Market Overview

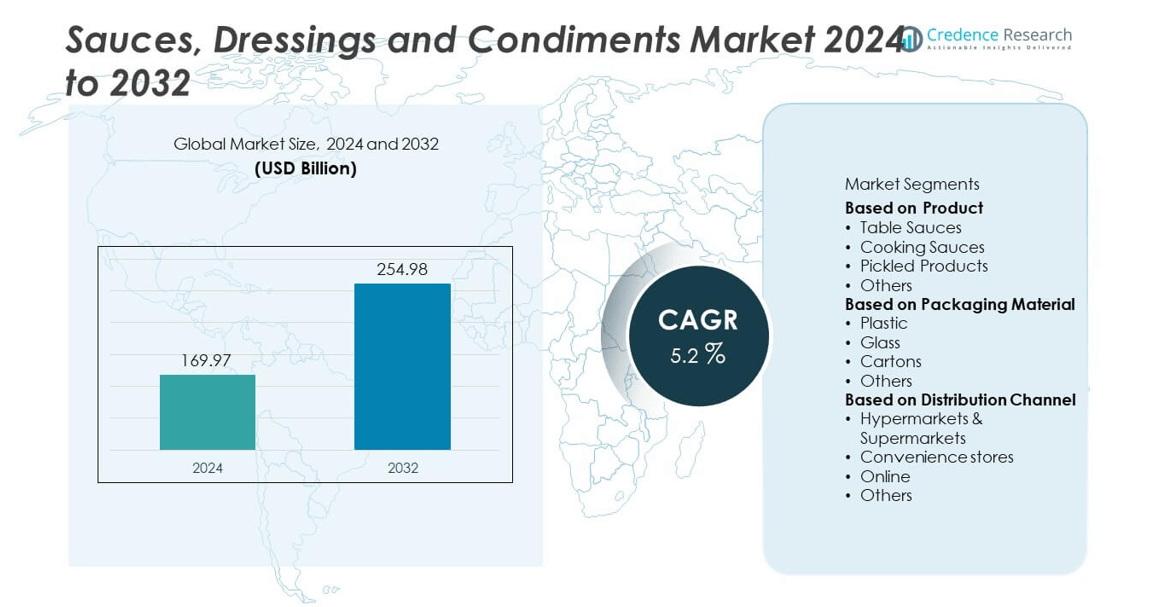

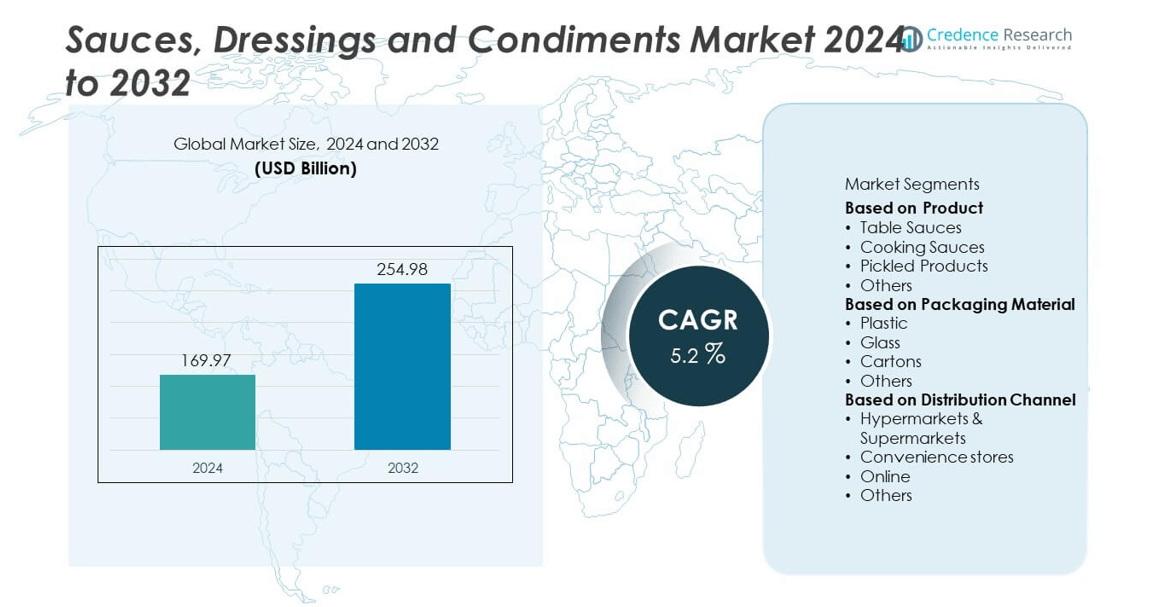

The Sauces, Dressings, and Condiments market size was valued at USD 169.97 billion in 2024 and is projected to reach USD 254.98 billion by 2032, expanding at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sauces, Dressings and Condiments Market Size 2024 |

USD 169.97 billion |

| Sauces, Dressings and Condiments Market, CAGR |

5.2% |

| Sauces, Dressings and Condiments Market Size 2032 |

USD 254.98 billion |

The sauces, dressings, and condiments market is driven by top players including Nestlé, Conagra Brands, Inc., The Kraft Heinz Company, PepsiCo, McCormick & Company, Inc., Unilever, Campbell Soup Company, General Mills Inc., Del Monte Foods, Inc., and Kikkoman Sales USA, Inc. These companies compete through strong brand portfolios, global distribution, and innovation in healthier, clean-label, and premium product lines. Regionally, Asia-Pacific led the market with 35% share in 2024, supported by high consumption of soy-based sauces, chili condiments, and expanding foodservice channels. North America followed with 30% share, driven by strong demand for table sauces, salad dressings, and premium condiments. Europe accounted for 28% share, reflecting steady consumption of mayonnaise, pickled products, and organic sauces, supported by strict food safety regulations and sustainability trends.

Market Insights

- The sauces, dressings, and condiments market was valued at USD 169.97 billion in 2024 and is projected to reach USD 254.98 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

- Rising demand for convenience foods and ready-to-eat meals drives market expansion, with table sauces leading by product segment with over 40% share in 2024, supported by strong consumption across households and quick-service restaurants.

- Trends include a growing shift toward organic, clean-label, and premium condiments, alongside increasing adoption of sustainable packaging solutions such as recyclable bottles and carton-based alternatives.

- Competitive dynamics are shaped by major players such as Nestlé, Conagra Brands, The Kraft Heinz Company, PepsiCo, McCormick & Company, and Unilever, focusing on product innovation, distribution expansion, and digital engagement strategies.

- Regionally, Asia-Pacific led with 35% share in 2024, followed by North America at 30%, Europe at 28%, while Latin America and Middle East & Africa accounted for smaller shares of 5% and 2%, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The table sauces segment dominated the sauces, dressings, and condiments market in 2024, accounting for over 40% share. Its leadership comes from strong global demand for ketchup, mayonnaise, and soy-based sauces in both households and quick-service restaurants. Rising consumption of ready-to-eat meals and international cuisines continues to fuel adoption. Cooking sauces follow closely with robust growth in Asian and Western markets, supported by growing home cooking trends. Pickled products and other specialty condiments maintain niche demand, often driven by regional flavors and artisanal offerings, but table sauces remain the largest contributor to revenue growth.

- For instance, Heinz has sold approximately 650 million bottles of its flagship ketchup annually, along with approximately 11 billion single-serve packets, distributed globally to retail stores and a vast number of quick-service restaurants.

By Packaging Material

Plastic packaging led the market with more than 45% share in 2024, driven by its lightweight, cost-effectiveness, and convenience for bulk distribution. The dominance of plastic bottles and pouches in sauces and dressings supports mass-market penetration, particularly in developing economies. Glass packaging retains steady demand in premium segments, offering better preservation and consumer perception of quality. Cartons and other sustainable packaging formats are gaining momentum as eco-conscious consumers and brands push for recyclable alternatives. However, plastic’s combination of durability and affordability ensures it remains the preferred material across both retail and foodservice distribution.

- For instance, Amcor supplies a vast range of packaging, including plastic bottles and pouches for sauces, to global markets, providing solutions engineered to operate with high-speed filling lines while ensuring product quality and integrity.

By Distribution Channel

Hypermarkets and supermarkets accounted for the dominant share of over 50% in 2024, supported by wide product availability, promotional campaigns, and strong consumer preference for one-stop shopping. The presence of private labels and diverse international brands in large retail outlets further drives this channel’s strength. Convenience stores also contribute significantly in urban markets due to accessibility and impulse buying. Online sales, though smaller, are expanding rapidly as e-commerce platforms promote direct-to-consumer options and subscription-based delivery models. Despite this growth, hypermarkets and supermarkets continue to anchor global distribution with their extensive reach and consumer trust.

Market Overview

Rising Demand for Convenience Foods

The growing consumption of ready-to-eat and processed meals continues to fuel demand for sauces, dressings, and condiments. Busy urban lifestyles and increasing disposable incomes drive consumers toward packaged food options that save time while offering taste and variety. Products like table sauces, cooking sauces, and ready-to-use dressings enhance quick meal preparation and complement fast-food expansion worldwide. This trend is especially strong in Asia-Pacific, where urbanization and fast-food penetration are accelerating, pushing global brands and regional players to expand product lines with convenient and innovative offerings.

- For instance, Nestlé’s Maggi brand offers a range of ready-to-use cooking sauces in India, capturing growing demand in urban households for quick meal solutions, which are produced using advanced automated packaging lines.

Expansion of International Cuisines

Global exposure to diverse cuisines significantly drives the consumption of sauces and condiments. Rising popularity of Asian, Mediterranean, and Latin American food has led to increased use of soy sauce, salsa, hummus, and other specialty condiments across households and restaurants. Foodservice operators and retailers are also expanding their portfolios with ethnic and fusion products to capture shifting consumer tastes. This expansion is especially notable in Europe and North America, where consumers actively experiment with global flavors, encouraging continuous product innovation and stronger cross-cultural penetration.

- For instance, Conagra Brands has expanded its offerings with brands like Frontera, bringing gourmet Mexican food to its portfolio and evolving to satisfy consumers’ changing food preferences for global flavors and convenience.

Shift Toward Premium and Health-Oriented Products

Health-conscious consumers are increasingly seeking sauces and dressings with low-fat, organic, gluten-free, and clean-label formulations. Premium offerings with natural ingredients and reduced sugar or sodium are gaining traction across developed and emerging markets. Producers are innovating with functional condiments that incorporate probiotics, plant-based proteins, and natural preservatives to meet growing wellness preferences. This shift is strengthening brand differentiation and allowing manufacturers to capture higher margins, especially through e-commerce and specialty stores. The premium segment’s growth reflects both evolving health awareness and consumer readiness to pay more for quality.

Key Trends & Opportunities

Digital Retail Expansion

The rapid adoption of e-commerce platforms creates strong growth opportunities for sauces, dressings, and condiments. Consumers increasingly prefer online channels for convenience, wider product access, and subscription services. Digital platforms also enable brands to reach niche audiences with personalized promotions, driving sales of specialty condiments and premium dressings. With advanced logistics and partnerships between producers and online retailers, this trend accelerates market penetration in both urban and rural areas. The online channel is expected to evolve into a critical distribution platform for innovation-driven and health-oriented product lines.

- For instance, in the second quarter of 2024, Walmart captured 37% of the U.S. online grocery market, an all-time high for the company, and is heavily focused on expanding product availability through its extensive last-mile delivery network.

Sustainability and Eco-Friendly Packaging

Sustainability is emerging as a major trend shaping the packaging and marketing of sauces and condiments. Companies are introducing recyclable bottles, biodegradable pouches, and carton-based alternatives to reduce environmental impact. Growing regulatory pressure on single-use plastics and consumer demand for eco-friendly solutions further accelerate this shift. Brands that actively adopt sustainable packaging not only strengthen market appeal but also align with global environmental goals. This creates opportunities for manufacturers to enhance brand image, improve compliance, and capture eco-conscious consumers across both developed and emerging regions.

- For instance, Amcor, a global packaging supplier, is collaborating with leading condiment brands to integrate eco-design principles and recycled materials, including through its recycle-ready AmPrima® pouches for wet condiments.

Key Challenges

Rising Raw Material Costs

olatility in the prices of key raw materials such as tomatoes, edible oils, and spices poses a major challenge for manufacturers. Weather disruptions, supply chain constraints, and inflationary pressures increase production costs, impacting profit margins. Companies often face difficulty in fully passing these costs onto consumers due to competitive market dynamics. To mitigate risks, manufacturers must diversify sourcing strategies and invest in supply chain resilience. However, persistent cost fluctuations continue to limit pricing flexibility and create barriers to consistent profitability in the market.

Stringent Regulatory Compliance

The sauces, dressings, and condiments market faces increasing regulatory scrutiny related to food safety, labeling, and nutritional transparency. Requirements for clean labeling, allergen declarations, and restrictions on additives vary widely across regions, creating compliance complexity for multinational brands. Non-compliance can result in product recalls, fines, and reputational damage, particularly in highly regulated markets such as the U.S. and Europe. Companies must continually adapt formulations, packaging, and disclosures to meet evolving standards, which raises operational costs and slows time-to-market for new product launches.

Regional Analysis

North America

North America held 30% share in 2024, driven by strong demand for table sauces, salad dressings, and premium condiments. The U.S. market benefits from widespread consumption of fast food, packaged meals, and global cuisines, while Canada supports growth with rising interest in organic and clean-label dressings. Consumers increasingly seek health-conscious options, such as low-fat and low-sodium variants, alongside premium gourmet sauces. Retail giants like Walmart and Kroger, coupled with established foodservice networks, strengthen product accessibility. Innovation in flavors and sustainable packaging further drives adoption, making North America a key contributor to overall market revenue growth.

Europe

Europe accounted for 28% share in 2024, supported by established consumption of sauces and condiments across diverse cuisines. The region shows high demand for mayonnaise, pickled products, and cooking sauces, driven by strong culinary traditions in Germany, France, Italy, and the U.K. Consumer preference for organic and gluten-free condiments is expanding, aligning with stricter EU food safety and labeling regulations. Leading supermarkets and specialty stores promote premium and private-label offerings, reinforcing accessibility. The growing popularity of Mediterranean diets and ethnic condiments adds momentum, while sustainability initiatives in packaging strengthen market positioning across both Western and Eastern Europe.

Asia-Pacific

Asia-Pacific dominated the global market with 35% share in 2024, led by high consumption of soy sauce, chili-based condiments, and cooking sauces. Rising urbanization, expanding middle-class income, and growing demand for convenience foods are fueling regional growth. China, Japan, India, and Southeast Asia are major contributors, supported by robust foodservice industries and expanding retail infrastructure. Traditional flavors and international brands coexist, offering variety across households and restaurants. E-commerce adoption is accelerating online sales, especially for premium and imported condiments. Rapidly evolving dietary preferences and strong cultural ties to sauces reinforce Asia-Pacific as the largest and fastest-growing regional market.

Latin America

Latin America captured 5% share in 2024, driven by strong demand for salsas, chili sauces, and regional condiments. Mexico and Brazil lead consumption, with increasing preference for packaged sauces that align with expanding urban lifestyles. Local flavors remain central, but international brands are also gaining traction through supermarkets and convenience stores. Rising fast-food consumption and middle-income growth contribute to higher adoption of dressings and packaged condiments. Despite economic challenges, the region benefits from strong culinary traditions and rising demand for convenient packaging. The fusion of traditional and global sauces positions Latin America as a growing niche market.

Middle East & Africa

The Middle East and Africa accounted for 2% share in 2024, reflecting steady but smaller-scale growth. Rising demand for packaged sauces and condiments in urban centers, especially in the Gulf states and South Africa, supports expansion. Cultural preferences for pickled products, tahini, and spice-based sauces drive regional variety. Increasing tourism, hospitality development, and international food chain penetration further expand opportunities. However, limited cold chain infrastructure and economic disparities pose challenges for broader adoption. Gradual modernization of retail channels, alongside demand for affordable and traditional offerings, sustains steady progress in the sauces, dressings, and condiments market across MEA.

Market Segmentations:

By Product

- Table Sauces

- Cooking Sauces

- Pickled Products

- Others

By Packaging Material

- Plastic

- Glass

- Cartons

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience stores

- Online

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the sauces, dressings, and condiments market is shaped by leading players such as Nestlé, Conagra Brands, Inc., The Kraft Heinz Company, PepsiCo, McCormick & Company, Inc., Unilever, Campbell Soup Company, General Mills Inc., Del Monte Foods, Inc., and Kikkoman Sales USA, Inc. These companies maintain their positions through strong global distribution networks, wide product portfolios, and continuous innovation in flavor varieties and packaging formats. Strategic investments in clean-label, organic, and low-sodium offerings cater to rising health-conscious consumer demand. Expansion into emerging markets, particularly Asia-Pacific and Latin America, allows companies to capture growth from urbanization and evolving dietary preferences. Partnerships with retailers and foodservice operators further strengthen reach, while digital marketing and e-commerce channels support direct engagement with consumers. Sustainability initiatives, including recyclable packaging and reduced environmental footprints, are also gaining importance as companies balance competitive differentiation with compliance to global food safety and environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé

- Conagra Brands, Inc.

- The Kraft Heinz Company

- PepsiCo

- McCormick & Company, Inc.

- Unilever

- Campbell Soup Company

- General Mills Inc.

- Del Monte Foods, Inc.

- Kikkoman Sales USA, Inc.

Recent Developments

- In August 2025, McCormick increased its stake in its Mexican JV with Grupo Herdez from 50% to 75% to bolster its presence in Latin American condiments.

- In February 2025, The Kraft Heinz Company introduced its “Flavor Tour” line of three globally-inspired sauces (Mexican Street Corn, Korean Sweet & Tangy BBQ, Thai Sweet Chili).

- In 2025, McCormick forecasted flat to low revenue growth and planned reformulations (removing artificial colors, reducing sodium) amid weak demand in China.

- In 2024, Nestlé’s MAGGI brand launched a new dry condiments with Khaleeji, truffle, and smoked seasonings.

Report Coverage

The research report offers an in-depth analysis based on Product, Packaging Material, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by rising global consumption of convenience foods.

- Table sauces will continue to dominate due to strong household and foodservice demand.

- Premium and health-focused condiments will gain traction among health-conscious consumers.

- Clean-label, organic, and plant-based formulations will attract wider adoption across regions.

- Sustainable and recyclable packaging will become a central focus for manufacturers.

- Digital retail channels will grow rapidly, boosting online sales and subscription-based models.

- Asia-Pacific will remain the leading regional market with the fastest growth rate.

- North America and Europe will sustain strong demand through premium and organic products.

- Emerging markets in Latin America and Africa will offer niche growth opportunities.

- Competitive intensity will increase as global brands and regional players invest in innovation.