Market Overview

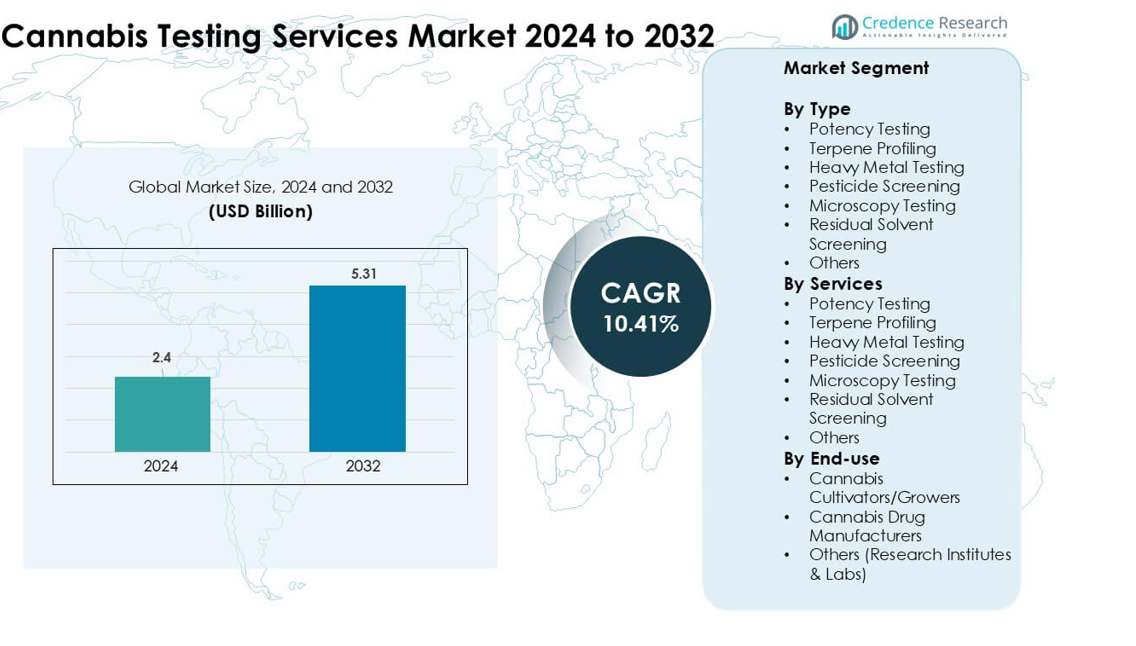

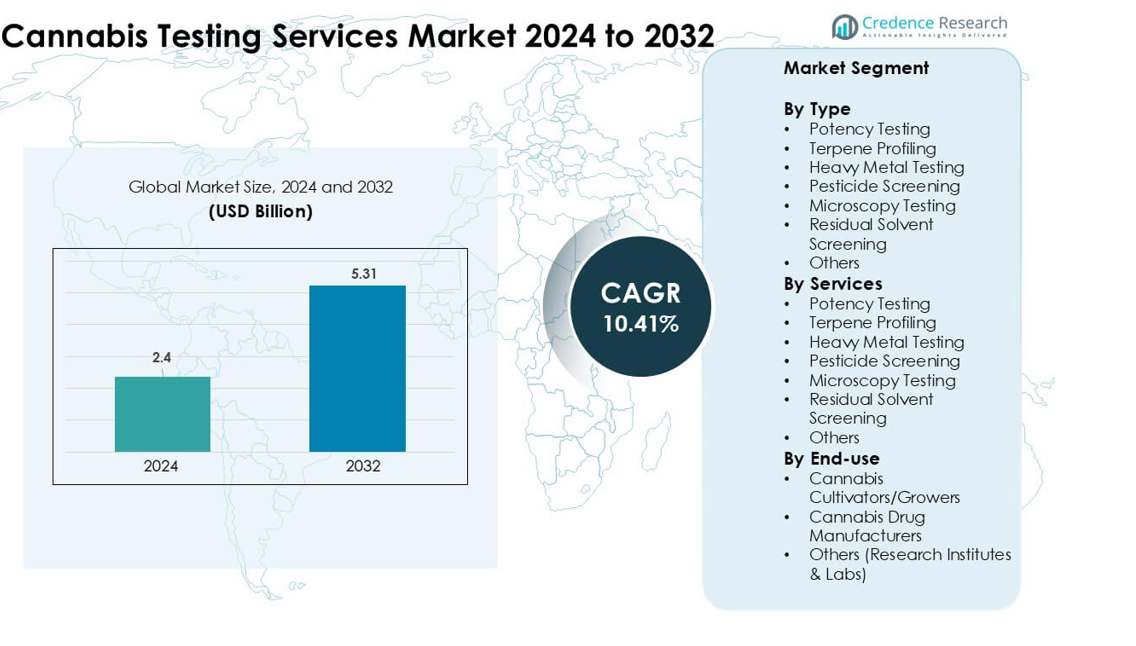

Cannabis Testing Services Market was valued at USD 2.4 billion in 2024 and is anticipated to reach USD 5.31 billion by 2032, growing at a CAGR of 10.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cannabis Testing Services Market Size 2024 |

USD 2.4 billion |

| Cannabis Testing Services Market, CAGR |

10.41% |

| Cannabis Testing Services Market Size 2032 |

USD 5.31 billion |

The Cannabis Testing Services Market is shaped by leading labs such as Eurofins Scientific, GREEN LEAF LAB, ADACT Medical Ltd., SGS Canada, Laboratorium Dr. Liebich, BRITISH CANNABIS, PhytoVista Laboratories, SC Labs, AZ Biopharm GmbH, and PharmLabs. These companies strengthen their positions through accredited testing capabilities, advanced analytical methods, and wide service portfolios that cover potency, terpene profiling, contaminants, and residual solvent screening. Strong investment in automation, mass spectrometry, and digital reporting platforms further enhances their competitiveness. North America remained the leading region in 2024 with a 46% share, supported by strict regulatory frameworks, high testing volumes, and widespread legalization across major markets.

Market Insights

- The Cannabis Testing Services Market reached USD 2.4 billion in 2024 and is projected to hit USD 5.31 billion by 2032, growing at a CAGR of 10.41%.

- Growing legalization and strict compliance rules drive strong demand for potency testing, pesticide screening, and contaminant analysis across medical and adult-use markets.

- Automation, high-resolution mass spectrometry, and terpene profiling adoption shape major trends as labs expand advanced test menus to meet evolving product categories.

- Competition intensifies as key players strengthen accredited capabilities and invest in faster turnaround times, while small labs face high equipment and operational costs.

- North America held 46% share in 2024, while potency testing dominated the type segment with 41%, supported by strict labeling rules and high sample volumes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Potency testing led the type segment in 2024 with about 41% share. This segment grew as regulators asked for precise THC and CBD quantification to ensure consumer safety. Cultivators rely on potency data to meet labeling rules and maintain product consistency across batches. Rising demand for high-strength extracts also pushed labs to adopt advanced HPLC and GC technologies. Terpene profiling and pesticide screening gained steady traction, but potency testing stayed ahead due to strict compliance checks and strong adoption among both medical and adult-use producers.

- For instance, a study by MedPharm Research LLC licensing-compliant cannabis testing facility along with a research team at University of Colorado Boulder analyzed 281 cannabis products (182 flower, 99 concentrates) and found that for concentrate products, the mean observed THC potency was 70.7% (SD = 7.53, range 17.9–83.6).

By Services

Potency testing dominated the services segment in 2024 with nearly 39% share. Regulatory bodies across North America and Europe require potency verification before product release, which drives strong testing volumes. Labs invest in automated analytical platforms to handle larger sample loads and reduce turnaround times. Rising production from licensed cultivators further increased service orders. While terpene and residual solvent tests expanded with new vape and concentrate products, potency testing remained the core service because it determines classification, pricing, and compliance for every cannabis product.

- For instance, Eurofins Cannabis Testing applies validated HPLC-DAD methods for precise THC and CBD quantification, supporting regulatory-compliant potency reporting for licensed cannabis products.

By End-use

Cannabis cultivators and growers held the leading share in 2024 with close to 52%. Growers test crops at multiple stages to ensure compliance with state or national potency limits and to detect contamination early. Large cultivation facilities depend on accredited labs for pesticide and heavy metal screening to protect supply chains. Expansion of indoor and greenhouse farms increased routine testing frequency. Cannabis drug manufacturers and research labs grew steadily, but cultivators stayed dominant due to mandatory testing rules tied to market entry, product quality assurance, and licensing compliance.

Key Growth Drivers

Growing Global Legalization and Strict Compliance Requirements

Expanding legalization across North America, Europe, and parts of Asia continues to push demand for regulated cannabis testing. Governments enforce strict standards for potency, pesticides, heavy metals, and microbial contaminants, which increases mandatory lab testing volumes for both medical and adult-use products. Regulators also update testing frameworks more often as product categories diversify into edibles, vapes, beverages, and concentrates. These rules force producers to rely on accredited labs to maintain market access and avoid product recalls. As legalization broadens and oversight strengthens, testing services grow as a core compliance requirement rather than an optional quality step, creating sustained long-term demand.

- For instance, ALS Limited supports regulated cannabis markets through ISO/IEC 17025-accredited laboratories, offering multi-residue pesticide screening and ICP-MS-based heavy-metal testing with parts-per-billion sensitivity to meet regulatory requirements.

Rising Consumption of High-Quality Cannabis Products

Growing consumer focus on safety, purity, and consistent potency drives the need for reliable testing. Medical patients depend on verified cannabinoid levels to manage symptoms, while adult-use consumers seek predictable product experiences. Premium brands use certified testing results to support label claims, build trust, and differentiate in crowded retail markets. Expanding demand for vape oils, concentrates, and infused products increases the need for more complex tests, including terpene profiling and residual solvent analysis. As consumers become more educated and selective, producers invest more in advanced analytical testing to improve product quality, reduce contamination risks, and meet higher retail standards.

- For instance, SC Labs delivers cannabinoid profiling using HPLC and terpene analysis using GC-MS, supporting accurate labeling and quality claims for regulated and premium cannabis brands.

Expansion of Licensed Cultivation and Manufacturing Capacity

Rapid growth in licensed cultivation sites and processing facilities increases sample volumes across the testing ecosystem. Large indoor and greenhouse operations rely on frequent batch testing to meet regulatory deadlines and prevent costly supply-chain disruption. Manufacturers of edibles, beverages, and concentrates require multiple test cycles for formulation, stability, and final release. As more countries introduce structured licensing systems, lab networks expand to serve regional clusters of growers and processors. The scaling of production capacity directly boosts the need for accurate potency tests, contaminant screening, and advanced analytical services.

Key Trends & Opportunities

Adoption of Advanced Analytical Technologies and Automation

Laboratories increasingly deploy high-resolution mass spectrometry, next-generation sequencing, and automated sample-handling tools to improve speed, accuracy, and detection limits. Automation lowers turnaround time and supports higher testing volumes, which benefits large cultivation hubs. AI-based analytics and digital LIMS platforms help labs manage compliance records and track sample integrity from seed to sale. These advancements also enable labs to offer new high-value services such as detailed terpene fingerprinting and expanded contaminant panels. As technology adoption increases, labs can scale efficiently and deliver more profitable, differentiated services.

- For instance, cannabis testing laboratories widely use SCIEX LC-MS/MS systems to detect pesticide residues at levels as low as 0.01 µg/g, enabling high-sensitivity contaminant screening to meet regulatory safety limits.

Growing Demand for Standardized Testing and International Accreditation

The global market faces strong interest in harmonized testing standards to support cross-border trade and regulatory alignment. International accreditation frameworks such as ISO/IEC 17025 create opportunities for labs to expand into new regions and win contracts from multinational producers. Governments encourage uniform protocols to eliminate inconsistent results and reduce product recalls. As emerging markets in Europe, South America, and Asia develop their cannabis industries, standardized testing becomes essential for export-ready products. This trend opens new opportunities for accredited labs to support global supply chains and collaborate with research institutes.

- For example, Medicine Creek Analytics was the first cannabis testing laboratory in Washington State to achieve ISO/IEC 17025 accreditation. That accreditation enabled the lab to perform regulatory-compliant testing and issue validated Certificates of Analysis.

Expansion of New Product Categories and Research-Driven Applications

The rise of functional cannabis products such as wellness beverages, nano-emulsions, and precision-dose formulations creates opportunities for specialized testing services. Research institutions explore rare cannabinoids, minor terpenes, and new extraction methods, which further increases demand for advanced analytical profiling. Pharmaceutical-grade development pipelines require stringent validation studies, stability testing, and contaminant screening. As scientific interest rises, labs gain opportunities to partner with drug developers, universities, and biotech firms. This broadens revenue streams beyond routine compliance testing and supports long-term market growth.

Key Challenges

Lack of Uniform Global Testing Standards

The cannabis industry still faces inconsistent testing rules across countries, states, and regions. Variations in approved methods, required contaminant panels, and acceptable potency variance lead to inconsistent results between labs. Producers often face delays, added cost, or compliance issues when shifting products between jurisdictions. These inconsistencies also weaken consumer trust and slow cross-border trade. Establishing globally aligned frameworks remains a major challenge, as each regulator moves at a different pace. Until uniform standards emerge, labs must operate with fragmented requirements and invest heavily in method validation.

High Operating Costs and Limited Testing Infrastructure in Emerging Markets

Setting up a certified cannabis testing lab requires significant investment in instruments, skilled staff, and accreditation processes. High-end equipment such as LC-MS/MS and GC-MS adds cost barriers for smaller operators. Many emerging markets lack experienced technicians, forcing labs to spend more on training or outsourced expertise. Slow licensing procedures and limited government support further restrict lab expansion. These challenges lead to testing bottlenecks, long turnaround times, and higher costs for cultivators. Building a scalable and affordable testing ecosystem remains a key hurdle for developing cannabis markets.

Regional Analysis

North America

North America held the largest share in 2024 with about 46%. The region leads due to advanced regulatory frameworks, widespread legalization, and strong testing demand across medical and adult-use markets. The U.S. records high sample volumes from large cultivation clusters in states such as California, Colorado, and Michigan. Canada’s federal system adds consistent nationwide testing requirements, further strengthening market growth. Accredited labs continue to expand capacity to support diverse product categories, including edibles, concentrates, and infused beverages. Strong investment, skilled analytical networks, and strict compliance rules keep North America at the forefront of the market.

Europe

Europe accounted for nearly 28% share in 2024, driven by growing medical cannabis programs and increasing regulatory oversight. Countries such as Germany, the U.K., and the Netherlands enforce strict quality checks for imported and domestically produced cannabis. Rising demand for pharmaceutical-grade products pushes laboratories to adopt advanced analytical methods. The region also invests heavily in research, expanding opportunities for detailed terpene and contaminant profiling. As more nations progress toward structured legalization, testing requirements continue to rise. Europe’s emphasis on safety and harmonized standards supports steady market expansion.

Asia-Pacific

Asia-Pacific held about 17% share in 2024, supported by emerging medical cannabis frameworks in countries such as Australia, Thailand, and South Korea. The region increases testing demand as governments introduce tight rules for cannabinoid limits, contaminant screening, and product certification. Growth in clinical research and pharmaceutical applications also drives high-value analytical services. Australia and Thailand are key hubs due to active cultivation and export-oriented production. As more countries ease restrictions and adopt controlled medical programs, laboratories invest in advanced technologies to meet rising compliance expectations across the region.

Latin America

Latin America captured nearly 6% share in 2024, driven by expanding medical cannabis cultivation in Colombia, Uruguay, and Brazil. The region develops testing needs as countries strengthen export requirements for pharmaceutical-grade cannabis and derivatives. Colombia’s large-scale cultivation boosts sample volumes for potency and contaminant screening. Regulatory updates across the region aim to improve product safety, encouraging more investment in accredited labs. Although testing infrastructure remains limited, increasing participation in global supply chains supports steady adoption of standardized analytical services.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024. Growth is driven by early-stage medical cannabis developments in countries such as Israel, Lesotho, and South Africa. Israel’s strong research ecosystem elevates demand for advanced analytical testing in clinical studies and pharmaceutical development. African nations with export-focused cultivation rely on accredited labs to meet international compliance standards. Limited infrastructure and strict regulations slow broader adoption, but rising interest in medical and research applications supports gradual market expansion across the region.

Market Segmentations:

By Type

- Potency Testing

- Terpene Profiling

- Heavy Metal Testing

- Pesticide Screening

- Microscopy Testing

- Residual Solvent Screening

- Others

By Services

- Potency Testing

- Terpene Profiling

- Heavy Metal Testing

- Pesticide Screening

- Microscopy Testing

- Residual Solvent Screening

- Others

By End-use

- Cannabis Cultivators/Growers

- Cannabis Drug Manufacturers

- Others (Research Institutes & Labs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cannabis Testing Services Market features a diverse and expanding competitive landscape shaped by accredited laboratories, global testing networks, and specialized analytical providers. Leading players such as Eurofins Scientific, GREEN LEAF LAB, ADACT Medical Ltd., SGS Canada, Laboratorium Dr. Liebich, BRITISH CANNABIS, PhytoVista Laboratories, SC Labs, AZ Biopharm GmbH, and PharmLabs strengthen their positions through advanced analytical platforms, validated testing methods, and strict compliance with ISO/IEC 17025 standards. Companies compete by offering broad test menus covering potency, terpene profiling, pesticides, heavy metals, microbial contaminants, and residual solvents. Many players invest in automated workflows, high-resolution mass spectrometry, and digital LIMS systems to enhance accuracy and improve turnaround times. Strategic expansions, mergers, and regional partnerships help laboratories scale capacity to meet rising sample volumes from cultivators and manufacturers. Growing regulatory complexity across global markets continues to drive competition, pushing companies to maintain strong quality assurance, transparent reporting, and reliable regulatory support services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eurofins Scientific

- GREEN LEAF LAB

- ADACT Medical Ltd.

- SGS Société Générale de Surveillance SA (SGS Canada Inc.)

- Laboratorium Dr. Liebich

- BRITISH CANNABIS

- PhytoVista Laboratories (BRITISH CANNABIS GROUP)

- SC Labs

- AZ Biopharm GmbH

- Robert Shrewsbury & the UNC Eshelman School of Pharmacy (PharmLabs)

Recent Developments

- In September 2025, Eurofins Scientific Completed the acquisition of related‑party owned laboratory sites as part of a strategic expansion of its lab network.

- In August 2025, The license of Green Leaf Lab was suspended by the regulatory authority in Oklahoma after inspection found that 19,000 cannabis product samples previously marked “passed” for yeast and mold testing failed triggering retesting, product recalls or remediation.

Report Coverage

The research report offers an in-depth analysis based on Type, Services, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for accredited cannabis testing will rise as more countries legalize medical and adult-use products.

- Potency, terpene, and contaminant testing will expand with growing product diversity in edibles, vapes, and concentrates.

- Automation and AI-driven analytics will help labs improve accuracy and shorten turnaround times.

- Advanced mass spectrometry and genomic tools will support deeper profiling of cannabinoids and contaminants.

- Standardized global testing guidelines will strengthen cross-border trade and regulatory alignment.

- Pharmaceutical-grade testing will grow as clinical research on cannabinoids accelerates worldwide.

- Regional lab networks will expand to handle higher sample volumes from large cultivation hubs.

- Digital LIMS platforms will gain adoption to enhance traceability, reporting, and compliance management.

- Partnerships between labs, research institutions, and manufacturers will drive innovation in testing methods.

- Growing emphasis on consumer safety will push regulators to enforce stricter quality and contamination limits.