Market Overview

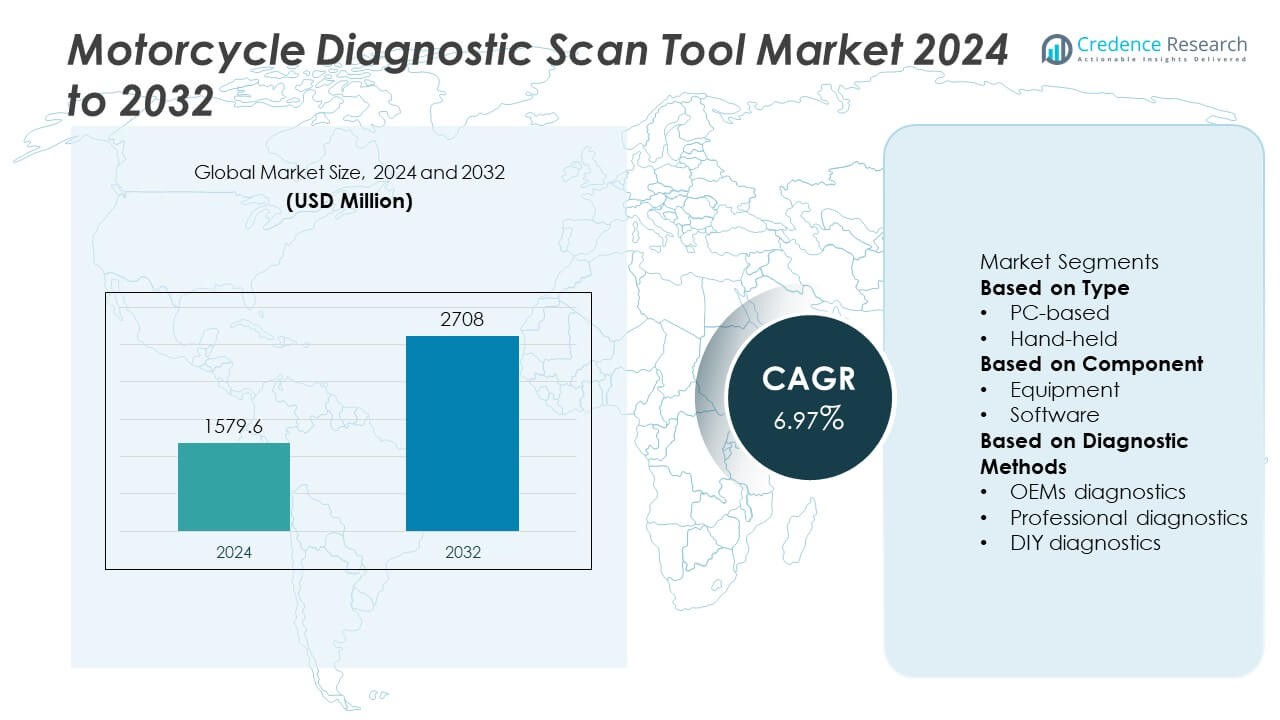

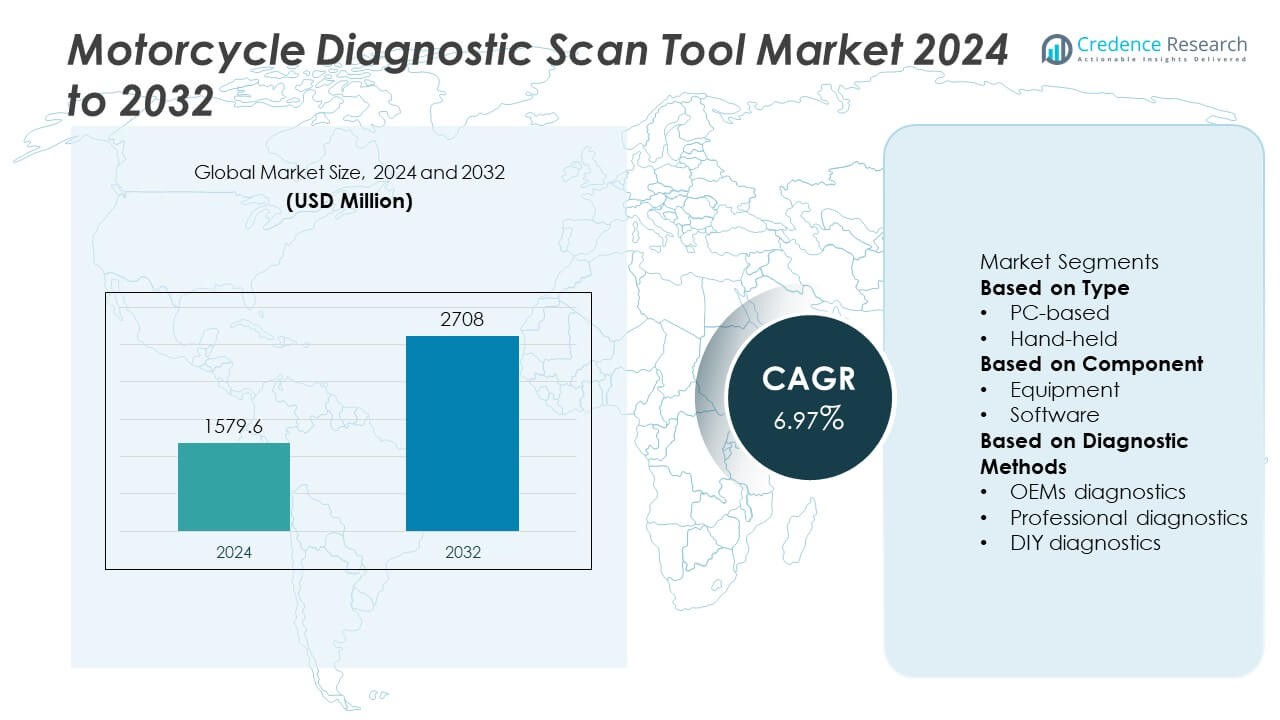

Motorcycle Diagnostic Scan Tool Market was valued at USD 1579.6 million in 2024 and is projected to reach USD 2708 million by 2032, growing at a CAGR of 6.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Motorcycle Diagnostic Scan Tool Market Size 2024 |

USD 1579.6 Million |

| Motorcycle Diagnostic Scan Tool Market, CAGR |

6.97% |

| Motorcycle Diagnostic Scan Tool Market Size 2032 |

USD 2708 Million |

The Motorcycle Diagnostic Scan Tool Market grows with the increasing complexity of motorcycle electronics, stricter emission regulations, and rising demand for preventive maintenance solutions. Advanced systems such as ABS, ride-by-wire, and fuel injection require accurate fault detection, boosting the need for specialized tools. Expanding motorcycle sales, particularly in emerging markets, create a broader service base.

The Motorcycle Diagnostic Scan Tool Market has a strong global footprint, with North America and Europe leading adoption due to advanced service infrastructure, stringent emission regulations, and high penetration of premium motorcycles requiring sophisticated diagnostics. Asia-Pacific is experiencing rapid growth driven by increasing motorcycle ownership, expanding service networks, and rising demand for multi-brand diagnostic solutions in countries such as China, India, and Japan. Latin America and the Middle East & Africa present emerging opportunities as urban mobility trends and preventive maintenance awareness expand. Key players shaping this market include Snap-on Inc., known for its professional-grade diagnostic equipment with broad vehicle coverage; Autel Intelligent Technology Co., recognized for its wireless and cloud-enabled diagnostic platforms; HealTech Electronics Ltd., specializing in motorcycle-specific electronics and diagnostic tools; and Dynojet Research Inc., offering precision tuning and diagnostic solutions for performance-oriented motorcycles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Motorcycle Diagnostic Scan Tool Market was valued at USD 1,579.6 million in 2024 and is projected to reach USD 2,708 million by 2032, growing at a CAGR of 6.97% during the forecast period.

- Growth is fueled by increasing motorcycle electronics complexity, the adoption of advanced systems such as ABS and EFI, and stricter emission compliance requirements driving demand for accurate diagnostic tools.

- Trends include the integration of wireless connectivity, cloud-based data storage, mobile app compatibility, and multi-brand support to improve service efficiency and accessibility for workshops and independent technicians.

- Competitive dynamics are shaped by players such as Snap-on Inc., Autel Intelligent Technology Co., HealTech Electronics Ltd., and Dynojet Research Inc., focusing on innovation, software updates, and expanding brand coverage.

- Key restraints include the high initial cost of advanced diagnostic systems, ongoing software licensing fees, and the need for technician training to handle increasingly complex motorcycle systems.

- North America and Europe lead adoption due to developed service infrastructures and strong regulatory frameworks, while Asia-Pacific is witnessing rapid growth from expanding motorcycle ownership and diversified service networks.

- Emerging opportunities in Latin America and the Middle East & Africa stem from rising urban mobility, growing preventive maintenance awareness, and the demand for cost-effective multi-brand diagnostic solutions in developing service markets.

Market Drivers

Increasing Complexity of Motorcycle Electronics Driving Demand

Modern motorcycles integrate advanced electronic systems, including ABS, ride-by-wire throttles, traction control, and onboard diagnostics. The Motorcycle Diagnostic Scan Tool Market benefits from this trend by providing essential solutions for accurate fault detection and maintenance. It enables workshops and service centers to address increasingly sophisticated control units efficiently. Manufacturers require tools compatible with multiple brands and models to reduce downtime. The integration of electronic fuel injection and emission control systems further raises the need for specialized diagnostics. This shift positions scan tools as indispensable in professional servicing environments.

- For instance, Snap-on Inc. offers its TRITON-D10 platform equipped with a 2 GHz quad-core processor and a 10-inch capacitive touchscreen, capable of reading and clearing fault codes from over 70 motorcycle brands, delivering comprehensive coverage and rapid data processing.

Rising Adoption of Preventive Maintenance Practices

Motorcycle owners and fleet operators recognize the value of regular diagnostics to prevent costly breakdowns. The Motorcycle Diagnostic Scan Tool Market supports this shift by offering accurate and fast fault code reading, sensor analysis, and system calibration. It enables early detection of wear or malfunctions, reducing repair costs and improving safety. Preventive maintenance also extends vehicle lifespan, appealing to cost-conscious and performance-focused riders. Service centers integrate diagnostic scanning into routine inspections to enhance customer trust. Growing awareness of proactive servicing fuels consistent demand for these tools.

- For instance, Autel Intelligent Technology Co. developed the MaxiSYS MS908S Pro II featuring a Qualcomm 660 octa-core processor, 128 GB of onboard storage, and a 9.7‑inch 2048×1536 LED touchscreen, enabling performance of 36+ maintenance services and 3× faster Auto Scan performance for comprehensive diagnostics

Growth in Motorcycle Sales and Aftermarket Services

Expanding motorcycle ownership in both developed and emerging markets directly increases the need for diagnostic capabilities. The Motorcycle Diagnostic Scan Tool Market gains from the rising number of workshops and service outlets catering to diverse models. It supports rapid troubleshooting, improving service throughput and customer satisfaction. Urban mobility trends, including the use of motorcycles for deliveries and commuting, further expand the service base. Higher usage rates drive more frequent maintenance cycles. This creates steady opportunities for scan tool suppliers targeting the aftermarket segment.

Technological Advancements Enhancing Diagnostic Capabilities

Continuous innovation in diagnostic technology improves accuracy, speed, and connectivity. The Motorcycle Diagnostic Scan Tool Market benefits from features such as wireless data transfer, cloud-based reporting, and mobile app integration. It allows technicians to perform updates and diagnostics remotely, streamlining operations. Enhanced user interfaces and multilingual support increase accessibility across global markets. Compatibility with evolving motorcycle architectures ensures long-term tool relevance. These advancements position diagnostic scan tools as critical assets for both OEM-authorized and independent service providers.

Market Trends

Integration of Wireless and Cloud-Based Diagnostic Solutions

Advancements in connectivity are transforming diagnostic processes. The Motorcycle Diagnostic Scan Tool Market adopts wireless communication protocols such as Bluetooth and Wi-Fi to enable faster, cable-free data transfer. It supports cloud-based platforms for storing diagnostic histories, enabling remote analysis and updates. These features improve service efficiency by allowing technicians to access real-time data and software updates without physical connections. Cloud integration also supports predictive maintenance by analyzing historical performance trends. The shift toward connected diagnostics enhances operational flexibility for workshops and fleet operators.

- For instance, Snap‑on’s P1000™ Motorcycle Scan Tool offers Wi‑Fi capability, boots up in under 10 seconds, and enables automatic upload of system reports to the Snap‑on Cloud for technician access via mobile or PC

Expansion of Multi-Brand and Universal Compatibility Tools

Workshops increasingly demand tools that serve multiple motorcycle brands and models. The Motorcycle Diagnostic Scan Tool Market responds with universal compatibility features, reducing the need for separate tools for each manufacturer. It supports multi-protocol communication standards to ensure wide coverage. This trend benefits independent service providers by lowering equipment investment costs. Manufacturers enhance software libraries to include more makes and models, ensuring adaptability to market changes. Universal compatibility strengthens the appeal of these tools in both developed and emerging markets.

- For instance, Snap‑on’s Solus Legend delivers a single solution capable of diagnosing motorcycles from nine OEM brands dating back to year 2000, combining automotive and motorcycle diagnostics in one compact device

Growing Adoption of Advanced User Interfaces and Mobile Integration

Improved user experience is a key focus for tool developers. The Motorcycle Diagnostic Scan Tool Market incorporates intuitive touchscreens, simplified menu navigation, and multilingual support. It integrates with mobile applications, enabling technicians to operate tools via smartphones or tablets. This mobile connectivity allows for flexible work environments, particularly in field service scenarios. Enhanced visual displays support clearer fault code interpretation and data visualization. These improvements reduce training requirements and speed up diagnostic procedures.

Rising Demand for Data-Driven and Predictive Maintenance

The industry is moving toward leveraging diagnostic data for predictive insights. The Motorcycle Diagnostic Scan Tool Market utilizes analytics to forecast potential failures before they occur. It processes data from sensors, control units, and historical maintenance records to recommend service intervals. Predictive maintenance helps optimize part replacements and reduce downtime. This trend aligns with the growing emphasis on operational efficiency in commercial and high-mileage motorcycle use. Data-driven maintenance strategies also enhance customer trust through proactive service recommendations.

Market Challenges Analysis

High Cost of Advanced Diagnostic Equipment

The adoption of sophisticated diagnostic tools requires significant investment from workshops and service centers. The Motorcycle Diagnostic Scan Tool Market faces resistance in price-sensitive regions where smaller operators may struggle to justify the expense. It demands continuous software updates, licensing fees, and periodic hardware upgrades to remain compatible with new motorcycle models. These ongoing costs can deter smaller businesses from upgrading to the latest technology. The challenge intensifies in markets with high competition, where service pricing pressures limit budget allocation for advanced tools. Manufacturers must balance innovation with affordability to ensure broader adoption.

Complexity of Evolving Motorcycle Electronics and Protocols

Rapid advancements in motorcycle electronics create challenges for diagnostic tool compatibility. The Motorcycle Diagnostic Scan Tool Market must adapt to varying communication protocols, encrypted systems, and proprietary manufacturer technologies. It requires constant software development to maintain relevance across diverse brands and model years. Delays in integrating support for new systems can hinder service capabilities and lead to customer dissatisfaction. Training technicians to operate increasingly complex diagnostic functions also adds to operational costs. This complexity places pressure on tool developers to deliver fast, reliable updates without compromising usability.

Market Opportunities

Expansion Potential in Emerging Motorcycle Markets

Rapid growth in motorcycle ownership across Asia-Pacific, Latin America, and parts of Africa creates a significant opportunity. The Motorcycle Diagnostic Scan Tool Market can leverage rising demand for maintenance services by introducing cost-effective and adaptable diagnostic solutions. It benefits from the expansion of service networks in urban and semi-urban areas. Localized tools with multi-language support and region-specific model coverage can strengthen market penetration. Partnerships with regional distributors and training programs for technicians can accelerate adoption. Increasing awareness of preventive maintenance in these regions further supports demand for modern diagnostic systems.

Integration with Connected and Smart Maintenance Platforms

The shift toward connected vehicles offers a path for tool manufacturers to expand capabilities. The Motorcycle Diagnostic Scan Tool Market can integrate with IoT-based platforms to provide real-time monitoring, remote diagnostics, and predictive maintenance. It enables fleet operators and service centers to optimize performance and reduce downtime through data-driven insights. Compatibility with mobile apps and cloud-based reporting enhances accessibility for both professional and independent users. Developing subscription-based software models can create recurring revenue streams. These innovations position diagnostic tools as essential components in the evolving smart mobility ecosystem.

Market Segmentation Analysis:

By Type

The Motorcycle Diagnostic Scan Tool Market divides into standalone diagnostic devices, PC-based diagnostic software, and mobile app-integrated solutions. Standalone devices remain preferred in professional workshops due to their durability, embedded software, and direct plug-and-play functionality. PC-based solutions offer greater processing power, detailed reporting, and integration with service management systems. Mobile app-based tools are gaining traction among smaller garages and independent mechanics for their portability and lower upfront costs. It benefits from the flexibility to cater to both high-volume service centers and individual technicians. Hybrid models that combine handheld hardware with cloud-connected software are emerging to meet diverse operational needs.

- For instance, Autel’s MaxiSYS Ultra features a 12.7‑inch touchscreen, 256 GB of built‑in memory, and an Octa‑core processor, enabling complex standalone diagnostics while supporting data synchronization with the Autel cloud platform

By Component

Key components include hardware units, diagnostic software, and accessories such as connectors, cables, and adapters. The hardware segment dominates due to the requirement for physical interfaces compatible with multiple motorcycle models. Diagnostic software drives recurring revenue through updates, licensing, and model coverage expansion. Accessories ensure compatibility with varying on-board diagnostic (OBD) ports and manufacturer-specific connectors. It relies on continuous hardware refinement to keep pace with evolving electronic control unit (ECU) designs. Software advancements, including real-time fault code interpretation and guided troubleshooting, enhance operational efficiency for service providers. Integration of both hardware and software components ensures comprehensive diagnostic coverage.

- For instance, Snap‑on offers a comprehensive accessory suite that includes over 20 distinct adapter cables and personality keys to support OBD interfaces across multiple OEMs, ensuring wide physical and software compatibility

By End-User

End-users include OEM-authorized service centers, independent repair shops, and individual motorcycle owners or enthusiasts. OEM service centers prioritize manufacturer-specific tools to ensure complete compatibility and warranty compliance. Independent repair shops value multi-brand diagnostic solutions that allow them to serve a wider range of customers without investing in multiple systems. The Motorcycle Diagnostic Scan Tool Market also addresses the growing community of motorcycle enthusiasts who perform their own diagnostics for maintenance or customization purposes. It gains from rising demand for user-friendly tools that require minimal technical training. The increasing complexity of motorcycle electronics strengthens the role of diagnostic tools across all end-user segments, reinforcing their importance in preventive maintenance and repair operations.

Segments:

Based on Type

Based on Component

Based on Diagnostic Methods

- OEMs diagnostics

- Professional diagnostics

- DIY diagnostics

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 29% of the global Motorcycle Diagnostic Scan Tool Market, supported by a well-developed motorcycle service ecosystem and high adoption of advanced diagnostic technology. The United States leads the region with a large base of premium motorcycle brands, strong aftermarket networks, and a culture of motorcycle customization that demands accurate diagnostics. Canada contributes through growing interest in preventive maintenance and increasing adoption of digital service solutions. It benefits from the presence of established tool manufacturers and a high concentration of service centers equipped with modern diagnostic infrastructure. Regulatory emphasis on emission control compliance also drives the use of scan tools for regular inspections. The widespread use of Bluetooth- and Wi-Fi-enabled diagnostic systems improves workshop efficiency and enhances the service experience.

Europe

Europe accounts for 31% of the Motorcycle Diagnostic Scan Tool Market, making it the largest regional contributor. Countries such as Germany, Italy, France, and the UK are major hubs for motorcycle production and performance-oriented models, both of which require sophisticated diagnostic capabilities. The region’s strong regulatory environment, including strict Euro 5 emission standards, reinforces the demand for accurate, multi-system diagnostics. It benefits from dense dealership networks and a high share of OEM-authorized workshops with brand-specific diagnostic tools. Consumer preference for regular maintenance of high-value motorcycles encourages investment in advanced systems. Increasing integration of cloud-based service records and predictive maintenance tools further strengthens market adoption.

Asia-Pacific

Asia-Pacific holds 27% of the Motorcycle Diagnostic Scan Tool Market, driven by rapid growth in motorcycle ownership and expanding service infrastructure. Major markets such as China, India, Japan, and Indonesia account for significant demand due to large two-wheeler populations and rising consumer awareness of preventive maintenance. It gains momentum from urban mobility trends and the popularity of motorcycles for commuting and commercial delivery. Service providers increasingly invest in multi-brand diagnostic tools to serve diverse vehicle fleets. Local manufacturing of affordable diagnostic equipment helps lower acquisition costs for small workshops. The region’s ongoing adoption of advanced motorcycle technologies, including fuel injection and ABS, accelerates the need for compatible diagnostic solutions.

Latin America

Latin America represents 7% of the Motorcycle Diagnostic Scan Tool Market, with Brazil, Mexico, and Argentina leading demand. The growing presence of international motorcycle brands and the expansion of dealership networks create opportunities for tool suppliers. It benefits from increased motorcycle usage for urban transport and delivery services, which raises the need for frequent diagnostics and maintenance. Economic conditions in the region drive interest in cost-effective, multi-brand solutions that can support varied service requirements. Investment in technician training programs and access to diagnostic updates are key factors influencing adoption.

Middle East & Africa

The Middle East & Africa account for 6% of the Motorcycle Diagnostic Scan Tool Market, characterized by an emerging service network and rising motorcycle sales in select markets such as South Africa, the UAE, and Saudi Arabia. It benefits from a growing community of motorcycle enthusiasts and touring riders who value professional maintenance. Limited local manufacturing of diagnostic equipment creates opportunities for imports from Europe and Asia-Pacific. Increasing availability of smartphone-compatible scan tools supports adoption among smaller workshops and independent mechanics. The region’s gradual regulatory shift toward stricter emission controls is expected to boost demand for compliant diagnostic systems in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Duynojet Research Inc.

- Nexas Tech

- Moto Tech Diagnostics

- Autel Intelligent Technology Co.

- HealTech Electronics Ltd.

- Snap On Inc.

- Hex Innovate UK Ltd.

- Eautotools

- HELLA GmbH and Co. KGaA

- Duonix GmbH

Competitive Analysis

The Motorcycle Diagnostic Scan Tool Market features prominent players such as Snap-on Inc., Autel Intelligent Technology Co., HealTech Electronics Ltd., Dynojet Research Inc., HELLA GmbH and Co. KGaA, Hex Innovate UK Ltd., Duonix GmbH, Nexas Tech, Moto Tech Diagnostics, and Eautotools, each competing through innovation, product diversification, and global expansion. Snap-on Inc. offers professional-grade diagnostic platforms with extensive multi-brand coverage and advanced fault analysis features tailored for high-volume workshops. Autel Intelligent Technology Co. leverages wireless connectivity, cloud integration, and frequent software updates to enhance efficiency and compatibility across diverse motorcycle models. HealTech Electronics Ltd. specializes in motorcycle-specific diagnostic and electronic solutions, providing compact, user-friendly tools for both professional and enthusiast use. Dynojet Research Inc. focuses on performance tuning and diagnostic systems for high-performance motorcycles, integrating precision measurement and calibration capabilities. HELLA GmbH and Co. KGaA combines automotive-grade electronic expertise with motorcycle-specific applications, ensuring high accuracy and durability. Other players such as Hex Innovate UK Ltd. and Duonix GmbH strengthen market competition through specialized niche tools and region-specific support, while Nexas Tech, Moto Tech Diagnostics, and Eautotools target value-driven segments with cost-effective, portable diagnostic solutions. This diverse competitive landscape drives continuous technological advancement and broader market adoption.

Recent Developments

- In April 2025, Snap on Released its Spring 2025 Diagnostic Software Update, expanding coverage with support for over 30 new vehicle makes, adding 2025 model year code scan and clear functionality, and enhancing guided component tests and secure gateway access

- In February 2025, Field users confirmed that its OBD Tool performs nearly all functions of a factory-level diagnostic unit while offering automatic setup and free lifetime software updates

- In January 2024, Autel integrated MOTOR Information Systems’ TruSpeed Repair OEM repair data into its Ultra Series diagnostic tablets (MaxiSYS Ultra, Ultra EV, Ultra ADAS). This integration provides users with access to comprehensive repair information, including component locations, fault codes, TSBs, wiring diagrams, and repair procedures, within days of their release by the original equipment manufacturers (OEMs)

Market Concentration & Characteristics

The Motorcycle Diagnostic Scan Tool Market demonstrates a moderately concentrated structure, with a mix of global leaders and specialized regional players competing through technology innovation, product coverage, and aftersales support. Large manufacturers such as Snap-on Inc., Autel Intelligent Technology Co., and Dynojet Research Inc. leverage advanced software platforms, multi-brand compatibility, and continuous update cycles to maintain strong market positions. It benefits from a competitive environment shaped by rapid motorcycle technology evolution, regulatory compliance requirements, and the growing integration of wireless and cloud-based diagnostics. Entry barriers exist due to the need for proprietary communication protocol access, extensive R&D investment, and ongoing software maintenance. Regional companies enhance competitiveness by offering cost-effective, brand-focused solutions that address local market needs. The market favors providers capable of delivering both hardware and software components with broad model coverage, real-time data capabilities, and intuitive user interfaces, ensuring adaptability to increasingly complex motorcycle electronic systems.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Diagnostic Methods and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for motorcycle diagnostic tools will increase with the expansion of advanced electronic systems in new models.

- Integration of cloud-based platforms will enhance remote diagnostics and service record management.

- Wireless connectivity will become standard in most professional-grade and portable diagnostic devices.

- Multi-brand compatibility will remain a priority for workshops serving diverse motorcycle fleets.

- Predictive maintenance features will gain adoption to reduce downtime and improve service planning.

- Mobile application integration will expand tool accessibility for independent technicians and enthusiasts.

- Software subscription models will generate recurring revenue and support continuous updates.

- Emerging markets will adopt cost-effective diagnostic solutions as service networks expand.

- Partnerships between tool manufacturers and OEMs will improve protocol access and accuracy.

- User interface improvements will reduce training requirements and speed up diagnostic workflows.