Market Overview

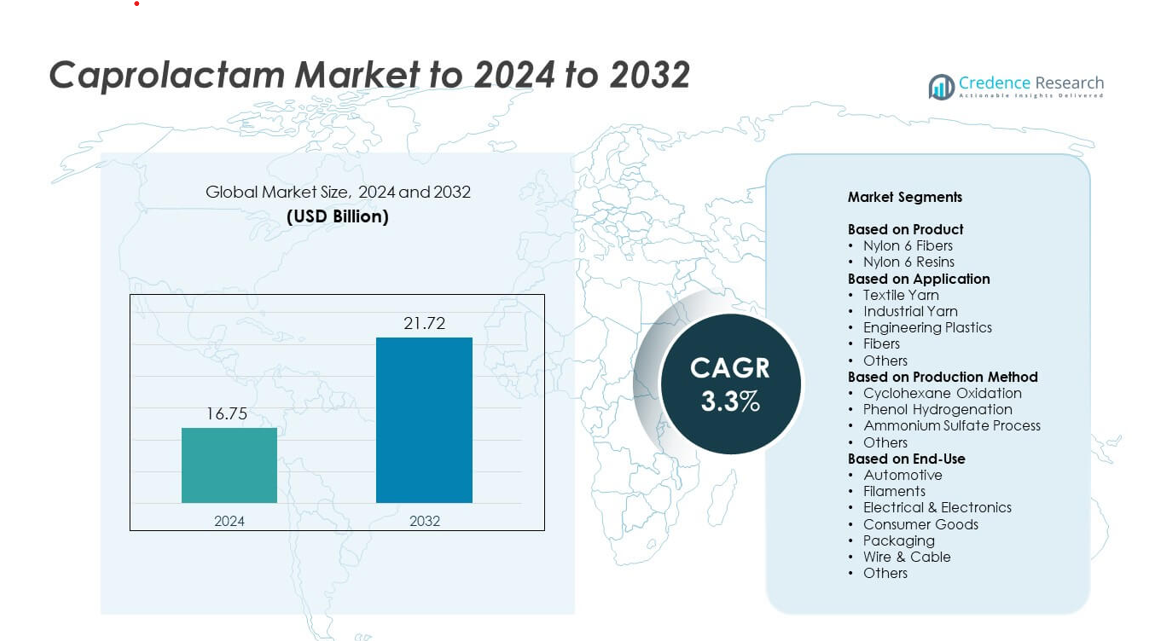

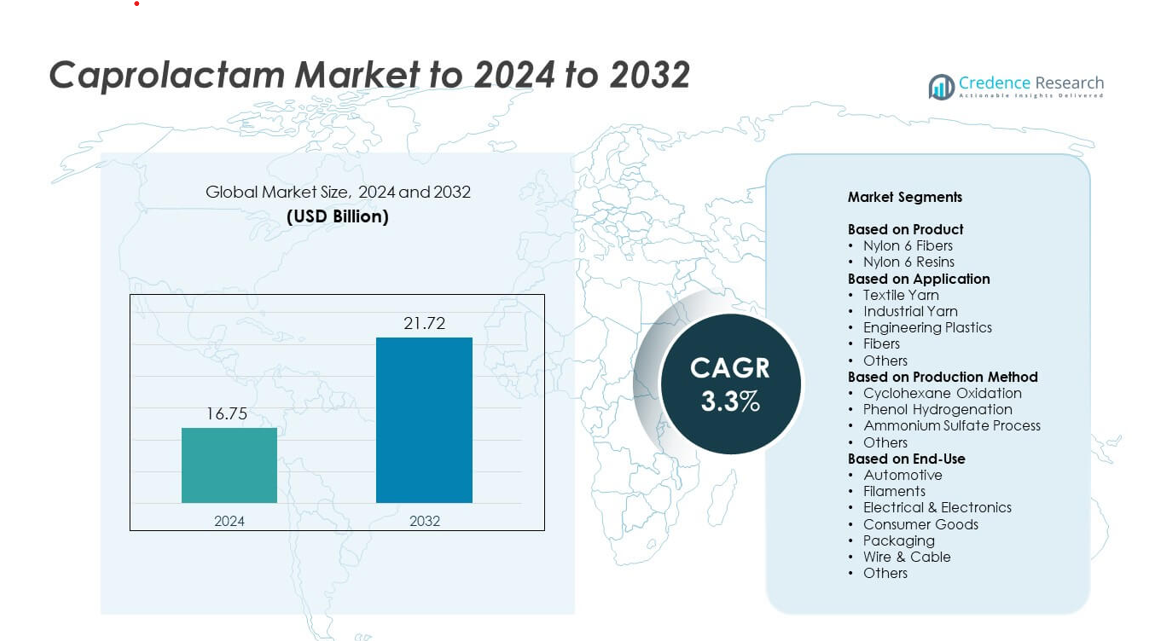

Caprolactam market size was valued at USD 16.75 billion in 2024 and is anticipated to reach USD 21.72 billion by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Autonomous Ships Market Size 2024 |

USD 16.75 billion |

| Autonomous Ships Market, CAGR |

3.3% |

| Autonomous Ships Market Size 2032 |

USD 21.72 billion |

The caprolactam market is led by major players such as Domo Chemicals, China Petrochemical Development Corporation, BASF SE, Highsun Group, Gujarat State Fertilizers & Chemicals Limited, KuibyshevAzot PJSC, AdvanSix Inc., Alpek S.A.B. de C.V., Grupa Azoty, and The Aquafil Group, each strengthening their presence through capacity expansion, process efficiency, and strong nylon 6 integration. Asia Pacific remained the leading region in 2024 with about 42% share, supported by large textile production and strong automotive manufacturing. Europe followed with nearly 27% share, driven by advanced engineering plastics demand, while North America accounted for around 23%, supported by steady industrial and automotive applications.

Market Insights

- The caprolactam market reached USD 16.75 billion in 2024 and is projected to hit USD 21.72 billion by 2032, growing at a CAGR of 3.3%.

• Rising demand for nylon 6 fibers, which held about 62% share in 2024, drives steady consumption across textiles, industrial goods, and automotive lightweight components.

• Key trends include the shift toward sustainable nylon production, adoption of energy-efficient processes, and growth in engineering plastics used in electronics and mobility sectors.

• Competition remains strong as major producers expand capacities, enhance catalyst efficiency, and develop integrated supply chains to support nylon 6 applications globally.

• Asia Pacific led with nearly 42% share in 2024, followed by Europe at around 27% and North America at close to 23%, supported by high textile output, advanced manufacturing, and stable resin demand across regional industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Nylon 6 fibers dominated the caprolactam market in 2024 with about 62% share. Strong demand from textiles and carpets supported this lead. The fibers offered high strength and durability for mass-market and technical uses. Rising consumption in apparel, home furnishings, and automotive interiors also helped growth. Nylon 6 resins expanded due to use in packaging and molded parts, but their share stayed lower than fibers. Growing preference for lightweight materials in electronics and automotive sectors continued to boost resin adoption across global manufacturing lines.

- For instance, after acquiring Fibrant and following various expansion projects, the Highsun Group became the world’s largest caprolactam producer, with facilities in the Netherlands and China. Their Fibrant (Nanjing) facility alone has a capacity of 400,000 tons per year, while their Fibrant (Netherlands) operation is a significant facility.

By Application

Textile yarn held the largest share in 2024 with nearly 48% of the market. The segment grew due to high usage in apparel, sportswear, and home textiles. Strong production in Asia pushed consumption higher in woven and knitted goods. Industrial yarn increased as factories used it in ropes, airbags, and reinforcement materials. Engineering plastics gained traction in auto and electrical parts. The fibers category advanced in carpets and upholstery. Other uses grew steadily with rising demand across packaging and consumer goods.

- For instance, Aquafil reports its regenerated nylon ECONYL is used by over 2,500 brands worldwide, many specifying yarns for apparel, sportswear, carpets, and interior textiles.

By Production Method

Cyclohexane oxidation led the market in 2024 with about 57% share. Producers preferred this method due to stable yields, mature technology, and strong integration with nylon supply chains. The process delivered consistent quality, which supported large-scale fiber and resin output. Phenol hydrogenation grew slowly as firms valued lower emissions and cleaner reaction steps. The ammonium sulfate process maintained moderate use in older plants. Other emerging methods advanced with improvements in catalyst efficiency and reduced energy demand across modern chemical facilities.

Key Growth Drivers

Rising demand for nylon 6 fibers and resins

Global use of nylon 6 fibers and resins continues to expand due to strong demand in textiles, automotive parts, and industrial goods. Manufacturers favor nylon 6 for its strength, abrasion resistance, and cost efficiency, which boosts caprolactam consumption. Growth in sportswear, carpets, and technical fabrics supports steady fiber use, while lightweight auto components raise resin requirements. Emerging economies with large textile bases further strengthen demand, making this the most significant driver for the caprolactam market.

- For instance, Prismane Consulting and company reports indicate that India’s domestic caprolactam production capacity primarily comes from two sources: For instance, GSFC has two plants with rated capacities of 20,000 TPA and 50,000 TPA, totaling a combined capacity of 70 kilotons per year (ktpa), and FACT, which has a separate plant with an annual capacity of 50 kilotons.

Expansion of automotive and electronics manufacturing

Automakers and electronics companies adopt nylon 6 components to reduce weight, improve fuel efficiency, and enhance design flexibility. Caprolactam-based engineering plastics replace metal parts in engine covers, connectors, housings, and structural components. This shift increases material efficiency and lowers production costs. Rising output of electric vehicles and consumer electronics adds momentum. As OEMs push for higher performance materials, caprolactam demand remains strong across global production hubs.

- For instance, LANXESS now has 110,000 metric tons yearly engineering plastics compounding capacity in China, producing Durethan and Pocan materials for lightweight automotive parts and electrical components.

Growth in textile production across Asia

Textile manufacturing in China, India, Bangladesh, Vietnam, and Indonesia continues to rise, driving large-scale consumption of nylon 6 yarn. Apparel brands rely on durable and stretchable synthetic fibers for activewear, outerwear, and fashion textiles. Expanding export capacity improves raw material usage, while regional investments in spinning and weaving technologies enhance demand stability. This sustained growth in textile output strongly supports the long-term expansion of the caprolactam market.

Key Trends and Opportunities

Shift toward sustainable nylon production

Producers explore low-emission and energy-efficient pathways for nylon 6 to meet global sustainability goals. Advances in bio-based feedstocks and improved catalytic routes present new opportunities for greener production. Brands seek recycled and eco-friendly materials to align with consumer expectations. This trend creates space for innovation in caprolactam manufacturing, supporting premium applications and strengthening long-term market competitiveness across industries.

- For instance, Geno targets 100 million tons of avoided greenhouse emissions from its plant-based nylon 6 technology, supporting collaborations with brands like lululemon and Covestro on low-impact materials.

Rising use of caprolactam in high-performance engineering plastics

Engineering plastics made from caprolactam gain popularity in automotive, electrical, and industrial sectors. The push for lightweight components, better heat resistance, and improved mechanical strength increases adoption in advanced applications. Growth in battery housings, connectors, smart devices, and industrial machinery opens new demand pockets. Expanding performance requirements offer strong opportunities for technology-driven producers to introduce improved nylon grades.

- For instance, Asahi Kasei’s Leona nylon 66 filament line, which is used for industrial applications like airbags and tire cords, has an annual production capacity of approximately 33,000 tons at its Nobeoka facility in Japan, according to a January 2018 company press release.

Key Challenges

Volatility in raw material prices

Fluctuating prices of benzene, cyclohexane, and related petrochemical inputs affect production stability and cost planning. Market uncertainty pressures manufacturers, especially those relying on imports for feedstocks. Rising energy costs further influence profit margins. These fluctuations make long-term investment planning difficult and reduce flexibility for small and mid-sized producers competing in large-volume applications.

Environmental concerns and regulatory pressure

Caprolactam production faces regulatory challenges due to emissions, waste generation, and high energy use. Governments enforce strict environmental standards, increasing compliance costs for producers. Companies must upgrade plants, adopt cleaner processes, or shift toward greener technologies. These requirements add financial and operational pressure, especially in regions with older manufacturing facilities, limiting the pace of capacity expansion.

Regional Analysis

North America

North America held about 23% share of the caprolactam market in 2024. Steady demand from engineering plastics, automotive components, and industrial yarn applications supported regional consumption. Growth in electric vehicle production increased the use of nylon 6 parts in connectors and lightweight modules. The U.S. remained the leading country due to strong manufacturing capacity and consistent demand from packaging and electrical industries. Rising investments in advanced resins and improved processing technologies continued to strengthen the regional outlook.

Europe

Europe accounted for nearly 27% share in 2024, driven by strong adoption of nylon 6 in automotive, textiles, and electrical applications. Regional manufacturers focused on high-performance engineering plastics for lightweight vehicle parts and electronics. Germany, France, and Italy contributed most to demand due to advanced industrial sectors. Strict sustainability regulations encouraged producers to adopt cleaner production routes and energy-efficient technologies. The market benefited from ongoing innovation in textile yarns and premium performance fibers.

Asia Pacific

Asia Pacific dominated the market with around 42% share in 2024. Large-scale textile production in China, India, Vietnam, and Indonesia drove high consumption of nylon 6 fibers and yarns. Expanding automotive manufacturing in China and Southeast Asia also boosted resin demand. Strong export capabilities, large labor availability, and rising investments in capacity expansion strengthened the region’s leadership. Rapid industrialization, growing consumer industries, and improved petrochemical integration continued to support long-term growth.

Latin America

Latin America captured about 5% share in 2024, supported by growing automotive and industrial sectors in Brazil and Mexico. Increasing use of nylon 6 components in vehicle interiors, packaging films, and industrial yarns helped stabilize demand. Textile and apparel production showed moderate growth, supporting fiber consumption across key countries. Investments in manufacturing modernization and improved supply chains encouraged steady adoption. The region’s demand outlook remained positive due to rising industrial activity and improving trade networks.

Middle East and Africa

The Middle East and Africa held nearly 3% share in 2024. The region benefited from expanding petrochemical capacity, especially in the Gulf countries, enabling stable access to raw materials. Industrial applications, packaging, and developing textile industries supported moderate demand growth. The construction-driven rise in engineering plastics consumption further improved the market scenario. Africa saw emerging opportunities as consumer goods and automotive industries gradually expanded. The region maintained a steady but smaller contribution compared to larger global markets.

Market Segmentations:

By Product

- Nylon 6 Fibers

- Nylon 6 Resins

By Application

- Textile Yarn

- Industrial Yarn

- Engineering Plastics

- Fibers

- Others

By Production Method

- Cyclohexane Oxidation

- Phenol Hydrogenation

- Ammonium Sulfate Process

- Others

By End-Use

- Automotive

- Filaments

- Electrical & Electronics

- Consumer Goods

- Packaging

- Wire & Cable

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the caprolactam market features Domo Chemicals, China Petrochemical Development Corporation, BASF SE, Highsun Group, Gujarat State Fertilizers & Chemicals Limited, KuibyshevAzot PJSC, AdvanSix Inc., Alpek S.A.B. de C.V., Grupa Azoty, and The Aquafil Group as the leading participants in 2024. Companies focused on expanding nylon 6 production, improving process efficiency, and securing raw material integration to strengthen their positions. Many producers invested in energy-efficient technologies and low-emission pathways to meet rising sustainability requirements. Strong competition emerged across fibers, resins, and engineering plastics segments due to rising end-use demand from textiles, automotive, and electrical industries. Players enhanced supply reliability by adding new capacities and optimizing logistics networks across Asia, Europe, and North America. Continuous product quality upgrades, long-term contracts with industrial buyers, and improved catalyst systems further supported competitive strength. The market remained dynamic as global demand for high-performance nylon materials continued to increase.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, AdvanSix Inc. introduced a high-purity caprolactam grade specifically for medical-grade nylon applications, enhancing its product portfolio for specialized uses.

- In 2025, Aquafil launched a demonstration plant in Slovenia for chemical separation of elastic fiber from nylon, highlighting innovation in recycling and circular economy practices.

- In 2023, BASF SE announced the shutdown of its caprolactam production line at its Ludwigshafen site in Germany due to soaring energy prices impacting competitiveness in Europe.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Production Method, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Caprolactam demand will rise with steady growth in nylon 6 fibers and resins.

- Automotive manufacturers will increase the use of lightweight nylon components.

- Textile production in Asia will continue to support strong material consumption.

- Engineering plastics applications will expand across electronics and industrial sectors.

- Producers will adopt cleaner and energy-efficient production technologies.

- Recycling and bio-based nylon initiatives will gain more industry attention.

- Capacity expansions in Asia will strengthen global supply availability.

- Sustainability regulations will push manufacturers toward low-emission processes.

- High-performance nylon grades will see rising adoption in advanced applications.

- Market competition will intensify as global players upgrade technologies and output.