Market Overview

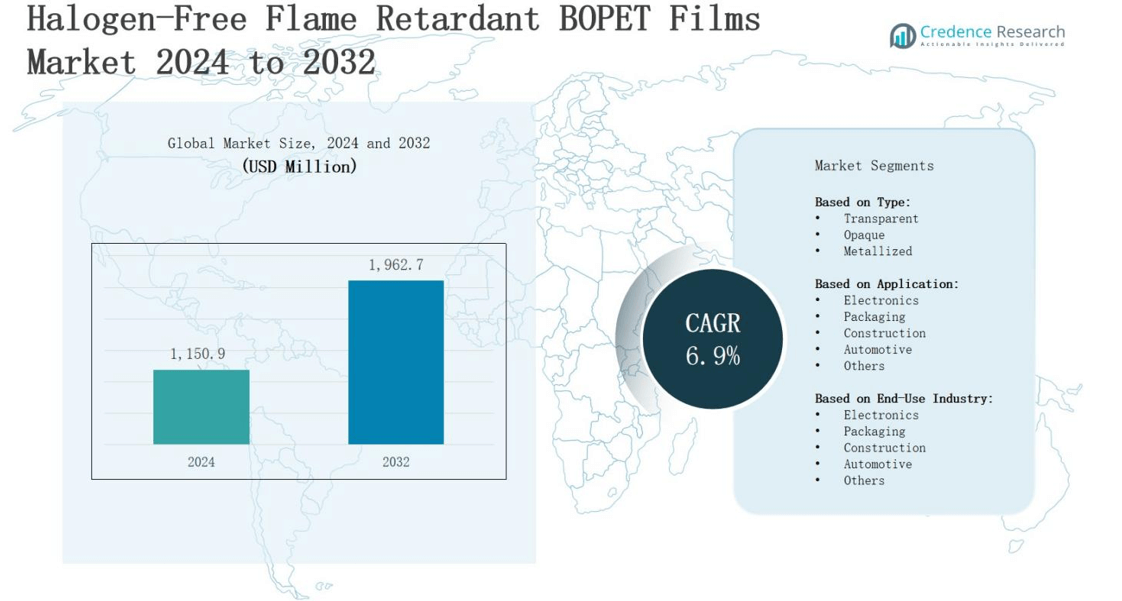

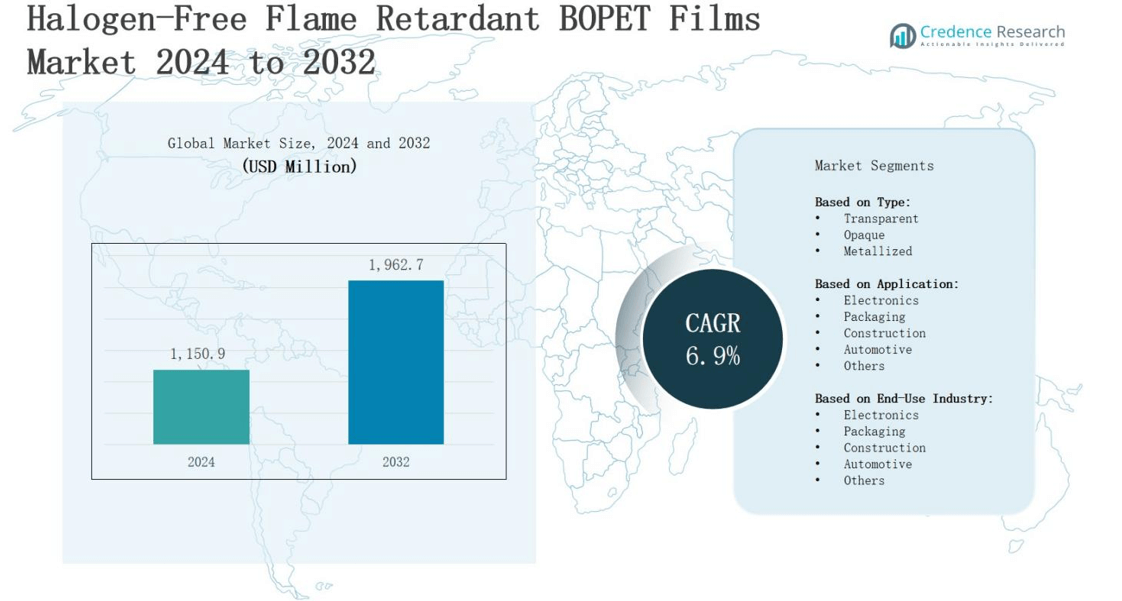

The halogen-free flame retardant BOPET films market is projected to grow from USD 1,150.9 million in 2024 to USD 1,962.7 million by 2032, registering a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Halogen-Free Flame Retardant BOPET Films Market Size 2024 |

USD 1,150.9 million |

| Halogen-Free Flame Retardant BOPET Films Market, CAGR |

6.9% |

| Halogen-Free Flame Retardant BOPET Films Market Size 2032 |

USD 1,962.7 million |

The halogen-free flame retardant BOPET films market is expanding due to rising demand for eco-friendly, non-toxic flame-retardant materials in electronics, automotive, and construction applications. Stringent fire safety standards and the growing focus on sustainable solutions are driving adoption. Increasing use in lightweight, high-performance packaging and insulation is further propelling growth. Key trends include innovations in polymer engineering to improve thermal resistance and durability, development of recyclable and environmentally compliant films, and broader application in flexible electronics and advanced industrial uses, supported by ongoing R&D initiatives and the expansion of global production capacities.

The halogen-free flame retardant BOPET films market spans North America, Europe, Asia-Pacific, and the Rest of the World, each contributing to global growth through distinct strengths. North America and Europe lead with strong regulatory frameworks and advanced manufacturing. Asia-Pacific dominates in production capacity and rapid demand growth, while the Rest of the World shows rising adoption in emerging economies. Key players include SKC Co., Ltd., Shanghai Huahong Composite Materials Co., Ltd., Mitsubishi Polyester Film, Inc., Polyplex (Thailand) Public Company Limited, DuPont Teijin Films, Uflex Limited, Nan Ya Plastics Corporation, Kolon Industries, Inc., JCT Co., Ltd., and Toray Industries, Inc.

Market Insights

- The halogen-free flame retardant BOPET films market is projected to grow from USD 1,150.9 million in 2024 to USD 1,962.7 million by 2032, at a CAGR of 6.9%, driven by rising adoption of eco-friendly and non-toxic materials in electronics, automotive, and construction.

- Strong demand from electronics manufacturing supports market growth, with applications in insulation layers, flexible circuits, and protective barriers due to superior thermal stability and dielectric strength.

- Automotive and transportation sectors are boosting consumption, particularly in wiring harnesses, battery insulation, and interior components to meet stringent fire safety standards.

- Innovations in polymer engineering and manufacturing processes are improving thermal resistance, flexibility, and recyclability, enabling use in high-performance packaging, flexible electronics, and industrial applications.

- High production costs, technical manufacturing complexity, and price sensitivity in certain markets remain challenges, alongside limited awareness in smaller industries and compatibility constraints with traditional materials.

- Asia-Pacific leads with 34% share, followed by North America at 28%, Europe at 25%, and the Rest of the World at 13%, each region contributing unique strengths to market expansion.

- Key players include SKC Co., Ltd., Shanghai Huahong Composite Materials Co., Ltd., Mitsubishi Polyester Film, Inc., Polyplex (Thailand) Public Company Limited, DuPont Teijin Films, Uflex Limited, Nan Ya Plastics Corporation, Kolon Industries, Inc., JCT Co., Ltd., and Toray Industries, Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Eco-Friendly Flame-Retardant Solutions

The halogen-free flame retardant BOPET films market is witnessing strong growth driven by increasing adoption of non-toxic, environmentally safe materials in multiple industries. Governments and regulatory bodies are implementing stricter safety and environmental standards, encouraging manufacturers to replace halogen-based products. It offers excellent flame resistance without releasing harmful gases. Growing consumer preference for sustainable and recyclable materials is accelerating its use in industrial, packaging, and consumer electronics sectors.

- For instance, Toray Industries, Inc. launched a new halogen-free flame retardant BOPET film in early 2024 specifically targeting automotive and electronics applications. This innovation supports stringent environmental sustainability and fire safety regulations in those industries.

Expansion in Electronics and Electrical Applications

The halogen-free flame retardant BOPET films market benefits from the rapid growth of electronics manufacturing and demand for advanced safety components. It is widely used in insulation layers, flexible circuits, and protective barriers due to superior thermal stability and dielectric properties. Rising demand for safer materials in consumer devices and electrical equipment is increasing its integration. Strong performance in high-temperature conditions further strengthens its role in the electronics supply chain.

- For instance, in consumer electronics, flame-retardant BOPET films are used as insulation pads in lithium-ion battery packs to enhance fire resistance under short circuit conditions.

Growth in Automotive and Transportation Sectors

The halogen-free flame retardant BOPET films market is gaining momentum in automotive and transportation applications where fire safety and durability are critical. It is used in wiring harnesses, battery insulation, and interior components to enhance fire resistance and safety compliance. Rising production of electric vehicles is boosting demand due to the need for lightweight and heat-resistant materials. Its ability to meet stringent automotive safety norms supports its market expansion.

Advancements in Material Technology and Manufacturing

The halogen-free flame retardant BOPET films market is supported by continuous innovation in polymer formulations and manufacturing processes. It benefits from improved flame-retardant additives that enhance performance without compromising recyclability. Manufacturers are focusing on optimizing strength, flexibility, and temperature resistance to meet diverse industry needs. Expanding production capacity and global supply networks are ensuring consistent availability. Growing investment in R&D is enabling the development of specialized films for niche applications.

Market Trends

Increasing Adoption in High-Performance Packaging Applications

The halogen-free flame retardant BOPET films market is witnessing a growing shift toward high-performance packaging solutions that meet both safety and sustainability requirements. It is being utilized in sectors requiring heat resistance, flame retardancy, and strong mechanical strength, such as electronics packaging and industrial goods. The demand for lightweight, recyclable materials is driving its acceptance. Rising global awareness of eco-friendly packaging regulations is further reinforcing its use across multiple industries.

Integration into Flexible Electronics and Wearable Devices

The halogen-free flame retardant BOPET films market is experiencing increased adoption in flexible electronics, wearables, and advanced display technologies. It provides critical flame resistance, dimensional stability, and insulation properties while remaining thin and lightweight. Manufacturers are incorporating it into printed circuit substrates, touchscreens, and sensor components. The growing consumer electronics sector and the trend toward compact, flexible devices are boosting demand for films that can meet stringent safety and performance criteria.

- For instance, SKC Co., Ltd. focuses on eco-friendly, sustainable halogen-free flame retardant BOPET films and applies Industry 4.0 analytics to optimize production, enhancing availability for electronics manufacturers needing safe and reliable flame retardant materials.

Advancements in Recyclable and Sustainable Product Development

The halogen-free flame retardant BOPET films market is benefitting from innovations in sustainable manufacturing processes and recyclable material formulations. It now features improved flame-retardant additives that reduce environmental impact while maintaining performance standards. Global brands are adopting it to meet corporate sustainability goals and comply with tightening environmental regulations. The trend toward closed-loop recycling and low-carbon production is further enhancing its relevance in industrial, consumer, and packaging applications.

- For instance, DuPont Teijin Films launched Melinex FR32x PET films in April 2020, a halogen-free flame retardant film that meets UL94 VTM-0 flame rating and is used in electronics, industrial, and transportation sectors.

Expansion into Automotive and Energy Storage Systems

The halogen-free flame retardant BOPET films market is expanding into automotive and energy storage applications, driven by the transition to electric mobility and renewable energy solutions. It plays a key role in battery insulation, wiring protection, and heat management systems. Growing investments in EV infrastructure and energy storage facilities are creating sustained demand. The focus on lightweight, high-durability materials is solidifying its position in advanced engineering and energy safety solutions.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes

The halogen-free flame retardant BOPET films market faces challenges due to high production costs and the technical complexity of manufacturing. It requires specialized flame-retardant additives and precise processing techniques to maintain performance without compromising recyclability. The need for advanced equipment and skilled labor increases operational expenses. Smaller manufacturers struggle to compete with established players that benefit from economies of scale. Price sensitivity in certain end-use sectors can limit adoption, particularly in cost-driven markets.

Limited Awareness and Compatibility Constraints in Certain Applications

The halogen-free flame retardant BOPET films market is also impacted by limited awareness of its benefits among smaller industries and emerging markets. It may face compatibility issues in applications that traditionally rely on halogenated materials with different performance profiles. The transition to eco-friendly alternatives can require redesign of components or adjustments in production processes, creating resistance among end-users. Inconsistent regulatory enforcement in some regions slows adoption, while availability of cheaper substitutes adds competitive pressure.

Market Opportunities

Rising Demand from Electric Vehicles and Renewable Energy Sectors

The halogen-free flame retardant BOPET films market has significant growth potential from the expanding electric vehicle and renewable energy industries. It offers excellent thermal stability, flame resistance, and insulation properties required for battery systems, wiring protection, and solar panel components. Increasing investments in EV manufacturing and charging infrastructure are creating new application opportunities. The transition toward clean energy solutions is driving demand for high-performance, eco-friendly materials. Manufacturers can leverage this trend to develop specialized products tailored to these sectors.

Expanding Use in High-Value Packaging and Advanced Electronics

The halogen-free flame retardant BOPET films market is also poised to benefit from rising adoption in premium packaging, flexible electronics, and smart devices. It combines safety compliance with lightweight, durable, and recyclable properties, making it attractive for high-end applications. Growth in consumer electronics, IoT devices, and industrial automation is fueling demand for flame-retardant films with superior mechanical and dielectric performance. Increasing regulatory emphasis on sustainable materials provides opportunities for product differentiation. Companies investing in innovation and customization can capture emerging niche markets.

Market Segmentation Analysis:

By Type

The halogen-free flame retardant BOPET films market is segmented into transparent, opaque, and metallized types. Transparent films are widely used in electronics and display applications where clarity and safety are essential. Opaque variants serve in packaging and construction for enhanced UV resistance and privacy. Metallized films offer superior barrier properties, making them suitable for high-performance packaging and insulation. It meets diverse performance needs by offering tailored properties for different industrial and consumer applications.

- For instance, HyMax RT-A1 flame retardant masterbatch is applied in transparent BOPET films to enhance flame retardancy without compromising their high transparency and mechanical strength, making them ideal for packaging and electronic product protection.

By Application

The halogen-free flame retardant BOPET films market covers applications in electronics, packaging, construction, automotive, and others. Electronics remain the largest segment, driven by demand for insulation and heat-resistant layers in devices. Packaging benefits from flame-retardant and recyclable properties, making it suitable for premium and safety-critical goods. Construction applications include insulation wraps and safety films. Automotive use focuses on wiring harnesses and battery protection. It continues to expand into niche uses such as aerospace and industrial safety solutions.

- For instance, in packaging, Mitsubishi Chemical employs these films for recyclable and flame-retardant packaging solutions tailored to safety-sensitive products.

By End-Use Industry

The halogen-free flame retardant BOPET films market serves electronics, packaging, construction, automotive, and other industries. Electronics lead due to the material’s compatibility with high-voltage and heat-sensitive components. Packaging follows with strong adoption in consumer goods and industrial sectors requiring safety compliance. Construction applications are growing in fire-safe materials. Automotive use is increasing with the rise of electric vehicles. It also finds opportunities in emerging industries requiring advanced flame-retardant, lightweight, and eco-compliant solutions.

Segments:

Based on Type:

- Transparent

- Opaque

- Metallized

Based on Application:

- Electronics

- Packaging

- Construction

- Automotive

- Others

Based on End-Use Industry:

- Electronics

- Packaging

- Construction

- Automotive

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 28% share of the halogen-free flame retardant BOPET films market, driven by strong demand from electronics, automotive, and construction sectors. It benefits from stringent fire safety regulations and high adoption of eco-friendly materials. The region’s advanced manufacturing capabilities support production of high-performance films for critical applications. Electric vehicle growth is fueling demand for flame-retardant components. Packaging innovations in food, electronics, and industrial sectors also contribute to market expansion. Companies in the region are investing in R&D to enhance material performance and recyclability.

Europe

Europe accounts for 25% share of the halogen-free flame retardant BOPET films market, supported by strict environmental and fire safety standards. It has a well-established packaging industry and a strong focus on sustainable materials. Automotive manufacturers are increasingly using these films in wiring, battery systems, and interiors to meet safety compliance. Construction applications are expanding, especially in fire-resistant building materials. Electronics production and renewable energy investments are also driving demand. Regional innovation in material science is promoting wider adoption across industries.

Asia-Pacific

Asia-Pacific leads with 34% share of the halogen-free flame retardant BOPET films market, fueled by rapid industrialization, electronics manufacturing, and automotive production. It benefits from large-scale packaging demand in consumer goods, e-commerce, and food sectors. The region’s growing electric vehicle market is increasing the use of flame-retardant materials in batteries and wiring. Construction growth in emerging economies is also creating opportunities. Manufacturers are expanding capacity to meet domestic and export needs. Government initiatives promoting green materials strengthen its market position.

Rest of the World

The Rest of the World holds 13% share of the halogen-free flame retardant BOPET films market, with growth driven by emerging infrastructure and industrial projects. It is gaining traction in Latin America, the Middle East, and Africa, where fire safety awareness is increasing. Adoption is rising in automotive, construction, and electronics assembly. Limited local manufacturing capacity is encouraging imports from Asia-Pacific and Europe. Expansion of renewable energy projects is creating new application areas. Regional players are focusing on cost-effective supply solutions to support market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SKC Co., Ltd.

- Shanghai Huahong Composite Materials Co., Ltd.

- Mitsubishi Polyester Film, Inc.

- Polyplex (Thailand) Public Company Limited

- DuPont Teijin Films

- Uflex Limited

- Nan Ya Plastics Corporation

- Kolon Industries, Inc.

- JCT Co., Ltd.

- Toray Industries, Inc.

Competitive Analysis

The halogen-free flame retardant BOPET films market is characterized by intense competition among global and regional players focusing on innovation, product quality, and regulatory compliance. It is driven by advancements in material engineering, sustainability initiatives, and expanding end-use applications across electronics, automotive, packaging, and construction. Leading companies such as SKC Co., Ltd., Shanghai Huahong Composite Materials Co., Ltd., Mitsubishi Polyester Film, Inc., Polyplex (Thailand) Public Company Limited, DuPont Teijin Films, Uflex Limited, Nan Ya Plastics Corporation, Kolon Industries, Inc., JCT Co., Ltd., and Toray Industries, Inc. are investing in R&D to enhance flame resistance, thermal stability, and recyclability. Strategic moves include capacity expansions, technology collaborations, and development of customized solutions for high-growth sectors like electric vehicles and flexible electronics. Many players are strengthening their global supply chains to ensure consistent delivery and competitive pricing while meeting stringent environmental and safety standards. The competitive landscape remains dynamic, with companies leveraging technical expertise, strong distribution networks, and sustainable manufacturing practices to secure market share.

Recent Developments

- In February 2024, Toray Industries, Inc. introduced a new range of halogen-free flame retardant BOPET films designed for electronics and automotive safety applications.

- In November 2023, DuPont de Nemours, Inc. launched a next-generation halogen-free flame retardant film incorporating phosphorus-based flame retardants.

- In March 2024, Kolon Industries expanded its production capacity in South Korea to address rising market demand.

- In 2023, Toyobo released its “Teflon™ FFR” halogen‑free flame retardant BOPET film, offering improved flame resistance, low smoke generation, and reduced environmental impact.

Market Concentration & Characteristics

The halogen-free flame retardant BOPET films market demonstrates a moderately consolidated structure, with a mix of global leaders and regional manufacturers competing through product innovation, quality, and compliance with stringent safety and environmental standards. It is characterized by high entry barriers due to the need for advanced manufacturing technology, specialized flame-retardant additives, and significant R&D investment. Leading players maintain competitive advantage through strong distribution networks, diversified product portfolios, and integration across the value chain. It serves multiple industries, including electronics, automotive, construction, and packaging, each requiring tailored performance characteristics. The market shows steady growth potential supported by regulatory shifts toward eco-friendly materials and increasing demand for high-performance, recyclable films. Competition is influenced by technological advancements, capacity expansion strategies, and the ability to meet region-specific safety regulations. It remains dynamic, with continuous innovation shaping product differentiation and enabling manufacturers to target emerging applications in energy storage, flexible electronics, and premium packaging.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow in electronics due to rising need for safe, high-performance insulation and protective materials.

- Adoption will increase in electric vehicles for battery insulation, wiring protection, and thermal management.

- Packaging applications will expand with the shift toward recyclable and flame-retardant materials.

- Construction sector will see higher usage in fire-safe building components and insulation.

- Innovation in polymer formulations will enhance durability, flexibility, and thermal stability.

- Manufacturers will invest in recyclable and eco-compliant product lines to meet regulatory demands.

- Flexible electronics and wearable devices will emerge as key growth areas.

- Regional manufacturing capacities will expand to reduce supply chain dependency.

- Strategic partnerships will grow to accelerate technology development and market reach.

- Competition will intensify with companies focusing on product differentiation and niche applications.