Market Overview

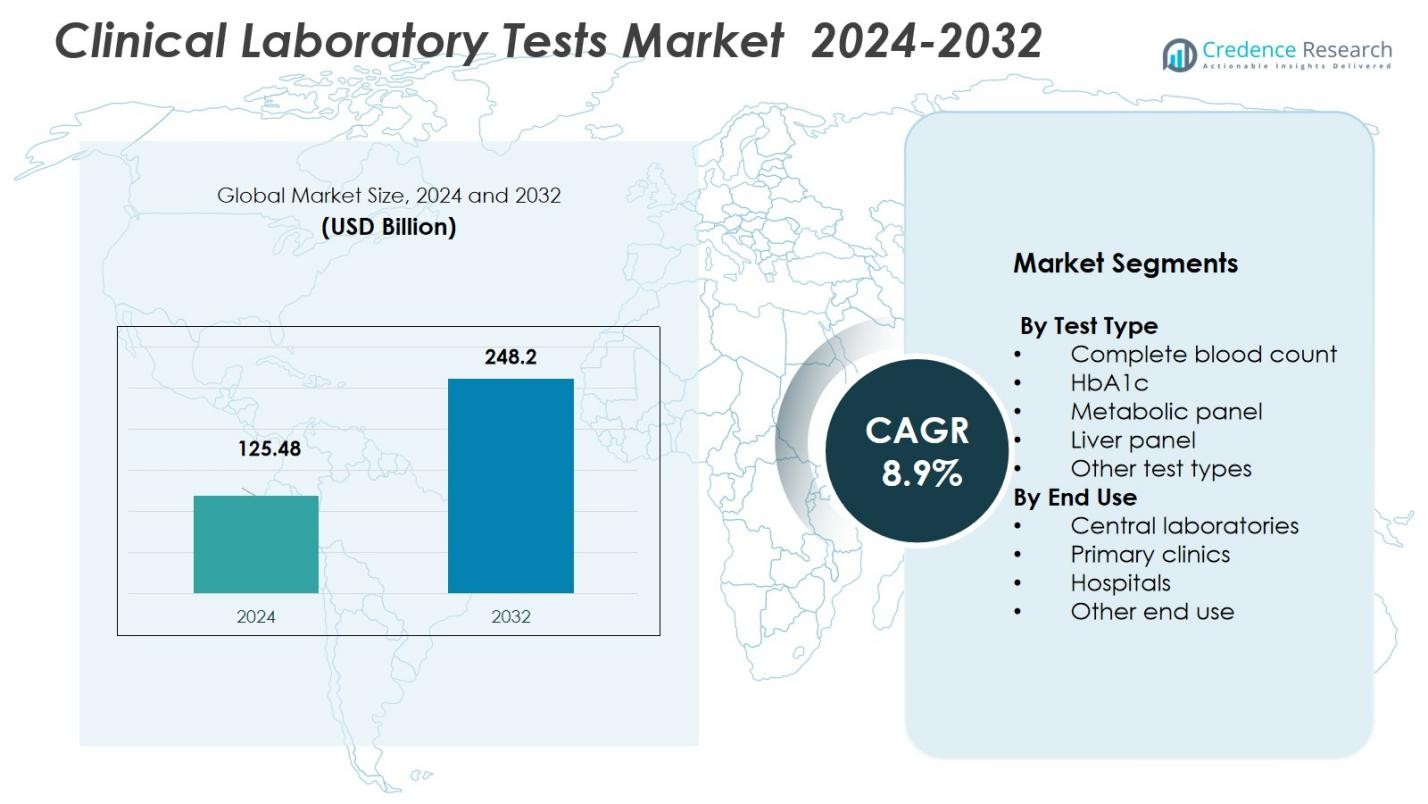

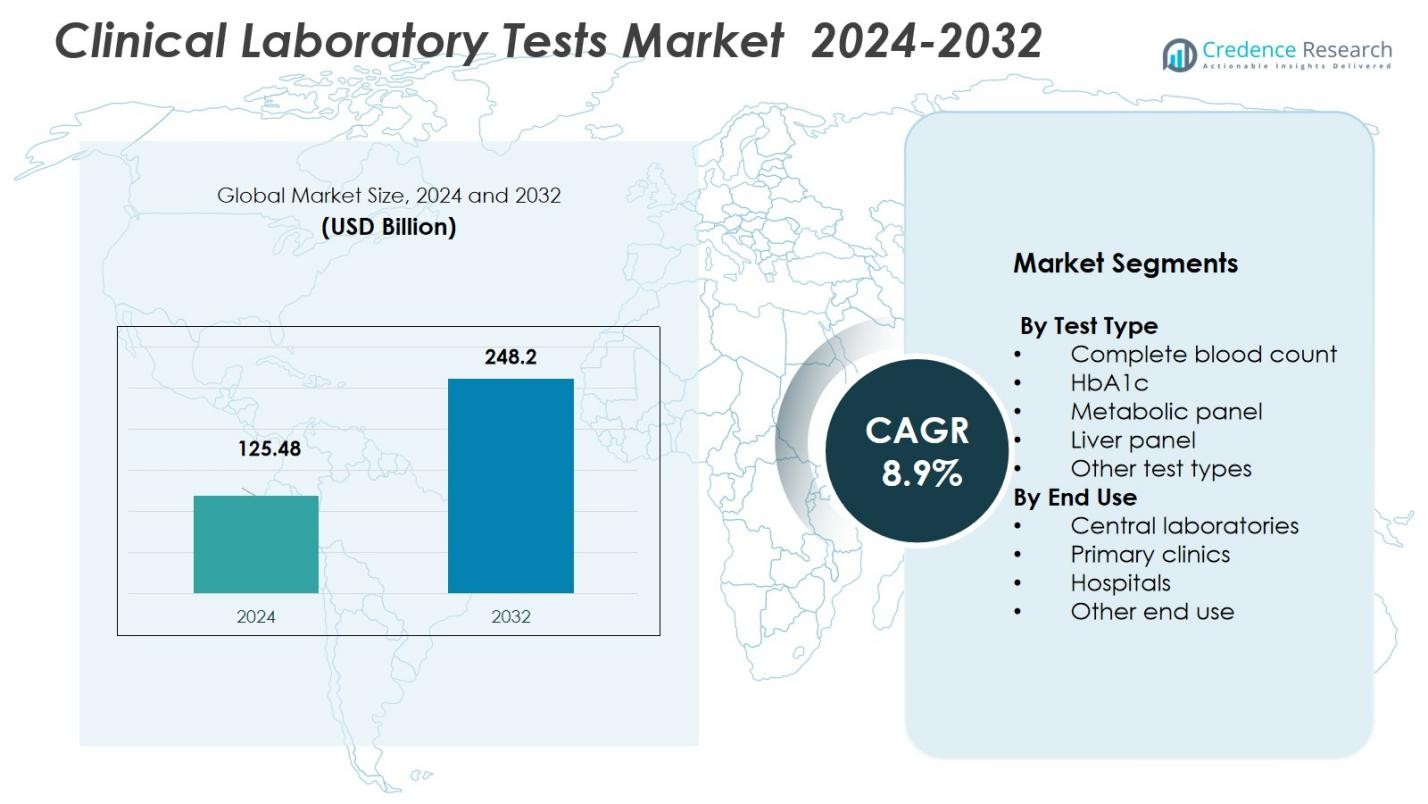

The Clinical Laboratory Tests Market size was valued at USD 125.48 Billion in 2024 and is anticipated to reach USD 248.2 Billion by 2032, at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Laboratory Tests Market Size 2024 |

USD 125.48 Billion |

| Clinical Laboratory Tests Market, CAGR |

8.9% |

| Clinical Laboratory Tests Market Size 2032 |

USD 248.2 Billion |

The Clinical Laboratory Tests Market features leading players such as Abbott Laboratories, F. Hoffmann‑La Roche Ltd., Danaher Corporation, bioMérieux, Bio-Rad Laboratories, Becton, Dickinson and Company (BD), Agilent Technologies, Hologic, Inc. and Illumina, Inc., which together shape global diagnostics offerings. Market growth draws most heavily from the North America region, which accounted for a 47.40% share in 2024, supported by advanced healthcare infrastructure, high testing volumes, and widespread adoption of modern diagnostic technologies. Other regions, including Asia‑Pacific and Europe, continue to contribute meaningfully as investments in healthcare infrastructure and testing capabilities expand globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Clinical Laboratory Tests Market size was valued at USD 125.48 Billion in 2024 and is expected to reach USD 248.2 Billion by 2032, growing at a CAGR of 8.9% during the forecast period.

- The rising prevalence of chronic diseases, such as diabetes and cardiovascular diseases, is driving the demand for routine and specialized diagnostic testing across the globe.

- Increasing adoption of automation, AI in diagnostics, and high-throughput testing platforms are key trends enhancing testing accuracy, speed, and efficiency.

- The Central Laboratories segment leads the market with a 45% share in 2024, driven by economies of scale and high-volume testing capabilities, particularly in North America, which holds 47.4% of the market share.

- Regulatory hurdles and reimbursement challenges remain as key restraints, especially in emerging markets where healthcare access is limited and policy frameworks are evolving.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Test Type:

The Clinical Laboratory Tests Market is dominated by the Complete Blood Count (CBC) sub-segment, which holds the largest share due to its widespread use in diagnosing a range of conditions, including anemia, infection, and leukemia. The CBC test’s versatility and cost-effectiveness drive its dominance, representing a significant portion of the market share at 32% in 2024. Other test types such as HbA1c, metabolic panels, and liver panels are also significant contributors, driven by increasing chronic disease prevalence and advancements in diagnostic technologies that improve test accuracy and speed.

- For instance, Roche Diagnostics has enhanced diagnostic precision for conditions like diabetes and kidney disease through the introduction of AI-powered digital solutions rather than solely through changes to metabolic panel assays.

By End Use:

The Central Laboratories sub-segment commands the largest share of the Clinical Laboratory Tests Market, holding 45% of the market share in 2024. Central laboratories benefit from economies of scale, high throughput capabilities, and their ability to handle a wide variety of tests, which drive demand from hospitals, clinics, and research institutions. Hospitals and primary clinics are also significant end users, with increasing healthcare infrastructure and demand for rapid diagnostic services contributing to the growth of these sub-segments. The rise of outpatient care and diagnostic outsourcing further supports the central laboratory segment’s dominance.

- For instance, Labcorp operates a network of global central labs and offers “integrated central laboratory support” for large clinical‑trial and diagnostic workloads enabling standardized testing and higher throughput than smaller in‑house labs.

Key Growth Drivers

Increasing Prevalence of Chronic Diseases

The rising global burden of chronic diseases such as diabetes, cardiovascular diseases, and cancer is a significant growth driver for the Clinical Laboratory Tests Market. As these diseases become more prevalent, the demand for regular diagnostic testing, including blood tests, metabolic panels, and HbA1c tests, is accelerating. Early detection through clinical laboratory testing plays a crucial role in managing chronic conditions, enhancing patient outcomes, and reducing healthcare costs, further fueling market growth. This trend is expected to continue as healthcare systems focus on preventive care.

- For instance, Roche Diagnostics reported that its HbA1c test system improved diabetes monitoring accuracy, aiding in better patient management.

Technological Advancements in Diagnostics

Ongoing technological advancements in diagnostic tools and techniques are significantly enhancing the accuracy, speed, and cost-effectiveness of clinical laboratory tests. Innovations such as automation, artificial intelligence (AI), and high-throughput diagnostic systems are enabling faster results with greater precision. These advancements are improving the overall efficiency of clinical laboratories and driving adoption across healthcare settings. As the demand for more accurate and rapid diagnostic solutions grows, these technological improvements are expected to drive significant growth in the clinical laboratory tests market.

- For instance, Thermo Fisher Scientific’s Ion Torrent Genexus System delivers next-generation sequencing results within 24 hours, dramatically speeding up genetic testing processes

Rising Demand for Point-of-Care Testing

The increasing demand for point-of-care (POC) testing is another key driver for the Clinical Laboratory Tests Market. POC testing enables quicker diagnosis and faster decision-making, reducing the need for patients to visit central laboratories. With healthcare becoming more decentralized and mobile, the convenience of testing at home or in primary care settings is becoming more popular. The ongoing adoption of POC devices in outpatient care, emergency medical services, and rural areas is expected to continue driving market growth, especially for tests such as blood glucose and cholesterol.

Key Trends & Opportunities

Shift Towards Home-Based Testing

There is a growing trend towards home-based clinical laboratory testing, driven by patient demand for convenience, reduced healthcare costs, and faster results. Consumers increasingly prefer testing services that can be performed at home, such as blood glucose monitoring, cholesterol testing, and pregnancy tests. The market is witnessing the launch of new, user-friendly diagnostic kits that enable patients to conduct tests at home and send samples to central laboratories for analysis. This trend is creating new opportunities for companies in the clinical laboratory testing market, as more players enter the home-testing segment.

- For instance, Abbott’s FreeStyle Libre system allows diabetic patients to monitor glucose levels continuously at home without frequent finger pricks.

Growth of Personalized Medicine

Personalized medicine, which tailors healthcare treatments based on individual genetic and biomarker profiles, is creating a significant opportunity in the clinical laboratory tests market. With the increasing use of genetic testing, such as genomics and biomarker-based tests, physicians can offer customized treatment plans for patients. This shift towards precision medicine is driving the demand for specialized laboratory tests that cater to genetic predispositions and treatment responses. As the focus on personalized care intensifies, clinical laboratories are capitalizing on this trend by offering more targeted, individualized testing services.

- For instance, Thermo Fisher Scientific’s Oncomine assays help identify specific mutations to guide targeted treatments in oncology.

Key Challenges

Regulatory and Reimbursement Challenges

One of the significant challenges faced by the Clinical Laboratory Tests Market is navigating complex regulatory and reimbursement landscapes. Governments and regulatory bodies impose stringent requirements on clinical laboratory tests, which can delay product approval and market entry. Additionally, reimbursement policies for diagnostic tests vary by region and can create barriers to widespread adoption, particularly for newer or more specialized tests. These challenges may hinder the growth of the market, especially in emerging economies where regulatory frameworks may not be as robust.

Sample Contamination and Quality Control Issues

Another challenge in the Clinical Laboratory Tests Market is ensuring sample integrity and maintaining high standards of quality control. Contamination of samples or errors in test procedures can lead to inaccurate results, potentially affecting patient diagnosis and treatment. Maintaining strict quality control measures is essential for clinical laboratories to ensure the reliability and accuracy of test results. However, managing quality control consistently across different laboratory settings remains a complex and costly task, particularly as laboratory volumes increase, posing an ongoing challenge for the market.

Regional Analysis

North America

North America leads the global Clinical Laboratory Tests Market, accounting for 47.4% of the market share in 2024. This dominance stems from advanced healthcare infrastructure, widespread adoption of diagnostic technologies, and high testing volumes driven by a large and aging population with significant chronic disease burden. Well‑established central laboratories and robust healthcare reimbursement frameworks further support the region’s strong market position. The region’s early adoption of novel diagnostics and regulatory support for preventive healthcare continue to drive sustained demand.

Asia‑Pacific

The Asia‑Pacific region is emerging as the fastest-growing region in the Clinical Laboratory Tests Market, with a projected growth rate contributing to a market share of 28.5% by 2032. Expansion of healthcare infrastructure, rising healthcare awareness, and increasing prevalence of chronic and lifestyle diseases propel growth. Governments in countries such as India, China, and Southeast Asian nations are investing in diagnostic capabilities, while private diagnostic chains are expanding reach. Enhanced access to tests, growing middle-class populations, and increasing out-of-pocket healthcare expenditure contribute to rising adoption of laboratory testing across urban and rural areas.

Europe

Europe holds a substantial portion of the global Clinical Laboratory Tests Market, with a share of 30% in 2024. This growth is supported by advanced healthcare systems, high per‑capita healthcare spending, and rising demand for early disease detection. The region benefits from strong regulatory frameworks, high adoption of automated and high-throughput diagnostic technologies, and well-established central laboratory networks. An aging population and rising prevalence of chronic conditions such as cardiovascular disease and diabetes further sustain demand for routine and specialized testing across hospitals, clinics, and independent labs.

Latin America

Latin America’s share of the Clinical Laboratory Tests Market stands at 7.2% in 2024, with steady growth driven by expanding healthcare access, rising awareness of diagnostics, and increasing disease burden. Governments across key countries are investing in public health infrastructure and diagnostic capabilities. Improved health insurance coverage and growing private healthcare providers are boosting demand for both routine and advanced laboratory tests. However, economic variability and structural disparities in rural vs. urban healthcare access influence the growth pace.

Middle East & Africa

The Middle East & Africa region holds a 6.9% share of the global Clinical Laboratory Tests Market, gradually strengthening its position through rising investments in healthcare infrastructure and growing demand for preventive diagnostics. Governments in some countries are promoting diagnostic and screening programs to address the increasing incidence of chronic diseases. Expansion of private diagnostic chains, international collaborations, and gradual adoption of advanced diagnostic technologies support market growth. Nonetheless, challenges such as uneven access to healthcare, limited lab capacity in remote areas, and workforce shortages continue to constrain full regional potential.

Market Segmentations:

By Test Type

- Complete blood count

- HbA1c

- Metabolic panel

- Liver panel

- Other test types

By End Use

- Central laboratories

- Primary clinics

- Hospitals

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Clinical Laboratory Tests Market is highly competitive, with key players including Abbott Laboratories, F. Hoffmann-La Roche Ltd., Danaher Corporation, bioMérieux, Bio-Rad Laboratories, Becton, Dickinson and Company (BD), Agilent Technologies, Hologic, Inc., and Illumina, Inc. These companies maintain strong market positions through extensive product portfolios, advanced diagnostic technologies, and continuous investment in research and development. They differentiate themselves by offering comprehensive, integrated diagnostic solutions that include test reagents, instruments, and software. Innovation in areas such as molecular diagnostics, automation, and point-of-care testing is crucial to their competitive strategies. Additionally, geographic expansion, particularly in emerging markets, and compliance with stringent regulatory standards are key factors that drive competition. The ongoing focus on improving diagnostic accuracy, speed, and efficiency, coupled with the growing demand for personalized medicine, strengthens the position of these players in the global market.

Key Player Analysis

- Grifols

- Abbott Laboratories

- Hologic

- F. Hoffmann-La Roche

- Becton, Dickinson and Company

- Danaher

- Illumina

- Agilent Technologies

- Bio-Rad Laboratories

- bioMérieux

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In September 2025, Labcorp completed the acquisition of select oncology and clinical testing assets of BioReference Health, expanding its oncology diagnostics and clinical testing services.

- In May 2025, Roche entered into a collaboration with Broad Clinical Labs to adopt its new SBX sequencing technology aiming to integrate advanced whole‑genome sequencing, especially for critically ill newborns and their parents.

- In August 2025, Quest Diagnostics acquired clinical‑testing assets from Fresenius Medical Care to enable accelerated testing services for dialysis‑clinic patients, improving turnaround times and access to diagnostics.

Report Coverage

The research report offers an in-depth analysis based on Test Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to continue growing due to the increasing demand for diagnostic testing driven by the rising prevalence of chronic diseases.

- Advances in molecular diagnostics and next-generation sequencing technologies will play a significant role in expanding testing capabilities.

- Automation in laboratory processes will improve efficiency, reduce human error, and accelerate test results, fostering market growth.

- The demand for point-of-care testing is anticipated to rise, especially in outpatient care, home testing, and rural areas.

- Integration of artificial intelligence and machine learning into diagnostic tools will enhance accuracy and help streamline laboratory workflows.

- Personalized medicine will continue to drive the need for specialized tests that cater to individual genetic profiles and disease conditions.

- Expanding healthcare infrastructure in emerging markets will create new opportunities for diagnostic testing adoption.

- There will be an increasing focus on non-invasive diagnostic techniques, reducing the need for traditional invasive testing methods.

- Regulatory advancements and standardization in diagnostic testing will improve the consistency and reliability of laboratory results.

- Rising awareness of preventive healthcare and early disease detection will lead to greater adoption of routine testing among patients and healthcare providers.

Market Segmentation Analysis:

Market Segmentation Analysis: