries embrace smart manufacturing and digital twins, the opportunity for intelligent boiler controls expands, creating new revenue prospects for solution providers offering analytics-driven services.

- For instance, Honeywell’s Connected Plant platform uses AI-enabled asset analytics to detect boiler performance anomalies and has been documented to reduce unplanned downtime by up to 30% across industrial sites through early fault detection.

Increasing Demand for Low-NOx and Sustainable Boiler Technologies

The global push toward sustainability and carbon reduction is creating strong opportunities for low-NOx and eco-friendly boiler control technologies. Industries are prioritizing greener combustion systems to comply with international emission norms and corporate ESG targets. Advanced control systems enable precise fuel-air ratio management, flue gas recirculation, and real-time emissions optimization, making them essential for low-emission boiler operations. The rise of biomass, biofuel, and hybrid boiler installations also fuels demand for adaptive control platforms capable of handling fuel variability and multi-fuel combustion. As green industrial transitions accelerate, manufacturers offering emission-optimized controls, energy recovery features, and carbon-reporting functionalities are positioned to capitalize on expanding environmental compliance markets.

- For instance, Honeywell’s SLATE™ platform is widely used in low-NOx burner systems and supports precise air–fuel ratio control, helping facilities meet stringent sub-30 ppm NOx emission requirements documented across industrial heating applications.

Key Challenges

High Initial Investment and Integration Complexity

One of the major challenges for the Boiler Control Solutions market is the high initial investment associated with advanced control technologies and digital integration. Many industries operate legacy boiler systems that require significant retrofitting, wiring upgrades, or compatibility modifications before new controls can be installed. These upgrades involve substantial capital expenditure, which can be a barrier for small and medium-sized enterprises. Additionally, integrating new control systems with existing SCADA, DCS, or plant automation platforms often requires specialized technical expertise, increasing project complexity and deployment timelines. Limited skilled workforce availability further complicates the adoption process. Despite long-term savings, the upfront cost burden remains a restraint for widespread implementation.

Cybersecurity Risks in Connected Boiler Systems

The growing adoption of IoT-enabled and cloud-connected boiler controls introduces notable cybersecurity challenges. As boilers become integrated into broader industrial automation ecosystems, they become potential entry points for cyberattacks targeting operational disruption, data theft, or unauthorized system manipulation. Compromised boiler controls can cause severe safety hazards, production shutdowns, or equipment damage. Many industrial facilities still lack mature cybersecurity frameworks, making them vulnerable to threats. Ensuring secure data transmission, network segmentation, authentication protocols, and real-time threat detection becomes essential. The increasing frequency of industrial cyberattacks heightens concerns and forces solution providers to invest in robust cybersecurity architectures, which adds complexity and cost to deployment.

Regional Analysis

North America

North America holds a significant position in the Boiler Control Solutions market, capturing 32.6% of the global share in 2024. The region benefits from strong industrial automation adoption across power generation, oil and gas, chemicals, and food processing industries. Increasing emphasis on energy efficiency, emission compliance, and modernization of aging boiler infrastructure drives demand for advanced control systems. The presence of major technology innovators and supportive regulatory frameworks accelerates digital upgrades. Ongoing investments in smart manufacturing, combined with the growing need for real-time monitoring and predictive maintenance, further strengthen the region’s leadership in boiler control adoption.

Europe

Europe accounts for 27.4% of the Boiler Control Solutions market, supported by strict environmental regulations, decarbonization initiatives, and rapid industrial modernization. Countries such as Germany, the U.K., France, and Italy are actively upgrading industrial boilers to meet stringent NOx reduction and energy-efficiency standards. The region’s strong focus on sustainability fuels demand for smart combustion controls, low-emission boilers, and automation-integrated monitoring systems. Growth in the district heating sector and adoption of Industry 4.0 technologies further support market expansion. Continuous upgrades in manufacturing plants and widespread acceptance of digital boiler management systems reinforce Europe’s strong market position.

Asia Pacific

Asia Pacific dominates the Boiler Control Solutions market with 38.9% share in 2024, making it the largest regional contributor. Rapid industrialization, strong expansion of power generation capacity, and large-scale manufacturing activities in China, India, Japan, and Southeast Asia drive robust demand. Governments across the region are enforcing stricter energy-efficiency and emission norms, prompting industries to adopt automated boiler control platforms. Investments in smart factories, advanced monitoring technologies, and infrastructure development further support market acceleration. The region’s growing focus on operational reliability, cost optimization, and digitization ensures sustained growth and solidifies Asia Pacific’s leading position.

Latin America

Latin America represents 6.2% of the Boiler Control Solutions market, driven by increasing modernization of industrial boilers in Brazil, Mexico, Argentina, and Chile. Rising investments in food processing, chemicals, pulp and paper, and energy industries create opportunities for advanced combustion and automation systems. Although adoption is slower compared to developed regions, rising fuel costs and the need for efficient heat-generation processes encourage digital control implementation. Governments are also promoting industrial energy-efficiency programs, supporting gradual upgrades. The region’s expanding industrial base and improving regulatory frameworks contribute to steady demand for intelligent boiler management technologies.

Middle East & Africa

The Middle East & Africa region holds 4.9% of the global Boiler Control Solutions market, driven by strong demand from oil and gas, petrochemicals, and power-generation sectors. Countries such as Saudi Arabia, UAE, and South Africa are increasingly investing in industrial modernization and automation initiatives. Harsh operating environments and high energy consumption levels encourage adoption of advanced boiler controls that enhance reliability and reduce operational risks. Growing focus on emission compliance and energy-efficient technologies supports market growth. Although overall adoption remains at an early stage, ongoing industrial expansion and smart infrastructure projects are expected to boost future demand.

Market Segmentations

By Boiler Type

By Component

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Boiler Control Solutions market features a diverse and well-established competitive landscape, led by global automation, instrumentation, and boiler technology providers. Companies such as Siemens AG, ABB, Schneider Electric, Emerson Electric Co., Yokogawa Electric Corporation, and Honeywell International Inc. dominate the market through advanced control platforms, smart sensors, and integrated automation solutions. Cleaver-Brooks Company, Inc., Burnham Commercial Boilers, Spirax Sarco Limited, and HBX Control Systems strengthen competition with specialized boiler technology, efficient combustion controls, and tailored solutions for industrial and commercial applications. Players focus heavily on digital upgrades, cloud-based monitoring, low-NOx control systems, and predictive maintenance capabilities to meet regulatory requirements and enhance operational efficiency. Strategic partnerships, technology innovation, and expansion into emerging industrial economies remain key focus areas as companies compete to offer more intelligent, energy-efficient, and safety-driven boiler control systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Sellers Manufacturing announced new “rapid‑response boilers and medical‑waste autoclaves,” featuring a novel multi‑flame boiler technology likely to include advanced control solutions.

- In July 2024, Bradford White Corporation Acquired Heatflo, a stainless-steel indirect water-heating and hydronic storage specialist, broadening its portfolio for efficient heating and control technologies.

- In 2024, Miura Co. (Japan) acquired Cleaver‑Brooks a well-known boiler manufacturer. This could impact the boiler control solutions market via upstream consolidation.

Report Coverage

The research report offers an in-depth analysis based on Boiler Type, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward fully automated and interconnected boiler systems supported by IoT and cloud platforms.

- AI-driven predictive maintenance will become a core feature, reducing downtime and improving operational reliability.

- Adoption of low-emission and low-NOx combustion control technologies will accelerate as global sustainability regulations tighten.

- Integration of digital twins will enhance real-time performance simulation and optimization for industrial boiler operations.

- Remote monitoring capabilities will expand, enabling multi-site management and faster issue resolution.

- The demand for retrofitting legacy boilers with advanced control hardware and software will grow significantly.

- Cybersecurity solutions for connected boiler systems will gain priority as digitalization increases system vulnerabilities.

- Industrial sectors such as power, chemicals, and food processing will remain major adopters of advanced control platforms.

- Emerging markets in Asia Pacific, Latin America, and the Middle East will drive strong installation growth.

- Collaboration between automation providers and boiler manufacturers will deepen to deliver integrated, high-efficiency control ecosystems.