Market Overview

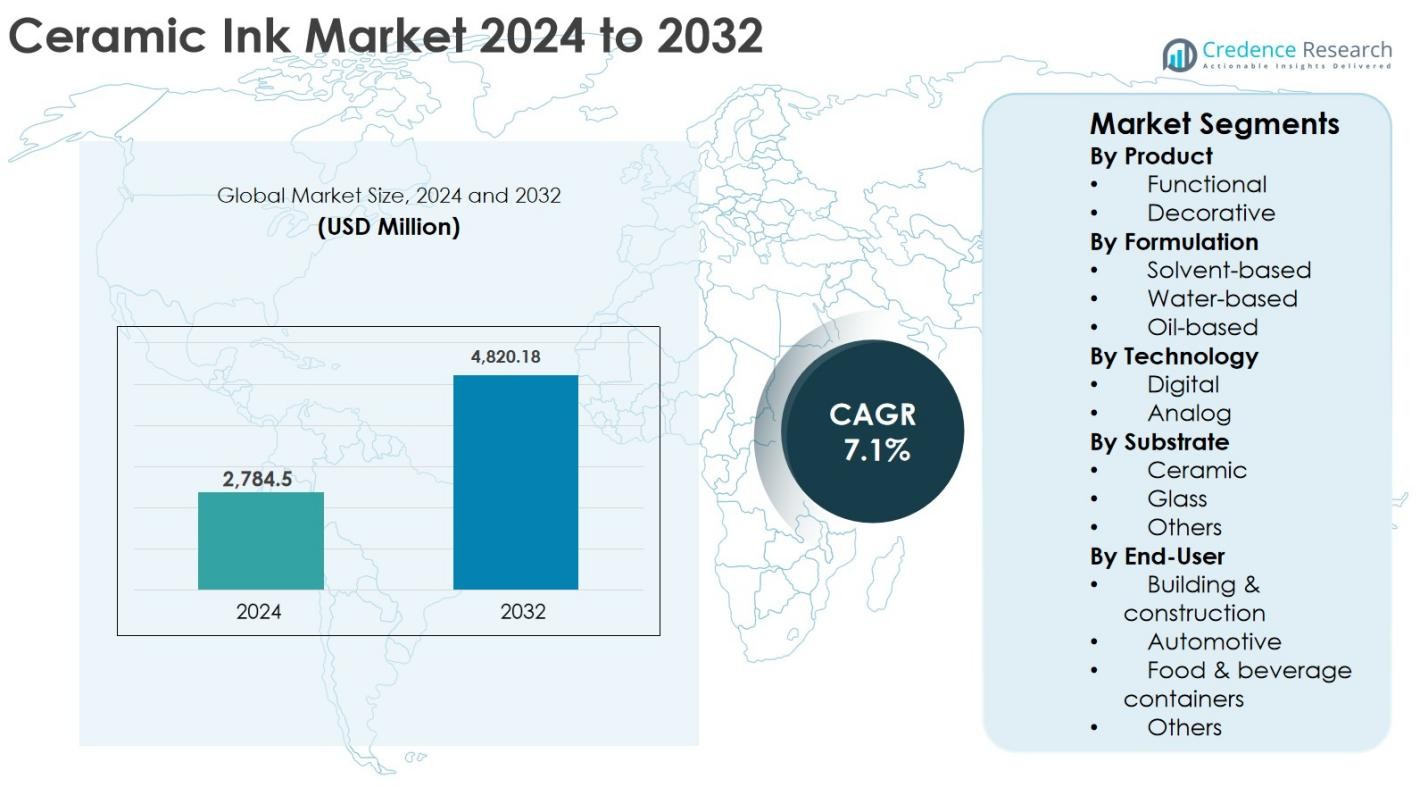

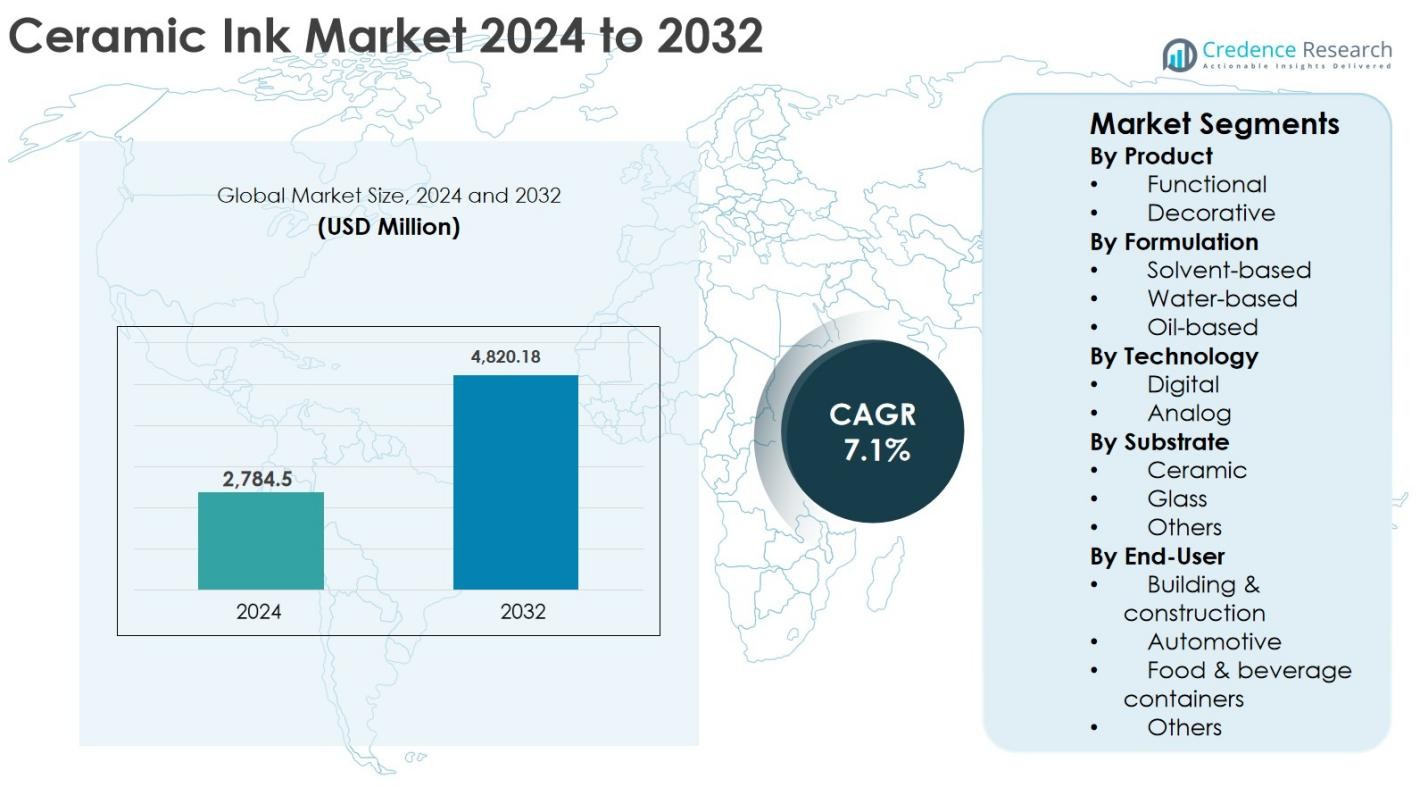

Ceramic Ink Market size was valued at USD 2,784.5 million in 2024 and is anticipated to reach USD 4,820.18 million by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Ink Market Size 2024 |

USD 2,784.5 Million |

| Ceramic Ink Market, CAGR |

7.1% |

| Ceramic Ink Market Size 2032 |

USD 4,820.18 Million |

The Ceramic Ink market is driven by established global players such as Ferro Corporation, Torrecid SA, Sun Chemical, SACMI, Tec Glass, Kyocera Corporation, Ricoh Company, Ltd., and Marabu GmbH & Co. KG, which focus on advanced formulations and digital printing compatibility. These companies strengthen their positions through continuous product innovation, strategic partnerships with ceramic tile manufacturers, and expansion of digital ink portfolios. Regionally, Asia Pacific leads the Ceramic Ink market with a 46.8% share in 2024, supported by large-scale ceramic tile production in China and India. Europe follows with a 27.5% share, driven by high-end tile manufacturing in Italy and Spain, while North America holds 15.2% share, supported by premium construction and renovation demand.

Market Insights

Market Insights

- Ceramic Ink market size was valued at USD 2,784.5 million in 2024 and is projected to reach USD 4,820.18 million by 2032, growing at a CAGR of 7.1% during the forecast period.

- Market growth is driven by rising adoption of digital ceramic printing, increasing construction and renovation activities, and strong demand for high-definition decorative tiles, with the decorative product segment holding 62.4% share in 2024 due to widespread use in tiles and sanitaryware.

- Key market trends include rapid shift toward digital printing technology, which accounted for 71.3% share, growing demand for customized and premium designs, and gradual development of eco-friendly ceramic ink formulations to meet environmental regulations.

- The competitive landscape includes established players such as Ferro Corporation, Torrecid SA, Sun Chemical, SACMI, Tec Glass, Kyocera Corporation, and Ricoh Company, Ltd., focusing on formulation innovation, digital compatibility, and strategic collaborations.

- Regionally, Asia Pacific dominated with 46.8% share, driven by large-scale production in China and India, followed by Europe with 27.5%, North America with 15.2%, while Latin America and Middle East & Africa collectively accounted for the remaining market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Ceramic Ink market by product is led by the Decorative segment, which accounted for 62.4% market share in 2024, driven by strong demand from ceramic tiles, sanitaryware, and tableware applications. Decorative ceramic inks enable high-resolution patterns, color consistency, and design flexibility, supporting premium aesthetics in residential and commercial construction. Rapid urbanization, growth in real estate renovation activities, and rising consumer preference for customized and digitally printed tiles continue to fuel adoption. Meanwhile, functional ceramic inks are gaining traction in electronics and advanced ceramics, but decorative applications remain dominant due to higher volume consumption and wider end-use penetration.

- For instance, EFI’s Cretaprint digital ceramic printers are used globally for high-resolution tile decoration, enabling manufacturers to print complex, multi-color designs directly onto porcelain and ceramic bodies.

By Formulation

Based on formulation, solvent-based ceramic inks dominated the Ceramic Ink market with a 48.7% share in 2024, owing to their superior adhesion, color stability, and compatibility with high-speed printing systems. These inks perform reliably on glazed and unglazed ceramic surfaces, making them widely preferred in large-scale tile manufacturing. The segment benefits from established production infrastructure and consistent print quality across varied firing temperatures. Although water-based and oil-based formulations are expanding due to environmental considerations and niche applications, solvent-based inks maintain leadership due to their proven performance and cost-effectiveness in mass production environments.

- For instance, Torrecid’s solvent-based digital ceramic inks are widely used on single- and double-firing tile lines, where they deliver stable color and adhesion across different kiln profiles.

By Technology

The Ceramic Ink market by technology is primarily driven by digital printing, which held a dominant 71.3% market share in 2024. Digital technology enables precise ink deposition, reduced material wastage, shorter design cycles, and rapid customization compared to analog methods. Its adoption is accelerated by advancements in inkjet printers and compatibility with modern ceramic inks. Manufacturers increasingly favor digital printing to meet evolving design trends and shorter product lifecycles. Although analog technology remains in use for traditional and cost-sensitive applications, digital printing continues to outpace it due to operational efficiency and superior design versatility.

Key Growth Drivers

Expanding Demand for Digitally Printed Ceramic Tiles

The Ceramic Ink market is strongly driven by the rapid adoption of digital printing technologies in ceramic tile manufacturing. Digital ceramic inks enable high-definition graphics, precise color control, and complex design reproduction, which are increasingly demanded by architects, interior designers, and end users. Growing construction activity across residential, commercial, and hospitality sectors has accelerated the use of digitally printed tiles to achieve premium aesthetics and customization. Manufacturers benefit from shorter production cycles, reduced inventory requirements, and lower material wastage compared to traditional printing methods. In addition, digital ceramic inks support just-in-time production and rapid design changes, aligning with evolving consumer preferences. These operational advantages continue to push tile producers toward digital platforms, directly supporting sustained demand growth for advanced ceramic ink solutions.

- For instance, System Ceramics Creadigit HD printing platform is widely installed in large-format porcelain tile lines, allowing manufacturers to execute complex graphic designs while reducing setup times and print defects.

Growth in Construction and Infrastructure Development

Rising construction and infrastructure development worldwide remains a major growth driver for the Ceramic Ink market. Expanding urban populations, increasing investments in housing projects, and large-scale renovation of commercial spaces are driving higher consumption of ceramic tiles, sanitaryware, and architectural ceramics. Ceramic inks play a critical role in enhancing surface aesthetics, durability, and product differentiation. Emerging economies are witnessing strong real estate expansion supported by government housing initiatives and infrastructure spending. Additionally, increased investments in hotels, airports, retail complexes, and public buildings further elevate demand for decorative ceramic surfaces. As construction activity accelerates, ceramic ink consumption rises in parallel, reinforcing long-term market growth.

- For instance, India’s Pradhan Mantri Awas Yojana (Urban) had sanctioned over 11.8 million houses by 2024, supporting sustained tile demand in key ceramic clusters such as Morbi and increasing usage of decorative ceramic inks in floor and wall applications.

Advancements in Ceramic Ink Formulations and Performance

Ongoing advancements in ceramic ink formulations significantly contribute to market growth by improving print quality, durability, and operational efficiency. Innovations in pigment dispersion, particle size control, and thermal stability have enhanced compatibility with high-speed digital printers and diverse ceramic substrates. These improvements ensure consistent performance during high-temperature firing while preserving color accuracy and surface integrity. Advanced formulations also enable special effects such as textured finishes, metallic appearances, and three-dimensional visuals, expanding design capabilities. Improved ink performance reduces production defects and downtime, supporting higher manufacturing efficiency. As ceramic producers seek reliable and differentiated solutions, technological innovation remains a key driver of ceramic ink adoption.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Low-Emission Ink Solutions

A prominent trend in the Ceramic Ink market is the increasing shift toward eco-friendly and low-emission ink formulations. Stricter environmental regulations related to volatile organic compound emissions and workplace safety are encouraging the adoption of water-based and low-solvent ceramic inks. This trend creates opportunities for manufacturers to develop sustainable solutions without compromising print performance or firing stability. Green building initiatives and environmentally conscious consumers further support demand for cleaner production processes. Companies investing in sustainable ceramic ink technologies gain long-term advantages by meeting regulatory compliance and aligning with global sustainability goals, unlocking new growth opportunities across multiple regions.

- For instance, Colorobbia Group has introduced eco-optimized digital ink ranges that support compliance with European environmental and worker-safety standards in modern tile plants.

Rising Demand for Customization and Premium Ceramic Designs

Growing consumer preference for customized and premium ceramic designs presents a strong opportunity for the Ceramic Ink market. High-end residential, commercial, and hospitality projects increasingly demand unique patterns, natural stone aesthetics, and bespoke finishes. Ceramic inks enable short production runs and rapid design changes without increasing manufacturing complexity or costs. This flexibility allows ceramic manufacturers to differentiate their product offerings and improve margins. Additionally, the influence of digital design trends and social media accelerates demand for visually distinctive surfaces. As customization becomes a key purchasing factor, ceramic ink suppliers that support advanced design capabilities are well positioned for sustained growth.

- For instance, advanced digital printing lines in Italian and Spanish tile clusters use ceramic inks to deliver limited-edition décor series and book-matched stone designs, enabling manufacturers to offer tailored patterns for architects and interior designers.

Key Challenges

Volatility in Raw Material Prices

Volatility in raw material prices poses a significant challenge for the Ceramic Ink market. Key inputs such as inorganic pigments, solvents, and specialty additives are subject to fluctuating costs due to supply chain disruptions, geopolitical tensions, and energy price variations. These factors directly impact production costs and compress profit margins for manufacturers. Passing cost increases to end users can be difficult in competitive and price-sensitive markets. Smaller manufacturers face greater pressure due to limited procurement flexibility and financial resilience. Managing cost stability while maintaining product quality remains a persistent challenge for ceramic ink producers.

High Capital Investment for Digital Printing Adoption

The transition to digital ceramic ink technology requires high initial capital investment in advanced printing equipment and supporting infrastructure. This financial barrier limits adoption among small and medium-sized ceramic manufacturers, particularly in developing regions. In addition to equipment costs, digital systems demand skilled labor, regular maintenance, and technical training, increasing operational expenses. Limited access to financing further restricts adoption in cost-sensitive markets. Although digital printing offers long-term efficiency and design benefits, the upfront investment remains a key obstacle, potentially slowing the pace of digital ceramic ink penetration globally.

Regional Analysis

Asia Pacific

Asia Pacific dominated the Ceramic Ink market with a 46.8% market share in 2024, supported by large-scale ceramic tile manufacturing and strong construction activity across China, India, Vietnam, and Indonesia. The region benefits from cost-efficient production, abundant raw material availability, and rapid adoption of digital ceramic printing technologies. Growing urbanization, rising residential housing demand, and infrastructure investments continue to fuel ceramic tile consumption. China remains the leading producer and exporter of ceramic products, driving high ceramic ink demand. Increasing preference for decorative and customized tiles in emerging Asian economies further strengthens regional market leadership.

Europe

Europe accounted for 27.5% market share in 2024, driven by advanced ceramic manufacturing capabilities and strong demand for premium and designer tiles. Countries such as Italy and Spain act as global hubs for ceramic tile innovation, supporting high adoption of digital ceramic inks. The region emphasizes high-quality aesthetics, sustainability, and design differentiation, which boosts demand for advanced ink formulations. Renovation of residential and commercial buildings and green building initiatives further support market growth. Strict environmental regulations encourage adoption of high-performance and low-emission ceramic inks across the region.

North America

North America held a 15.2% market share in 2024, supported by steady construction activity and growing adoption of digitally printed ceramic tiles in residential and commercial projects. The United States leads regional demand due to renovation-driven housing markets and increasing preference for customized interior designs. Ceramic ink consumption benefits from rising use of premium tiles in kitchens, bathrooms, and commercial spaces. Technological advancements and strong digital printing infrastructure support market growth, sustaining consistent demand for high-value ceramic ink applications.

Latin America

Latin America represented 6.3% market share in 2024, driven primarily by ceramic manufacturing hubs in Brazil and Mexico. Expanding residential construction, urban development, and rising middle-class income levels support ceramic tile consumption. The region is gradually adopting digital ceramic printing technologies to enhance product aesthetics and competitiveness in export markets. Manufacturers are investing in design upgrades to align with changing consumer preferences. Despite economic volatility, long-term housing and infrastructure development continue to support steady market expansion.

Middle East & Africa

The Middle East & Africa region captured 4.2% market share in 2024, supported by infrastructure development and large-scale construction projects, particularly across the Gulf Cooperation Council countries. High demand for luxury residential and commercial buildings drives consumption of decorative ceramic tiles and ceramic inks. Investments in tourism, hospitality, and smart city projects in the UAE and Saudi Arabia further boost demand. In Africa, gradual urbanization and housing development contribute to stable growth, supported by rising ceramic product imports.

Market Segmentations:

By Product

By Formulation

- Solvent-based

- Water-based

- Oil-based

By Technology

By Substrate

By End-User

- Building & construction

- Automotive

- Food & beverage containers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ceramic Ink market features a moderately consolidated competitive landscape characterized by the presence of established global manufacturers and specialized regional players focusing on innovation, product performance, and digital printing compatibility. Key players such as Ferro Corporation, Torrecid SA, Sun Chemical, Tec Glass, and SACMI dominate the market through strong R&D capabilities, extensive product portfolios, and close collaboration with ceramic tile manufacturers. Companies including Kyocera Corporation, Ricoh Company, Ltd., and Marabu GmbH & Co. KG leverage advanced inkjet technologies and materials expertise to strengthen their positions in digital ceramic printing. Asian players such as Jiangsu Linyang Energy Co., Ltd. and Zhongtian Technology Co., Ltd. benefit from cost-efficient manufacturing and growing domestic demand. Strategic initiatives such as formulation upgrades, capacity expansion, and partnerships with printer manufacturers remain central to maintaining market presence and expanding global reach.

Key Player Analysis

- Zhongtian Technology Co., Ltd.

- Marabu GmbH & Co. KG

- Torrecid SA

- Ricoh Company, Ltd.

- SACMI

- Jiangsu Linyang Energy Co., Ltd.

- Sun Chemical

- Kyocera Corporation

- Tec Glass

- Ferro Corporation

Recent Developments

- In February 2025, Sun Chemical in a joint venture with Vidres released SUNIC Inkjet Inks, providing a broad range of colours and effects with high stability across various ceramic technologies.

- In May 2024, Megacolor Ceramic Products launched a new range of digital effect ceramic inks (reactive, matt, glossy, opaque, luster), offering eco-friendly formulations and unique customization options for digital printing.

- In April 2024, Ferro Corporation introduced a new line of lead-free digital ceramic inks designed for sustainable tile decoration, enhancing color vibrancy and reducing environmental impact.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Formulation, Technology, Substrate, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Ceramic Ink market is expected to witness sustained growth supported by continued expansion of digital ceramic printing across tile and sanitaryware manufacturing.

- Increasing demand for high-definition and customized ceramic designs will further strengthen adoption of advanced ceramic ink solutions.

- Ongoing investments in construction and infrastructure development will continue to drive ceramic tile consumption globally.

- Technological advancements in ink formulations will enhance color stability, firing performance, and printer compatibility.

- Adoption of eco-friendly and low-emission ceramic inks will accelerate in response to stricter environmental regulations.

- Manufacturers will increasingly focus on value-added inks offering special effects such as textures and metallic finishes.

- Strategic collaborations between ink producers and printer manufacturers will support innovation and market penetration.

- Emerging economies will play a key role in future demand growth due to rapid urbanization and housing development.

- Competitive intensity will increase as regional players expand capacity and strengthen distribution networks.

- Digital printing technology will remain the dominant production method, reinforcing long-term efficiency and design flexibility.

Market Insights

Market Insights