Market Overview

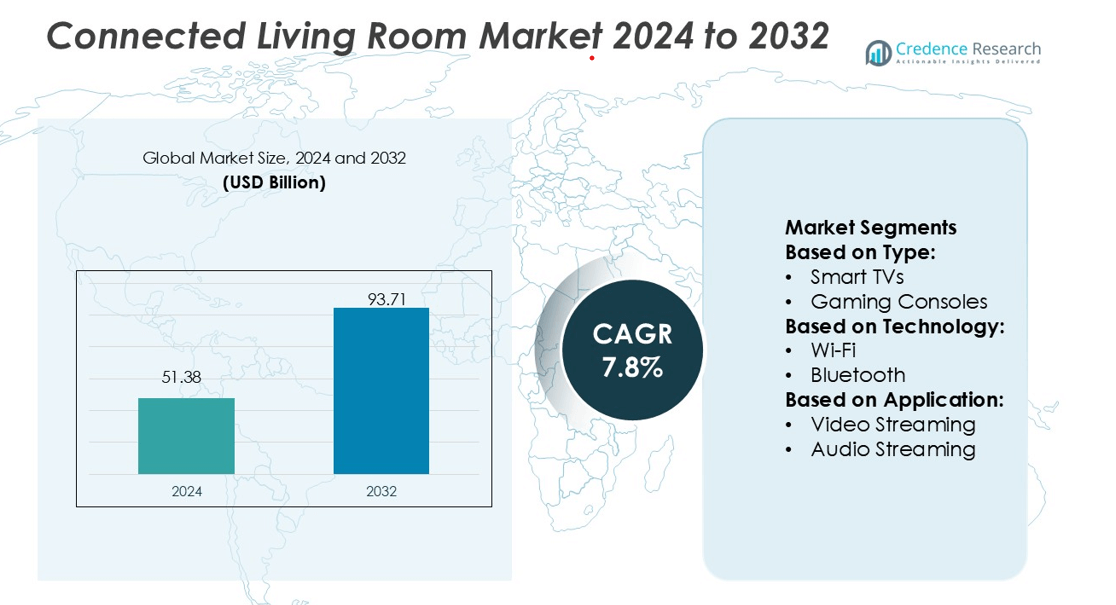

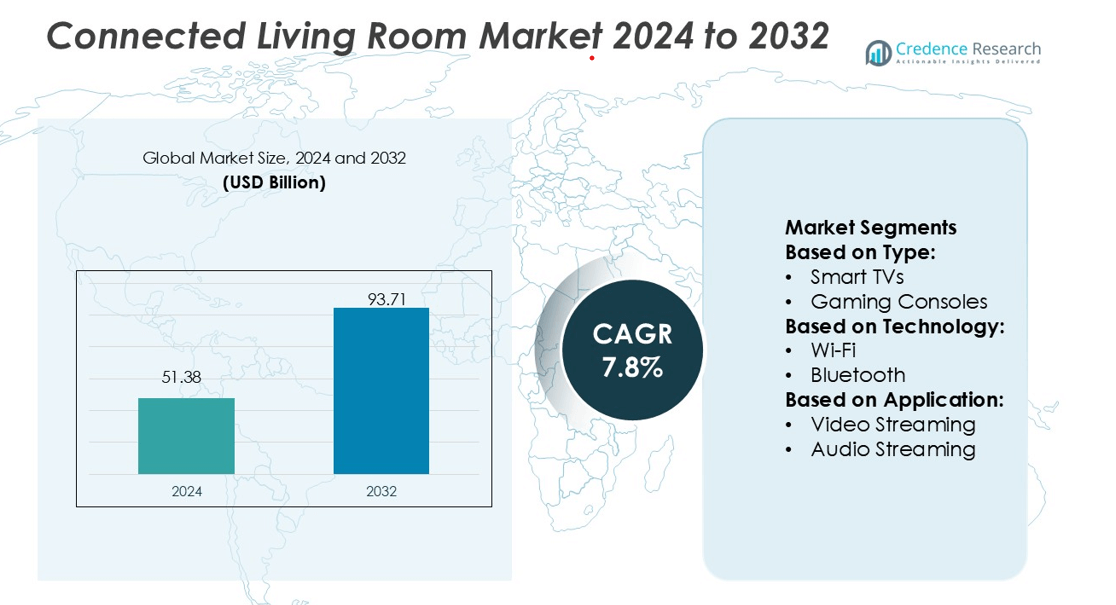

Connected Living Room Market size was valued USD 51.38 billion in 2024 and is anticipated to reach USD 93.71 billion by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Living Room Market Size 2024 |

USD 51.38 billion |

| Connected Living Room Market, CAGR |

7.8% |

| Connected Living Room Market Size 2032 |

USD 93.71 billion |

The Connected Living Room Market is driven by leading players including Honeywell International, Dexcom, AliveCor, Abbott Laboratories, CareCloud, Garmin, GE Healthcare, Fitbit (Google), Koninklijke Philips, and Allscripts. These companies focus on developing integrated ecosystems that connect entertainment, automation, and health monitoring through IoT and AI technologies. Their strategies emphasize interoperability, personalized experiences, and data-driven connectivity. North America leads the global market with a 37% share in 2024, supported by strong broadband infrastructure, early technology adoption, and high consumer spending on smart home and entertainment systems. Continuous innovation and strategic collaborations strengthen regional dominance.

Market Insights

- The Connected Living Room Market was valued at USD 51.38 billion in 2024 and is projected to reach USD 93.71 billion by 2032, growing at a CAGR of 7.8%.

- Growing demand for integrated smart entertainment, automation, and health monitoring systems is driving market expansion across residential and commercial applications.

- Advancements in IoT, AI, and 5G connectivity are transforming device interoperability and enabling seamless voice-controlled experiences within connected ecosystems.

- High product costs and interoperability challenges among brands remain key restraints, limiting large-scale adoption in developing regions.

- North America leads with a 37% share, followed by Europe at 28%, while the smart TV segment holds the largest share within product types due to rising adoption of streaming and cloud-based entertainment platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Smart TVs dominate the Connected Living Room Market, holding over 35% market share in 2024. The segment benefits from growing demand for high-resolution displays, integrated voice assistants, and smart home connectivity. Advancements in OLED, QLED, and AI-based picture enhancement further strengthen adoption. Smart speakers and smartphones also contribute significantly, driven by multi-device synchronization and smart home integration. Increasing affordability and streaming content availability continue to push consumer preference toward connected devices that offer seamless entertainment and home automation experiences.

- For instance, Dexcom introduced the Dexcom G7 CGM system, whose sensor is 60 % smaller in physical footprint compared to its G6 predecessor. The G7 sensor warms up in 30 minutes, compared to ~2 hours in prior models.

By Technology

Wi-Fi technology leads the Connected Living Room Market with over 60% market share. Its dominance stems from widespread home network adoption and compatibility with a wide range of smart devices. The rollout of Wi-Fi 6 and Wi-Fi 7 standards enhances speed, capacity, and connectivity stability, supporting 4K and 8K streaming. Bluetooth technology holds a growing share due to its use in wireless speakers and gaming controllers. Advancements in low-energy Bluetooth and multi-device pairing improve performance, while emerging protocols in the “Others” segment address niche IoT use cases.

- For instance, AliveCor’s Kardia 12L ECG System, cleared in June 2024, uses a reduced leadset (versus full conventional systems) to detect 35 cardiac determinations (14 arrhythmias and 21 morphological indicators).

By Application

Video streaming represents the leading application segment, accounting for over 40% market share in 2024. The dominance reflects increasing subscriptions to OTT platforms and demand for 4K and HDR content. Smart TVs and connected media devices drive higher viewing engagement. Audio streaming follows closely, powered by smart speakers and integration with music platforms like Spotify and Apple Music. Gaming is rapidly expanding due to cloud-based play, while security applications gain traction through device interconnectivity and real-time monitoring features within smart home ecosystems.

Key Growth Drivers

Rising Demand for Smart Entertainment Devices

The increasing adoption of smart TVs, gaming consoles, and streaming devices is driving growth in the Connected Living Room Market. Consumers prefer integrated ecosystems that offer seamless access to content and personalized experiences. The availability of affordable 4K and 8K displays, coupled with embedded AI and voice control, enhances user engagement. Companies like Samsung, LG, and Sony are launching advanced models with intuitive interfaces and multi-device connectivity, strengthening the market’s shift toward unified entertainment and smart home integration.

- For instance, CareCloud’s AI Center of Excellence is now fully operational and is scaling toward 500 full-time team members.It deploys cirrusAI modules such as ambient listening, smart summarization, and call auditing—CareCloud claims 100 % call audit coverage using AI in its internal systems.

Expansion of High-Speed Internet and 5G Networks

The widespread deployment of high-speed broadband and 5G networks fuels device interconnectivity and data-rich entertainment experiences. Fast and stable connections support ultra-high-definition video streaming, low-latency gaming, and real-time device synchronization. Network operators are expanding 5G infrastructure across key regions, enabling faster adoption of connected devices. This technological advancement enhances cloud-based content access and device control, allowing users to manage smart homes efficiently and boosting the global demand for connected living room ecosystems.

- For instance, Garmin’s Connect Plus launched an Active Intelligence feature that generates personalized insights from health and activity data.The company also integrated satellite connectivity into its fēnix 8 Pro watch via a collaboration with Skylo, enabling SOS texting and GPS sharing directly from wrist without a phone.

Integration of AI and IoT in Home Automation

Artificial intelligence (AI) and the Internet of Things (IoT) are transforming the connected home experience by enabling automation and personalization. Smart devices now interact seamlessly through centralized platforms, learning user preferences to optimize lighting, sound, and temperature settings. Voice assistants like Alexa and Google Assistant enhance user convenience through hands-free control. The growing focus on energy efficiency and adaptive technology integration strengthens the role of AI and IoT as key enablers of connected living room innovation.

Key Trends & Opportunities

Growing Shift Toward Cloud-Based Entertainment

The transition to cloud streaming and gaming platforms is reshaping digital entertainment. Services like Netflix, Amazon Prime, and Xbox Cloud Gaming reduce the need for local storage while improving accessibility across devices. Consumers favor subscription-based models offering diverse content and real-time updates. This trend creates new revenue opportunities for content providers and device manufacturers that integrate cloud-based interfaces, ensuring faster, smoother, and more interactive living room experiences.

- For instance, Philips’ SmartSpeed Precise MRI enables scan times up to 3× faster while retaining image quality. Their Ingenia Ambition MR with BlueSeal magnet consumes only 7 liters of helium over lifetime, compared to ~1,500 liters in conventional designs.

Rising Focus on Energy-Efficient Smart Devices

Sustainability is emerging as a core focus, leading to innovations in energy-efficient connected devices. Manufacturers are developing products with low power consumption and eco-friendly materials to meet global environmental standards. Energy Star-certified smart TVs, automatic power-saving features, and recyclable packaging are becoming common. The growing consumer awareness of green technologies presents a significant opportunity for brands aligning with ESG goals and sustainable smart living solutions.

- For instance, Veradigm, the company claims its network now links 300,000 U.S. healthcare providers and supports data for 170 million patients via the Veradigm platform.

Key Challenges

Data Privacy and Security Concerns

The growing connectivity between devices increases exposure to cyber threats and unauthorized access. Smart TVs, speakers, and cameras can be vulnerable to data breaches if not properly secured. Manufacturers must ensure strong encryption, regular firmware updates, and compliance with data protection laws. Rising consumer awareness regarding digital privacy is pressuring brands to enhance security frameworks. Addressing these issues is critical to maintaining user trust and ensuring long-term adoption of connected living technologies.

Interoperability and Compatibility Issues

The lack of universal standards among device ecosystems poses a major challenge in the Connected Living Room Market. Products from different brands often fail to integrate seamlessly, limiting user experience and system efficiency. Consumers prefer unified platforms that allow centralized control across devices. Industry players are working toward open-source frameworks and cross-brand collaborations to resolve compatibility gaps. Achieving full interoperability remains essential for expanding the connected living ecosystem and improving overall customer satisfaction.

Regional Analysis

North America

North America dominates the Connected Living Room Market with a 37% market share in 2024. The region benefits from strong broadband infrastructure, high consumer spending, and rapid adoption of smart home ecosystems. Major technology firms like Google, Amazon, and Apple continue expanding product portfolios with AI-integrated and voice-controlled devices. The growing popularity of streaming platforms and 4K smart TVs further drives adoption. The U.S. leads regional demand, supported by advanced network connectivity and evolving consumer preferences toward multi-device entertainment and automation solutions. Canada follows, driven by expanding IoT integration and increasing smart device penetration.

Europe

Europe holds a 28% market share in the Connected Living Room Market, supported by growing consumer awareness of home automation and sustainability. Countries such as Germany, the UK, and France lead adoption due to strong digital infrastructure and smart home investments. The European Union’s focus on energy-efficient electronics encourages the production of eco-friendly connected devices. Rising demand for streaming services and voice-activated assistants supports market growth. Leading brands like Philips and Bosch are focusing on interoperability and privacy compliance, aligning their products with the region’s stringent data protection and environmental standards.

Asia-Pacific

Asia-Pacific accounts for 25% market share and represents the fastest-growing region in the Connected Living Room Market. Expanding urbanization, rising disposable income, and affordable smart device availability fuel regional growth. China, Japan, and South Korea dominate due to strong electronics manufacturing bases and high digital adoption rates. The rollout of 5G networks and integration of local streaming platforms enhance entertainment connectivity. Companies such as Samsung, Xiaomi, and Sony continue to expand their connected product lines, driving technological innovation and affordability. Rapid smart home penetration across India and Southeast Asia further strengthens market expansion.

Latin America

Latin America captures a 6% market share in the Connected Living Room Market, driven by growing digital infrastructure and increasing smartphone adoption. Brazil and Mexico lead regional growth with expanding internet penetration and rising interest in streaming services. Consumers are gradually adopting smart TVs and voice-enabled devices as affordability improves. Global brands are entering the region through strategic partnerships with telecom operators to enhance accessibility. Although adoption is slower compared to developed regions, government initiatives promoting digital inclusion and smart connectivity are expected to boost long-term market development.

Middle East & Africa

The Middle East & Africa hold a 4% market share in the Connected Living Room Market. The region’s growth is supported by urbanization, expanding broadband networks, and growing demand for smart devices among high-income households. The UAE and Saudi Arabia lead adoption with smart city initiatives integrating IoT and AI technologies into home automation. Local consumers increasingly prefer multi-functional entertainment systems and voice-enabled devices. Infrastructure limitations in parts of Africa currently restrict widespread adoption, but improving internet connectivity and rising awareness of digital lifestyles are expected to accelerate future growth.

Market Segmentations:

By Type:

- Smart TVs

- Gaming Consoles

By Technology:

By Application:

- Video Streaming

- Audio Streaming

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Connected Living Room Market features key players such as Honeywell International, Dexcom, AliveCor, Abbott Laboratories, CareCloud, Garmin, GE Healthcare, Fitbit (Google), Koninklijke Philips, and Allscripts. The Connected Living Room Market is highly competitive, driven by rapid innovation and convergence of smart technologies. Companies are focusing on developing integrated ecosystems that combine entertainment, automation, and health monitoring within a unified platform. Advancements in IoT, AI, and voice control enable seamless connectivity between devices such as smart TVs, speakers, and home assistants. Manufacturers are prioritizing user experience through intuitive interfaces, cloud synchronization, and energy-efficient designs. Strategic collaborations with streaming service providers and smart home platforms strengthen market positioning. Continuous product differentiation and investment in sustainable technology are key to maintaining competitiveness in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, ASSA ABLOY announced the acquisition of Uhlmann & Zacher GmbH, a Germany-based supplier of access-control knobs and handles and their complementary software. The acquisition aims to strengthen ASSA ABLOY’s market positioning and product offerings in Germany.

- In January 2025, Signify has unveiled new AI-powered innovations for Philips Hue, including a generative AI assistant that creates personalized lighting scenes, and enhanced home security features such as smoke alarm sound detection and improved voice and app controls.

- In December 2024, Glance and Airtel Digital TV have launched Glance TV, transforming idle TV screens into AI-powered smart surfaces that display live, personalized content. The platform delivers real-time updates across news, sports, entertainment, and weather when TVs are not in active use.

- In November 2024, Samsung announced the collaboration of its SmartThings platform with YouTube Music, allowing the former to effectively customize the Music Sync experience as per users’ requirements. This partnership aims to provide options to users of YouTube Music Premium to synchronize the light of Philips Hue bulbs while listening to songs

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of AI-driven automation for personalized user experiences.

- Integration between smart entertainment and health monitoring devices will become more common.

- Voice assistants will evolve into central control hubs for all connected living room devices.

- Demand for interoperable and cross-brand compatible systems will continue to rise.

- Energy-efficient and eco-friendly smart devices will gain higher consumer preference.

- Growth in 5G networks will enhance connectivity speed and enable smoother streaming experiences.

- Cloud-based gaming and entertainment services will drive next-generation home experiences.

- Manufacturers will focus on improved cybersecurity and data privacy measures.

- Regional expansion in emerging economies will open new growth opportunities.

- Collaboration between device makers and content providers will strengthen integrated home ecosystems.