Market Overview

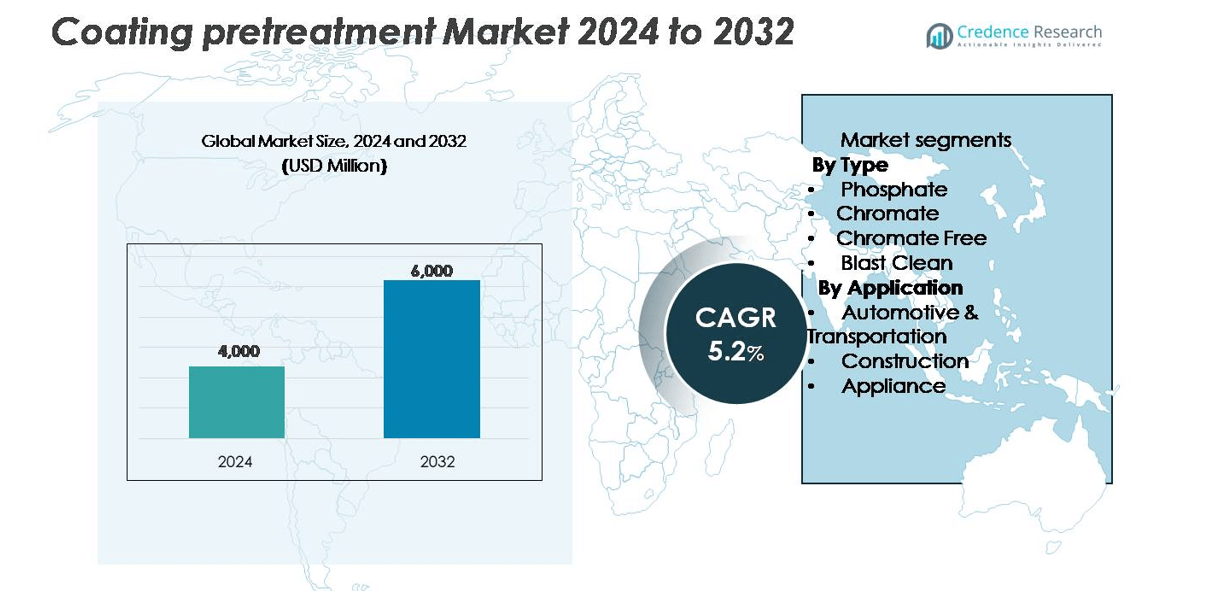

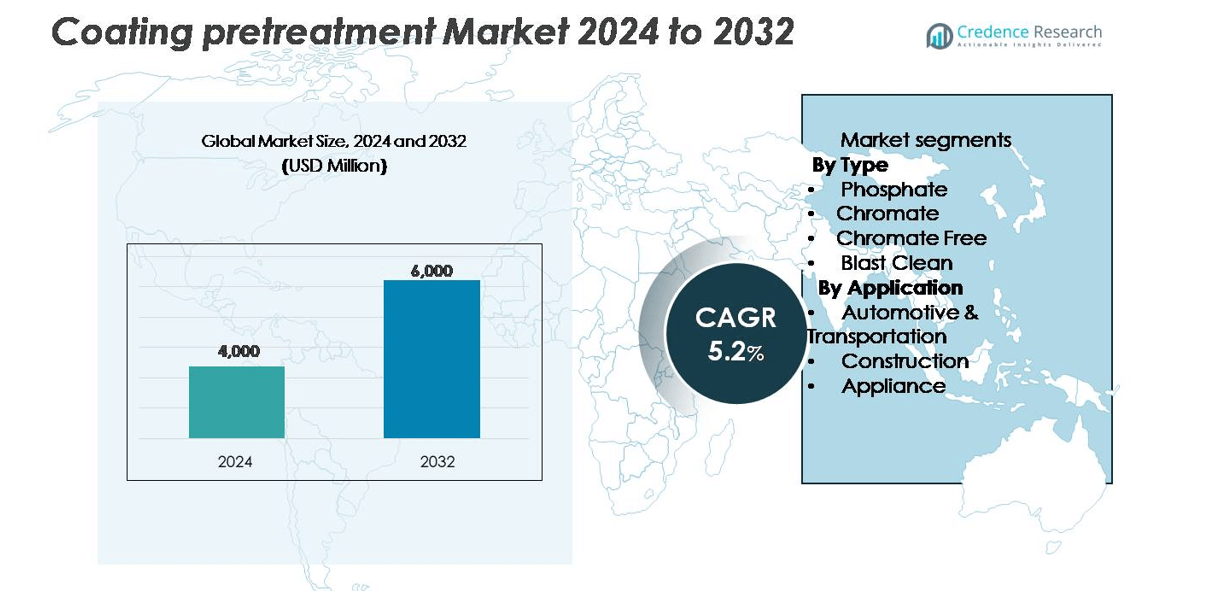

The Coating Pretreatment Market size was valued at USD 4,000 million in 2024 and is projected to reach USD 6,000 million by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coating Pretreatment Market Size 2024 |

USD 4,000 million |

| Coating Pretreatment Market, CAGR |

5.2% |

| Coating Pretreatment Market Size 2032 |

USD 6,000 million |

The coating pretreatment market is dominated by key players such as Henkel AG & Co. KGaA, PPG Industries, BASF SE, Akzo Nobel N.V., Axalta Coating Systems, Nippon Paint Holdings Co., Ltd., and The Sherwin-Williams Company. These companies lead through continuous innovation, strong distribution networks, and sustainable product development focused on chromate-free and nanoceramic technologies. Strategic investments in R&D and partnerships with automotive and construction manufacturers enhance their global presence. Asia-Pacific leads the market with a 37% share, driven by rapid industrialization, growing automotive production, and expanding infrastructure projects across China, India, and Japan, positioning the region as the key growth hub.\

Market Insights

- The coating pretreatment market was valued at USD 4,000 million in 2024 and is projected to reach USD 6,000 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- Increasing demand from automotive and transportation industries drives market growth, supported by expanding vehicle production and the shift toward lightweight materials.

- The market is witnessing a trend toward chromate-free and eco-friendly pretreatment technologies, driven by regulatory compliance and sustainability goals.

- Leading players such as Henkel, PPG Industries, BASF, and Akzo Nobel dominate through innovation, product diversification, and strong regional distribution networks.

- Asia-Pacific leads with a 37% share, followed by North America (34%) and Europe (29%). The phosphate segment holds a 42% share, driven by superior corrosion resistance and cost efficiency in automotive and construction applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The phosphate segment leads the coating pretreatment market with a 42% market share in 2024. Its dominance comes from strong adhesion and corrosion resistance, especially for metal components used in automotive and construction industries. The chromate segment follows but faces declining use due to environmental restrictions. Meanwhile, chromate-free formulations are gaining ground as eco-friendly alternatives that meet REACH and RoHS compliance. Blast clean methods continue to find use in surface preparation, offering superior cleaning efficiency for heavy-duty applications before coating.

- For instance, Henkel AG & Co. KGaA’s Bonderite M-NT 41044 technology reduces the number of processing stages from a typical eight to ten steps down to as few as four, cutting water consumption significantly (with reports of up to 30% savings in specific applications) while maintaining strong corrosion resistance, which is a key performance benchmark often measured in tests lasting up to 1,000 hours in a salt spray environment.

By Application

The automotive and transportation segment dominates the market with a 48% share in 2024, driven by the rising production of vehicles and adoption of lightweight materials requiring advanced coating protection. Coating pretreatments enhance paint adhesion, corrosion resistance, and durability of automotive bodies and components. The construction segment records steady growth, fueled by infrastructure expansion and rising demand for weather-resistant metal structures. The appliance industry also benefits from pretreatments that improve coating uniformity and extend product lifespan, especially for home and industrial equipment.

- For instance, Henkel AG & Co. KGaA’s Next Generation Metal Pretreatment process (known by brands like PALLUMINA™ and TecTalis™) treats more than 6 million vehicles a year, supporting full aluminium-body designs while significantly reducing process steps (typically from seven down to four).

Key Growth Drivers

Rising Demand from the Automotive and Transportation Sector

The automotive and transportation industry remains a major growth driver for the coating pretreatment market. Increasing global vehicle production and the shift toward lightweight materials such as aluminum and magnesium have intensified the need for effective surface treatment solutions. Phosphate and chromate-free pretreatments enhance corrosion resistance, improve paint adhesion, and ensure long-lasting finishes under harsh environmental conditions. Electric vehicle manufacturing further accelerates demand for eco-friendly pretreatments that can accommodate mixed-metal assemblies. Additionally, the push for extended vehicle lifespans and superior coating performance strengthens the adoption of advanced pretreatment technologies worldwide.

- For instance, Henkel AG & Co. KGaA’s cleaner-and-coater product Bonderite M-NT 41044 reduces the number of processing steps from eight to ten down to four.

Growing Focus on Environmentally Sustainable Solutions

Stringent environmental regulations and the shift toward sustainable industrial processes are driving significant adoption of eco-friendly pretreatment solutions. Traditional chromate-based products are being replaced by non-chromate and zirconium-based alternatives that comply with global standards such as REACH and RoHS. These innovations reduce hazardous waste and lower energy consumption during application. Manufacturers are investing in waterborne and low-VOC technologies to enhance sustainability without compromising performance. This transition also benefits industries aiming to achieve carbon neutrality goals. As a result, the development of sustainable coating pretreatments has become a central competitive strategy for key market players.

- For instance, Henkel AG & Co. KGaA’s BONDERITE® M-NT Zirconate coating range generates 70 % less sludge compared with traditional iron phosphate processes, and it operates at room temperature for multi-metal substrates.

Expansion of Construction and Industrial Manufacturing Activities

Rapid industrialization and urban development, particularly in Asia-Pacific and the Middle East, are boosting the coating pretreatment market. The construction sector demands durable and corrosion-resistant coatings for steel structures, pipelines, and equipment exposed to humidity and pollutants. Pretreatment enhances the adhesion and longevity of protective coatings used in building materials, appliances, and machinery. Additionally, growing infrastructure investments in renewable energy facilities and industrial plants create consistent demand for metal surface treatments. The combination of expanding construction output and increased industrial manufacturing continues to fuel the adoption of pretreatment systems designed for performance efficiency and environmental compliance.

Key Trends & Opportunities

Technological Advancements in Pretreatment Formulations

Continuous innovation in coating pretreatment formulations is transforming the industry. Companies are developing multi-metal compatible and nanoceramic coatings that deliver enhanced corrosion protection and adhesion on various substrates. For instance, zirconium and titanium-based nanocoatings offer superior performance with lower sludge generation and shorter process times. Automation and process control technologies also optimize application consistency and reduce chemical usage. These advancements create opportunities for manufacturers to offer high-performance, sustainable products across multiple industries, including automotive, construction, and consumer appliances. The integration of smart monitoring systems further enhances process reliability and operational efficiency.

- For instance, Henkel AG & Co. KGaA’s BONDERITE® NT-1™ nanoceramic conversion coating operates without activation and passivation steps and functions at ambient temperature, reducing the number of process stages.

Increasing Shift Toward Chromate-Free Technologies

A major market trend involves the shift away from chromate-based pretreatments toward safer, non-toxic alternatives. Growing environmental awareness and regulatory restrictions have accelerated R&D efforts in developing effective substitutes such as silane, phosphate-free, and zirconium-based chemistries. These technologies provide comparable corrosion resistance and coating adhesion while minimizing environmental impact. Manufacturers adopting such solutions benefit from improved sustainability credentials and easier compliance with global standards. The widespread adoption of chromate-free systems represents a strategic opportunity for long-term growth, particularly in markets prioritizing green manufacturing practices and circular economy principles.

- For instance, Henkel AG & Co. KGaA’s BONDERITE M-NT Zirconate coating range reduces sludge generation by 70 % compared to traditional iron phosphate processes.

Expansion of Smart Manufacturing and Automation

The adoption of Industry 4.0 and digital manufacturing technologies is reshaping surface treatment operations. Automated dosing, real-time monitoring, and predictive maintenance systems enhance process precision, reduce waste, and ensure consistent coating quality. Smart factories integrating IoT-enabled pretreatment lines achieve higher productivity and lower operational costs. This shift also allows manufacturers to track environmental metrics, optimize resource use, and maintain compliance with sustainability targets. The growing focus on automation creates opportunities for equipment suppliers and chemical formulators to collaborate in delivering intelligent, scalable pretreatment solutions for global manufacturing industries.

Key Challenges

High Operational and Maintenance Costs

Despite growing demand, high installation and maintenance costs remain a key challenge in the coating pretreatment market. The process involves energy-intensive stages, including cleaning, rinsing, and chemical treatment, which significantly raise operational expenses. Moreover, maintaining wastewater treatment systems and ensuring chemical stability add to the cost burden for manufacturers. Smaller and medium-sized enterprises often struggle to adopt advanced pretreatment technologies due to capital limitations. Balancing cost efficiency with performance and sustainability is therefore a pressing concern. Market players must focus on process optimization and innovative formulations to make pretreatment solutions more affordable and resource-efficient.

Stringent Environmental and Safety Regulations

Strict regulatory frameworks governing hazardous chemicals and emissions pose challenges to traditional pretreatment practices. Chromate and phosphate-based formulations are under scrutiny due to their environmental and health risks. Complying with standards such as REACH, EPA, and OSHA increases operational complexity and requires continuous reformulation efforts. The transition to eco-friendly alternatives demands significant R&D investment and requalification of production lines. Additionally, achieving consistent performance across diverse substrates without using restricted substances remains difficult. These factors create barriers for manufacturers aiming to maintain cost competitiveness while adhering to evolving environmental and safety requirements

Regional Analysis

North America

North America holds a 34% market share in the global coating pretreatment market, driven by robust automotive production and strong demand from aerospace and construction sectors. The U.S. dominates regional growth due to rapid adoption of eco-friendly, chromate-free technologies supported by EPA regulations. Investments in infrastructure and electric vehicle manufacturing further strengthen demand for high-performance pretreatment solutions. Canada and Mexico also contribute significantly, with expanding automotive supply chains and metal fabrication industries supporting sustained market expansion across the region.

Europe

Europe accounts for a 29% share of the coating pretreatment market, supported by stringent environmental regulations and advanced industrial infrastructure. Germany, France, and the U.K. lead due to a strong automotive base and growing demand for sustainable metal finishing processes. The region’s emphasis on REACH-compliant, phosphate-free, and low-VOC formulations drives continuous product innovation. Increasing adoption of lightweight materials in vehicles and machinery enhances the need for effective pretreatment solutions. Technological advancements and investments in green manufacturing continue to sustain Europe’s competitive edge in this market.

Asia-Pacific

Asia-Pacific dominates the coating pretreatment market with a 37% market share, fueled by rapid industrialization and expanding automotive, construction, and appliance industries. China, Japan, and India are major contributors, driven by large-scale manufacturing and infrastructure development. The growing presence of global OEMs and rising demand for corrosion-resistant coatings in industrial and consumer goods strengthen regional growth. Supportive government initiatives promoting domestic manufacturing and environmental compliance also accelerate the adoption of advanced pretreatment solutions, positioning Asia-Pacific as the primary hub for both production and consumption.

Latin America

Latin America represents an emerging market with a 6% share, driven by increasing industrial activities in Brazil, Mexico, and Argentina. The automotive and construction sectors are major contributors, focusing on cost-effective surface treatment technologies. Growing awareness of corrosion protection and the gradual shift toward sustainable coating solutions support market penetration. However, economic fluctuations and limited local manufacturing capacity restrain faster adoption. Regional collaborations with international chemical companies are expected to enhance access to advanced formulations, fostering gradual modernization of coating pretreatment systems.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, supported by growth in the construction, oil and gas, and industrial manufacturing sectors. Countries like Saudi Arabia, the UAE, and South Africa are investing in infrastructure and energy projects that require corrosion-resistant coatings for metal equipment. The rising adoption of sustainable coating technologies and partnerships with global players are improving market dynamics. However, limited technological expertise and dependency on imports challenge rapid expansion. Gradual industrial diversification and localization efforts are expected to drive steady regional market growth.

Market Segmentations:

By Type

- Phosphate

- Chromate

- Chromate Free

- Blast Clean

By Application

- Automotive & Transportation

- Construction

- Appliance

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The coating pretreatment market features a moderately consolidated competitive landscape, with key players focusing on innovation, sustainability, and global expansion. Major companies such as PPG Industries, Henkel AG & Co. KGaA, BASF SE, Akzo Nobel N.V., Axalta Coating Systems, Nippon Paint Holdings Co., Ltd., and The Sherwin-Williams Company lead through advanced product portfolios and strong regional presence. These firms invest heavily in developing eco-friendly and chromate-free pretreatments to meet stringent environmental regulations. Strategic collaborations, mergers, and acquisitions are common, enabling firms to expand into high-growth markets in Asia-Pacific and Latin America. Continuous R&D in nanoceramic and zirconium-based technologies also strengthens product performance and competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Henkel AG & Co. KGaA

- PPG Industries

- Nihon Parkerizing Co., Ltd.

- The Sherwin-Williams Company

- Axalta Coating Systems LLC

- Chemetall GmbH

- Kansai Paint Co., Ltd.

- AkzoNobel N.V.

- 3M

- Nippon Paint Co., Ltd.

Recent Developments

- In June 2024, Henkel, a leading provider of coating pretreatment solutions, introduced a new cleaner and coater technology, Bonderite M-NT 41044, to enhance efficiency and sustainability in metal pretreatment. This innovation reduces processing steps from ten to four, conserving water and energy while ensuring robust corrosion protection and paint adhesion.

- In November 2023, Henkel, a surface treatment provider, expanded its manufacturing capacity in Spain by introducing solvent- and chromium-free metal pretreatment technologies for coating facilities to its European range

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand steadily, supported by rising demand from automotive, construction, and appliance industries.

- Sustainability will be a central focus, with companies investing in eco-friendly and chromate-free pretreatment solutions.

- Asia-Pacific will maintain its leadership with a 37% share, driven by rapid industrialization and manufacturing growth.

- North America and Europe will see strong demand for advanced, REACH- and RoHS-compliant formulations.

- Technological innovation, including nanoceramic and zirconium-based coatings, will enhance efficiency and corrosion protection.

- Key players will prioritize R&D and strategic collaborations to strengthen market presence and regional reach.

- Automation and digital process monitoring will gain traction, improving quality and reducing operational costs.

- Rising raw material costs and environmental compliance challenges will pressure manufacturers to optimize production.

- Growing use of lightweight materials in automotive manufacturing will create new pretreatment requirements.

- Expanding industrial infrastructure in emerging economies will fuel consistent global market growth.