Market Overview

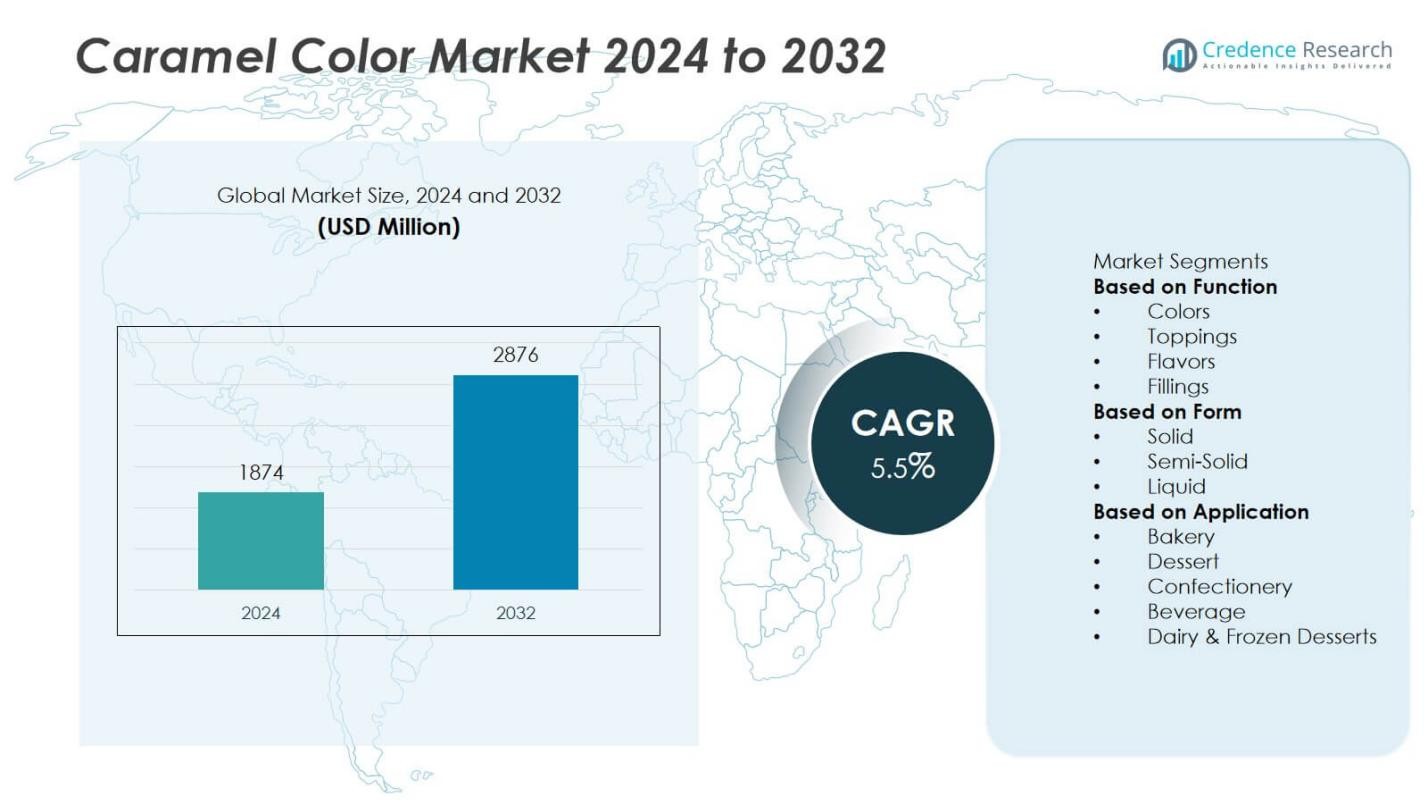

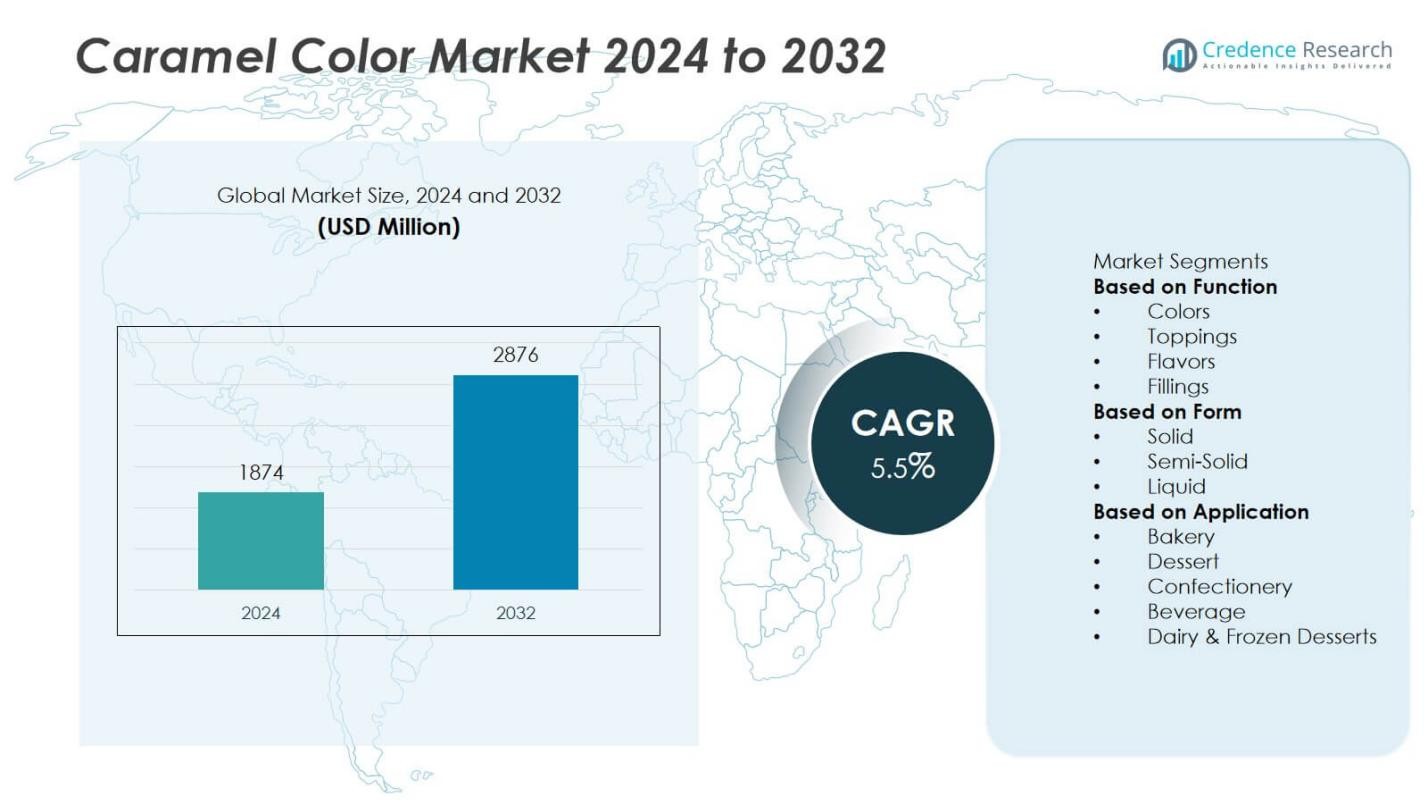

The Caramel Color Market size was valued at USD 1,874 million in 2024 and is projected to reach USD 2,876 million by 2032, reflecting a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Caramel Color Market Size 2024 |

USD 1,874 Million |

| Caramel Color Market, CAGR |

5.5% |

| Caramel Color Market Size 2032 |

USD 2,876 Million |

The Caramel Color Market grows through strong demand from the food and beverage industry, driven by its widespread use in soft drinks, confectionery, bakery, and sauces to enhance visual appeal and flavor consistency. Rising consumer preference for clean-label and natural formulations is prompting manufacturers to develop Class I variants free from ammonia and sulfites. Technological advancements in production processes improve stability, solubility, and color precision across diverse applications.

The Caramel Color Market demonstrates a broad geographical footprint, with North America and Europe leading in product innovation and clean-label adoption, supported by advanced regulatory frameworks and established food and beverage industries. Asia-Pacific is experiencing rapid growth, driven by urbanization, rising disposable incomes, and expanding packaged food consumption in markets such as China, India, and Japan. Latin America and the Middle East & Africa are witnessing steady demand, supported by growing beverage, bakery, and confectionery sectors. Key players shaping the competitive landscape include Cargill Inc., known for its diverse caramel color portfolio and global supply capabilities; DDW The Color House, specializing in natural and customized color solutions; and Sethness-Roquette Caramel Color, recognized for its expertise in high-quality, application-specific formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Caramel Color Market was valued at USD 1,874 million in 2024 and is projected to reach USD 2,876 million by 2032, growing at a CAGR of 5.5% during the forecast period.

- It benefits from rising demand in the food and beverage industry, particularly in carbonated drinks, bakery, confectionery, and sauces, where it delivers consistent color, stability, and flavor enhancement.

- Growing preference for clean-label and natural formulations is driving the adoption of Class I caramel colors, which are free from ammonia and sulfites, meeting both regulatory standards and consumer health expectations.

- The competitive landscape features key players such as Cargill Inc., DDW The Color House, Sethness-Roquette Caramel Color, and Sensient Technologies Corporation, focusing on innovation, sustainability, and tailored product solutions.

- The market faces challenges from fluctuating raw material prices, regulatory compliance requirements, and competition from alternative natural colorants, impacting cost structures and production planning.

- Geographically, North America and Europe lead in product innovation and regulatory compliance, Asia-Pacific records rapid growth from urbanization and rising processed food demand, while Latin America and the Middle East & Africa show steady expansion through beverage and bakery sectors.

- Sustainability initiatives, application-specific product development, and expansion into non-food sectors such as pharmaceuticals, cosmetics, and pet food present new growth opportunities for manufacturers.

Market Drivers

Rising Demand from the Food and Beverage Industry

The Caramel Color Market benefits from strong consumption in the food and beverage sector, particularly in soft drinks, alcoholic beverages, confectionery, and bakery products. It provides an appealing brown hue and enhances the visual quality of products, influencing consumer purchase decisions. Beverage manufacturers rely on caramel color for consistent product appearance across batches, supporting brand identity. The growth of ready-to-drink beverages and craft brewing intensifies demand for high-quality colorants. Manufacturers are investing in production technologies that ensure stability under varying pH and temperature conditions. Expansion of fast-food and packaged snack segments further stimulates market growth.

- For instance, Cargill Inc. operates a high-capacity soybean processing plant with a daily crush capacity of approximately 1,200 metric tons, though not specific to caramel color, it reflects the scale of its ingredient processing capabilities.

Increasing Preference for Natural and Clean-Label Products

Consumers are showing heightened interest in natural ingredients, prompting manufacturers to develop cleaner caramel color formulations with reduced or no chemical additives. It aligns with industry efforts to meet regulatory requirements and growing health awareness. Food brands increasingly use labels highlighting natural sourcing and minimal processing to appeal to conscious buyers. Regulatory frameworks in North America and Europe encourage reduced use of synthetic additives, driving reformulation strategies. The demand for Class I caramel color, produced without ammonia or sulfites, is rising across multiple applications. Clean-label positioning enhances brand value and supports long-term customer loyalty.

- For instance, DDW, The Color House (DD Williamson) manufactures caramel color with a typical color intensity range of 0.055–0.065 (e.g., for product #310) and EBC values around 16,000, along with a hue index of approximately 5.7 and percent solids near 74%

Technological Advancements in Manufacturing Processes

Ongoing improvements in processing methods enable the production of caramel colors with enhanced stability, solubility, and flavor neutrality. It allows broader application across challenging product formulations, including acidic beverages and high-sugar confectionery. Advancements in controlled heating techniques help manufacturers achieve precise color intensity without undesirable flavor changes. Automation in production lines improves batch consistency and reduces contamination risks. Continuous R&D investment fosters the development of customized solutions for specific industries. Technology-driven efficiency also contributes to reducing production costs, making premium caramel colors more accessible.

Expanding Applications Beyond Food and Beverage

The Caramel Color Market is diversifying into pharmaceuticals, cosmetics, and pet food, driven by the need for safe and stable coloring agents. It is used in capsules, syrups, and topical formulations to enhance product aesthetics. Cosmetic brands employ caramel color in skincare and makeup products for natural brown shades. Pet food manufacturers use it to improve visual appeal without compromising nutritional safety. The expansion into these sectors creates new revenue streams for producers. This diversification reduces dependency on traditional markets and increases resilience against sector-specific demand fluctuations.

Market Trends

Shift Toward Class I and Natural Formulations

The Caramel Color Market is witnessing a notable shift toward Class I caramel colors, which are produced without ammonia or sulfites. It aligns with clean-label trends and consumer demand for naturally processed ingredients. Food and beverage companies are reformulating products to reduce synthetic additives, enhancing appeal to health-conscious buyers. Regulatory support in key markets is accelerating the adoption of such formulations. The rise in organic and premium product lines is further boosting demand for minimally processed caramel colors. This trend is expected to dominate future product development strategies.

- For instance, DDW, The Color House, expanded its Class I caramel color production capacity to 12 million kilograms annually in 2022 to meet rising demand from beverage manufacturers.

Integration of Sustainable Sourcing and Production Practices

Manufacturers are adopting sustainable sourcing of raw materials such as cane sugar and corn syrup to reduce environmental impact. It supports corporate social responsibility goals and strengthens brand reputation among environmentally aware consumers. Energy-efficient manufacturing processes and waste minimization strategies are gaining traction. Certification programs for sustainability are becoming a differentiator in competitive markets. Companies are increasingly disclosing their carbon reduction achievements to attract eco-conscious partners. This emphasis on sustainability is shaping procurement and production planning across the industry.

- For instance, Cargill’s 2023 Sustainability Report reveals it has transitioned 880,000 acres of North American agricultural land to regenerative practices since 2020 and has restored more than 9 billion liters of water in that year alone.

Expansion of Application-Specific Product Development

Producers are introducing caramel color variants tailored for specific applications such as acidic beverages, dairy, confectionery, and savory snacks. It ensures optimal stability, flavor neutrality, and visual consistency in each product category. Customized formulations are enabling brands to maintain consistent color even under challenging storage conditions. Collaboration between colorant producers and food technologists is growing to address complex product requirements. High-performance solutions for alcohol-based beverages and plant-based food alternatives are gaining momentum. The ability to deliver targeted performance is becoming a core competitive advantage.

Adoption of Advanced Processing Technologies

Innovations in controlled heating, filtration, and concentration techniques are enhancing the quality and efficiency of caramel color production. It allows for precise control over hue, intensity, and transparency. Automation and digital monitoring systems are improving batch consistency and traceability. Manufacturers are leveraging process optimization to reduce costs while maintaining product standards. Advanced technologies also enable compliance with stringent safety and quality regulations in global markets. These advancements are positioning producers to meet evolving customer expectations effectively.

Market Challenges Analysis

Regulatory Compliance and Health Concerns

The Caramel Color Market faces ongoing challenges related to regulatory compliance and consumer health concerns. It must adhere to varying international standards that govern allowable production methods and permissible levels of by-products such as 4-MEI. Stricter rules in regions like North America and Europe compel manufacturers to invest in advanced processing methods to meet safety benchmarks. Public awareness of potential health risks linked to certain caramel color classes can influence purchasing decisions. Negative media coverage or regulatory actions can impact brand reputation and sales. Balancing compliance with cost efficiency remains a pressing challenge for producers.

Price Volatility and Raw Material Dependence

Fluctuating prices of raw materials, particularly sugar and corn syrup, create cost management issues for caramel color manufacturers. It relies heavily on consistent quality and supply of these inputs to maintain product standards. Market instability in agricultural commodities can affect profit margins and pricing strategies. Supply chain disruptions caused by climate events, trade restrictions, or logistical constraints further complicate production planning. Competition from alternative natural colorants such as annatto or beet juice intensifies pressure on market share. Maintaining cost competitiveness while ensuring quality consistency is a key operational hurdle for the industry.

Market Opportunities

Expansion in Emerging Economies and Diversified Applications

The Caramel Color Market has strong growth potential in emerging economies where urbanization and rising disposable incomes are fueling demand for packaged foods and beverages. It can capitalize on the expansion of quick-service restaurants, soft drink consumption, and confectionery production in Asia-Pacific, Latin America, and the Middle East. Increased investment in local manufacturing facilities can reduce supply chain costs and improve responsiveness to regional preferences. The market can also expand through non-food applications, including cosmetics, pharmaceuticals, and pet food. These segments value caramel color for its stability, safety, and aesthetic appeal, offering a pathway to diversified revenue streams.

Innovation in Clean-Label and Premium Product Segments

Rising consumer demand for clean-label and premium products presents a significant opportunity for manufacturers to develop advanced formulations. It can focus on producing Class I caramel colors that meet natural ingredient standards and align with health-conscious purchasing trends. Collaboration with food and beverage brands to co-create specialty color solutions can drive premium positioning. The shift toward plant-based and functional food categories also opens space for caramel color integration. Investment in sustainable sourcing and low-carbon production processes can strengthen market competitiveness. Brands that combine innovation with transparency are well-positioned to capture long-term loyalty in this evolving industry landscape.

Market Segmentation Analysis:

By Function

The Caramel Color Market segments by function into coloring, flavoring, and other specialized roles. Coloring remains the dominant function, driven by its use in achieving consistent brown tones in beverages, bakery items, confectionery, and sauces. It also serves as a flavoring agent in products where caramelized notes enhance taste profiles, such as in desserts and savory marinades. The versatility of caramel color supports its integration into both sweet and savory product lines. In brewing and alcoholic beverages, it is valued for its ability to maintain stability without altering taste. Other functions, including textural enhancement and masking undesirable hues in processed foods, contribute to niche demand growth.

- For instance, Sethness-Roquette’s Class II liquid caramel color 2200 lists tinctorial power at 0.175–0.200 absorbance units (measured at 560 nm in 0.1% solution), hue index 6.0–6.5, specific gravity 1.345–1.355 at 20 °C, and viscosity 4500 mPa·s at 25 °C, delivering robust, clear-brown coloration for sauces and marinades; this information appears in the manufacturer’s technical data sheet released in mid-2022.

By Form

The market divides by form into liquid and powder caramel colors, each suited to distinct industrial needs. Liquid caramel color holds a substantial share due to its ease of incorporation in beverages, syrups, and liquid food formulations. It offers uniform dispersion and compatibility with various pH levels, making it ideal for large-scale beverage production. Powder form is preferred for dry mixes, baked goods, and applications requiring extended shelf stability. It allows manufacturers to reduce shipping weight and optimize storage space. Both forms benefit from advancements in processing that improve solubility, color stability, and resistance to heat and light.

- For instance, Sethness-Roquette’s Class III powdered caramel color P330 lists tinctorial power 0.300–0.350 absorbance units (560 nm, 0.1% solution), color intensity 0.155–0.205 absorbance units (610 nm, 0.1% solution), and pH 7.2–8.2 (1% solution), enabling strong coloration for dry mixes with neutral flavor impact; the product specification provides full analytical methods and was issued by the manufacturer

By Application

The Caramel Color Market covers applications in beverages, bakery and confectionery, dairy products, sauces and seasonings, and other sectors such as pharmaceuticals and cosmetics. Beverages, including carbonated soft drinks, beer, and spirits, account for the largest application share, supported by consistent consumer demand. Bakery and confectionery use caramel color to create appealing shades in bread, cakes, candies, and fillings. Dairy products, particularly flavored milk and ice cream, rely on it for uniform color distribution. Sauces, condiments, and seasonings incorporate caramel color to achieve rich, appetizing tones in savory recipes. Emerging applications in pharmaceutical syrups, capsules, and cosmetic formulations further expand market scope, highlighting its adaptability across diverse industries.

Segments:

Based on Function

- Colors

- Toppings

- Flavors

- Fillings

Based on Form

Based on Application

- Bakery

- Dessert

- Confectionery

- Beverage

- Dairy & Frozen Desserts

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the Caramel Color Market, accounting for approximately 32% of the global revenue in 2024. The region’s dominance is driven by strong consumption in the carbonated beverage industry, which remains a primary user of caramel color. Large-scale production by established soft drink brands ensures consistent demand. It also benefits from extensive application in bakery, confectionery, and ready-to-eat meal segments, supported by a mature processed food market. Regulatory scrutiny from the U.S. Food and Drug Administration (FDA) has encouraged the adoption of cleaner formulations, particularly Class I caramel color, which appeals to health-conscious consumers. The market is further reinforced by investment in technological advancements to meet diverse product specifications. Growth opportunities are emerging from increasing use in craft brewing, specialty beverages, and premium snack categories.

Europe

Europe commands around 27% of the Caramel Color Market share, supported by a well-established food and beverage sector and stringent regulatory standards. Countries such as Germany, the UK, and France lead in consumption, with notable demand in beer production, confectionery, and gourmet sauces. It is witnessing a steady shift toward natural and low-ammonia formulations in compliance with the European Food Safety Authority (EFSA) guidelines. The growing preference for organic and clean-label products is influencing both large manufacturers and artisanal producers. Sustainable sourcing and production transparency are increasingly important factors for European consumers. The region also benefits from advanced R&D capabilities, enabling the development of specialized caramel colors for niche applications, such as plant-based dairy alternatives and functional foods.

Asia-Pacific

Asia-Pacific represents approximately 24% of the Caramel Color Market and is the fastest-growing regional segment. Rising urbanization, increasing disposable incomes, and changing dietary patterns are boosting demand for packaged foods and beverages. Countries like China, India, and Japan are witnessing high consumption in soft drinks, bakery products, and instant sauces. It benefits from expanding manufacturing capabilities and relatively lower production costs, which support competitive pricing in both domestic and export markets. The adoption of caramel color in traditional and modern food formulations is widening the consumer base. Global players are investing in production facilities and partnerships to tap into this high-growth market. The region’s strong growth trajectory is also supported by the rising popularity of Western-style fast food chains and premium beverage offerings.

Latin America

Latin America holds about 10% of the Caramel Color Market share, with Brazil and Mexico leading consumption. The region’s beverage industry, particularly in carbonated soft drinks and alcoholic beverages, is a key growth driver. It also sees substantial demand from confectionery and bakery segments, where caramel color enhances both flavor and visual appeal. Economic fluctuations and currency volatility can affect raw material sourcing and pricing strategies. However, local production capabilities and favorable trade agreements are supporting supply chain stability. Increasing awareness of clean-label trends is gradually influencing reformulation efforts in premium product lines.

Middle East & Africa

The Middle East & Africa account for roughly 7% of the Caramel Color Market. Demand is concentrated in countries with developed food and beverage sectors, including the UAE, Saudi Arabia, and South Africa. It is used extensively in soft drinks, sauces, and bakery products catering to both domestic and expatriate populations. Growth is supported by expanding retail infrastructure and rising consumption of processed foods. Import dependency for raw materials poses a challenge, but investments in local manufacturing are helping to mitigate supply risks. The adoption of premium and health-oriented food products is gradually increasing, creating opportunities for cleaner caramel color formulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ferrero SpA

- DDW The Color House

- Mars Inc.

- Cargill Inc.

- Sethness-Roquette Caramel Color

- Frito-Lay

- Nestlé S.A.

- Goetze’s Candy Company Inc.

- Sensient Technologies Corporation

- Kerry Group

Competitive Analysis

The competitive landscape of the Caramel Color Market is characterized by the presence of global leaders such as Cargill Inc., DDW The Color House, Sethness-Roquette Caramel Color, Sensient Technologies Corporation, Kerry Group, Nestlé S.A., Mars Inc., Ferrero SpA, Goetze’s Candy Company Inc., and Frito-Lay. These companies compete on product quality, innovation, application-specific solutions, and sustainable sourcing practices. Cargill Inc. leverages its extensive global network to offer a broad portfolio of caramel colors tailored for beverages, bakery, and confectionery applications. DDW The Color House focuses on natural and customized formulations, catering to clean-label demands across regions. Sethness-Roquette Caramel Color is recognized for its technical expertise and consistent quality in Class I, II, III, and IV caramel colors. Sensient Technologies Corporation invests heavily in R&D to develop stable, high-performance colorants with reduced environmental impact. Multinational food companies like Nestlé S.A., Mars Inc., Ferrero SpA, and Frito-Lay integrate caramel color into their diverse product lines, ensuring consistent consumer experiences. Kerry Group emphasizes innovation in food ingredient solutions, while Goetze’s Candy Company Inc. applies caramel color in confectionery products to maintain visual appeal.

Recent Developments

- In June 2025, Nestlé USA committed to eliminating FD&C synthetic colors from its U.S. food and beverage portfolio by mid‑2026, reaffirming its move toward cleaner, more natural formulations.

- In May 2025, Ferrero North America unveiled a slate of innovative product launches—such as Ferrero Rocher chocolate squares (including a Caramel Hazelnut variant).

- In May 2025, Mars revealed its 2025 Halloween line‑up, including seasonal SKUs of Twix, Snickers, M&Ms, and Skittles

Market Concentration & Characteristics

The Caramel Color Market displays a moderately concentrated structure, with a mix of global leaders and specialized regional players shaping competition. It is characterized by the dominance of multinational ingredient manufacturers such as Cargill Inc., DDW The Color House, Sethness-Roquette Caramel Color, and Sensient Technologies Corporation, which hold significant influence through extensive distribution networks, advanced R&D capabilities, and broad product portfolios. The market operates under strict regulatory frameworks, driving continuous investment in cleaner formulations, sustainable sourcing, and application-specific innovations. Product differentiation often relies on functionality, stability, and compatibility across diverse food and beverage applications, as well as emerging uses in pharmaceuticals, cosmetics, and pet food. It is also marked by a strong emphasis on customization, with manufacturers collaborating closely with clients to meet color, flavor, and texture requirements while maintaining compliance with safety and quality standards. Competitive advantage is achieved through technological innovation, supply chain efficiency, and strategic partnerships with global brands.

Report Coverage

The research report offers an in-depth analysis based on Function, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see growing demand from the expanding global food and beverage sector, particularly in soft drinks, bakery, and confectionery.

- Clean-label and natural caramel color formulations will gain wider adoption across multiple industries.

- Class I caramel color will continue to dominate new product development due to health and regulatory preferences.

- Technological advancements will improve color stability, solubility, and production efficiency.

- Sustainable sourcing of raw materials will become a key differentiator among leading manufacturers.

- Customized application-specific solutions will drive stronger collaboration between producers and end users.

- Expansion into pharmaceuticals, cosmetics, and pet food will create new revenue streams.

- Asia-Pacific will remain the fastest-growing regional market due to rising processed food consumption.

- Regulatory compliance will push companies to innovate safer and cleaner production methods.

- Strategic partnerships and acquisitions will strengthen global market presence and product portfolios.