Market Overview

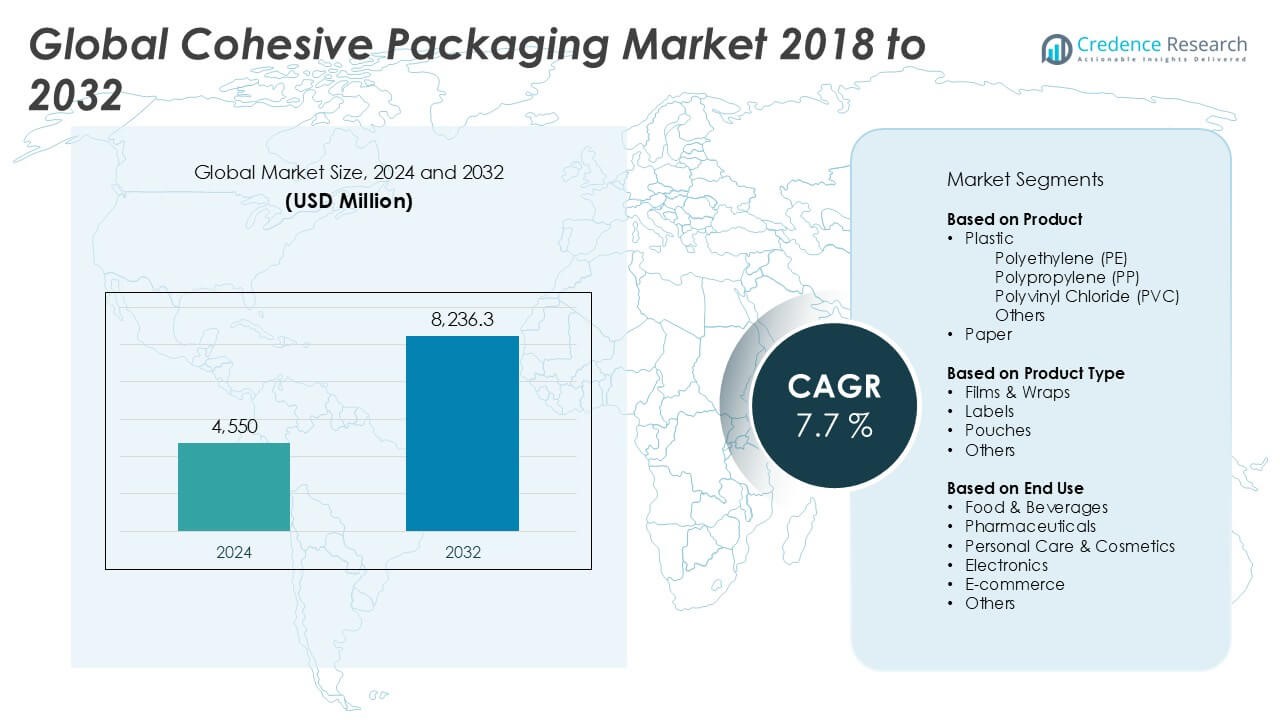

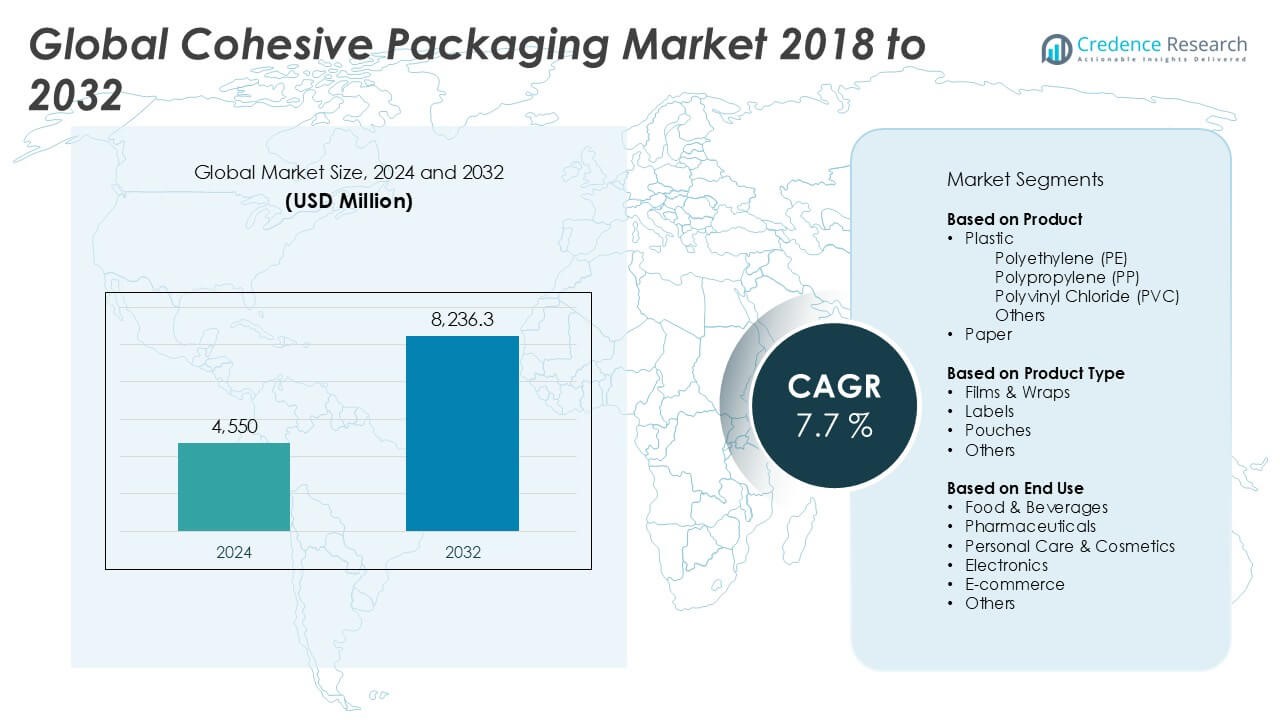

The cohesive packaging market size was valued at USD 4,550 million in 2024 and is anticipated to reach USD 8,236.3 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| cohesive packaging Market Size 2024 |

USD 4,550 Million |

| cohesive packaging Market, CAGR |

7.7% |

| cohesive packaging Market Size 2032 |

USD 8,236.3 Million |

The cohesive packaging market is led by prominent players such as Pregis LLC, Sealed Air Corporation, 3M Company, Mondi Group Plc, and Smurfit Kappa Group, all of which have established strong global footprints and extensive product portfolios. These companies focus on delivering innovative, sustainable, and automation-compatible packaging solutions across key sectors like e-commerce, food & beverages, and pharmaceuticals. North America emerged as the dominant regional market in 2024, accounting for 34% of the global market share, driven by advanced logistics infrastructure, high consumer demand for packaged goods, and strong adoption of eco-friendly packaging practices. Europe followed closely, supported by stringent environmental regulations and increased investment in recyclable cohesive materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cohesive packaging market was valued at USD 4,550 million in 2024 and is projected to reach USD 8,236.3 million by 2032, growing at a CAGR of 7.7% during the forecast period.

- Growth is primarily driven by rising e-commerce and logistics demand, increased focus on sustainable packaging, and expanding applications in food & beverages and pharmaceuticals.

- A key trend shaping the market is the shift toward automation-friendly and recyclable cohesive materials, along with rising investment in biodegradable packaging solutions.

- The market is moderately consolidated, with major players like Pregis LLC, Sealed Air Corporation, and Mondi Group focusing on sustainability, innovation, and global expansion to gain a competitive edge.

- Regionally, North America held 34% of the market share in 2024, followed by Europe with 27% and Asia Pacific with 24%; segment-wise, films & wraps dominated the product category, while polyethylene (PE) led the material segment due to its cost-efficiency and flexibility.

Market Segmentation Analysis:

By Material

The cohesive packaging market is segmented by material into plastic and paper, with plastic accounting for the dominant market share of over 65% in 2024. Among plastic types, polyethylene (PE) emerged as the leading sub-segment due to its superior flexibility, durability, and cost-efficiency. Its widespread application in cohesive films and wraps across food, e-commerce, and consumer goods drives its dominance. Additionally, polyethylene’s compatibility with various printing technologies and sealing properties makes it ideal for branding and secure packaging. Paper, although gaining traction due to sustainability trends, remains a smaller segment driven by eco-conscious consumer demand.

- For instance, Berry Global, Inc. produces more than 1.3 billion pounds of polyethylene films annually, much of which is used in flexible cohesive packaging solutions across multiple industries.

By Product Type:

Within the product type segmentation, films & wraps held the largest market share, contributing approximately 48% in 2024. This dominance is fueled by their extensive usage in bundling and unitizing products without external adhesives. The ease of application and strong cohesive properties make films and wraps particularly popular in logistics and retail packaging. Pouches and labels are gaining momentum, especially in food and pharmaceutical applications, due to their convenience and ability to enhance product presentation. However, films & wraps continue to outperform due to their versatility across industries and reduced packaging material waste.

- For instance, Pregis LLC’s Cohesive AirSpeed® HC film systems can wrap up to 25 packages per minute without adhesive tapes, and are deployed in over 4,500 retail and fulfillment facilities globally.

By End Use:

The food & beverages segment led the cohesive packaging market in 2024, capturing nearly 30% of the total share. Rising demand for secure, tamper-evident packaging and extended shelf-life solutions supports this dominance. Cohesive packaging ensures product integrity during transit and offers branding opportunities, making it an attractive choice for food manufacturers and distributors. The e-commerce sector follows closely, driven by surging online retail volumes and the need for efficient, self-sealing packaging. Pharmaceuticals and personal care products also contribute significantly, emphasizing hygiene, protection, and branding in cohesive pack formats.

Key Growth Drivers

Rising E-commerce and Logistics Demand

The rapid growth of e-commerce and third-party logistics is a primary driver of the cohesive packaging market. As online retail continues to expand, there is a growing need for secure, lightweight, and cost-effective packaging solutions that streamline shipping processes. Cohesive packaging offers self-sealing capabilities without external adhesives, reducing handling time and packaging waste. Its ability to bundle multiple items securely while protecting goods during transit makes it highly preferred in logistics operations. This efficiency and protective advantage align well with the operational needs of modern fulfillment centers and last-mile delivery networks.

- For instance, Amazon’s Frustration-Free Packaging initiative integrated IPG’s cohesive wrap systems across more than 200 fulfillment centers, cutting package preparation time by up to 40%.

Increased Focus on Sustainability

Sustainability initiatives across industries are significantly driving the adoption of cohesive packaging. Manufacturers are increasingly shifting towards recyclable, reusable, and minimal material-based solutions to meet environmental regulations and consumer expectations. Cohesive packaging, particularly in paper-based or recyclable film formats, supports waste reduction and efficient material usage. Additionally, brands aiming to minimize their carbon footprint are choosing cohesive packaging for its reduced reliance on adhesives and tapes, which often hinder recyclability. This eco-friendly characteristic is positioning cohesive packaging as a preferred alternative in sustainable supply chain strategies.

- For instance, Mondi Group developed a paper-based cohesive wrap that enabled a 70% reduction in plastic usage for 185 million e-commerce packages shipped annually by one of its European clients.

Growth in Food and Beverage Packaging Needs

The expanding food and beverage sector contributes substantially to the growth of cohesive packaging. The demand for packaging that ensures hygiene, product integrity, and efficient storage is rising, especially for perishable and ready-to-eat items. Cohesive packaging solutions provide tamper-evident seals and protective layering that preserve freshness during transportation and shelf display. Their ability to conform to various shapes and sizes also supports customization and brand differentiation. As urbanization and consumption of packaged foods increase globally, cohesive packaging is increasingly adopted for its safety, functionality, and visual appeal.

Key Trends & Opportunities

Adoption of Automation-Friendly Packaging Solutions

Cohesive packaging is gaining traction in automated packaging lines due to its compatibility with high-speed machinery and ease of application. As manufacturers aim to enhance productivity and reduce labor costs, demand is rising for materials that integrate seamlessly into automated systems. Cohesive films and wraps allow quick packaging without the need for additional adhesives, making them ideal for automation. This trend is expected to accelerate, particularly in sectors such as electronics, e-commerce, and pharmaceuticals, where volume and efficiency are key performance factors.

- For instance, Sealed Air’s Autobag® 850S system supports cohesive film integration and enables packaging throughput of up to 45 bags per minute in automated workflows.

Expansion into Sustainable and Biodegradable Materials

A growing trend in the cohesive packaging market is the shift toward sustainable and biodegradable materials. With rising regulatory pressure and eco-conscious consumer preferences, manufacturers are exploring innovative material alternatives like recyclable films, biodegradable paper, and compostable adhesives. This transition is creating new opportunities for R&D investments and product differentiation. Companies that develop cohesive packaging solutions aligned with circular economy principles are likely to capture a significant competitive advantage and expand their market presence in the coming years.

- For instance, DS Smith Plc introduced a recyclable paper-based cohesive wrap that replaced over 273 million plastic mailers used annually by a leading U.K. fashion retailer.

Key Challenges

High Initial Investment in Machinery and Setup

One of the major challenges hindering cohesive packaging adoption is the high initial cost associated with specialized machinery and operational setup. Small and medium enterprises often face capital constraints, making it difficult to invest in automated cohesive packaging systems. Additionally, the need for staff training and maintenance further adds to the operational burden. These cost barriers can limit widespread adoption, particularly in developing regions where packaging budgets are constrained.

Material Compatibility and Limited Versatility

Cohesive packaging materials may not be compatible with all types of products, especially those requiring barrier protection against moisture, oxygen, or light. This limits their application in certain food and pharmaceutical categories where extended shelf life is crucial. Furthermore, the cohesive layer must be carefully formulated to ensure performance across varying temperatures and handling conditions, adding complexity to the production process. Such limitations can reduce market penetration and require tailored solutions for diverse industries.

Environmental Concerns over Plastic-Based Variants

Despite cohesive packaging’s sustainability advantages, the continued use of plastic-based cohesive films raises concerns among regulators and consumers. Polyethylene and polypropylene films, though recyclable, often end up in landfills due to inadequate recycling infrastructure. This undermines the eco-friendly appeal of cohesive packaging and could attract stricter environmental regulations in the future. Companies must address these concerns by accelerating the development of bio-based or fully recyclable alternatives to maintain long-term market relevance.

Regional Analysis

North America

North America accounted for the largest share of the cohesive packaging market in 2024, holding approximately 34% of the global market. The dominance is attributed to the region’s advanced logistics infrastructure, high e-commerce penetration, and strong demand from the food and pharmaceutical industries. The U.S. leads the regional market with widespread adoption of automated packaging solutions and sustainable packaging practices. Rising investment in retail-ready and tamper-evident packaging solutions continues to fuel growth. Additionally, the shift toward recyclable cohesive films and growing preference for labor-saving packaging formats support long-term market expansion across North America.

Europe

Europe held a substantial 27% share of the cohesive packaging market in 2024, driven by stringent environmental regulations and a strong push toward sustainable packaging alternatives. Countries such as Germany, the UK, and France are leading in the adoption of recyclable paper-based cohesive packaging, particularly in the food, cosmetics, and e-commerce sectors. Regulatory frameworks such as the EU Packaging and Packaging Waste Directive have compelled manufacturers to transition toward eco-friendly solutions. Moreover, growing demand for automation-compatible cohesive wraps in logistics and retail applications further supports market growth across the region, making Europe a key player in sustainability-led innovations.

Asia Pacific

Asia Pacific captured around 24% of the cohesive packaging market in 2024, emerging as the fastest-growing regional market. Rapid industrialization, booming e-commerce, and expanding manufacturing sectors in China, India, and Southeast Asia are driving demand for cohesive packaging solutions. The region’s growth is supported by rising consumer awareness of product safety and branding, along with the increasing need for efficient logistics packaging. Moreover, the low cost of raw materials and labor, along with government incentives for sustainable packaging, provides fertile ground for market expansion. Key players are actively investing in local production facilities to cater to this rising demand.

Latin America

Latin America represented about 8% of the global cohesive packaging market in 2024. Growth in the region is supported by the expanding food and beverage sector, particularly in Brazil, Mexico, and Argentina. Increasing adoption of protective and cost-effective packaging for domestic distribution and exports is fueling demand. Although limited technological infrastructure restricts automation adoption, the rising middle-class population and growing retail penetration are encouraging the use of flexible packaging formats like cohesive wraps and films. The shift toward lightweight, sustainable packaging is also gaining momentum, offering future growth potential for local and regional players.

Middle East & Africa (MEA)

The Middle East & Africa accounted for approximately 7% of the cohesive packaging market in 2024. The region shows growing interest in secure and cost-efficient packaging solutions driven by the expansion of the e-commerce and pharmaceutical sectors, particularly in the UAE, Saudi Arabia, and South Africa. Although the market is at a nascent stage compared to developed regions, rising investments in retail and logistics infrastructure are gradually boosting demand. Sustainability initiatives and government support for packaging innovation are beginning to influence procurement decisions, positioning MEA as a developing yet promising market for cohesive packaging solutions.

Market Segmentations:

By Material:

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Others

- Paper

By Product Type:

- Films & Wraps

- Labels

- Pouches

- Others

By End Use:

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- E-commerce

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cohesive packaging market features a moderately consolidated competitive landscape, with key players focusing on innovation, sustainability, and strategic partnerships to strengthen their market positions. Major companies such as Pregis LLC, Sealed Air Corporation, 3M Company, Mondi Group Plc, and Smurfit Kappa Group dominate the market with extensive product portfolios and global distribution networks. These players are investing in eco-friendly materials and automation-compatible solutions to meet the evolving demands of industries such as e-commerce, food, and pharmaceuticals. Mid-sized and regional companies like LAMATEK, Inc., Argrov Box, and Polypak Packaging contribute to the market by offering cost-effective and customized packaging options. Strategic mergers, acquisitions, and capacity expansions are common as companies aim to enhance their market share and technological capabilities. The growing emphasis on recyclable and biodegradable cohesive packaging solutions is also intensifying competition, driving innovation and creating opportunities for new entrants with sustainable product offerings and efficient packaging technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Polypak Packaging

- Smurfit Kappa Group

- Bong Group

- LAMATEK, Inc.

- French Paper Company

- Intertape Polymer Group (IPG)

- Argrov Box

- Mondi Group Plc

- International Cushioning Company LLC.

- DS Smith Plc

- Sealed Air Corporation

- Papier Mettler GmbH

- 3M Company

- Pregis LLC

- United Envelope

- Berry Global, Inc.

- WestRock Company

- Capital Envelopes LLC

- International Plastics Inc.

- Cenveo Worldwide Limited

Recent Developments

- In September 2024, Premier Tech launched a new product line leveraging cobot technology to help companies quicken their packaging automation projects. TOMA is developed with the goal of creating a unique, cohesive, and immersive experience across all touchpoints.

- In June 2024, Pregis LLC have adopted sustainability in one of its product portfolios called EverTec™ one of ready to pack envelopes.

- In March 2024, Pregis LLC introduced Pregis EverTec Automated Mailer manufactured specifically adhere to integrate with one of their automated bagging machines.

Market Concentration & Characteristics

The Cohesive Packaging Market demonstrates a moderate level of market concentration, with a mix of global leaders and regional players competing across various end-use industries. Key players such as Pregis LLC, Sealed Air Corporation, and Mondi Group hold significant shares due to their broad product portfolios, strong distribution networks, and focus on sustainable innovation. It remains characterized by a growing preference for recyclable and automation-compatible materials, particularly in sectors like e-commerce, food and beverages, and pharmaceuticals. The market rewards companies that offer cost-effective, flexible, and efficient packaging solutions that meet evolving consumer and regulatory demands. While large firms dominate in terms of scale and technological capabilities, smaller regional companies differentiate through customization, pricing, and localized service. It supports steady product innovation driven by sustainability goals and operational efficiency requirements. Regulatory pressures and end-user expectations for waste reduction and recyclability continue to shape its competitive dynamics and product development priorities across all tiers of players.

Report Coverage

The research report offers an in-depth analysis based on Material, Product Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand from e-commerce and third-party logistics sectors.

- Adoption of recyclable and biodegradable cohesive materials will increase due to stricter environmental regulations.

- Automation-friendly packaging solutions will gain traction across manufacturing and fulfillment centers.

- Food and beverage companies will continue to invest in cohesive packaging for hygiene and shelf-life benefits.

- Pharmaceutical and personal care industries will expand usage for secure and tamper-evident applications.

- Companies will focus on reducing packaging waste and material usage without compromising performance.

- Investment in R&D will rise to develop cohesive packaging suited for diverse climates and product types.

- Regional manufacturers will grow by offering customized and cost-effective alternatives to global brands.

- Sustainability certifications and compliance will become critical for gaining customer trust and market access.

- Digital printing and branding features will become standard to support consumer engagement and product differentiation.