Market Overview

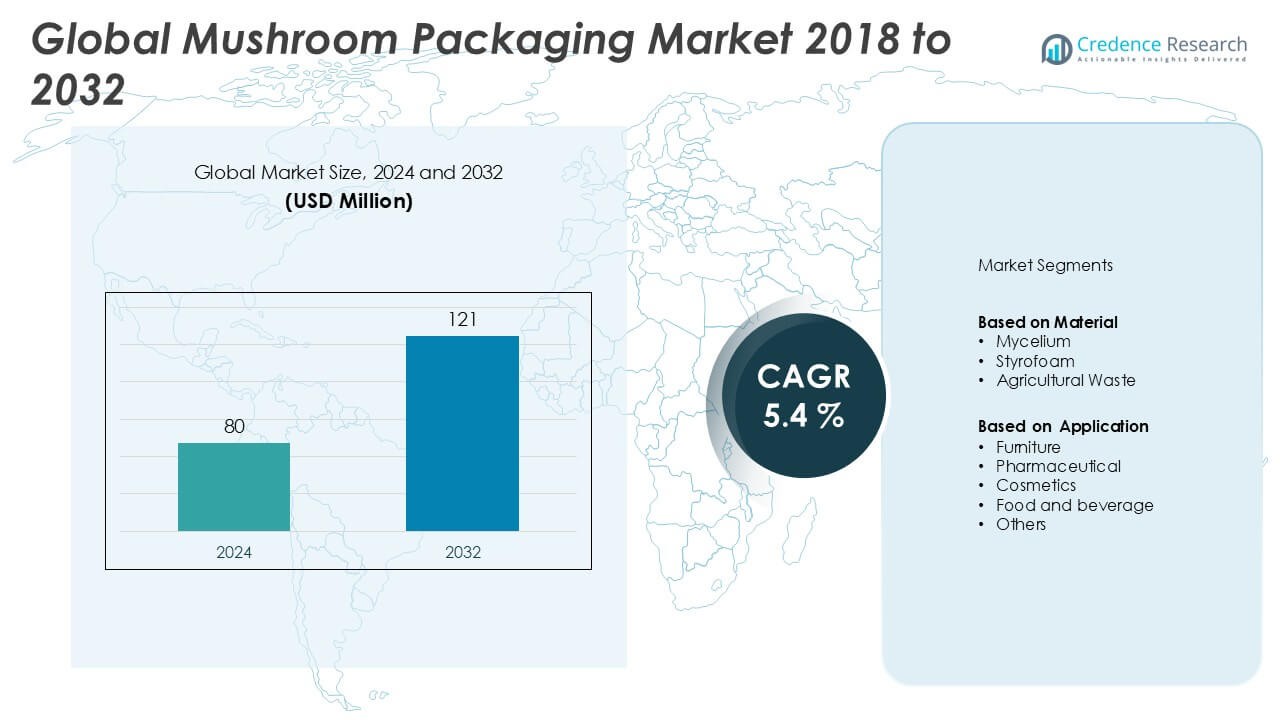

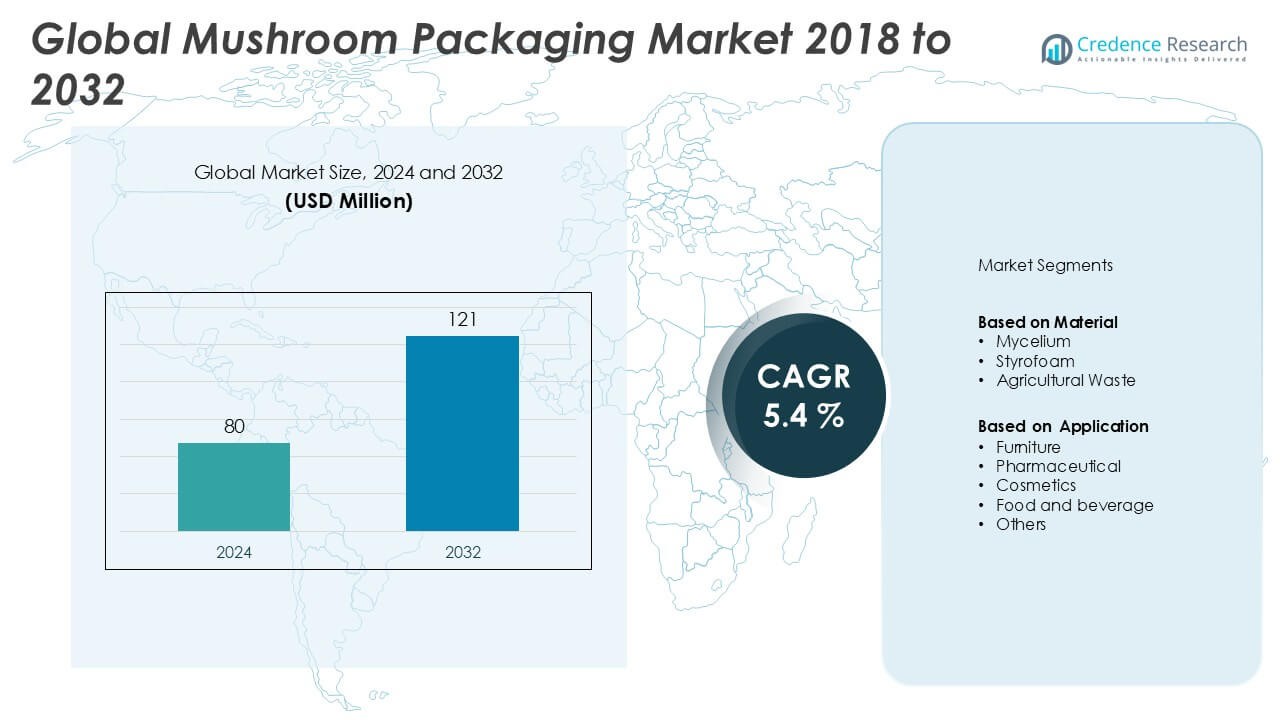

The Mushroom Packaging market size was valued at USD 80 million in 2024 and is anticipated to reach USD 121 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mushroom Packaging Market Size 2024 |

USD 80 Million |

| Mushroom Packaging Market, CAGR |

5.4% |

| Mushroom Packaging Market Size 2032 |

USD 121 Million |

The mushroom packaging market is led by key players such as Ecovative Design LLC, Magical Mushroom Company, Sealed Air Corporation, Steelcase, and Interpack, among others. These companies drive market innovation through advanced mycelium-based technologies, sustainable product development, and strategic partnerships. Ecovative Design LLC and Magical Mushroom Company are at the forefront, offering scalable, biodegradable packaging solutions across sectors. North America dominates the global market with a 38% share in 2024, supported by robust demand from the electronics, food, and consumer goods industries. Europe follows closely, driven by strict environmental regulations and high consumer awareness of sustainable packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The mushroom packaging market was valued at USD 80 million in 2024 and is projected to reach USD 121 million by 2032, growing at a CAGR of 5.4% during the forecast period.

- Rising environmental concerns and regulatory bans on single-use plastics are driving the demand for biodegradable and compostable alternatives like mushroom-based packaging.

- The market is witnessing growing trends in adoption across food & beverage, electronics, and cosmetics industries, with mycelium emerging as the dominant material segment due to its insulation and structural benefits.

- Key players such as Ecovative Design LLC, Magical Mushroom Company, and Sealed Air Corporation are focusing on R&D and strategic partnerships, while new entrants explore cost-effective innovations; however, scalability and limited awareness still restrain growth.

- Regionally, North America leads with 38% share, followed by Europe at 30%, while the food & beverage segment remains the top application area due to high demand for eco-friendly packaging.

Market Segmentation Analysis:

By Material

The mushroom packaging market is segmented by material into mycelium, styrofoam, and agricultural waste. Among these, mycelium dominates the market, accounting for the largest share in 2024. Its dominance is driven by its biodegradable nature, low cost, and excellent insulation properties, making it a preferred choice in sustainable packaging solutions. Mycelium’s growing popularity in eco-conscious industries is supported by advancements in biotechnology and increased investment in green alternatives. Although styrofoam and agricultural waste are used to a lesser extent, they serve as supportive materials in composite packaging solutions, especially in customized applications.

- For instance, Ecovative Design LLC developed a proprietary mycelium technology platform that has been used to produce over 1.1 million packaging units annually, significantly reducing the company’s reliance on petroleum-based foams.

By Application

Based on application, the mushroom packaging market is segmented into furniture, pharmaceutical, cosmetics, food and beverage, and others. The food and beverage segment holds the highest market share due to the rising demand for biodegradable and non-toxic packaging for perishable goods. Regulatory bans on plastic and consumer preference for sustainable packaging drive adoption in this segment. Additionally, the pharmaceutical and cosmetics industries are showing significant growth, driven by the need for eco-friendly secondary packaging. The furniture segment, while niche, is gaining traction for protective packaging during transport, especially for fragile and lightweight items.

- For instance, Steelcase Inc. adopted mycelium packaging for its premium seating components, resulting in the diversion of approximately 9 metric tons of EPS (expanded polystyrene) from landfill in a single fiscal year.

Key Growth Drivers

Rising Demand for Sustainable Packaging Solutions

The increasing global focus on environmental sustainability is a primary driver for mushroom packaging. Governments and organizations are actively promoting the reduction of plastic waste, leading industries to adopt biodegradable and compostable alternatives. Mushroom packaging, derived from agricultural waste and mycelium, offers a naturally decomposing solution that aligns with these eco-friendly objectives. This shift is particularly evident in consumer-driven sectors like food and cosmetics, where environmentally conscious branding adds value. As sustainability becomes integral to business strategy, demand for mushroom-based packaging is expected to rise steadily across multiple industries.

- For instance, Magical Mushroom Company reported the successful delivery of over 500,000 custom mycelium-based protective packaging units to clients in the food and beverage industry within the last 18 months.

Regulatory Push Against Plastic Use

Stringent environmental regulations and plastic bans are propelling the adoption of alternative packaging materials. Many countries have implemented laws limiting or eliminating single-use plastics, compelling manufacturers to explore sustainable substitutes like mushroom packaging. These regulations not only create a favorable policy landscape but also encourage investment in biodegradable technologies. The regulatory momentum acts as a catalyst for both startups and established companies to scale mushroom-based packaging production, accelerating market growth. Additionally, incentives and subsidies for eco-packaging innovations further support the transition toward mycelium-based solutions.

Biodegradable and Cost-Effective Manufacturing

Mushroom packaging production is both environmentally responsible and economically viable. It uses agricultural byproducts as feedstock, minimizing raw material costs and making it an affordable alternative to synthetic packaging. The low energy requirement in manufacturing processes also reduces operational costs and carbon emissions. This cost-effectiveness, coupled with the material’s ability to degrade naturally within weeks, makes it highly appealing for businesses seeking sustainable yet practical solutions. The combination of economic and environmental advantages continues to drive its adoption, particularly among SMEs and startups looking to align with green business models.

Key Trends & Opportunities

Growing Investment in Green Packaging Technologies

Companies and investors are increasingly directing capital toward sustainable packaging innovations, including mushroom-based solutions. This trend is reinforced by the demand for corporate sustainability and ESG compliance across sectors. Strategic partnerships and research initiatives are expanding the scalability and performance of mycelium packaging, enabling mass production with consistent quality. Emerging opportunities lie in automation and 3D molding techniques that can tailor packaging for various product categories. The expanding ecosystem of eco-conscious suppliers and manufacturers is poised to transform mushroom packaging from a niche product to a mainstream offering.

- For instance, Ecovative Design LLC, through its partnership with Sealed Air Corporation, has built a 30,000 sq. ft. production facility in New York dedicated solely to mycelium-based packaging solutions.

Expansion into New End-Use Industries

While the food and beverage sector currently leads in mushroom packaging adoption, emerging opportunities are appearing in pharmaceutical, electronics, and consumer goods industries. These sectors are increasingly seeking protective, shock-absorbent, and biodegradable materials for shipping and product safety. The structural integrity and lightweight properties of mycelium packaging allow customization for fragile or premium products, opening doors to high-margin applications. As more brands seek to enhance their environmental image, mushroom packaging is poised to replace traditional foam and plastic in diverse, high-value industries.

- For instance, Paradise Packaging Company recently expanded its product line to include anti-static mushroom-based packaging inserts for electronic device shipments, delivering over 75,000 units to regional tech manufacturers in Q2 alone.

Key Challenges

Limited Awareness and Market Penetration

Despite its advantages, mushroom packaging still faces low market penetration due to limited awareness among manufacturers and end-users. Many businesses remain unfamiliar with its capabilities and compatibility across various applications. Additionally, misconceptions regarding its durability and scalability persist, which can deter adoption. The market requires extensive educational efforts and demonstration of case studies to build confidence among stakeholders. Overcoming this barrier is essential for broader commercialization and acceptance across industries.

Scalability and Supply Chain Constraints

Large-scale production of mushroom packaging presents logistical and infrastructural challenges. The cultivation and molding process, although low-cost, requires controlled environmental conditions and time, which may not meet the high-volume demand of global supply chains. Moreover, the current manufacturing infrastructure is insufficient to support mass deployment, especially in emerging markets. Developing robust supply chains and enhancing production efficiency are critical to overcoming this limitation and ensuring a consistent, high-quality product output.

Regional Analysis

North America

North America holds the largest share in the mushroom packaging market, accounting for approximately 38% of the global market in 2024. The region benefits from strong consumer awareness, supportive environmental policies, and high adoption of sustainable packaging across industries. The United States leads with significant investments in green packaging startups and robust demand from the food and beverage, electronics, and cosmetics sectors. The presence of established players and government-backed sustainability initiatives further enhances market growth. Additionally, North America’s advanced logistics and recycling infrastructure enable smoother production and distribution of mushroom-based packaging products.

Europe

Europe represents the second-largest market, contributing nearly 30% of the global mushroom packaging share in 2024. Countries such as Germany, the Netherlands, and France are driving adoption due to stringent EU regulations on plastic use and growing emphasis on circular economy practices. The region’s proactive stance on environmental preservation, combined with increasing collaboration between packaging companies and research institutions, supports innovation in biodegradable materials like mycelium. Consumer demand for eco-conscious products and widespread bans on single-use plastics further accelerate market penetration across various European industries, particularly in food packaging, pharmaceuticals, and consumer goods.

Asia Pacific

Asia Pacific accounts for around 18% of the global mushroom packaging market, with notable growth potential driven by rising environmental concerns and regulatory shifts. China, India, and Japan are emerging as key contributors, fueled by increasing urbanization, industrial packaging needs, and government-led plastic reduction policies. While the market is still in the early stages, growing awareness and local innovations in sustainable agriculture and biotechnology are fostering regional adoption. Additionally, rising demand from electronics and food sectors, combined with a large agricultural base for raw materials, positions Asia Pacific as a promising growth hub for mushroom packaging solutions.

Latin America

Latin America holds approximately 8% of the global market share, with gradual adoption of mushroom packaging observed in Brazil, Mexico, and Argentina. The region is beginning to embrace sustainable alternatives due to growing pressure from environmental organizations and international trade regulations. Although limited in manufacturing infrastructure, Latin America presents opportunities in agricultural waste utilization and eco-conscious packaging, particularly in the food export industry. Local startups and NGOs are increasingly exploring low-cost biodegradable solutions, which may drive future growth. However, lack of awareness and investment still restrain the market from achieving large-scale expansion at this stage.

Middle East & Africa

The Middle East & Africa region accounts for about 6% of the mushroom packaging market, with nascent adoption primarily driven by niche applications in the UAE, South Africa, and Saudi Arabia. Environmental sustainability is gaining importance, supported by government initiatives and pilot programs aimed at reducing plastic waste. However, the region faces infrastructural and economic constraints that limit rapid scaling. Opportunities lie in the hospitality, retail, and food export sectors, which are increasingly aligning with global eco-packaging standards. With continued awareness campaigns and partnerships with global players, the region may see moderate growth in the coming years.

Market Segmentations:

By Material

By Application

- Furniture

- Pharmaceutical

- Cosmetics

- Food and beverage

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the mushroom packaging market is characterized by the presence of both established players and innovative startups focused on sustainable packaging solutions. Leading companies such as Ecovative Design LLC and Magical Mushroom Company have pioneered the use of mycelium-based packaging, setting industry benchmarks through patented technologies and scalable production models. These players emphasize research and development, product customization, and environmental certifications to gain a competitive edge. Additionally, firms such as Sealed Air Corporation, Interpack, and Paradise Packaging Company are exploring partnerships and regional expansions to strengthen their market presence. Emerging players like Shroom Labs and Poly Tech are gaining traction through cost-effective, locally sourced solutions. The market remains dynamic, driven by innovation, regulatory compliance, and increasing consumer demand for eco-friendly alternatives, encouraging continuous evolution among competitors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermo Packer

- Poly Tech

- Costa Group

- Ecovative Design LLC

- Mushroom Packaging

- Steelcase

- UNO PLAST

- Interpack

- Sealed Air Corporation

- Paradise Packaging Company

- Shroom Labs

- MANNOK

- Magical Mushroom Company

Recent Developments

- In February 2024, Morae worked alongside Evocative, a company that specializes in mycelium packaging, to create sustainable mushroom-based packaging for the haircare brand, the Rootist. This innovative tray is fully compostable, allowing consumers to compost it at home.

- In February 2023, New mycelium-based materials science and biology are opening an intriguing multibillion-dollar business potential that Mushrooms, Inc. has been quietly advancing in. To accomplish feasible industrial innovation in this new industry, Mushrooms Inc. is creating lucrative paths to support the research and development branch.

- In August 2023, an Israeli startup created a commercially viable prototype, MadeRight has obtained funds to grow its development team and improve its mushroom-based packaging production method.

- In November 2023, South Mill Champs made a significant announcement confirming its acquisition of World Fresh Produce, a global company specializing in fresh produce sourcing. South Mill Champs is renowned for producing diverse mushroom products for food service, co-packing, and private-label purposes, including Minute Mushrooms, Saucy Mushrooms, and Shrooms Mushroom Coffee. This strategic move underscores South Mill Champs’ commitment to expanding its portfolio and strengthening its position in the market by incorporating the capabilities of world fresh produce into its operations.

- In December 2022, the world’s foremost mycelium technology firm for mushrooms, ecovative, purchased Lambert Spawn Europa B.V., a cutting-edge mushroom spawn manufacturing plant located in the Netherlands, from a division of the Pennsylvania-based Lambert Spawn firm.

Market Concentration & Characteristics

The Mushroom Packaging Market exhibits a moderately concentrated structure, with a mix of established players and emerging startups competing for market share. Companies such as Ecovative Design LLC and Magical Mushroom Company lead in technological innovation and product development. It remains characterized by strong environmental appeal, low energy consumption in production, and growing applicability across sectors such as food and beverage, electronics, and cosmetics. The market relies on agricultural waste and mycelium, offering a fully compostable and non-toxic alternative to plastic and Styrofoam. Manufacturers prioritize customization, lightweight properties, and shock absorption. Demand grows steadily in regions with strict environmental regulations, especially North America and Europe. Supply chain scalability and consumer awareness influence the pace of adoption. The market’s competitive landscape continues to evolve with increased investment in R&D and government support for biodegradable materials.

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The mushroom packaging market is expected to witness steady growth due to increasing demand for biodegradable and eco-friendly materials.

- Mycelium-based packaging will continue to dominate, driven by its low cost, compostability, and structural strength.

- Rising environmental regulations and plastic bans will accelerate the shift toward sustainable packaging alternatives.

- Adoption in the food and beverage industry will remain strong, particularly for protective and secondary packaging.

- Technological advancements will enhance scalability and reduce production time for mushroom packaging solutions.

- Increased investment in green packaging startups will drive innovation and regional expansion.

- Asia Pacific is likely to emerge as a high-growth region due to growing awareness and government initiatives.

- Partnerships between packaging companies and consumer brands will fuel wider market penetration.

- Customization and product design flexibility will attract interest from cosmetics and electronics sectors.

- Awareness campaigns and sustainability certifications will play a key role in educating consumers and promoting adoption.