Market Overview

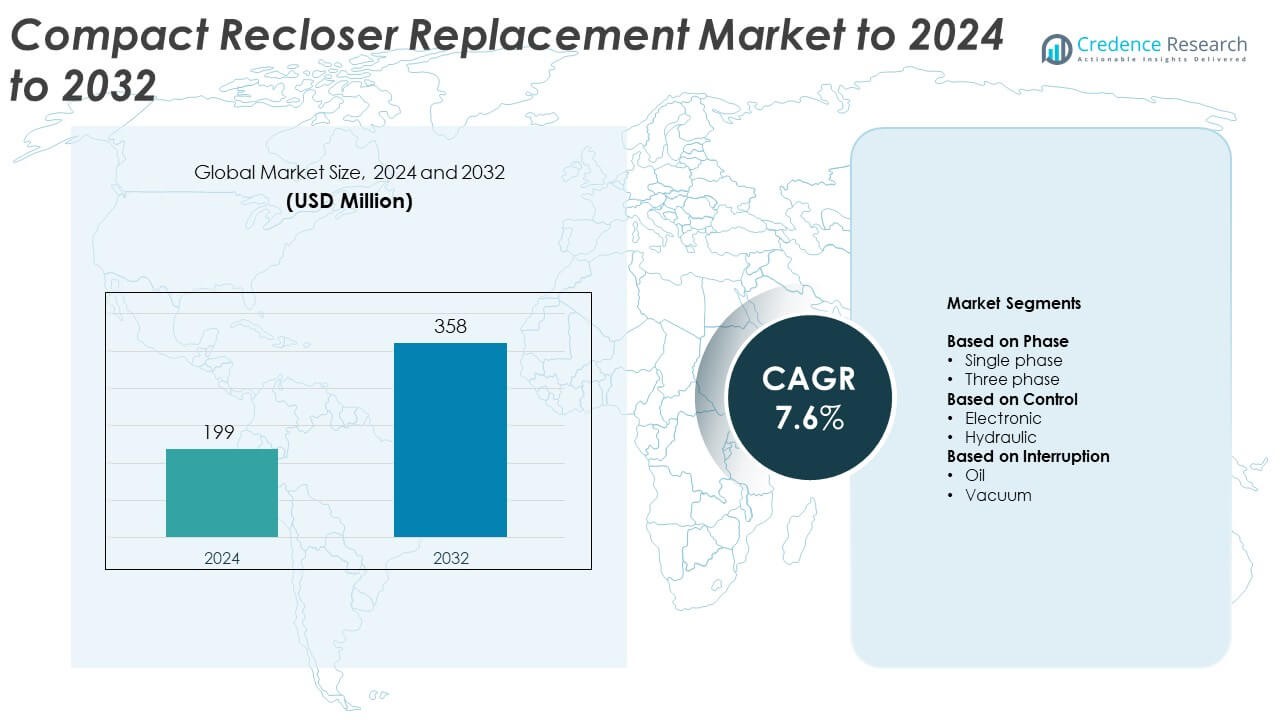

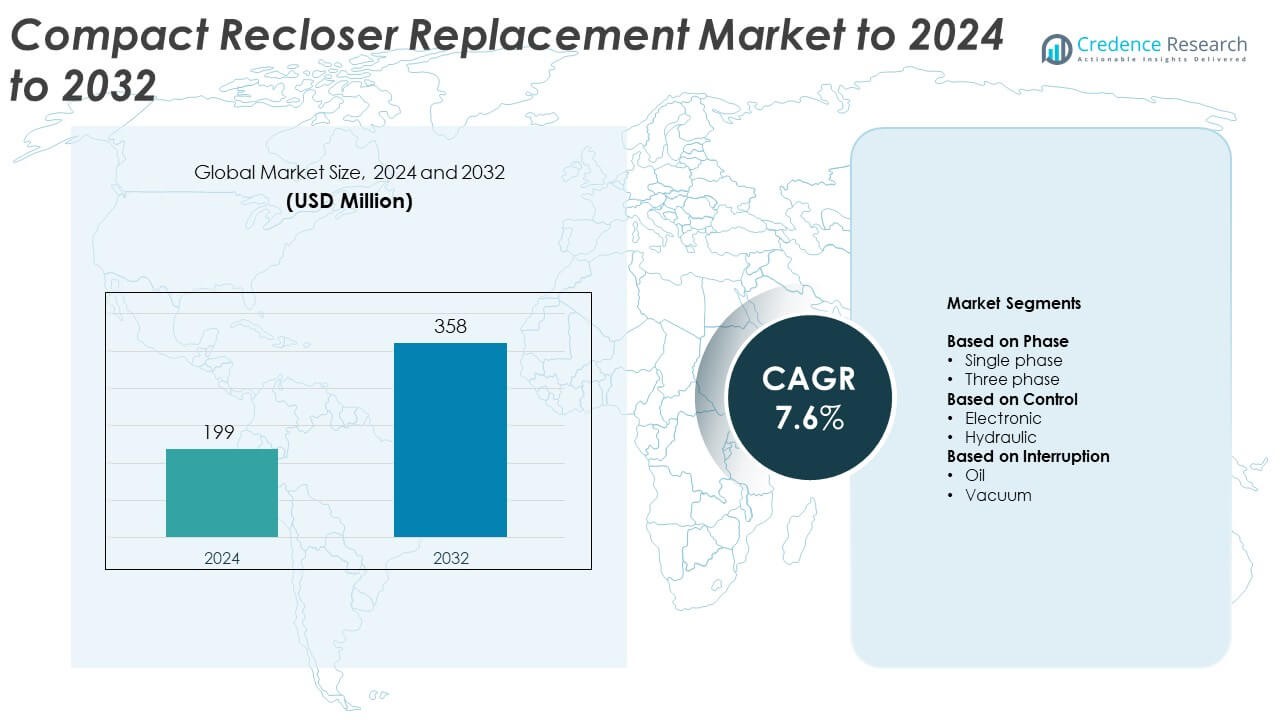

The global compact recloser replacement market size was valued at USD 199 million in 2024 and is anticipated to reach USD 358 million by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compact Recloser Replacement Market Size 2024 |

USD 199 Million |

| Compact Recloser Replacement Market, CAGR |

7.6% |

| Compact Recloser Replacement Market Size 2032 |

USD 358 Million |

The compact recloser replacement market is characterized by strong competition among major players such as Siemens, ABB, Schneider Electric, Eaton, Hubbell Power Systems, G&W Electric, S&C Electric, NOJA Power Switchgear, Tavrida Electric, Rockwill Electric Group, Hughes Power System, Sriwin Electric, and Camlin Group. These companies focus on developing advanced, automated recloser systems to support grid modernization and renewable integration. North America leads the global market with a 37.2% share in 2024, driven by large-scale investments in smart grid infrastructure and utility upgrades. Europe follows with 28.5%, emphasizing sustainability and digital grid transformation, while Asia Pacific accounts for 24.7%, supported by rapid urbanization and energy infrastructure expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The compact recloser replacement market was valued at USD 199 million in 2024 and is projected to reach USD 358 million by 2032, growing at a CAGR of 7.6%.

• Growth is driven by increasing grid modernization efforts, replacement of aging infrastructure, and rising renewable energy integration across distribution networks.

• Market trends highlight the transition toward vacuum-based reclosers, IoT-enabled control systems, and predictive maintenance solutions for improved efficiency.

• Competition remains strong among global manufacturers focusing on smart, compact, and maintenance-free reclosers to expand market reach and meet sustainability goals.

• North America leads with a 37.2% share in 2024, followed by Europe at 28.5% and Asia Pacific at 24.7%, while the three-phase segment dominates the market with a 63.4% share due to its high efficiency and reliability in modern distribution systems.

Market Segmentation Analysis:

By Phase

The three phase segment dominated the compact recloser replacement market with a 63.4% share in 2024. This dominance is driven by its widespread use in medium- and high-voltage distribution systems that demand stable power flow and fault protection. Three phase reclosers ensure balanced load distribution and faster fault clearance, reducing downtime and improving grid efficiency. The growing integration of renewable energy and smart grid systems further supports demand for three phase configurations due to their superior performance in industrial and utility-scale networks.

- For instance, Schneider Electric’s N-Series three-phase recloser is rated 15/27/38 kV, up to 800 A load, and up to 16 kA short-circuit current. These ratings suit utility-scale feeders needing balanced protection.

By Control

The electronic control segment held the largest share of 71.8% in 2024. Its leadership stems from the increasing adoption of digital control systems that enable remote operation, fault detection, and real-time monitoring. Utilities are upgrading legacy hydraulic systems with intelligent electronic controllers to enhance grid reliability and automation. The integration of SCADA and IoT platforms further strengthens this segment, offering predictive maintenance capabilities and data-driven decision-making for efficient power restoration during faults.

- For instance, GE Grid Solutions’ Multilin DGCR (Digital Grid Control Relay or Recloser Controller) measures 3 phase currents plus ground current, and up to 6 voltages.

By Interruption

The vacuum interruption segment accounted for the dominant 67.5% share in 2024. Vacuum reclosers are preferred for their eco-friendly, maintenance-free operation and superior arc-quenching efficiency. They eliminate the use of insulating oil, reducing environmental risks and operational costs. Growing regulatory emphasis on sustainable grid equipment and declining lifecycle costs accelerate their adoption. Additionally, the extended service life and compatibility with automation systems make vacuum reclosers the standard choice for modern power distribution infrastructure.

Key Growth Drivers

Modernization of Aging Power Infrastructure

Aging power infrastructure in developed and developing regions is driving replacement demand for compact reclosers. Many utilities are upgrading outdated electromechanical systems with advanced, automated reclosers to improve reliability and reduce outage durations. Governments and energy agencies are investing in grid modernization to support renewable integration and digitalization. These initiatives are fostering large-scale replacement projects, strengthening the market’s growth momentum through improved fault management, reduced maintenance needs, and enhanced operational safety.

- For instance, ABB’s REC615 relay stores load-profile measurements with a selection of averaging periods in nonvolatile memory, with options that typically include intervals such as 1 minute, 5 minutes, 10 minutes, 15 minutes, 20 minutes, 30 minutes, 1 hour, and 3 hours.

Rising Adoption of Smart Grid Technologies

The expansion of smart grid networks is accelerating the replacement of conventional reclosers with intelligent and connected models. Utilities are increasingly adopting digital monitoring, remote control, and fault analytics to improve system efficiency and reduce response time during faults. Integration with IoT platforms and SCADA systems allows predictive maintenance and real-time data exchange. This transition toward smart, automated power distribution systems continues to be a key growth driver across both developed and emerging economies.

- For instance, S&C’s TripSaver II cutout-mounted recloser performs up to 3 reclosing operations (4 tripping operations in total) before it drops open.

Growing Renewable Energy Integration

The rapid increase in distributed renewable energy generation, including solar and wind farms, is creating new demand for compact recloser replacements. These installations require reliable fault protection and voltage regulation to maintain grid stability. Compact reclosers with advanced sensing and communication capabilities support bidirectional power flow, ensuring seamless connection between renewable assets and distribution networks. The focus on sustainability and grid flexibility is pushing utilities to adopt modern, replacement-ready solutions.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Maintenance-Free Designs

Utilities are adopting vacuum-type reclosers to eliminate the need for oil-based insulation, aligning with sustainability goals. Vacuum reclosers provide cleaner operation, longer service life, and minimal maintenance compared to traditional designs. Growing environmental awareness and stricter emission norms present opportunities for manufacturers to offer low-emission, recyclable, and energy-efficient products. These developments are transforming the market toward greener, more reliable grid protection equipment.

- For instance, Eaton’s NOVA three-phase vacuum reclosers are available in models covering the 15 kV, 27 kV, and 38 kV voltage classes, enabling protection for distribution systems operating at a nominal voltage of up to 34.5 kV (via the 38 kV model).

Expansion of Remote Monitoring and Predictive Analytics

Advancements in predictive analytics and cloud-based monitoring platforms are creating new opportunities in recloser replacements. Utilities now rely on sensor-based data collection to assess equipment performance and predict failures before they occur. This trend reduces unplanned outages and extends asset life, improving overall operational efficiency. The ongoing digital transformation of distribution networks continues to attract investments in intelligent recloser systems with enhanced connectivity and analytics features.

- For instance, SEL’s 651R recloser control provides six 300 Vac PT inputs and reports THD for current and voltage.

Key Challenges

High Initial Investment and Integration Costs

Despite operational advantages, compact recloser replacements require significant upfront capital and complex integration into existing systems. Utilities with constrained budgets often delay modernization due to high equipment costs and limited financial support. Additionally, retrofitting older grids with digital components can demand specialized labor and extended installation time. These financial and logistical barriers slow down large-scale replacement adoption in cost-sensitive markets.

Technical Compatibility and Cybersecurity Risks

The integration of advanced electronic controls and IoT-enabled systems exposes power networks to interoperability and cybersecurity challenges. Older grid infrastructures may face compatibility issues with new digital reclosers, requiring extensive calibration or redesign. Moreover, increased connectivity heightens vulnerability to cyberattacks, demanding robust security frameworks. Addressing these concerns remains essential for maintaining grid reliability and ensuring safe deployment of smart recloser technologie

Regional Analysis

North America

North America dominated the compact recloser replacement market with a 37.2% share in 2024. The region benefits from well-established utility networks and large-scale grid modernization programs. The United States and Canada are investing heavily in smart grid infrastructure and renewable integration, driving replacement demand for intelligent reclosers. Supportive government initiatives and rising concerns about power reliability amid extreme weather conditions further stimulate market growth. Upgrades in rural and suburban distribution systems also contribute significantly to the region’s strong market performance.

Europe

Europe accounted for a 28.5% share of the compact recloser replacement market in 2024. The region’s focus on decarbonization, energy efficiency, and grid resilience supports strong demand for advanced recloser technologies. Countries such as Germany, the United Kingdom, and France are rapidly modernizing their aging electrical networks to meet carbon-neutral goals. Regulatory support for renewable grid integration and digital monitoring enhances the adoption of automated reclosers. Continued expansion of distributed generation and smart energy management systems drives steady market growth across Europe.

Asia Pacific

Asia Pacific held a 24.7% share of the compact recloser replacement market in 2024. Rapid urbanization, industrial growth, and expanding power infrastructure in China, India, and Southeast Asia are fueling strong replacement activity. Government-backed electrification projects and increased renewable energy adoption are promoting the use of intelligent reclosers. Utilities in the region are upgrading outdated systems to enhance grid reliability and fault management. The presence of local manufacturers offering cost-effective solutions further accelerates market penetration across emerging economies.

Latin America

Latin America captured a 6.1% share of the compact recloser replacement market in 2024. Countries such as Brazil, Mexico, and Chile are investing in modern distribution systems to reduce outages and improve efficiency. The rising integration of renewable energy sources, coupled with regulatory reforms in power distribution, supports steady replacement demand. Limited financial capacity and infrastructure challenges slow adoption in some areas, yet ongoing regional grid modernization projects are expected to sustain market growth over the forecast period.

Middle East & Africa

The Middle East & Africa region held a 3.5% share of the compact recloser replacement market in 2024. The demand is primarily driven by expanding utility networks, urban electrification, and renewable energy development projects. Nations such as Saudi Arabia, the UAE, and South Africa are prioritizing smart grid technologies to improve reliability and energy efficiency. Despite infrastructure limitations in certain regions, increasing investments in power distribution and the shift toward automated systems are expected to strengthen market adoption in coming years.

Market Segmentations:

By Phase

By Control

By Interruption

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the compact recloser replacement market features leading players such as Siemens, Hubbell Power Systems, Tavrida Electric, NOJA Power Switchgear Pty Ltd, ABB, Rockwill Electric Group, Eaton, S&C Electric, Sriwin Electric, Hughes Power System, Schneider Electric, G&W Electric, and Camlin Group. These companies focus on developing advanced, reliable, and automated recloser solutions to support the modernization of power distribution networks. The market is witnessing rising competition as manufacturers emphasize compact designs, enhanced fault detection, and IoT-enabled monitoring systems. Strategic collaborations with utilities, continuous R&D investments, and expansion into emerging markets remain key approaches to strengthening market presence. Many firms are also prioritizing sustainability by replacing oil-based systems with vacuum technology to reduce maintenance and environmental risks. Increasing demand for digitalized grid solutions is encouraging industry participants to introduce smart reclosers that ensure operational safety, lower downtime, and improve energy efficiency across global utility infrastructures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Eaton introduced its HiZ Protect solution. This technology is an AI-powered innovation designed to help utilities prevent wildfires by accurately and rapidly detecting high-impedance (HiZ) powerline faults.

- In 2025, G&W Electric introduced its “next-generation” Viper-ST recloser product line with significant upgrades.

- In 2025, S&C Electric showcased its established recloser products, emphasizing their advanced features for grid resilience and reliability,At the DISTRIBUTECH 2025 event .

Report Coverage

The research report offers an in-depth analysis based on Phase, Control, Interruption and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by continuous grid modernization initiatives.

- Rising adoption of smart grid infrastructure will boost demand for intelligent recloser replacements.

- Utilities will increasingly shift toward vacuum-based systems for sustainable operations.

- Integration of IoT and cloud analytics will enhance fault detection and monitoring capabilities.

- Replacement demand will rise in regions upgrading aging power distribution networks.

- Renewable energy integration will create new opportunities for recloser deployment and upgrades.

- Manufacturers will focus on developing compact, modular, and maintenance-free designs.

- Cybersecurity and data protection will become major priorities for connected systems.

- Emerging economies will adopt recloser replacements faster due to electrification programs.

- Collaboration between utilities and technology providers will accelerate digital transformation across power grids.