Market Overview:

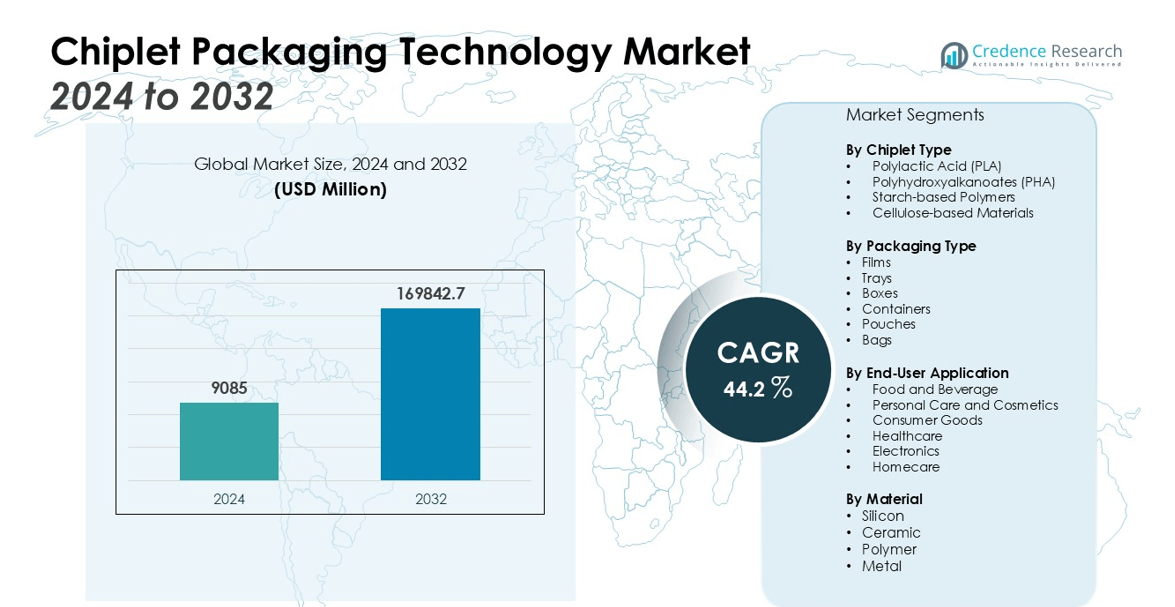

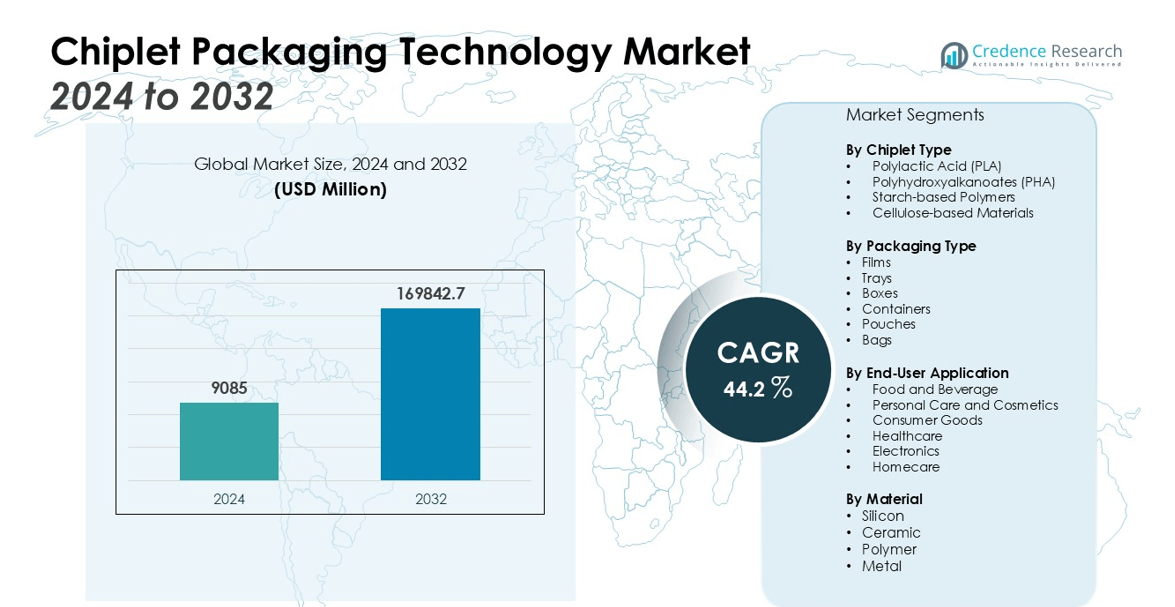

The Chiplet Packaging Technology Market size was valued at USD 9085 million in 2024 and is anticipated to reach USD 169842.7 million by 2032, at a CAGR of 44.2% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chiplet Packaging Technology Market Size 2024 |

USD 9085 million |

| Chiplet Packaging Technology Market, CAGR |

44.2% |

| Chiplet Packaging Technology Market Size 2032 |

USD 169842.7 million |

The adoption of chiplet packaging technology is driven by the need for more compact, faster, and energy-efficient electronic devices. This modular approach enables the integration of different process nodes and technologies within a single package, enhancing performance and reducing manufacturing costs. Chiplet designs also offer flexibility and scalability, which make them ideal for advanced semiconductor applications. Furthermore, the rise of heterogeneous integration is accelerating market demand, as it provides an efficient method for combining various semiconductor components into a unified system, offering substantial cost and performance benefits.

Regionally, North America holds the largest market share, bolstered by the presence of leading semiconductor firms and ongoing technological innovations in chiplet packaging. The Asia Pacific region is anticipated to experience the highest growth due to the rising demand for semiconductors in consumer electronics, automotive, and telecommunications. Europe is also contributing significantly to the market, driven by continuous advancements in semiconductor manufacturing technologies.

Market Insights:

- The Chiplet Packaging Technology Market is expected to grow from USD 9,085 million in 2024 to USD 169,842.7 million by 2032, reflecting a CAGR of 44.2%.

- The increasing demand for high-performance, energy-efficient devices drives market growth, as chiplet packaging optimizes performance and energy efficiency in sectors such as AI and 5G.

- Chiplet packaging enables cost reduction and performance enhancement by integrating modular chiplets, which improves efficiency and allows for greater customization.

- The technology offers flexibility and scalability, supporting heterogeneous integration and enabling the creation of customized semiconductor solutions for diverse applications.

- Heterogeneous integration allows the combination of multiple semiconductor components into a unified system, improving performance and simplifying complex designs for various industries.

- The market faces challenges in design and manufacturing complexity, including the need for precise integration and maintaining consistent performance across different chiplets.

- North America leads the market with a 35% share, followed by Asia Pacific at 30%, and Europe at 20%, driven by technological advancements and increasing demand in key sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for High-Performance, Energy-Efficient Devices

The Chiplet Packaging Technology Market is driven by the growing need for high-performance and energy-efficient devices across various industries. With the expansion of technologies such as AI, high-performance computing, and 5G, the demand for advanced semiconductor solutions has surged. Chiplet packaging technology addresses this demand by enabling the integration of diverse components within a single package, optimizing both performance and energy efficiency. It allows for the creation of smaller, faster, and more powerful devices, which is crucial in meeting the requirements of next-generation applications.

- For instance, Marvell Technology has introduced a multi-die solution that enables AI accelerator designs to be 2.8 times larger than conventional single-die implementations—improving compute density and lowering power consumption for hyperscale AI infrastructure deployments.

Cost Efficiency and Performance Optimization

One of the key drivers of the Chiplet Packaging Technology Market is its ability to reduce manufacturing costs while enhancing performance. By utilizing modular chiplets, manufacturers can integrate components from different process nodes, lowering production expenses without compromising on functionality. This approach enables the customization of chip designs, improving overall performance and efficiency. The ability to select chiplets based on specific needs also helps optimize cost, making it an attractive solution for manufacturers looking to enhance their competitive edge in the semiconductor industry.

- For instance, TSMC and Arm jointly demonstrated an industry-first 7nm dual-chiplet system, successfully achieving 4GHz operation with an 8Gb/s per pin data rate using their CoWoS packaging and LIPINCON interconnect technology.

Flexibility and Scalability in Design

Chiplet packaging technology offers significant flexibility in semiconductor design. It supports heterogeneous integration, allowing the combination of chips with varying functions and performance characteristics into a single package. This capability enables the creation of customized solutions that can be easily scaled to meet different market demands. The ability to mix and match chiplets with different technologies provides manufacturers with the freedom to innovate and optimize their designs for specific applications, making chiplet packaging a key enabler of future semiconductor advancements.

Advancements in Heterogeneous Integration

Heterogeneous integration is a significant factor driving the growth of the Chiplet Packaging Technology Market. By allowing the integration of different types of chips—such as processors, memory, and analog chips—into one cohesive system, this technology enhances system performance and reduces design complexity. It provides a more efficient solution for industries that require high-performing, energy-efficient devices. The ability to combine various semiconductor components in a single package facilitates innovation in diverse sectors, including automotive, telecommunications, and consumer electronics.

Market Trends:

Shift Toward Modular and Scalable Chip Designs

The Chiplet Packaging Technology Market is increasingly embracing modular and scalable chip designs. As semiconductor applications demand higher performance, lower power consumption, and compact form factors, chiplet packaging technology offers an effective solution. It enables the integration of different specialized chips within a single package, allowing manufacturers to optimize performance while controlling costs. The modular nature of chiplets allows for greater flexibility in design, enabling customization based on specific application requirements. This trend is gaining momentum as industries seek more efficient, high-performance solutions, driving further adoption of chiplet packaging in various sectors, including high-performance computing, AI, and 5G.

- For instance, AMD’s second-generation EPYC server processor utilizes eight CPU chiplets in a single package, supporting up to 64 cores and doubling both Infinity Fabric and PCIe bandwidth compared to previous generations.

Expansion of Heterogeneous Integration and System-Level Packaging

Heterogeneous integration and system-level packaging are becoming central to the growth of the Chiplet Packaging Technology Market. By combining diverse semiconductor components—such as processors, memory, and analog chips—into one integrated system, it enhances overall performance and functionality. This trend supports the creation of more compact, multifunctional chips that cater to the growing demand for energy-efficient, high-performance devices across industries like automotive, telecommunications, and consumer electronics. As the need for more powerful and efficient devices increases, system-level packaging, driven by heterogeneous integration, is set to propel the market forward by providing innovative solutions for complex semiconductor applications.

- For instance, Texas Instruments’ BQ40Z50-R2 battery-management IC incorporates two distinct silicon technologies—low-cost logic and critical analog—in a single multichip package, achieving a 2× increase in channel density and providing enhanced power management within a footprint of just 6mm × 6mm.

Market Challenges Analysis:

Complexity in Design and Manufacturing

The Chiplet Packaging Technology Market faces significant challenges in design and manufacturing complexity. Integrating chiplets from various process nodes and technologies requires careful coordination to ensure proper functionality and efficiency. Custom interfaces and advanced packaging solutions are necessary to facilitate seamless communication between components, which can increase both development time and production costs. Additionally, maintaining consistent performance across chiplets with different characteristics, such as power consumption, speed, and heat dissipation, presents further challenges. The intricate nature of these designs demands high precision in engineering and rigorous testing, which can impede the widespread adoption of chiplet packaging technology.

Reliability and Compatibility Issues

Reliability and compatibility issues remain key challenges for the Chiplet Packaging Technology Market. Ensuring that chiplets from different sources or process nodes function together seamlessly within a single package is a complex task. Differences in materials, packaging methods, and thermal management strategies can result in integration difficulties. Achieving long-term reliability in chiplet-based designs, especially in demanding applications, requires overcoming these compatibility challenges. Manufacturers must address issues related to signal integrity, heat dissipation, and electrical performance to ensure reliable operation. These concerns may hinder the adoption of chiplet packaging technology across industries requiring high reliability.

Market Opportunities:

Expansion in High-Performance Computing and AI Applications

The Chiplet Packaging Technology Market offers significant opportunities in the rapidly growing sectors of high-performance computing (HPC) and artificial intelligence (AI). These fields demand advanced semiconductor solutions that provide enhanced processing power and energy efficiency to handle complex computations and large data sets. Chiplet packaging technology, with its modular and scalable design, enables the integration of multiple specialized chips within a single package, offering both performance improvements and reduced power consumption. As the need for more powerful computing capabilities continues to grow in AI and HPC applications, chiplet technology presents manufacturers with the opportunity to deliver customized solutions that meet these evolving requirements.

Growth in Consumer Electronics and 5G Infrastructure

The increasing demand for next-generation consumer electronics and the expansion of 5G infrastructure create substantial opportunities for the Chiplet Packaging Technology Market. As the demand for smaller, more powerful devices grows, chiplet packaging enables manufacturers to integrate multiple chips into compact designs, offering higher performance and energy efficiency. In the context of 5G, the need for high-bandwidth, low-latency semiconductors is accelerating, and chiplet technology can meet these requirements effectively. This trend presents a significant opportunity for the widespread adoption of chiplet packaging solutions, especially in applications where both miniaturization and enhanced performance are critical.

Market Segmentation Analysis:

By Chiplet Type:

The market is primarily divided into logic chiplets, memory chiplets, and mixed-chiplet solutions. Logic chiplets provide processing power, while memory chiplets handle data storage and retrieval. Mixed-chiplet solutions, which combine both logic and memory chiplets, are increasingly popular due to their ability to offer enhanced functionality and flexibility for high-performance applications like AI and 5G.

- For instance, AMD’s Ryzen 3000 processors, launched in 2019, utilize a chiplet-based design with up to 16 CPU cores on a single desktop processor through its Zen 2 architecture, marking a significant leap in multi-core capability for consumer CPUs.

By Packaging Type:

The packaging types in the market include wafer-level packaging (WLP), system-in-package (SiP), and 2.5D/3D packaging. Wafer-level packaging is widely used for its cost-effectiveness and high-density integration. System-in-package (SiP) offers integration of multiple chips within a single package, providing a compact and efficient solution for diverse applications. 2.5D and 3D packaging solutions are gaining traction in high-performance computing due to their ability to improve bandwidth, reduce latency, and enhance overall performance.

- For instance, Analog Devices employs WLP technology in its ICs, achieving package sizes as compact as 1.3×1.3mm and thicknesses of just 200µm for MEMS devices, enabling miniaturization while maintaining robust performance.

By End-User Application:

The Chiplet Packaging Technology Market caters to various end-user applications, including consumer electronics, automotive, telecommunications, and industrial sectors. Consumer electronics, such as smartphones and wearables, require compact, efficient chiplets. In automotive, chiplets are crucial for advanced driver-assistance systems (ADAS) and electric vehicles (EVs). The telecommunications sector, particularly 5G, relies on chiplets for high-performance communication systems, while industrial applications demand robust, scalable solutions for automation and control.

Segmentations:

By Chiplet Type:

- Logic Chiplets

- Memory Chiplets

- Mixed-Chiplet Solutions

By Packaging Type:

- Wafer-Level Packaging (WLP)

- System-in-Package (SiP)

- 5D/3D Packaging

By End-User Application:

- Consumer Electronics

- Automotive

- Telecommunications

- Industrial

By Material Type:

- Silicon

- Ceramic

- Polymer

- Metal

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Chiplet Packaging Technology Market, accounting for 35%. The region’s dominance is attributed to a strong presence of key semiconductor manufacturers and continuous advancements in packaging technologies. The United States leads with high investments in research and development, focusing on next-generation technologies such as AI, high-performance computing, and 5G. The growing demand for energy-efficient and high-performance devices in various industries further solidifies North America’s position as a market leader. The region is expected to maintain its dominant market share due to its robust infrastructure and technological innovation.

Asia Pacific

Asia Pacific holds a 30% share of the Chiplet Packaging Technology Market and is poised for rapid growth. The increasing demand for semiconductors in sectors such as consumer electronics, telecommunications, and automotive drives this expansion. Key countries, including China, Japan, and South Korea, are investing heavily in semiconductor manufacturing capabilities and research and development. The rapid adoption of 5G technologies and the rising need for advanced semiconductor solutions in high-performance devices are further accelerating the market’s growth in this region. Asia Pacific’s market share is expected to continue rising as technology integration and demand for efficient packaging solutions expand.

Europe

Europe represents a 20% share of the Chiplet Packaging Technology Market. The region’s emphasis on sustainability and innovation in semiconductor manufacturing supports its strong presence in this sector. Germany, France, and the United Kingdom are leading contributors, with significant advancements in automotive, industrial, and telecommunications applications. Europe’s focus on reducing production costs while improving energy efficiency through chiplet packaging solutions is driving market growth. The region’s ongoing commitment to environmental sustainability ensures continued adoption of chiplet technology across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AMD

- TSMC

- ARM

- Cambrian

- JCET Group

- Samsung

- NVIDIA

- Intel

- Marvell

- Tongfu Microelectronics

- ASE Group

- Jiangsu Dagang

- Northrop Grumman

- Tianshui Huatian Technology

Competitive Analysis:

The Chiplet Packaging Technology Market is characterized by strong competition, with major players leading technological advancements. Leading semiconductor companies such as Intel Corporation, AMD, TSMC, and Samsung Electronics are actively developing and deploying chiplet packaging solutions to enhance system performance and reduce manufacturing costs. These companies focus on integrating diverse chip components, leveraging their extensive R&D resources to push the boundaries of semiconductor packaging technology. Smaller, specialized firms are also gaining traction, contributing innovations in heterogeneous integration and modular chip designs. Collaborations and strategic partnerships are increasingly common, as companies work to expand their capabilities and address growing demand for energy-efficient and high-performance solutions. The rapid adoption of chiplet technology across industries, including consumer electronics, automotive, and telecommunications, is intensifying market competition, prompting companies to develop scalable, cost-effective solutions to meet the evolving needs of these sectors.

Recent Developments:

- In July 2025, AMD announced the availability of the “Zen 5”-based Ryzen Threadripper PRO 9000 WX-Series, designed for powerful professional workstations.

- In January 2025, Intel launched its Core Ultra (Series 2) processors at CES 2025, focusing on AI-enhanced mobile computing.

- In April 2025, Intel announced the sale of a 51% stake in its Altera programmable chip business to Silver Lake Partners. The deal is expected to close in the second half of 2025.

Market Concentration & Characteristics:

The Chiplet Packaging Technology Market is moderately concentrated, with major players holding a significant share while smaller, specialized companies contribute innovative solutions. Leading semiconductor companies like Intel, TSMC, and Samsung Electronics dominate the market, leveraging their extensive R&D capabilities and manufacturing expertise to advance chiplet packaging technologies. These companies focus on developing high-performance, energy-efficient solutions for industries such as AI, telecommunications, and automotive. At the same time, smaller firms are driving innovation through advancements in heterogeneous integration and modular chip designs, enhancing market diversity. The market is marked by rapid technological advancements, with companies continuously optimizing performance, reducing costs, and scaling solutions. Strategic collaborations between large and small players are common, fostering innovation and driving the development of scalable, cost-effective chiplet packaging solutions that meet the growing demand for high-performance semiconductor devices.

Report Coverage:

The research report offers an in-depth analysis based on Chiplet Type, Packaging Type, End-User Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of advanced packaging techniques, such as 2.5D and 3D integration, to meet the increasing demand for high-performance computing.

- Standardization efforts, like the Universal Chiplet Interconnect Express (UCIe), are being developed to promote interoperability across chiplet technologies and manufacturers.

- The integration of photonic interconnects is being explored to enhance bandwidth and reduce power consumption in chiplet-based systems.

- Modular chiplet designs are gaining traction, enabling the creation of customized solutions that can be tailored to specific application requirements.

- There is a growing focus on energy-efficient chiplet systems to address the rising power demands of modern applications.

- Advancements in thermal management solutions are being developed to manage heat dissipation challenges associated with densely packed chiplet systems.

- The demand for chiplet technology is driven by its applications in artificial intelligence (AI) and high-performance computing (HPC), where performance and efficiency are critical.

- Industry collaborations are fostering the development of a strong ecosystem for chiplet technology, addressing common challenges and encouraging innovation.

- Significant investments are being made in research and development to overcome existing limitations and unlock new capabilities in chiplet technologies.

- The evolving regulatory landscape is influencing the development and deployment of chiplet technologies, with a focus on compliance and standardization.