Market Overview

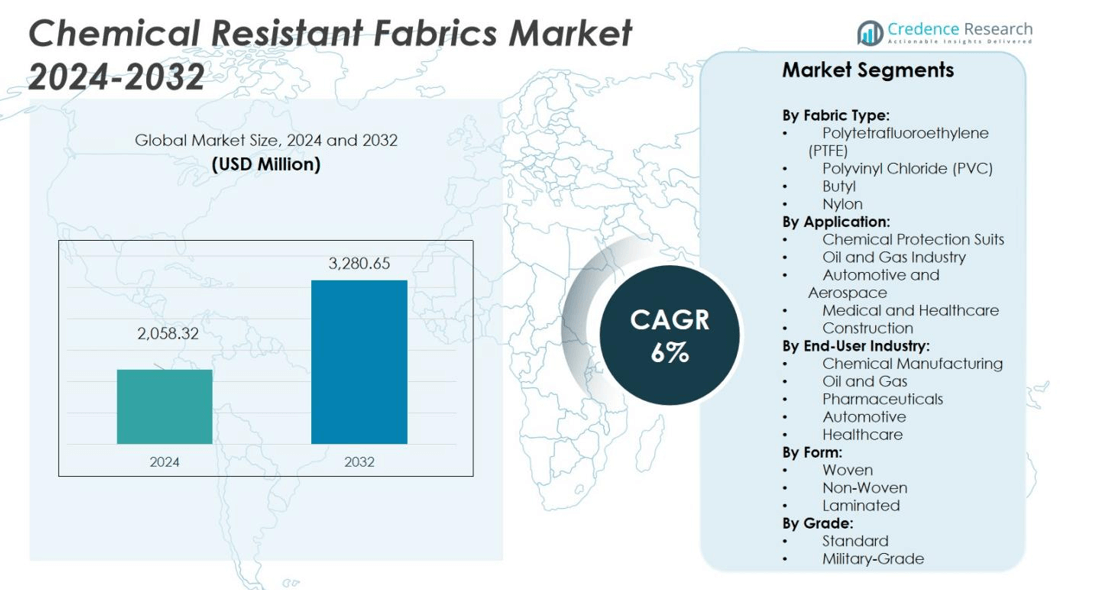

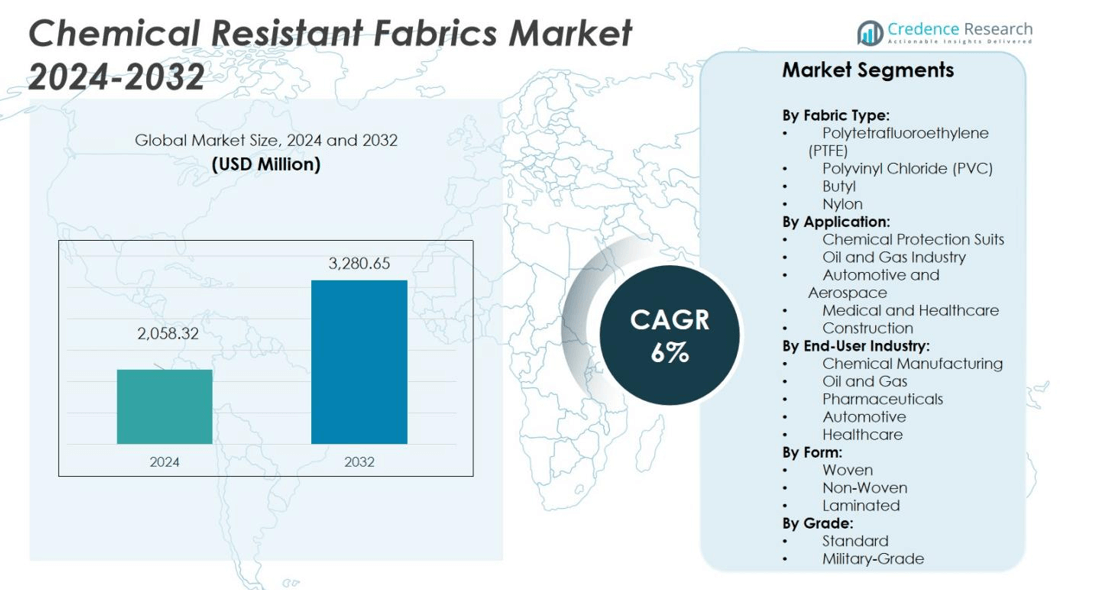

The Chemical Resistant Fabrics Market size was valued at USD 2,058.32 million in 2024, and is anticipated to reach USD 3,280.65 million by 2032, at a CAGR of 6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical Resistant Fabrics Market Size 2024 |

USD 2,058.32 million |

| Chemical Resistant Fabrics Market, CAGR |

6% |

| Chemical Resistant Fabrics Market Size 2032 |

USD 3,280.65 million |

The competitive landscape in the Chemical Resistant Fabrics Market includes key players such as 3M Company, DuPont, Teijin Ltd, Milliken & Company, Kolon Industries, Lakeland Industries, W.L. Gore & Associates, Klopman International, Glen Raven, and Cetriko. These companies drive the market by innovating fabrics with enhanced chemical resistance, durability, and wearer comfort. They leverage global manufacturing networks and strategic partnerships to expand regional presence and meet rising regulatory standards in protective apparel and industrial textiles. The region leading this market is the Asia‑Pacific region, capturing a market share of 34 %. Its dominance stems from rapid industrialisation, growing chemical and oil & gas sectors, and increasing safety compliance, which collectively fuel strong demand for chemical‑resistant fabrics.

Market Insights

- The Chemical Resistant Fabrics Market size was valued at USD 2,058.32 million in 2024 and is projected to reach USD 3,280.65 million by 2032, growing at a CAGR of 6% during the forecast period.

- Key drivers include rising industrial safety regulations, expanding oil & gas activities, and technological advancements in fabric manufacturing, contributing to strong market demand across industries.

- Sustainability is a growing trend, with manufacturers investing in eco-friendly fabrics that offer similar levels of protection while reducing environmental impact.

- The market is highly competitive, with key players such as DuPont, Teijin Ltd., and 3M focusing on innovation, strategic mergers, and regional expansion to strengthen their market presence.

- Asia-Pacific holds the largest market share of 34%, driven by rapid industrialization, increasing chemical manufacturing, and growing awareness of worker safety, particularly in countries like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fabric Type

The Polytetrafluoroethylene (PTFE) fabric type dominates the market, holding 31.2% of the market share. PTFE’s exceptional chemical and heat resistance, along with its durability in harsh environments, makes it the preferred choice for protective clothing. While other fabric types, such as Polyvinyl Chloride (PVC), Butyl, and Nylon, each hold smaller shares, they cater to niche applications like the oil and gas, automotive, and medical sectors. The continued growth of industrial safety regulations drives the dominance of PTFE in the market.

- For instance, AFC offers PTFE-coated fabrics under its DuraFlow® and DuraLam® series, engineered to withstand extreme temperatures up to 550°F and resist oils and grease, catering to demanding industrial applications.

By Application

The Chemical Protection Suits segment leads the application category, with 38.5% of the market share. This dominance is driven by the increasing demand for protective suits in high-risk industries, including chemical manufacturing, oil and gas, and healthcare. Chemical protection suits provide critical safety against hazardous chemicals, acids, and solvents, contributing to their significant share in the market. The rising emphasis on workplace safety and stricter industrial regulations continue to boost demand in this segment.

- For instance, DuPont recently launched Tyvek APX, a next-generation disposable chemical protective garment material designed to enhance chemical resistance and user comfort, reflecting the industry’s focus on innovation and safety.

By End-User Industry

The Chemical Manufacturing industry is the leading end-user of chemical-resistant fabrics, holding 35% of the market share. This sector’s reliance on aggressive chemicals, acids, and solvents drives the high demand for protective fabrics. Although other industries like oil and gas and pharmaceuticals also contribute, chemical manufacturing is the largest consumer due to stringent safety regulations and the need for reliable, durable protective gear. Increased focus on worker protection and regulatory compliance fuels this segment’s strong market position.

Key Growth Drivers

Rising Industrial Safety Standards

The increasing implementation of stringent safety standards across various industries is a significant growth driver for the chemical-resistant fabrics market. Regulatory bodies worldwide have enforced tougher occupational safety laws, particularly in high-risk sectors like chemical manufacturing, oil and gas, and pharmaceuticals. These regulations mandate the use of protective clothing, boosting demand for fabrics that offer chemical and heat resistance. As industries strive to ensure employee safety and comply with these standards, the market for chemical-resistant fabrics continues to expand, creating a growing need for advanced materials.

- For instance, DuPont’s Tychem® 2000 fabric offers at least 30 minutes of protection against more than 40 chemical challenges, meeting rigorous protective clothing standards.

Expanding Oil and Gas Industry

The oil and gas industry’s expansion plays a crucial role in driving the demand for chemical-resistant fabrics. This sector frequently deals with hazardous chemicals, extreme temperatures, and potentially explosive environments, making protective fabrics essential for worker safety. As global oil exploration and extraction activities continue to grow, the need for high-quality, durable protective clothing increases. The consistent growth in the oil and gas industry, particularly in offshore and remote locations, is directly linked to a higher consumption of chemical-resistant fabrics, fueling market expansion.

- For instance, Klopman offers high-performance flame-retardant fabrics that withstand repeated high-temperature laundering and provide chemical splash protection, ensuring durability and safety on the job.

Technological Advancements in Fabric Manufacturing

Technological innovations in fabric manufacturing have significantly contributed to the market growth of chemical-resistant fabrics. Advanced materials, such as PTFE (Polytetrafluoroethylene) and PVC (Polyvinyl Chloride), are now produced with enhanced durability, flexibility, and resistance to a broader range of chemicals. These advancements enable the development of fabrics suitable for various applications, including specialized industries like medical, automotive, and construction. As manufacturing processes become more efficient and materials are improved, the range and performance of chemical-resistant fabrics continue to expand, driving market demand.

Key Trends & Opportunities

Sustainability in Chemical-Resistant Fabrics

Sustainability is a growing trend in the chemical-resistant fabrics market. As industries and consumers increasingly prioritize environmentally friendly products, there is rising demand for fabrics that are not only durable but also recyclable or made from renewable materials. Manufacturers are investing in eco-friendly fabric options that offer the same level of protection while reducing environmental impact. This shift towards sustainable fabric production presents significant opportunities for companies to innovate and appeal to environmentally conscious consumers, further expanding their market share in a competitive landscape.

- For instance, Aquafil Global produces ECONYL®, a regenerated nylon made from ocean plastic waste and discarded fishing nets, which saves 70,000 barrels of crude oil and avoids 57,000 tonnes of CO2 emissions per 10,000 tonnes of recycled material.

Growth of Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the chemical-resistant fabrics market. Rapid industrialization, expanding manufacturing sectors, and increasing safety regulations are driving the demand for protective clothing in these regions. As safety standards improve and industries like oil and gas, construction, and healthcare expand, the need for chemical-resistant fabrics is on the rise. Companies that focus on these growing markets have the potential to capture new revenue streams, positioning themselves for long-term growth as these regions continue to develop.

- For instance, in China, the chemical-resistant fabrics market is expanding steadily due to increased demand from chemical processing and industrial safety sectors, with manufacturers focusing on advanced fabrics that provide superior protection against acids and solvents.

Key Challenges

High Production Costs

The high production costs associated with chemical-resistant fabrics remain a significant challenge for manufacturers. The advanced materials required to provide optimal protection, such as PTFE and PVC, are expensive to produce. These costs are passed down the supply chain, making the end products more expensive for consumers. As a result, there is a constant pressure on manufacturers to find cost-effective ways to produce high-quality chemical-resistant fabrics without compromising on safety standards. This challenge limits the affordability and accessibility of these products, especially in price-sensitive markets.

Competition from Alternative Protective Materials

Chemical-resistant fabrics face increasing competition from alternative protective materials, such as coated textiles and synthetic polymers, which offer similar levels of protection at a lower cost. These alternatives are becoming more popular in industries where budget constraints are a concern. As newer materials enter the market, traditional chemical-resistant fabrics must adapt by offering enhanced performance, durability, and cost-effectiveness. This competition creates pricing pressures and forces manufacturers to continually innovate and differentiate their products to maintain their market position.

Regional Analysis

North America

The North American region holds a market share of 29% in the chemical‑resistant fabrics market. Strong regulatory frameworks for workplace safety, especially in the U.S. and Canada, drive demand for protective fabrics. The presence of major chemical manufacturing and oil & gas operations reinforces the need for high‑performance textiles. Frequent enforcement of chemical‑hazard standards pushes firms to adopt advanced fabric types like PTFE and coated materials. Continued investments in refineries, pipelines, and industrial expansions maintain the region’s robust demand and steady growth trajectory.

Europe

Europe accounts for approximately 24% of the chemical‑resistant fabrics market. The region’s adoption is propelled by stringent safety and environmental regulations across the EU, alongside an established chemicals, pharmaceuticals and heavy‑industry base. Western European nations drive premium‑end purchases of high‑spec fabrics, while Eastern Europe’s growing industrialisation adds volume. Demand is further boosted by infrastructure upgrades and modern protective equipment mandates. European manufacturers also invest heavily in sustainable and innovative fabric technologies, helping maintain the region’s competitive position and steady share.

Asia Pacific

The Asia Pacific region commands the largest share at 34% in the chemical‑resistant fabrics market. Rapid industrialisation, especially in China, India and Southeast Asia, fuels strong demand for protective fabrics across chemicals, automotive, oil & gas and construction sectors. Increasing awareness of worker safety, rising environmental compliance and infrastructure projects amplify adoption of advanced fabric types. Local manufacturing bases and government support for safety standards also expand usage. With expanding end‑user industries and cost‑effective production capacities, the region is well‑positioned for sustained market leadership.

Latin America

Latin America holds a market share of around 8% in the chemical‑resistant fabrics market. Growth in the region stems from rising investments in oil & gas and mining, coupled with expanding chemical manufacturing in Brazil and Argentina. The push for enhanced occupational safety and import of higher‑spec protective fabrics contributes to market expansion. However, volume remains tempered by lower per‑capita expenditure on protective gear and slower regulatory adoption compared to developed regions. The opportunity lies in upgrading existing industrial facilities and increasing local fabric manufacturing to support growth.

Middle East & Africa

The Middle East & Africa region accounts for roughly 5% of the chemical‑resistant fabrics market. The heavy presence of oil & gas operations and petrochemical hubs in the Gulf region drives demand for chemical‑resistant textiles. Investments in large‑scale industrial and infrastructure projects stimulate fabric consumption. Nonetheless, the share remains constrained by limited manufacturing capacity and slower industrial diversification in some African countries. As safety standards improve and infrastructure development proceeds, the region shows moderate potential for increased adoption of advanced chemical‑resistant fabrics.

Market Segmentations:

By Fabric Type:

- Polytetrafluoroethylene (PTFE)

- Polyvinyl Chloride (PVC)

- Butyl

- Nylon

By Application:

- Chemical Protection Suits

- Oil and Gas Industry

- Automotive and Aerospace

- Medical and Healthcare

- Construction

By End-User Industry:

- Chemical Manufacturing

- Oil and Gas

- Pharmaceuticals

- Automotive

- Healthcare

By Form:

- Woven

- Non-Woven

- Laminated

By Grade:

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the chemical-resistant fabrics market includes key players such as DuPont de Nemours (DuPont), Teijin Ltd., Milliken & Company, Kolon Industries Inc., and Koninklijke Ten Cate NV. These companies lead the market by continuously innovating and offering high-performance fabrics that meet stringent industry safety standards. They focus on enhancing fabric properties like chemical resistance, durability, and comfort through extensive research and development. Strategic mergers, acquisitions, and partnerships have also enabled them to expand their product portfolios and global presence. As regulatory pressures around safety standards increase, these companies are also investing in sustainable fabric solutions to meet the growing demand for environmentally friendly products. Additionally, players are targeting emerging markets with industrial growth, where safety compliance is becoming a priority. The focus on technological advancements, superior quality, and meeting regulatory standards will continue to be key differentiators in maintaining a competitive edge in this dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M Company

- Glen Raven

- Lakeland Industries

- Klopman International

- DuPont

- Milliken

- W.L. Gore & Associates

- Teijin Ltd

- Cetriko

- Kolon Industries

Recent Developments

- In March 24, 2025, RTS Textiles Ltd unified its operations and joint venture partners (TMG – Acabamentos Têxteis S.A. and Sapphire Textile Mills Limited) to officially form the new entity, RTS Textiles Group Ltd. The new group was indeed created to establish a global leader in the workwear and protective textiles markets.

- In November 2025, TEXTILCOLOR AG launched a strategic collaboration with Alpex Protection (France), Majocchi (Italy), and Trans-Textil (Germany) to advance flame-retardant finishing using patented Pyroshell™ technology.

- In December 2022, Tejin Frontier Co. Ltd. launched the new plant-derived PLA resin to help reduce microplastics as it accelerates the biodegradation rate as well as lower CO2 emissions at the time of product lifecycles.

Report Coverage

The research report offers an in-depth analysis based on Fabric Type, Application, End User Industry, Form, Grade and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of chemical‑resistant fabrics will expand as industrial safety regulations tighten globally.

- Emerging economies will drive growth as chemical manufacturing and processing facilities scale up in regions like Asia‑Pacific.

- Fabric innovations will focus on multi‑functional materials that combine chemical resistance with flame resistance, anti‑static and breathable properties.

- Manufacturers will increasingly develop eco‑friendly and recyclable chemical‑resistant fabrics, aligning with sustainability demands.

- Demand in applications such as oil & gas, healthcare protective apparel and construction materials will rise, boosting overall market uptake.

- Producers will invest more in automation and smart textile manufacturing to reduce costs and improve production consistency.

- Strategic expansion into underserved regional markets will open new revenue streams and foster market diversification.

- Supply chain integration and localised production in high‑growth regions will enhance responsiveness and reduce lead times.

- Rising raw‑material prices and fluctuations will push fabric makers to optimise material usage and enhance productivity.

- Competitive pressure will increase as new entrants introduce alternative protective materials, prompting legacy manufacturers to differentiate via performance and value.