Market Overview

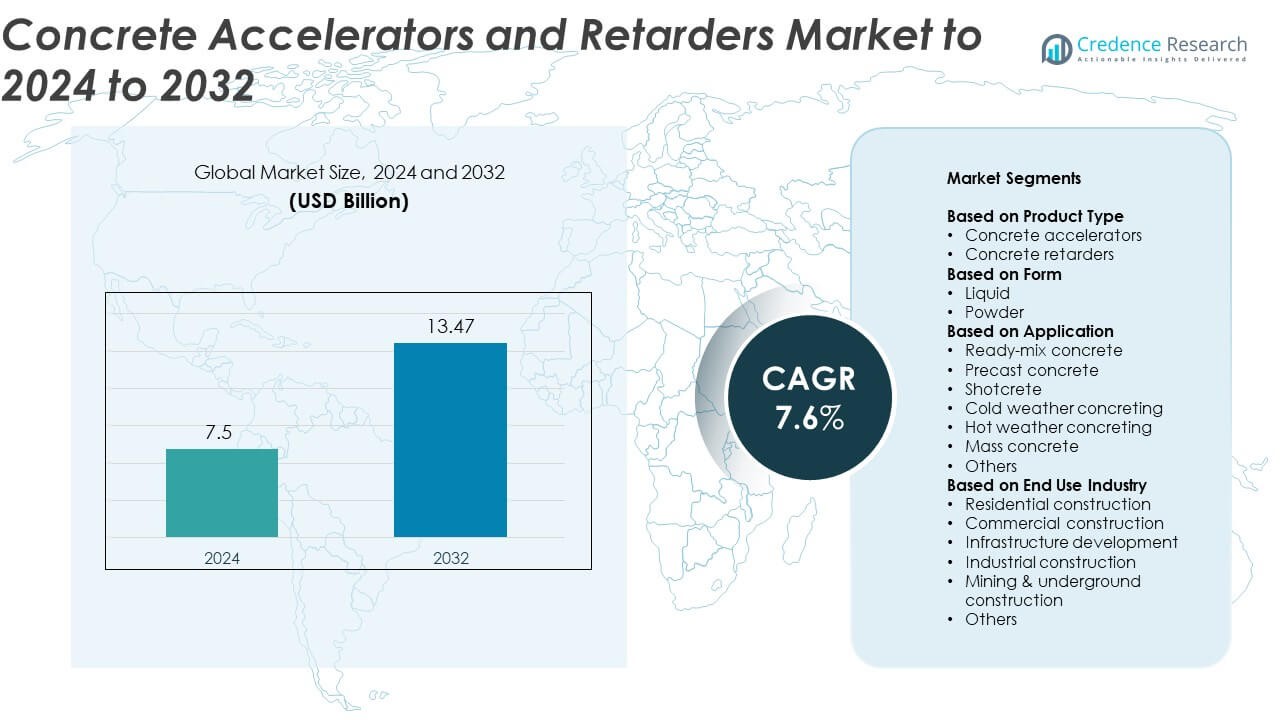

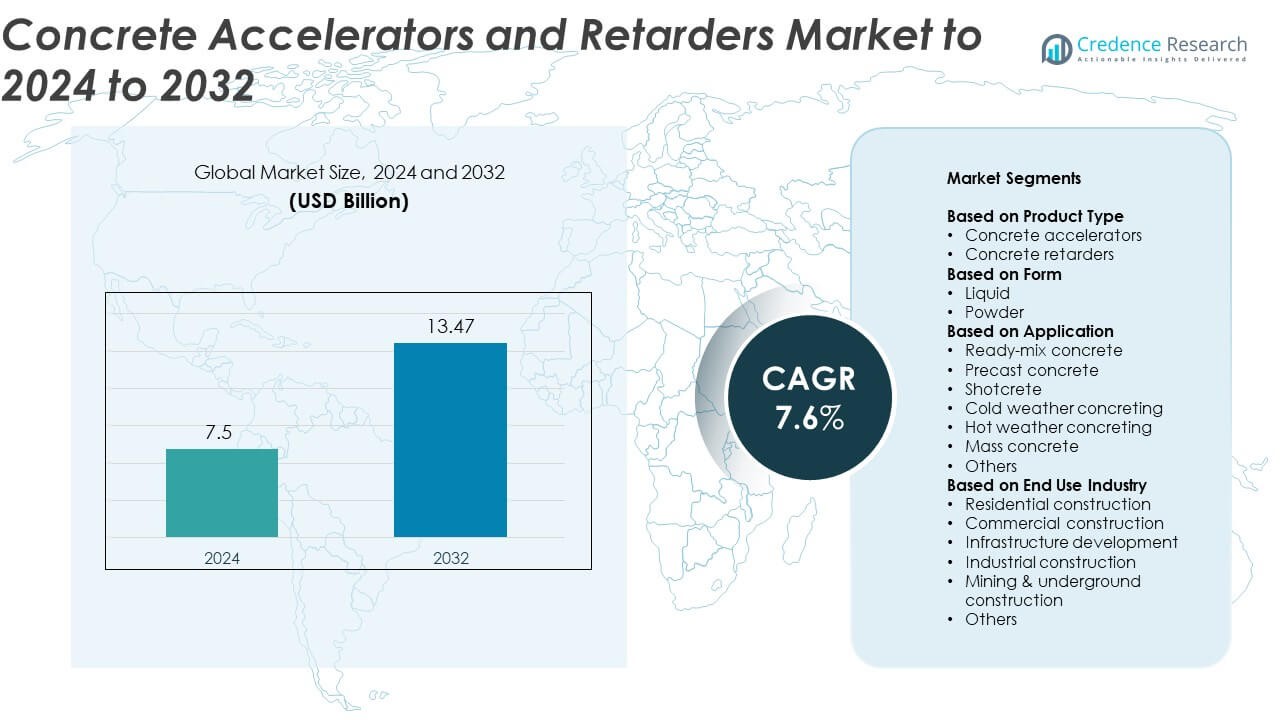

The Concrete Accelerators and Retarders Market size was valued at USD 7.5 Billion in 2024 and is anticipated to reach USD 13.47 Billion by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Accelerators and Retarders Market Size 2024 |

USD 7.5 Billion |

| Concrete Accelerators and Retarders Market, CAGR |

7.6% |

| Concrete Accelerators and Retarders Market Size 2032 |

USD 13.47 Billion |

The concrete accelerators and retarders market is led by major players such as BASF SE (MBCC Group), Mapei S.p.A., CHRYSO S.A.S, Fosroc International Ltd., Sika AG, RPM International Inc., GCP Applied Technologies Inc., and CICO Technologies Ltd. These companies dominate through advanced admixture formulations, strong distribution networks, and a focus on sustainability-driven innovations. Asia Pacific leads the global market with a 29.6% share in 2024, supported by large-scale infrastructure and urban development projects. North America follows with a 32.8% share, driven by growing demand for high-performance concrete in commercial and residential construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The concrete accelerators and retarders market was valued at USD 7.5 billion in 2024 and is projected to reach USD 13.47 billion by 2032, growing at a CAGR of 7.6%.

- Rising global infrastructure projects and rapid urbanization are driving demand for faster-setting and durable concrete solutions, particularly in ready-mix and precast applications.

- Sustainability trends are encouraging the use of eco-friendly and chloride-free admixtures, while digital construction practices enhance material efficiency.

- The market is moderately consolidated, with leading manufacturers focusing on R&D, product innovation, and expanding distribution networks to strengthen global presence.

- Asia Pacific leads the market with 29.6% share, followed by North America at 32.8% and Europe at 27.5%, while the concrete accelerator segment dominates product type with 57.2% share in 2024.

Market Segmentation Analysis:

By Product Type

Concrete accelerators dominate the market, accounting for nearly 57.2% share in 2024. Their widespread use in speeding up early strength development of concrete makes them vital for time-sensitive projects. Growing infrastructure projects in cold regions and high-rise construction drive demand. Accelerators reduce setting time, enabling rapid formwork removal and early load-bearing capacity. Increasing adoption of non-chloride formulations supports compatibility with reinforced concrete. Rising emphasis on construction productivity and shorter project timelines further strengthen this segment’s leadership over concrete retarders, which remain essential for hot weather concreting applications.

- For instance, Master Builders Solutions reported 26 N/mm² after 12 hours on Marienturm using Master X-Seed, exceeding the 22 N/mm² at 14 hours requirement.

By Form

The liquid form segment holds a dominant 63.4% share in 2024, attributed to its superior dispersion and ease of mixing in concrete batches. Liquid additives are preferred in large-scale ready-mix and precast concrete production due to precise dosing and uniform performance. Their compatibility with automated batching systems enhances consistency and productivity. The demand for liquid accelerators and retarders continues to grow with advancements in admixture formulations, improving workability and performance. Powder forms, while cost-effective for transport and storage, are more common in remote or small-scale construction projects.

- For instance, Sika notes SikaRapid-1 targets rapid early strength within 6–24 hours, supporting liquid dosing in automated batching.

By Application

Ready-mix concrete leads the market, capturing around 48.9% share in 2024. This segment benefits from expanding infrastructure and urban housing developments requiring fast and consistent concrete production. The integration of accelerators and retarders in ready-mix plants optimizes setting time across varying site conditions. Precast concrete applications also show strong growth due to the need for enhanced production cycles and structural precision. Meanwhile, shotcrete and cold-weather concreting gain traction in tunneling, mining, and repair projects demanding high early strength and durability under challenging environments.

Key Growth Drivers

Rising Infrastructure Development Worldwide

Global infrastructure expansion is a major growth driver for the concrete accelerators and retarders market. Rapid urbanization and government investments in highways, bridges, and metro projects are driving large-scale concrete usage. Accelerators enable faster curing and early strength gain, improving project turnaround times. Meanwhile, retarders maintain workability in hot climates and large pours. The growing focus on durable, high-performance structures in emerging economies like India, China, and Brazil continues to strengthen demand across both residential and commercial segments.

- For instance, Fosroc’s Conplast NC shows strength gains most significant in the first 18 hours, supporting fast cycles on infrastructure pours.

Increasing Adoption of High-Performance Concrete Additives

The shift toward high-performance concrete materials is accelerating market growth. Modern construction projects demand additives that enhance strength, durability, and setting time efficiency. Concrete accelerators and retarders are integral to achieving these goals, especially in extreme temperature conditions or complex structural designs. Innovations in admixture chemistry have led to more environmentally compatible and chloride-free formulations. These advancements improve compatibility with various cement types while ensuring compliance with green construction standards, encouraging broader adoption in both industrial and infrastructure projects.

- For instance, Mapei’s Mapefast ULTRA delivered >12 MPa after 19 hours in testing, enabling earlier formwork removal in demanding builds.

Expansion of Precast and Ready-Mix Concrete Applications

The growing preference for precast and ready-mix concrete is a key market driver. These methods enhance efficiency, reduce waste, and ensure quality consistency. Accelerators reduce curing time in precast production lines, enabling faster component turnover. Retarders support extended workability during transportation of ready-mix concrete, minimizing material losses. Increasing urban housing projects and modular construction trends further boost demand. The rise in prefabricated infrastructure elements such as tunnels, bridges, and drainage systems continues to create steady growth for admixture producers.

Key Trends & Opportunities

Sustainability and Green Construction Focus

Sustainability is emerging as a critical opportunity for admixture manufacturers. The industry is shifting toward bio-based and non-toxic formulations to reduce environmental impact. Demand for low-carbon concrete and eco-friendly accelerators is growing due to tightening emission regulations. Manufacturers are investing in research to develop biodegradable additives and materials compatible with recycled aggregates. As sustainable construction certifications become standard practice, environmentally responsible admixtures are expected to play a larger role in the competitive landscape.

- For instance, Saint-Gobain Construction Chemicals (which encompasses brands like CHRYSO, GCP Applied Technologies, and Fosroc, following the completion of the Fosroc acquisition in February 2025) leverages a network of over 100 industrial sites and a significant number of R&D centers globally.

Technological Advancements in Admixture Formulation

Continuous innovation in admixture technology offers new opportunities for market expansion. Advanced formulations provide precise control over setting time, strength development, and durability under diverse weather conditions. Digital monitoring systems and smart batching technologies are integrating with chemical additives to enhance process optimization. The rise of AI-driven concrete performance modeling and nanomaterial-based additives also enhances the reliability of concrete accelerators and retarders, aligning with the construction industry’s move toward automation and data-driven material design.

- For instance, MC-Bauchemie’s MC-FastKick 111 is a chloride-free liquid hardening accelerator for winter concreting and shortened cycles, per its technical datasheet.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material costs poses a major challenge for manufacturers. Ingredients like calcium nitrate, sodium thiocyanate, and lignosulfonates experience price fluctuations due to supply chain disruptions and energy market instability. These variations directly affect production costs and profit margins. Smaller manufacturers face difficulties maintaining price competitiveness against larger players with stronger procurement capabilities. The industry must focus on diversifying raw material sources and improving production efficiency to offset these cost pressures.

Stringent Environmental and Safety Regulations

Stringent environmental policies regarding chemical usage in construction materials remain a key challenge. Regulations limiting chloride-based accelerators and synthetic compounds have increased compliance costs. Manufacturers are required to reformulate products to meet global standards such as REACH and LEED. This transition demands significant R&D investment and prolonged certification timelines. Adapting to regional regulatory differences across markets also complicates global distribution strategies, slowing innovation cycles and market entry for new admixture solutions.

Regional Analysis

North America

North America accounted for around 32.8% share of the concrete accelerators and retarders market in 2024. Growth is supported by strong infrastructure renovation, commercial construction, and residential housing projects across the United States and Canada. The adoption of advanced concrete admixtures in cold-weather construction enhances productivity and strength performance. Demand for accelerators dominates due to faster project timelines and rising use in ready-mix and precast concrete applications. Government funding for highway and bridge upgrades also fuels market expansion, while sustainability initiatives encourage the use of low-chloride and eco-friendly admixture formulations.

Europe

Europe held approximately 27.5% share of the market in 2024, driven by stringent environmental standards and advanced construction technologies. The region’s mature construction sector in countries like Germany, France, and the United Kingdom continues to demand high-quality admixtures for durable and sustainable concrete. Retarders are widely adopted for mass concrete and hot-weather projects, particularly in southern Europe. Infrastructure modernization, especially in transport and energy networks, supports consistent growth. The shift toward green construction materials and EU regulatory emphasis on reducing VOC emissions further drive product innovation across regional manufacturers.

Asia Pacific

Asia Pacific leads the market with nearly 29.6% share in 2024, fueled by rapid urbanization and large-scale infrastructure projects across China, India, and Southeast Asia. Expanding residential and commercial construction activities continue to boost consumption of both accelerators and retarders. Government-led initiatives like smart cities and high-speed rail networks increase the need for fast-setting and durable concrete solutions. The growing presence of global admixture manufacturers and local production facilities strengthens regional supply capacity. Cost-effective manufacturing and high concrete consumption make Asia Pacific the key growth engine for the overall market.

Latin America

Latin America accounted for about 6.2% share of the global market in 2024. The region benefits from ongoing infrastructure expansion and urban development programs, particularly in Brazil, Mexico, and Chile. Growing investments in energy, transport, and commercial real estate drive concrete consumption. Accelerators gain preference in regions with tight project schedules, while retarders are used in large pours under tropical climates. Adoption of sustainable admixtures is slowly increasing as countries implement stricter environmental regulations. Economic recovery and regional construction investments are expected to sustain moderate growth in the coming years.

Middle East & Africa

The Middle East & Africa captured around 3.9% share of the market in 2024. Growth is supported by infrastructure development across the Gulf Cooperation Council countries and rising construction activities in South Africa and Egypt. Large-scale projects such as smart cities, stadiums, and industrial complexes drive the use of concrete accelerators for faster completion. Retarders are essential for maintaining workability under high-temperature conditions. Increasing focus on sustainable construction practices and foreign investments in commercial infrastructure further enhance regional demand, positioning MEA as an emerging growth frontier for admixture producers.

Market Segmentations:

By Product Type

- Concrete accelerators

- Concrete retarders

By Form

By Application

- Ready-mix concrete

- Precast concrete

- Shotcrete

- Cold weather concreting

- Hot weather concreting

- Mass concrete

- Others

By End Use Industry

- Residential construction

- Commercial construction

- Infrastructure development

- Industrial construction

- Mining & underground construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the concrete accelerators and retarders market includes key players such as BASF SE (MBCC Group), Mapei S.p.A., CHRYSO S.A.S, Fosroc International Ltd., Sika AG, RPM International Inc., GCP Applied Technologies Inc., and CICO Technologies Ltd. The market remains moderately consolidated, with global manufacturers focusing on product innovation, regional expansion, and sustainability-driven solutions. Companies are investing heavily in R&D to develop chloride-free, eco-friendly admixtures that comply with evolving environmental regulations. Strategic collaborations with construction firms and infrastructure developers are strengthening brand presence across emerging markets. Many producers are expanding production capacities and improving distribution networks to cater to the growing demand from ready-mix and precast concrete applications. Digitalization in construction and data-driven material performance analysis are further reshaping competition, pushing firms toward advanced formulation technologies and performance optimization. Overall, continuous innovation and sustainability integration remain central to maintaining competitive advantage in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Master Builders Solutions re-entered the Indian market, outlining plans to achieve significant revenue by 2028 through high-performance admixtures for infrastructure projects.

- In 2023, Sika completed the acquisition of the MBCC Group (formerly BASF Construction Chemicals) in May after receiving all necessary regulatory approvals. This transaction significantly strengthened Sika’s footprint and product range, including concrete admixtures.

- In 2023, CHRYSO (Saint-Gobain Construction Chemicals) announced the development of a solution for the use of ultra-low carbon concrete based on the new admixture CHRYSO EnviroMix ULC 5500.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing investment in infrastructure and smart city projects will continue to boost market demand.

- Rising adoption of precast and ready-mix concrete will enhance the use of accelerators and retarders.

- Increasing focus on sustainable and low-carbon construction materials will drive product innovation.

- Advancements in admixture formulation technology will improve efficiency and performance consistency.

- Expanding residential and commercial construction activities will sustain long-term market growth.

- Government initiatives promoting green building standards will encourage eco-friendly admixture adoption.

- Emerging economies in Asia Pacific and the Middle East will offer strong growth opportunities.

- Digitalization in construction processes will improve precision in admixture dosing and application.

- Strategic partnerships between admixture manufacturers and contractors will enhance market penetration.

- Rising demand for durable, high-performance concrete will reinforce steady market expansion globally.