Market Overview:

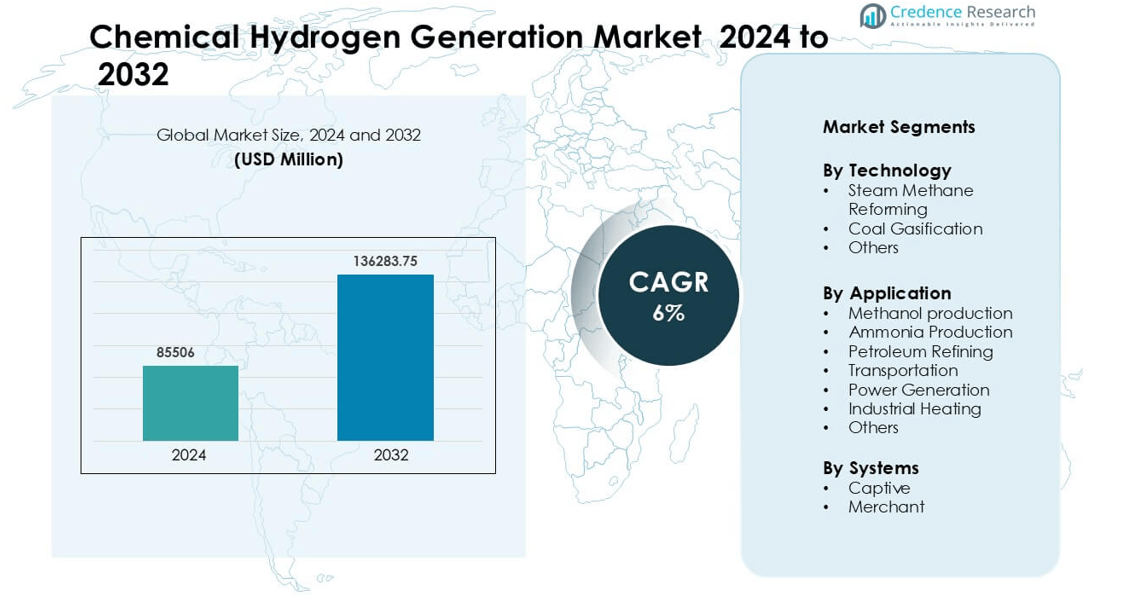

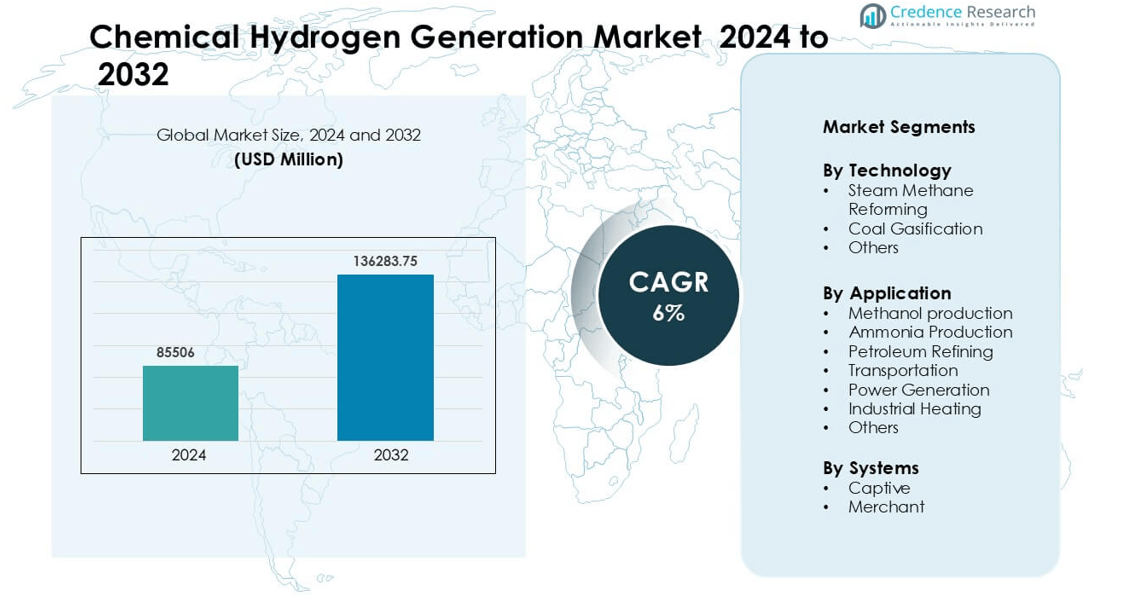

Chemical Hydrogen Generation Market was valued at USD 85506 million in 2024 and is anticipated to reach USD 136283.57 million by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical Hydrogen Generation Market Size 2024 |

USD 85506 million |

| Chemical Hydrogen Generation Market, CAGR |

6% |

| Chemical Hydrogen Generation Market Size 2032 |

USD 136283.57 million |

The Chemical Hydrogen Generation Market includes major industrial gas producers and technology suppliers such as Linde Plc, Air Liquide International S.A, Air Products and Chemicals, Inc., INOX Air Products Ltd., Messer, Matheson Tri-Gas, Inc., SOL Group, Hydrogenics Corporation, Tokyo Gas Chemicals Co., Ltd., and Iwatani Corporation. These companies provide large-scale reforming, gasification, and purification systems for refining, methanol, and ammonia production. Most invest in advanced catalysts, membrane separation, and carbon capture to enhance purity and reduce emissions. Asia-Pacific remains the leading regional market with a 35% share, supported by expanding refining capacity, fertilizer demand, and strong chemical manufacturing output across China, India, and Southeast Asia.

Market Insights

- The Chemical Hydrogen Generation Market was valued at USD 85506 million in 2024 and is projected to reach USD 136283.57 million by 2032, registering a CAGR of 6% driven by rising industrial demand.

- Strong market drivers include expanding refining, methanol, and ammonia production, where steam methane reforming holds the dominant technology share due to high conversion efficiency and established infrastructure.

- Key trends involve investment in carbon capture, modular reformers, and membrane purification to reduce emissions and enhance hydrogen purity across large chemical plants and industrial clusters.

- Leading players such as Linde Plc, Air Liquide International S.A, Air Products and Chemicals, Inc., INOX Air Products Ltd., and others strengthen competitiveness through long-term supply contracts, captive plant development, and merchant distribution networks.

- Asia-Pacific leads the regional market with 35% share, supported by strong refining and fertilizer output, while captive systems hold the largest segment share as chemical manufacturers prefer on-site hydrogen units for operational reliability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Steam methane reforming leads this segment with the largest share, supported by mature infrastructure, high conversion efficiency, and lower operational cost than other routes. Many chemical producers prefer this method because natural gas feedstock remains widely available in major industrial hubs. Coal gasification holds a smaller portion of demand, mainly in regions with abundant coal supply and limited natural gas access. Other emerging technologies such as biomass gasification and thermochemical water splitting grow steadily due to cleaner output and reduced carbon intensity, but commercial adoption stays limited to pilot and regional projects.

- For instance, Jindal Steel & Power Limited (JSPL) has a coal gasification-based plant in Angul, Odisha with a production capacity of 2 million tonnes per annum using ‘swadeshi’ coal for steel-making, illustrating how coal-gasification is leveraged in resource-rich regions.

By Application

Ammonia production holds the dominant share in this segment, driven by strong fertilizer demand and large-scale industrial synthesis across Asia-Pacific, the Middle East, and North America. Refineries also account for significant hydrogen consumption in hydrotreating and desulfurization, aligning with stricter fuel-quality regulations. Methanol plants continue to adopt large on-site hydrogen units to increase production efficiency and maintain steady supply reliability. Power generation, transportation, and industrial heating show rising interest but remain smaller due to limited fueling networks and high capital cost for hydrogen-based energy systems.

- For instance, around 57% of total hydrogen used in European refining is currently consumed in the sector, with a significant portion of this (much of it from dedicated production plants and largely fossil-based) representing approximately 4.55 million tonnes (4,550 kilotonnes) per year of hydrogen that needs a decarbonized supply.

By Systems

Captive systems command the largest market share because large chemical and refinery complexes prefer on-site hydrogen units to ensure continuous supply and stable operating cost. These plants integrate production units with downstream processes, minimizing transportation losses and boosting overall efficiency. Merchant systems grow in regions where smaller businesses and distributed users require outsourced supply from centralized hydrogen producers. Growing investments in storage, tube trailers, and pipeline networks support merchant expansion; however captive installations remain dominant due to scale economies, in-house control of purity, and long-term operational reliability.

Key Growth Drivers

Rising Demand in Refining and Petrochemicals

Growing hydrogen use in refining drives strong market expansion as refineries continue to invest in hydrotreating and hydrocracking to meet cleaner fuel standards. Stricter sulfur reduction norms across Asia-Pacific, the Middle East, Europe, and North America push operators to upgrade units and expand hydrogen supply capacity. Petrochemical complexes also rely on large on-site hydrogen plants to support olefin production, methanol synthesis, and ammonia manufacturing. Modern catalytic processes require high-purity hydrogen, which increases adoption of steam methane reforming and integrated recovery systems. Rapid refining capacity additions in emerging economies amplify hydrogen consumption, while aging plants in developed markets are being modernized to handle heavier, sour crude. This dual pathway new capacity and retrofits strengthen long-term demand for dedicated hydrogen production units.

- For instance, Global hydrogen use reached 95 Mt in 2022 across all traditional applications, including industry and refining.

Expansion of Fertilizer and Ammonia Production

Ammonia remains the backbone of global fertilizer supply, and rising food security pressures in Asia, Africa, and Latin America increase ammonia output. Chemical hydrogen generation provides the largest share of hydrogen required for ammonia synthesis, making it a critical driver. Many fertilizer producers install captive hydrogen units to stabilize feedstock supply and reduce dependency on imports. New urea and ammonia complexes in India, China, and the Middle East demand efficient hydrogen production and purification technologies. Clean ammonia projects for export also drive interest, especially for maritime fuel and carbon-neutral shipping. Governments promote domestic fertilizer manufacturing through subsidies and infrastructure investments, motivating companies to expand hydrogen capacity. These developments create stable, long-term demand for hydrogen plants designed for continuous, high-volume operation.

- For instance, Hygenco Green Energies Ltd in India has a green ammonia facility at Gopalpur, Odisha where the first phase is planned at 600 tonnes per day, and the second phase will double that to 1,200 tonnes per day, targeting a full output of 1.1 million tonnes per annum.’

Integration of Clean and Low-Carbon Hydrogen Pathways

The market benefits from growing focus on carbon management and cleaner industrial production. Emerging low-carbon hydrogen solutions, including CCS-equipped reformers and hybrid biomass gasification, attract interest from chemical producers trying to reduce emissions without interrupting existing operations. Industrial clusters and petrochemical hubs deploy carbon capture to lower footprint and meet ESG targets. Policymakers encourage low-carbon hydrogen through tax credits, decarbonization mandates, and funding for demonstration plants. Technology developers improve reformer efficiency through heat recovery, oxygen-based reforming, and advanced catalysts that increase yield and lower fuel consumption. These improvements allow traditional production technologies to remain competitive in a low-emission environment, ensuring sustained adoption across large-scale chemical industries.

Key Trend & Opportunity

Merchant Supply Models and Distributed Hydrogen Networks

Merchant hydrogen supply grows as small and mid-sized businesses seek outsourced delivery instead of installing costly captive units. Investments in tube-trailers, liquid hydrogen tanks, and regional storage hubs support last-mile delivery. Industrial zones and mobility projects explore shared infrastructure to reduce operational cost. The rise of distributed networks enables flexible supply for refineries, chemical plants, food processing units, and electronics manufacturing. As more countries develop hydrogen corridors and refueling stations, merchant suppliers gain new customers in transportation and power generation. This shift opens opportunities for large producers and gas companies to expand distribution-based revenue models.

- For instance, China Petroleum & Chemical Corporation (Sinopec) introduced a 30 MPa hydrogen tube-trailer capable of delivering roughly 450 kg of hydrogen per trip (compared with ~220 kg for standard 20 MPa units).

Technological Improvements in Reforming and Gasification

Efficiency advancements in steam methane reforming and coal gasification offer attractive cost advantages for high-volume users. Modern systems use improved heat integration, membrane separation, and pressure swing adsorption to increase purity and yield. Modular reformers support faster commissioning, reduced footprint, and scalable investment. Gasification plants adopt oxygen-blown technology and syngas cleanup systems to reduce pollutants and enhance downstream flexibility. These improvements encourage petrochemical industries to upgrade legacy units. Countries with coal-based industrial economies leverage advanced gasifiers to maintain supply reliability. Continuous R&D also enables blending of biomass and waste feedstocks, unlocking cleaner hydrogen pathways without severe infrastructure change.

Key Challenge

High Energy Consumption and Carbon Intensity

Conventional chemical hydrogen generation especially steam methane reforming and coal gasification remains energy intensive and carbon heavy. Fuel combustion and process emissions contribute significantly to industrial CO₂ output, pressuring producers to adopt mitigation strategies. Carbon capture systems raise capital and operating cost, which restricts broad adoption. Regions with high gas prices face elevated production costs, reducing competitiveness. Environmental concerns drive policymakers to scrutinize fossil-based hydrogen, which could lead to stricter regulations and penalties. As green and renewable hydrogen alternatives expand, conventional producers face pressure to justify emissions and energy use, forcing continuous process improvement and cleaner technologies.

Infrastructure and Investment Barriers

Hydrogen generation units require high capital investment, complex engineering, and reliable feedstock logistics, which limit adoption among small or new chemical firms. Transporting hydrogen also demands specialized pipelines, storage tanks, or compression systems that increase cost. Many countries lack integrated hydrogen infrastructure, slowing expansion of merchant supply chains. Industrial users hesitate to shift from conventional fuels due to long payback periods and uncertainty in hydrogen pricing. Regulatory frameworks and permitting processes vary widely across regions, creating delays and compliance risks. Without supportive policies, financing, and standardized safety rules, hydrogen adoption progresses slower than anticipated in emerging markets.

Regional Analysis

North America

North America holds a significant share of the chemical hydrogen generation market, driven by large refining and petrochemical complexes in the United States. The region accounts for nearly 32% of global demand, supported by strict fuel-quality regulations and ongoing refinery upgrades. Companies invest in steam methane reforming units and carbon capture integration to meet low-emission targets. Rising ammonia and methanol production also increases hydrogen requirements. Strong pipeline and storage infrastructure supports merchant supply networks for industrial users. Canada contributes to the regional share with new chemical projects and clean hydrogen initiatives that align with decarbonization policies.

Europe

Europe commands close to 27% share, driven by tight environmental standards and rapid adoption of low-carbon hydrogen pathways. Refineries and fertilizer manufacturers modernize production units to meet emissions targets under EU climate goals. Countries such as Germany, the Netherlands, and Italy deploy CCS-equipped hydrogen plants and explore biomass gasification to reduce fossil dependency. Merchant hydrogen supply grows due to fuel-cell transportation projects and industrial clusters. Investments in ammonia and methanol facilities remain steady, while policy-driven incentives support technology upgrades. The region also promotes hydrogen storage hubs and pipeline networks, strengthening long-term supply reliability.

Asia-Pacific

Asia-Pacific represents the largest regional share at nearly 35%, led by heavy refining capacity, expanding chemical manufacturing, and high ammonia production. China, India, and Japan invest in large captive units to secure feedstock stability and reduce import reliance. Fertilizer and petrochemical plants across Southeast Asia increase hydrogen adoption through integrated steam methane reformers. Rapid industrialization boosts fuel processing and syngas applications, further lifting demand. Government clean-energy programs also encourage low-emission hydrogen technologies and hybrid gasification projects. Strong domestic natural gas and coal resources help maintain competitive production costs across major chemical hubs.

Middle East & Africa

The Middle East & Africa region holds close to 4% share, driven by refinery expansion and large-scale petrochemical investments. Gulf countries, particularly Saudi Arabia, the UAE, and Qatar, install high-capacity hydrogen units for fuel processing and ammonia export. Low feedstock cost and abundant natural gas availability support large captive installations. Africa shows rising adoption in fertilizer production and gas-to-chemicals projects, but infrastructure gaps still limit broader merchant supply networks. Clean hydrogen initiatives linked to renewable power and blue ammonia exports create long-term growth prospects, improving the region’s role in global hydrogen trade.

Latin America

Latin America accounts for nearly 2% of the global market, with growth supported by refining upgrades and fertilizer projects in Brazil, Argentina, and Chile. Most hydrogen demand comes from captive refinery systems used in hydrotreating and desulfurization. Petrochemical plants also adopt reformers to expand methanol and ammonia output. Limited infrastructure restricts wide merchant distribution, but investments in export-oriented ammonia and low-carbon hydrogen projects are rising. Government policies promoting cleaner industrial processes and new gas discoveries in the region enhance supply security. Continued modernization of refining assets keeps hydrogen generation relevant for long-term operations.

Market Segmentations:

By Technology

- Steam Methane Reforming

- Coal Gasification

- Others

By Application

- Methanol production

- Ammonia Production

- Petroleum Refining

- Transportation

- Power Generation

- Industrial Heating

- Others

By Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chemical hydrogen generation market features a mix of industrial gas companies, refinery technology providers, and engineering firms that supply large-scale reforming, gasification, and purification systems. Global leaders such as Linde Plc, Air Liquide International S.A, Air Products and Chemicals, Inc., INOX Air Products Ltd., Messer, Matheson Tri-Gas, Inc., SOL Group, Hydrogenics Corporation, Tokyo Gas Chemicals Co., Ltd., and Iwatani Corporation expand their portfolios through advanced reformer designs, modular hydrogen plants, and carbon capture integration. Many players invest in low-carbon hydrogen pathways to align with decarbonization targets in refining, ammonia, and methanol production. Strategic partnerships with chemical producers enable long-term supply agreements and captive plant construction. Companies also strengthen regional positions through joint ventures, pipeline networks, and dedicated merchant supply chains. Continuous improvements in membrane separation, pressure swing adsorption, and catalyst efficiency help reduce operational costs and enhance hydrogen purity, making these vendors central to industrial hydrogen reliability worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, MATHESON announced a new Las Vegas air separation plant that expands liquid gases and strengthens HyCO (hydrogen and carbon monoxide) supply capability across the U.S. Southwest.

- In March 2025, INOX Air Products commissioned a green hydrogen plant at Asahi India’s Soniyana facility, sized for 190 TPA with a 20-year offtake for float glass production.

- In December 2022, MATHESON won a long-term award to build a large multi-feed hydrogen plant for Numaligarh Refinery in Assam, using Topsoe reforming technology and L&T EPC execution

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Systems and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as refineries expand hydrotreating capacity to meet cleaner fuel standards.

- Fertilizer and ammonia producers will increase captive hydrogen installations to secure feedstock.

- Carbon capture integration will accelerate, reducing emissions from steam methane reforming units.

- Merchant hydrogen supply networks will expand through storage hubs and tube-trailer logistics.

- Modular reformers and skid-mounted units will gain adoption for faster deployment in chemical plants.

- Biomass and waste-blended gasification will create new low-carbon hydrogen pathways.

- Industrial clusters will develop shared hydrogen pipelines and storage infrastructure.

- Technology upgrades will improve catalyst efficiency and lower energy consumption.

- Clean ammonia projects will create export opportunities for hydrogen-intensive producers.

- Government incentives and decarbonization policies will boost investment in low-emission hydrogen systems.