Market Overview:

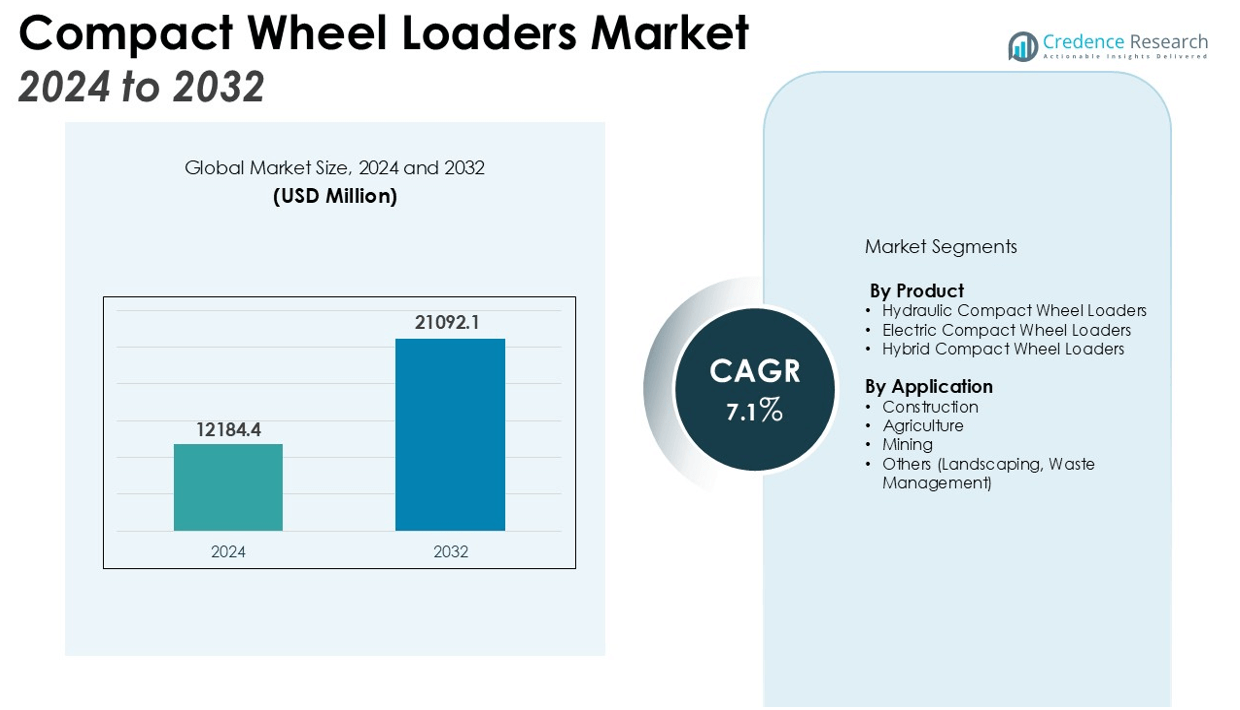

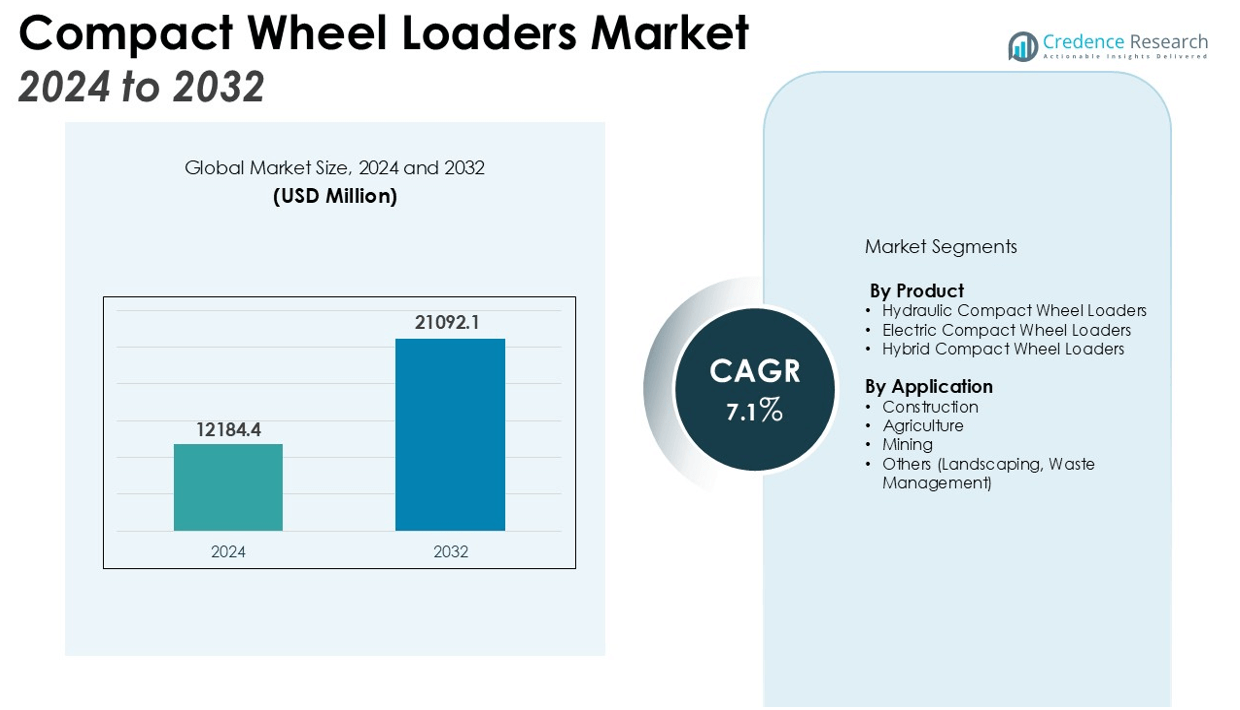

The Compact Wheel Loaders Market size was valued at USD 12184.4 million in 2024 and is anticipated to reach USD 21092.1 million by 2032, at a CAGR of 7.1% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compact Wheel Loaders Market Size 2024 |

USD 12184.4 million |

| Compact Wheel Loaders Market, CAGR |

7.1% |

| Compact Wheel Loaders Market Size 2032 |

USD 21092.1 million |

Key drivers of the market include the rising demand for compact machinery with higher productivity and lower operational costs. The adoption of advanced technologies such as telematics and hydraulic systems in compact wheel loaders enhances performance, efficiency, and fuel economy, further boosting market growth. Additionally, the growing trend toward sustainable construction practices, combined with the need for equipment that meets stringent emission standards, is expected to propel market demand. Furthermore, the increased focus on rental services for compact wheel loaders is also contributing to market growth, offering cost-effective solutions for short-term and project-specific needs.

Regionally, North America holds the largest market share, driven by the high demand for construction and infrastructure development projects in the U.S. and Canada. Europe follows closely with steady demand from countries like Germany and the U.K., while the Asia-Pacific region is anticipated to witness the highest growth rate due to rapid urbanization and infrastructure development in emerging economies such as China and India. Additionally, increasing government investments in infrastructure development in regions like Southeast Asia are expected to drive further market expansion.

Market Insights:

- The Compact Wheel Loaders Market is projected to grow from USD 12,184.4 million to USD 21,092.1 million, with a CAGR of 7.1% during the forecast period.

- The increasing demand for versatile and efficient construction equipment is driving market growth, with compact wheel loaders being highly sought after for urban construction and material handling.

- Technological advancements, such as telematics and hydraulic systems, enhance machine performance and fuel efficiency, making compact wheel loaders more attractive for cost-conscious businesses.

- The shift toward sustainable and eco-friendly practices in construction and agriculture is pushing for machinery that meets stringent emission standards, boosting demand for compact wheel loaders.

- Rental services are gaining popularity, allowing businesses to access advanced compact wheel loaders without the high initial investment, thereby fostering market growth.

- North America holds the largest market share, with a 35% share, driven by strong demand in construction, mining, and agriculture, along with the availability of rental services.

- The Asia-Pacific region is expected to see the highest growth rate, fueled by rapid urbanization and infrastructure development in emerging economies like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Versatile and Efficient Construction Equipment

The Compact Wheel Loaders Market is experiencing significant growth due to the rising demand for versatile and efficient construction equipment across various industries. Compact wheel loaders offer improved productivity in confined spaces, which is crucial for urban construction projects and material handling. Their small size and maneuverability make them ideal for working in tight or hard-to-reach areas, especially for small-scale construction and agriculture operations. This versatility allows businesses to optimize operations and reduce downtime, boosting demand for these machines globally.

- For instance, Volvo Construction Equipment offers a high-speed driveline option for its L45H and L50H compact wheel loaders, enabling the machines to reach a top speed of 50 km per hour.

Technological Advancements in Hydraulic and Telematics Systems

Technological innovation is a key driver for the Compact Wheel Loaders Market. Advanced hydraulic systems enhance machine performance, providing operators with better lifting capacity, speed, and fuel efficiency. The integration of telematics further improves efficiency by enabling real-time tracking of machine performance and maintenance needs. These technologies reduce operational costs and downtime, making compact wheel loaders a more attractive option for industries looking to maximize productivity while minimizing expenses.

- For instance, CASE Construction Equipment’s 321F compact wheel loader features adjustable electro-hydraulic controls and delivers a full-height lifting capacity of 8,354 pounds.

Focus on Sustainable and Eco-Friendly Practices

Sustainability is becoming a top priority in the construction and agriculture sectors, driving the demand for compact wheel loaders that comply with stringent environmental regulations. The market sees a shift toward equipment that minimizes fuel consumption and emissions. Manufacturers are focusing on producing compact wheel loaders that meet the latest emission standards, thus enabling companies to maintain environmental responsibility without sacrificing performance. This focus on eco-friendly solutions boosts market growth as industries aim to align with global sustainability goals.

Growth in Rental Services for Short-Term Equipment Needs

The rising popularity of rental services is fueling the growth of the Compact Wheel Loaders Market. Renting compact wheel loaders provides businesses with a cost-effective option for short-term or project-based needs. This reduces the capital expenditure required for equipment purchases and offers flexibility in terms of fleet management. With construction projects becoming more specialized and temporary, rental services allow companies to access the latest models and technologies without long-term commitments, driving further demand in the market.

Market Trends:

Shift Towards Electrification and Hybrid Models

The Compact Wheel Loaders Market is witnessing a growing trend towards electrification and hybrid models. Manufacturers are focusing on developing electric and hybrid compact wheel loaders to meet stringent environmental regulations and reduce emissions. These models offer reduced fuel consumption and lower operating costs, which make them an appealing option for environmentally conscious businesses. The demand for these eco-friendly solutions is particularly strong in regions with strict emission standards, such as Europe and North America. The adoption of electric-powered equipment is expected to rise as technological advancements in battery efficiency and charging infrastructure continue to improve, further driving the growth of this segment in the market.

- For instance, CNH new electric compact wheel loader, available under the CASE and New Holland brands, can be recharged with an optional fast charger in just 1 hour, allowing for continuous use throughout a workday.

Integration of Smart Technologies for Enhanced Operational Efficiency

Smart technologies are becoming an integral part of compact wheel loaders, enhancing operational efficiency and productivity. The integration of telematics, GPS systems, and automated controls allows operators to track machine performance, optimize fuel usage, and schedule maintenance proactively. These advancements provide businesses with valuable data insights, reducing downtime and improving decision-making. The increasing demand for automation in construction and agriculture is fueling the adoption of smart features in compact wheel loaders. The ability to integrate compact wheel loaders into a connected network of machinery and equipment is expected to become a standard practice, contributing to the market’s future growth.

- For instance, Volvo Construction Equipment enhances operator interaction and data visibility on its wheel loaders with the onboard Volvo Co-Pilot, a high-resolution 10-inch touchscreen that displays real-time data from its machine applications.

Market Challenges Analysis:

High Initial Capital Investment

One of the significant challenges in the Compact Wheel Loaders Market is the high initial capital investment required for purchasing these machines. While compact wheel loaders offer long-term cost savings through efficiency and productivity, the upfront cost can be a barrier for smaller businesses or those with limited budgets. Many companies in developing regions face difficulty in securing the necessary capital, which slows the adoption of advanced equipment. This financial constraint may hinder the market’s expansion, especially in areas where construction and agricultural activities are growing rapidly but businesses lack access to financing options.

Maintenance and Operational Costs

The maintenance and operational costs associated with compact wheel loaders also present a challenge in the market. While these machines are designed for efficiency, they still require regular upkeep, including servicing of hydraulic systems, engines, and other components. For businesses with tight margins, the cost of spare parts, labor, and fuel can significantly impact profitability. Furthermore, the lack of skilled operators in certain regions may increase operational costs, as improper handling or misuse of equipment can lead to higher maintenance requirements and reduced machine lifespan. These factors may limit the widespread adoption of compact wheel loaders in cost-sensitive markets.

Market Opportunities:

Expansion of Construction and Infrastructure Projects in Emerging Markets

The Compact Wheel Loaders Market holds significant opportunities in emerging economies where rapid urbanization and infrastructure development are underway. As construction activities in regions like Asia-Pacific and Africa increase, the demand for compact wheel loaders that can operate in confined spaces and offer versatile functionality will rise. These regions benefit from expanding infrastructure projects, such as roads, buildings, and utilities, creating a strong market for compact equipment. The low cost of ownership and high efficiency make these loaders an attractive option for businesses looking to optimize their operations within tight budgets.

Advancements in Rental Services for Short-Term Needs

Another promising opportunity in the Compact Wheel Loaders Market lies in the growing popularity of rental services. Businesses, especially in industries with fluctuating equipment needs, are turning to rental solutions to reduce the capital expenditure involved in purchasing machinery. Rental services allow access to the latest technology without long-term commitments, making them a cost-effective option for short-term or project-specific needs. The increased focus on flexibility and reducing operational costs is driving the demand for compact wheel loader rentals, particularly in construction, landscaping, and agricultural sectors. This trend is expected to continue growing, creating opportunities for companies offering rental services.

Market Segmentation Analysis:

By Product

The Compact Wheel Loaders Market is segmented by product type into hydraulic compact wheel loaders, electric compact wheel loaders, and hybrid compact wheel loaders. Hydraulic compact wheel loaders dominate the market due to their superior lifting capacity, speed, and fuel efficiency. These models are preferred for heavy-duty applications in construction and mining. Electric compact wheel loaders are gaining traction due to their environmental benefits, offering reduced emissions and lower operational costs. Hybrid compact wheel loaders combine the best of both worlds, providing fuel efficiency while maintaining high performance. The growing trend toward sustainability is boosting the demand for these energy-efficient models, particularly in regions with stringent emission standards.

- For instance, during a year-long pilot project, the Volvo L25 electric wheel loader contributed to a reduction of 6 metric tons of carbon dioxide over 400 hours of operation.

By Application

The Compact Wheel Loaders Market is also segmented by application into construction, agriculture, mining, and others. Construction holds the largest share, driven by the need for compact equipment that can maneuver easily in urban and residential areas. In agriculture, these machines are used for material handling and transporting goods, especially in small-scale operations. The mining sector’s demand is driven by the need for compact loaders capable of operating in confined spaces while providing high productivity. Other applications include landscaping and waste management, where compact wheel loaders are valued for their versatility and efficiency. Each sector benefits from the compact loader’s ability to operate in limited spaces and provide multifunctional capabilities.

- For instance, in heavy-duty mining operations, a large wheel loader like the Caterpillar 995 is used for its efficiency and power, featuring a bucket that can handle a capacity of up to 57 cubic yards of material in a single scoop.

Segmentations:

By Product

- Hydraulic Compact Wheel Loaders

- Electric Compact Wheel Loaders

- Hybrid Compact Wheel Loaders

By Application

- Construction

- Agriculture

- Mining

- Others (Landscaping, Waste Management)

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Leading the Market Growth

North America commands the largest share of the Compact Wheel Loaders Market, holding 35% of the global market. The demand in the U.S. and Canada is driven by a surge in infrastructure projects, particularly in construction, mining, and agriculture sectors. Both countries are focused on developing urban areas and road networks, which creates a substantial need for compact equipment. The availability of rental services enhances accessibility, allowing businesses to manage project-specific needs effectively. Furthermore, stringent environmental regulations encourage the adoption of eco-friendly, fuel-efficient machinery, contributing to market expansion.

Europe: Strong Demand Amid Sustainable Practices

Europe holds a significant share of 30% in the global Compact Wheel Loaders Market. The region is experiencing steady demand, driven by sustainability initiatives and strict environmental standards. Countries like Germany, the U.K., and France are focusing on reducing carbon emissions, which is promoting the use of fuel-efficient and environmentally-friendly machinery. The market benefits from the presence of leading manufacturers, bolstering both production and sales. As the region pushes toward sustainable construction and agricultural practices, the demand for compact wheel loaders continues to grow, supported by advanced technology such as telematics.

Asia-Pacific: Rapid Expansion and Infrastructure Development

The Asia-Pacific region is expected to witness the highest growth in the Compact Wheel Loaders Market, accounting for 25% of the global market share. Rapid urbanization and infrastructure projects in countries like China, India, and Southeast Asia are driving demand for compact machinery. The need for equipment that can operate efficiently in confined spaces and perform multiple tasks is contributing to the rising popularity of compact wheel loaders. With increasing construction activities and a shift toward equipment rental services, the region is poised for substantial growth in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Manitou Group

- Yanmar Holdings Co., Ltd.

- Volvo Construction Equipment

- JCB Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Sany Group

- Doosan Bobcat Inc.

- Liugong Machinery Co., Ltd.

- Takeuchi Manufacturing

- Terex Corporation

Competitive Analysis:

The Compact Wheel Loaders Market is highly competitive, with key players focusing on innovation, performance, and sustainability. Major companies such as Caterpillar, Volvo Construction Equipment, Komatsu, and JCB dominate the market through their diverse product offerings and strong brand recognition. These companies invest heavily in technological advancements, including hydraulic systems and telematics, to enhance the performance and fuel efficiency of their machines. The market also sees the emergence of electric and hybrid models, with players like Bobcat and Doosan exploring eco-friendly solutions to meet environmental regulations. Regional players are expanding their presence by offering tailored solutions for specific markets, such as compact loaders designed for tight urban construction sites. The competitive landscape is shaped by ongoing product innovations, partnerships, and increasing investments in research and development to stay ahead in a rapidly evolving market.

Recent Developments:

- In June 2025, Volvo Construction Equipment announced plans to expand its U.S. production by manufacturing crawler excavators and large wheel loaders in Shippensburg, Pennsylvania.

- In March 2025, Doosan Bobcat entered into a partnership with LG Energy Solution to co-develop standardized battery packs for compact construction equipment, aiming to accelerate electrification in the sector.

- In April 2025, Takeuchi debuted two new electric excavator prototypes, the TB10e and TB35e, at the bauma 2025 trade fair in Munich.

Market Concentration & Characteristics:

The Compact Wheel Loaders Market is moderately concentrated, with a few key players holding significant market shares, including Caterpillar, Volvo Construction Equipment, and Komatsu. These major companies dominate the market by offering advanced, high-performance products, supported by strong distribution networks and after-sales services. The market also includes a mix of regional and emerging players that focus on cost-effective, specialized models tailored for specific applications, such as urban construction or agricultural use. Innovation is central to the market, with key players focusing on integrating advanced technologies like telematics, hydraulic systems, and electric and hybrid models. The demand for eco-friendly solutions and versatile equipment drives continuous product development, ensuring that the market remains dynamic and competitive. Small and medium-sized enterprises continue to gain traction by offering flexible and region-specific solutions.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for compact wheel loaders is expected to grow as construction, agriculture, and mining sectors expand globally.

- Technological innovations such as automation, telematics, and hydraulic systems will continue to enhance machine efficiency and performance.

- The shift towards eco-friendly and energy-efficient models, including electric and hybrid compact wheel loaders, will gain momentum.

- Manufacturers will increasingly focus on producing machines that comply with stringent emission standards and sustainability goals.

- Rental services will play a significant role in market expansion, offering cost-effective solutions for short-term and project-based needs.

- The rise in urbanization and infrastructure development in emerging economies will drive the adoption of compact wheel loaders.

- Market players will focus on expanding their product offerings to include more versatile and specialized models.

- North America and Europe will maintain their strong market positions due to high demand in construction and infrastructure sectors.

- The Asia-Pacific region is expected to see the highest growth, driven by rapid industrialization and urbanization.

- Strategic partnerships, mergers, and acquisitions will remain common as companies seek to expand their market reach and technological capabilities.