Market Overview

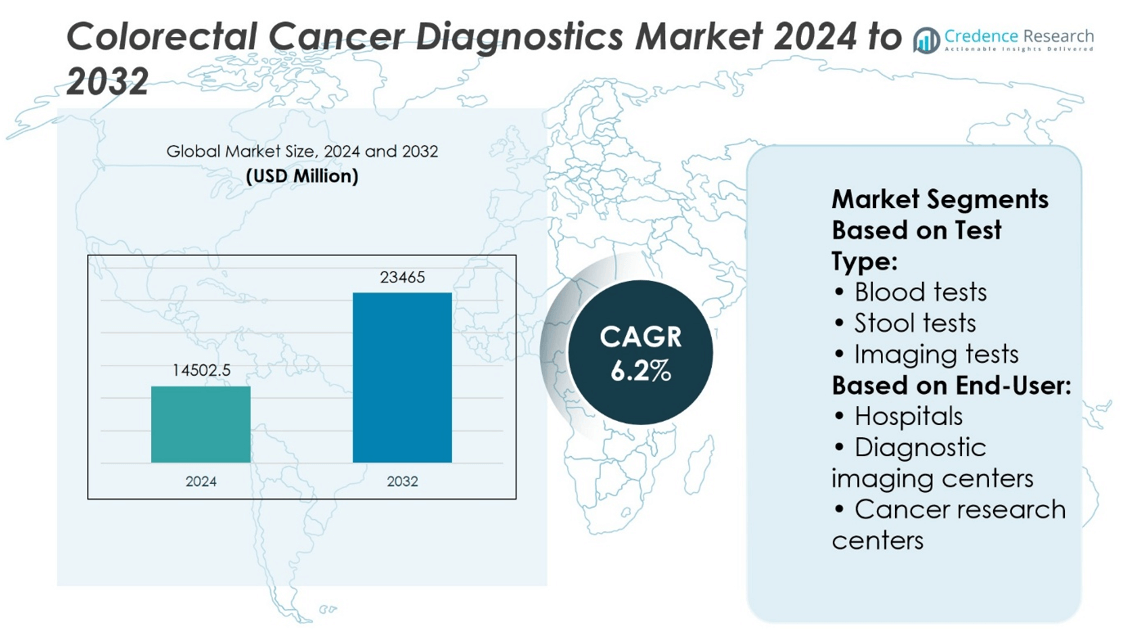

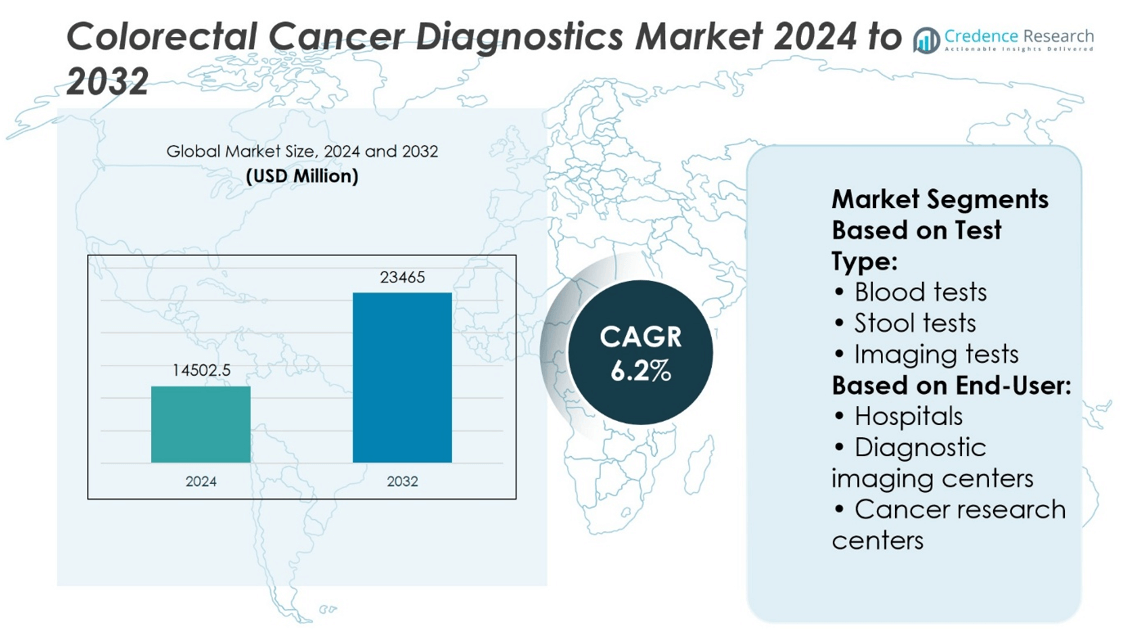

Colorectal Cancer Diagnostics Market size was valued at USD 14502.5 million in 2024 and is anticipated to reach USD 23465 million by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Colorectal Cancer Diagnostics Market Size 2024 |

USD 14502.5 million |

| Colorectal Cancer Diagnostics Market, CAGR |

6.2% |

| Colorectal Cancer Diagnostics Market Size 2032 |

USD 23465 million |

The Colorectal Cancer Diagnostics Market is driven by the rising incidence of colorectal cancer, growing awareness of early detection, and increased adoption of non-invasive diagnostic tools. Governments and healthcare systems are expanding national screening programs and supporting access to advanced diagnostic technologies. Technological advancements in molecular testing, liquid biopsy, and AI-powered pathology are reshaping diagnostic accuracy and efficiency. Trends such as home-based testing, personalized diagnostics, and integration of digital health platforms are gaining momentum. It reflects a shift toward earlier intervention, patient-centric approaches, and expanded diagnostic reach across both developed and emerging healthcare markets.

North America leads the Colorectal Cancer Diagnostics Market due to strong healthcare infrastructure and widespread screening programs, followed by Europe with robust government-led initiatives. Asia Pacific is witnessing rapid growth driven by rising awareness and improving diagnostic access, while Latin America and the Middle East & Africa show gradual development. Key players shaping the market include Abbott Laboratories, Danaher Corporation, Exact Sciences Corporation, F. Hoffmann-La Roche, GE HealthCare Technologies, Guardant Health, DiaCarta, Geneoscopy, H.U. Group Holdings, and New Day Diagnostics.

Market Insights

- The Colorectal Cancer Diagnostics Market was valued at USD 14,502.5 million in 2024 and is projected to reach USD 23,465 million by 2032, growing at a CAGR of 6.2%.

- Rising incidence of colorectal cancer and increased awareness of early detection continue to drive market demand globally.

- Growing adoption of non-invasive diagnostics, including liquid biopsy and stool-based DNA testing, is improving screening participation rates.

- Technological advancements in molecular diagnostics, AI-powered pathology, and digital health integration are reshaping diagnostic accuracy and accessibility.

- Key market players focus on innovation, strategic collaborations, and expanding product portfolios to maintain competitive advantage.

- High cost of advanced diagnostic technologies and limited reimbursement in some regions remain major market restraints.

- North America leads the market, followed by Europe, while Asia Pacific shows the fastest growth; Latin America and Middle East & Africa are gradually expanding.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increased Disease Burden and Growing Awareness Fueling Diagnostic Demand

The Colorectal Cancer Diagnostics Market is expanding due to the increasing global burden of colorectal cancer and greater awareness among patients and healthcare providers. Rising incidence rates, especially in countries undergoing demographic transitions, are driving the need for early and accurate diagnostic solutions. Governments and healthcare organizations are investing in public awareness campaigns and national screening programs. These initiatives are helping more patients seek timely diagnosis and medical attention. Awareness has improved compliance with routine screening, particularly among populations over 50 years old. It is encouraging healthcare systems to strengthen diagnostic infrastructure.

- For instance, Exact Sciences reported that its Cologuard® test had been used in over 12 million completed tests in the United States as of 2023.

Advancements in Diagnostic Technologies Enhancing Accuracy and Speed

Ongoing technological developments are strengthening the capabilities of the Colorectal Cancer Diagnostics Market. Molecular diagnostics, next-generation sequencing (NGS), and liquid biopsy techniques are improving detection accuracy and reducing the time required for results. New assays can now detect mutations and biomarkers at earlier stages of the disease. Automation in pathology and imaging has also reduced operator errors and improved throughput. These innovations are enabling laboratories and hospitals to process higher volumes without compromising precision. It is creating a more efficient diagnostic ecosystem.

- For instance, Guardant Health’s Guardant360 CDx liquid biopsy test delivers comprehensive genomic profiling from a single blood draw, detecting alterations in 55 cancer-related genes.

Strong Institutional Support for Early Screening and Risk Stratification

The Colorectal Cancer Diagnostics Market benefits from institutional focus on early-stage detection and population-based screening models. Health authorities are emphasizing the need for stratified risk assessment to prioritize screening for high-risk individuals. Guidelines from leading organizations, including the recommendation to begin screening at age 45, are reshaping diagnostic practices. Hospitals are incorporating non-invasive methods to enhance patient compliance. Expanded insurance coverage in several countries is reducing out-of-pocket costs for patients. It is making diagnostic procedures more accessible across socioeconomic groups.

Rising Investments in Healthcare Infrastructure and Laboratory Capacity

Healthcare systems are investing in laboratory modernization and capacity expansion to support the Colorectal Cancer Diagnostics Market. Public and private sector funding is directed toward procurement of advanced diagnostic equipment and training of skilled personnel. Laboratory networks are expanding in both urban and semi-urban areas. This growth is improving the availability of reliable colorectal cancer testing across geographies. Increasing collaboration between diagnostics firms and healthcare institutions is accelerating the rollout of advanced platforms. It is reinforcing the market’s foundation for sustained growth.

Market Trends

Integration of Liquid Biopsy and Non-Invasive Testing Broadens Adoption

Non-invasive diagnostic methods are gaining traction in the Colorectal Cancer Diagnostics Market. Liquid biopsy tests using blood or stool samples are replacing invasive procedures like colonoscopy for preliminary screening. These tools offer faster turnaround times and reduce discomfort, encouraging wider participation in early detection programs. Advances in circulating tumor DNA (ctDNA) analysis have increased the sensitivity of blood-based diagnostics. Companies are expanding test menus to include multi-gene panels and methylation markers. It is strengthening the case for routine screening through less intrusive means.

- For instance, Epigenomics AG’s Epi proColon®, the first FDA-approved blood-based colorectal cancer screening test, was evaluated in a pivotal clinical trial (NCT01580540) involving 2,422 subjects.

Artificial Intelligence and Digital Pathology Enhancing Diagnostic Precision

Artificial intelligence (AI) and digital pathology are emerging as key enablers in the Colorectal Cancer Diagnostics Market. AI-driven algorithms can analyze histopathological images with high accuracy and identify patterns invisible to the human eye. Digital slide scanning allows pathologists to collaborate remotely and improve diagnostic consistency. Machine learning tools are also supporting predictive analytics for treatment response. Integration with hospital information systems ensures streamlined workflow and data storage. It is improving turnaround time while minimizing human error.

- For instance, Paige, a leader in AI-powered pathology, developed an AI model trained on over 32,000 whole-slide images to detect cancerous tissue in colorectal biopsies.

Home-Based Testing Solutions Expanding Access and Compliance

The Colorectal Cancer Diagnostics Market is witnessing a growing interest in home-based testing kits. These tests enable users to collect samples privately and send them to labs for analysis, increasing participation in regular screening. Major diagnostic firms are investing in mail-in fecal immunochemical tests (FIT) and DNA-based kits. Health providers are incorporating remote test delivery into public screening programs. This trend supports early detection in regions with limited clinical infrastructure. It is improving engagement across underserved populations.

Personalized Diagnostics and Biomarker-Driven Testing Gaining Ground

Precision medicine is influencing the evolution of the Colorectal Cancer Diagnostics Market. Biomarker-driven tests are helping clinicians identify specific mutations linked to colorectal tumors. KRAS, BRAF, and MSI testing are becoming standard components in diagnostic workflows. Personalized diagnostics are guiding treatment choices and improving patient outcomes. Pharmaceutical companies are aligning with diagnostic firms to co-develop companion diagnostics. It is advancing the market toward more targeted, outcome-based care.

Market Challenges Analysis

High Cost of Advanced Diagnostics and Limited Reimbursement Slow Adoption

The Colorectal Cancer Diagnostics Market faces challenges due to the high cost of next-generation testing platforms. Advanced molecular diagnostics and genomic assays often require expensive equipment, skilled personnel, and specialized infrastructure. These cost barriers limit adoption in low-resource settings and delay integration into standard care. Reimbursement frameworks remain inconsistent across regions, with many health systems not covering the full cost of innovative tests. Patients in middle- and low-income countries often pay out of pocket, restricting equitable access. It hampers large-scale screening initiatives and slows early detection efforts.

Uneven Infrastructure and Shortage of Skilled Professionals Impact Diagnostic Efficiency

Diagnostic capabilities vary widely between urban and rural regions, affecting the consistency of care within the Colorectal Cancer Diagnostics Market. Many regions lack trained pathologists, genetic counselors, and laboratory technicians required for high-quality diagnostic processing. Delays in test results and misdiagnoses are more likely where capacity is low. Infrastructure gaps also limit the availability of digital pathology and AI-supported tools in many healthcare settings. Public hospitals often operate with outdated technology and limited connectivity. It reduces diagnostic throughput and affects the reliability of test outcomes.

Market Opportunities

Rising Demand for Early Detection in Emerging Economies Creates Growth Potential

Emerging economies present a strong opportunity for the Colorectal Cancer Diagnostics Market due to rising awareness and improving healthcare access. Governments are launching national screening initiatives to detect colorectal cancer at earlier stages. Expanding insurance coverage and public health funding are enabling broader access to diagnostic services. Private hospitals and diagnostic chains are investing in advanced technologies to meet the demand. Multinational diagnostic firms are forming regional partnerships to supply cost-effective, scalable solutions. It positions the market for strong expansion across underserved populations.

Technological Innovation and Companion Diagnostics Support Precision Medicine Adoption

Ongoing advances in personalized diagnostics open new opportunities within the Colorectal Cancer Diagnostics Market. Companion diagnostics integrated with targeted therapies allow for more precise treatment decisions. Pharmaceutical companies are collaborating with diagnostic developers to align new drug approvals with biomarker-specific testing. This approach drives demand for KRAS, NRAS, BRAF, and MSI testing in clinical workflows. Laboratories are expanding genomic testing panels to offer comprehensive profiling of tumor biology. It supports a shift toward individualized patient care pathways and expands the role of diagnostics in treatment planning.

Market Segmentation Analysis:

By Test Type:

The Colorectal Cancer Diagnostics Market includes a diverse range of diagnostic methods designed to detect cancer at various stages. Blood tests are gaining adoption due to their ease of use and minimal patient discomfort. These tests help identify tumor markers and circulating tumor DNA (ctDNA), making them suitable for both early detection and disease monitoring. Stool tests remain foundational in colorectal screening programs. This category includes the fecal occult blood test (FOBT), widely used for routine screening, and the fecal biomarker test, which offers improved specificity. The CRC DNA screening test detects genetic mutations associated with colorectal cancer and is used in cases requiring more accurate results.

- For instance, Freenome developed a multiomics blood test for early colorectal cancer detection and evaluated it in the PREEMPT CRC study, which enrolled 14,175 participants across the United States.

By End-User:

The Colorectal Cancer Diagnostics Market sees widespread application across various healthcare settings. Hospitals represent the largest segment, performing comprehensive diagnostics including imaging, colonoscopy, biopsy, and follow-up assessments. Their ability to integrate multiple diagnostic tools supports accurate staging and treatment planning. Diagnostic imaging centers provide focused services such as CT, MRI, and PET scans, often working in coordination with referring physicians and hospitals. Cancer research centers contribute to innovation by evaluating new diagnostic approaches, validating biomarkers, and supporting clinical trials. Other end-use segments, including outpatient clinics and mobile diagnostic units, expand access in rural and underserved areas. It supports early detection initiatives and reduces diagnostic delays across different patient populations.

- For instance, according to the U.S. Centers for Disease Control and Prevention (CDC), hospitals performed over 15,000,000 colorectal diagnostic procedures in a five-year span across the country.

Segments:

Based on Test Type:

- Blood tests

- Stool tests

- Imaging tests

Based on End-User:

- Hospitals

- Diagnostic imaging centers

- Cancer research centers

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the Colorectal Cancer Diagnostics Market, accounting for over 40% of the global market. The region benefits from high healthcare spending, strong reimbursement frameworks, and early adoption of advanced diagnostic technologies. The United States leads in this region due to its widespread screening programs, high awareness levels, and robust infrastructure. The Centers for Disease Control and Prevention (CDC) and American Cancer Society support regular colorectal cancer screening starting at age 45, which has increased compliance rates. Leading healthcare providers and diagnostic laboratories in the region offer a full range of services including blood-based screening, colonoscopy, and molecular testing. Canada also contributes steadily, supported by public health initiatives and universal healthcare coverage that improves access to screening and diagnostics. The presence of key diagnostic developers and favorable regulatory pathways further strengthen the market in North America.

Europe

Europe represents the second-largest share in the Colorectal Cancer Diagnostics Market, with a market share of approximately 30%. Countries such as Germany, the United Kingdom, France, and Italy lead the region with established national screening programs and advanced diagnostic systems. The European Commission’s Cancer Screening Guidelines encourage early detection, and several member states have adopted population-based screening strategies. Hospitals and diagnostic centers across Europe offer colonoscopy, imaging, and molecular diagnostics as standard practice for colorectal cancer evaluation. The adoption of non-invasive tests, including fecal immunochemical tests (FIT) and DNA-based screening kits, is increasing as patient awareness grows. In recent years, investments in digital pathology and AI-powered diagnostics have helped improve diagnostic accuracy and reduce workload on pathologists. Europe’s aging population also contributes to consistent demand for colorectal cancer diagnostics across multiple care settings.

Asia Pacific

Asia Pacific holds a growing share of the Colorectal Cancer Diagnostics Market, currently at around 18%. Rapid urbanization, improving healthcare access, and rising cancer awareness are supporting market expansion across this region. Japan, China, South Korea, and Australia are the major contributors. Japan and South Korea maintain high screening participation rates through government-funded programs, while China is investing heavily in early detection infrastructure under its Healthy China 2030 initiative. The large patient pool and increasing middle-class population are creating strong demand for cost-effective diagnostics. Private diagnostic chains and public hospitals are expanding their colorectal cancer testing services in urban and semi-urban areas. Although challenges remain in rural outreach, mobile screening units and home-based tests are improving access. Regional manufacturers are also playing a role in producing affordable diagnostics for mass screening campaigns.

Latin America

Latin America accounts for around 7% of the global Colorectal Cancer Diagnostics Market. Countries such as Brazil, Mexico, Argentina, and Chile are leading adoption, although diagnostic access remains uneven across the region. Public health authorities in Brazil and Mexico have introduced organized screening efforts, particularly targeting urban centers. However, many rural areas still lack adequate diagnostic infrastructure. Non-governmental organizations and public-private partnerships are helping to fill these gaps through education, mobile clinics, and subsidized testing programs. The rising incidence of colorectal cancer, driven by changes in lifestyle and diet, is prompting governments to invest in early detection systems. Growth in this region is also supported by expanding insurance coverage and increasing availability of colonoscopy and fecal testing in public hospitals.

Middle East and Africa

The Middle East and Africa hold the smallest share of the Colorectal Cancer Diagnostics Market, at around 5%. Diagnostic access in this region varies significantly between high-income countries like the UAE, Saudi Arabia, and Qatar, and low-income regions in Sub-Saharan Africa. In wealthier Middle Eastern countries, government-led cancer control programs are increasing colorectal screening coverage, often using colonoscopy and imaging-based diagnostics in tertiary care hospitals. Meanwhile, much of Africa faces critical shortages in trained medical staff, diagnostic infrastructure, and public health funding. Limited awareness and competing healthcare priorities continue to affect early detection rates. Despite these challenges, international health organizations and NGOs are initiating pilot programs to introduce stool-based screening in targeted populations. Mobile health units and regional training initiatives are slowly improving diagnostic capacity, creating long-term potential for market development in select areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Guardant Health

- DiaCarta

- GE HealthCare Technologies

- Geneoscopy

- U. Group Holdings

- F-Hoffmann-La Roche

- New Day Diagnostics

- Danaher Corporation

- Exact Sciences Corporation

- Abbott Laboratories

Competitive Analysis

The Colorectal Cancer Diagnostics Market include Abbott Laboratories, Danaher Corporation, DiaCarta, Exact Sciences Corporation, F. Hoffmann-La Roche, GE HealthCare Technologies, Geneoscopy, Guardant Health, H.U. Group Holdings, and New Day Diagnostics. The Colorectal Cancer Diagnostics Market is highly competitive, driven by rapid advancements in diagnostic technologies, growing demand for early detection, and rising awareness among healthcare providers and patients. Companies are investing heavily in the development of non-invasive tests, molecular diagnostics, and liquid biopsy tools that improve accuracy and patient compliance. The market is also influenced by the integration of digital pathology and AI-powered diagnostic platforms, which enhance efficiency and reduce diagnostic errors. Strategic collaborations with research institutions and healthcare systems are helping firms expand their clinical reach and validate new biomarkers. Regulatory approvals for innovative screening solutions continue to shape product pipelines and market dynamics. Overall, the competitive landscape is defined by continuous innovation, evolving clinical guidelines, and a strong emphasis on precision medicine.

Recent Developments

- In November 2024, Thermo Fisher Scientific, through its subsidiary Life Technologies Corporation, announced a collaboration agreement with Mainz Biomed N.V. to jointly develop and potentially commercialize Mainz Biomed’s next-generation colorectal cancer screening product.

- In October 2024, Exact Sciences Corporation announced the U.S FDA approval of its Cologuard Plus multitarget stool-based DNA test. This test was indicated for the detection of CRC in medium-risk patients aged 45 years and older.

- In July 2024, Guardant Health announced that it had received FDA approval for Shield, a blood-based test designed for colorectal cancer (CRC) screening in adults aged 45 and older who are at average risk.

- In May 2024, Geneoscopy announced the U.S. FDA approval of its ColoSense non-invasive screening test for detecting colorectal cancer. ColoSense is an RNA biomarker test intended for CRC screening in adults with average risk. This product approval expanded the company’s CRC diagnostics product portfolio.

Market Concentration & Characteristics

The Colorectal Cancer Diagnostics Market shows moderate to high market concentration, with a mix of global diagnostic giants and specialized molecular testing firms shaping the competitive landscape. It is characterized by strong innovation cycles, regulatory-driven product development, and increasing demand for non-invasive, high-accuracy screening methods. Market leaders hold significant influence due to established distribution networks, proprietary technologies, and clinical partnerships. The market also features high entry barriers, including strict regulatory requirements, large capital investment needs, and complex validation protocols. Companies differentiate through test sensitivity, ease of use, turnaround time, and integration with digital health platforms. It remains dynamic, with emerging players introducing niche solutions in RNA, ctDNA, and microbiome-based diagnostics. The Colorectal Cancer Diagnostics Market continues to evolve through advances in personalized medicine, biomarker research, and adoption of decentralized testing models.

Report Coverage

The research report offers an in-depth analysis based on Test Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with rising global demand for early colorectal cancer detection.

- Non-invasive testing methods such as liquid biopsy and stool DNA tests will see broader adoption.

- AI and machine learning will play a greater role in enhancing diagnostic precision and workflow efficiency.

- Home-based testing kits will gain popularity due to convenience and increasing patient compliance.

- Integration of diagnostics with digital health platforms will streamline screening and follow-up processes.

- Biomarker-driven diagnostics will support personalized treatment strategies and improve clinical outcomes.

- Partnerships between diagnostic companies and pharmaceutical firms will increase for companion diagnostic development.

- Regulatory bodies will support faster approvals of innovative diagnostic tools with proven clinical value.

- Emerging markets will present new growth opportunities through expanding healthcare infrastructure and screening programs.

- Investment in research and development will drive innovation in early detection and disease monitoring technologies.