Market Overview

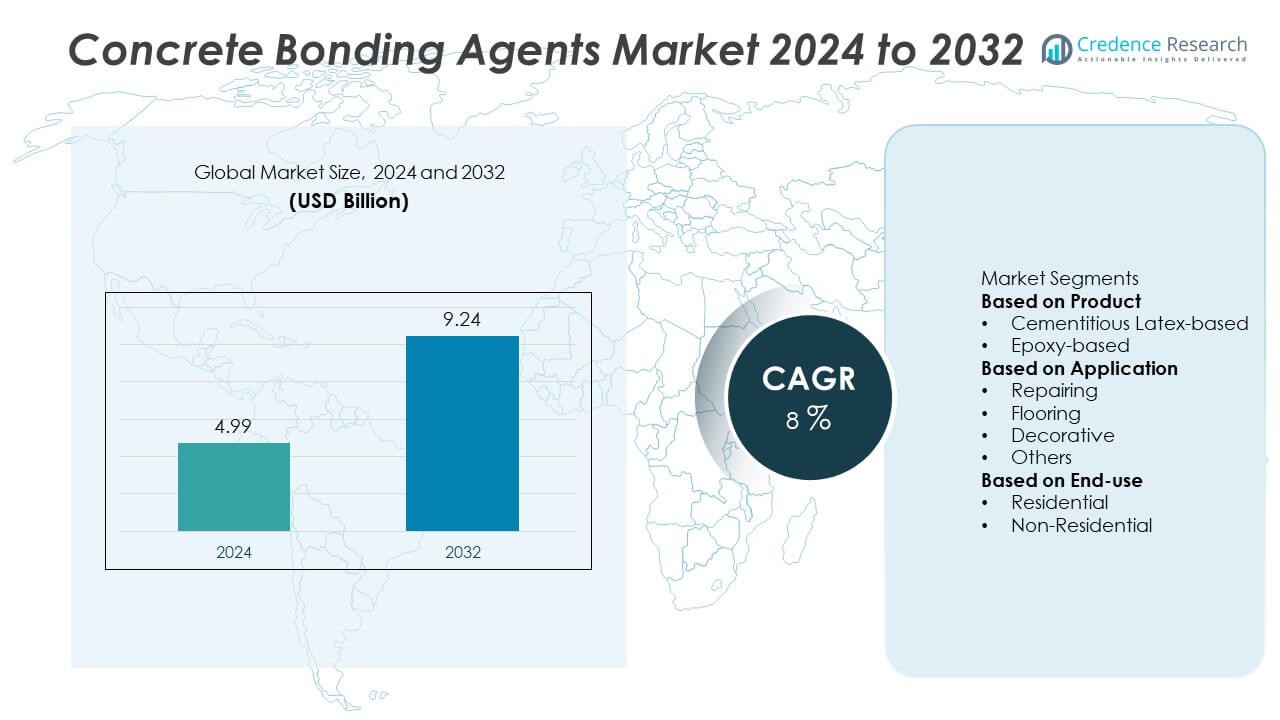

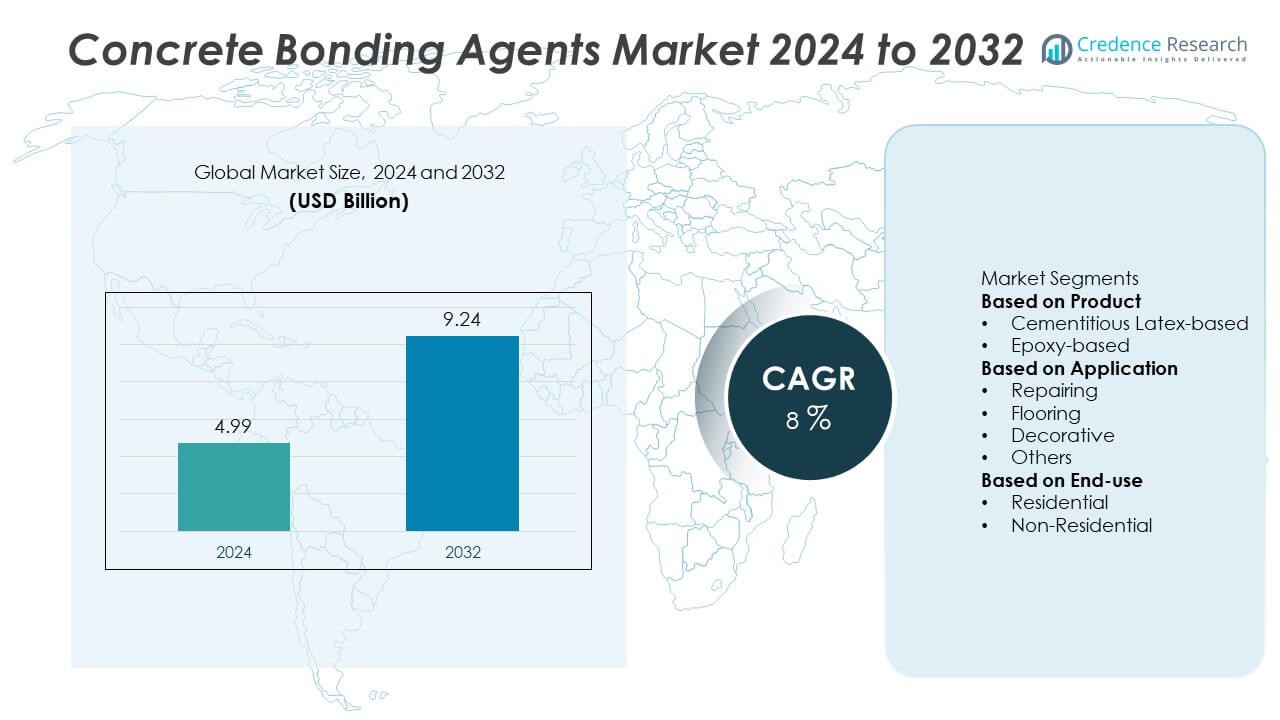

The Concrete Bonding Agents Market was valued at USD 4.99 billion in 2024 and is projected to reach USD 9.24 billion by 2032, growing at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Bonding Agents Market Size 2024 |

USD 4.99 Billion |

| Concrete Bonding Agents Market, CAGR |

8% |

| Concrete Bonding Agents Market Size 2032 |

USD 9.24 Billion |

The concrete bonding agents market is led by key players such as Sika AG, ChemCo Systems Inc., Mapei S.P.A., Fosroc Inc., BASF SE, Flowcrete Group Ltd., LafargeHolcim, Saint-Gobain Weber S.A., GCP Applied Technologies Inc., and The Dow Chemical Company. These companies focus on developing advanced epoxy and polymer-modified bonding solutions to enhance structural strength and durability across construction applications. Asia-Pacific dominated the market with a 36% share in 2024, driven by rapid urbanization and infrastructure development in China and India. North America followed with 27%, supported by strong repair and renovation activity, while Europe, holding 25%, benefited from stringent sustainability and building quality standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The concrete bonding agents market was valued at USD 4.99 billion in 2024 and is projected to reach USD 9.24 billion by 2032, growing at a CAGR of 8% during the forecast period.

- Market growth is driven by rising infrastructure renovation, expanding construction projects, and increasing adoption of polymer-modified bonding agents for enhanced adhesion and durability.

- Key trends include the growing use of eco-friendly, low-VOC formulations and technological advancements in epoxy- and latex-based bonding systems that improve strength and resistance.

- The market is competitive, with major players such as Sika AG, BASF SE, Mapei S.P.A., and Fosroc Inc. focusing on innovation, sustainability, and strategic partnerships to expand regional presence.

- Asia-Pacific led with a 36% share in 2024, followed by North America with 27% and Europe with 25%, while the epoxy-based segment dominated with a 54% share due to its superior mechanical performance in structural applications.

Market Segmentation Analysis:

By Product

The epoxy-based segment dominated the concrete bonding agents market in 2024, accounting for a 54% share. Epoxy bonding agents are preferred for their superior adhesion, chemical resistance, and ability to withstand heavy mechanical stress. They are widely used in structural repairs, bridge decks, and industrial flooring applications where strength and durability are critical. Their fast-setting properties and compatibility with various substrates make them ideal for modern construction and restoration projects. The increasing use of epoxy-based systems in infrastructure rehabilitation is driving steady segment growth across both developed and emerging regions.

- For instance, Sika AG introduced its Sikadur-32 LP epoxy bonding agent with a compressive strength of at least 55 megapascals (MPa) after seven days, suitable for structural bonding in applications like bridge and tunnel construction.

By Application

The repairing segment held the largest share of 48% in 2024, driven by the growing need for concrete restoration and maintenance in aging infrastructure. These bonding agents are extensively used to repair cracks, spalled concrete, and damaged structural components, enhancing surface integrity and extending lifespan. Rapid urbanization and government-led refurbishment initiatives in highways, bridges, and public buildings are accelerating demand. The segment also benefits from increasing adoption of high-performance bonding formulations that offer improved tensile strength and resistance to water ingress, supporting their dominance across global repair projects.

- For instance, Mapei S.p.A. launched Eporip Turbo, a quick-hardening, two-component polyester resin for sealing cracked screeds that achieves its final cure in two hours and has a tensile adhesion strength to concrete of 3.0 MPa.

By End-use

The non-residential segment captured a 63% share in 2024, supported by extensive application in commercial, industrial, and infrastructural projects. Rapid construction of manufacturing facilities, warehouses, and transportation networks is fueling demand for strong and durable bonding systems. Non-residential projects often require high-strength, chemical-resistant agents suitable for heavy-load conditions. Government infrastructure investments and private-sector construction in Asia-Pacific and the Middle East continue to drive usage. Additionally, rising adoption of polymer-modified bonding agents in commercial flooring and structural rehabilitation projects further strengthens the segment’s leadership in the global market.

Key Growth Drivers

Rising Infrastructure Renovation and Repair Activities

Increasing global investment in infrastructure repair and renovation is a major driver for the concrete bonding agents market. Aging bridges, highways, and industrial structures require effective bonding materials to extend service life and prevent costly replacements. Governments across North America, Europe, and Asia-Pacific are prioritizing maintenance over new construction to enhance sustainability. Epoxy- and polymer-based bonding agents offer excellent adhesion and load-bearing capacity, making them essential in restoring deteriorated concrete structures and improving long-term structural performance.

- For instance, the Master Builders Solutions brand MasterBrace ADH 2200 is an epoxy bonding and repair mortar with a tensile strength of 10 MPa and compressive strength of 65 MPa. This product is suitable for various applications, including repairing defects in concrete in infrastructure projects.

Rapid Urbanization and Construction Expansion

Growing urbanization and population growth are fueling large-scale residential and commercial construction projects worldwide. Emerging economies, especially in Asia-Pacific, are witnessing a surge in infrastructure development, including roads, railways, and high-rise buildings. Concrete bonding agents are increasingly used in these projects for surface preparation, structural repair, and finishing applications. Their ability to improve cohesion, prevent cracking, and ensure long-lasting adhesion between old and new concrete is driving widespread adoption in both new construction and retrofitting projects.

- For instance, Saint-Gobain Weber, an industrial mortar specialist part of the Saint-Gobain Group, manufactures products used for construction projects, including epoxy adhesives for bonding tiles and stones. They have a presence in India with manufacturing plants and offer various construction chemicals for different applications, such as waterproofing and bonding.

Increasing Adoption of Polymer-Modified Bonding Solutions

Technological advancements are promoting the use of polymer-modified bonding agents due to their superior flexibility, water resistance, and durability. Acrylic and latex-based formulations provide enhanced bonding performance in variable climatic conditions, making them ideal for both indoor and outdoor use. These products are gaining popularity in decorative flooring, waterproofing, and surface repair applications. The growing preference for high-performance, low-VOC, and easy-to-apply bonding materials is creating significant opportunities for innovation and market expansion among leading manufacturers.

Key Trends & Opportunities

Shift Toward Sustainable and Low-VOC Materials

A major trend shaping the market is the increasing focus on environmentally friendly bonding agents. Manufacturers are developing water-based and low-VOC formulations to comply with stringent environmental standards and green building certifications. These sustainable alternatives reduce emissions and improve worker safety without compromising performance. The trend aligns with global sustainability goals, prompting construction firms to replace solvent-based products with eco-friendly bonding solutions. This shift is expected to drive strong market opportunities, especially in Europe and North America, where environmental regulations are most stringent.

- For instance, The Dow Chemical Company introduced its MAINCOTE™ AEH acrylic epoxy hybrid, which can be formulated into ultra-low VOC waterborne concrete coatings designed for high adhesion and tire pickup resistance.

Technological Innovation in Adhesion and Durability Enhancement

Ongoing R&D efforts are leading to innovations that enhance the performance of concrete bonding agents. Advances in nanotechnology, hybrid polymers, and reactive resins are improving adhesion strength, crack resistance, and chemical stability. Digital mixing and automated application systems are further optimizing precision and reducing waste during use. These technological improvements are expanding applications beyond traditional construction into specialized fields such as industrial flooring and infrastructure rehabilitation, opening new avenues for manufacturers to differentiate their products.

- For instance, GCP Applied Technologies Inc. launched its ADVA Cast 575 polycarboxylate-based high-range water reducer, which is used to produce high-performance concrete with high early strength suitable for demanding structural applications.

Key Challenges

High Material and Installation Costs

The relatively high cost of epoxy and advanced polymer bonding agents poses a challenge, especially for small-scale projects and cost-sensitive markets. Installation often requires skilled labor and specific surface preparation techniques, which add to overall expenses. While the superior performance of these agents justifies the price in large infrastructure applications, cost-conscious contractors may opt for cheaper alternatives. Manufacturers are focusing on optimizing raw material use and developing cost-effective formulations to increase affordability and expand market accessibility.

Limited Awareness in Emerging Economies

In developing countries, limited awareness of the long-term benefits of concrete bonding agents restricts their adoption. Many contractors still rely on traditional repair methods that lack the durability and adhesion provided by modern bonding solutions. Insufficient training, lack of technical support, and minimal promotional activities from suppliers exacerbate this issue. Expanding educational initiatives, on-site demonstrations, and partnerships with local construction firms are essential to increase awareness and accelerate market penetration across these regions.

Regional Analysis

North America

North America held a 27% market share in 2024, driven by increasing renovation projects and the modernization of aging infrastructure across the United States and Canada. The region’s strict building codes and strong demand for durable, high-performance materials support the adoption of epoxy- and latex-based bonding agents. Rapid growth in industrial and commercial construction further boosts consumption. Major manufacturers focus on product innovation and sustainability, developing low-VOC and water-based solutions. Ongoing infrastructure investment programs, such as the U.S. Infrastructure Investment and Jobs Act, continue to fuel market expansion in this region.

Europe

Europe accounted for a 25% share of the concrete bonding agents market in 2024, supported by rising investments in green building and infrastructure rehabilitation projects. Countries such as Germany, France, and the U.K. are leading adopters of polymer-modified bonding agents due to their superior adhesion and environmental compatibility. Strict EU emission regulations are accelerating the shift toward low-VOC and waterborne formulations. Additionally, the increasing focus on restoring historical and public structures contributes to steady product demand. Collaboration among construction firms and chemical producers continues to enhance the region’s market strength.

Asia-Pacific

Asia-Pacific dominated the market with a 36% share in 2024, driven by rapid urbanization, industrial expansion, and government infrastructure initiatives in China, India, and Southeast Asia. Massive investments in transportation, housing, and industrial construction projects are fueling the use of epoxy- and cementitious bonding agents. The region benefits from a growing focus on cost-effective and durable repair solutions for large-scale developments. Rising awareness of advanced bonding technologies and the expansion of domestic manufacturing capacities are further strengthening the market. The push toward sustainable, polymer-modified products continues to shape the region’s growth trajectory.

Middle East & Africa

The Middle East & Africa captured a 7% share of the global market in 2024, supported by the ongoing construction boom in Saudi Arabia, the UAE, and South Africa. The region’s growing emphasis on high-durability materials for infrastructure and commercial projects is increasing the use of concrete bonding agents. Hot climatic conditions are driving the preference for heat- and moisture-resistant formulations. Investments under national development plans, such as Saudi Vision 2030, are supporting market expansion. Rising demand for renovation and modernization of older structures further strengthens the regional market outlook.

South America

South America held a 5% share of the concrete bonding agents market in 2024, led by increasing construction and infrastructure renovation projects in Brazil, Argentina, and Chile. The region’s expanding commercial and residential sectors are fueling demand for polymer-modified and epoxy-based bonding agents. Government efforts to improve transportation and public facilities also contribute to market growth. Economic recovery and greater awareness of concrete surface restoration benefits are enhancing adoption rates. Partnerships between global suppliers and local distributors are improving product availability and affordability, supporting steady regional market development.

Market Segmentations:

By Product

- Cementitious Latex-based

- Epoxy-based

By Application

- Repairing

- Flooring

- Decorative

- Others

By End-use

- Residential

- Non-Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the concrete bonding agents market features major players such as Sika AG, ChemCo Systems Inc., Mapei S.P.A., Fosroc Inc., BASF SE, Flowcrete Group Ltd., LafargeHolcim, Saint-Gobain Weber S.A., GCP Applied Technologies Inc., and The Dow Chemical Company. These companies focus on developing high-performance, polymer-modified bonding agents that enhance adhesion, durability, and water resistance. Strategic initiatives such as product innovation, mergers, and partnerships with construction firms are strengthening their global presence. Leading manufacturers are investing in eco-friendly and low-VOC formulations to meet green building regulations. Continuous R&D efforts are advancing epoxy and latex-based technologies for better compatibility and faster curing times. The growing emphasis on infrastructure repair and sustainable construction is intensifying competition, prompting players to expand production capacities and adopt advanced material technologies to meet rising global demand across residential, commercial, and industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Sika AG made a strategic investment in Giatec™ Scientific Inc., a provider of smart concrete sensors and analytics (for temperature, strength, etc.), to advance digital concrete control and durability monitoring.

- In February 2025, Saint-Gobain completed its acquisition of Fosroc, integrating Fosroc’s construction chemicals (including bonding agents) into its portfolio.

- In July 2024, GCP Applied Technologies and CHRYSO introduced the EnviroMix® Impact app for sustainable construction chemical design and specification support.

- In April 2024, Sika AG acquired Kwik Bond Polymers, a U.S. polymer systems specialist in concrete applications, to strengthen its bonding & polymer portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as infrastructure repair and renovation projects increase worldwide.

- Demand for epoxy-based bonding agents will remain strong due to their superior strength and durability.

- Asia-Pacific will continue to dominate driven by large-scale urban and industrial development.

- North America and Europe will see growth supported by sustainability regulations and advanced construction standards.

- Manufacturers will focus on low-VOC, eco-friendly, and water-based formulations to meet green building requirements.

- Technological innovation will improve adhesion performance and reduce application time.

- Strategic collaborations between chemical producers and construction firms will expand market presence.

- Rising investments in smart city and transportation projects will boost product demand.

- Residential renovation and flooring applications will drive consistent consumption globally.

- Long-term growth will rely on advanced polymer technologies and sustainable construction materials.