Market Overview

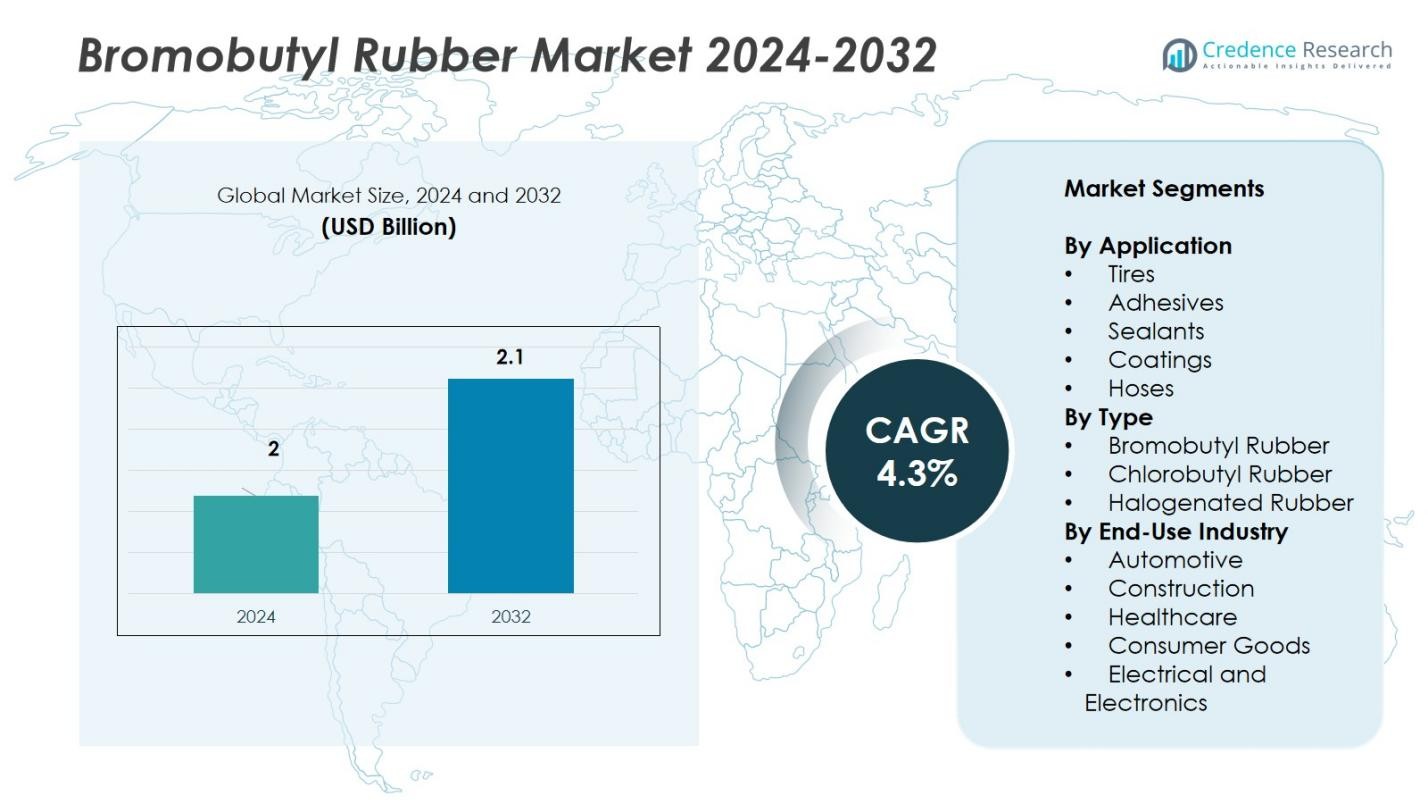

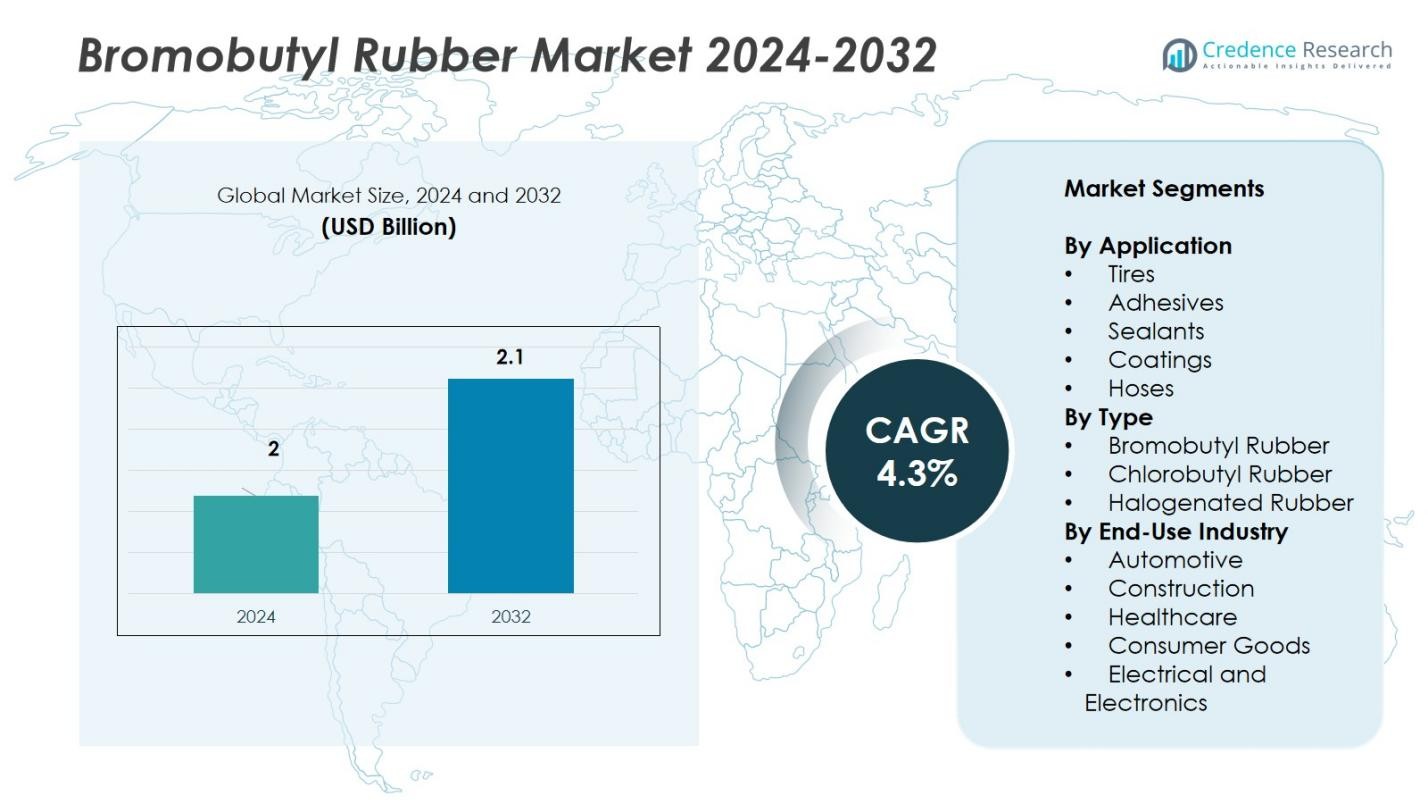

Bromobutyl Rubber Market size was valued USD 2 Billion in 2024 and is anticipated to reach USD 2.1 Billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bromobutyl Rubber Market Size 2024 |

USD 2 Billion |

| Bromobutyl Rubber Market, CAGR |

4.3% |

| Bromobutyl Rubber Market Size 2032 |

USD 2.1 Billion |

The Bromobutyl Rubber Market features Exxon Mobil, ARLANXEO, and Lanxess as core leaders. ENEOS Materials, Reliance Sibur Elastomers, Nizh Yug (Nizhnekamskneftekhim), and ELGI Rubber strengthen supply depth. Hebei Xiangyi, POLYPLAST, and YUSHENG expand regional access and niche grades. Players focus on tire inner liners, pharma closures, and durable sealing systems. Asia-Pacific leads the market with a 43% share, supported by large tire production hubs. Europe holds 25% on strong automotive and medical packaging demand. North America accounts for 22%, aided by EV programs and pharma scale. Investments target process efficiency, sustainable formulations, and long-term OEM contracts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Bromobutyl Rubber Market was valued at USD 2 Billion in 2024 and is projected to reach USD 2.1 Billion by 2032, expanding at a CAGR of 4.3%.

- Strong automotive demand, especially for tire inner liners and seals, drives market growth alongside rising healthcare applications in sterile packaging and closures.

- The market trends toward sustainable elastomers and advanced polymer technologies that enhance product performance, durability, and recyclability.

- Intense competition among players such as Exxon Mobil, ARLANXEO, and Lanxess focuses on innovation, cost optimization, and regional expansion, shaping industry dynamics.

- Asia-Pacific leads with a 43% share, followed by Europe at 25% and North America at 22%, while the tires segment holds over 55%, highlighting automotive dominance in overall consumption.

Market Segmentation Analysis:

By Application

Tires hold the dominant share of over 55% in the Bromobutyl Rubber Market, driven by growing demand for air retention and puncture resistance in high-performance and commercial vehicle tires. The material’s superior impermeability and heat resistance make it essential for tire inner liners and tubes, improving durability and fuel efficiency. Expanding automotive production in Asia-Pacific and increasing adoption of electric vehicles further strengthen segment growth. Adhesives and sealants segments also show steady gains due to their use in vibration damping and industrial assembly applications.

- For instance, ExxonMobil’s Thermax® N990 bromobutyl inner liner compound reduces mixing power consumption by up to 22% and enhances tire building process efficiency.

By Type

Bromobutyl Rubber accounts for the largest share of around 60% within the market, owing to its excellent ozone resistance, superior flexibility, and enhanced cure reactivity compared to other halogenated rubbers. It is widely used in tire manufacturing, pharmaceutical closures, and automotive sealing applications. Chlorobutyl and Halogenated Rubber types follow, supported by demand in specialized coatings and high-temperature applications. The rising shift toward sustainable elastomer formulations and growing use in hybrid vehicle components continue to drive growth across all types.

- For instance, Bridgestone utilizes Bromobutyl rubber in the inner linings of their tubeless radial tires, delivering superior air retention and durability for automotive applications.

By End-Use Industry

The automotive industry dominates the Bromobutyl Rubber Market with a market share exceeding 50%, supported by its critical role in tire inner liners, hoses, and vibration-damping components. Increasing vehicle production and emphasis on performance efficiency boost material demand. The healthcare segment follows, leveraging bromobutyl’s low permeability and chemical stability in medical stoppers and closures. Construction, consumer goods, and electronics sectors are also expanding their usage for insulation, sealing, and protective coating applications as industrialization and urbanization accelerate globally.

Key Growth Drivers

Expanding Demand from the Automotive Sector

The Bromobutyl Rubber Market grows significantly due to strong automotive production and rising demand for durable tire materials. Bromobutyl rubber offers excellent air impermeability, heat resistance, and vibration absorption, making it vital for tire inner liners, tubes, and seals. The increasing production of electric and hybrid vehicles further supports usage as manufacturers prioritize lightweight, efficient materials. Continuous innovation in tire technology and expanding mobility infrastructure across developing economies strengthen long-term demand for bromobutyl rubber in automotive applications.

- For instance, ARLANXEO’s X_Butyl® bromobutyl polymers are utilized in tire inner liners for their superior low permeability to gases and moisture, as well as high resistance to aging and heat key for tire durability in passenger and commercial vehicles.

Rising Adoption in Pharmaceutical and Healthcare Applications

The healthcare industry increasingly uses bromobutyl rubber for medical stoppers, closures, and sealing components. Its low permeability, biocompatibility, and chemical resistance make it ideal for pharmaceutical packaging. The market benefits from the growing production of injectable drugs and vaccines that require high-quality elastomer seals. Regulatory standards emphasizing safety and contamination prevention also enhance its adoption. With global healthcare spending expanding and pharmaceutical output increasing, bromobutyl rubber continues to gain traction in sterile and critical medical applications.

- For instance, Aptar Pharma ships over 1 billion bromobutyl rubber components annually, including their PremiumCoat® line which uses ETFE film coatings to significantly reduce extractables and enhance compatibility with sensitive drugs such as vaccines and biologics.

Industrial Expansion and Infrastructure Development

Rapid industrialization in emerging economies supports growth in the Bromobutyl Rubber Market through demand for hoses, sealants, and coatings. The material’s flexibility, weather resistance, and durability make it suitable for heavy-duty construction and industrial sealing operations. Infrastructure development projects in Asia-Pacific and the Middle East drive large-scale consumption across construction and manufacturing sectors. Growth in energy, chemical, and industrial equipment markets further fuels material demand, especially in applications requiring long service life under extreme environmental and chemical conditions.

Key Trends & Opportunities

Focus on Sustainable and Recyclable Rubber Solutions

A growing trend toward eco-friendly elastomers drives innovation in bromobutyl rubber production. Manufacturers explore bio-based feedstocks and recycling processes to reduce environmental impact. Sustainable material development supports compliance with global environmental regulations and corporate sustainability goals. This shift creates opportunities for producers to differentiate through greener product lines and circular economy practices. Emerging demand from automotive and medical industries for sustainable rubber components enhances long-term potential for innovation-driven growth.

- For instance, ExxonMobil’s continuous bromobutyl rubber production process improves efficiency and supports cleaner manufacturing practices by reducing energy use and emissions.

Technological Advancements in Manufacturing Processes

Ongoing advancements in polymer modification and halogenation techniques improve bromobutyl rubber performance and processing efficiency. These innovations enhance product consistency, curing speed, and mechanical strength, enabling broader industrial use. Modern compounding methods allow manufacturers to customize formulations for specific applications, from pharmaceutical seals to automotive parts. The integration of digital quality control systems and smart manufacturing technologies helps reduce waste and boost productivity, driving competitiveness and profitability in global markets.

For instance, Datwyler’s FM259 bromobutyl compound with Omniflex coating achieves exceptional fragmentation and resealing properties for wearable injector septa, meeting stringent ISO coring standards.

Key Challenges

Volatile Raw Material Prices

Fluctuations in raw material costs, particularly isobutylene and isoprene, pose a major challenge for bromobutyl rubber producers. Price instability in petrochemical supply chains affects manufacturing costs and profit margins. Dependence on crude oil derivatives makes pricing sensitive to global energy market dynamics. Manufacturers face pressure to optimize production efficiency and secure long-term supply contracts to maintain profitability and pricing stability amid volatile market conditions.

Environmental Regulations and Disposal Issues

Stringent environmental policies governing rubber production, waste management, and emissions control create operational challenges. Bromobutyl rubber manufacturing involves halogenated compounds that require proper disposal and compliance with safety standards. Non-compliance can lead to increased costs, regulatory penalties, and reputation risks. The industry faces growing pressure to adopt cleaner production technologies, reduce carbon footprints, and improve recycling infrastructure to align with global sustainability mandates.

Regional Analysis

North America

North America holds a market share of 22% in the Bromobutyl Rubber Market, supported by strong automotive and healthcare industries. The U.S. drives regional demand through large-scale tire manufacturing, pharmaceutical packaging, and industrial sealing applications. Technological advancements in elastomer production and the presence of key players like Exxon Mobil Corporation enhance market competitiveness. Growing adoption of high-performance materials for electric vehicles and medical-grade components further accelerates growth. Environmental regulations promoting sustainable rubber production continue to shape innovation and regional investment strategies.

Europe

Europe accounts for 25% of the Bromobutyl Rubber Market, driven by mature automotive, construction, and pharmaceutical sectors. Countries such as Germany, France, and Italy lead consumption through advanced tire production and medical sealing applications. The presence of leading manufacturers like ARLANXEO and Lanxess supports product innovation and regional export strength. Stringent EU regulations on material safety and emission reduction promote eco-friendly elastomer development. Increasing investments in sustainable mobility and healthcare expansion continue to reinforce Europe’s steady market position.

Asia-Pacific

Asia-Pacific dominates the Bromobutyl Rubber Market with a 43% share, fueled by rapid industrialization and strong automotive production in China, India, and Japan. Expanding tire manufacturing bases and infrastructure projects drive bulk material demand. The region benefits from low-cost raw materials, skilled labor, and rising pharmaceutical output. Government initiatives promoting electric mobility and industrial modernization further boost adoption. Continuous investment in capacity expansion and technological upgrades by regional producers enhances competitiveness and global export potential for bromobutyl rubber.

Latin America

Latin America captures 6% of the Bromobutyl Rubber Market, led by growing automotive assembly plants and construction projects in Brazil and Mexico. Expanding healthcare infrastructure also supports demand for pharmaceutical-grade rubber components. Increasing focus on industrial sealing and adhesive applications adds new growth avenues. Regional manufacturers invest in cost-efficient production and import partnerships to meet local needs. While the market remains smaller than other regions, steady economic recovery and trade expansion with Asia-Pacific strengthen long-term prospects.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the Bromobutyl Rubber Market, supported by infrastructure development and industrial diversification initiatives. Gulf nations, including Saudi Arabia and the UAE, drive demand through energy, construction, and automotive maintenance sectors. Expanding healthcare investments in Africa enhance use in medical packaging applications. Strategic alliances with global suppliers improve raw material availability and distribution networks. Ongoing industrial growth, coupled with government efforts to attract manufacturing investments, is expected to support gradual regional market expansion.

Market Segmentations:

By Application

- Tires

- Adhesives

- Sealants

- Coatings

- Hoses

By Type

- Bromobutyl Rubber

- Chlorobutyl Rubber

- Halogenated Rubber

By End-Use Industry

- Automotive

- Construction

- Healthcare

- Consumer Goods

- Electrical and Electronics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Bromobutyl Rubber Market features key players such as Exxon Mobil Corporation, ARLANXEO, Lanxess International SA, ENEOS Materials Corporation, Reliance Sibur Elastomers Private Limited, ELGI Rubber, Hebei Xiangyi International Trading Co., Ltd., POLYPLAST, Nizh Yug (Nizhnekamskneftekhim), and YUSHENG ENTERPRISE LIMITED. The market is moderately consolidated, with global manufacturers focusing on capacity expansion, product innovation, and long-term supply contracts to secure raw materials. Companies emphasize advanced polymer modification and sustainable rubber formulations to strengthen their competitive edge. Strategic collaborations with tire manufacturers and healthcare packaging companies help expand market reach. Rising demand from Asia-Pacific encourages regional players to enhance production efficiency and quality standards. Continuous R&D investment in halogenation technology and high-performance elastomer applications supports differentiation among leading participants, while sustainability initiatives and digitalized manufacturing remain core focus areas driving future competitiveness.

Key Player Analysis

- ARLANXEO (Netherlands)

- Hebei Xiangyi International Trading Co., Ltd. (China)

- Exxon Mobil Corporation (U.S.)

- ELGI Rubber (India)

- ENEOS Materials Corporation (Japan)

- Reliance Sibur Elastomers Private Limited (India)

- POLYPLAST (Russia)

- Lanxess International SA (Germany)

- Nizh Yug (Nizhnekamskneftekhim) (Russia)

- YUSHENG ENTERPRISE LIMITED (China)

Recent Developments

- In July 2024, ARLANXEO, a leading manufacturer of performance elastomers, achieved ISCC PLUS certification for its EPDM plant in Geleen, Butyl plant in Singapore, and EVM plant in Dormagen, Germany.

- In December 2023, SIBUR’s subsidiary Nizhnekamskneftekhim completed a major upgrade of its halobutyl rubber (HBR) production facilities, increasing output by one-third, from 150,000 to 200,000 kilotons.

- In October 2025, India’s Directorate General of Trade Remedies (DGTR) initiated an antidumping investigation into halobutyl rubber (including bromobutyl rubber) imports from three countries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Type, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand from automotive and pharmaceutical industries.

- Electric vehicle production will boost tire inner liner applications using bromobutyl rubber.

- Pharmaceutical closures and medical stoppers will see higher adoption for sterile packaging.

- Asia-Pacific will remain the leading regional market due to industrial and infrastructure growth.

- Sustainability and eco-friendly elastomer development will gain stronger focus among manufacturers.

- Technological innovations in halogenation and polymer processing will improve product performance.

- Strategic partnerships between raw material suppliers and tire producers will increase.

- Healthcare sector expansion in emerging economies will drive long-term material demand.

- Recycling and green rubber initiatives will shape production strategies across regions.

- R&D investments in high-performance, low-permeability compounds will strengthen market competitiveness.