Market Overview:

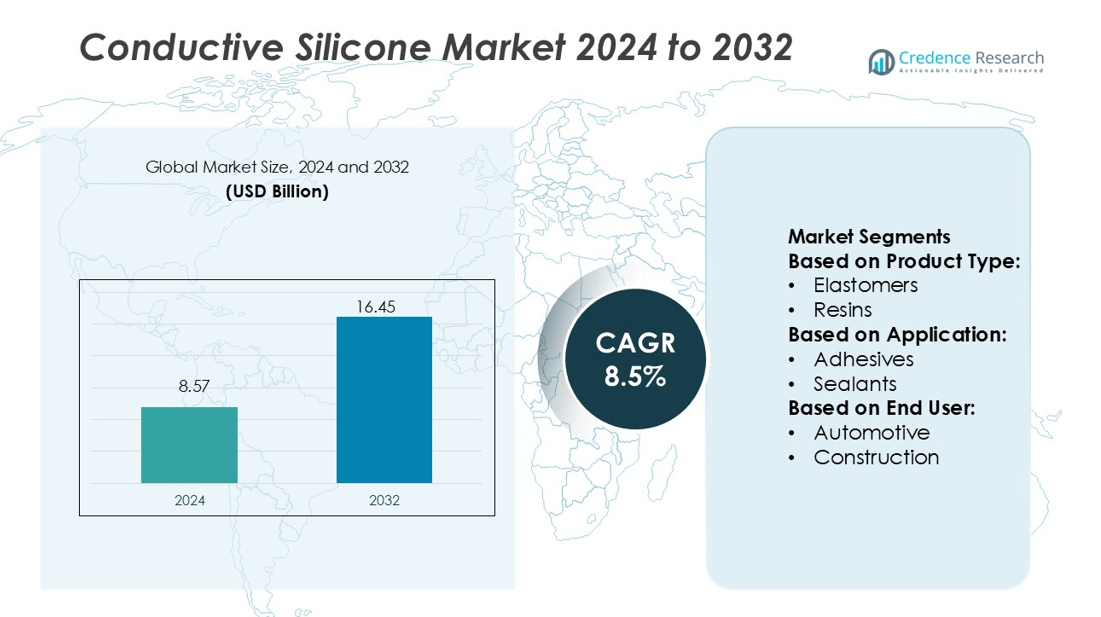

Conductive Silicone Market size was valued USD 8.57 billion in 2024 and is anticipated to reach USD 16.45 billion by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conductive Silicone Market Size 2024 |

USD 8.57 billion |

| Conductive Silicone Market, CAGR |

8.5% |

| Conductive Silicone Market Size 2032 |

USD 16.45 billion |

The Conductive Silicone Market is led by major companies such as KCC Corporation, Globe Specialty Metals Inc., Evonik Industries AG, Nusil Technologies LLC, Shin-Etsu Chemical Company Ltd, Wacker Chemie AG, Elkem AS, Dow Chemical Company, ACC Silicones, and Becancour Silicon Inc. These firms focus on developing high-performance silicone materials for applications in electronics, automotive, and renewable energy sectors. Continuous investment in R&D, product innovation, and sustainable manufacturing strengthens their global reach. Strategic alliances and facility expansions remain central to maintaining leadership positions. Asia Pacific dominates the market with a 52% share in 2024, supported by large-scale production, rapid industrialization, and the growing demand for advanced electronic components across China, Japan, and South Korea.

Market Insights

- Conductive Silicone Market size was valued at USD 8.57 billion in 2024 and is projected to reach USD 16.45 billion by 2032, registering a CAGR of 8.5% during the forecast period.

- Rising demand from the automotive and electronics sectors drives market expansion, supported by increasing use in EV components and thermal interface materials.

- Growing adoption of sustainable and high-performance silicones shapes market trends, with manufacturers focusing on eco-friendly formulations and advanced conductivity properties.

- The market shows strong rivalry among major players emphasizing product differentiation, innovation, and global manufacturing capacity to sustain leadership.

- Asia Pacific holds a 52% share in 2024, leading the global market due to rapid industrialization and high consumption in China, Japan, and South Korea, while North America and Europe collectively account for over one-third of total demand through technology-driven applications and regulatory support for advanced materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Within the conductive silicone market, the elastomers segment dominates, accounting for approximately 51% of total share in 2024. These elastomeric conductive silicones are favored for their combined flexibility, insulation, and electrical conduction. For instance, a leading producer formulates elastomers with volume resistivity of ~10⁻³ Ω·cm while sustaining elongation above 300% and Shore A hardness around 60. Growth of this segment is mainly driven by demand in automotive ignition wiring and electronics EMI shielding, where elastomers replace rigid components due to their vibration resilience and insulative performance.

- For instance, KCC Silicone offers a range of general-purpose extruding silicone rubber products with various Shore A hardness levels, specifically listing 30, 40, 50, 60, 70, and 80.

By Application

In terms of application, adhesives and sealants lead with about 45% of the market share in 2024. These formulations enable both bonding and conductivity, serving in EV battery modules and solar panel assemblies. For example, a manufacturer recently introduced a sealant with glass transition temperature of −60 °C to +150 °C and electrical resistivity less than 1 × 10⁻² Ω·cm after cure. Growth in this application is propelled by expansion in electronics assembly, thermal management in power systems, and rugged deployment in renewable energy.

- For instance, Evonik’s AEROSIL® R 104 and AEROSIL® R 106 reinforcing silicas for silicone rubber achieve tensile strengths of 8.6 N/mm² and 9.3 N/mm² respectively in HTV silicone rubber vulcanizates, with elongations at break of 420 % and 480 %.

By End‑User

The electrical & electronics end‑user sector accounts for around 62% of the global conductive silicone market in 2024. Many conductive silicone products within this sector offer dielectric strength exceeding 20 kV/mm and thermal conductivity above 1.0 W/m·K to meet miniaturization and high‑power demands. For instance, one provider offers a gasket material with compression set under 10% after 1,000 hours at 125 °C and a conductive pathway with contact resistance below 50 mΩ. Growth here is driven by miniaturised devices, 5G infrastructure, and automotive electronics integration.

Key Growth Drivers

Rising Demand in Electronics and 5G

The growing expansion of 5G technology and consumer electronics is a major driver of the conductive silicone market. These materials are essential for EMI shielding, thermal interface materials, and flexible circuit assemblies in devices like smartphones, wearables, and base stations. Conductive silicone’s ability to maintain stable conductivity and insulation under high frequencies supports the performance of advanced communication systems. The miniaturization of components and demand for lightweight, heat-resistant materials in electronic devices further accelerate its use across semiconductors and telecommunication equipment.

- For instance, Nusil’s “CV‑2946” series silicone shows a thermal conductivity of 1.60 W/m·K, has a lap‑shear strength of 150 psi (1.0 MPa) after cure, and volume resistivity of 5.3 × 10^14 Ω·cm.

Expansion of Electric Vehicles and Power Systems

The rising production of electric vehicles and hybrid systems has created strong demand for conductive silicone in battery modules, sensors, and power converters. Its excellent heat dissipation, vibration resistance, and durability make it suitable for high-voltage environments. Conductive silicones are used in EV battery seals, cable connectors, and charging stations to enhance performance and prevent thermal failures. Governments promoting EV adoption and renewable energy infrastructure are boosting market growth, as manufacturers integrate these materials into efficient, long-life automotive and energy systems.

- For instance, Shin‑Etsu’s “TC‑THE Series” thermal‑pad product offers a density of 2.90 g/cm³, a Shore 00 hardness of 60, dielectric strength of 20.0 kV/mm, and thermal conductivity of 2.50 W/m·K in a 1.0 mm thickness version.

Industrial Growth and Renewable Infrastructure

Rapid industrialization and expansion in renewable energy and power transmission sectors drive the demand for conductive silicone. The material’s resistance to extreme weather, electrical stability, and long service life make it ideal for wind turbines, solar panels, and power grid insulation systems. In developing economies, ongoing infrastructure development and industrial modernization are increasing its use in high-voltage insulation and electronic protection. Additionally, conductive silicone’s ability to maintain performance across harsh environments supports global efforts to enhance sustainability and reduce downtime in industrial and energy systems.

Key Trends & Opportunities

Advancements in Flexible and Smart Electronics

The trend toward miniaturized and flexible electronic devices is fueling innovation in conductive silicone formulations. Manufacturers are developing ultra-thin, stretchable, and highly conductive silicones suited for next-generation wearables, flexible displays, and medical sensors. These advanced compounds enable seamless electrical connectivity and mechanical flexibility. Smart material integration, such as self-healing silicones and embedded nanofillers, allows manufacturers to meet the performance demands of compact, durable, and energy-efficient electronics used in IoT and healthcare applications.

- For instance, “ELASTOSIL® S 692 A/B” electrical conductive RTV‑2 silicone rubber operates at temperatures down to below −100 °C and is admitted for space applications according to ESA ECSS‑Q‑70‑01A.

Adoption of Advanced Fillers and Eco-Friendly Materials

Companies are investing in research to develop eco-friendly conductive silicones using graphene, carbon nanotubes, and silver nanowires as fillers. These enhance conductivity, reduce weight, and improve environmental performance. Manufacturers are also focusing on low-VOC and recyclable silicone formulations to meet global sustainability standards. Such developments align with stricter environmental regulations and the growing preference for green materials across industrial and consumer applications, offering new growth opportunities in high-performance and sustainable markets.

- For instance, SILBIONE™ LSR Select EC 70 offers an electrical resistivity below 10 Ω·cm, enabling conductive elastomeric applications in medical wearables.

Rising Integration in Energy Storage and Smart Grids

The shift toward renewable power systems and smart grid infrastructure is increasing the application of conductive silicone in energy storage, solar inverters, and smart meters. These materials ensure efficient current flow and thermal stability under fluctuating loads. Their compatibility with silicon-based energy components also makes them valuable for next-generation energy storage devices. This trend supports the broader transition toward clean and digitally managed energy ecosystems across developed and emerging markets.

Key Challenges

High Manufacturing and Raw Material Costs

Conductive silicone production involves costly raw materials such as carbon black, silver, and advanced polymer additives. The processes for achieving high conductivity and mechanical strength require precise temperature control and specialized curing systems, raising production costs. Small and medium manufacturers often face challenges in scaling due to these capital-intensive requirements. Moreover, price volatility of key fillers and silicone base materials can affect profitability, especially in cost-sensitive applications like consumer electronics and construction.

Competition from Alternative Materials

The market faces competition from alternative conductive materials such as metal-filled epoxies, thermoplastics, and conductive polymers. These substitutes offer lower costs and simpler processing in certain applications. While conductive silicone provides superior flexibility and temperature resistance, alternative materials are gaining ground in low-temperature or disposable product categories. To stay competitive, silicone manufacturers must focus on performance differentiation, cost optimization, and the development of hybrid materials combining silicone resilience with polymer affordability.

Regional Analysis

North America

North America accounts for 22% of the global conductive silicone market in 2024. The region benefits from strong demand in electric vehicles, aerospace, and high-end electronics. The U.S. leads due to its robust R&D ecosystem and the presence of key material suppliers. Expanding semiconductor manufacturing and stricter environmental standards are driving the adoption of conductive silicone in advanced insulation and EMI shielding applications. Canada’s clean energy projects and Mexico’s industrial growth further strengthen regional demand, positioning North America as a steady-growth market throughout the forecast period.

Asia Pacific

Asia Pacific dominates the conductive silicone market with a 52% share in 2024. Rapid industrialization, electric vehicle adoption, and the expansion of consumer electronics manufacturing across China, Japan, India, and South Korea fuel demand. China remains the largest contributor due to high production capacity and domestic demand for conductive materials. Japan’s advanced technology sector and India’s infrastructure development further support growth. The region benefits from cost-effective manufacturing and large-scale exports, securing Asia Pacific’s position as both the leading and fastest-growing regional market.

Europe

Europe holds nearly 18% of the conductive silicone market in 2024. Growth is supported by the expansion of electric mobility, renewable energy integration, and stricter energy efficiency standards. Germany, France, and the U.K. drive demand through advanced automotive and electronics industries. Ongoing 5G network deployment and environmental sustainability initiatives encourage the use of high-performance silicones. The European Union’s emphasis on green manufacturing practices and circular economy goals continue to foster innovation, making Europe one of the most progressive markets for conductive silicone applications.

Latin America

Latin America represents approximately 5% of the global conductive silicone market in 2024. Brazil dominates regional demand due to expanding automotive production and consumer electronics manufacturing. Argentina and Mexico are emerging contributors, supported by increased infrastructure investment and industrial modernization. The region’s growth is moderate but consistent, driven by gradual adoption in renewable energy and construction applications. However, limited domestic production capacity and dependency on imports restrain market penetration, offering opportunities for global players to strengthen their presence in Latin America.

Middle East & Africa

The Middle East & Africa region accounts for around 3% of the global conductive silicone market in 2024. Market growth is driven by rising investments in renewable energy, infrastructure modernization, and industrial automation. The UAE and Saudi Arabia are the key markets, supported by national strategies for technological diversification. South Africa contributes through its growing electronics and automotive assembly industries. Despite a smaller market size, ongoing government-led industrial initiatives are expected to enhance demand for conductive silicone products across the region.

Market Segmentations:

By Product Type:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The conductive silicone market features key players such as KCC Corporation, Globe Specialty Metals Inc., Evonik Industries AG, Nusil Technologies LLC, Shin-Etsu Chemical Company Ltd, Wacker Chemie AG, Elkem AS, Dow Chemical Company, ACC Silicones, and Becancour Silicon Inc. The conductive silicone market demonstrates strong competition driven by rapid innovation, product differentiation, and capacity expansion. Companies focus on developing high-performance materials for applications in electronics, automotive, and renewable energy sectors. Strategic priorities include enhancing conductivity, heat resistance, and flexibility to meet the evolving needs of advanced manufacturing. Market participants invest heavily in R&D to create sustainable and cost-efficient silicone formulations. Partnerships with end-use industries and regional distributors strengthen global supply chains and improve market reach. Additionally, rising demand for lightweight and durable materials in electric vehicles and consumer electronics continues to shape growth strategies and intensify market rivalry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KCC Corporation

- Globe Specialty Metals Inc.

- Evonik Industries AG

- Nusil Technologies LLC

- Shin-Etsu Chemical Company Ltd

- Wacker Chemie AG

- Elkem AS

- Dow Chemical Company

- ACC Silicones

- Becancour Silicon Inc.

Recent Developments

- In May 2024, KCC Corporation completed the acquisition of Momentive Performance Materials, effectively becoming the sole owner and causing the exit of minority shareholder SJL Partners LLC; KCC pledged to support Momentive’s growth by leveraging its resources in technology, people, and innovation.

- In May 2024, Shin-Etsu Chemical decided to establish a new company, Shin-Etsu Silicone (Pinghu) Co. Ltd, in Zhejiang Province, China, and construct a new silicone products plant to expand its silicone business.

- In August 2023, DuPont acquired Spectrum Plastics Group. This acquisition will strengthen DuPont’s position in the production of medical devices and packaging, biopharma, and pharma processing, including DuPont’s Liveo silicone solutions

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for conductive silicone will rise due to expanding electric vehicle production worldwide.

- Advancements in 5G infrastructure will boost the use of conductive silicone in electronics.

- The growing renewable energy sector will drive adoption in solar and wind power applications.

- Miniaturization of electronic devices will increase the need for high-performance silicone compounds.

- Manufacturers will focus on bio-based and recyclable silicone materials to meet sustainability goals.

- Integration of conductive silicone in wearable devices will enhance product flexibility and durability.

- Increased investment in semiconductor manufacturing will create long-term growth opportunities.

- Collaboration between chemical companies and OEMs will strengthen innovation pipelines.

- Asia Pacific will remain the primary growth hub due to industrial expansion and low-cost production.

- Automation and smart manufacturing will accelerate the development of advanced conductive silicone formulations.