Market Overview:

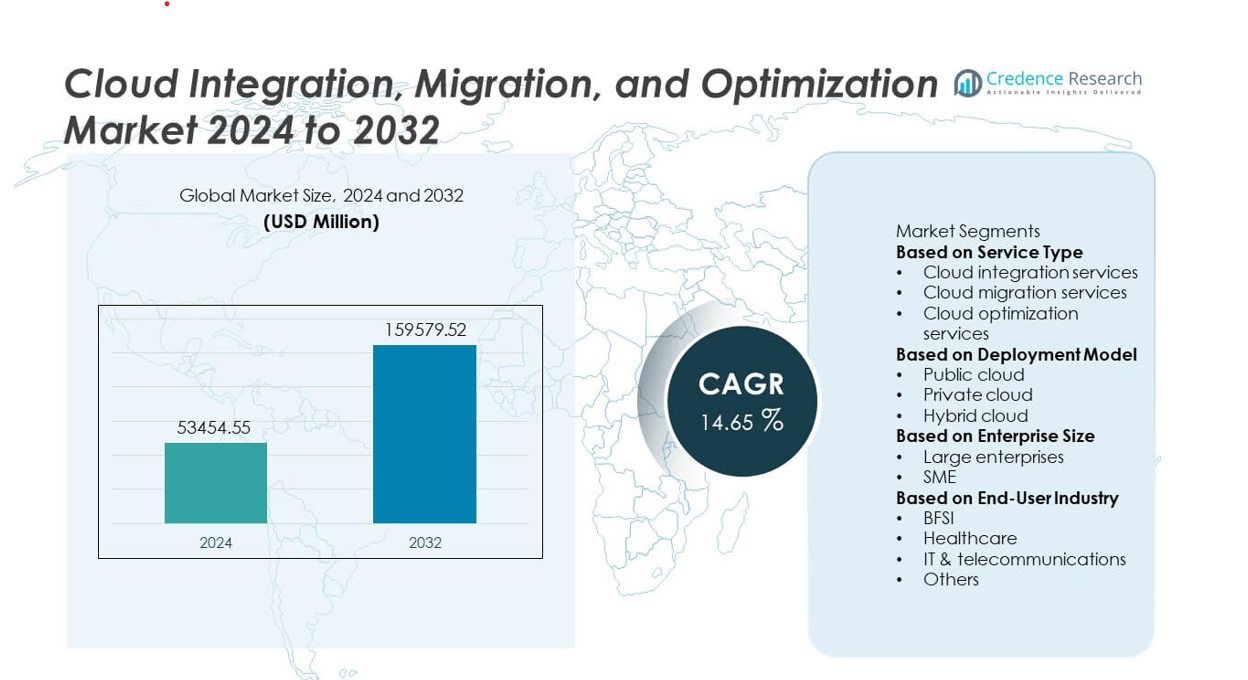

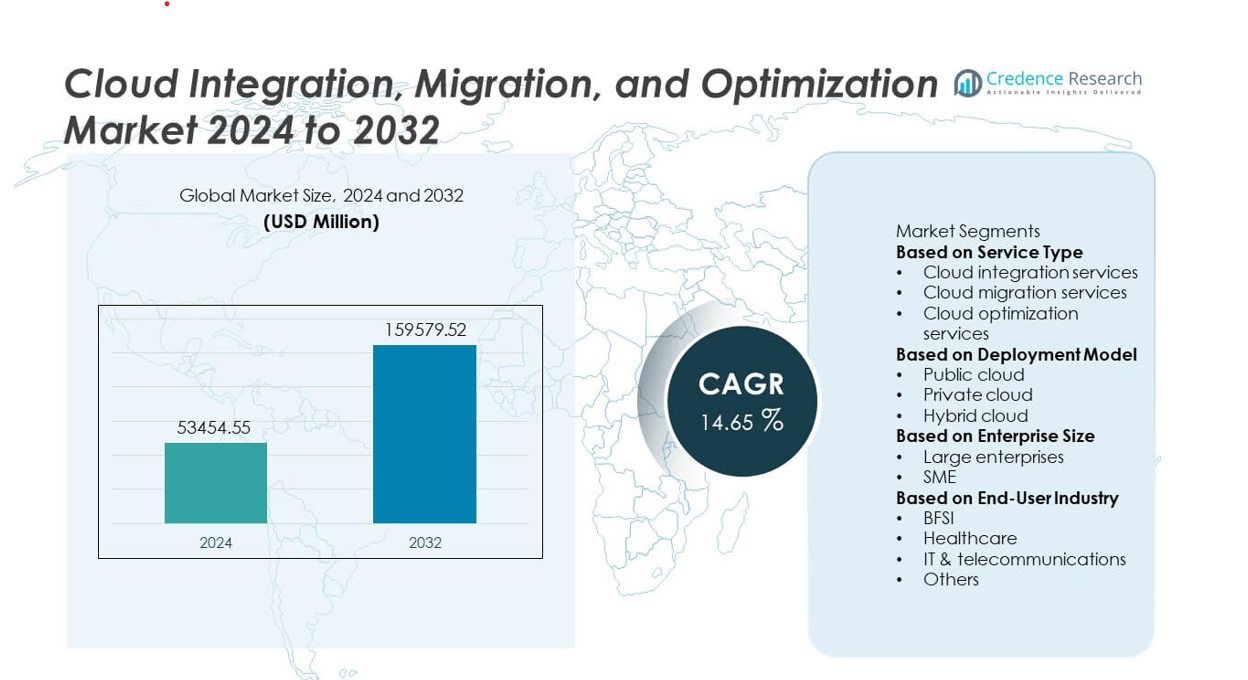

The Cloud Integration, Migration, and Optimization Market was valued at USD 53454.55 million in 2024 and is projected to reach USD 159579.52 million by 2032, expanding at a CAGR of 14.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Integration, Migration, and Optimization Market Size 2024 |

USD 53454.55 million |

| Cloud Integration, Migration, and Optimization Market, CAGR |

14.65% |

| Cloud Integration, Migration, and Optimization Market Size 2032 |

USD 159579.52 million |

The Cloud Integration, Migration, and Optimization market is led by major players such as Infosys Limited, VMware (Broadcom), Accenture plc, Oracle Corporation, Rackspace Technology, Google LLC, Deloitte Touche Tohmatsu Limited, IBM Corporation, Microsoft Corporation, and Amazon Web Services (AWS). These companies dominate through strategic collaborations, cloud modernization services, and AI-driven optimization platforms that enhance performance and reduce operational costs. North America led the market in 2024 with a 39.1% share, driven by strong cloud adoption and digital transformation initiatives, followed by Europe with 27.5% and Asia-Pacific with 25.8%, where rapid industrial digitization and government cloud initiatives continue to accelerate growth.

Market Insights

- The Cloud Integration, Migration, and Optimization market was valued at USD 53454.55 million in 2024 and is projected to reach USD 159579.52 million by 2032, growing at a CAGR of 14.65% during the forecast period.

- Rising multi-cloud adoption and accelerated digital transformation initiatives are driving demand for integration, migration, and optimization services across industries.

- Key trends include the integration of AI and automation, increasing adoption of hybrid cloud models, and rising investments in workload performance optimization.

- The market is highly competitive, with players such as Microsoft, IBM, Accenture, Oracle, and Amazon Web Services focusing on hybrid solutions, automation, and consulting-led digital modernization strategies.

- North America held 39.1% of the market in 2024, followed by Europe at 27.5% and Asia-Pacific at 25.8%, while the hybrid cloud segment accounted for 52.1% of total deployment due to growing enterprise preference for flexible and secure cloud environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

Cloud migration services dominated the Cloud Integration, Migration, and Optimization market in 2024, accounting for 47.6% of the total share. The dominance is driven by the growing enterprise shift from on-premises infrastructure to scalable cloud platforms. Businesses are prioritizing migration services to improve agility, reduce operational costs, and modernize legacy systems. Increasing adoption of AI-based automation tools and workload assessment frameworks further supports seamless transition and performance optimization. Major cloud providers such as Amazon Web Services, Microsoft Azure, and Google Cloud continue to expand managed migration offerings to meet evolving enterprise needs.

- For instance, Microsoft Azure’s Migrate program is designed to scale for large workload transitions, enabling users to discover and assess up to 35,000 servers in a single project.

By Deployment Model

The hybrid cloud segment held the largest share of 52.1% in the Cloud Integration, Migration, and Optimization market in 2024. Its leadership stems from enterprises’ preference for combining public and private cloud environments to balance flexibility, data security, and cost efficiency. Hybrid models enable organizations to integrate workloads seamlessly while maintaining regulatory compliance and data sovereignty. Growing reliance on sensitive data storage and the need for real-time connectivity across distributed systems further drive adoption. Continuous investments by IBM, Dell Technologies, and VMware in hybrid cloud platforms strengthen the segment’s market position globally.

- For instance, VMware Cloud Foundation (VCF) is a comprehensive hybrid cloud platform that provides a complete set of software-defined services for compute, storage, networking, security, and cloud management to run enterprise applications in private or public environments.

By Enterprise Size

Large enterprises accounted for 63.4% of the Cloud Integration, Migration, and Optimization market in 2024, reflecting their extensive adoption of multi-cloud ecosystems and digital modernization initiatives. These organizations prioritize integration and optimization services to streamline operations and support complex IT infrastructures. Demand is fueled by increasing investments in automation, cloud-native application deployment, and analytics-driven cost management. Large enterprises are leveraging advanced migration strategies to improve scalability and ensure business continuity. Key technology providers such as Oracle, SAP, and Accenture are enhancing enterprise-grade solutions that support efficient workload management and continuous cloud performance improvement.

Key Growth Drivers

Rising Multi-Cloud Adoption Across Enterprises

The increasing adoption of multi-cloud strategies is a major driver for the Cloud Integration, Migration, and Optimization market. Enterprises are leveraging multiple cloud platforms to enhance flexibility, reduce vendor dependency, and ensure business continuity. This approach requires robust integration and migration tools to manage diverse workloads seamlessly. Organizations are adopting automation-driven solutions to optimize performance and cost across hybrid and multi-cloud environments. The growing need for interoperability among different cloud infrastructures continues to accelerate demand for advanced cloud management and optimization services.

- For instance, the IBM CIO’s office used the API Connect suite within the IBM Cloud Pak for Integration platform to manage hundreds of millions of API calls a month, ensuring efficient workload orchestration in multi-cloud setups.

Accelerated Digital Transformation and Legacy Modernization

The surge in digital transformation initiatives across industries is fueling cloud migration and integration demand. Enterprises are modernizing legacy IT systems to improve agility, scalability, and operational efficiency. Cloud-based platforms enable faster application deployment, data accessibility, and real-time analytics. Organizations are increasingly adopting AI-powered migration tools and DevOps frameworks to streamline modernization efforts. This shift toward cloud-native infrastructure supports continuous innovation, making cloud integration and optimization essential for digital-first business strategies.

- For instance, the Infosys Cobalt platform offers solutions that help clients accelerate their cloud journey and can provide a 40% improvement in operations for successful cloud migrations.

Cost Efficiency and Performance Optimization Needs

Enterprises are focusing on optimizing cloud investments to balance performance and cost. Cloud optimization services help organizations monitor usage patterns, eliminate redundancies, and reduce infrastructure expenses. AI-driven analytics and automated resource management are key to achieving cost transparency and efficiency. As cloud expenditures rise globally, businesses are prioritizing optimization tools to prevent over-provisioning and ensure sustainable cloud operations. This trend has made cloud cost management a central component of digital infrastructure planning and strategic IT budgeting.

Key Trends & Opportunities

AI and Automation Driving Cloud Efficiency

Artificial intelligence and automation are transforming cloud management by enabling predictive insights and dynamic resource allocation. Automated tools enhance migration speed, reduce errors, and improve workload balancing across multiple environments. Machine learning models assist in real-time performance optimization and anomaly detection, supporting smarter decision-making. Vendors are integrating AI capabilities into their service portfolios to offer self-healing and auto-scaling solutions. This trend presents new opportunities for enterprises seeking to boost operational efficiency and maximize return on cloud investments.

- For instance, Google Cloud’s AI-driven Active Assist provides a portfolio of intelligent tools that leverage machine learning to deliver recommendations to optimize cloud environments by reducing costs, increasing performance, and improving security.

Growing Adoption of Hybrid and Edge Cloud Solutions

The increasing demand for hybrid and edge computing environments is reshaping the cloud services landscape. Enterprises are adopting hybrid cloud models to ensure data compliance, latency reduction, and flexible workload deployment. Edge integration enhances performance for real-time applications in manufacturing, healthcare, and retail sectors. This trend creates strong opportunities for vendors providing hybrid integration platforms and distributed optimization tools. The combination of edge and hybrid capabilities allows enterprises to manage data more efficiently while maintaining centralized cloud governance.

- For instance, Dell Technologies’ NativeEdge (formerly Project Frontier) is an edge operations software platform designed to help enterprises securely manage and orchestrate their own edge applications and infrastructure at scale, enabling centralized management, zero-touch deployment, and automation of operations across potentially thousands of edge locations.

Key Challenges

Data Security and Compliance Risks

Ensuring data security and regulatory compliance remains a key challenge in cloud integration and migration. Transferring sensitive information across environments increases exposure to data breaches and unauthorized access. Enterprises must comply with region-specific regulations like GDPR and HIPAA, which require strict data governance. The absence of unified security frameworks across cloud platforms further complicates compliance efforts. As a result, organizations are investing in encryption, identity management, and audit solutions to mitigate risks and maintain trust in cloud ecosystems.

Complex Integration and Skill Shortages

Managing integration across diverse cloud platforms and legacy systems requires advanced expertise, which many organizations lack. The shortage of skilled professionals in cloud architecture, DevOps, and automation slows deployment and optimization efforts. Complex interdependencies between on-premises and cloud environments can lead to operational disruptions and cost overruns. Vendors are addressing this challenge by developing simplified integration frameworks and offering managed services. However, bridging the skill gap remains critical for sustaining smooth cloud transformation across industries.

Regional Analysis

North America

North America dominated the Cloud Integration, Migration, and Optimization market in 2024, holding a 39.1% share. The region’s leadership is driven by early cloud adoption, strong IT infrastructure, and rapid digital transformation across sectors. Major technology providers such as Microsoft, Amazon Web Services, and Google Cloud are continuously investing in automation and AI-driven migration tools. Enterprises are adopting hybrid and multi-cloud models to enhance operational agility and data control. The presence of established cloud service ecosystems and strict compliance standards further strengthens North America’s position as the global innovation hub for cloud modernization.

Europe

Europe accounted for 27.5% of the Cloud Integration, Migration, and Optimization market in 2024. The region’s growth is supported by robust regulatory frameworks such as GDPR and increased demand for secure, compliant cloud migration solutions. Countries like the United Kingdom, Germany, and France are leading adoption, emphasizing hybrid deployments for flexibility and data sovereignty. Enterprises in banking, manufacturing, and telecom sectors are investing heavily in integration and optimization to reduce IT costs. Collaboration between European cloud providers and hyperscalers continues to drive service innovation and support enterprise cloud transformation initiatives.

Asia-Pacific

Asia-Pacific held 25.8% of the Cloud Integration, Migration, and Optimization market in 2024 and is projected to grow fastest during the forecast period. The region’s expansion is fueled by large-scale digitalization programs, government cloud initiatives, and rapid adoption of multi-cloud strategies. Key economies including China, Japan, India, and South Korea are driving demand for scalable and cost-efficient cloud migration services. Increasing investments by technology firms and startups in automation and data analytics enhance competitiveness. The surge in e-commerce, fintech, and smart city projects continues to position Asia-Pacific as a major growth hub for cloud integration and optimization.

Latin America

Latin America captured 4.3% of the Cloud Integration, Migration, and Optimization market in 2024, with steady growth driven by digital transformation among small and mid-sized enterprises. Countries such as Brazil, Mexico, and Chile are adopting hybrid cloud solutions to modernize IT infrastructure. Government-led digitalization programs and expanding 5G connectivity are supporting the shift toward cloud-based operations. Local enterprises are increasingly partnering with global providers for integration and optimization services. Although limited technical expertise and data governance challenges persist, growing regional investment in automation and cybersecurity is expected to sustain market growth.

Middle East & Africa

The Middle East & Africa held 3.3% of the global Cloud Integration, Migration, and Optimization market in 2024. The region’s growth is fueled by government initiatives promoting cloud-first policies, particularly in the UAE, Saudi Arabia, and South Africa. Enterprises are migrating to the cloud to improve scalability and reduce operational costs while maintaining data compliance. Increasing investments in smart city projects and digital infrastructure are enhancing adoption rates. Global players are collaborating with regional cloud providers to strengthen service availability, driving steady progress in integration, migration, and optimization capabilities across emerging markets.

Market Segmentations:

By Service Type

- Cloud integration services

- Cloud migration services

- Cloud optimization services

By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

By Enterprise Size

By End-User Industry

- BFSI

- Healthcare

- IT & telecommunications

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud Integration, Migration, and Optimization market is highly competitive, with key players including Infosys Limited, VMware (Broadcom), Accenture plc, Oracle Corporation, Rackspace Technology, Google LLC, Deloitte Touche Tohmatsu Limited, IBM Corporation, Microsoft Corporation, and Amazon Web Services (AWS) leading the global landscape. These companies focus on delivering end-to-end cloud transformation solutions through strategic investments in AI, automation, and hybrid cloud frameworks. Major players are expanding their service portfolios with advanced integration and workload optimization capabilities to support large-scale digital modernization. Partnerships with hyperscalers and enterprises are strengthening multi-cloud ecosystems, while consulting firms emphasize industry-specific migration strategies. Vendors are also focusing on cost optimization and managed cloud services to enhance client agility and scalability. Continuous innovation, coupled with robust consulting expertise, allows these market leaders to maintain strong competitiveness and accelerate enterprise cloud adoption across diverse industries worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Infosys Limited

- VMware (Broadcom)

- Accenture plc

- Oracle Corporation

- Rackspace Technology

- Google LLC

- Deloitte Touche Tohmatsu Limited

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services (AWS)

Recent Developments

- In October 2025, Accenture plc and Amazon Web Services (AWS) expanded their collaboration to deliver AI-powered cloud modernisation and migration services for public-sector organisations, focusing on cost optimisation and migration assessments.

- In August 2025, Rackspace Technology launched its “Rackspace Cloud Management Platform” with AI-enabled capabilities for hybrid environments, enabling streamlined workload operations and cloud optimisation from a single platform.

- In January 2025, Oracle Corporation and Google LLC announced the expansion of eight new global regions and cross-region disaster-recovery support for Oracle Database@Google Cloud, enabling easier migration and cost-effective multicloud use.

- In June 2024, Oracle and Google Cloud revealed a multicloud partnership offering Oracle Cloud Infrastructure services within Google data centres, aimed at accelerating application migration, multicloud deployment and management

Report Coverage

The research report offers an in-depth analysis based on Service Type, Deployment Model, Enterprise Size, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with rising enterprise demand for multi-cloud management.

- AI and automation will become central to enhancing migration accuracy and efficiency.

- Hybrid and edge cloud adoption will accelerate as businesses seek flexible infrastructure models.

- Vendors will focus on offering industry-specific cloud transformation and optimization solutions.

- Integration of analytics and monitoring tools will improve cost transparency and resource utilization.

- Partnerships between cloud providers and consulting firms will strengthen end-to-end service delivery.

- Security and compliance solutions will gain greater focus within migration and integration frameworks.

- The rise of cloud-native applications will drive higher demand for continuous optimization services.

- Asia-Pacific and Latin America will emerge as key high-growth regions due to rapid digitalization.

- The market will shift toward managed and outcome-based cloud optimization services for sustained scalability.