Market Overview

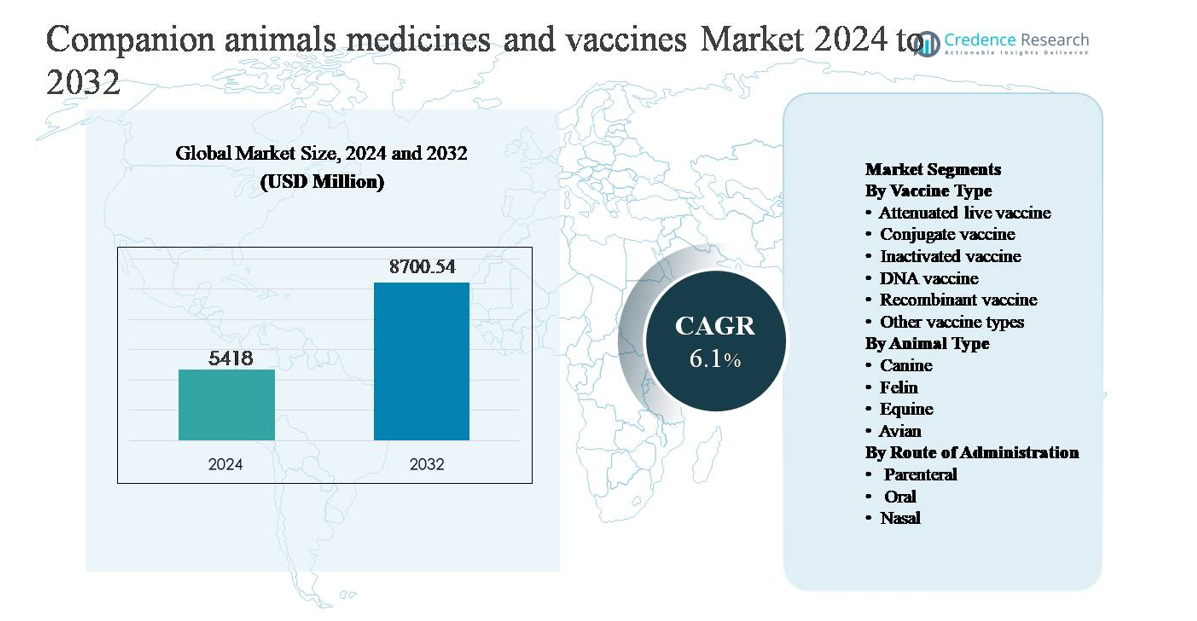

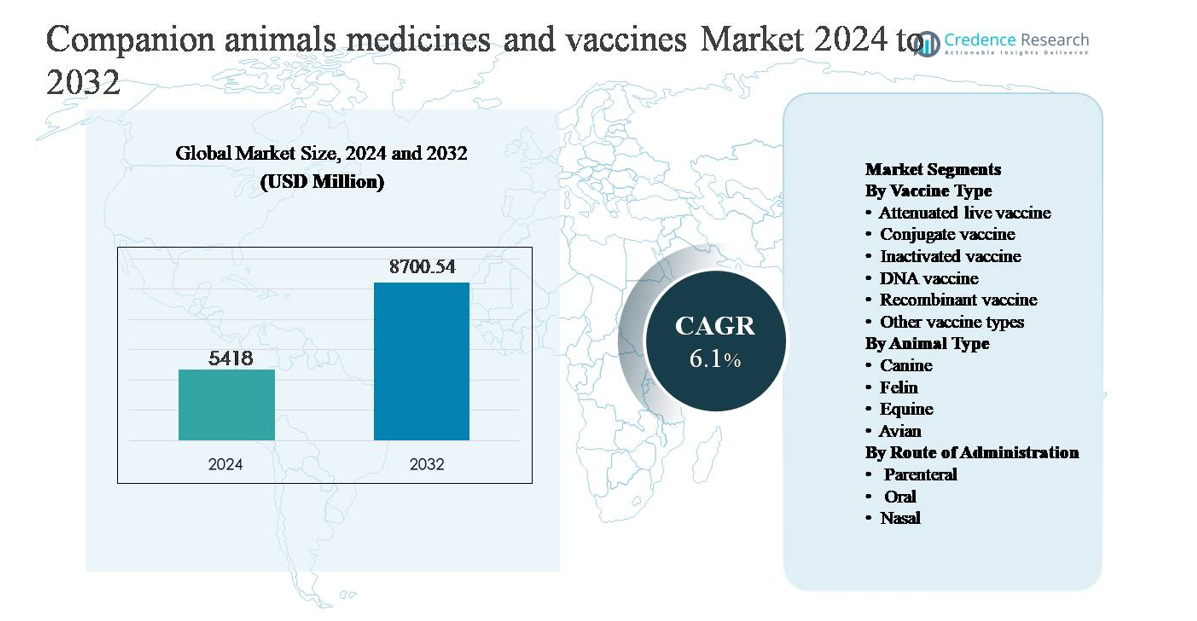

The companion animals medicines and vaccines market was valued at USD 5,418 million in 2024 and is anticipated to reach USD 8,700.54 million by 2032, expanding at a compound annual growth rate (CAGR) of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Companion Animals Medicines and Vaccines Market Size 2024 |

USD 5,418 million |

| Companion Animals Medicines and Vaccines Market, CAGR |

6.1% |

| Companion Animals Medicines and Vaccines Market Size 2032 |

USD 8,700.54 million |

The companion animals medicines and vaccines market is led by a group of globally established players, including Merck Animal Health, Boehringer Ingelheim International, Elanco Animal Health, Ceva Santé Animale, HIPRA, Bioveta, Indian Immunologicals, Biogenesis Bago, Brilliant Bio Pharma, and Durvet. These companies compete through broad vaccine portfolios, strong therapeutic pipelines, global manufacturing capabilities, and deep engagement with veterinary professionals. Strategic emphasis on preventive care, biologics, and region-specific vaccine development strengthens their market positioning. North America is the leading region, accounting for approximately 39% of global market share, supported by high companion animal ownership, advanced veterinary infrastructure, strong regulatory compliance, and high per-animal healthcare spending. Europe follows closely, while Asia Pacific is emerging as the fastest-growing region due to rising pet adoption and expanding veterinary services.

Market Insights

- The companion animals medicines and vaccines market was valued at USD 5,418 million in 2024 and is projected to reach USD 8,700.54 million by 2032, growing at a CAGR of 6.1% during the forecast period.

- Market growth is primarily driven by rising companion animal ownership, increasing pet humanization, and higher spending on preventive veterinary care, with vaccines representing a core demand pillar across routine immunization and disease prevention programs.

- Key trends include growing adoption of inactivated and recombinant vaccines, which together account for over 55% of vaccine-type demand, alongside increased focus on preventive healthcare models and long-acting formulations that improve compliance and treatment continuity.

- The competitive landscape is dominated by multinational animal health companies with strong R&D pipelines, global distribution networks, and expanding biologics portfolios, while regional players compete through cost-effective and localized vaccine offerings.

- Regionally, North America leads with ~39% market share, followed by Europe at ~28% and Asia Pacific at ~23%, while the canine segment dominates animal type demand with over 50% share, reflecting higher vaccination frequency and healthcare spending.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vaccine Type:

The vaccine type segment is led by inactivated vaccines, which account for the dominant market share, estimated at over 40%, driven by their strong safety profile, broad pathogen coverage, and regulatory acceptance across companion animal practices. Veterinarians widely prefer inactivated vaccines for routine immunization against rabies, leptospirosis, and influenza due to minimal risk of reversion to virulence. Recombinant vaccines represent a fast-growing sub-segment, supported by advances in antigen engineering and improved immunogenicity. Attenuated live and DNA vaccines maintain niche adoption, primarily in specialized or emerging indications.

- For instance, Zoetis’ Nobivac® Rabies Inactivated vaccine is manufactured using purified, chemically inactivated rabies virus and is licensed for use in dogs and cats with a standardized 1.0 mL dose per animal, supporting consistent immunization protocols across clinics.

By Animal Type:

The canine segment dominates, contributing approximately 50-55% of total market revenue, supported by high global dog ownership, frequent vaccination schedules, and extensive availability of approved medicines and vaccines. Dogs require routine preventive care for rabies, parvovirus, distemper, and parasitic infections, driving consistent demand. The feline segment follows, benefiting from rising cat adoption in urban households and improved awareness of feline-specific diseases. Equine and avian segments hold smaller shares but remain essential, particularly in performance horses and poultry-related companion birds requiring targeted prophylactic treatments.

- For instance,Boehringer Ingelheim’s Purevax® Feline 3 vaccine uses modified live virus technology for its core components and is administered as a 0.5 mL or 1.0 mL dose to protect against feline rhinotracheitis (herpesvirus), calicivirus, and panleukopenia. The onset of immunity for the core components has been documented as rapidly as one week after completion of the primary vaccination series.

By Route of Administration:

The parenteral route holds the dominant share, exceeding 65% of total administrations, driven by its reliability, precise dosing, and rapid immune response, making it the standard for core vaccines and injectable therapeutics. Intramuscular and subcutaneous injections remain preferred in clinical settings due to established veterinary protocols. Oral administration is gaining traction for antiparasitics and select immunotherapies, supported by improved palatability and owner compliance. Nasal vaccines represent a smaller but strategic segment, particularly for respiratory diseases, offering faster mucosal immunity and reduced systemic exposure.

Key Growth Drivers

Rising Companion Animal Ownership and Humanization

The sustained rise in companion animal ownership, coupled with the growing humanization of pets, is a primary driver of the companion animals medicines and vaccines market. Urbanization, smaller household sizes, and changing lifestyles have positioned pets as integral family members, leading owners to prioritize preventive healthcare and timely disease management. This shift directly increases demand for routine vaccinations, chronic disease medications, and preventive therapeutics such as antiparasitics. Pet owners increasingly seek veterinarian-recommended treatment regimens that mirror human healthcare standards, including combination vaccines and long-term therapies. Higher spending per animal, particularly in developed and emerging urban markets, continues to expand the addressable market and supports consistent revenue growth for pharmaceutical and vaccine manufacturers.

- For instance, Elanco’s Trifexis® combines spinosad and milbemycin oxime into a single monthly oral tablet, delivering flea control and heartworm prevention in one dose, simplifying compliance for pet owners managing multi-year treatment regimens.

Expansion of Veterinary Healthcare Infrastructure

The rapid expansion of veterinary clinics, hospitals, diagnostic laboratories, and specialty care centers is significantly accelerating market growth. Improved access to professional veterinary services increases diagnosis rates, vaccination coverage, and adherence to treatment protocols. Corporate veterinary chains and hospital networks are standardizing care pathways, promoting regular vaccination schedules and preventive medicine adoption. In parallel, investments in cold-chain logistics and distribution networks improve vaccine availability in secondary cities and rural areas. This expanding infrastructure supports higher throughput of companion animal treatments, enabling manufacturers to scale volumes and introduce advanced formulations with greater confidence in market penetration.

- For instance, Mars Veterinary Health operates a global network of more than 2,500 veterinary clinics and hospitals under brands such as Banfield, VCA, and AniCura, enabling standardized vaccination and preventive care protocols supported by centralized electronic medical record systems across its facilities.

Advancements in Veterinary Pharmaceuticals and Vaccine Technologies

Technological progress in veterinary drug formulation and vaccine development is driving broader adoption and market expansion. Innovations such as recombinant vaccines, long-acting injectables, and targeted biologics improve efficacy, safety, and dosing convenience. These advances address unmet needs in disease prevention, chronic condition management, and emerging zoonotic threats. Improved adjuvants and delivery platforms enhance immune response while reducing adverse reactions, increasing veterinarian confidence. As regulatory frameworks evolve to accommodate novel veterinary biologics, companies gain opportunities to differentiate portfolios through innovation, supporting premium pricing and sustained demand growth across companion animal segments.

Key Trends & Opportunities

Shift Toward Preventive and Lifelong Pet Healthcare

Preventive care is emerging as a central trend, creating strong opportunities across medicines and vaccines. Veterinarians increasingly emphasize early immunization, routine booster schedules, and year-round parasite control to reduce long-term disease burden. This approach encourages recurring product usage rather than episodic treatment, improving revenue predictability for suppliers. Preventive healthcare programs, wellness plans, and bundled vaccine offerings further support adoption. The trend also opens opportunities for combination vaccines and extended-duration therapies that simplify compliance for pet owners while maintaining clinical effectiveness.

- For instance, Merck Animal Health’s Nobivac® canine combination vaccines consolidate multiple antigens into a standardized 1.0 mL injection, allowing veterinarians to complete primary immunization and booster protocols efficiently within routine clinic visits.

Growth of Biologics and Precision Veterinary Medicine

The increasing focus on biologics and precision medicine represents a significant opportunity within the market. Recombinant vaccines, monoclonal antibodies, and immune-modulating therapies enable targeted disease management with improved safety profiles. These solutions are particularly valuable for aging pets and animals with chronic or immune-mediated conditions. Advances in diagnostics and genetic screening support more personalized treatment strategies, allowing veterinarians to select therapies tailored to specific breeds or risk profiles. This trend favors companies with strong R&D capabilities and biologics manufacturing expertise.

- For instance, HIPRA has expanded its recombinant vaccine development platforms using controlled antigen-expression systems, with veterinary biologics manufactured in GMP-certified facilities capable of producing multi-million-dose batches annually to ensure consistent antigen purity and reproducibility.

Rising Demand in Emerging Markets

Emerging economies present substantial growth opportunities as pet ownership rises alongside disposable incomes and veterinary awareness. Governments and private players are investing in animal health infrastructure, improving vaccine access and regulatory clarity. Urban middle-class populations increasingly adopt pets and seek professional veterinary care, expanding demand for both essential vaccines and branded medicines. Market entrants that tailor pricing, packaging, and distribution strategies to local conditions can capture significant long-term growth in these regions.

Key Challenges

Regulatory Complexity and Approval Timelines

Regulatory requirements for companion animal medicines and vaccines remain complex and vary significantly across regions. Lengthy approval timelines, extensive clinical testing requirements, and evolving safety standards increase development costs and delay market entry. Compliance with pharmacovigilance, labeling, and post-market surveillance obligations further adds to operational burden. These challenges particularly affect smaller manufacturers and can limit the speed at which innovative products reach veterinarians. Navigating diverse regulatory frameworks requires substantial expertise and investment, constraining portfolio expansion and geographic scalability.

Cost Sensitivity and Limited Access in Price-Constrained Markets

Despite growing awareness, cost sensitivity among pet owners remains a key challenge, especially in emerging and rural markets. High prices of advanced vaccines and specialty medicines can limit adoption, leading owners to delay or forgo treatment. Inadequate insurance coverage for pets in many regions exacerbates this issue, placing the financial burden directly on owners. Limited veterinary access in remote areas further restricts market penetration. Addressing affordability while maintaining product quality and margins remains a critical challenge for industry participants.

Regional Analysis

North America:

North America dominates the companion animals medicines and vaccines market, accounting for approximately 38-40% of global market share, supported by high pet ownership rates, advanced veterinary infrastructure, and strong preventive healthcare adoption. The United States leads regional demand due to well-established vaccination protocols, widespread pet insurance penetration, and high per-animal healthcare spending. Strong regulatory oversight ensures product quality and accelerates adoption of advanced biologics and recombinant vaccines. Canada contributes steadily through rising companion animal humanization and expanding veterinary clinic networks, reinforcing North America’s leadership position.

Europe:

Europe represents around 27-29% of the global market, driven by stringent animal health regulations, high awareness of zoonotic disease prevention, and strong vaccination compliance. Countries such as Germany, the UK, and France lead demand due to dense veterinary service networks and mature pet healthcare ecosystems. Preventive care remains central, with routine immunization and antiparasitic treatments widely adopted. The region also supports innovation in veterinary biologics, aided by regulatory harmonization across the EU. Rising companion animal adoption in Southern and Eastern Europe further supports steady regional growth.

Asia Pacific:

Asia Pacific accounts for approximately 22-24% of market share and is the fastest-growing regional market. Rapid urbanization, increasing disposable incomes, and rising pet ownership particularly in China, India, and Southeast Asia are key growth enablers. Veterinary infrastructure is expanding, improving access to vaccines and essential medicines beyond tier-one cities. Awareness of preventive healthcare is increasing, driving demand for routine immunization and parasite control. Although price sensitivity persists, improving regulatory frameworks and private investment in animal healthcare services are strengthening long-term market potential.

Latin America:

Latin America holds an estimated 6-7% share of the global companion animals medicines and vaccines market. Brazil and Mexico lead regional demand due to growing pet populations and expanding veterinary care access in urban centers. Preventive vaccination programs are gaining traction, supported by rising awareness of animal health and zoonotic disease risks. However, uneven access to veterinary services and cost sensitivity limit adoption in rural areas. Gradual improvements in distribution networks and increased availability of affordable vaccines continue to support moderate regional growth.

Middle East & Africa:

The Middle East & Africa region accounts for approximately 3-4% of global market share, reflecting an emerging but underpenetrated market. Growth is driven by increasing pet adoption in urban areas of the Gulf Cooperation Council countries and South Africa. Expanding private veterinary clinics and rising awareness of companion animal health support demand for core vaccines and basic therapeutics. However, limited veterinary infrastructure, regulatory fragmentation, and lower healthcare spending constrain market expansion. Ongoing investments in animal healthcare services are expected to gradually improve regional market participation.

Market Segmentations:

By Vaccine Type

- Attenuated live vaccine

- Conjugate vaccine

- Inactivated vaccine

- DNA vaccine

- Recombinant vaccine

- Other vaccine types

By Animal Type

- Canine

- Feline

- Equine

- Avian

By Route of Administration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The companion animals medicines and vaccines market is characterized by a highly consolidated and innovation-driven competitive landscape, led by multinational animal health companies with diversified product portfolios and global distribution networks. Key players compete on the basis of vaccine breadth, therapeutic efficacy, safety profiles, and strong relationships with veterinary professionals. Continuous investment in research and development supports the launch of recombinant vaccines, long-acting formulations, and biologics targeting chronic and preventive care. Strategic acquisitions and partnerships are widely used to expand product pipelines, access novel technologies, and strengthen regional presence, particularly in high-growth emerging markets. Leading companies also focus on expanding manufacturing capacity, enhancing cold-chain logistics, and offering integrated solutions that combine vaccines, pharmaceuticals, and diagnostics. Smaller and regional players remain active through niche offerings and cost-competitive products, intensifying competition in price-sensitive markets while reinforcing overall market dynamism.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bioveta

- Ceva Santé Animale

- Merck Animal Health

- Indian Immunologicals

- Elanco Animal Health

- Biogenesis Bago

- HIPRA

- Boehringer Ingelheim International

- Brilliant Bio Pharma

- Durvet

Recent Developments

- In August 8, 2025, Bioveta participated in the Congreso Veterinario de León (CVDL) 2025 in Mexico, showcasing its presence at one of the world’s largest veterinary congresses and underlining its engagement with global veterinary professionals and product visibility.

- In July 29, 2025, Bioveta introduced ORNIVAC FC emulsion for injection, an inactivated vaccine targeting bacterial poultry diseases caused by Pasteurella multocida serotypes A1, A3, A4, and A3×4, expanding its biologics portfolio.

- In January 16, 2025, Ceva Animal Health signed a long-term collaboration with Touchlight to deploy dbDNA technology for next-generation vaccine and therapeutic development, enabling high-purity DNA vaccine production without antibiotic resistance markers.

Report Coverage

The research report offers an in-depth analysis based on Vaccine type, Animal type, Route of administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Preventive healthcare will remain the primary focus, driving sustained demand for routine vaccinations and long-term disease management solutions.

- Adoption of recombinant and biologic vaccines will increase as veterinarians seek safer and more targeted immunization options.

- Canine healthcare will continue to dominate product demand due to higher vaccination frequency and broader therapeutic needs.

- Growth in feline-specific vaccines and medicines will accelerate alongside rising urban cat ownership.

- Expansion of veterinary clinic networks will improve treatment access and standardize vaccination protocols.

- Long-acting and combination formulations will gain preference by improving compliance and reducing dosing frequency.

- Emerging markets will contribute a growing share of demand as pet ownership and veterinary awareness rise.

- Digital health tools will increasingly support treatment monitoring and preventive care planning.

- Strategic partnerships and acquisitions will strengthen product portfolios and regional reach.

- Regulatory alignment and quality standards will continue to shape innovation and market entry strategies.