CHAPTER NO. 1 : INTRODUCTION 20

1.1.1. Report Description 20

Purpose of the Report 20

USP & Key Offerings 20

1.1.2. Key Benefits for Stakeholders 20

1.1.3. Target Audience 21

1.1.4. Report Scope 21

CHAPTER NO. 2 : EXECUTIVE SUMMARY 22

2.1. DISPOSABLE MEDICAL SUPPLIES Market Snapshot 22

2.1.1. China DISPOSABLE MEDICAL SUPPLIES Market, 2018 – 2032 (USD Million) 23

CHAPTER NO. 3 : GEOPOLITICAL CRISIS IMPACT ANALYSIS 24

3.1. Russia-Ukraine and Israel-Palestine War Impacts 24

CHAPTER NO. 4 : DISPOSABLE MEDICAL SUPPLIES MARKET – INDUSTRY ANALYSIS 25

4.1. Introduction 25

4.2. Market Drivers 26

4.2.1. Rising Chronic Diseases 26

4.2.1. Growing hospital admissions 27

4.3. Market Restraints 28

4.3.1. Stringent regulations for approvals 28

4.4. Market Opportunities 29

4.4.1. Market Opportunity Analysis 29

4.5. Porter’s Five Forces Analysis 30

4.6. Value Chain Analysis 31

4.7. Buying Criteria 32

CHAPTER NO. 5 : IMPORT EXPORT ANALYSIS 33

5.1. Import Analysis by China 33

5.1.1. China DISPOSABLE MEDICAL SUPPLIES Market Import Volume/Revenue, By China, 2018 – 2023 33

5.2. Export Analysis by China 34

5.2.1. China DISPOSABLE MEDICAL SUPPLIES Market Export Volume/Revenue, By China, 2018 – 2023 34

CHAPTER NO. 6 : DEMAND SUPPLY ANALYSIS 35

6.1. Demand Analysis by China 35

6.1.1. China DISPOSABLE MEDICAL SUPPLIES Market Demand Volume/Revenue, By China, 2018 – 2023 35

6.2. Supply Analysis by China 36

6.2.1. China DISPOSABLE MEDICAL SUPPLIES Market Supply Volume/Revenue, By China, 2018 – 2023 36

CHAPTER NO. 7 : PRODUCTION ANALYSIS 37

7.1. Production Analysis by China 37

7.1.1. China DISPOSABLE MEDICAL SUPPLIES Market Production Volume/Revenue, By China, 2018 – 2023 37

CHAPTER NO. 8 : PRICE ANALYSIS 38

8.1. Price Analysis by Type 38

8.1.1. China DISPOSABLE MEDICAL SUPPLIES Market Price, By Type, 2018 – 2023 38

8.1.2. China Type Market Price, By Type, 2018 – 2023 38

CHAPTER NO. 9 : RAW MATERIALS ANALYSIS 39

9.1. Key Raw Materials and Suppliers 39

9.2. Key Raw Materials Price Trend 39

CHAPTER NO. 10 : MANUFACTURING COST ANALYSIS 40

10.1. Manufacturing Cost Analysis 40

10.2. Manufacturing Process 40

CHAPTER NO. 11 : ANALYSIS COMPETITIVE LANDSCAPE 41

11.1. Company Market Share Analysis – 2023 41

11.1.1. China DISPOSABLE MEDICAL SUPPLIES Market: Company Market Share, by Volume, 2023 41

11.1.2. China DISPOSABLE MEDICAL SUPPLIES Market: Company Market Share, by Revenue, 2023 42

11.1.3. China DISPOSABLE MEDICAL SUPPLIES Market: Top 6 Company Market Share, by Revenue, 2023 42

11.1.4. China DISPOSABLE MEDICAL SUPPLIES Market: Top 3 Company Market Share, by Revenue, 2023 43

11.2. China DISPOSABLE MEDICAL SUPPLIES Market Company Volume Market Share, 2023 44

11.3. China DISPOSABLE MEDICAL SUPPLIES Market Company Revenue Market Share, 2023 45

11.4. Company Assessment Metrics, 2023 46

11.4.1. Stars 46

11.4.2. Emerging Leaders 46

11.4.3. Pervasive Players 46

11.4.4. Participants 46

11.5. Start-ups /SMEs Assessment Metrics, 2023 46

11.5.1. Progressive Companies 46

11.5.2. Responsive Companies 46

11.5.3. Dynamic Companies 46

11.5.4. Starting Blocks 46

11.6. Strategic Developments 47

11.6.1. Acquisitions & Mergers 47

New Product Launch 47

China Expansion 47

11.7. Key Players Product Matrix 48

CHAPTER NO. 12 : PESTEL & ADJACENT MARKET ANALYSIS 49

12.1. PESTEL 49

12.1.1. Political Factors 49

12.1.2. Economic Factors 49

12.1.3. Social Factors 49

12.1.4. Technological Factors 49

12.1.5. Environmental Factors 49

12.1.6. Legal Factors 49

12.2. Adjacent Market Analysis 49

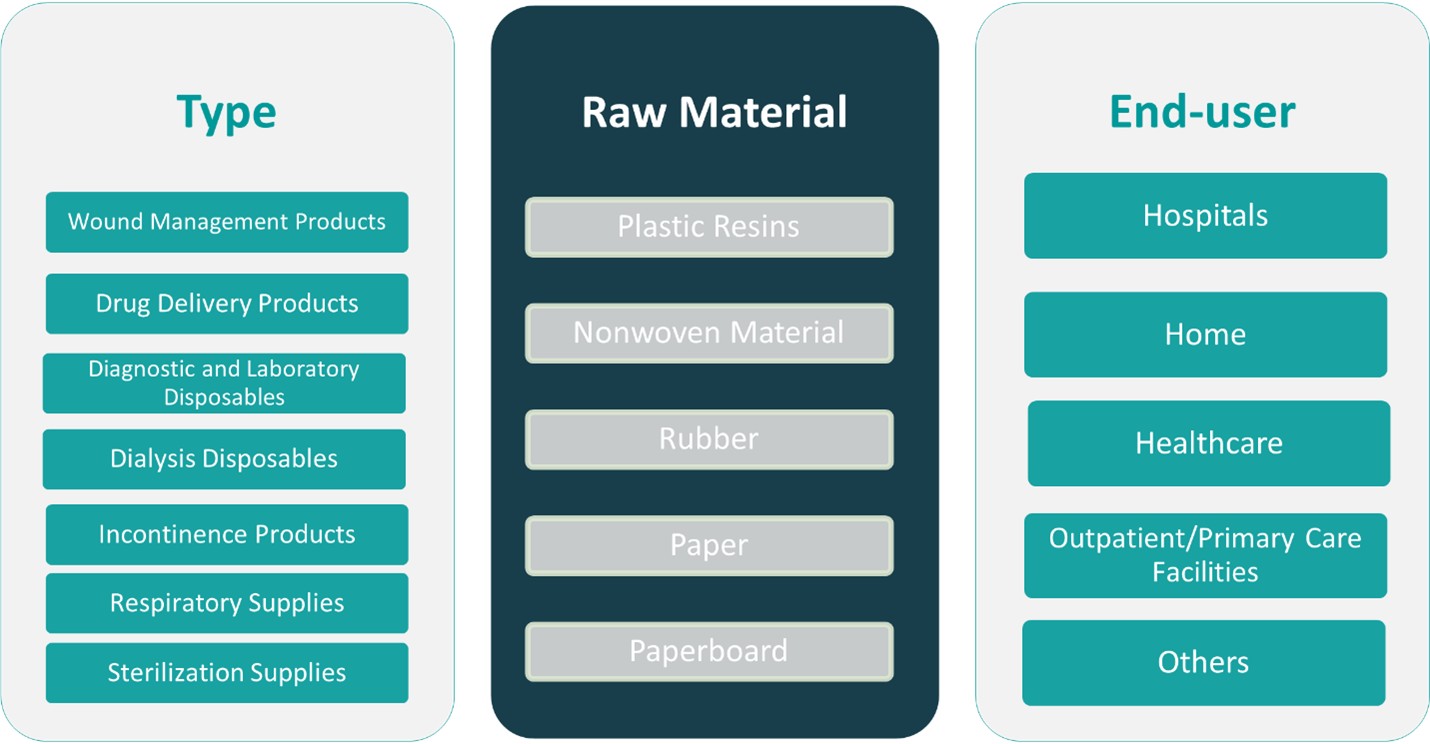

CHAPTER NO. 13 : DISPOSABLE MEDICAL SUPPLIES MARKET – BY TYPE SEGMENT ANALYSIS 50

13.1. DISPOSABLE MEDICAL SUPPLIES Market Overview, by Type Segment 50

13.1.1. DISPOSABLE MEDICAL SUPPLIES Market Revenue Share, By Type, 2023 & 2032 51

13.1.2. DISPOSABLE MEDICAL SUPPLIES Market Attractiveness Analysis, By Type 52

13.1.3. Incremental Revenue Growth Opportunity, by Type, 2024 – 2032 52

13.1.4. DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Type, 2018, 2023, 2027 & 2032 53

13.2. Wound Management Products 54

13.3. Drug Delivery Products 55

13.4. Diagnostic and Laboratory Disposables 56

13.5. Dialysis Disposables 57

13.6. Incontinence Products 58

CHAPTER NO. 14 : DISPOSABLE MEDICAL SUPPLIES MARKET – BY RAW MATERIAL SEGMENT ANALYSIS 59

14.1. DISPOSABLE MEDICAL SUPPLIES Market Overview, by Raw Material Segment 59

14.1.1. DISPOSABLE MEDICAL SUPPLIES Market Revenue Share, By Raw Material, 2023 & 2032 60

14.1.2. DISPOSABLE MEDICAL SUPPLIES Market Attractiveness Analysis, By Raw Material 61

14.1.3. Incremental Revenue Growth Opportunity, by Raw Material, 2024 – 2032 61

14.1.4. DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Raw Material, 2018, 2023, 2027 & 2032 62

14.2. Plastic Resins 63

14.3. Nonwoven Material 64

14.4. Rubber 65

14.5. Paper 66

14.6. Paperboard 67

CHAPTER NO. 15 : DISPOSABLE MEDICAL SUPPLIES MARKET – BY END-USER SEGMENT ANALYSIS 68

15.1. DISPOSABLE MEDICAL SUPPLIES Market Overview, by End-user Segment 68

15.1.1. DISPOSABLE MEDICAL SUPPLIES Market Revenue Share, By End-user, 2023 & 2032 69

15.1.2. DISPOSABLE MEDICAL SUPPLIES Market Attractiveness Analysis, By End-user 70

15.1.3. Incremental Revenue Growth Opportunity, by End-user, 2024 – 2032 70

15.1.4. DISPOSABLE MEDICAL SUPPLIES Market Revenue, By End-user, 2018, 2023, 2027 & 2032 71

15.2. Hospitals 72

15.3. Home 73

15.4. Healthcare 74

15.5. Outpatient/Primary Care Facilities 75

CHAPTER NO. 16 : DISPOSABLE MEDICAL SUPPLIES MARKET – CHINA ANALYSIS 76

16.1. Type 76

16.1.1. China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Type, 2018 – 2023 (USD Million) 76

16.2. China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Type, 2024 – 2032 (USD Million) 76

16.3. Raw Material 77

16.3.1. China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Raw Material, 2018 – 2023 (USD Million) 77

16.3.2. China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Raw Material, 2024 – 2032 (USD Million) 77

16.4. End-user 78

16.4.1. China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By End-user, 2018 – 2023 (USD Million) 78

16.4.2. China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By End-user, 2024 – 2032 (USD Million) 78

CHAPTER NO. 17 : COMPANY PROFILES 79

17.1. Smith+Nephew 79

17.1.1. Company Overview 79

17.1.2. Product Portfolio 79

17.1.3. Swot Analysis 79

17.1.4. Business Strategy 80

17.1.5. Financial Overview 80

17.2. Shanghai Neo-Medical Co., Ltd 81

17.3. Procter & Gamble 81

17.4. Principle Business Enterprises, Inc 81

17.5. Ontex 81

17.6. Medtronic 81

17.7. Nu-Life Medical & Surgical Supplies Inc 81

17.8. Narang Medical Limited 81

17.9. Molnlycke Health Care 81

17.10. Mellon Medical B.V. 81

17.11. MedGyn Products, Inc 81

17.12. MED-CON Inc. 81

17.13. SeaskyMedical 81

17.14. Ningbo EZ Medical Instruments Co. Ltd 81

List of Figures

FIG NO. 1. China DISPOSABLE MEDICAL SUPPLIES Market Revenue, 2018 – 2032 (USD Million) 22

FIG NO. 2. Porter’s Five Forces Analysis for China DISPOSABLE MEDICAL SUPPLIES Market 29

FIG NO. 3. Value Chain Analysis for China DISPOSABLE MEDICAL SUPPLIES Market 30

FIG NO. 4. China DISPOSABLE MEDICAL SUPPLIES Market Import Volume/Revenue, By China, 2018 – 2023 32

FIG NO. 5. China DISPOSABLE MEDICAL SUPPLIES Market Export Volume/Revenue, By China, 2018 – 2023 33

FIG NO. 6. China DISPOSABLE MEDICAL SUPPLIES Market Demand Volume/Revenue, By China, 2018 – 2023 34

FIG NO. 7. China DISPOSABLE MEDICAL SUPPLIES Market Supply Volume/Revenue, By China, 2018 – 2023 35

FIG NO. 8. China DISPOSABLE MEDICAL SUPPLIES Market Production Volume/Revenue, By China, 2018 – 2023 36

FIG NO. 9. China DISPOSABLE MEDICAL SUPPLIES Market Price, By Type, 2018 – 2023 37

FIG NO. 10. Raw Materials Price Trend Analysis, 2018 – 2023 38

FIG NO. 11. Manufacturing Cost Analysis 39

FIG NO. 12. Manufacturing Process 39

FIG NO. 13. Company Share Analysis, 2023 40

FIG NO. 14. Company Share Analysis, 2023 41

FIG NO. 15. Company Share Analysis, 2023 41

FIG NO. 16. Company Share Analysis, 2023 42

FIG NO. 17. DISPOSABLE MEDICAL SUPPLIES Market – Company Volume Market Share, 2023 43

FIG NO. 18. DISPOSABLE MEDICAL SUPPLIES Market – Company Revenue Market Share, 2023 44

FIG NO. 19. DISPOSABLE MEDICAL SUPPLIES Market Revenue Share, By Type, 2023 & 2032 50

FIG NO. 20. Market Attractiveness Analysis, By Type 51

FIG NO. 21. Incremental Revenue Growth Opportunity by Type, 2024 – 2032 51

FIG NO. 22. DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Type, 2018, 2023, 2027 & 2032 52

FIG NO. 23. China DISPOSABLE MEDICAL SUPPLIES Market for Wound Management Products, Revenue (USD Million) 2018 – 2032 53

FIG NO. 24. China DISPOSABLE MEDICAL SUPPLIES Market for Drug Delivery Products, Revenue (USD Million) 2018 – 2032 54

FIG NO. 25. China DISPOSABLE MEDICAL SUPPLIES Market for Diagnostic and Laboratory Disposables, Revenue (USD Million) 2018 – 2032 55

FIG NO. 26. China DISPOSABLE MEDICAL SUPPLIES Market for Dialysis Disposables, Revenue (USD Million) 2018 – 2032 56

FIG NO. 27. China DISPOSABLE MEDICAL SUPPLIES Market for Incontinence Products, Revenue (USD Million) 2018 – 2032 57

FIG NO. 28. DISPOSABLE MEDICAL SUPPLIES Market Revenue Share, By Raw Material, 2023 & 2032 59

FIG NO. 29. Market Attractiveness Analysis, By Raw Material 60

FIG NO. 30. Incremental Revenue Growth Opportunity by Raw Material, 2024 – 2032 60

FIG NO. 31. DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Raw Material, 2018, 2023, 2027 & 2032 61

FIG NO. 32. China DISPOSABLE MEDICAL SUPPLIES Market for Plastic Resins, Revenue (USD Million) 2018 – 2032 62

FIG NO. 33. China DISPOSABLE MEDICAL SUPPLIES Market for Nonwoven Material, Revenue (USD Million) 2018 – 2032 63

FIG NO. 34. China DISPOSABLE MEDICAL SUPPLIES Market for Rubber, Revenue (USD Million) 2018 – 2032 64

FIG NO. 35. China DISPOSABLE MEDICAL SUPPLIES Market for Paper, Revenue (USD Million) 2018 – 2032 65

FIG NO. 36. China DISPOSABLE MEDICAL SUPPLIES Market for Paperboard, Revenue (USD Million) 2018 – 2032 66

FIG NO. 37. DISPOSABLE MEDICAL SUPPLIES Market Revenue Share, By End-user, 2023 & 2032 68

FIG NO. 38. Market Attractiveness Analysis, By End-user 69

FIG NO. 39. Incremental Revenue Growth Opportunity by End-user, 2024 – 2032 69

FIG NO. 40. DISPOSABLE MEDICAL SUPPLIES Market Revenue, By End-user, 2018, 2023, 2027 & 2032 70

FIG NO. 41. China DISPOSABLE MEDICAL SUPPLIES Market for Hospitals, Revenue (USD Million) 2018 – 2032 71

FIG NO. 42. China DISPOSABLE MEDICAL SUPPLIES Market for Home, Revenue (USD Million) 2018 – 2032 72

FIG NO. 43. China DISPOSABLE MEDICAL SUPPLIES Market for Healthcare, Revenue (USD Million) 2018 – 2032 73

FIG NO. 44. China DISPOSABLE MEDICAL SUPPLIES Market for Outpatient/Primary Care Facilities, Revenue (USD Million) 2018 – 2032 74

List of Tables

TABLE NO. 1. : China DISPOSABLE MEDICAL SUPPLIES Market: Snapshot 21

TABLE NO. 2. : Drivers for the DISPOSABLE MEDICAL SUPPLIES Market: Impact Analysis 25

TABLE NO. 3. : Restraints for the DISPOSABLE MEDICAL SUPPLIES Market: Impact Analysis 27

TABLE NO. 4. : China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Type, 2018 – 2023 37

TABLE NO. 5. : Key Raw Materials & Suppliers 38

TABLE NO. 6. : China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Type, 2018 – 2023 (USD Million) 75

TABLE NO. 7. : China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Type, 2024 – 2032 (USD Million) 75

TABLE NO. 8. : China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Raw Material, 2018 – 2023 (USD Million) 76

TABLE NO. 9. : China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By Raw Material, 2024 – 2032 (USD Million) 76

TABLE NO. 10. : China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By End-user, 2018 – 2023 (USD Million) 77

TABLE NO. 11. : China DISPOSABLE MEDICAL SUPPLIES Market Revenue, By End-user, 2024 – 2032 (USD Million) 77