Market Overview:

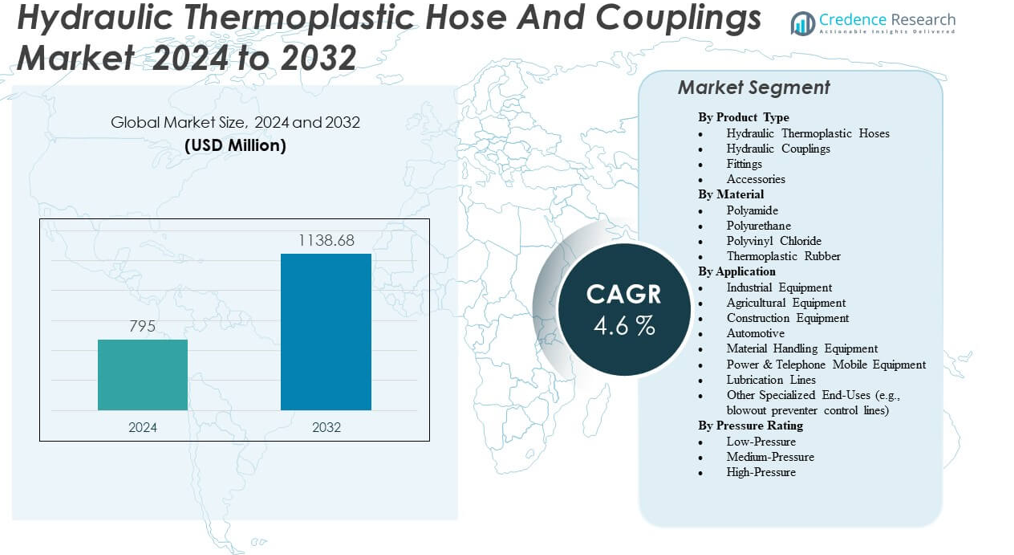

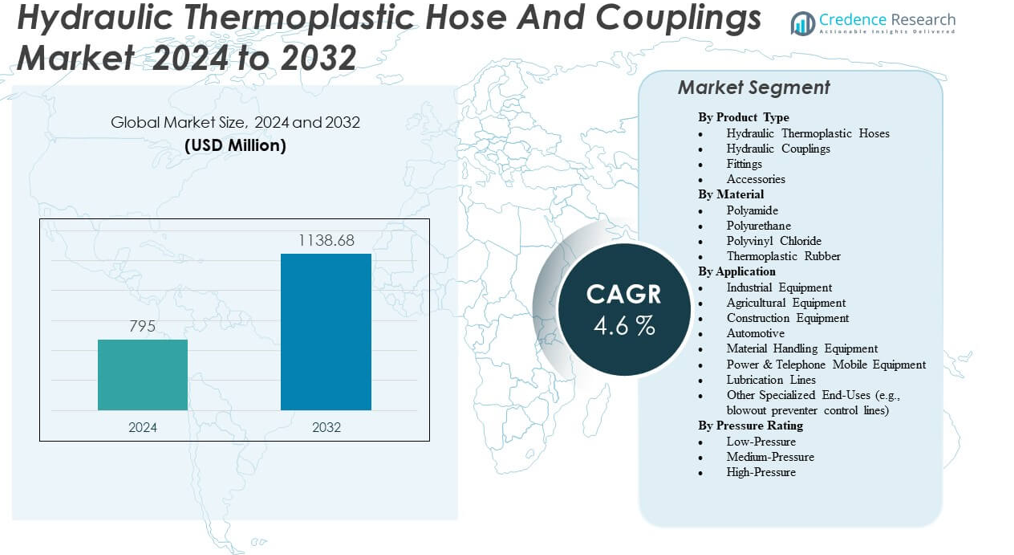

The Hydraulic Thermoplastic Hose and Couplings Market is projected to grow from USD 795 million in 2024 to an estimated USD 1,138.68 million by 2032, with a compound annual growth rate (CAGR) of 4.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydraulic Thermoplastic Hose and Couplings Market Size 2024 |

USD 795 million |

| Hydraulic Thermoplastic Hose and Couplings Market, CAGR |

4.6% |

| Hydraulic Thermoplastic Hose and Couplings Market Size 2032 |

USD 1,138.68 million |

The growth of the Hydraulic Thermoplastic Hose and Couplings Market is driven by increasing demand for durable, high-performance hydraulic components across industries such as construction, agriculture, and automotive. The need for lightweight, flexible, and environmentally friendly hydraulic hoses is also fueling this demand. As industries continue to modernize their equipment and embrace automation, the market for advanced hose solutions is expected to expand, with thermoplastic hoses offering superior resistance to wear, temperature, and chemical exposure.

Regionally, North America and Europe dominate the Hydraulic Thermoplastic Hose and Couplings Market due to their mature industrial sectors and high demand for hydraulic systems in manufacturing and construction. North America, led by the United States, benefits from technological advancements and strong regulatory frameworks that promote high-quality hydraulic components. Asia-Pacific is emerging as a high-growth region, driven by rapid industrialization in countries like China and India, where infrastructure development and agricultural mechanization are expanding rapidly.

Market Insights:

- The Hydraulic Thermoplastic Hose and Couplings Market is projected to grow from USD 795 million in 2024 to USD 1,138.68 million by 2032, with a CAGR of 4.6%.

- Increasing demand for durable and flexible hoses across industries like construction, agriculture, and automotive is driving market growth.

- Technological advancements in material science are enhancing the performance of thermoplastic hoses, making them more durable and resistant to wear.

- Rising adoption of hydraulic systems in industrial automation and heavy machinery applications is further boosting the market.

- However, competition from alternative materials like rubber and metal hoses could challenge market expansion.

- North America and Europe lead the market, benefiting from strong industrial sectors and regulatory standards.

- Asia-Pacific is emerging as a high-growth region, driven by rapid industrialization and infrastructure development in countries like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Adoption Across Various Industries

The Hydraulic Thermoplastic Hose And Couplings Market benefits from increasing demand in industries requiring high-performance hydraulic systems. Industries such as construction, agriculture, and oil & gas rely heavily on advanced hydraulic hoses for fluid transfer applications. These hoses offer superior durability and chemical resistance compared to traditional rubber hoses. End-users are shifting to thermoplastic hoses for their lightweight nature and long-term cost-effectiveness. The demand for more efficient, environmentally friendly, and safer fluid transfer systems propels market growth. As these industries modernize and adopt advanced technologies, hydraulic thermoplastic solutions are expected to play an essential role in improving machinery performance.

Technological Advancements in Hydraulic Systems

Technological developments in hydraulic systems drive the growth of the Hydraulic Thermoplastic Hose And Couplings Market. Manufacturers are integrating digital technologies such as sensors and predictive maintenance into hydraulic systems. These advancements require hoses and couplings with higher pressure tolerance and enhanced performance. Thermoplastic hoses meet these demands, offering better flexibility, high resistance to abrasions, and extended service life. Their ability to function effectively in extreme conditions makes them a top choice for new machinery and retrofitting existing systems. The continued progress in automation and machinery technology further boosts the market’s growth potential.

- For instance, Eaton’s LifeSense hose technology integrates advanced sensors to monitor hose health in real time, reducing hose-related downtime by up to 50% in manufacturing plants. These innovations drive the demand for hoses with higher pressure tolerance and enhanced performance, supporting greater operational efficiency across industries.

Rising Infrastructure and Construction Investments

The Hydraulic Thermoplastic Hose And Couplings Market is poised for growth due to significant infrastructure development and construction investments worldwide. Governments and private enterprises are prioritizing large-scale projects, including transportation, energy, and urban development. As heavy machinery and construction vehicles become increasingly integral to these projects, there is a higher demand for durable hydraulic systems. These systems rely on thermoplastic hoses that can handle high pressures and environmental stress. The need for efficient, long-lasting components in critical machinery directly impacts the increasing demand for hydraulic hoses and couplings.

Regulatory Pressure and Safety Standards

Regulatory changes are driving the growth of the Hydraulic Thermoplastic Hose And Couplings Market. Governments worldwide are enforcing stricter regulations on fluid systems, especially in industries such as mining, construction, and manufacturing. These industries face heightened scrutiny regarding safety standards and environmental impact. Thermoplastic hoses, with their enhanced safety features and environmental benefits, are being adopted to meet these regulations. The demand for compliance with global standards has prompted industries to upgrade their hydraulic systems, creating a significant market opportunity for thermoplastic hose manufacturers.

- For instance, Polyhose’s PH149 SAE 100R8 thermoplastic hose is specified for high-pressure lines at 100–420 bar with aramid-fiber reinforcement and a −40 °C to +100 °C range, fitting safety-critical applications in regulated environments.

Market Trends:

Shift Toward Lightweight Hydraulic Solutions

The demand for lightweight hydraulic components is a key trend in the Hydraulic Thermoplastic Hose And Couplings Market. Lightweight hoses improve fuel efficiency and reduce the overall weight of machinery, contributing to higher operational efficiency. These products are being increasingly adopted in industries such as automotive, construction, and agriculture, where reducing weight plays a crucial role in enhancing machine performance. Thermoplastic hoses are gaining popularity due to their ability to deliver high performance while maintaining a low weight. This trend is pushing manufacturers to design lighter yet stronger hoses that offer better flexibility and durability.

Integration of Smart and IoT Capabilities

The integration of smart features and Internet of Things (IoT) technology is influencing the Hydraulic Thermoplastic Hose And Couplings Market. Hydraulic systems are now incorporating sensors and smart components that allow for real-time monitoring of system performance. These innovations help predict maintenance needs, reduce downtime, and enhance efficiency. Thermoplastic hoses equipped with these capabilities offer enhanced functionality, including monitoring pressure, temperature, and wear levels. The growing adoption of connected technologies is expected to continue driving demand for high-performance hoses that integrate seamlessly into smart hydraulic systems.

Increased Focus on Sustainability and Eco-Friendly Materials

Sustainability has become a prominent trend in the Hydraulic Thermoplastic Hose And Couplings Market, with manufacturers focusing on producing eco-friendly hoses and couplings. As industries strive to meet sustainability targets, thermoplastic hoses, which offer recyclability and reduced environmental impact, are gaining traction. These materials are being favored over traditional rubber-based solutions, which are less environmentally friendly. With growing concerns about environmental regulations and corporate social responsibility, the demand for greener hydraulic components is expected to rise, presenting opportunities for companies investing in sustainable solutions.

- Manuli Hydraulics, for instance, launched a new range of thermoplastic hoses made from recyclable materials, aligning with global sustainability goals while maintaining superior performance in high-pressure applications, particularly in mining and construction.

Customization and Tailored Solutions for Specific Applications

Another notable trend in the Hydraulic Thermoplastic Hose And Couplings Market is the increasing demand for customized hoses that meet the unique needs of specific industries. As industries diversify and develop more complex machinery, there is a greater need for hoses and couplings tailored to particular environmental and operational conditions. Manufacturers are responding by offering specialized hoses designed for high-pressure, high-temperature, or corrosive environments. This trend is particularly evident in sectors like aerospace, automotive, and offshore oil & gas, where standard hoses may not meet performance requirements. Customization is becoming a key differentiator for suppliers in the competitive landscape.

- For instance, Polyhose is a renowned manufacturer of thermoplastic and ultra-high-pressure hoses used in demanding industries like oil and gas. The company provides high-performance hydraulic solutions that meet the stringent requirements of various sectors, including offshore and drilling operations.

Market Challenges Analysis:

Pressure to Maintain Performance Standards

One of the significant challenges in the Hydraulic Thermoplastic Hose And Couplings Market is the need to maintain consistent performance standards. As applications in sectors like oil & gas, construction, and automotive become more demanding, the required quality of hydraulic hoses becomes increasingly stringent. Thermoplastic hoses must perform effectively under extreme pressure, temperature fluctuations, and environmental stresses. Ensuring that these products maintain reliability over extended periods, while still meeting safety and performance standards, is a challenge for manufacturers. Failure to meet these expectations can result in costly downtime and increased maintenance costs, which pose risks to market growth.

Competition from Alternative Solutions

The Hydraulic Thermoplastic Hose And Couplings Market faces competition from alternative materials and technologies that offer similar benefits. Rubber, metal, and other composite hoses continue to serve as viable alternatives in certain applications. Despite the growing preference for thermoplastic solutions, some industries remain hesitant to adopt new materials due to concerns about compatibility, initial costs, and lack of familiarity with the technology. Manufacturers must continuously innovate to differentiate their thermoplastic hoses, providing better performance, cost-efficiency, and long-term benefits to outpace the competition and gain wider acceptance.

Market Opportunities:

Expansion in Emerging Economies

Emerging economies present significant growth opportunities for the Hydraulic Thermoplastic Hose And Couplings Market. Rapid industrialization in regions such as Asia-Pacific, Latin America, and the Middle East is fueling the demand for advanced hydraulic systems in various industries, including manufacturing, agriculture, and construction. As these economies continue to expand, the need for efficient, cost-effective, and durable hydraulic components will grow. Thermoplastic hoses, with their ability to provide high performance and reliability at lower costs, position themselves as an ideal solution for these developing markets. This presents a promising opportunity for manufacturers to expand their market share in these high-growth regions.

Technological Innovation Driving New Applications

Advancements in material science and manufacturing processes are opening new applications for hydraulic thermoplastic hoses. Ongoing research is leading to the development of more advanced, high-performance materials that can withstand even more extreme environments. The ability to create hoses that can operate in higher-pressure, higher-temperature conditions opens up opportunities in sectors like aerospace, defense, and offshore drilling. Furthermore, the integration of IoT and smart technologies into hydraulic systems is driving demand for hoses that support real-time monitoring and predictive maintenance. This trend offers opportunities for companies to develop next-generation hydraulic hoses and couplings that meet the evolving needs of high-tech industries.

Market Segmentation Analysis:

By Product Type

The Hydraulic Thermoplastic Hose And Couplings Market is segmented into hydraulic thermoplastic hoses, hydraulic couplings, fittings, and accessories. Hydraulic thermoplastic hoses dominate the market due to their durability, flexibility, and resistance to abrasion, making them essential for fluid transfer systems in various industries. Hydraulic couplings and fittings play a critical role in connecting hoses and ensuring leak-free, secure operations. Accessories complement these products by offering additional features such as protection against mechanical damage. The increasing demand for high-performance hydraulic systems across industries further drives growth in this segment.

- For instance, Parker Hannifin’s TOUGHJACKET hose line includes a hose designed to withstand over 650,000 abrasion cycles in the ASTM D 6037 test, representing a significant improvement over standard hose wear-cycle performance for extreme environments.

By Material

The materials used in hydraulic thermoplastic hoses are crucial to their performance. The market is segmented into polyamide, polyurethane, polyvinyl chloride (PVC), and thermoplastic rubber. Polyamide hoses are highly resistant to wear, offering long service life in harsh conditions. Polyurethane hoses are valued for their high flexibility and resistance to abrasion. PVC, though more affordable, provides good chemical resistance for various applications. Thermoplastic rubber combines the benefits of both rubber and plastic, offering excellent performance in dynamic applications. Each material type caters to specific industry needs, influencing the market’s expansion.

- For instance, Eaton announced in 2023 that its Synflex thermoplastic hydraulic hoses made from specially engineered polyamide blends can operate continuously at temperatures up to 100°C and achieve a bend radius as tight as 51 mm for the 3/8-inch size, enabling efficient use in compact industrial installations.

By Application

The application segment of the Hydraulic Thermoplastic Hose And Couplings Market covers a wide range of industries, including industrial equipment, agricultural equipment, construction equipment, automotive, material handling, power & telephone mobile equipment, lubrication lines, and other specialized end-uses. Industrial and construction equipment require high-pressure hoses for efficient operations, driving significant demand. Agricultural and automotive sectors rely on flexible, durable hoses for machinery that must withstand challenging environments. The specialization of end-uses, such as blowout preventer control lines in the oil and gas industry, also presents unique opportunities for market growth.

By Pressure Rating

The pressure rating segment of the Hydraulic Thermoplastic Hose And Couplings Market is categorized into low-pressure, medium-pressure, and high-pressure hoses. Low-pressure hoses are used in applications where fluid transfer occurs at lower pressures, offering cost-effective solutions for light-duty systems. Medium-pressure hoses are commonly used in agricultural and industrial machinery. High-pressure hoses are essential in demanding environments like construction, automotive, and power equipment. As industries continue to adopt more sophisticated machinery and systems, the demand for high-pressure hydraulic solutions grows, further expanding this segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Product Type

- Hydraulic Thermoplastic Hoses

- Hydraulic Couplings

- Fittings

- Accessories

By Material

- Polyamide

- Polyurethane

- Polyvinyl Chloride

- Thermoplastic Rubber

By Application

- Industrial Equipment

- Agricultural Equipment

- Construction Equipment

- Automotive

- Material Handling Equipment

- Power & Telephone Mobile Equipment

- Lubrication Lines

- Other Specialized End-Uses (e.g., blowout preventer control lines)

By Pressure Rating

- Low-Pressure

- Medium-Pressure

- High-Pressure

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The Hydraulic Thermoplastic Hose and Couplings Market in North America holds approximately 38% of the global market share, driven by well‑established manufacturing infrastructure, high demand in construction and agriculture equipment sectors, and strong industrial service networks. It benefits from advanced technology adoption and frequent replacement cycles of hydraulic systems in heavy machinery. The United States serves as a major contributor, supported by stable capital goods spending and regulatory incentives. The presence of leading hose and coupling manufacturers further strengthens the regional market.

In Europe, the market commands around 27% share, thanks to strict safety and environmental regulations, high automation levels in manufacturing, and strong demand from automotive and construction equipment sectors. Suppliers meet rigorous standards for fluid transfer systems, which drives demand for advanced thermoplastic hose solutions. The region’s emphasis on sustainability and light‑weight components also supports its steady growth trend. Leading European countries include Germany, France and Italy where heavy industry remains active.

The Asia‑Pacific region accounts for about 35% share and exhibits the fastest growth profile due to rapid industrialisation, infrastructure development and expansion of agriculture mechanisation in countries such as China and India. It benefits from large volumes of construction machinery and mobile equipment procurement. While Middle East & Africa and Latin America hold smaller shares under 10%, they offer emerging opportunities tied to mining, oil & gas and resource‑based infrastructure projects.

Key Player Analysis:

- Parker Hannifin Corporation

- Gates Corporation

- Eaton Corporation

- Continental AG

- Manuli Hydraulics

- Trelleborg AB

- Alfagomma S.p.A.

- Kurt Hydraulics

- Polyhose India Pvt. Ltd.

- Ryco Hydraulics

- Saint-Gobain

- Piranha Hose Products, Inc.

- Semperit AG

- Dunlop Hiflex

- NRP Jones

Competitive Analysis:

The Hydraulic Thermoplastic Hose and Couplings Market features multiple global players competing across material innovation, distribution reach and service support. Key companies such as Parker Hannifin Corporation, Gates Corporation, and Eaton Corporation lead through strong R&D investments and broad product portfolios. These firms emphasise quality, customized solutions and global service networks. Mid‑tier and regional players also compete aggressively on cost and local responsiveness. Competitive intensity remains high, with firms differentiating through material advances, high‑performance ratings and aftermarket support. As manufacturers focus on expanding their market share, partnerships, acquisitions, and geographic expansion are common strategies to strengthen their presence. Ongoing product development and technological enhancements also play a crucial role in maintaining competitive advantage in this growing market.

Recent Developments:

- In November 2025, Danfoss Power Solutions entered into an agreement to acquire Hydro Holding Spa, a premier manufacturer of hose fittings headquartered in Castello d’Argile, Italy. Hydro Holding will integrate into Danfoss Power Solutions’ Fluid Conveyance division, expanding the company’s hose fittings portfolio and bolstering its position in the European market.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material, Application and Pressure Rating. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Continued demand for lightweight, durable hoses in various industries will drive market growth.

- The push for increased industrial automation will expand the need for high-performance hydraulic systems.

- Technological advancements in material science will enhance the capabilities of thermoplastic hoses.

- Growth in construction and agricultural machinery sectors will fuel demand for hydraulic hoses.

- Environmental regulations will encourage the adoption of eco-friendly, recyclable hydraulic solutions.

- The integration of IoT and smart technology in hydraulic systems will create new opportunities for hose manufacturers.

- The expansion of manufacturing operations in emerging economies will increase market penetration.

- Strategic mergers and acquisitions among key players will lead to a more consolidated market.

- There will be a rise in demand for customized solutions catering to specific industrial needs.

- Continued investments in R&D will result in more efficient, cost-effective hydraulic hose products.