Market Overview

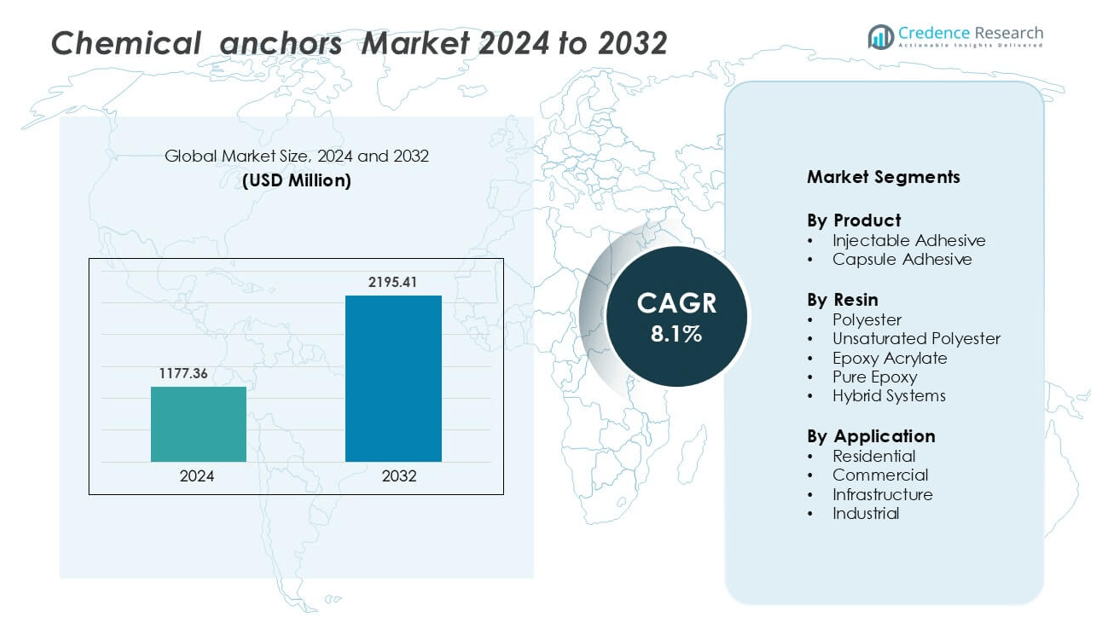

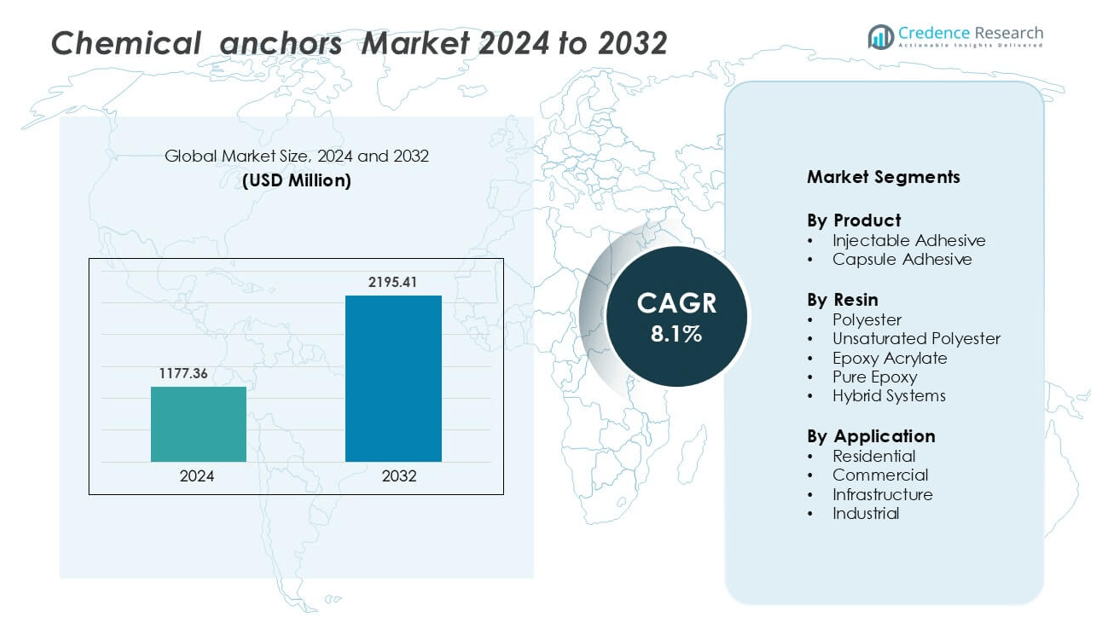

Chemical anchors Market was valued at USD 1177.36 million in 2024 and is anticipated to reach USD 2195.41 million by 2032, growing at a CAGR of 8.1 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical Anchors Market Size 2024 |

USD 1177.36 million |

| Chemical Anchors Market, CAGR |

8.1% |

| Chemical Anchors Market Size 2032 |

USD 2195.41 million |

Top players in the chemical anchors market include Hilti Group, Fischer Group, Leviat B.V., MKT Fastening, Chemfix Products Ltd., FIXDEX Fastening Technology, Power Fasteners, Koelner Rawlplug IP, Mungo Befestigungstechnik AG, and Ripple India. These companies compete through high-strength epoxy acrylate, pure epoxy, and hybrid adhesive systems designed for structural applications such as rebar connections, façade anchoring, seismic retrofitting, and industrial equipment installation. Strong distribution networks and certified product portfolios help them secure large commercial and infrastructure projects. Asia Pacific leads the global market with a 39% share, driven by rapid urban development, smart city investments, and large-scale transportation construction.

Market Insights

- The chemical anchors market was valued at USD 1177.36 million in 2024 and is projected to grow at a CAGR of 8.1% through 2032.

- Growing construction and infrastructure development drive demand for strong bonding solutions in rebar installation, façade systems, and heavy machinery fixing.

- Fast-curing epoxy acrylate and hybrid adhesives gain traction as contractors seek higher load capacity, better installation speed, and improved performance in cracked concrete and wet conditions.

- Leading players such as Hilti Group, Fischer Group, Leviat B.V., and MKT Fastening compete on certified products, distribution networks, and technology improvements, while smaller suppliers expand through regional partnerships.

- Asia Pacific holds a 39% regional share, North America follows with 26%, and infrastructure remains the dominant application segment with 41% share due to major investments in transport networks, smart cities, and commercial construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Injectable adhesive holds the dominant share of 64% in the chemical anchors market. Construction firms prefer injectable systems because they fill irregular drill holes and bond well with concrete, brick, and hollow blocks. The product supports heavy loads, which benefits structural repairs and rebar connections. Fast curing and easy on-site mixing reduce installation time. Capsule adhesive remains useful for predictable dosing, but its fixed volume limits flexibility on complex projects. As urban high-rise development rises, injectable adhesives continue to lead due to better strength, reduced waste, and lower labor effort.

- For instance, Hilti marketing materials and technical data sheets state the product has a “Tensile Bond Strength: Up to 25 MPa.

By Resin

Epoxy acrylate accounts for 38% share and leads the resin segment. Epoxy acrylate anchors provide strong mechanical performance and support critical loads in steel dowels, seismic retrofitting, and heavy machinery installation. The resin cures in damp conditions and maintains bond strength under vibration, heat, and chemical exposure. Pure epoxy serves industrial projects with very high load demands but takes longer to cure. Hybrid systems gain adoption where faster curing is required. Rising safety rules in infrastructure strengthens epoxy acrylate demand due to reliable strength and improved durability.

- For instance, The Fischer FIS EM Plus is a high-performance epoxy mortar (not epoxy acrylate resin) designed for high load-bearing capacity in both cracked and non-cracked concrete, as per its ETA (European Technical Assessment) and ICC approvals.

By Application

Infrastructure dominates the market with a 41% share. Large construction projects, including bridges, tunnels, metro rail, and highways, rely on chemical anchors to fix rebar, crash barriers, and guardrails. The anchors work well in cracked and uncracked concrete, making them suitable for heavy load applications. Commercial buildings follow as shopping centers and offices use chemical anchors for HVAC systems, glass façades, and steel connections. Growth in government spending on transport networks and public utilities continues to drive infrastructure demand, reinforcing the segment’s leading position.

Key Growth Drivers

Growth in Large-Scale Infrastructure and Urban Development Projects

Large infrastructure projects remain a major growth engine for the chemical anchors market. Governments and private developers continue investing in expressways, tunnels, metro rail, airports, commercial towers, and utility structures. These projects demand strong bonding solutions for rebar connections, concrete reinforcement, façade installation, and seismic retrofitting. Chemical anchors support heavy loads and maintain structural integrity in both cracked and uncracked concrete, giving them an advantage over mechanical fasteners. Rapid urbanization in Asia Pacific, the Middle East, and Latin America fuels high consumption across transportation, power distribution, and industrial construction. As nations focus on resilient infrastructure and smart city programs, demand for high-strength chemical anchors is expected to increase further.

- For instance, Fischer supplied numerous safety solutions for the Istanbul Airport expansion, where its Fischer FireStop passive fire protection solutions—such as the FCPS panel system, FiAM, FiGM, and FiPW sealants—were extensively deployed across the terminal building, control tower, and various utility buildings to seal penetration openings.

Rising Adoption of Fast-Curing and High-Performance Adhesive Systems

Fast-curing adhesives are becoming a priority due to shorter construction timelines and labor cost optimization. Modern chemical anchors offer quick gel time, strong adhesion, and consistent performance in various temperatures and moisture conditions. Epoxy acrylate and hybrid formulations support critical loads in seismic zones, high-rise buildings, ports, and industrial equipment installation. The trend toward prefabrication and modular construction also drives demand, as contractors require reliable anchoring with minimal downtime. Improved cartridges, dispensing guns, and mixing nozzles enhance jobsite efficiency and reduce material wastage. The shift toward faster, durable adhesives encourages adoption in both developed and emerging markets, supporting accelerated market growth.

- For instance, Hilti’s HIT-HY 200-R V3 hybrid adhesive has a working time (gel time) of nine minutes at standard temperatures (20°C to 24°C) during ICC-ES or ETA testing, enabling rapid load application (after a 1-hour full cure) on congested job sites

Increasing Safety Standards and Strength Requirements in Construction

Stricter building codes and certification standards drive adoption of chemical anchors over traditional fasteners. Infrastructure segments such as bridges, parking structures, stadiums, and heavy industrial plants require anchors that withstand vibration, corrosion, extreme temperature changes, and dynamic loads. Chemical anchors deliver high pull-out strength, even under cracked concrete and seismic stress. Manufacturers continue investing in international certifications such as ETA and ICC-ES, ensuring compliance in public infrastructure works. As construction firms emphasize long-term safety and lifecycle performance, contractors choose chemical systems to prevent failures and reduce maintenance. This regulatory push creates sustained demand for reliable and tested adhesive anchors.

Key Trend & Opportunity

Growing Demand for Green and Low-VOC Adhesive Formulations

Sustainability compliance is becoming a key trend in construction chemicals. Governments encourage low-VOC, non-toxic, and eco-friendly materials for buildings, public infrastructure, and industrial plants. Manufacturers are developing formulations with reduced styrene content, giving better workplace safety and lower emissions. Green-certified anchors help builders meet environmental rating systems such as LEED and BREEAM. This trend creates opportunities for new product lines, especially in commercial real estate, hospitals, and residential projects. As contractors shift toward environmentally responsible construction materials, companies that innovate with safer resins, recyclable packaging, and cleaner curing chemistry gain a competitive edge.

- For instance, Rawlplug product information confirms that the R-CAS-V (which is likely the product referred to as R-CAS-VF, as F often denotes foil/flexible packaging) is styrene free and virtually odourless . This formulation is a key characteristic of low-VOC chemical anchors.

Expansion in Seismic Retrofitting and Renovation Activities

Aging infrastructure and rising seismic retrofitting programs create new demand channels. Many urban regions upgrade bridges, tunnels, heritage structures, and public buildings to meet modern safety standards. Chemical anchors are preferred during retrofitting because they deliver high tensile strength and bond well in confined spaces where mechanical anchors cannot be applied. Renovation of old commercial spaces, airports, and industrial plants supports additional consumption. Growing awareness of climate resilience and disaster-proof engineering widens the market scope. As retrofitting budgets rise across Asia Pacific, Europe, and North America, suppliers benefit from recurring installation needs and specialized high-strength adhesive products.

- For instance, Hilti’s HIT-RE 500 V3 was used in the seismic strengthening of the Los Angeles Metro bridge deck, where more than 18,000 post-installed rebars were anchored.

Key Challenge

Fluctuating Raw Material Prices and Supply Constraints

Volatility in resin and chemical feedstock prices remains a major barrier. Epoxy, polyester, and hybrid resins depend on petrochemical raw materials, which face cost fluctuations and supply disruptions due to geopolitical issues, crude oil pricing, global shipping delays, and production outages. High costs increase the final price of chemical anchors, making adoption challenging for cost-sensitive builders. Smaller manufacturers struggle to maintain stable margins and adequate inventory. During supply shortages, project delays occur, forcing contractors to switch products or reduce consumption. Long-term pricing uncertainty affects expansion plans and slows market penetration in developing regions.

Limited Awareness and Skilled Application Requirements

Improper installation remains a risk in chemical anchoring. These systems require correct hole cleaning, mixing, dispensing, curing, and load testing. Lack of training in smaller construction firms can lead to weak bonding, rework, or safety failures. Mechanical anchors remain popular in low-skilled markets due to easy installation and lower cost, restricting chemical anchor adoption. Additionally, contractors may avoid adhesives in cold or wet environments without knowledge of specialized formulations. Manufacturers must invest in training, demo programs, and on-site support to address this gap. Without skill development, market growth may remain slower in emerging regions.

Regional Analysis

Asia Pacific

Asia Pacific leads the chemical anchors market with a 39% share. Rapid urban growth, infrastructure upgrades, and industrial expansion drive strong demand across China, India, Japan, and Southeast Asia. The region invests in highways, metro rail, airports, and commercial real estate, requiring reliable anchoring for rebar connections, façade systems, and heavy machinery. Governments promote seismic safety and durable bonding solutions, pushing contractors toward epoxy acrylate and hybrid adhesives. Manufacturing development in electronics, chemicals, and automotive plants supports industrial usage. Rising construction spending and foreign direct investment continue to reinforce Asia Pacific’s leading position in the global market.

North America

North America holds a 26% market share, supported by renovation activities, seismic retrofitting, and strict construction standards. The U.S. and Canada use chemical anchors in bridges, parking structures, industrial facilities, and commercial buildings. Fast-curing adhesives and ICC-ES certified products are in high demand for critical infrastructure and safety-sensitive applications. Growth in modular construction, renewable energy projects, and warehouse development increases anchor consumption. The region also sees rising use in residential repair, HVAC installation, and steel reinforcement. Strong presence of global manufacturers and high awareness of application standards maintain steady market expansion across the region.

Europe

Europe accounts for 21% of the chemical anchors market. The region focuses on sustainable construction, green-certified buildings, and energy-efficient infrastructure. Countries such as Germany, the U.K., France, and Italy use chemical anchors for commercial complexes, transportation networks, and industrial plants. Strict engineering codes, seismic upgrades, and heritage building restoration boost adoption of pure epoxy and epoxy acrylate systems. Manufacturers benefit from demand in rebar connections, tunnel reinforcement, and structural repairs. Growing need for low-VOC and styrene-free adhesives aligns with environmental rules. Despite slower new construction growth, renovation and maintenance activities sustain steady market demand.

Middle East & Africa

The Middle East & Africa region holds an 8% share, driven by commercial construction, oil and gas infrastructure, and transport network development. Countries such as the UAE, Saudi Arabia, and Qatar invest in high-rise towers, airports, and industrial zones, increasing demand for heavy load anchoring. Extreme temperatures and seismic activity encourage use of strong and thermally stable resin systems. Africa’s growth remains gradual, supported by urban expansion and foreign-funded infrastructure. The region continues adopting international building standards, creating opportunities for certified chemical anchor products in large civil engineering projects.

South America

South America holds a 6% share of the global market. Chemical anchors are used in mining infrastructure, industrial plants, bridges, and commercial spaces across Brazil, Argentina, and Chile. The region focuses on seismic reinforcement, structural repair, and equipment installation in heavy industries. Economic fluctuations and slower construction cycles challenge growth, but government-backed infrastructure programs support baseline demand. Increasing adoption of fast-curing adhesives in residential repairs and commercial maintenance also helps the market. As more contractors shift from mechanical fasteners to high-strength adhesive anchors, South America maintains steady but moderate growth.

Market Segmentations:

By Product

- Injectable Adhesive

- Capsule Adhesive

By Resin

- Polyester

- Unsaturated Polyester

- Epoxy Acrylate

- Pure Epoxy

- Hybrid Systems

By Application

- Residential

- Commercial

- Infrastructure

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chemical anchors market includes global fastening specialists and regional manufacturers focused on high-strength bonding solutions for commercial, residential, and infrastructure projects. Key players such as Hilti Group, Leviat B.V., Fischer Group, and MKT Fastening compete through certified products that meet strict load, seismic, and temperature performance standards. Companies expand portfolios with epoxy acrylate, pure epoxy, and hybrid anchors to support heavy structural applications, including rebar connections, façade systems, and industrial equipment installation. Firms like Chemfix Products Ltd., FIXDEX Fastening Technology, Power Fasteners, Koelner Rawlplug IP, Mungo Befestigungstechnik AG, and Ripple India strengthen market reach through distribution networks, installer training, and fast-curing systems designed for quicker jobsite productivity. Strategic moves include product innovation, improved cartridge dispensing, and compliance with international certifications to secure large infrastructure contracts. As construction quality and safety standards rise worldwide, competition centers on reliability, installation efficiency, and long-term structural performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Chemfix Products Ltd.

- Ripple India

- MKT Fastening

- Koelner Rawlplug IP

- Hilti Group

- Leviat B.V.

- Fischer Group

- FIXDEX Fastening Technology

- Power Fasteners

- Mungo Befestigungstechnik AG

Recent Developments

- In March 2025, Chemfix Products Ltd.: Extended ETA fire coverage for threaded rods used with Chemfix injection resins.

- In January 2025, MKT Fastening (MKT Group) Released the 2025/26 product range catalog, including updated adhesive and mechanical anchoring systems

Report Coverage

The research report offers an in-depth analysis based on Product, Resin, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as countries expand metro rail, highways, and smart city projects.

- Seismic retrofitting and structural repair work will boost adoption in aging buildings and bridges.

- Fast-curing and high-performance epoxy acrylate systems will gain more preference on construction sites.

- Green and low-VOC adhesive formulations will attract contractors focused on sustainable building practices.

- Manufacturers will invest in advanced dispensing systems and cleaner mixing technologies to improve installation efficiency.

- Certified products will become essential as regulators tighten safety and performance standards in public infrastructure.

- Pure epoxy anchors will see higher usage in heavy industrial plants, ports, and power facilities.

- Rising renovation spending in North America and Europe will sustain steady market growth.

- Asia Pacific will remain the growth center due to rapid urbanization and capital projects.

- Partnerships between suppliers, contractors, and distributors will expand market reach in emerging regions.