Market Overview

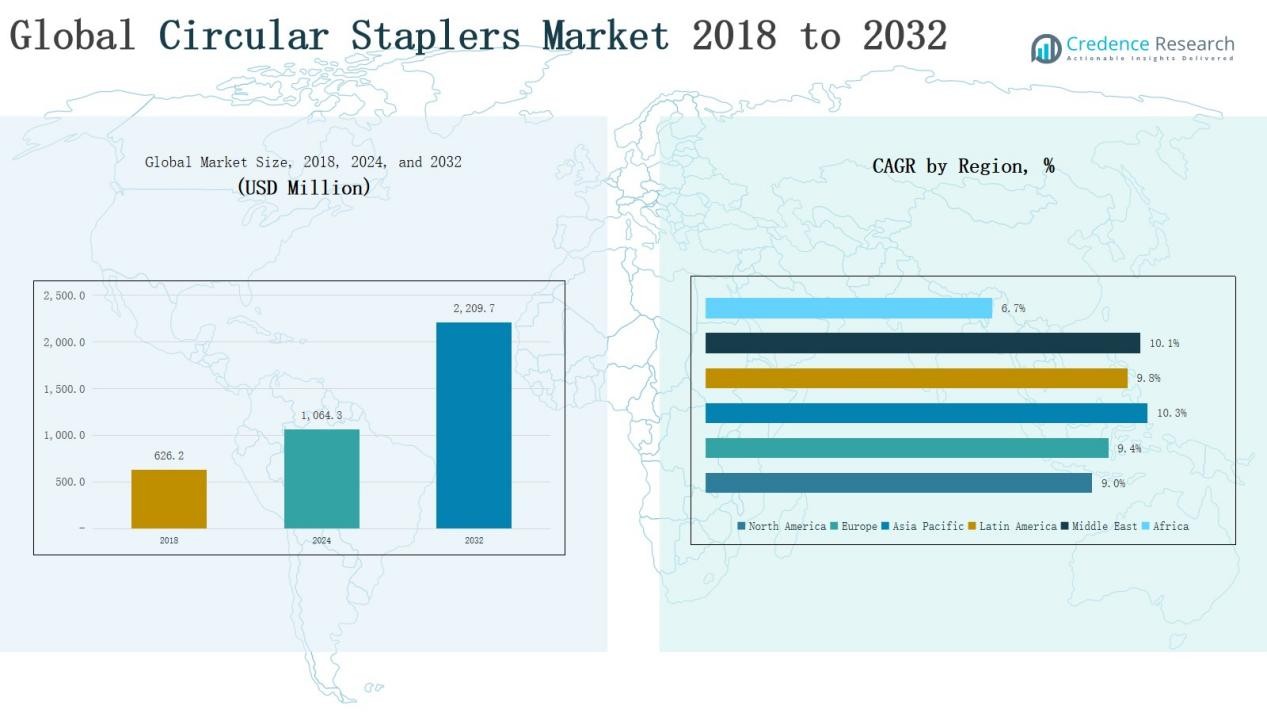

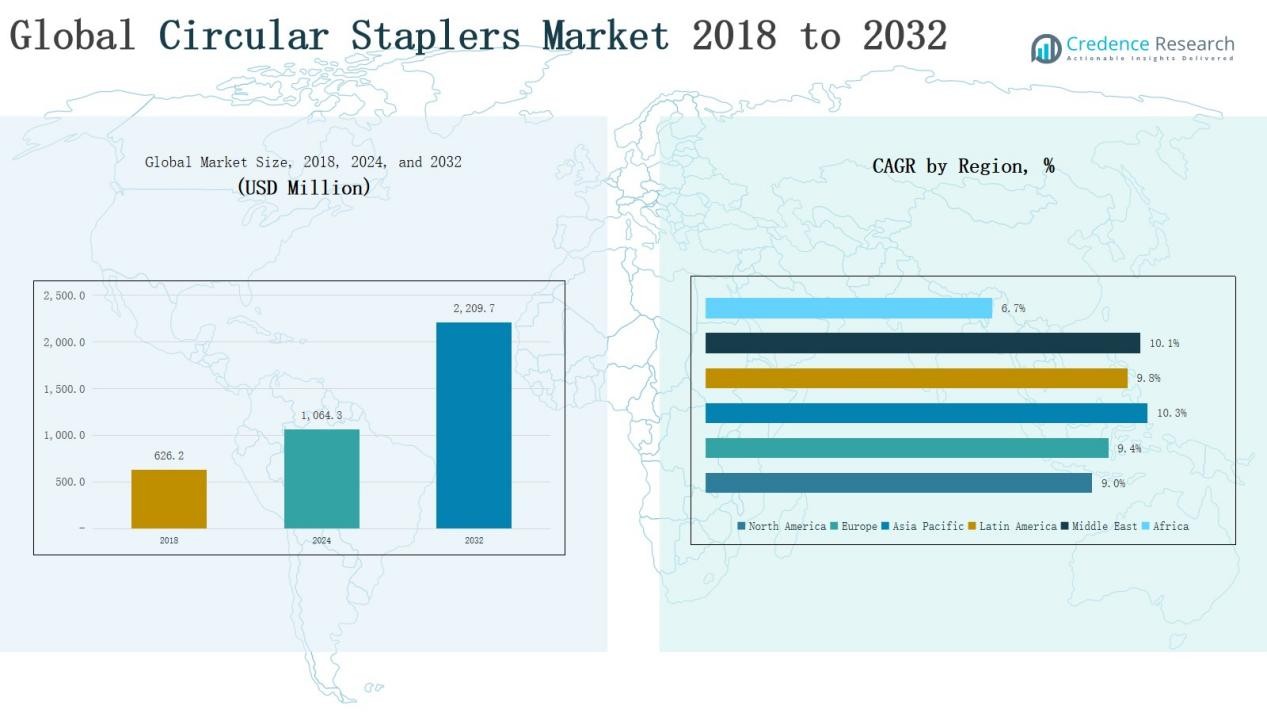

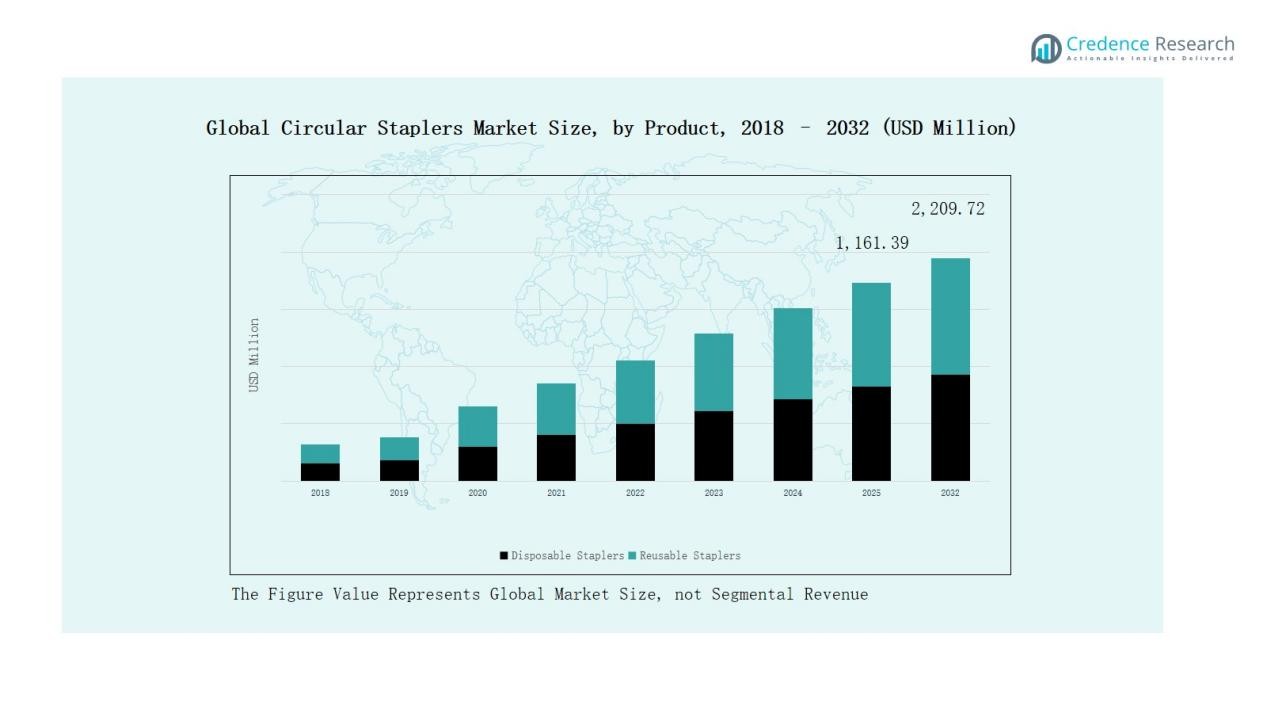

Global Circular Staplers Market size was valued at USD 626.2 million in 2018 to USD 1,064.3 million in 2024 and is anticipated to reach USD 2,209.7million by 2032, at a CAGR of 9.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Circular Staplers Market Size 2024 |

USD 1,064.3 Million |

| Circular Staplers Market, CAGR |

9.62% |

| Circular Staplers Market Size 2032 |

USD 2,209.7 Million |

The Global Circular Staplers Market is shaped by the presence of leading companies such as Medtronic Inc., Meril Life Sciences, Frankenman International, Purple Surgical, Changzhou Ankang Medical Instruments, Reach Surgical, Vector Medical Instruments, Narang Medical Instruments, and Surkon Medical. These players maintain strong positions through extensive product portfolios, technological advancements, and robust distribution networks, focusing on reusable and precision-enhanced staplers to meet rising surgical demands. Regionally, Asia Pacific emerged as the largest market in 2024 with a 38.9% share, driven by rapid healthcare infrastructure development, increasing surgical volumes, and strong adoption of advanced stapling technologies across China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Circular Staplers Market grew from USD 626.2 million in 2018 to USD 1,064.3 million in 2024 and is projected to reach USD 2,209.7 million by 2032.

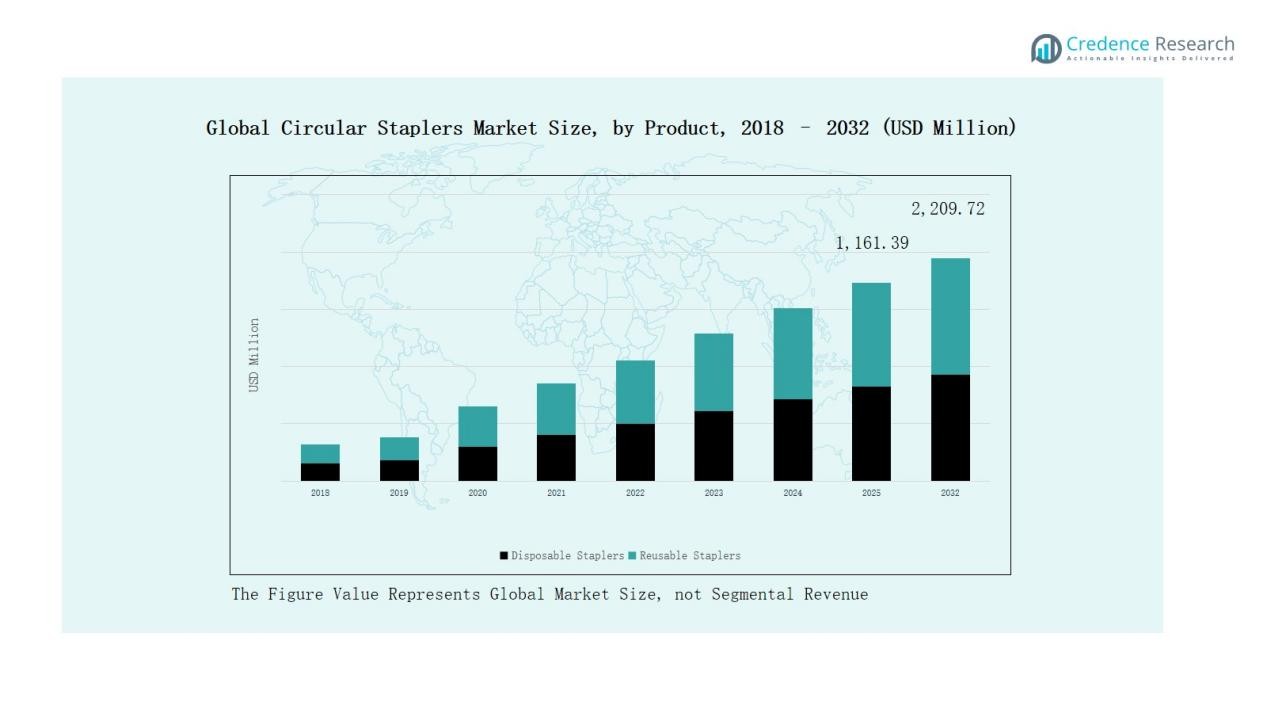

- Reusable staplers dominated with a 58% share in 2024, while metal staplers led materials with 65%, reflecting demand for cost efficiency, durability, and precision.

- Hospitals remained the leading end user with 71% share in 2024, supported by high surgical volumes, advanced infrastructure, and strong purchasing power compared to other healthcare providers.

- Asia Pacific led the market with 38.9% share in 2024, driven by expanding healthcare networks, rising colorectal surgeries, and strong adoption in China, Japan, and India.

- Key players such as Medtronic Inc., Meril Life Sciences, Frankenman International, Purple Surgical, Changzhou Ankang Medical Instruments, Reach Surgical, and Surkon Medical shape competition with innovation and distribution strength.

Market Segment Insights

By Product

Reusable staplers dominate the Global Circular Staplers Market with a revenue share of 58% in 2024. Their leadership stems from cost efficiency in repeated use, rising adoption in high-volume surgical procedures, and growing preference in developed healthcare systems for sustainable solutions. Disposable staplers, holding the remaining share, gain traction in infection control-sensitive environments but lag due to higher per-procedure costs.

- For instance, Ethicon’s ECHELON Circular Powered Stapler showed a 74% reduction in anastomotic leak rates compared to manual staplers, demonstrating its clinical safety and efficacy while being single-use.

By Material

Metal circular staplers lead the market with a 65% revenue share in 2024, supported by durability, precision, and reliability during complex surgeries. Their robust structure reduces mechanical failures and enhances patient outcomes, driving demand across hospitals globally. Plastic staplers account for the rest, with rising use in cost-sensitive markets where affordability and lightweight designs are prioritized.

- For instance, EziSurg Medical disclosed ongoing R&D developments on ultrasonic surgical staplers, aiming to improve surgical outcomes by combining stapling with ultrasonic tissue sealing technology, targeting reductions in operative time and complications.

By End User

Hospitals represent the largest end-user segment, contributing 71% of the market share in 2024. Their dominance is driven by the high volume of surgical procedures, strong purchasing power, and advanced infrastructure enabling wide adoption of both reusable and metal-based staplers. Ambulatory surgical centers hold a smaller but growing share, driven by the trend toward minimally invasive procedures and outpatient care. The “Others” category, including specialty clinics, accounts for a limited portion with niche applications.

Key Growth Drivers

Rising Surgical Volumes and Prevalence of Chronic Diseases

The increasing incidence of colorectal cancer, obesity, and gastrointestinal disorders is driving surgical demand worldwide. Circular staplers are extensively used in procedures such as colorectal resections, gastric bypass, and esophageal surgeries. Hospitals and surgical centers prefer staplers for their efficiency in reducing procedure time and enhancing precision. With an aging global population and rising lifestyle-related conditions, the demand for minimally invasive and advanced surgical instruments is set to expand, making circular staplers a critical tool in modern surgical care.

- For instance, Johnson & Johnson MedTech (Ethicon) launched a circular stapler tailored for variable tissue thickness, expanding its advanced-energy portfolio and improving outcomes in gastrointestinal surgeries.

Shift Toward Minimally Invasive Procedures

Global healthcare systems are increasingly prioritizing minimally invasive surgical approaches due to faster recovery, reduced hospital stays, and lower overall costs. Circular staplers play a crucial role in enabling such procedures, particularly in laparoscopic and robotic-assisted surgeries. Their precision in creating secure anastomoses enhances patient safety and clinical outcomes. Growing patient preference for minimally invasive options, combined with rising adoption of advanced surgical technologies, is fueling consistent demand for circular staplers across hospitals and ambulatory surgical centers.

Technological Advancements in Stapling Devices

Continuous innovation in stapler design and functionality is driving market growth. Manufacturers are introducing staplers with enhanced ergonomics, better staple line security, and reduced risk of leakage. The integration of lightweight materials and single-use innovations also expands adoption in infection-sensitive environments. Furthermore, advancements in powered stapling devices support efficiency and ease of use during complex surgeries. These improvements not only enhance surgeon confidence but also ensure greater patient safety, reinforcing the preference for modern circular staplers in operating rooms globally.

- For instance, Ethicon (Johnson & Johnson MedTech) introduced the ECH60L+ Powered Circular Stapler, designed with 3D staple technology to minimize leaks and ensure uniform compression during colorectal surgeries.

Key Trends & Opportunities

Growing Adoption in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa present significant growth opportunities. Rapid improvements in healthcare infrastructure, rising disposable incomes, and increasing awareness of advanced surgical techniques are boosting demand for circular staplers. Governments in these regions are also investing in expanding hospital networks and adopting cost-effective surgical devices. With multinational companies expanding distribution networks and local manufacturers entering the market, emerging regions are expected to register faster adoption rates, creating long-term opportunities for circular stapler suppliers.

- For instance, India’s Apollo Hospitals Group partnered with Intuitive and global device makers to scale robotic and stapler-assisted surgeries, highlighting rising institutional adoption across emerging markets.

Sustainability and Reusable Device Preference

Sustainability is becoming a central trend across the surgical device industry. Healthcare providers in developed markets are increasingly shifting toward reusable staplers to reduce medical waste and overall costs. Hospitals recognize the environmental benefits of minimizing disposable instruments while maintaining efficiency in high-volume surgeries. This trend also aligns with global regulatory push for greener practices in healthcare. Manufacturers offering durable, sterilizable, and cost-effective reusable staplers are positioned to gain competitive advantage in this evolving market landscape.

- For instance, Covidien introduced the fully powered, reusable, battery-operated endoscopic surgical iDrive Ultra stapling system, which was compatible with their market-leading portfolio of disposable stapling reloads.

Key Challenges

High Cost of Advanced Surgical Staplers

Circular staplers, particularly powered and technologically advanced variants, involve significant upfront costs. Many healthcare systems in low- and middle-income countries struggle with affordability, limiting access. Even in developed markets, budget constraints in smaller hospitals and surgical centers can slow adoption. The high per-unit price and additional costs for accessories and maintenance create a financial barrier for widespread penetration, particularly when alternatives such as sutures are more cost-effective. This continues to challenge manufacturers in expanding market reach globally.

Risk of Post-Surgical Complications

Despite technological progress, circular staplers remain associated with risks such as anastomotic leakage, bleeding, and stricture formation. These complications can result in extended hospital stays, additional surgeries, and increased healthcare costs, creating concerns among surgeons and patients. Negative outcomes undermine surgeon confidence and may lead to cautious adoption, particularly in sensitive procedures like colorectal surgeries. Addressing these risks through improved design, safety features, and clinical training remains a critical challenge for manufacturers competing in this market.

Regulatory and Compliance Barriers

The medical device industry faces stringent regulatory approvals, clinical testing requirements, and compliance standards. Circular staplers must adhere to rigorous safety, efficacy, and sterilization protocols before entering markets. Delays in approvals, coupled with varying regional regulatory frameworks, create hurdles for product launches and global distribution. Manufacturers also face challenges in meeting evolving compliance demands related to patient safety and sustainable manufacturing. Navigating this complex regulatory environment requires high investment and slows time-to-market, limiting competitive flexibility.

Regional Analysis

North America

North America held a 26.2% share of the Global Circular Staplers Market in 2024, generating USD 244.97 million. The region is projected to reach USD 486.14 million by 2032 at a CAGR of 9.0%. Growth is fueled by advanced healthcare infrastructure, high surgical procedure volumes, and early adoption of technologically advanced staplers. Strong presence of leading medical device companies and rising demand for minimally invasive surgeries further strengthen the market. U.S. accounts for the largest share, supported by robust reimbursement policies and increasing prevalence of gastrointestinal disorders requiring surgical intervention.

Europe

Europe accounted for 32.4% of the global market in 2024, with revenue of USD 302.28 million, expected to rise to USD 616.51 million by 2032, growing at a CAGR of 9.4%. The region’s dominance is supported by established surgical practices, favorable government healthcare spending, and widespread adoption of reusable staplers. Countries such as Germany, France, and the UK lead in procedure volumes, particularly in colorectal and bariatric surgeries. Strong clinical focus on patient safety and the presence of key European manufacturers also reinforce the region’s competitive strength in circular staplers adoption.

Asia Pacific

Asia Pacific held the largest share at 38.9% in 2024, valued at USD 363.77 million, and is projected to reach USD 793.29 million by 2032, recording the fastest CAGR of 10.3%. Rapid healthcare infrastructure development, expanding hospital networks, and rising patient awareness drive growth. High prevalence of colorectal cancer and obesity-related surgeries in China, Japan, and India boosts adoption of staplers. Additionally, growing investments from multinational players and increasing demand for minimally invasive surgeries in emerging economies position Asia Pacific as the key growth engine for the circular staplers market globally.

Latin America

Latin America represented 7.9% of the global market in 2024, generating USD 74.26 million, and is forecasted to reach USD 156.45 million by 2032, advancing at a CAGR of 9.8%. Growth is supported by increasing healthcare expenditure, rising number of specialty hospitals, and gradual adoption of minimally invasive techniques in Brazil and Argentina. Market expansion is further encouraged by government initiatives to modernize surgical facilities and improve patient outcomes. However, limited affordability and uneven access to advanced surgical devices across the region present constraints to wider circular staplers adoption.

Middle East

The Middle East accounted for 5.6% of the global market in 2024, with revenue of USD 52.33 million, projected to reach USD 112.70 million by 2032 at a CAGR of 10.1%. Demand is driven by rapid improvements in healthcare infrastructure, growing prevalence of lifestyle-related disorders, and increasing adoption of advanced surgical technologies. GCC countries dominate due to higher investments in healthcare modernization, while Turkey and Israel contribute significantly with rising procedural volumes. Expanding partnerships with global medical device manufacturers further boost accessibility to circular staplers in the region.

Africa

Africa held the smallest share at 2.8% in 2024, with revenue of USD 26.67 million, expected to grow to USD 44.64 million by 2032 at a CAGR of 6.7%. Growth is mainly driven by gradual improvements in healthcare facilities, rising government investment, and expanding private healthcare networks. South Africa and Egypt lead the market, supported by higher surgical procedure volumes compared to the rest of the region. However, limited awareness, affordability issues, and lower access to advanced surgical devices continue to restrict large-scale adoption of circular staplers across most African countries.

Market Segmentations:

By Product

- Reusable Staplers

- Disposable Staplers

By Material

- Plastic Circular Staplers

- Metal Circular Staplers

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Global Circular Staplers Market is moderately consolidated, with a mix of multinational corporations and regional manufacturers competing for share. Leading players such as Medtronic Inc., Meril Life Sciences, Frankenman International, Purple Surgical, and Changzhou Ankang Medical Instruments dominate through extensive product portfolios, strong distribution networks, and continuous investments in innovation. These companies focus on developing staplers with enhanced ergonomics, improved staple-line security, and reusable designs to meet hospital demands for cost efficiency and sustainability. Regional manufacturers, including Surkon Medical, Reach Surgical, and Narang Medical Instruments, strengthen competition by offering cost-effective alternatives and expanding presence in emerging markets. Strategic initiatives such as partnerships with healthcare providers, mergers, acquisitions, and geographic expansion remain central to competitive positioning. Rising demand for reusable devices and minimally invasive procedures is pushing companies to differentiate through advanced technology and tailored offerings, intensifying competition across both developed and emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Changzhou Ankang Medical Instruments

- Medtronic Inc.

- Meril Life Sciences

- Frankenman International

- Purple Surgical

- Reach Surgical

- Vector Medical Instruments

- Narang Medical Instruments

- Surkon Medical

- Other Key Players

Recent Developments

l In June 2025, Johnson & Johnson launched the Ethicon 4000 Stapler featuring advanced stapling technology designed for the OTTAVA Robotic Surgical System.

l In May 2024, Lexington Medical launched the AEON-Powered Stapling System, a linear surgical stapler, marking a significant product introduction in surgical staplers.

l In 2024, Medtronic rolled out a new disposable circular stapler equipped with advanced safety features, aimed at supporting rising surgical procedure volumes worldwide.

l In May 2024, Johnson & Johnson MedTech introduced the ECHELON LINEAR™ Cutter, the first surgical stapler with combined 3D-Stapling and Gripping Surface Technology, reducing staple-line leaks by 47%.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Hospitals will continue to drive the majority of demand due to high surgical volumes.

- Adoption of reusable staplers will increase as healthcare systems prioritize cost efficiency.

- Technological advancements will enhance precision, safety, and ease of use in surgeries.

- Asia Pacific will emerge as the fastest-growing region with expanding healthcare infrastructure.

- Rising prevalence of gastrointestinal and obesity-related conditions will boost procedure volumes.

- Ambulatory surgical centers will gain market share as outpatient procedures expand.

- Regulatory focus on patient safety will push manufacturers to innovate safer devices.

- Sustainability initiatives will accelerate the shift toward environmentally friendly reusable staplers.

- Local manufacturers in emerging markets will strengthen competition with affordable solutions.

- Strategic collaborations and product launches will shape competitive differentiation globally.