Market Overview

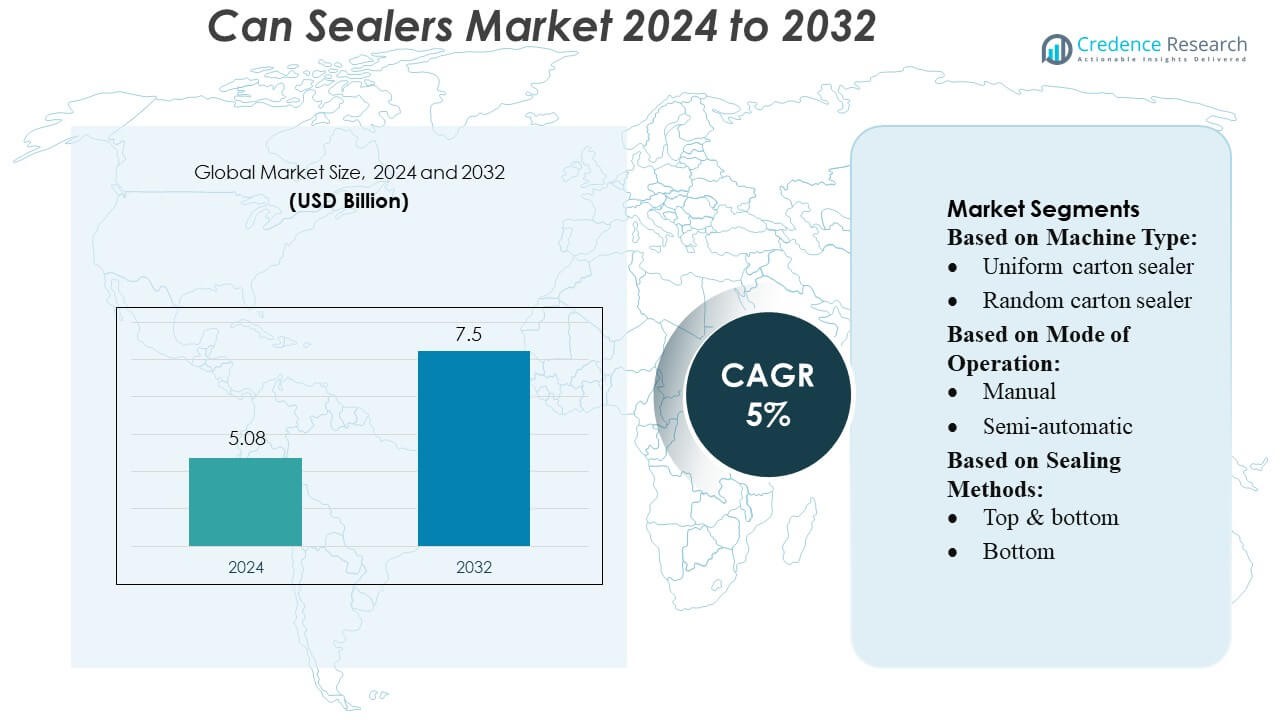

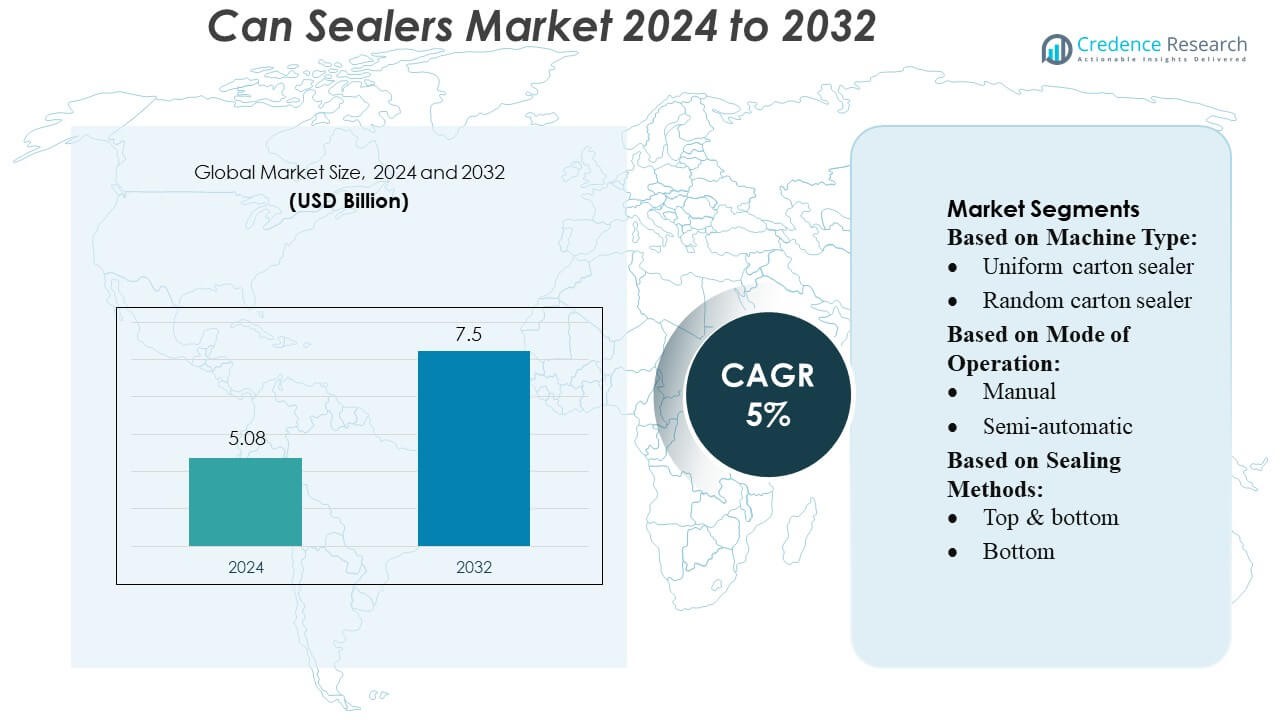

Can Sealers Market size was valued USD 5.08 billion in 2024 and is anticipated to reach USD 7.5 billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Can Sealers Market Size 2024 |

USD 5.08 Billion |

| Can Sealers Market, CAGR |

5% |

| Can Sealers Market Size 2032 |

USD 7.5 Billion |

The can sealers market is characterized by strong competition among major global manufacturers that continue to expand their technological capabilities, product portfolios, and service networks to meet rising packaging automation demands. Companies increasingly focus on high-speed, precision sealing systems, energy-efficient designs, and multi-format flexibility to strengthen their market presence across food, beverage, and pharmaceutical applications. Asia-Pacific emerges as the leading region, holding approximately 30–32% of the global market, driven by large-scale manufacturing growth, rising packaged food consumption, and rapid adoption of automated production lines. This regional dominance continues to attract investments and strategic expansions from key industry participants.

Market Insights

- The Can Sealers Market was valued at USD 5.08 billion in 2024 and is expected to reach USD 7.5 billion by 2032, registering a CAGR of 5% during the forecast period.

- Rising demand for packaged food and beverages, along with the need for high-speed and contamination-free sealing, drives adoption of advanced systems; uniform carton sealers lead the segment with 55–58%, while fully automatic machines dominate with 52–56% share.

- Market trends reflect increasing integration of IoT-enabled monitoring, predictive maintenance, and multi-format flexibility to support diverse production requirements across manufacturing lines.

- Competitive activity intensifies as global players enhance automation, energy efficiency, and service capabilities, though high installation and maintenance costs remain key restraints for small and mid-sized manufacturers.

- Asia-Pacific remains the leading region with 30–32% share, supported by strong manufacturing expansion, while top & bottom sealing maintains dominance within sealing methods at 48–50% due to its structural reliability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Machine Type

Uniform carton sealers dominate the can sealer market with an estimated 55–58% share, driven by their reliability, consistent sealing quality, and suitability for high-volume packaging lines. Manufacturers in food, beverage, and consumer goods industries prefer uniform systems because they reduce setup time and ensure repeatable sealing precision across standardized carton dimensions. Their compatibility with automated conveyor systems further accelerates throughput and minimizes operational errors, making them the preferred choice for facilities prioritizing speed, uniformity, and low maintenance requirements.

- For instance, Dixie Canner Co. manufactures direct-drive can seamers such as the Model 25D-TWIN-AL, which achieves an output rate of up to 30 cans per minute, demonstrating how uniform-type machines deliver high throughput with consistent seam integrity.

By Mode of Operation

Fully automatic can sealers lead this segment, capturing roughly 52–56% of the market, as industries shift toward labor-efficient and high-throughput packaging solutions. These systems deliver continuous operation, advanced sensor-based alignment, and precise sealing mechanisms that reduce material waste and eliminate manual intervention. Their ability to integrate with smart factory technologies, including real-time monitoring and automated quality control, supports higher productivity and operational stability, positioning them as the most attractive option for large manufacturing units seeking consistent performance.

- For instance, Ferrum Ltd. offers its F12-1 can seamer — a 12-station machine that processes between 580 and 1,600 cans per minute (equivalent to 34,800–96,000 cans per hour), delivering continuous, high-speed sealing with minimal manual intervention.

By Sealing Methods

Top & bottom sealing remains the dominant method with an approximate 48–50% market share, driven by its enhanced structural reinforcement and suitability for heavy or fragile packaged goods. This method improves load-bearing capacity, prevents product leakage, and supports long-distance shipping durability, making it the preferred sealing configuration for food processing, pharmaceuticals, and e-commerce fulfillment. Its compatibility with both semi-automatic and fully automatic machines further strengthens adoption among manufacturers aiming to achieve secure, tamper-resistant packaging at scale.

Key Growth Drivers

- Expansion of Packaged Food and Beverage Consumption

Rising global demand for packaged food and beverages remains a primary driver of the can sealers market, as manufacturers prioritize fast, reliable, and contamination-free sealing processes. Growth in ready-to-eat meals, energy drinks, canned fruits, and nutraceutical beverages has increased the need for high-volume, precision sealing systems. Food safety regulations and extended shelf-life requirements further accelerate investment in advanced sealing machines that ensure airtight, tamper-evident packaging while supporting high-speed production lines across large-scale processing facilities.

- For instance, JK Somme reports its modern “SAGA” round-can seamer machines achieve capacities up to 600 cans per minute, enabling large-scale production of canned fish, ready meals, and beverages.

- Automation Adoption in Manufacturing Facilities

The ongoing shift toward automated packaging workflows significantly boosts can sealer adoption, especially in industries pursuing efficiency, labor reduction, and operational consistency. Automated sealers enable continuous production, minimize human error, and integrate with smart factory platforms for real-time monitoring and performance analytics. Their ability to maintain consistent seal integrity at high throughput levels supports higher output with less downtime. As manufacturers face rising labor costs and demand for precision, automated sealing systems continue to replace manual equipment.

- For instance, Innovus Engineering Ltd. offers the 10VGT — a fully automated vacuum-and-gassing can seamer that achieves residual oxygen levels below 0.5%, providing an airtight seal for sensitive products.

- Growth of Metal Packaging in Pharmaceutical and Personal Care Sectors

Increasing adoption of metal cans for pharmaceuticals, cosmetics, and personal care products is driving demand for advanced sealing technologies. These sectors require airtight, contamination-resistant packaging to protect sensitive formulations from moisture, oxidation, and light exposure. Can sealers capable of delivering micro-precision seals and accommodating varying can sizes are seeing increased deployment. Regulatory standards emphasizing packaging safety and quality further enhance the demand for reliable sealing systems, particularly for ointments, aerosols, powders, and specialty chemical-based products.

Key Trends & Opportunities

- Integration of Smart Monitoring and IoT-Enabled Systems

Can sealer manufacturers are increasingly incorporating IoT sensors, predictive maintenance tools, and automation software, creating opportunities for factories to enhance productivity and reduce unplanned downtime. Smart sealers allow real-time monitoring of sealing pressure, temperature, and alignment, ensuring consistent quality. The rise of Industry 4.0 and digital twins further enables packaging lines to optimize operational parameters and energy consumption. This trend opens substantial opportunities for suppliers offering connected, data-driven sealing solutions tailored for high-speed production environments.

- For instance, JBT’s X-59 seamer operates at speeds up to 1,500 cans per minute, processing a wide variety of food, beverage, and powder products while maintaining consistent double-seam quality and requiring minimal maintenance.

- Rising Demand for Energy-Efficient and Sustainable Equipment

Growing sustainability requirements are driving demand for energy-efficient can sealing machines designed to reduce material waste and operational emissions. Manufacturers are adopting sealers with optimized power consumption, recyclable sealing materials, and reduced compressed-air usage. This shift creates opportunities for companies offering eco-designed systems that comply with global environmental standards. As brands commit to carbon-reduction goals, demand increases for sealing technologies that deliver high performance while minimizing environmental impact across food, beverage, and industrial packaging operations.

- For instance, Pneumatic Scale Angelus’s “V‑Series” can seamers reduce component complexity by 25% compared with legacy models while maintaining 80% commonality across parts, streamlining maintenance and spare‑parts management.

- Customization and Flexibility in Multi-Format Packaging Lines

The surge in SKU diversification across FMCG, beverage, and healthcare sectors is creating strong opportunities for flexible can sealing systems capable of handling multiple can sizes and formats. Manufacturers increasingly seek modular, quick-changeover machines that enable faster batch switching and shorter production cycles. This trend offers growth prospects for vendors developing adaptable sealing heads, adjustable conveyors, and multi-format tooling systems. The ability to support customized packaging without sacrificing speed or seal integrity becomes a key differentiator in competitive markets.

Key Challenges

- High Initial Investment and Integration Costs

Despite technological advancements, the high upfront cost of automated and semi-automatic can sealers remains a significant barrier for small and medium manufacturers. Expenses related to installation, operator training, system integration, and maintenance add to the financial burden. Many companies struggle to justify these investments, especially when production volumes fluctuate. Additionally, integrating advanced sealers with existing packaging lines requires technical expertise, which can increase project complexity and delay ROI, limiting adoption in cost-sensitive segments.

- Operational Downtime and Maintenance Complexity

Can sealing machines require precise mechanical alignment and consistent maintenance to sustain seal integrity and avoid production interruptions. Wear and tear in sealing heads, rollers, and drive systems may cause unexpected downtime if not monitored closely. For high-speed lines, even minor performance deviations can result in defective seals, product wastage, and quality compliance issues. Limited availability of skilled technicians further complicates repairs, increasing operational risk for manufacturers that rely heavily on continuous, uninterrupted production cycles.

Regional Analysis

North America

North America holds an estimated 32–34% share of the can sealers market, supported by strong demand from the food, beverage, and pharmaceutical industries. Manufacturers in the United States and Canada increasingly adopt automated and high-precision sealing systems to meet strict packaging safety regulations and rising production volumes. The region’s advanced manufacturing infrastructure and rapid adoption of energy-efficient equipment further strengthen market expansion. Growth in canned beverages, ready-to-eat foods, and specialty metal-packaged healthcare products continues to reinforce North America’s leadership in high-performance can sealing technologies.

Europe

Europe accounts for roughly 27–29% of the market, driven by stringent packaging standards, sustainability regulations, and strong adoption of advanced sealing technologies across Germany, the U.K., France, and Italy. The region’s emphasis on recyclable metal packaging and energy-efficient production systems supports steady investment in modern can sealers. Growth in premium food products, craft beverages, and pharmaceutical packaging boosts demand for precise, contamination-resistant sealing systems. Continuous technological upgrades and digitalized production lines position Europe as a key market for high-quality, automated sealing solutions.

Asia-Pacific

Asia-Pacific leads in growth momentum and represents approximately 30–32% share, supported by rapid industrialization, expanding consumer goods manufacturing, and rising packaged food consumption. China, India, Japan, and Southeast Asia drive significant demand for high-speed sealing machines, particularly within large-scale food processing and beverage production facilities. Increasing investments in automation, along with strong export-oriented manufacturing, strengthen the region’s adoption of advanced sealing technologies. APAC’s growing pharmaceutical and personal care sectors further accelerate deployment of precision sealing systems designed for product safety and extended shelf life.

Latin America

Latin America holds around 5–6% of the market, with demand increasingly driven by expanding food and beverage processing industries in Brazil, Mexico, and Argentina. The region is gradually adopting automated sealing machines to improve productivity and meet rising demand for packaged and shelf-stable foods. Growth in canned beverages, regional exports, and improving manufacturing capabilities supports market adoption. However, higher capital investment requirements and operational cost constraints slow the transition from manual to fully automated sealing systems, keeping the market at a steady but developing stage.

Middle East & Africa (MEA)

The Middle East & Africa region captures approximately 4–5% share, driven by growing food processing, beverage manufacturing, and chemical packaging activities, particularly in the UAE, Saudi Arabia, and South Africa. Increasing demand for long-shelf-life packaged products and expanding retail infrastructure contribute to rising use of can sealers. Adoption remains moderate due to limited automation penetration, but investment in modern manufacturing facilities and food security initiatives is boosting interest in advanced sealing technologies. The region’s gradual industrial expansion supports long-term opportunities for semi-automatic and fully automatic sealing systems.

Market Segmentations:

By Machine Type:

- Uniform carton sealer

- Random carton sealer

By Mode of Operation:

By Sealing Methods:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the can sealers market features a diverse mix of global and regional manufacturers, including Dixie Canner Co., Ferrum Ltd., JK Somme, Innovus Engineering Ltd., JBT, MWM Engineering Ltd., Pneumatic Scale Angelus, Bubber Machine Tools, SHIN I MACHINERY WORKS CO., LTD., and ProMach Inc. the can sealers market is defined by continuous innovation, expanding automation capabilities, and a strong focus on operational efficiency. Companies prioritize the development of high-speed, precision sealing systems that support multi-format production and minimize downtime. Advanced features such as predictive maintenance, IoT-based monitoring, and energy-efficient components are becoming standard as manufacturers aim to meet rising demand for reliability and cost optimization. Market players also emphasize modular machine designs and flexible configurations to accommodate diverse can sizes and frequent changeovers. Growing investments in R&D, service support networks, and customized solutions further intensify competition across global and regional markets.

Key Player Analysis

Recent Developments

- In March 2025, H.B. Fuller launched the Millennium PG-1 EF ECO2, a commercial roofing adhesive that uses naturally occurring atmospheric gases instead of chemical blowing agents in its canister propellant system.

- In February 2025, Syntegon launched its Kliklok advanced carton closer (ACC) for high-speed carton sealing, a machine designed with customer feedback to deliver high flexibility and precision. This carton closer can seal up to 200 cartons per minute, handling both cardboard and corrugated board with features like servo-driven alignment, tool-free changeovers, and options for different carton entry and exit configurations.

- In October 2024, Intertape Polymer Group (IPG) launched the iTrack tape monitoring system, which uses data and alerts to optimize case sealing machinery. The system ensures proper tape application, tracks machine uptime and downtime, and detects issues like low tape, uncut tape, partially taped cases, and jams.

- In February 2024, ProMach acquired the Italian company Zanichelli Meccanica S.p.A. (Zacmi), a manufacturer of filling, seaming, and pasteurization equipment for the food and beverage industry. This acquisition expands ProMach’s processing and packaging capabilities, allowing it to offer more integrated systems by combining Zacmi’s technology with its other companies, such as Allpax.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Mode of Operation, Sealing Methods and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward fully automated sealing systems to enhance production efficiency and reduce labor dependency.

- Adoption of IoT-enabled and smart monitoring technologies will grow as manufacturers prioritize real-time quality control.

- Energy-efficient and low-maintenance sealing machines will gain traction due to rising sustainability requirements.

- Demand for flexible, multi-format sealers will increase as companies expand product variants and packaging formats.

- Growth in packaged food and ready-to-drink beverages will continue to drive high-volume sealing system installations.

- Pharmaceutical and personal care sectors will adopt more precision sealing machines to meet stringent safety standards.

- Manufacturers will invest in modular machine designs that support faster changeovers and reduced downtime.

- Emerging markets will experience faster adoption as local production capacities and packaging standards improve.

- Predictive maintenance solutions will become essential for minimizing operational disruptions in high-speed lines.

- Competition will intensify as companies expand service networks and integrate advanced digital features into sealing equipment.