Market Overview

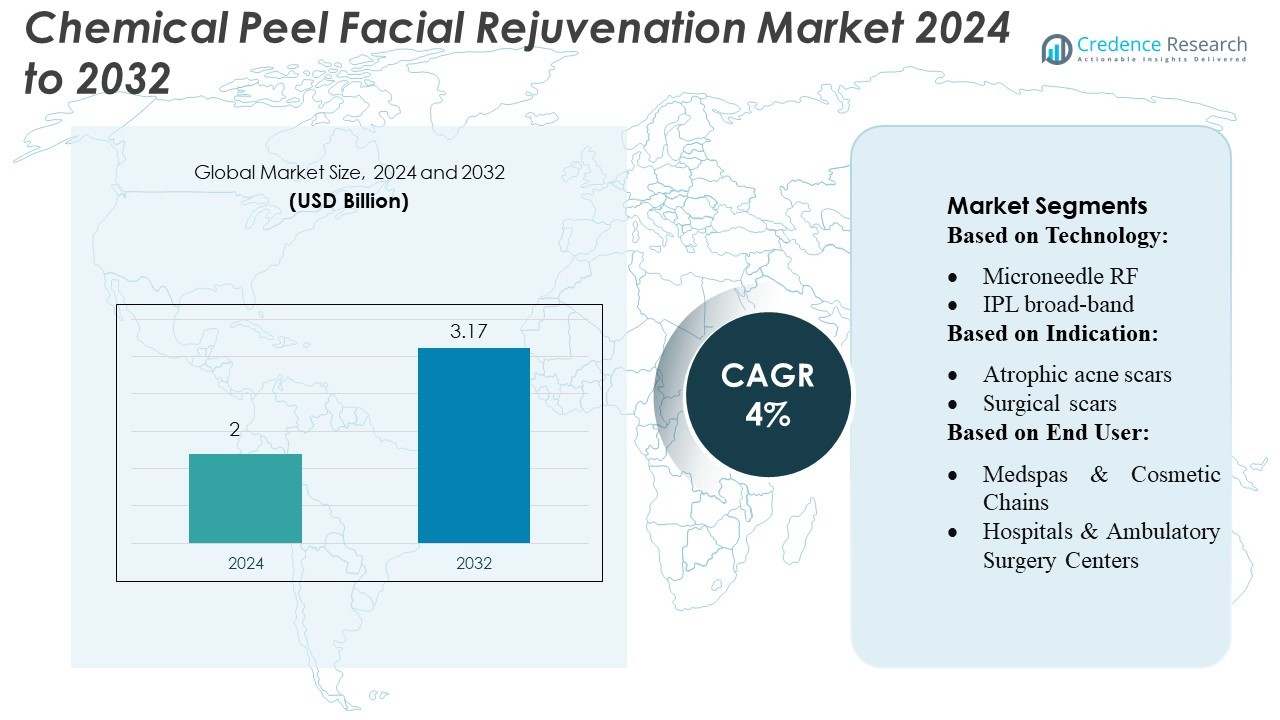

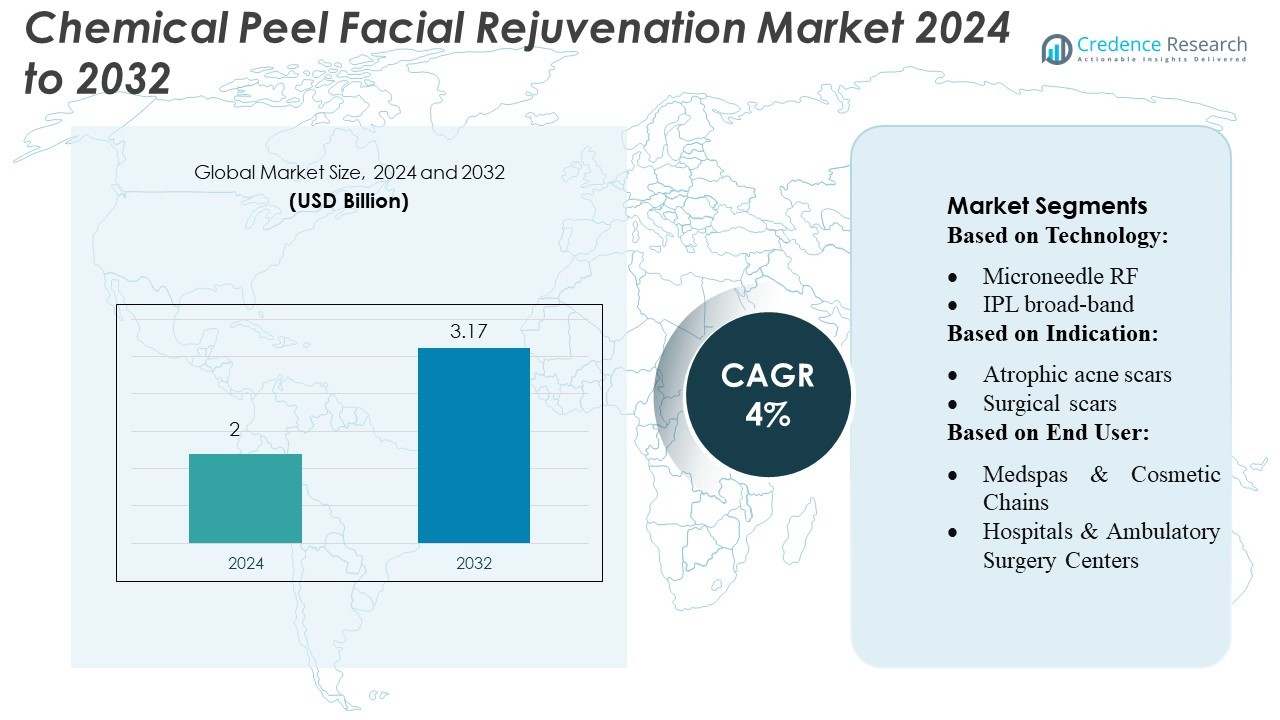

Chemical Peel Facial Rejuvenation Market size was valued USD 2 billion in 2024 and is anticipated to reach USD 3.17 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical Peel Facial Rejuvenation Market Size 2024 |

USD 2 Billion |

| Chemical Peel Facial Rejuvenation Market , CAGR |

4% |

| Chemical Peel Facial Rejuvenation Market Size 2032 |

USD 3.17 Billion |

The Chemical Peel Facial Rejuvenation Market is shaped by leading global manufacturers and dermatology-focused skincare companies that continue to expand portfolios through advanced formulations, pH-controlled systems, and peel-compatible multimodal treatment platforms. These players invest heavily in practitioner training and evidence-based protocols to strengthen clinical outcomes and differentiate premium peel categories. North America remains the dominant region, commanding 35–38% of the global market, supported by strong adoption of medical-grade peels, a mature aesthetic services ecosystem, and high patient demand for minimally invasive rejuvenation. Ongoing innovation and rising procedure volumes reinforce the region’s leadership in technology integration and treatment standardization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Chemical Peel Facial Rejuvenation Market was valued at USD 2 billion in 2024 and is projected to reach USD 3.17 billion by 2032, advancing at a 4% CAGR driven by rising demand for non-invasive resurfacing treatments.

- Growing preference for pH-controlled, multi-acid formulations and combination protocols with lasers and RF devices continues to elevate treatment efficacy and accelerate market uptake.

- Competitive activity intensifies as manufacturers expand clinical training programs, introduce safer pigment-targeting peels, and develop integrated device–consumable ecosystems for clinics.

- Market growth faces restraints from risks of PIH, practitioner variability, and increasing commoditization of superficial peels, prompting stronger emphasis on safety standards and differentiation.

- North America leads with 35–38% regional share, while ablative fractional technologies dominate the technology segment with 35–40% share, supported by high procedure volumes and adoption of advanced resurfacing systems.

Market Segmentation Analysis:

By Technology

Ablative fractional systems dominate the technology segment with an estimated 35–40% market share, driven by their strong clinical outcomes in deep resurfacing and collagen regeneration. Their precision-controlled ablation makes them preferred for wrinkles, scars, and texture correction. Picosecond and Q-switched lasers represent the fastest-growing sub-segment as clinics increasingly adopt ultra-short-pulse platforms for high-density pigment fragmentation and tattoo retreatment. Microneedle RF continues to expand due to its dual thermal–mechanical remodeling impact, while IPL broadband systems remain widely used for photodamage and vascular dyschromia. LED photobiomodulation is gaining traction as a supportive modality for inflammation control and accelerated healing.

- For instance, Solta Medical’s Fraxel Re:pair® system delivers CO₂ fractional ablation columns reaching depths of up to 1,500 µm with an energy output capacity of 70 mJ per microbeam.

By Indication

Wrinkle reduction and skin tightening remain the leading indication category, accounting for approximately 30–35% market share as aging-related concerns drive patient volume globally. Demand accelerates further across periorbital, perioral, forehead, cheek, and neck rejuvenation due to multi-layered treatment approaches combining fractional lasers, RF, and chemical peels. Pigmentation and melasma management is a rapidly expanding sub-segment supported by adoption of picosecond toning and energy-modulated peels. Scar and acne-scar remodeling also shows strong growth, particularly for atrophic and surgical scars, while texture refinement, pore reduction, vascular lesions, rosacea care, and full-face combination protocols broaden treatment applicability.

- For instance, Lynton’s Focus Dual® platform delivers RF microneedling with adjustable needle depths ranging from 0.5 to 3.5 mm and RF energy outputs up to 2 MHz, enabling controlled dermal coagulation for collagen remodeling.

By End User

Dermatology and plastic surgery clinics dominate the end-user landscape with over 45% market share, supported by their integration of advanced laser platforms, physician-supervised protocols, and capability to deliver ablative and energy-intensive procedures. Medspas and cosmetic chains continue to scale due to rising demand for non-invasive peel-based rejuvenation and subscription-based skincare programs. Hospitals and ambulatory surgery centers maintain steady adoption for perioperative resurfacing and combination therapies. At-home FDA-cleared devices form a niche but growing segment as consumers seek maintenance-oriented exfoliation, LED-based rejuvenation, and low-strength chemical resurfacing options.

Key Growth Drivers

- Rising Demand for Non-Invasive Skin Rejuvenation

The market grows steadily as consumers increasingly prefer non-invasive resurfacing solutions with minimal downtime compared to surgical interventions. Chemical peels offer controlled epidermal exfoliation, dermal remodeling, and pigment correction, making them suitable for diverse skin types and climates. Clinics integrate peels with lasers and RF technologies to enhance collagen synthesis and accelerate results, further boosting demand. Social media–driven aesthetic awareness and expanding procedure affordability attract younger and middle-aged demographics seeking preventive and corrective rejuvenation.

- For instance, Alma’s Opus Plasma® operates at a 40.68 MHz RF frequency and delivers fractional plasma micro-thermal zones with energy settings between 10–40 W, enabling ablative-like results with significantly reduced recovery periods.

- Advancements in Peel Formulations and Combination Protocols

Growth accelerates due to innovations in multi-acid formulations, controlled-release actives, and pH-optimized systems designed for safer, deeper, and more uniform peeling. Dermatologists increasingly adopt protocols pairing chemical peels with fractional lasers, microneedle RF, and LED therapy to improve collagen stimulation and downtime recovery. These hybrid approaches yield superior outcomes for melasma, scars, enlarged pores, and photoaging. Manufacturers also introduce skin-type–specific peels with lower irritation profiles, expanding treatment access among patients with sensitive or higher Fitzpatrick phototypes.

- For instance, Merz’s Ultherapy® MFU-V platform delivers micro-focused ultrasound at frequencies of 4–10 MHz with focal depths of 1.5 mm, 3.0 mm, and 4.5 mm, producing precise thermal coagulation points without epidermal disruption.

- Expansion of Professional Aesthetic Facilities and Consumer Access

The proliferation of dermatology clinics, medspa chains, and trained aesthetic practitioners strengthens global access to professional-grade chemical peel services. The availability of FDA-cleared, at-home superficial peel kits further increases consumer reach and supports maintenance treatments between clinical sessions. Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East enhance patient volumes. Additionally, growing corporate investment in training programs and practitioner certification improves treatment safety, expanding the market’s credibility and adoption.

Key Trends & Opportunities

- Growth of Personalized and Skin-Type–Specific Peel Solutions

Personalized skincare drives new opportunities as providers adopt diagnostic tools, AI-based skin analysis, and tailored peel formulations to match patient-specific concerns and phototypes. Demand rises for pigment-safe peels suitable for higher Fitzpatrick types, addressing melasma and PIH with reduced complication risk. Customizable multi-step protocols that combine exfoliation, antioxidants, and bioactive boosters create a premium service segment. Manufacturers pursuing adaptive formulations and clinic-led customization kits stand to capture significant growth in high-demand markets.

- For instance, Sciton’s HALO® hybrid fractional laser combines a 1470 nm non-ablative wavelength delivering up to 450 mJ with a 2940 nm ablative wavelength reaching 200 µm ablation depth, enabling precision intensity adjustments for individualized protocols.

- Increasing Adoption of Combination Therapy Protocols

Combination treatments represent a major trend, with practitioners pairing chemical peels with microneedling, fractional lasers, LED photobiomodulation, and dermal infusion systems to achieve layered rejuvenation. These synergistic protocols offer improved efficacy for wrinkles, scars, dyspigmentation, and texture irregularities, creating broader clinical versatility. As consumers prioritize noticeable results with reduced downtime, clinics increasingly market hybrid solutions as high-value packages. This trend opens opportunities for companies to develop peel lines engineered for compatibility with multimodal energy-based procedures.

- For instance, Galderma’s Restylane® Skinboosters contain 20 mg/mL stabilized hyaluronic acid formulated with NASHA™ technology, enabling uniform dermal hydration when combined with superficial peels to improve fine lines and texture.

- Rising Demand for Minimal-Downtime and Sensitive-Skin Peels

The market sees strong opportunity for low-irritation, lactobionic and mandelic-based peels suitable for patients seeking mild resurfacing with fast recovery. These peels appeal to working professionals and first-time aesthetic consumers. Formulators are advancing barrier-supportive ingredients such as amino acids, peptides, and post-peel recovery complexes, enabling year-round treatments even in warmer climates. This supports broader patient adoption and positions superficial peels as ongoing skincare maintenance rather than occasional corrective procedures.

Key Challenges

- Risk of Adverse Events and Practitioner Variability

Despite their popularity, chemical peels pose risks such as PIH, burns, scarring, and unpredictable outcomes, especially on higher Fitzpatrick types when applied incorrectly. Variability in practitioner skill, improper patient selection, and inconsistent post-care practices contribute to complications that can reduce patient confidence. Strict adherence to concentration guidelines, pH control, and standardized training is essential. Clinics lacking certified professionals may face higher liability, making safety education and regulated practice critical to maintaining market integrity.

- Intense Competition and Commoditization of Basic Peel Services

The market faces pricing pressure as basic superficial peels become widely available in medspas, salons, and at-home kits, driving commoditization. Clinics must differentiate their offerings by integrating advanced peel systems, optimizing protocols, or offering combination treatments to maintain profitability. Manufacturers also encounter competitive strain due to numerous generic formulations with similar acid profiles. Developing clinically validated, premium-grade peels and evidence-backed protocols becomes crucial for maintaining differentiation and sustaining long-term market growth.

Regional Analysis

North America

North America holds the leading position in the Chemical Peel Facial Rejuvenation Market with an estimated 35–38% share, supported by high adoption of medical-grade peels and strong integration of combination protocols across dermatology and plastic surgery clinics. The region benefits from advanced practitioner training, a mature aesthetic services ecosystem, and strong patient demand for resurfacing solutions targeting pigmentation, acne scars, and photoaging. The presence of established skincare brands and FDA-cleared formulations further accelerates market penetration. Rising interest in minimal-downtime peels and monthly maintenance programs among millennials and mid-age consumers continues to drive consistent procedural volume.

Europe

Europe accounts for approximately 25–28% market share, driven by a well-established dermatology infrastructure and a strong preference for clinically validated, standardized peel formulations. The region shows high adoption of superficial and medium-depth peels suited for sensitive and phototype II–III skin, with growing uptake of combination protocols involving microneedling and LED therapy. Southern Europe demonstrates rising demand for pigment-safe peels due to increased incidence of sun-induced dyschromia. Regulatory emphasis on safety and ingredient compliance encourages manufacturers to invest in high-purity actives and controlled pH systems, strengthening product quality and consumer confidence.

Asia-Pacific

Asia-Pacific represents the fastest-growing regional market with 22–25% share, supported by large populations seeking treatment for pigmentation, melasma, acne scars, and texture irregularities. Clinics in South Korea, Japan, and China increasingly adopt tailored multi-acid peels optimized for higher Fitzpatrick phototypes to reduce PIH risk. Expanding medspa chains, rising disposable incomes, and strong influence from K-beauty trends accelerate demand for mild, repeatable peeling procedures. The region also sees growing adoption of integrated treatment packages that combine peels with RF microneedling and laser toning, positioning APAC as a major driver of innovation and procedural volume.

Latin America

Latin America contributes roughly 8–10% market share, supported by rising aesthetic procedure adoption in Brazil, Mexico, Colombia, and Argentina. High consumer interest in cost-effective facial rejuvenation fuels strong demand for superficial and medium-depth peels addressing acne, sun damage, and uneven tone. Dermatology clinics increasingly incorporate hybrid approaches combining peels with dermabrasion and energy-based treatments to enhance outcomes. Economic variability influences procedure affordability, yet growing urbanization and aesthetic tourism help sustain market momentum. The region’s climate-related pigmentation concerns further expand opportunities for pigment-safe and melasma-focused peel formulations.

Middle East & Africa

The Middle East & Africa region holds an emerging but expanding 5–7% market share, driven by increasing investment in premium aesthetic clinics and rising demand among younger, appearance-focused demographics. Gulf countries exhibit strong adoption of chemical peels for pigmentation, acne, and texture correction due to high UV exposure and climate-linked skin concerns. Clinics prioritize gentle formulations suitable for higher Fitzpatrick types to minimize PIH risk. Growth strengthens as medical tourism expands in the UAE and Saudi Arabia, while broader access to certified practitioners and modern skincare technologies accelerates market penetration across urban centers.

Market Segmentations:

By Technology:

- Microneedle RF

- IPL broad-band

By Indication:

- Atrophic acne scars

- Surgical scars

By End User:

- Medspas & Cosmetic Chains

- Hospitals & Ambulatory Surgery Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Chemical Peel Facial Rejuvenation Market features leading participants such as Solta Medical (Bausch Health), Lynton Lasers Ltd., Alma Lasers (Sisram Med), Merz GmbH & Co. KGaA, Sciton, Inc., Galderma Laboratories, L.P., Candela Medical, STRATA Skin Sciences, LUTRONIC, and Lumenis. The Chemical Peel Facial Rejuvenation Market is shaped by continuous innovation in formulation science, treatment safety, and multimodal aesthetic protocols. Manufacturers increasingly focus on developing pH-controlled, multi-acid peels with enhanced tolerability, enabling clinicians to address diverse concerns such as pigmentation, acne scars, wrinkles, and texture irregularities with greater precision. Competition intensifies as device companies integrate peel-compatible workflows into laser, RF, and LED platforms, creating comprehensive resurfacing systems that support combination therapies. Providers also emphasize standardized training, patient customization, and evidence-backed clinical outcomes to strengthen differentiation. Growing demand for minimal-downtime procedures and pigment-safe solutions further drives strategic R&D investments across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Bausch Health (via its aesthetics arm, Solta Medical) unveiled its new Fraxel FTX™ skin resurfacing laser system at the ASLMS (American Society for Laser Medicine & Surgery) conference. It is a dual‑wavelength fractional laser combining 1550 nm erbium‑glass and 1927 nm thulium wavelengths to treat both superficial and deeper skin layers.

- In April 2025, Candela Corporation launched Vbeam Pro device is the only vascular laser FDA-cleared for use in pediatric patients and combines an advanced 595 nm pulsed dye laser with a 1064 nm Nd:YAG wavelength, offering flexibility in treating a variety of skin issues.

- In October 2024, Skinnovation introduced two medical devices, Meta Cell Technology (MCT) and MIRApeel, to address common Indian skin concerns like sagging skin, fine lines, and acne scars. MCT works by enhancing the regenerative potential of autologous products like Platelet-Rich Plasma (PRP) and exosomes. MIRApeel is a medi-facial device that offers customizable treatments for issues such as pigmentation, acne scars, and uneven texture.

- In April 2024, BASF’s sustainable polyamide PA6 and PA6.6 product range, is now also certified as Recycled Claim Standard (RCS) for textile applications.The company’s sustainable polyamide PA6 and PA6.6 product range has been certified under the Recycled Claim Standard (RCS) for textile applications.

Report Coverage

The research report offers an in-depth analysis based on Technology, Indication, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as demand rises for non-invasive rejuvenation with minimal downtime.

- Clinics will increasingly adopt combination protocols pairing chemical peels with lasers, RF microneedling, and LED therapy.

- Formulators will introduce more pigment-safe and sensitive-skin–friendly peels to serve higher Fitzpatrick phototypes.

- AI-driven skin assessment tools will enhance treatment personalization and improve patient outcomes.

- Growth in medspa chains and franchised aesthetic centers will widen access to professional-grade peel services.

- At-home peel kits with controlled-strength formulations will gain traction for maintenance and preventive care.

- Regulatory focus on ingredient safety and standardized practitioner training will strengthen treatment reliability.

- Climate- and region-specific peel formulations will emerge to address melasma, sun damage, and PIH more effectively.

- Adoption of barrier-supportive post-peel recovery products will increase to improve healing and patient satisfaction.

- Aesthetic tourism and global clinic expansion will drive broader availability of advanced peeling technologies.