Market Overview:

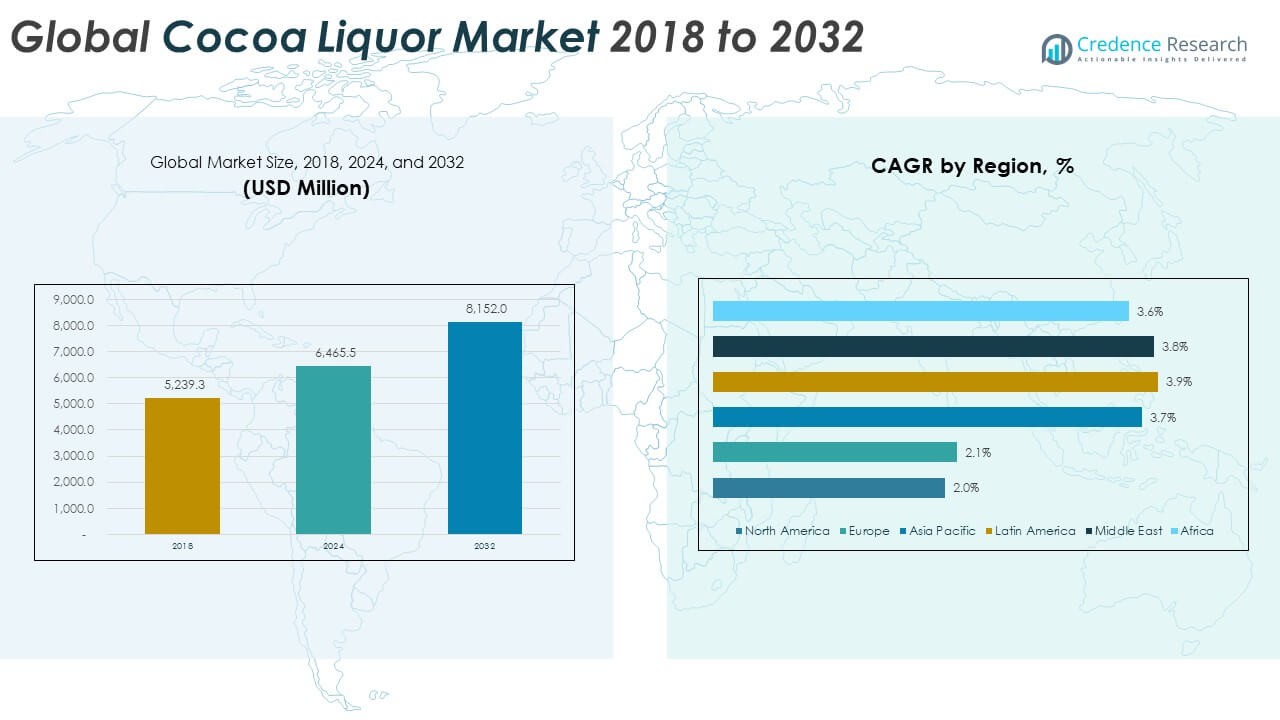

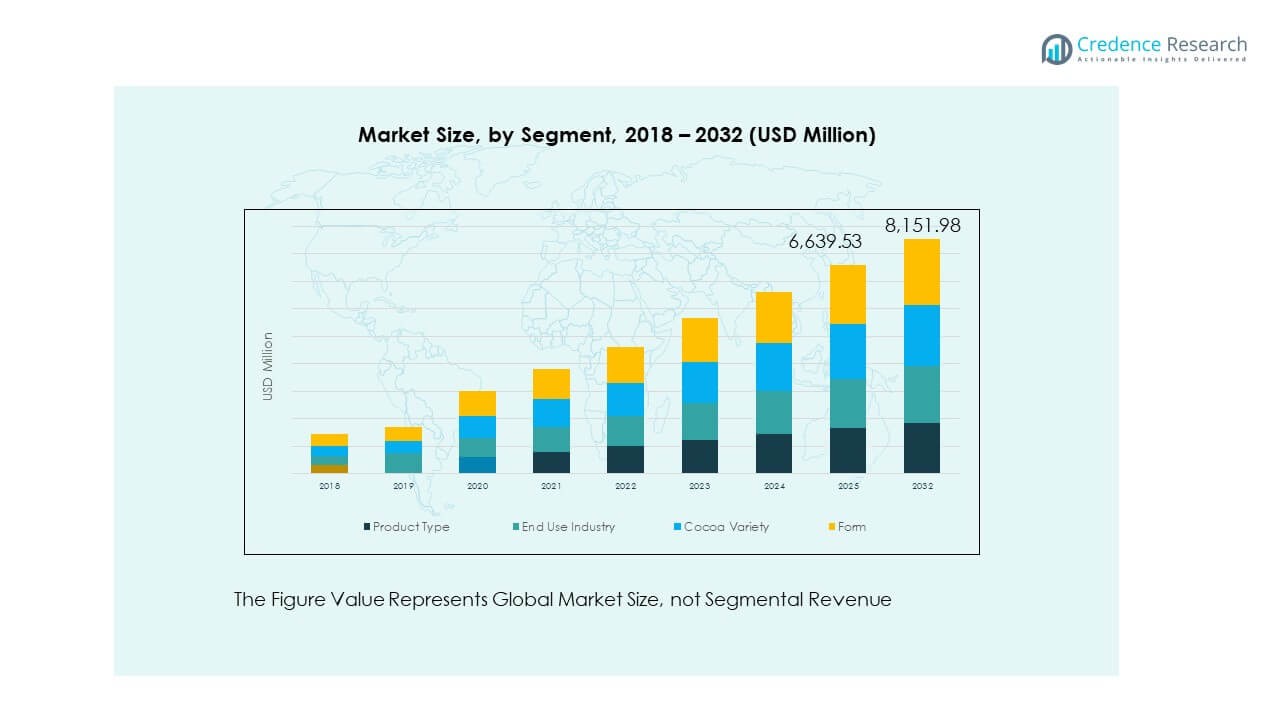

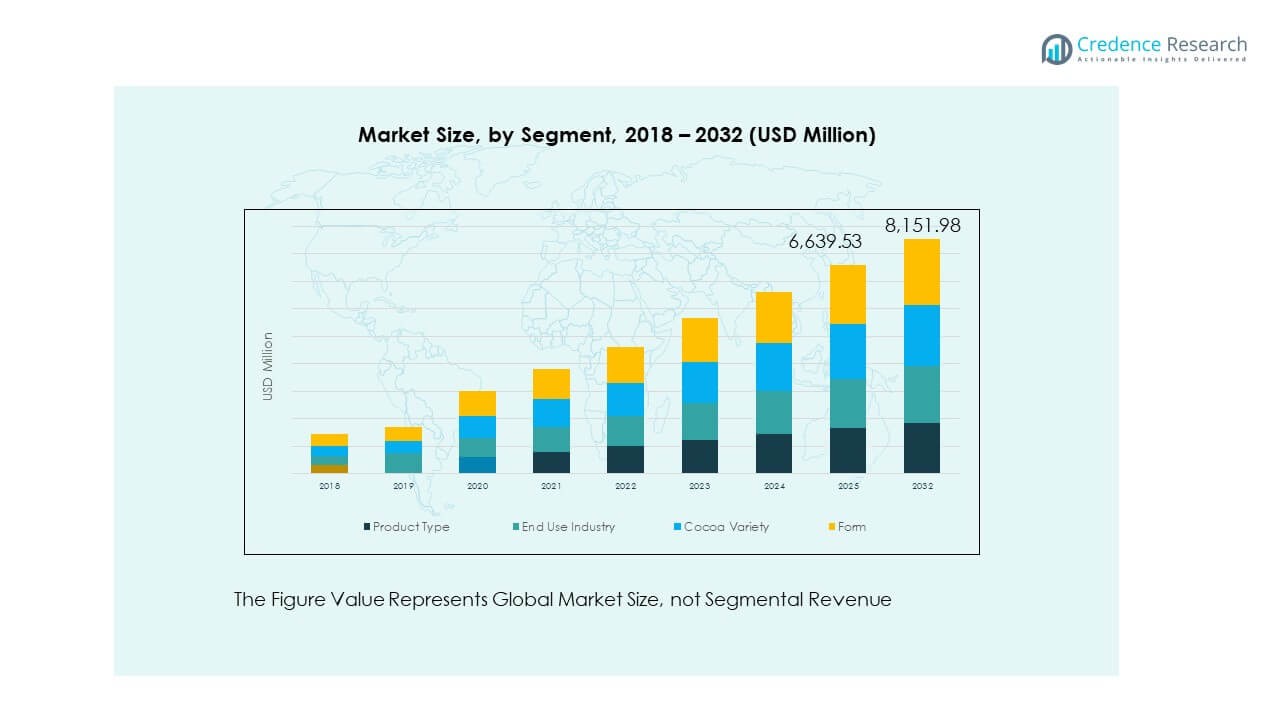

The Cocoa Liquor Market size was valued at USD 5,239.3 million in 2018 to USD 6,465.5 million in 2024 and is anticipated to reach USD 8,152.0 million by 2032, at a CAGR of 2.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cocoa Liquor Market Size 2024 |

USD 6,465.5 Million |

| Cocoa Liquor Market, CAGR |

2.98% |

| Cocoa Liquor Market Size 2032 |

USD 8,152.0 Million |

The growth of the cocoa liquor market is primarily driven by rising global demand for premium and artisanal chocolate products. Manufacturers are increasingly incorporating cocoa liquor into a wide range of confections, beverages, and bakery applications to enhance flavor and quality. In addition, growing consumer preference for organic and ethically sourced cocoa ingredients is pushing producers to invest in sustainable sourcing practices. Expanding awareness of the health benefits associated with dark chocolate, such as antioxidant properties, further fuels demand for cocoa liquor as a key ingredient in health-conscious product lines.

Regionally, Europe leads the cocoa liquor market due to its long-standing chocolate manufacturing tradition and high per capita consumption of chocolate. North America follows closely, supported by strong demand for premium and organic chocolate products. Meanwhile, Asia Pacific is emerging as a significant growth region, driven by rising disposable incomes, changing dietary habits, and increased urbanization in countries like China and India. Latin America and Africa, known for cocoa production, are also seeing growing domestic consumption, supported by local processing capabilities and rising awareness of cocoa-based product applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Cocoa Liquor Market was valued at USD 6,465.5 million in 2024 and is expected to reach USD 8,152.0 million by 2032, growing at a CAGR of 2.98%.

- Premiumization of chocolate products and rising consumer preference for origin-specific cocoa are fueling market expansion.

- Health-focused trends are increasing the use of cocoa liquor in dark chocolates, functional snacks, and clean-label formulations.

- Volatility in raw cocoa prices and supply chain disruptions pose consistent challenges to manufacturers.

- Europe leads the Cocoa Liquor Market due to its established chocolate industry and demand for high-quality cocoa liquor.

- Asia Pacific is witnessing the fastest growth, supported by rising disposable incomes and changing consumption patterns.

- Strict regulatory frameworks around food safety and sourcing compliance influence production and market access.

Market Drivers:

Rising global consumption of chocolate and premium confectionery boosts demand

The demand for high-quality chocolate products has surged across developed and developing economies, fueling the need for cocoa liquor. Global confectionery brands rely on it to produce intense flavor profiles in dark and milk chocolates. Consumers show strong preferences for richer textures and authentic cocoa-based offerings. The Cocoa Liquor Market responds to this trend by expanding supply chains and improving processing techniques. Premiumization across food sectors drives manufacturers to include cocoa liquor in product innovations. It supports better product positioning in luxury and artisanal segments. Retailers and chocolatiers invest in new offerings that emphasize cocoa origin and quality. Brand narratives focusing on rich cocoa content directly stimulate market growth.

- For instance, Cargill’s $100 million expansion of its Yopougon facility in Côte d’Ivoire, now the largest cocoa-grinding plant in Africa, aligns with rising global demand for premium chocolate and dark cocoa powders. The 50% increase in processing capacity supports broader flavor and color profiles, enabling high-volume supply to meet growing consumer preference for high-quality, richly flavored confectionery products.

Increasing health awareness supports dark chocolate product innovation

Cocoa liquor contains antioxidants, flavonoids, and other bioactive compounds that align with consumer health priorities. Dark chocolate, known for its cocoa richness, continues gaining ground in functional food categories. The Cocoa Liquor Market benefits from health-conscious buyers shifting away from sugar-heavy alternatives. Companies incorporate cocoa liquor into nutritional bars and wellness-centric snacks. It enables manufacturers to capture health-aware demographics without sacrificing indulgence. Rising interest in polyphenols and cardiovascular benefits strengthens its functional value. Nutrition-focused marketing campaigns highlight its potential in clean-label products. Health-aware retail categories actively push cocoa-rich innovations across shelves.

Ethical sourcing and sustainability influence cocoa liquor procurement

Manufacturers face growing scrutiny over ethical sourcing practices within cocoa-producing countries. The Cocoa Liquor Market must meet evolving regulatory and consumer expectations around fair trade and environmental responsibility. Brands adopt traceability systems and certification programs to validate their supply chains. It prompts suppliers to align with Rainforest Alliance, Fairtrade, or UTZ standards. Ethical positioning enhances brand loyalty in mature markets. Retailers demand transparency in procurement and labor standards, influencing supplier partnerships. Long-term sourcing contracts prioritize regions adhering to deforestation and labor compliance policies. Responsible production helps brands capture values-driven consumer segments globally.

Expanding bakery, dairy, and beverage industries create wider applications

Cocoa liquor finds utility in numerous categories beyond conventional chocolates. The Cocoa Liquor Market expands with increasing applications in baked goods, dairy desserts, and premium beverages. Pastry chefs and food developers leverage it for deeper flavor complexity in gourmet recipes. It integrates smoothly into liqueurs, coffee drinks, and spreads. Foodservice and QSR outlets innovate by incorporating cocoa-rich elements into indulgent desserts. Rising middle-class populations in Asia and Latin America support product diversification. It allows local producers to scale new product development strategies effectively. Market players explore untapped culinary and specialty beverage channels to boost penetration.

- Ferrero, for example, is offering cocoa liquor-based spreads with enhanced flavor complexity, while Olam Cocoa launched new lines designed for beverage stability. Fermented cocoa extracts and cocoa-derived peptides are now adopted in ready-to-drink beverages, savory sauces, and even sports nutrition applications, exemplifying the versatility unlocked by recent R&D

Market Trends

Single-origin and craft chocolate movements reshape consumer preferences

The Cocoa Liquor Market adapts to shifting consumer interest in authenticity, with growing demand for single-origin cocoa liquor. Artisanal chocolatiers emphasize the flavor distinctions of beans sourced from specific regions. It gives rise to micro-batch production and bean-to-bar concepts. Regional storytelling around cocoa heritage appeals to premium consumers. Direct trade models enable closer producer–manufacturer relationships. This enhances control over fermentation and roasting techniques that influence liquor quality. Retailers and e-commerce platforms promote origin-labeled chocolates. The trend supports regional cocoa processors aiming to enter premium global markets.

- For example, Barry Callebaut states, “Origin chocolate is made from cocoa beans grown in a specific country, region or even a specific plantation (estate),” underscoring its marketing on origin-specific sourcing and labeling.

Growing integration of cocoa liquor in plant-based product innovation

The rise of plant-based diets brings new formulations incorporating cocoa liquor into dairy alternatives and vegan confections. Manufacturers rely on its rich, emulsifying qualities to enhance flavor and texture in dairy-free chocolate. The Cocoa Liquor Market sees interest from producers replacing milk fats with cocoa content in bars, spreads, and beverages. This trend aligns with cleaner label expectations and free-from claims. Brands experiment with oat, almond, and coconut-based bases complemented by cocoa liquor. It meets both indulgent and dietary preferences. Vegan bakery and frozen dessert segments also leverage this shift for innovative cocoa-rich options.

Digitization of cocoa trade supports market transparency and pricing control

Digital platforms and blockchain adoption are gaining momentum in cocoa procurement and trade management. The Cocoa Liquor Market benefits from improved traceability and data-driven quality assurance. Transparent trade systems support better pricing models and sustainability verification. Buyers gain insight into harvesting, fermentation, and shipment timelines. This helps control quality variability and reduce procurement risks. Cocoa-producing cooperatives adopt tech tools to record production and compliance data. Certification agencies collaborate with tech startups to enhance field audits. Digital documentation streamlines sourcing decisions for global processors and brands alike.

Increased R&D investment drives specialty product customization

Leading producers allocate more resources toward R&D to develop customized cocoa liquor profiles. The Cocoa Liquor Market experiences innovations in flavor modulation, particle size reduction, and liquor viscosity. These adjustments help address specific application requirements across beverages, fillings, and aerated confections. R&D teams work closely with chocolatiers to co-develop distinctive flavor profiles. Flavor engineers explore novel roasting and conching techniques. Custom blends offer competitive differentiation for niche brands. Testing labs create liquor variants based on regional bean traits. Specialty liquor segments provide high-margin opportunities for manufacturers willing to invest in customization.

- Blommer Chocolate Company for example, officially announced the opening of a new 10,000-sq-ft Research & Development Center in Chicago in March 2025, part of a strategic $100 million investment into expanding technical and innovation capabilities across North America

Market Challenges Analysis

Volatile cocoa prices and inconsistent supply impact profit margins

The Cocoa Liquor Market contends with significant fluctuations in raw cocoa bean prices. Supply constraints due to climate events, crop diseases, and political instability disrupt consistency. Volatility makes it difficult for producers to forecast input costs, impacting pricing strategies. It also creates unpredictability in long-term contract negotiations. Manufacturers may absorb higher costs or risk product reformulation, both of which impact profitability. Low mechanization in producing countries limits production scalability. Efforts to build reserves or futures-based models only partially mitigate exposure. Price swings also deter smaller processors from market entry.

Regulatory barriers and food safety compliance increase operational complexity

Global food safety regulations vary across markets, compelling cocoa liquor manufacturers to navigate complex compliance landscapes. The Cocoa Liquor Market faces constant updates in allergen labeling, residue thresholds, and heavy metal limits. Exporters must tailor formulations or packaging based on region-specific regulations. Cross-border logistics become more expensive due to testing and documentation. It also demands additional quality assurance protocols, training, and certifications. Failing to meet these requirements risks costly recalls or import bans. Small and mid-tier companies struggle to maintain international certifications, narrowing their addressable markets. High compliance costs elevate barriers to scaling operations.

Market Opportunities

Emerging markets in Asia and Africa offer untapped potential for growth

Rising disposable income and urbanization in countries like India, Vietnam, and Kenya create favorable demand for cocoa-based products. The Cocoa Liquor Market can penetrate new middle-class consumer segments with premium yet affordable chocolate options. Regional processors benefit from closer proximity to cocoa-growing regions and increasing local awareness. It allows brands to reduce logistical costs while appealing to culturally specific flavor profiles.

Expansion in e-commerce and private label segments supports volume growth

E-commerce platforms give small brands and specialty producers direct access to consumers globally. The Cocoa Liquor Market benefits from online visibility and customizable packaging solutions that attract niche markets. Supermarkets also invest in private-label chocolate products, offering large volume demand at lower price points. It encourages cost-effective cocoa liquor formulations while expanding market presence.

Market Segmentation Analysis:

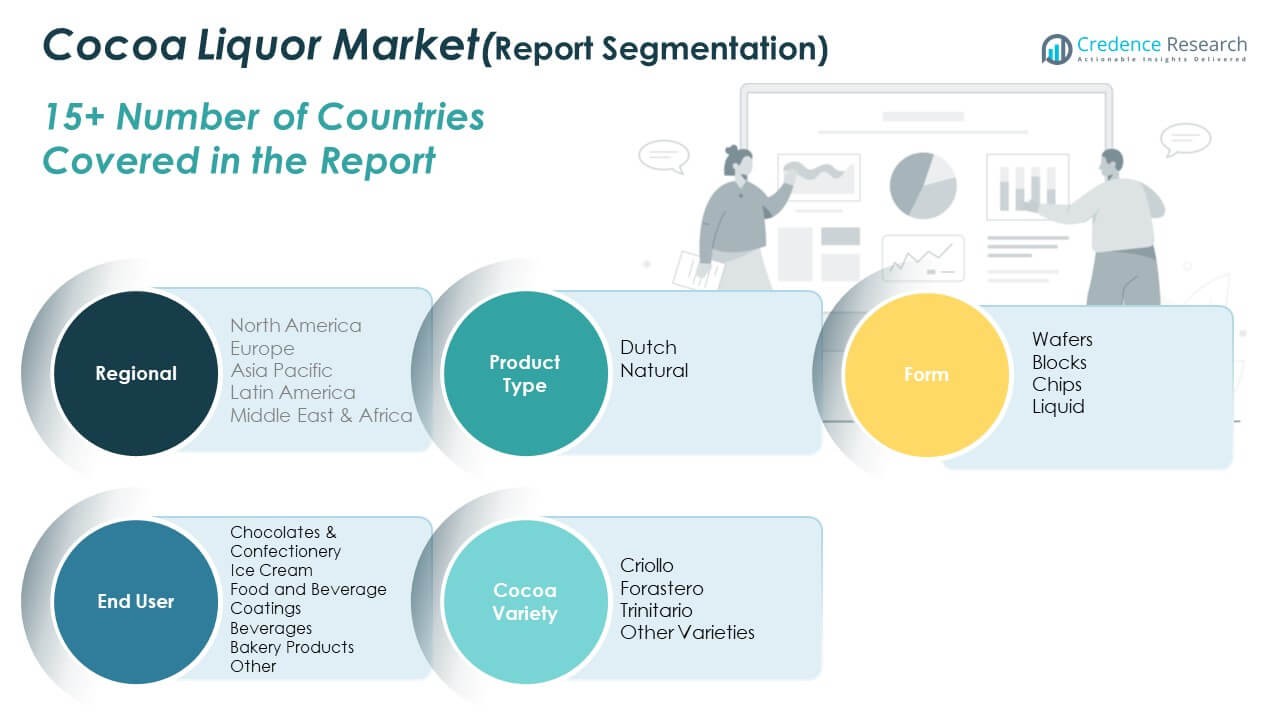

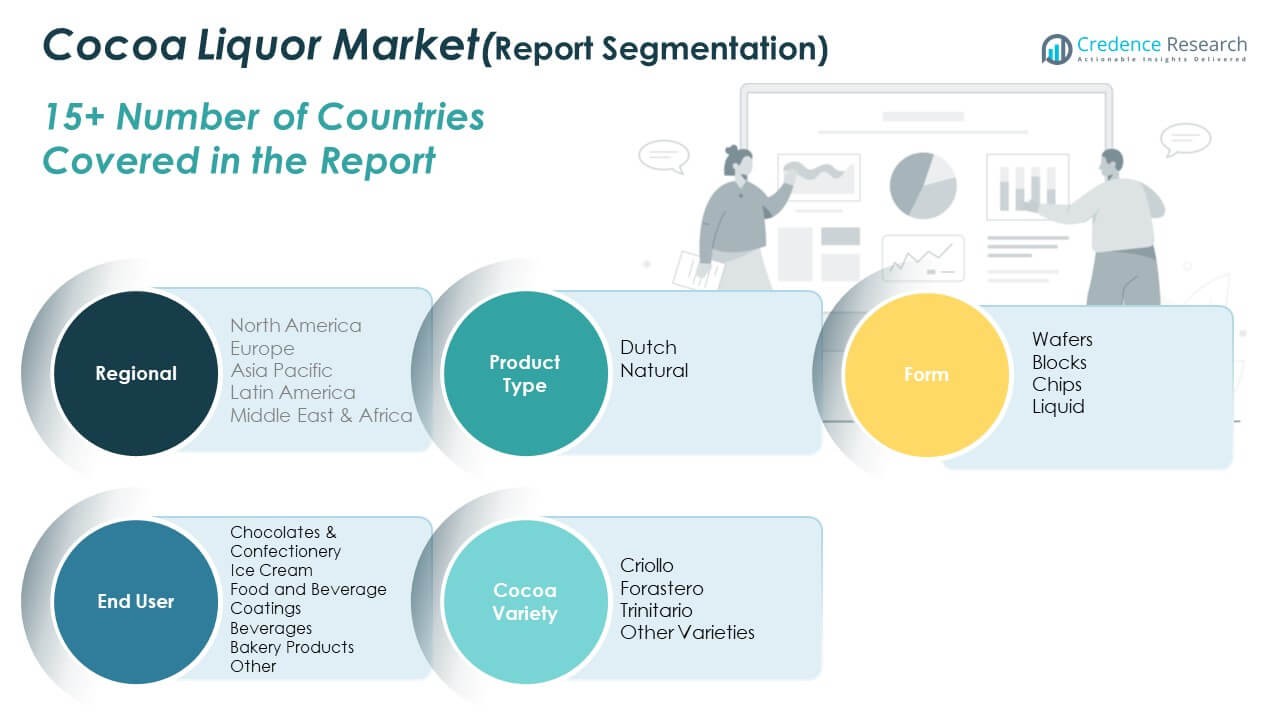

The Cocoa Liquor Market segments into product type, end use industry, cocoa variety, and form, each contributing uniquely to its growth.

By product type, Dutch cocoa liquor dominates due to its smoother taste and versatility in premium chocolate manufacturing. Natural cocoa liquor follows, favored for its stronger flavor and suitability in clean-label products.

- For example, Barry Callebaut’s official product catalogs and technical sheets confirm that they produce and market alkalized (Dutch-processed) cocoa liquor, also referred to as “alkalized cocoa mass,” specifically for professional and industrial chocolate applications.

By end use, chocolates and confectionery represent the largest segment, driven by consistent consumer demand and innovation in artisanal products. Ice cream and bakery products also show strong growth, leveraging cocoa liquor to enhance texture and flavor. Beverages and food coatings increasingly incorporate it for indulgent offerings and gourmet applications.

By cocoa variety, Forastero leads due to its wide availability and cost-effectiveness in mass-market production. Criollo and Trinitario hold smaller shares but attract niche buyers seeking rich, nuanced flavor profiles. These varieties support product differentiation in the premium and craft chocolate sectors.

By form, liquid form is the most widely used across large-scale production. Blocks and chips provide value in bakery and small-batch applications, while wafers serve convenient, portioned industrial usage. It remains dynamic across segments, with innovation, sustainability, and regional preferences shaping product demand.

- For example, Blommer’s product brochure lists chocolate liquor offerings in liquid form, including large format packaging, confirming supply in bulk liquid formats.

Segmentation:

By Product Type

By End Use Industry

- Chocolates & Confectionery

- Ice Cream

- Food and Beverage Coatings

- Beverages

- Bakery Products

- Other End Use Industries

By Cocoa Variety

- Criollo

- Forastero

- Trinitario

- Other Varieties

By Form

- Wafers

- Blocks

- Chips

- Liquid

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Cocoa Liquor Market size was valued at USD 1,234.37 million in 2018 to USD 1,444.85 million in 2024 and is anticipated to reach USD 1,689.90 million by 2032, at a CAGR of 2.0% during the forecast period. North America holds a 22.34% share of the global Cocoa Liquor Market. It demonstrates steady demand driven by the well-established chocolate confectionery industry in the United States and Canada. Consumers prioritize high-quality, ethically sourced chocolate products, which supports the market’s long-term stability. It benefits from an active premiumization trend in chocolate offerings across supermarkets and specialty stores. Major chocolate brands operate advanced production facilities, ensuring consistent product standards. Plant-based and vegan chocolate demand is also rising, leading to more cocoa liquor-based innovations. Import dependency remains high, prompting manufacturers to strengthen supplier relationships in West Africa and Latin America. Regulatory frameworks around food safety and labeling further influence production and packaging decisions.

Europe

The Europe Cocoa Liquor Market size was valued at USD 1,344.92 million in 2018 to USD 1,582.93 million in 2024 and is anticipated to reach USD 1,866.80 million by 2032, at a CAGR of 2.1% during the forecast period. Europe holds a 24.49% share of the global Cocoa Liquor Market. It leads globally due to its mature chocolate manufacturing sector and strong export orientation. Countries like Germany, Belgium, Switzerland, and the Netherlands maintain robust processing and distribution networks. The region sets quality benchmarks for cocoa liquor usage in artisan and luxury chocolates. It drives demand through innovation in clean-label, organic, and fair-trade-certified products. Retailers actively promote origin-specific and single-estate cocoa lines. Strict sustainability regulations shape sourcing and production practices. Market players continually invest in ethical supply chains and certification programs to meet consumer and regulatory expectations.

Asia Pacific

The Asia Pacific Cocoa Liquor Market size was valued at USD 1,123.82 million in 2018 to USD 1,450.85 million in 2024 and is anticipated to reach USD 1,936.91 million by 2032, at a CAGR of 3.7% during the forecast period. Asia Pacific accounts for 22.43% of the global Cocoa Liquor Market. It exhibits the fastest growth, driven by rising urbanization, income growth, and evolving consumer tastes. Markets such as China, India, Japan, and Indonesia show strong interest in premium chocolate and cocoa-rich products. It benefits from expanding middle-class demographics and exposure to Western confectionery. Domestic chocolate production is increasing, with manufacturers investing in local sourcing and processing. E-commerce channels play a critical role in driving product visibility and accessibility. Regional brands explore hybrid formats that integrate cocoa liquor into traditional sweets. Governments also support agricultural modernization to improve regional cocoa bean output.

Latin America

The Latin America Cocoa Liquor Market size was valued at USD 587.32 million in 2018 to USD 765.23 million in 2024 and is anticipated to reach USD 1,032.86 million by 2032, at a CAGR of 3.9% during the forecast period. Latin America holds an 11.84% share of the global Cocoa Liquor Market. It plays a dual role as both a cocoa-producing and processing region, with countries like Brazil, Ecuador, and Peru contributing significantly. Domestic consumption is increasing alongside improved income levels and urban growth. The market benefits from proximity to cocoa farms, ensuring fresher raw material access. It supports bean-to-bar movements and ethical sourcing initiatives led by local entrepreneurs. Export potential remains strong, with European and North American buyers sourcing liquor from certified Latin producers. Domestic players expand distribution in regional supermarkets and foodservice. Government support for sustainable agriculture also promotes cocoa-based product innovation.

Middle East

The Middle East Cocoa Liquor Market size was valued at USD 302.83 million in 2018 to USD 393.65 million in 2024 and is anticipated to reach USD 529.88 million by 2032, at a CAGR of 3.8% during the forecast period. The Middle East represents 6.57% of the global Cocoa Liquor Market. It shows growing demand for premium confectionery, particularly in the Gulf Cooperation Council (GCC) countries. The region imports high volumes of finished cocoa liquor for use in luxury chocolates and hospitality applications. It supports growth through tourism-driven demand for gourmet food experiences. Countries like the UAE and Saudi Arabia promote retail expansion and chocolate-themed product launches. Halal-certified and organic chocolate products gain popularity among health-conscious buyers. Imports from Africa and Asia remain critical for local processing needs. Market players explore niche offerings in dates, pastries, and spreads infused with cocoa liquor.

Africa

The Africa Cocoa Liquor Market size was valued at USD 646.00 million in 2018 to USD 827.95 million in 2024 and is anticipated to reach USD 1,095.63 million by 2032, at a CAGR of 3.6% during the forecast period. Africa holds a 12.81% share of the global Cocoa Liquor Market. It acts as the primary cocoa bean source globally, with Ghana, Ivory Coast, and Nigeria dominating supply chains. Local processing capacity is gradually expanding due to government and private investments. It presents significant growth opportunities through value addition and regional consumption. Domestic chocolate brands emerge in urban centers with rising demand for affordable indulgence. Infrastructure development supports improved logistics and export readiness. National policies aim to retain more value locally through liquor production rather than raw bean exports. Regional markets also benefit from increasing awareness of cocoa-based health and culinary products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hershey’s

- Ghirardelli

- Nestlé

- Mars, Inc.

- SunOpta Inc.

- Natra SA

- Cocoa Processing Company

- Olam International

- Cargill, Inc.

- Barry Callebaut

- Swiss Chalet Fine Foods

- Touton

- Dutch Cocoa

Competitive Analysis:

The Cocoa Liquor Market features a mix of multinational giants and regional players competing on quality, sourcing practices, and product innovation. Key companies such as Barry Callebaut, Cargill, Olam International, and ECOM Agroindustrial dominate global supply chains through vertically integrated operations. It allows them to control procurement, processing, and distribution, ensuring consistent quality and traceability. Smaller players focus on niche segments such as organic, single-origin, and craft cocoa liquor. Strategic partnerships with cocoa farmers and sustainability programs strengthen supplier relationships. Companies invest in technology to improve processing efficiency and flavor customization. Brand differentiation often hinges on ethical sourcing certifications and product transparency. Competitive intensity remains high in premium and health-conscious categories.

Recent Developments:

- In April 2025, Hershey’s announced its intent to acquire LesserEvil, a maker of organic snacks. This move is designed to expand Hershey’s snacking portfolio into new categories and better-for-you options, complementing its core confection brands like Hershey’s, Reese’s, and Jolly Ranchers. The acquisition will enhance Hershey’s manufacturing capacity and deliver more options to consumers across eating occasions.

- In May 2024, Ghirardelli partnered with Baa Baa Thai Tea to launch a new collection of eight frappe beverages, merging Ghirardelli’s renowned chocolate with innovative tea flavors. This collaboration aims to deliver a luxurious and unique beverage experience, reflecting Ghirardelli’s commitment to product innovation in new segments.

- In August 2024, Mars, Incorporated announced a definitive agreement to acquire Kellanova, the parent of snack brands such as Pringles and Cheez-It, for $35.9billion. This acquisition adds iconic billion-dollar brands to Mars’ portfolio, diversifies its offerings into new snacking categories, and extends their global reach, particularly in high-growth markets such as Africa and Latin America. The transaction is anticipated to close by the end of 2025.

- In August 2024, Nestlé Health Science signed an agreement to acquire the global rights to VOWST, a next-generation probiotic product. Having commercialized VOWST since June 2023, this deal grants Nestlé full control over the development, commercialization, and manufacturing of VOWST, further strengthening its health science business.

Market Concentration & Characteristics:

The Cocoa Liquor Market remains moderately concentrated, with a few major players controlling a significant portion of global production. It exhibits characteristics of vertical integration, strong emphasis on sustainability, and reliance on global cocoa supply chains. Multinational processors dominate volumes, while artisanal producers create differentiation through origin-specific offerings. The market favors suppliers with long-term grower relationships and advanced processing capabilities. Barriers to entry include raw material volatility, regulatory compliance, and capital-intensive infrastructure. Innovation in flavor, texture, and ethical branding continues to shape competitive positioning. Regional diversity in demand influences pricing and product formats.

Report Coverage:

The research report offers an in-depth analysis based on product type, end use industry, cocoa variety, and form, It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for premium and single-origin chocolate products will continue driving the need for high-quality cocoa liquor.

- Expansion of plant-based and vegan confectionery will open new formulation avenues for cocoa liquor.

- Advancements in fermentation and roasting technologies will enhance flavor profiling and product differentiation.

- Sustainable and traceable sourcing practices will become a critical factor in supplier selection and brand positioning.

- Asia Pacific and Latin America will emerge as key growth regions due to rising middle-class consumption.

- E-commerce will facilitate wider market access for artisanal and niche cocoa liquor producers.

- Investment in regional processing facilities will increase to reduce dependency on imported liquor.

- Integration of cocoa liquor in functional foods and beverages will create new product categories.

- Regulatory compliance and food safety protocols will drive innovation in clean-label production.

- Strategic collaborations between chocolate brands and cocoa farmers will strengthen supply chain resilience.