Market Overview:

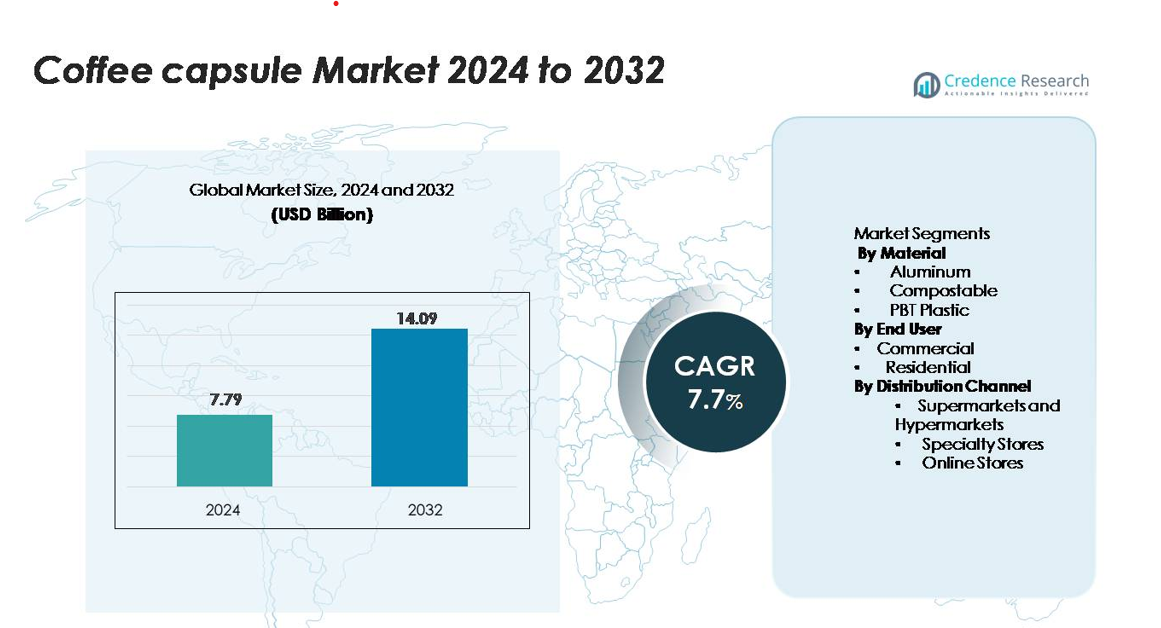

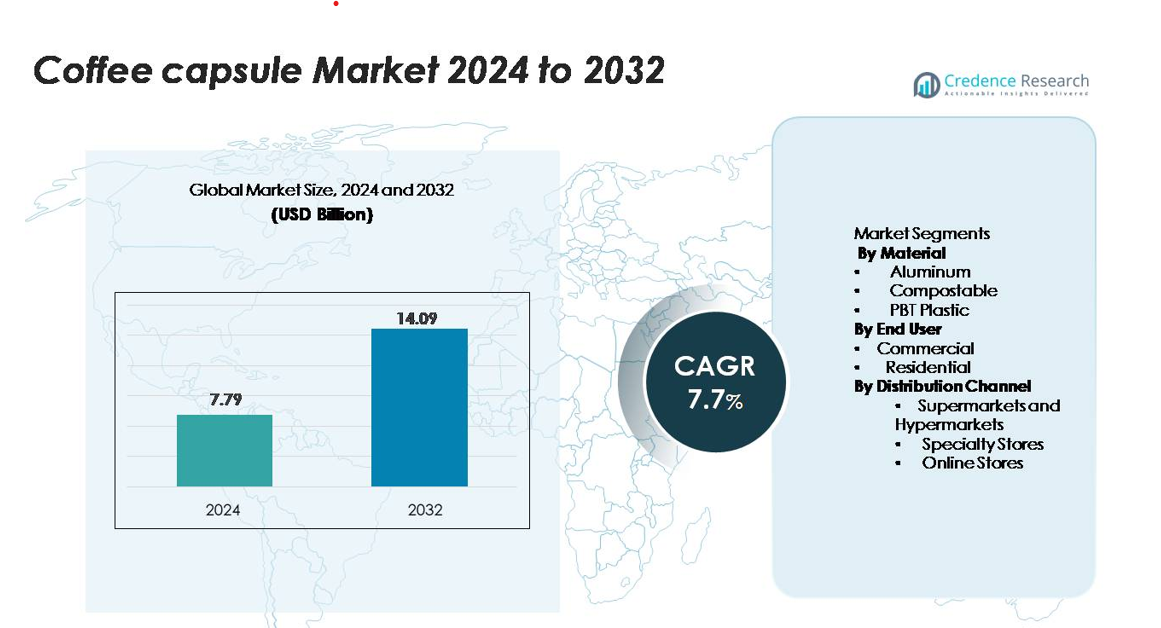

The Coffee Capsule Market was valued at USD 7.79 billion in 2024 and is anticipated to reach USD 14.09 billion by 2032, exhibiting a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coffee Capsule Market Size 2024 |

USD 7.79 billion |

| Coffee Capsule Market, CAGR |

7.7% |

| Coffee Capsule Market Size 2032 |

SD 14.09 billion |

The coffee capsule market is led by major players such as Nestlé (Nespresso), JDE Peet’s, Keurig Dr Pepper, Lavazza, Starbucks, and Vittoria Coffee. These brands compete through premium blends, machine compatibility, and sustainable capsule innovations. North America leads the global market with the highest share due to strong household adoption of single-serve brewing systems and subscription-based capsule delivery. Europe follows closely with a large share driven by high daily coffee consumption, premiumization, and strong retail penetration in Germany, France, Italy, and the U.K. Continuous product launches, flavor expansion, and eco-friendly packaging reinforce leadership across these regions.

Market Insights

- The Coffee Capsule Market was valued at USD 7.79 billion in 2024 and is projected to reach USD 14.09 billion by 2032, growing at a CAGR of 7.7%.

- Rising home consumption of single-serve brewing systems and subscription-based capsule delivery drive steady market expansion, supported by premium flavor innovation and machine affordability.

- Compostable and recyclable capsules gain popularity as sustainability trends influence product development, and brands invest in plant-based materials and closed-loop recycling programs.

- Competition intensifies as Nestlé, JDE Peet’s, Keurig Dr Pepper, and Lavazza expand premium blends, limited editions, and machine-compatible capsules, while private-label brands offer low-cost alternatives.

- North America holds the largest regional share due to strong household adoption, while Europe follows with high daily coffee consumption; the residential segment remains dominant as households prefer convenience and portion-controlled brewing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Aluminum leads the material segment with the highest market share due to strong barrier properties, extended shelf life, and compatibility with high-pressure brewing systems. Leading coffee brands prefer aluminum because it preserves aroma and maintains product freshness. Compostable capsules are growing fast as consumers shift toward eco-friendly solutions, and manufacturers invest in plant-based and biodegradable materials to reduce plastic waste. PBT plastic remains relevant for low-cost production and heat resistance, supporting affordability in emerging markets. Sustainability goals and premium product positioning continue to drive aluminum dominance across retail and commercial applications.

- For instance, Nespresso produces aluminum capsules compatible with 19-bar extraction machines, enabling precise pressure and consistent crema formation during each brew cycle.

By End User

The residential segment holds the dominant market share due to rising household adoption of convenient single-serve brewing systems. Busy lifestyles, growing work-from-home culture, and subscription-based capsule offerings boost household demand. Commercial usage is also expanding across hotels, cafés, offices, and vending machine networks, where capsule machines enable fast beverage service with consistent taste. Brands attract home users through premium flavors, seasonal blends, and machine-brand partnerships. Residential consumption remains the primary revenue generator as users shift from traditional brewing to portion-controlled coffee formats.

- For instance, Nespresso offers various recurring services for its Original Line, including a standard Coffee Subscription where users pay a monthly fee in exchange for credit to spend on products of their choice, and an ‘Auto-Delivery’ or ‘Recurring Order’ option that ships a user’s selected coffee quantities automatically at a chosen frequency.

By Distribution Channel

Supermarkets and hypermarkets command the largest market share, driven by wide product availability, attractive pricing, and strong brand visibility. Specialty stores attract consumers seeking gourmet flavors and premium capsule varieties, while coffee brands use dedicated retail counters to promote high-end machines and accessories. Online stores grow rapidly as customers prefer doorstep delivery, subscription packs, and bulk discounts. E-commerce platforms expand product reach in urban and semi-urban areas. The dominance of supermarkets and hypermarkets continues, supported by high stocking capacity and strong promotional campaigns.

Key Growth Drivers

Rising Household Consumption of Single-Serve Coffee Machines

Home consumption drives strong market expansion as users shift from traditional brewing to convenient capsule systems. Busy lifestyles, remote work, and demand for café-style beverages at home increase sales of single-serve machines and capsules. Capsule systems eliminate preparation time, reduce wastage, and offer consistent taste, which strengthens adoption. Premium brands release seasonal blends and flavored capsules to retain repeat customers. Subscription models and loyalty programs also boost consumption among regular coffee drinkers. As capsule machines become affordable and more compact, penetration increases in urban and semi-urban households. Retail and online platforms provide bundle offers, making machines and capsules easier to access.

- For instance, Keurig Dr Pepper’s brewer shipments totaled 7 million for the twelve months ending December 31, 2023, amidst a softer demand environment. The total number of Keurig brewing system households across North America reached approximately 40 million as of the end of 2023.

Product Premiumization and Flavor Innovation

Premiumization remains a powerful driver as brands offer gourmet blends, origin-specific roasts, and artisanal flavors. Consumers prefer capsules that deliver barista-level experience without cafes. Specialty coffee roasters partner with capsule companies to expand product portfolios. Limited-edition flavors, intensity levels, and organic or ethically sourced beans attract younger demographics. High-pressure extraction technology improves aroma retention, enhancing customer satisfaction. Increased awareness of bean quality, roast type, and freshness encourages consumers to upgrade to premium capsules. Strong branding, packaging appeal, and tasting events build customer loyalty across developed and emerging markets.

Convenient Distribution and Subscription-Based Sales Channels

Expanding retail presence ensures easy access to a wide capsule range. Supermarkets and hypermarkets offer competitive pricing and strong brand visibility. Online platforms accelerate growth through doorstep delivery, single-brand stores, and bulk pack discounts. Subscription-based sales models guarantee regular refilling and help companies retain customers through loyalty rewards. E-commerce also supports global reach for smaller brands that lack large retail networks. Mobile apps and digital coffee marketplaces simplify ordering and enable trial packs. Convenience in product availability and delivery remains a key factor supporting long-term market expansion.

Key Trends & Opportunities

Rising Demand for Compostable and Eco-Friendly Capsules

Sustainability emerges as a major trend as consumers reject non-recyclable waste. Compostable and biodegradable capsules are gaining traction among environmentally-aware users. Leading brands shift to plant-based and biopolymer materials to reduce reliance on plastic and aluminum. Governments encourage green packaging adoption through recycling programs and plastic-waste regulations. Refill-and-reuse capsule models appeal to cost-conscious and eco-focused customers. Companies that invest in certified compostable products, recyclable packaging, and waste-collection systems find strong growth opportunities in premium and organic coffee segments.

- For instance, Halo Coffee manufactures fully compostable capsules made from waste sugarcane fiber (bagasse) and paper pulp. The company received sales inquiries for 21 million capsules from potential business-to-business (B2B) customers after launching its product

Smart Coffee Machines and Digital Integration

Connected capsule machines enhance brewing control through mobile apps and smart interfaces. Features such as brew scheduling, temperature control, capsule recognition, and personalized recipes improve user experience. Digital integration increases adoption among tech-savvy consumers, especially in residential spaces. Brands collect user data to recommend flavors and automate capsule replenishment. Smart vending systems in corporate offices and commercial locations also drive capsule consumption. Technology partnerships with appliance manufacturers open new revenue channels and strengthen brand loyalty.

- For instance, For instance, Nespresso’s Prodigio smart machine linked with the Nespresso App via Bluetooth, allowing features such as remote brewing and capsule stock tracking.

Key Challenges

Environmental Impact and Waste Management Issues

Although capsules are convenient, waste generation remains a major concern. Most single-use aluminum and plastic capsules take years to decompose, leading to landfill accumulation. Rising consumer awareness and regulatory pressures challenge manufacturers relying on non-recyclable materials. Recycling programs face high collection costs and low participation rates. Companies must invest in biodegradable materials, closed-loop recycling, and waste-collection infrastructure to address sustainability demands. Failure to adopt greener alternatives can impact brand perception, especially among younger and environmentally conscious consumers.

High Cost of Premium Capsules and Machine Dependency

Capsule systems rely on compatible machines, which leads to higher upfront cost for users. Premium capsules also cost more than traditional ground or instant coffee, limiting adoption in price-sensitive regions. Brand-lock systems restrict the use of generic capsules, increasing long-term spending. Maintenance, machine breakdown, and flavor limitations also influence purchasing decisions. Low-cost brewing alternatives remain attractive in emerging markets. Companies must introduce affordable machines, refillable capsules, and flexible pricing strategies to overcome cost-driven adoption barriers.

Regional Analysis

North America

North America holds the largest market share due to strong penetration of single-serve brewing systems and high household consumption of premium coffee. The U.S. dominates regional sales with wide adoption of capsule machines, subscription-based capsule delivery, and strong retail availability across supermarkets and online platforms. Consumers prefer convenience, flavor diversity, and branded specialty blends, which strengthens capsule demand. Environmental concerns encourage the shift toward recyclable and compostable capsules. The presence of leading brands and aggressive product launches continues to support market dominance across the region.

Europe

Europe accounts for a significant market share, supported by strong café culture and high daily coffee consumption. Countries such as Germany, France, Italy, and the U.K. lead sales due to matured capsule adoption and premium product preferences. Eco-friendly packaging gains traction as EU regulations push manufacturers toward sustainable materials. Private-label brands expand retail presence with affordable capsule packs, increasing accessibility. Specialty roasters enter the capsule market with artisanal flavors, enhancing product variety. Growing machine installations in households and offices further strengthen Europe’s position as one of the fastest-growing regional markets.

Asia Pacific

Asia Pacific shows rapid growth and rising market share due to increasing urbanization, expanding café chains, and premium coffee adoption in China, Japan, South Korea, India, and Australia. Young consumers embrace capsule systems for convenience and café-style taste at home. E-commerce platforms drive sales through discounts and subscription programs. International brands collaborate with local roasters to introduce region-specific flavors tailored to taste profiles. Middle-class income growth and machine affordability accelerate household penetration. The region continues to attract new entrants, making Asia Pacific a key opportunity market for global and regional players.

Latin America

Latin America holds a growing market share, supported by strong local coffee culture and rising demand for modern brewing formats. Brazil and Mexico drive regional consumption as urban consumers adopt single-serve machines. Supermarkets expand capsule availability with affordable options, which increases accessibility across income groups. Domestic roasters introduce capsule versions of traditional blends, encouraging brand loyalty. E-commerce growth and global brand expansion also boost distribution channels. Although price sensitivity remains a factor, increasing exposure to premium coffee strengthens long-term demand in the region.

Middle East & Africa

Middle East & Africa represents a developing market with steadily increasing market share driven by rising café culture, tourism growth, and premium lifestyle trends. Urban households in the UAE, Saudi Arabia, and South Africa adopt capsule systems for convenient home brewing. Hotels, airports, and office spaces purchase capsule machines for guest and employee services. Imported premium flavors gain popularity, supported by specialty retail stores and online shopping. Manufacturers expand distribution with localized flavors and halal-certified offerings. Although penetration remains lower than other regions, rapid urbanization and rising disposable income create favorable growth potential.

Market Segmentations:

By Material

- Aluminum

- Compostable

- PBT Plastic

By End User

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the coffee capsule market is shaped by global brands, private-label manufacturers, and specialty coffee roasters competing for product differentiation and customer loyalty. Leading companies expand their portfolios with premium blends, organic options, and region-specific flavors to attract diverse consumer groups. Sustainability remains a core focus as brands introduce recyclable aluminum capsules and certified compostable materials to address waste concerns. Strategic partnerships between capsule brands and machine manufacturers help secure long-term customer retention through system compatibility. Subscription-based delivery models, loyalty programs, and limited-edition flavors strengthen repeat purchases. Private-label brands from major retailers offer cost-friendly alternatives, increasing competition in price-sensitive regions. Online channels enable smaller roasters to enter the market without large retail networks, further intensifying competition. Companies invest in technology-driven brewing systems, digital marketing, and personalized recommendations to maintain market share and enhance customer experience in both residential and commercial segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gourmesso Coffee

- The Kraft Heinz Company

- Blue Tokai Coffee

- Nestlé Nespresso SA

- RAVE COFFEE

- Dualit Limited

- Starbucks Corporation

- Coffeeza

- JACOBS DOUWE EGBERTS

- illycaffè S.p.A.

Recent Developments

- In May 2025, Nespresso unveiled its Summer 2025 collection featuring new flavours like “Pistachio Vanilla Over Ice” and limited-edition machines.

- In February 2023, Tassimo launched a free recycling envelope programme in Canada in partnership with TerraCycle to help consumers recycle used T-DISC capsules.

Report Coverage

The research report offers an in-depth analysis based on Material, End use, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and specialty coffee capsules will continue to rise across developed and emerging markets.

- Compostable and recyclable capsules will gain stronger adoption as brands focus on sustainability.

- Subscription-based sales models will expand due to customer preference for doorstep delivery and regular refills.

- Smart capsule machines with app control and personalization features will boost household usage.

- Local coffee roasters will enter the capsule space with region-specific flavors and artisanal blends.

- Private-label capsule brands will increase competition by offering cost-effective alternatives.

- Commercial usage in hotels, offices, and vending networks will grow as businesses seek fast and consistent beverage options.

- Partnerships between capsule makers and coffee machine manufacturers will strengthen brand loyalty.

- Retail and e-commerce distribution will expand, improving availability in urban and semi-urban regions.

- Brands will invest in advanced packaging, aroma-locking technology, and machine-compatible capsule formats to attract repeat customers.