Market Overview

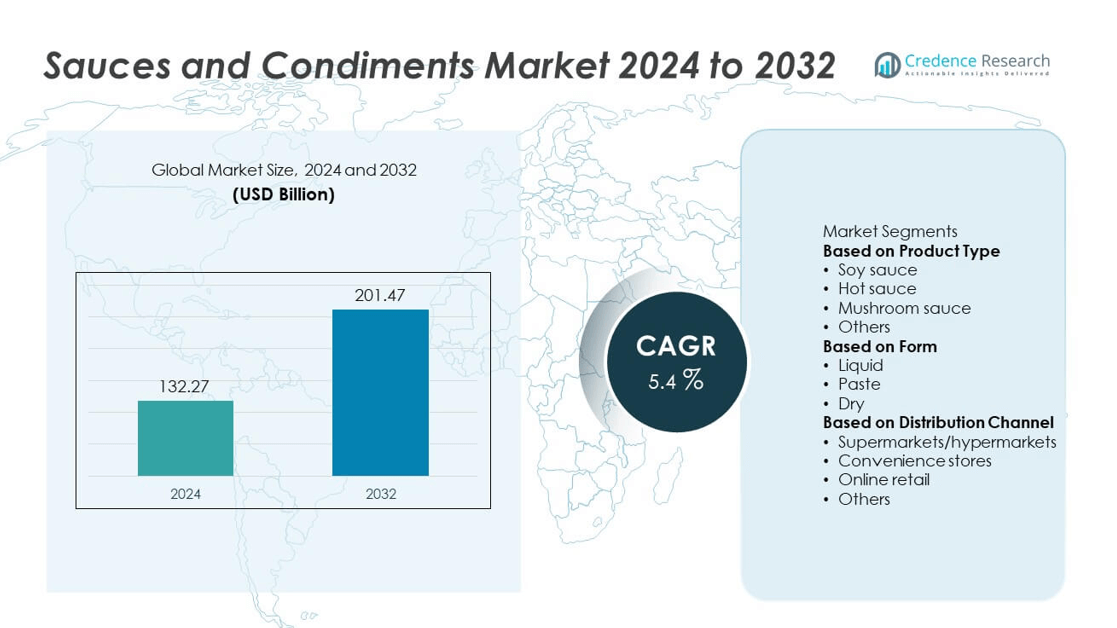

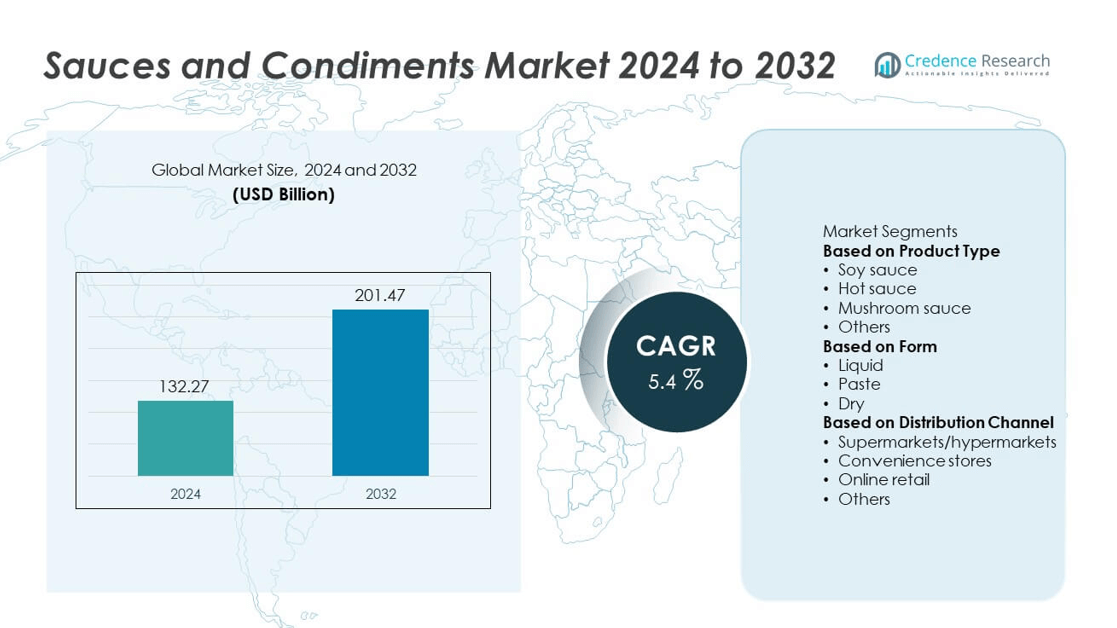

The Sauces and Condiments market size was valued at USD 132.27 billion in 2024 and is projected to reach USD 201.47 billion by 2032, expanding at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sauces and Condiments Market Size 2024 |

USD 132.27 billion |

| Sauces and Condiments Market, CAGR |

5.4% |

| Sauces and Condiments Market Size 2032 |

USD 201.47 billion |

The sauces and condiments market is driven by top players such as Casa Fiesta, Hormel Foods Corporation, Kikkoman Corporation, Bay Valley, Lee Kum Kee, Berner Foods, Conagra Brands, General Mills, Fuchs Gewürze GmbH, and Huy Fong Foods. These companies compete through diverse product portfolios, innovation in flavors, and strong distribution across retail and foodservice channels. Regionally, Asia-Pacific led the market with 34% share in 2024, supported by high consumption of soy-based and chili sauces. North America followed with 31% share, driven by strong demand for hot sauces and salad dressings, while Europe held 27% share, supported by steady use of mayonnaise, mushroom-based sauces, and premium condiments.

Market Insights

- The sauces and condiments market was valued at USD 132.27 billion in 2024 and is projected to reach USD 201.47 billion by 2032, growing at a CAGR of 5.4% during the forecast period.

- Rising demand for convenience foods and ready-to-eat meals drives market expansion, with soy sauce leading the product type segment at over 35% share in 2024, supported by its widespread use in Asian cuisines and growing global popularity.

- Trends highlight growing consumer preference for organic, clean-label, and premium condiments, along with increasing adoption of sustainable and recyclable packaging materials to address environmental concerns.

- Competitive dynamics are shaped by players such as Casa Fiesta, Hormel Foods Corporation, Kikkoman Corporation, Bay Valley, Lee Kum Kee, Berner Foods, Conagra Brands, General Mills, Fuchs Gewürze GmbH, and Huy Fong Foods, focusing on product innovation and global distribution strategies.

- Regionally, Asia-Pacific led with 34% share in 2024, followed by North America at 31%, Europe at 27%, while Latin America and the Middle East & Africa captured 6% and 2% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Soy sauce dominated the sauces and condiments market in 2024, holding over 35% share, supported by its extensive use in Asian cuisines and growing global adoption of ethnic flavors. Its versatility in cooking, marination, and seasoning makes it a staple in both households and foodservice sectors. Hot sauce continues to grow strongly, fueled by rising consumer preference for spicy flavors across Western and Latin American markets. Mushroom sauce and other specialty condiments cater to niche demand, but soy sauce remains the leading product type due to its cultural relevance and wide consumption base.

- For instance, ITC Limited, a food manufacturer with a significant presence in Maharashtra, uses AI to forecast demand and optimize its supply chain to reduce waste and increase efficiency.

By Form

The liquid form segment accounted for the dominant over 60% share in 2024, driven by its convenience, versatility, and widespread use in cooking and ready-to-eat meals. Liquid sauces such as soy, hot, and specialty variants remain popular for household and commercial applications, supported by packaging innovations like bottles and pouches. Paste-based condiments, including chili and mushroom sauces, are gaining traction for their concentrated flavors, while dry variants serve niche applications in seasoning mixes. However, the ease of use and integration of liquid sauces across global cuisines ensures their continued dominance in the market.

- For instance, Kikkoman Corporation produced over 400 million liters of liquid soy sauce globally, utilizing high-speed bottling lines and multi-format packaging to supply both retail and foodservice partners

By Distribution Channel

Supermarkets and hypermarkets led distribution in 2024 with over 50% share, providing consumers with access to diverse domestic and international brands. Their strength lies in extensive shelf space, promotional campaigns, and private-label offerings, which drive both affordability and premiumization. Convenience stores contribute notably in urban regions through impulse purchases and smaller pack sizes, while online retail is expanding rapidly with rising e-commerce adoption and direct-to-consumer models. Despite online growth, supermarkets and hypermarkets maintain their dominance as the primary purchasing channel, benefiting from consumer trust and one-stop shopping convenience.

Market Overview

Rising Global Consumption of Ethnic Flavors

The growing popularity of Asian, Latin American, and African cuisines is fueling the demand for soy sauce, hot sauce, and other condiments. Consumers worldwide are increasingly open to experimenting with bold, spicy, and authentic flavors. Restaurants and packaged food producers are responding with innovative sauce varieties to capture this trend. The strong cultural association of sauces like soy sauce in Asia-Pacific and hot sauces in North America further supports market expansion. Globalization of food habits continues to anchor ethnic sauces as a primary growth driver.

- For instance, Japanese soy sauce manufacturers collectively operated 13 overseas production plants and supplied 353,000 kiloliters of soy sauce to international markets in 2022, primarily produced locally at those overseas plants, reflecting a 50% increase in overseas consumption since 2012.

Expansion of Quick-Service Restaurants and Packaged Foods

The rapid growth of fast-food chains, convenience meals, and ready-to-eat food products is boosting the sauces and condiments market. Quick-service restaurants rely heavily on sauces to standardize taste, while packaged food manufacturers incorporate condiments to enhance flavor profiles. Rising disposable incomes and urban lifestyles further drive consumer dependence on easy-to-use products. Both global brands and local players are expanding portfolios to meet demand across diverse cuisines, ensuring sauces remain essential to the growth of processed and restaurant foods worldwide.

- For instance, Kraft Heinz’s Guangdong, China plant, which opened in 2020, is capable of producing 200,000 tons of soy sauce per year to supply international quick-service restaurant chains and processed food brands throughout Asia.

Shift Toward Premium and Health-Focused Offerings

Consumer focus on healthier and cleaner ingredients is reshaping the sauces and condiments market. Demand for organic, low-sodium, gluten-free, and preservative-free sauces is rising, particularly in North America and Europe. Premium offerings that emphasize natural ingredients, functional benefits, and authentic recipes appeal to health-conscious and high-income groups. Manufacturers are leveraging this trend to build brand loyalty and increase margins. The rising preference for premium and wellness-driven products ensures strong growth opportunities across both developed and emerging economies.

Key Trends & Opportunities

E-commerce and Direct-to-Consumer Channels

Online retail is transforming how consumers purchase sauces and condiments. Digital platforms allow brands to target niche audiences, promote premium products, and offer subscription-based models for consistent sales. E-commerce penetration is strong in developed markets, while emerging regions are witnessing fast growth due to expanding logistics networks. This channel provides opportunities for smaller brands to compete effectively with global players by reaching wider audiences. Online engagement, personalized promotions, and convenient delivery are set to strengthen e-commerce as a critical sales driver.

- For instance, McCormick & Company utilizes AI and data insights in its global flavor and product development, as demonstrated by its collaboration with IBM and its SAGE AI technology.

Sustainable Packaging and Eco-Friendly Practices

Sustainability is becoming a major opportunity for sauce and condiment manufacturers. Companies are introducing recyclable bottles, biodegradable pouches, and carton packaging to reduce environmental impact. Growing consumer preference for eco-conscious brands and regulatory pressure on single-use plastics are accelerating this shift. Investing in sustainable packaging not only strengthens brand image but also ensures compliance with evolving regulations. This trend offers long-term opportunities for manufacturers to differentiate their products and attract environmentally conscious consumers across both developed and developing markets.

- For instance, Nestlé is on track to reduce its use of virgin plastic by one-third by 2025 (compared to 2018 levels) by developing new, recyclable packaging across numerous brands, and its Institute of Packaging Sciences researches advanced materials like high-performance barrier papers and bio-based options to minimize environmental impact across the supply chain.

Key Challenges

Volatile Raw Material Prices

Fluctuations in the prices of key inputs such as tomatoes, chili peppers, edible oils, and spices create significant challenges for producers. Weather conditions, supply chain disruptions, and inflationary pressures increase cost volatility, directly impacting profitability. Passing these costs to consumers is difficult due to intense competition and price sensitivity in several regions. Manufacturers must adopt efficient sourcing strategies and invest in supply chain resilience, but ongoing volatility remains a barrier to stable margins in the sauces and condiments market.

Stringent Food Safety and Labeling Regulations

The sauces and condiments market faces strict regulatory scrutiny related to additives, allergens, and labeling standards. Non-compliance can lead to product recalls, fines, and reputational damage, especially in highly regulated markets such as North America and Europe. Constantly changing guidelines around nutritional transparency and health claims require continuous product reformulation and packaging updates. These compliance requirements increase operational costs and delay product launches, posing challenges for both global leaders and smaller regional players competing in the market.

Regional Analysis

North America

North America held 31% share in 2024, driven by strong demand for hot sauces, barbecue sauces, and salad dressings. The U.S. leads the region with high consumption in both households and quick-service restaurants, supported by growing preference for bold and spicy flavors. Rising demand for organic, low-sodium, and gluten-free sauces reflects increasing health awareness among consumers. Canada adds growth momentum with rising adoption of ethnic cuisines and premium condiments. Well-established retail chains, including Walmart and Costco, along with the rapid expansion of e-commerce platforms, ensure wide availability, supporting consistent regional dominance in the sauces and condiments market.

Europe

Europe accounted for 27% share in 2024, supported by widespread consumption of mayonnaise, pickled sauces, and mushroom-based condiments. Strong culinary traditions in countries such as France, Germany, and the U.K. sustain steady demand, while Mediterranean flavors add to regional diversity. Consumers increasingly favor clean-label and organic condiments, aligned with the EU’s strict food safety and labeling standards. Premiumization is also notable, as specialty condiments and artisanal sauces gain traction in retail and foodservice channels. The shift toward recyclable packaging and eco-friendly practices strengthens regional competitiveness, making Europe a critical hub for innovation in the sauces and condiments industry.

Asia-Pacific

Asia-Pacific dominated the market with 34% share in 2024, led by extensive consumption of soy sauce, chili-based sauces, and traditional condiments. China, Japan, India, and Southeast Asia drive strong demand, supported by growing middle-class income and fast-paced urbanization. Expansion of quick-service restaurants and packaged food industries further accelerates adoption. The region benefits from deep cultural ties to sauces and condiments, making them essential in daily diets. Increasing e-commerce penetration and rising interest in international cuisines enhance market potential. Asia-Pacific not only remains the largest market but also represents the fastest-growing region for sauces and condiments worldwide.

Latin America

Latin America captured 6% share in 2024, supported by the rising popularity of salsas, chili sauces, and tomato-based condiments. Mexico and Brazil dominate regional demand, driven by strong culinary traditions and expanding packaged food industries. Urbanization and middle-income growth have boosted supermarket and convenience store sales, while fast-food consumption further supports adoption of condiments. International brands continue to expand their presence, while local producers retain strength in traditional and spicy flavor offerings. Despite economic fluctuations, Latin America shows steady growth prospects, making it an emerging market for global and regional sauce and condiment manufacturers.

Middle East & Africa

The Middle East and Africa accounted for 2% share in 2024, reflecting a smaller but steadily growing market. Rising demand for tahini, pickled condiments, and spice-based sauces in Gulf states and North Africa supports regional adoption. South Africa contributes significantly, driven by strong foodservice growth and preference for international brands. Expanding tourism, hospitality, and quick-service restaurants create opportunities for wider condiment use. However, infrastructure limitations and economic disparities slow large-scale adoption. Gradual modernization of retail channels and growing interest in packaged food products are expected to sustain steady growth in the sauces and condiments market across MEA.

Market Segmentations:

By Product Type

- Soy sauce

- Hot sauce

- Mushroom sauce

- Others

By Form

By Distribution Channel

- Supermarkets/hypermarkets

- Convenience stores

- Online retail

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the sauces and condiments market is shaped by leading players including Casa Fiesta, Hormel Foods Corporation, Kikkoman Corporation, Bay Valley, Lee Kum Kee, Berner Foods, Conagra Brands, General Mills, Fuchs Gewürze GmbH, and Huy Fong Foods. These companies compete by offering diverse product portfolios ranging from traditional soy and chili sauces to innovative premium condiments tailored for health-conscious consumers. Their strategies emphasize expanding global distribution, strengthening partnerships with supermarkets, online platforms, and foodservice providers, and investing in product innovation to align with shifting dietary preferences. A strong focus on organic, clean-label, and reduced-sodium offerings allows brands to capture evolving consumer demand, particularly in developed regions. Companies are also prioritizing sustainable packaging, digital marketing, and e-commerce channels to expand market reach. Expansion into emerging markets, where rising disposable incomes and fast-food growth are creating fresh opportunities, remains a key strategy for maintaining competitiveness and long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Casa Fiesta

- Hormel Foods Corporation

- Kikkoman Corporation

- Bay Valley

- Lee Kum Kee

- Berner Foods

- Conagra Brands

- General Mills

- Fuchs Gewürze GmbH

- Huy Fong Foods

Recent Developments

- In August 2025, MegaMex Foods (a Hormel partner) launched a new line of topping sauces including a Verde Habanero salsa under the La Victoria brand.

- In 2025, MegaMex (Hormel-owned) formally introduced new signature topping sauces in three flavors (Chipotle, Fiery, etc.).

- In May 2024, Huy Fong Foods again announced a production pause as pepper supply remained constrained.

- In May 2024, Huy Fong Foods halted production of its Sriracha sauce until after Labor Day, citing that its jalapeño peppers were too green for proper processing

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by rising demand for convenience and packaged foods.

- Soy sauce will continue to dominate due to its strong cultural and culinary relevance.

- Hot sauce demand will increase as consumers favor spicy and bold flavor profiles.

- Premium and health-oriented condiments will gain traction among wellness-focused consumers.

- Clean-label and organic formulations will drive product differentiation across global markets.

- Sustainable and recyclable packaging will remain a top priority for manufacturers.

- Online retail and direct-to-consumer sales will grow as e-commerce penetration strengthens.

- Asia-Pacific will maintain its lead as the largest and fastest-growing regional market.

- North America and Europe will see stable demand for premium, organic, and reduced-sodium sauces.

- Competition will intensify as global players and regional brands invest in flavor innovation and distribution expansion.