Market Overview

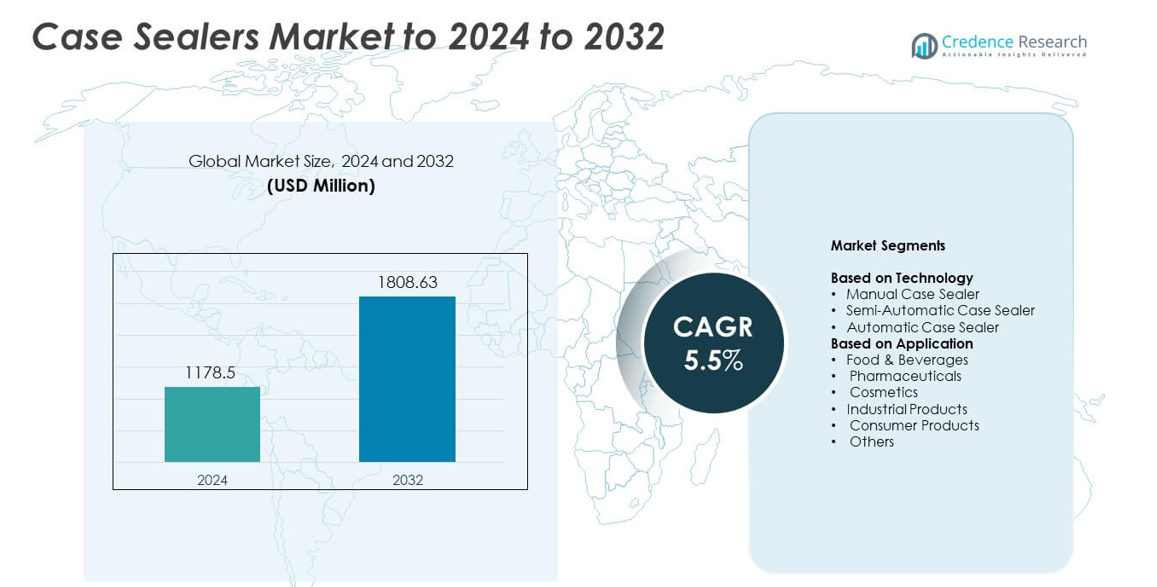

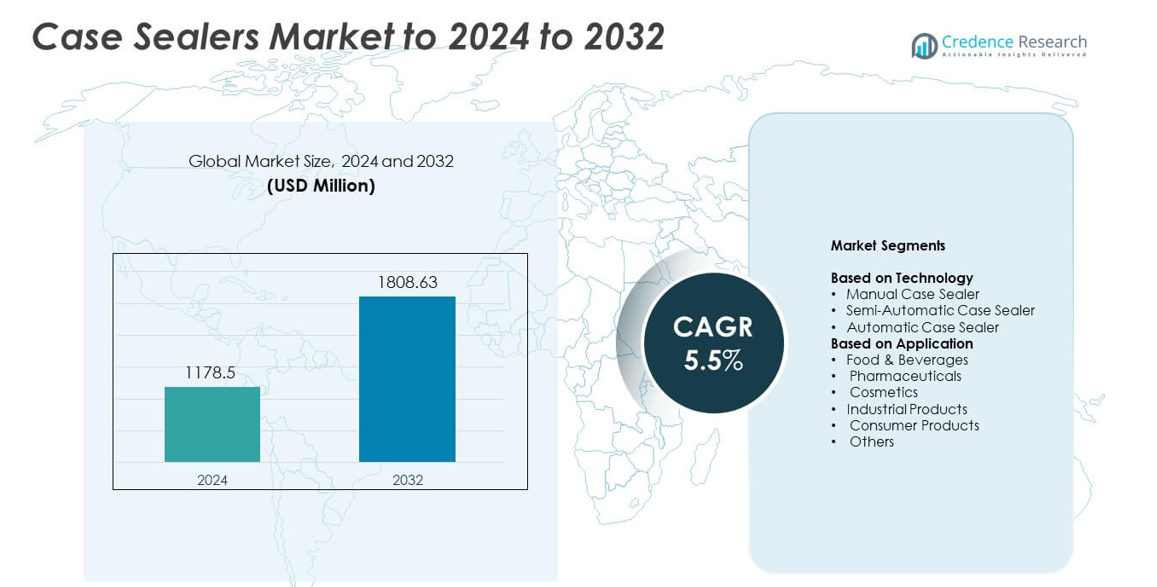

Case Sealers Market size was valued at USD 1178.5 million in 2024 and is anticipated to reach USD 1808.63 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Case Sealers Market Size 2024 |

USD 1178.5 million |

| Case Sealers Market, CAGR |

5.5% |

| Case Sealers Market Size 2032 |

USD 1808.63 million |

The Case Sealers Market is shaped by leading players such as Combi Packaging Systems LLC, Technopack Corporation, Marq Packaging Systems, Inc., UNITED CAPS, Endoline Machinery Ltd., Tape Dispenser Depot, Berry Global, Comarme S.r.l, A-B-C Packaging Machine Corporation, and Schneider Packaging Equipment Co., Inc. These companies strengthen the market through advanced sealing technologies, automation-ready systems, and high-efficiency designs that support diverse packaging lines. North America led the global landscape with a 34% share in 2024, driven by strong industrial automation and mature logistics networks. Europe followed with 28% share due to strict packaging standards, while Asia Pacific held 29% supported by rapid manufacturing expansion.

Market Insights

- The Case Sealers Market reached USD 1178.5 million in 2024 and is projected to hit USD 1808.63 million by 2032, growing at a CAGR of 5.5%.

- Market growth is driven by rising automation demand, expanding e-commerce networks, and the need for faster, consistent, and labor-efficient sealing operations across food, beverage, and consumer goods industries.

- Trends include adoption of smart sensor-enabled sealers, sustainable tape-efficient systems, and flexible designs that allow rapid adjustments for varied carton sizes.

- Competition remains strong as manufacturers focus on advanced sealing accuracy, energy-efficient models, improved durability, and partnerships that expand service and distribution reach.

- North America led with 34% share, Europe followed with 28%, and Asia Pacific held 29%, while food and beverages dominated applications with about 38% share and automatic case sealers led technology with around 49% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Automatic case sealers held the leading position in 2024 with nearly 49% share. Demand rose due to higher packaging speeds, lower labor use, and strong fit for large production lines. Automated systems helped firms cut sealing errors and maintain uniform tape quality across varied carton sizes. Semi-automatic sealers gained traction in mid-scale plants that needed faster changeovers and moderate automation. Manual units kept steady use in small facilities with low-volume operations. Growth across all technologies was supported by rising e-commerce activity and wider adoption of standardized packaging processes

- For instance, 3M’s 3M-Matic a80 case sealer runs at up to 30 cases per minute.

By Application

Food and beverages dominated the segment in 2024 with about 38% share. The category expanded as producers increased packaged meal output and adopted faster sealing systems for bulk shipments. Case sealers helped maintain hygiene, reduce contamination risk, and improve line efficiency in high-volume food plants. Pharmaceuticals followed with stable growth due to strict sealing accuracy and regulatory needs. Industrial and consumer products also used sealers to manage rising e-commerce orders. Broader automation across factories supported steady adoption across the remaining application areas.

- For instance, Tetra Pak sold 179 billion carton packages worldwide in 2023 for beverages.

Key Growth Drivers

Rising Automation Across Packaging Lines

Automation adoption expanded as factories shifted to faster and more reliable sealing operations. Case sealers reduced manual handling, improved sealing accuracy, and supported higher throughput in large production units. Many firms upgraded older lines to automatic systems to reduce labor costs and meet growing order volumes. Increased use in food, beverage, and industrial sectors strengthened the driver further. This trend positioned automation as the most influential growth driver in the Case Sealers Market.

- For instance, Syntegon’s CCM 3100 case packer is capable of placing up to 180 products per minute into cases, depending on product size and configuration.

Expansion of E-commerce and Distribution Networks

Online retail growth created heavier pressure on packaging speed and consistency. Case sealers helped companies handle larger carton volumes with minimal errors, which improved shipment quality. Warehouses and fulfillment centers adopted automated sealing systems to maintain fast dispatch cycles. Growth in direct-to-consumer brands also pushed demand for flexible sealing solutions. As e-commerce penetration deepened, this factor emerged as a key growth driver for the Case Sealers Market.

- For instance, Amazon has deployed more than 1 million robotic systems across its global operations network since 2012, with these robots assisting in over 75% of customer orders across more than 300 facilities.

Stricter Focus on Packaging Safety and Standardization

Food, pharmaceutical, and consumer goods producers increased focus on sealed-carton integrity to reduce contamination risks and product damage. Case sealers supported uniform tape application and secure closure, which met rising compliance and quality demands. Companies preferred automated systems to reduce human errors and improve traceability across packaging lines. Global packaging regulations and brand quality norms reinforced this driver. This shift toward controlled and standardized sealing became another major growth driver for the Case Sealers Market.

Key Trends and Opportunities

Adoption of Smart and Sensor-Enabled Sealers

Manufacturers added advanced sensors, fault-detection features, and automated adjustments to improve sealing reliability. Smart case sealers reduced downtime and improved tape usage efficiency. Data-enabled machines supported predictive maintenance and better process control. Firms investing in Industry 4.0 systems viewed these technologies as major opportunities to enhance productivity. This shift toward intelligent sealing equipment is one of the leading trends in the Case Sealers Market.

- For instance, a Siemens S7-300 PLC is capable of controlling a bottling station with four automated sealing positions, as demonstrated in various industrial automation applications and educational examples.

Growth of Sustainable and Eco-Friendly Packaging

Companies increased demand for recyclable cartons and water-based adhesive tapes. Case sealers adapted to eco-friendly materials while still delivering strong closure strength. Equipment makers developed energy-efficient systems and reduced tape waste to align with sustainability goals. Rising consumer preference for green packaging boosted adoption across many industries. This movement toward sustainable packaging remains a key trend and opportunity in the Case Sealers Market.

- For instance, Mondi reports producing 1.9 billion square metres of corrugated solutions in 2023.

Increased Customization for Variable Carton Sizes

Producers sought flexible sealing systems that could adjust quickly to different carton shapes. Automated case sealers with tool-less changeovers met this need and helped reduce downtime. Demand grew among e-commerce brands and contract packagers handling mixed SKUs. The focus on adaptable and modular sealers created wider opportunities for equipment innovation. This customization trend continues to shape the Case Sealers Market.

Key Challenges

High Upfront Investment and Integration Costs

Automatic case sealers required significant capital for purchase, installation, and integration with existing lines. Many small and mid-scale manufacturers hesitated due to budget constraints. Additional expenses for maintenance and operator training further limited rapid adoption. Firms with older production setups faced higher integration complexity. This financial burden remains a major challenge for the Case Sealers Market.

Operational Downtime and Maintenance Issues

Tape jams, misalignment, and mechanical faults created disruptions in fast-moving packaging lines. Inadequate maintenance practices increased wear on belts, rollers, and cutting units. Frequent stoppages reduced overall line efficiency and raised operational costs. Companies needed skilled technicians to manage repairs and maintain consistent sealing performance. These reliability-related issues continue to pose key challenges in the Case Sealers Market.

Regional Analysis

North America

North America led the Case Sealers Market in 2024 with about 34% share. The region benefited from strong automation adoption across food, beverage, and e-commerce packaging lines. Manufacturers focused on high-speed sealing systems to support large distribution networks and advanced logistics operations. Demand increased further as companies expanded fulfillment centers and upgraded packaging standards. Growth in private-label products and strict quality requirements also strengthened equipment adoption. The presence of major packaging machinery suppliers and high labor costs continued to push steady replacement of manual sealing processes across the region.

Europe

Europe held nearly 28% share in 2024, supported by strong packaging standards and rising investments in automated machinery. The region saw growing demand from food processors, pharmaceutical firms, and consumer goods manufacturers seeking consistent sealing quality. Sustainability regulations encouraged wider use of tape-efficient and energy-efficient sealing systems. E-commerce expansion in Western Europe also accelerated upgrades in fulfillment facilities. Central and Eastern Europe showed steady growth as manufacturers modernized aging equipment. Strong compliance norms and advanced production processes kept Europe a key contributor to the Case Sealers Market.

Asia Pacific

Asia Pacific accounted for about 29% share in 2024, driven by rapid industrial expansion and rising packaged product demand. China, India, and Southeast Asia saw strong adoption of automatic sealers in fast-moving consumer goods and food manufacturing. Local producers increased automation investment to boost output, reduce labor reliance, and support large export volumes. Expanding e-commerce networks created further demand for high-speed sealing lines. Growing manufacturing clusters and improving plant modernization also supported regional expansion, positioning Asia Pacific as one of the fastest-growing markets for case sealing equipment.

Latin America

Latin America held around 5% share in 2024, with growth supported by rising investments in food, beverage, and consumer goods packaging. Brazil and Mexico led adoption due to higher production activity and broader use of automated sealing solutions. Mid-scale manufacturers increased interest in semi-automatic units to improve sealing accuracy while managing operational costs. The region showed steady progress as e-commerce logistics expanded and packaging standards improved. Economic fluctuations continued to affect large-scale automation spending, yet long-term modernization efforts sustained moderate growth in the Case Sealers Market.

Middle East and Africa

Middle East and Africa captured nearly 4% share in 2024, driven by growing industrial packaging needs and expanding food processing capacity. Adoption increased in Gulf countries as manufacturers upgraded production lines to meet rising retail and export requirements. Demand for reliable sealing systems grew in emerging African markets with expanding distribution networks. Semi-automatic units saw strong use due to cost considerations and smaller plant sizes. Although automation levels remained lower than other regions, increasing investment in manufacturing and logistics supported gradual expansion of the Case Sealers Market.

Market Segmentations:

By Technology

- Manual Case Sealer

- Semi-Automatic Case Sealer

- Automatic Case Sealer

By Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics

- Industrial Products

- Consumer Products

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Case Sealers Market includes Combi Packaging Systems LLC, Technopack Corporation, Marq Packaging Systems, Inc., UNITED CAPS, Endoline Machinery Ltd., Tape Dispenser Depot, Berry Global, Comarme S.r.l, A-B-C Packaging Machine Corporation, and Schneider Packaging Equipment Co., Inc. The market features strong competition driven by automation demand, higher production speeds, and rising packaging efficiency requirements. Companies focus on offering advanced sealing technologies that support consistent performance across varied carton sizes. Many manufacturers invest in sensor-enabled systems, faster changeovers, and energy-efficient designs to meet evolving needs. Partnerships with distributors and packaging line integrators help extend market reach. Firms also expand service capabilities to reduce downtime and improve machine reliability. Growing adoption in food, beverage, pharmaceuticals, and industrial sectors encourages suppliers to develop flexible sealing platforms with improved durability and lower maintenance requirements. Continuous innovation shapes the competitive environment and supports steady market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Berry Global launched new, lightweight closures for protein powder and wellness supplements aimed at reducing the carbon footprint of nutraceuticals.

- In 2024, Schneider Packaging Equipment unveiled a unique solution integrating case erecting, taping, and palletizing automated with a collaborative robotic platform.

- In 2023, UNITED CAPS launched 23 H-PAK, an innovative closure designed for carton packs. The new product comes with an option to be held back, offering a cost-effective alternative to machinery alterations.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong adoption of automatic case sealers across high-volume plants.

- E-commerce logistics growth will push demand for faster and more reliable sealing systems.

- Smart and sensor-enabled sealers will gain wider use for predictive maintenance.

- Sustainability goals will drive interest in tape-efficient and energy-efficient machines.

- Demand for flexible sealers will rise as producers handle varied carton sizes and SKU mixes.

- Mid-scale manufacturers will increase upgrades from manual to semi-automatic systems.

- Packaging standardization will strengthen adoption in food, beverage, and pharma sectors.

- Asia Pacific will emerge as a key growth region due to rapid industrial expansion.

- Maintenance-friendly designs will gain importance to reduce downtime.

- Integration with automated conveyor and robotic systems will become more common.