Market Overview:

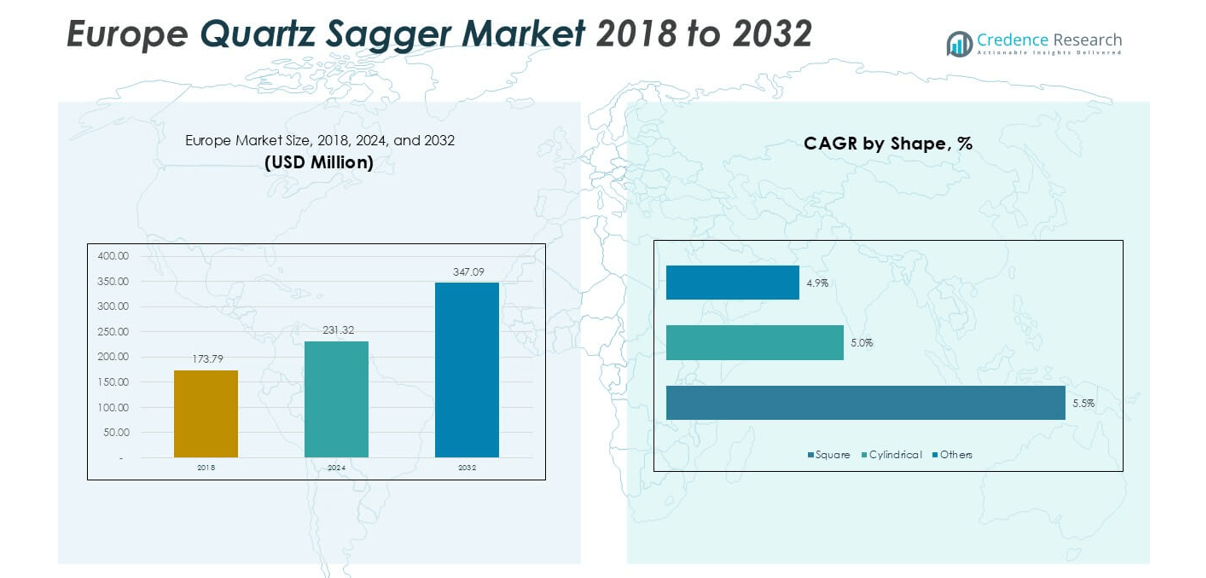

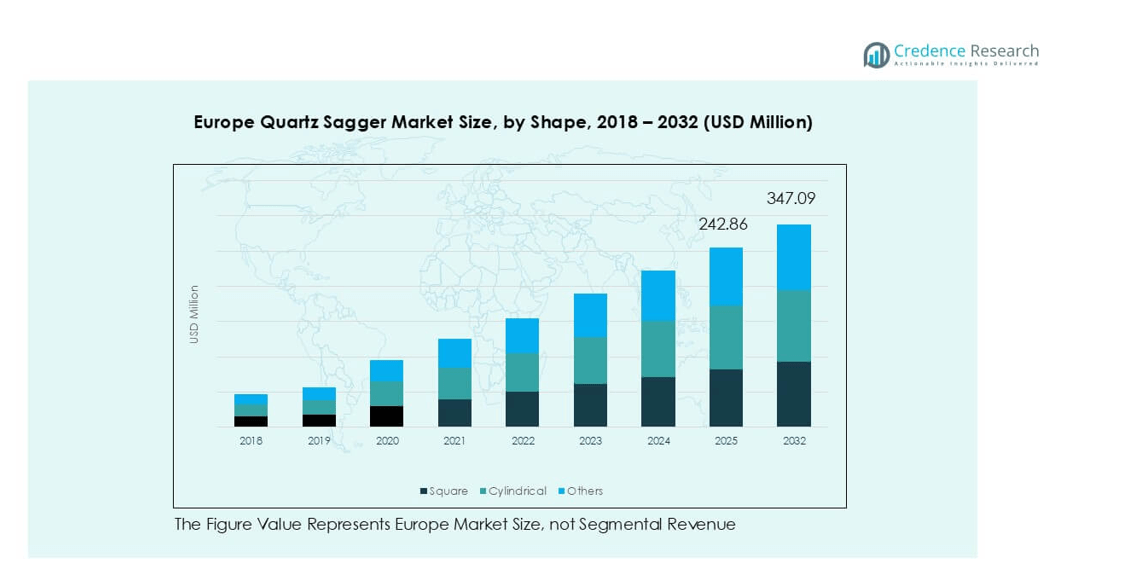

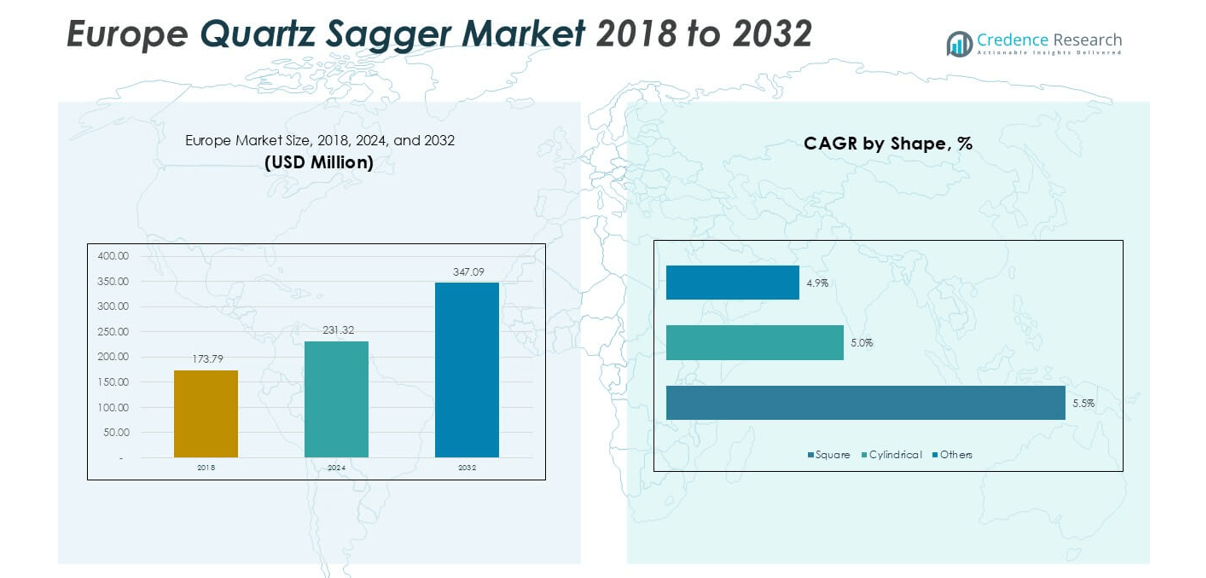

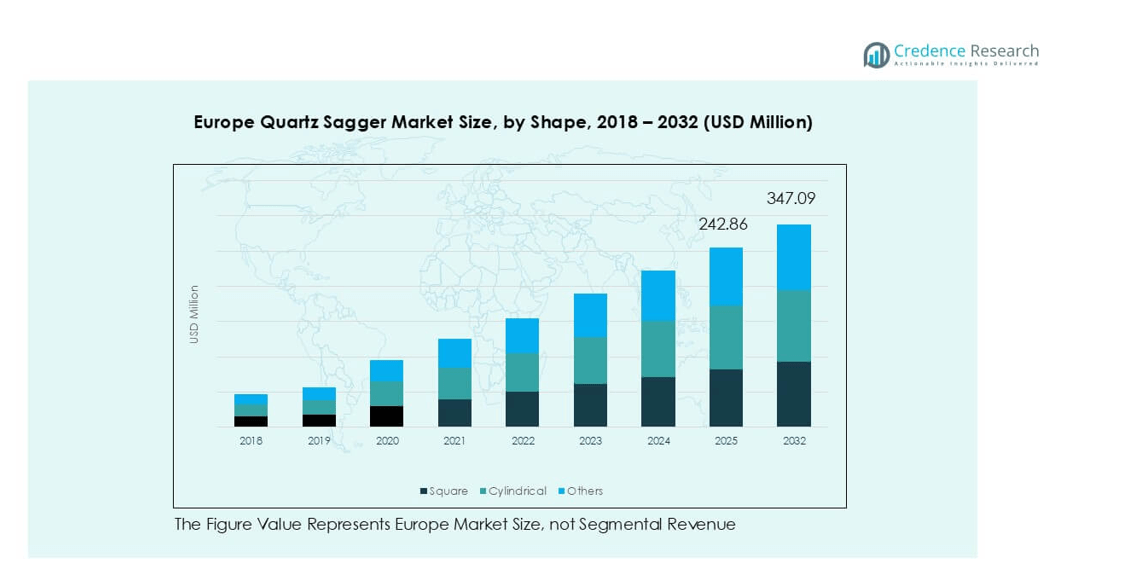

Europe Quartz Sagger market size was valued at USD 173.79 million in 2018, increased to USD 231.32 million in 2024, and is anticipated to reach USD 347.09 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Sagger Market Size 2024 |

USD 231.32 million |

| Europe Quartz Sagger Market, CAGR |

5.2% |

| Europe Quartz Sagger Market Size 2032 |

USD 347.09 million |

The Europe quartz sagger market is led by key players such as Saint-Gobain, Morgan Advanced Materials plc, NORITAKE CO., LIMITED, Zibo Gotrays Industry Co., Ltd, and Liling Zen Ceramic Co., Ltd. These companies dominate through technological innovation, advanced furnace materials, and extensive supply networks across the region. Germany remains the leading market, holding around 28% share in 2024, supported by its robust semiconductor and advanced ceramics manufacturing base. The U.K. and France follow, driven by growing demand in electronics and metallurgy. Continuous investments in clean manufacturing, automation, and contamination-free materials further reinforce Europe’s leadership in high-performance quartz saggers.

Market Insights

- The Europe quartz sagger market was valued at USD 231.32 million in 2024 and is projected to reach USD 347.09 million by 2032, growing at a CAGR of 5.2%.

- Rising demand from the electronics and semiconductor industry, particularly in Germany, drives market growth due to the increasing need for high-purity thermal components in wafer processing.

- The market is witnessing a trend toward automation and precision manufacturing, with growing adoption of digital furnace monitoring and contamination-free materials to improve operational efficiency.

- Key players such as Saint-Gobain, Morgan Advanced Materials plc, and NORITAKE CO., LIMITED dominate through innovation, sustainability, and advanced ceramic technologies.

- Regionally, Germany leads with 28% share, followed by the U.K. (17%) and France (14%), while the electronics and semiconductors segment accounts for nearly 50% of total demand, reflecting strong industrial modernization across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Shape

The cylindrical segment dominated the Europe quartz sagger market in 2024, accounting for over 45% of total share. Cylindrical saggers are preferred due to their uniform heat distribution and mechanical strength, making them ideal for high-temperature furnace operations. Their design minimizes cracking during repeated heating cycles, enhancing operational efficiency. Growing demand from semiconductor and advanced ceramic manufacturers further supports this segment’s dominance. Square saggers follow, favored for ease of stacking in compact furnaces, while other shapes serve niche applications in laboratory and specialty ceramic processes.

- For instance, Morgan Advanced Materials manufactures cylindrical quartz saggers with thermal resistance up to 1,750°C, used extensively in sintering semiconductor substrates and fuel cell ceramics.

By Application

The firing ceramics segment led the market in 2024, holding around 40% share. This dominance is driven by widespread use in kiln operations for electronic ceramics, structural components, and precision materials. Quartz saggers’ high-purity composition prevents contamination during sintering and firing, ensuring product consistency. The sintering powders segment also grows steadily, propelled by the expansion of additive manufacturing and powder metallurgy processes. Rising demand for defect-free ceramic parts in electronics and aerospace further reinforces the need for reliable, high-performance firing saggers.

- For instance, Kyocera Fineceramics Europe produces a wide range of advanced ceramic components, including multilayer ceramic capacitors and substrates. In the production of MLCCs, Kyocera utilizes high-purity ceramics and a sintering process that involves firing components at high temperatures in controlled kilns.

By End User

The electronics and semiconductors industry emerged as the leading end-user, capturing nearly 50% share of the Europe quartz sagger market in 2024. The segment benefits from increasing semiconductor fabrication and R&D activities across Germany, France, and the Netherlands. Quartz saggers are essential for diffusion and oxidation processes in wafer manufacturing, where thermal stability and purity are critical. Growing investment in chip production and material innovation under the EU Chips Act fuels continuous adoption. Metallurgy and glass industries also contribute, particularly in high-precision heat treatment applications.

Market Overview

Expansion of the Semiconductor Manufacturing Sector

The rapid expansion of Europe’s semiconductor industry serves as a major growth driver for the quartz sagger market. Governments across the region, led by Germany and France, are investing heavily to localize chip production and reduce reliance on Asian supply chains. Quartz saggers are critical in diffusion, oxidation, and sintering steps of wafer fabrication, ensuring purity and heat resistance. The EU Chips Act, with a funding target exceeding EUR 43 billion, further accelerates facility construction and material demand. As semiconductor fabs scale production, the need for durable, contamination-free saggers continues to rise, strengthening domestic supplier networks and encouraging R&D into advanced quartz processing technologies.

- For instance, Intel announced plans for a large semiconductor manufacturing complex in Magdeburg, Germany, with an expanded scope involving over €30 billion in total investment and production of advanced, ‘Angstrom-era’ chips. However, the project was officially canceled in July 2025 due to market conditions, restructuring, and high costs.

Rising Demand for High-Temperature Ceramic Processing

The growing use of high-performance ceramics in aerospace, defense, and energy sectors fuels quartz sagger adoption. These saggers provide stability under extreme heat, making them ideal for sintering technical ceramics such as alumina and zirconia. European manufacturers increasingly require components with tight dimensional tolerances and minimal impurities. As industries transition to lightweight and heat-resistant materials, saggers with superior mechanical strength and minimal thermal deformation gain traction. The trend is further supported by industrial decarbonization goals that promote energy-efficient furnaces and advanced refractory materials, creating consistent demand for precision quartz saggers across production lines.

- For instance, Kyocera Fineceramics Europe utilizes high-purity alumina ceramic setters or saggers for sintering zirconia components at temperatures up to 1,700 °C, for use in high-performance applications like aircraft sensors.

Focus on Clean Manufacturing and Contamination Control

Europe’s strict environmental and quality regulations drive a shift toward cleaner, contamination-free manufacturing processes. Quartz saggers, known for their high purity and inert properties, play a key role in preventing material contamination during thermal processing. Semiconductor and glass producers prioritize such materials to ensure product consistency and minimize yield loss. Manufacturers like Saint-Gobain and Morgan Advanced Materials are advancing their product portfolios with low-porosity, high-density saggers to meet these standards. The regulatory emphasis on product traceability, cleanroom compatibility, and sustainability continues to enhance the use of premium quartz saggers across critical industries.

Key Trend & Opportunity

Shift Toward Automation and Precision Manufacturing

The integration of automation and AI-driven furnace monitoring presents a strong growth opportunity. Advanced manufacturing plants now employ digital temperature control and predictive maintenance to reduce defects and extend sagger lifespan. Europe’s Industry 4.0 initiatives promote this shift, enabling real-time performance tracking of thermal components. Manufacturers leveraging sensor-equipped saggers can optimize heat cycles and reduce operational downtime. This convergence of precision ceramics and smart manufacturing enhances efficiency, positioning quartz sagger suppliers as vital partners in Europe’s industrial digitalization journey.

- For instance, Bosch’s wafer fabrication facility in Dresden operates as a fully automated “smart fab,” using over 250 AI-driven sensors to monitor thermal processes and prevent material stress in quartz-based furnace components.

Adoption of Recyclable and Sustainable Materials

Sustainability has become central to material innovation in Europe’s thermal processing industry. Companies are exploring eco-friendly quartz production and recyclable refractory components to align with EU Green Deal objectives. Waste reduction through sagger refurbishment and reuse is gaining momentum, particularly in electronics and glass industries. This opens opportunities for producers offering saggers with extended life cycles and low carbon footprints. Partnerships between ceramic producers and end users to develop closed-loop recycling systems could create long-term cost benefits and improve supply chain resilience.

Key Challenge

High Production and Replacement Costs

The high cost of manufacturing high-purity quartz saggers poses a significant challenge. Precision forming, machining, and controlled atmosphere firing make production energy-intensive and expensive. Frequent thermal cycling in semiconductor and ceramic applications accelerates wear, leading to costly replacements. Smaller manufacturers struggle to compete due to limited access to specialized raw materials and processing equipment. As energy prices remain volatile in Europe, maintaining profitability while meeting quality standards becomes increasingly difficult, prompting industry players to explore material optimization and life-extension coatings.

Supply Chain Constraints and Raw Material Dependency

Europe depends on imported high-purity quartz, primarily from the U.S. and Asia, exposing the market to supply disruptions. Any restriction in material availability directly impacts production timelines and costs for sagger manufacturers. Geopolitical tensions and transportation bottlenecks further add to uncertainty. Although local mining initiatives are underway, scaling them to industrial-grade purity remains challenging. Ensuring consistent supply while maintaining stringent quality benchmarks requires strategic partnerships and regional investments in quartz refining facilities to reduce dependence on foreign sources.

Regional Analysis

Germany

Germany held the largest share of around 28% in the Europe quartz sagger market in 2024. The country’s dominance is attributed to its strong semiconductor and advanced ceramics industries, supported by major players like Infineon Technologies and Bosch. Continuous investments in clean energy, electronics, and material science enhance demand for high-purity quartz components. German manufacturers also emphasize automation and precision processing, improving furnace efficiency. The nation’s leadership in sustainable industrial manufacturing, combined with expanding R&D in thermal applications, continues to position Germany as the core growth hub within the European quartz sagger landscape.

United Kingdom

The United Kingdom accounted for nearly 17% of the regional market share in 2024, driven by strong demand from semiconductor fabrication and glass processing sectors. The country’s National Semiconductor Strategy and growing focus on domestic chip manufacturing are key factors stimulating quartz sagger use. Advanced material research across universities and R&D centers also supports innovation in sagger performance and durability. The UK’s transition toward sustainable industrial production and energy-efficient furnace systems further boosts market prospects, with local firms investing in precision-engineered saggers suited for next-generation electronics and laboratory applications.

France

France captured around 14% of the Europe quartz sagger market in 2024, supported by robust activity in aerospace ceramics and metallurgy. The country’s growing electronics and glass manufacturing sectors rely heavily on high-purity saggers for thermal stability and contamination control. Strong governmental incentives for reindustrialization and clean technology investments enhance production capabilities. Companies are adopting advanced furnace designs for precision sintering, reinforcing domestic sagger demand. France’s continued focus on material innovation and collaboration with European partners in semiconductor expansion keeps the nation’s quartz sagger market steadily advancing.

Italy

Italy represented about 11% of the regional market share in 2024, driven by strong growth in glass and ceramic manufacturing. The country’s industrial clusters in Emilia-Romagna and Veneto contribute significantly to sagger demand for firing and sintering applications. Local producers emphasize cost-effective yet high-performance solutions to serve both traditional and advanced ceramics industries. Expanding adoption in metallurgy and laboratory furnaces adds further momentum. With ongoing modernization of thermal equipment and focus on export-oriented production, Italy continues to strengthen its position as a key consumer and manufacturer of quartz saggers in Southern Europe.

Spain

Spain accounted for nearly 9% of the Europe quartz sagger market in 2024. The country’s robust glass and tile industries, concentrated in Castellón and Valencia, fuel significant sagger consumption. Increasing investments in clean manufacturing and renewable energy components also drive adoption. Spanish producers are focusing on lightweight and durable saggers to enhance furnace energy efficiency. Additionally, the nation’s growing participation in European semiconductor initiatives opens new market opportunities. Continued modernization in industrial ceramics and sustainable production practices supports Spain’s steady growth within the regional quartz sagger landscape.

Russia

Russia held around 8% of the regional market share in 2024, supported by its expanding metallurgical and technical ceramics industries. Quartz saggers are primarily used in high-temperature applications such as metal heat treatment and refractory material production. Despite geopolitical challenges and supply chain constraints, domestic manufacturers are investing in local quartz processing capabilities to reduce dependence on imports. The demand from defense and energy-related industries remains stable. While limited by technology imports, Russia’s focus on industrial self-reliance and localized material sourcing sustains its moderate growth trajectory.

Rest of Europe

The Rest of Europe collectively captured about 13% of the regional quartz sagger market in 2024. Countries such as the Netherlands, Belgium, Switzerland, and Poland contribute to rising demand through advanced ceramics, laboratory research, and semiconductor applications. The Netherlands, with its strong semiconductor ecosystem, plays a notable role in driving sagger consumption. Increasing R&D collaborations and localized manufacturing support regional market expansion. Investments in high-temperature materials, clean energy projects, and academic research programs are expected to strengthen quartz sagger utilization across these emerging European economies through 2032.

Market Segmentations:

By Shape

- Square

- Cylindrical

- Others

By Application

- Firing Ceramics

- Sintering Powders

- Heat Treating Metals

- Others

By End User

- Electronics and Semiconductors Industry

- Metallurgy Industries

- Glass Industries

- Others

By Geography

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe quartz sagger market is moderately consolidated, with leading players including Saint-Gobain, Morgan Advanced Materials plc, NORITAKE CO., LIMITED, Zibo Gotrays Industry Co., Ltd, and Liling Zen Ceramic Co., Ltd. These companies maintain a strong presence through advanced material engineering, large production capacities, and established distribution networks across key markets such as Germany, France, and the U.K. Saint-Gobain and Morgan Advanced Materials focus on developing high-purity and thermally stable saggers for semiconductor and electronic applications, while NORITAKE emphasizes precision ceramic solutions for industrial firing processes. Chinese manufacturers like Zibo Gotrays and Shandong Topower are expanding their European footprint through cost-effective, high-performance products. Strategic collaborations, R&D in low-contamination quartz, and the adoption of automated furnace technologies remain central to competition. Continuous innovation, sustainability compliance, and product customization for cleanroom applications are emerging as critical differentiators among market participants striving to strengthen their regional presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Sumitomo Refractories announces the development of a sustainable, recyclable quartz sagger.

- In 2022, RHI Magnesita invests in a new manufacturing facility for advanced quartz saggers in China.

Report Coverage

The research report offers an in-depth analysis based on Shape, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe quartz sagger market will continue to expand with steady growth through 2032.

- Rising semiconductor manufacturing across Germany and France will sustain high product demand.

- Increasing investment in clean and contamination-free production will drive premium sagger adoption.

- Automation and digital furnace monitoring will enhance operational efficiency and product life.

- Manufacturers will focus on developing recyclable and sustainable quartz materials.

- Strategic collaborations between European and Asian suppliers will strengthen material supply chains.

- Research in heat-resistant and low-porosity saggers will improve performance for advanced ceramics.

- Expanding applications in aerospace and metallurgy will diversify end-user demand.

- Regulatory support for energy-efficient industrial processes will boost regional competitiveness.

- Continuous innovation by key players will shape the next phase of market consolidation and technological advancement.