Market Overview

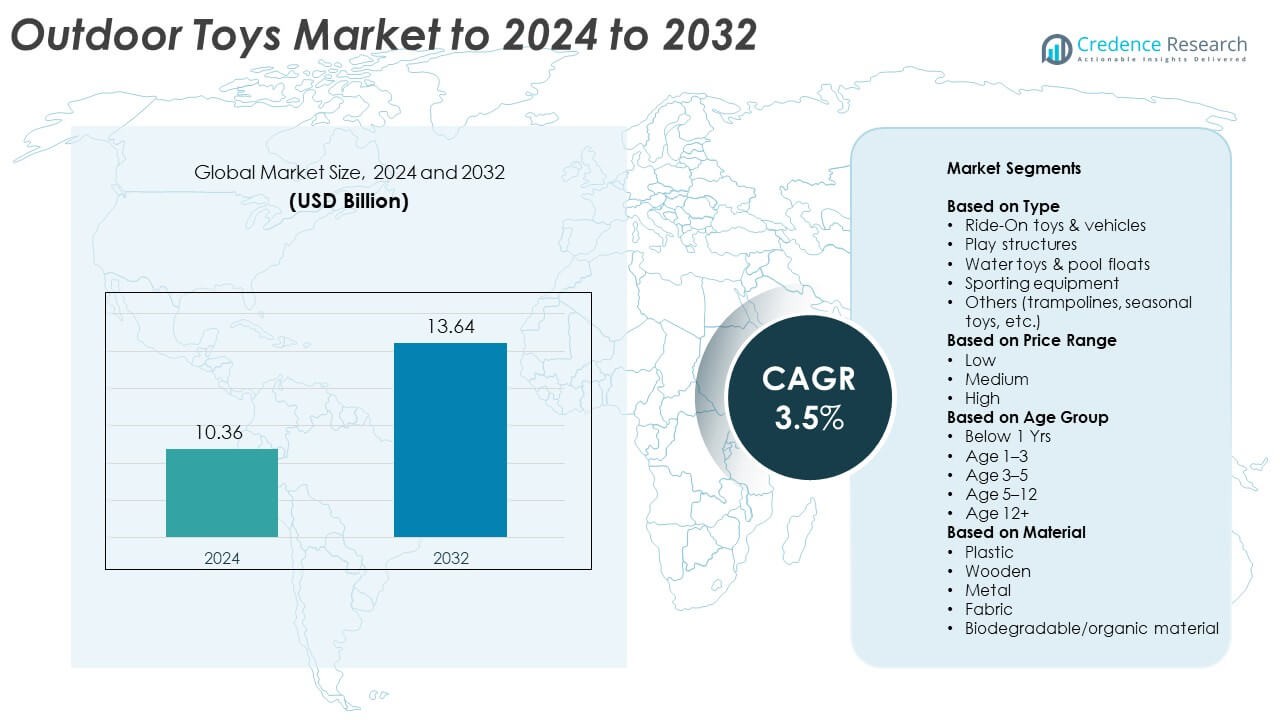

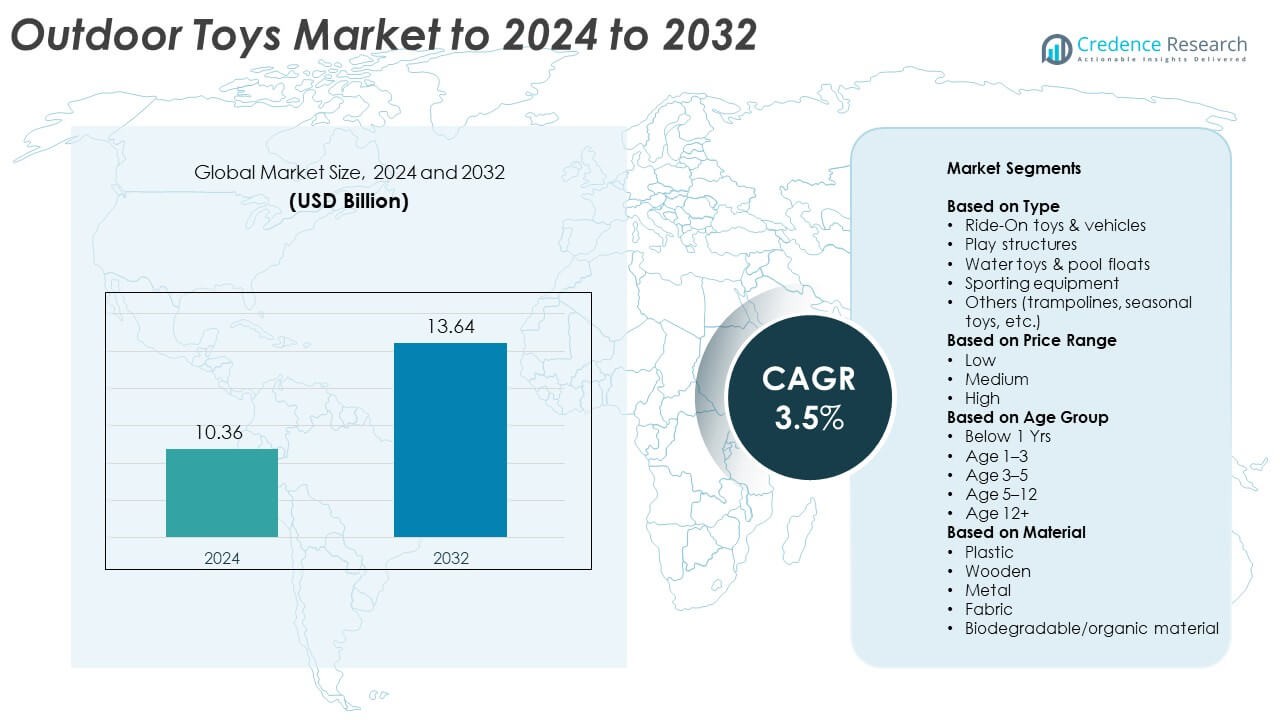

Outdoor Toys Market size was valued USD 10.36 Billion in 2024 and is anticipated to reach USD 13.64 Billion by 2032, at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Outdoor Toys Market Size 2024 |

USD 10.36 Billion |

| Outdoor Toys Market, CAGR |

3.5% |

| Outdoor Toys Market Size 2032 |

USD 13.64 Billion |

The outdoor toys market is driven by major players including Simba Dickie Group GmbH, Mattel, Inc., Decathlon, Jakks Pacific, Inc., Outdoor Toys, Ravensburger AG, Hasbro, Inc., Playmobil, Mookie Toys, and Little Tikes. These companies compete through wider product portfolios, strong distribution networks, and steady innovation in ride-on vehicles, sports equipment, and backyard play systems. North America leads the market with about 37% share due to higher household spending and strong adoption of premium outdoor toys. Europe follows with nearly 28% share, supported by strong demand for sustainable and safety-certified products. Asia Pacific holds about 24% share and remains the fastest-growing region due to rising urbanization and expanding online retail access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The outdoor toys market reached USD 10.36 Billion in 2024 and is projected to hit USD 13.64 Billion by 2032, growing at a CAGR of 3.5%.

- Demand rises due to parents encouraging outdoor activity, with the 5–12 age group holding the largest share at 42% and ride-on toys leading type demand with 34% share.

- Sustainable designs, modular backyard playsets, and tech-enabled outdoor toys shape key trends as brands focus on durability and safer materials.

- Competition remains strong as major companies expand product lines, improve safety testing, and enhance online distribution to strengthen their market presence.

- North America leads with 37% share, followed by Europe at 28% and Asia Pacific at 24%, while the medium price range remains the dominant segment with 48% share due to balanced affordability and quality.

Market Segmentation Analysis:

By Type

Ride-on toys and vehicles held the dominant position in 2024 with about 34% share of the outdoor toys market. Parents prefer these products because they support motor-skill growth and give children active playtime outdoors. Strong demand comes from battery-powered ride-ons, balance bikes, and push cars used across parks and home spaces. Play structures and water toys grew at a steady pace as families invested in backyard play zones, but ride-on toys stayed ahead due to wide product variety, strong brand presence, and higher replacement cycles during early childhood years.

- For instance, the Power Wheels brand, a subsidiary of Mattel’s Fisher-Price division since 1994, achieved record sales in 1999, a year which saw the introduction of the Harley-Davidson Motorcycle ride-on toy,

By Price Range

The medium price range led the market in 2024 with nearly 48% share. This range balances affordability with better durability and features, making it the most preferred choice among urban families. Parents choose mid-range outdoor toys because these products offer safer materials, longer life, and wider designs compared with low-priced options. High-priced toys expanded in premium homes, but the medium segment remained dominant as brands introduced stronger plastics, improved safety standards, and bundled accessories without steep price increases.

- For instance, Step2 established a manufacturing facility in Fort Valley, Georgia, with a total space of 109,250 square feet in 2000 to serve its growing southeast business, according to reports in Plastics News.

By Age Group

Children aged 5–12 years accounted for the largest share in 2024 with about 42% share. This group drives strong demand for bicycles, sports gear, outdoor play structures, and skill-based toys that support active outdoor routines. Rising participation in school sports and growing awareness of reducing screen time boost purchases in this segment. Younger groups such as ages 1–3 also showed healthy growth, but the 5–12 years category stayed dominant because of broader product usage, higher outdoor activity levels, and frequent upgrades as children grow.

Key Growth Drivers

Rising focus on active outdoor play

Parents are encouraging children to spend more time outdoors due to growing concerns over screen exposure and reduced physical activity. This trend boosts demand for bicycles, sports sets, ride-on toys, and backyard play structures that promote movement and skill development. Schools and community groups also add outdoor activities to support physical health, which increases product adoption. Brands expand product lines designed for skill building, balance training, and coordination support. This growing shift toward healthy outdoor routines acts as a major growth driver for the outdoor toys market.

- For instance, Decathlon supports organized sport and outdoor activity through 1,817 stores across 79 territories (countries and regions) and a workforce of about 101,100 employees, giving global reach to its sports and outdoor equipment range.

Increasing household spending on recreation

Higher disposable income and rising interest in home-based entertainment have increased demand for mid-range and premium outdoor toys. Families invest in durable playsets, upgraded ride-ons, and customized outdoor gear that enhances backyard use. Seasonal gifting and festive purchases further support strong sales across developed and emerging markets. Retailers expand product lists across online and offline channels, making it easier for families to access a wide range of designs. This steady rise in household recreational spending remains a major growth driver for the outdoor toys market.

- For instance, Spin Master has grown into a global toy and entertainment company with more than 2,500 employees working from 29 offices in nearly 20 countries, reflecting large-scale supply of branded play and recreation products.

Expansion of online retail and global brands

E-commerce platforms have made outdoor toys more accessible by offering wide product catalogs, discounts, and home delivery options. Global brands enter new markets through online channels, which increases consumer choice and improves product quality standards. Digital reviews and social media influence buyer decisions, pushing families toward safer and more innovative toys. Retail giants partner with toy makers to introduce exclusive collections, supporting sustained demand. This rapid expansion of online retail acts as another key growth driver for the outdoor toys market.

Key Trends & Opportunities

Growth of eco-friendly and sustainable toys

Many parents prefer toys made from recycled plastics, wood, or biodegradable materials due to rising environmental concerns. This shift creates strong opportunities for brands offering eco-certified outdoor toys with reduced chemical use. Companies focus on greener supply chains and packaging to meet sustainability expectations. Growing global awareness about environmental impact pushes retailers to add dedicated “green toy” categories. This rising adoption of sustainable products stands out as a key trend and opportunity in the outdoor toys market.

- For instance, Green Toys reported by May 2024 that it had recycled over 155 million post-consumer milk jugs into toy-grade plastic, directly tying toy production to large-scale waste diversion.

Integration of technology in outdoor play

Manufacturers introduce smart ride-ons, app-linked sports gear, and interactive outdoor games that blend physical activity with digital engagement. This shift attracts older children who want tech-driven play while still spending time outdoors. Brands explore sensor-based scoring, GPS navigation, and Bluetooth features that enhance safety and learning. Technology-supported outdoor toys also appeal to parents seeking controlled and measurable activity. This increased integration of digital tools presents a strong trend and opportunity within the outdoor toys market.

- For instance, Segway’s Ninebot eKickScooter ZING E8 for children offers a maximum speed of 14 kilometers per hour and a range of about 10 kilometers, and is designed for users aged 6 to 12 years, combining electronics with outdoor riding.

Rising demand for modular backyard play zones

Families invest in customizable backyard setups that include swings, climbers, mini sports turfs, and splash zones. Modular designs help parents expand or reconfigure play spaces as children grow, which increases repeat purchases. Home improvement trends and larger suburban homes further support adoption. Manufacturers introduce weather-resistant materials and easy installation systems, boosting the appeal of these products. This rise in modular outdoor play environments represents a key trend and opportunity for market expansion.

Key Challenges

Safety concerns and compliance requirements

Manufacturers must meet strict safety norms related to material quality, impact resistance, and chemical limits. Non-compliance leads to recalls and damages brand trust, which restricts product adoption. Parents closely monitor product reviews and certification labels before buying, raising the need for consistent quality checks. Complex regulations across regions increase operational costs and slow product launches. These rising safety and compliance pressures stand as a major challenge in the outdoor toys market.

Seasonal demand fluctuations and cost pressures

Outdoor toys experience peak demand during holidays and summer months, which leads to uneven sales cycles. Manufacturers face high storage and inventory management costs during off-season periods. Price fluctuations in plastics, metals, and packaging materials add further strain on production budgets. Retailers also reduce stock in cooler months, limiting full-year revenue potential. These seasonal shifts and material cost pressures remain a key challenge limiting stable growth in the outdoor toys market.

Regional Analysis

North America

North America held about 37% share of the outdoor toys market in 2024, driven by strong spending on premium ride-ons, play structures, and sports gear across the U.S. and Canada. Parents focus on outdoor recreation to reduce screen time, which boosts demand for durable and skill-based products. Retailers expand online and in-store selections, helping families access a wide range of designs. Backyard upgrades in suburban homes also support steady growth. Rising preference for safety-certified and eco-friendly toys continues to shape buying patterns across the region.

Europe

Europe captured nearly 28% share in 2024, supported by strong demand for eco-friendly outdoor toys and higher adoption of wooden and sustainable materials. Consumer preference for quality-certified products drives growth across Germany, the U.K., France, and Nordic countries. Outdoor sports participation among children increases sales of bicycles, scooters, and backyard sports sets. Seasonal festivals and holidays further push toy purchases. Widespread regulatory standards guide manufacturers toward safer and greener designs, keeping the region a key market for consistent product innovation.

Asia Pacific

Asia Pacific accounted for about 24% share in 2024 and showed the fastest growth due to rising urbanization and increasing household spending. Larger families in China, India, and Southeast Asia invest in affordable ride-ons, sports toys, and outdoor playsets. Expanding e-commerce platforms boost accessibility, offering a wide range of low- to mid-range products. Parents seek toys that support physical development and outdoor routines, pushing manufacturers to expand their portfolios. Growing interest in backyard play spaces strengthens regional demand.

Latin America

Latin America represented nearly 7% share in 2024, driven by growing interest in outdoor recreation across Brazil, Mexico, and Argentina. Urban families buy more ride-on vehicles, sports gear, and summer water toys as outdoor activities become more common. Local manufacturers introduce cost-effective products suited for warm climates, helping improve affordability. Economic improvements in several countries support greater spending on children’s leisure products. Seasonal events and holiday sales also encourage higher purchases across major cities.

Middle East & Africa

Middle East & Africa held around 4% share in 2024, with steady growth supported by rising urban development and increasing adoption of modern outdoor toys. Families in the UAE, Saudi Arabia, and South Africa invest in premium ride-ons, sports gear, and weather-resistant play structures suited for hot climates. Expanding retail chains and online marketplaces improve access to global brands. Water toys and pool accessories gain popularity due to warmer temperatures in many areas. Gradual income growth and rising focus on children’s recreation continue to support market expansion.

Market Segmentations:

By Type

- Ride-On toys & vehicles

- Play structures

- Water toys & pool floats

- Sporting equipment

- Others (trampolines, seasonal toys, etc.)

By Price Range

By Age Group

- Below 1 Yrs

- Age 1–3

- Age 3–5

- Age 5–12

- Age 12+

By Material

- Plastic

- Wooden

- Metal

- Fabric

- Biodegradable/organic material

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The outdoor toys market is shaped by leading companies such as Simba Dickie Group GmbH, Mattel, Inc., Decathlon, Jakks Pacific, Inc., Outdoor Toys, Ravensburger AG, Hasbro, Inc., Playmobil, Mookie Toys, and Little Tikes. The competitive landscape reflects strong innovation efforts focused on safety, durability, and child development, with manufacturers expanding product lines across ride-ons, sports gear, outdoor playsets, and water toys. Many companies invest in eco-friendly materials and weather-resistant designs to align with sustainability trends and longer outdoor usage. Online retail partnerships continue to strengthen brand visibility, while exclusive deals with large retailers help secure additional market share. Rising demand for multifunctional and modular play equipment pushes companies to upgrade designs and introduce customizable features. Firms also enhance quality certifications and safety testing to meet regional regulations, ensuring stronger consumer trust. Competition intensifies as both global and regional brands expand into new markets through e-commerce platforms.

Key Player Analysis

Recent Developments

- In 2025, Decathlon launched its 2025 Spring Outdoor Sports and Camping Collection in March 2025, featuring a variety of outdoor sports equipment and toys for children, including items like children’s mountain bikes.

- In 2025, Hasbro unveiled new products at the North American International Toy Fair, including the new intellectual property Nano-mals, a new line of PLAY-DOH BARBIE toys, and expanded offerings for established brands like FURBY and Peppa Pig

- In 2024, Jakks Pacific launched a new lifestyle products line beginning in Fall 2024 with skateboards, helmets, and roller skates under brands such as Roxy, Quiksilver, and Juicy Couture. The collection was expanded in early 2025 to include spring/summer focused items such as branded volleyballs, floaties, and other beach accessories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Price Range, Age Group, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The outdoor toys market will see steady growth as parents promote more outdoor play.

- Manufacturers will expand eco-friendly product lines using recycled and safer materials.

- Demand for modular backyard play zones will rise in suburban households.

- Smart features in ride-ons and sports gear will attract older children seeking interactive play.

- E-commerce platforms will increase product visibility and drive stronger cross-border sales.

- Brands will invest in durable, weather-resistant materials to improve product life.

- Sports-linked outdoor toys will grow as schools and clubs promote physical fitness.

- Premium outdoor toys will gain traction among higher-income families.

- Safety-certified products will remain a top priority for buyers and regulators.

- Seasonal demand patterns will continue, but promotions and online sales will reduce fluctuations.