Market Overview

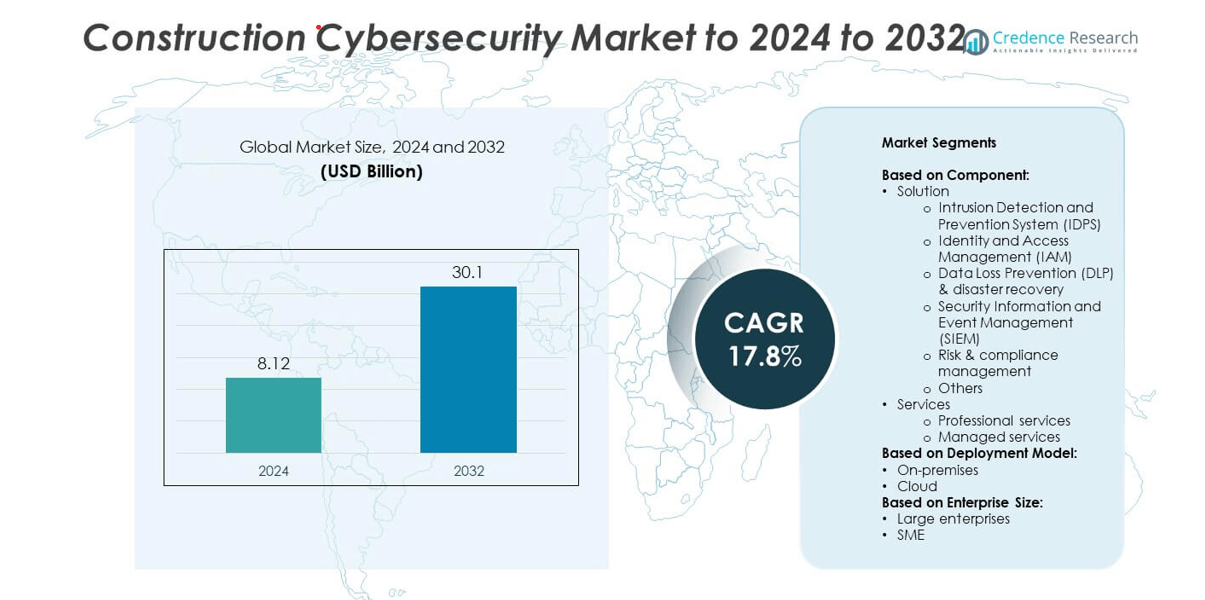

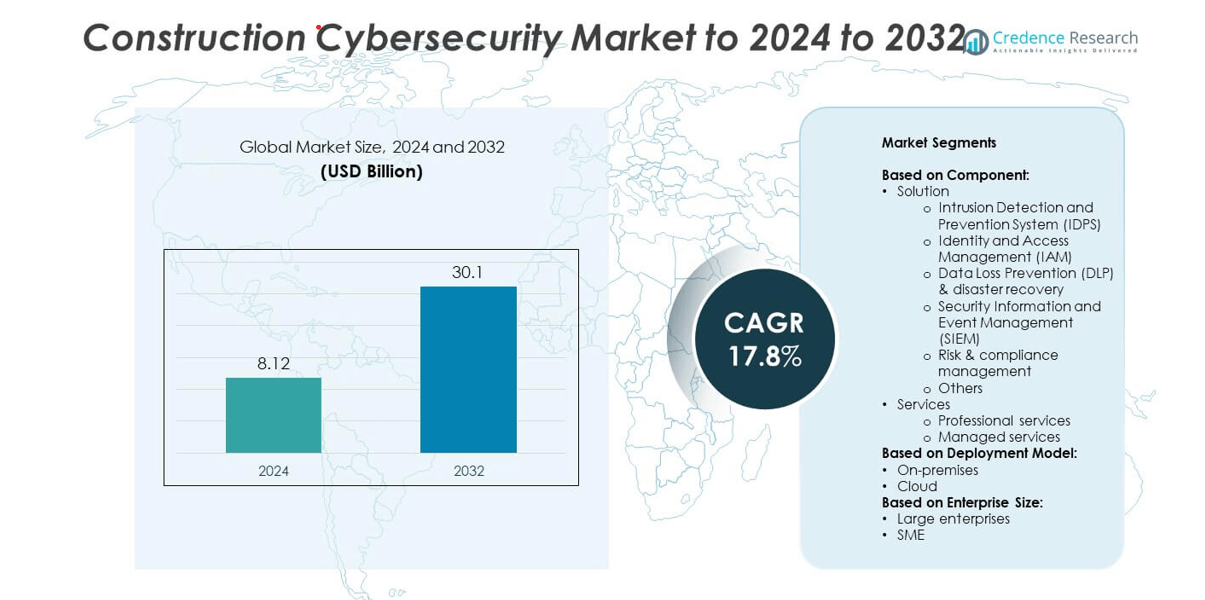

The Construction Cybersecurity Market size was valued at USD 8.12 Billion in 2024 and is anticipated to reach USD 30.1 Billion by 2032, growing at a CAGR of 17.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Cybersecurity Market Size 2024 |

USD 8.12 Billion |

| Construction Cybersecurity Market, CAGR |

17.8% |

| Construction Cybersecurity Market Size 2032 |

USD 30.1 Billion |

The construction cybersecurity market is led by major players such as IBM Corporation, Fortinet Inc., Palo Alto Networks, Cisco Systems, Check Point Software Technologies, Trend Micro, and CrowdStrike, which are actively expanding their portfolios with advanced threat detection and cloud-based security platforms. These companies focus on integrating AI, machine learning, and predictive analytics to safeguard construction data, IoT networks, and BIM systems from cyberattacks. North America emerged as the leading region in 2024, holding about 38% of the total market share, supported by strong digital infrastructure, strict cybersecurity regulations, and rapid adoption of smart construction technologies across large infrastructure projects.

Market Insights

- The construction cybersecurity market was valued at USD 8.12 billion in 2024 and is projected to reach USD 30.1 billion by 2032, growing at a CAGR of 17.8%.

- Rising digitalization of construction operations, including BIM and IoT-enabled platforms, is driving demand for identity management, risk monitoring, and intrusion prevention systems.

- AI-driven predictive analytics, cloud-based security deployment, and integration of cybersecurity with digital twins are key emerging trends across the sector.

- The market is highly competitive, with players focusing on managed security services and compliance-based offerings to strengthen their global presence.

- North America held 38% of the market in 2024, followed by Europe at 27% and Asia Pacific at 22%, while the solution segment led with a 69% share due to growing adoption of IAM and SIEM tools in large infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment dominated the construction cybersecurity market in 2024, accounting for around 69% of the total share. Within this, the Identity and Access Management (IAM) sub-segment led due to its critical role in securing project data and controlling access across multiple stakeholders. Construction firms increasingly deploy IAM and SIEM systems to prevent unauthorized network entry and enhance visibility across connected devices and project management software. The rise of IoT-enabled construction sites and growing ransomware threats have made comprehensive cybersecurity frameworks essential for protecting digital blueprints, BIM data, and cloud platforms.

- For instance, PwC upgraded its IAM platform and reduced new user registration time from 4–8 hours to 5 minutes.

By Deployment Model

The cloud-based deployment segment held the largest share of about 61% in 2024, driven by the rising adoption of SaaS and remote project collaboration tools. Cloud solutions allow construction companies to centralize data, monitor cybersecurity incidents in real time, and scale protection across multiple sites. As more firms use BIM and IoT-driven monitoring, cloud deployment supports rapid data recovery and continuous software updates. Construction majors prefer hybrid cloud infrastructure to reduce latency and enhance compliance with ISO/IEC 27001 standards, strengthening overall digital resilience.

- For instance, Navan cut the time it took to scan 10,000 users from 25–30 minutes down to 1–2 minutes by moving to AWS IAM Identity Center.

By Enterprise Size

Large enterprises dominated the construction cybersecurity market in 2024, capturing nearly 68% of the overall share. These organizations operate extensive digital ecosystems with multiple contractors, suppliers, and smart equipment, increasing their exposure to cyber risks. To mitigate threats, they invest in advanced IDPS and risk management solutions to secure operational data and maintain continuity. The increasing number of cyberattacks on large infrastructure and smart city projects has driven demand for robust, scalable security platforms. Meanwhile, SMEs are gradually adopting managed cybersecurity services due to cost efficiency and regulatory pressure.

Key Growth Drivers

Rising Digitalization of Construction Operations

The widespread adoption of Building Information Modeling (BIM), IoT sensors, and cloud-based project tools has increased the need for advanced cybersecurity solutions. Construction firms rely on digital twins and connected equipment for project planning and monitoring, making them vulnerable to ransomware and data breaches. This rapid digital transformation drives demand for identity management and intrusion detection systems. Protecting sensitive design data and operational technology networks has become a key priority, fueling investment in robust, real-time cybersecurity architectures across large infrastructure projects.

- For instance, VINCI runs its smart headquarters, L’archipel, which was designed to accommodate over 3,000 employees and features advanced digital infrastructure, including a “Zero Trust” network architecture with high-speed connectivity to support a large number of connected IT devices, demonstrating large-scale security and segmentation needs

Increasing Cyber Threats in Infrastructure Projects

Large-scale infrastructure projects, including smart cities and industrial complexes, are frequent targets of cyberattacks due to extensive digital connectivity. Attackers often exploit unsecured IoT endpoints and contractor networks to disrupt operations. As a result, governments and private players are prioritizing proactive threat management systems. The demand for Security Information and Event Management (SIEM) and Data Loss Prevention (DLP) solutions is increasing rapidly. This rise in cyber risks acts as a major growth catalyst for cybersecurity investments across global construction ecosystems.

- For instance, Progress Software’s MOVEit breach in 2023 exposed 93.3 million individual records across 2,700 organizations via supply chain compromise.

Regulatory Mandates and Data Protection Compliance

Stringent data protection laws such as GDPR, CCPA, and ISO/IEC 27001 compliance are compelling construction firms to adopt stronger cybersecurity frameworks. Contractors handling critical infrastructure projects must meet these standards to secure contracts and maintain operational continuity. Compliance-focused investment is accelerating the adoption of risk management and data recovery solutions. This shift ensures transparency in data handling and strengthens trust among stakeholders. The enforcement of government cybersecurity policies across construction and infrastructure sectors remains a key growth driver in this market.

Key Trends & Opportunities

Expansion of Cloud-Based Cybersecurity Solutions

The growing use of cloud deployment models across the construction sector presents strong opportunities for cybersecurity vendors. Cloud-based protection allows real-time monitoring of project data, seamless scalability, and efficient remote access management. Firms are adopting hybrid cloud strategies to support data recovery and cost-effective deployment. As multi-site collaboration and connected equipment expand, demand for cloud-native SIEM and IAM solutions will rise. This trend also enables smaller contractors to integrate advanced security frameworks without large infrastructure investments.

- For instance, Colonial Pipeline Company’s ransomware shutdown of 5,500 miles of pipeline triggered an emergency in 17 states plus D.C., accelerating cloud-centric monitoring in OT/critical infrastructure.

Integration of AI and Predictive Threat Intelligence

Artificial intelligence and predictive analytics are emerging as transformative tools in construction cybersecurity. AI-driven systems can analyze behavioral data to detect anomalies and predict potential intrusions before they escalate. Construction companies use these solutions to secure digital assets, project timelines, and communication networks. Predictive threat intelligence also reduces downtime and enhances response speed across connected platforms. As cyberattacks become more sophisticated, AI integration offers a key opportunity to enhance operational security and automate threat management.

- For instance, Exabeam reports UEBA can cut alert fatigue by up to 60% and reduce investigation time by as much as 80% in SOC workflows.

Key Challenges

High Implementation and Maintenance Costs

Deploying advanced cybersecurity frameworks requires significant investment in hardware, software, and skilled professionals. Many construction firms, especially SMEs, struggle with limited cybersecurity budgets, making it difficult to adopt comprehensive solutions. Continuous maintenance, software updates, and compliance audits add to the operational costs. The lack of affordable and scalable cybersecurity packages tailored to construction projects restricts widespread adoption. This cost barrier remains one of the primary challenges slowing down digital security transformation in smaller enterprises.

Limited Cybersecurity Awareness and Skill Shortage

Many construction firms still underestimate the importance of cybersecurity in daily operations. A shortage of skilled cybersecurity professionals further complicates the situation, leading to delayed responses to breaches. The sector’s traditional focus on physical safety often overshadows digital risk preparedness. Without adequate training, employees may unintentionally expose sensitive data through insecure communication or device use. Building workforce awareness and investing in cybersecurity education are essential steps to mitigate these ongoing industry challenges.

Regional Analysis

North America

North America held the largest share of about 38% of the construction cybersecurity market in 2024. The region’s dominance is driven by widespread digital transformation across the U.S. and Canada, where construction firms deploy IoT, BIM, and cloud-based collaboration tools. Increasing cyber incidents targeting large infrastructure projects and government-funded smart city developments are fueling security investments. Strict data privacy laws such as CCPA and strong adoption of IAM and SIEM systems further support growth. Major players emphasize AI-driven and predictive cybersecurity frameworks to protect connected construction environments and maintain operational integrity.

Europe

Europe accounted for approximately 27% of the construction cybersecurity market share in 2024. The region benefits from robust regulatory compliance under GDPR, pushing construction firms to prioritize data protection and risk management systems. Growing investment in sustainable infrastructure, smart building projects, and green construction enhances the adoption of cloud-based security frameworks. Countries like Germany, the UK, and France lead in integrating cybersecurity into project lifecycles. The rising need for compliance audits and advanced DLP solutions continues to strengthen Europe’s cybersecurity posture across public and private infrastructure sectors.

Asia Pacific

Asia Pacific captured nearly 22% of the construction cybersecurity market share in 2024. Rapid urbanization and massive infrastructure projects in China, India, and Japan are accelerating digital adoption in construction. Governments are investing in secure IT frameworks for smart cities, highways, and housing projects. Cloud deployment and IoT-enabled construction management platforms are growing rapidly, increasing vulnerability to cyber threats. As a result, regional firms are deploying real-time intrusion detection systems and endpoint security solutions. The surge in foreign investments and public-private partnerships further drives cybersecurity spending across Asia Pacific’s evolving construction ecosystem.

Middle East & Africa

The Middle East & Africa region accounted for around 7% of the construction cybersecurity market share in 2024. Large-scale infrastructure programs in Saudi Arabia, the UAE, and Qatar, such as NEOM and smart city developments, are fueling demand for advanced cybersecurity frameworks. Companies are integrating AI-driven monitoring systems to protect sensitive project data from potential cyberattacks. Limited regional expertise and reliance on global cybersecurity vendors remain key challenges. However, increasing government focus on digital safety and international partnerships are gradually improving cybersecurity readiness across the construction sector.

Latin America

Latin America held approximately 6% of the construction cybersecurity market share in 2024. The region’s growth is supported by digital modernization in infrastructure and transportation projects, especially in Brazil, Mexico, and Chile. Rising cyber threats targeting public works and smart building systems are prompting contractors to adopt IAM and DLP solutions. Limited cybersecurity budgets and fragmented digital infrastructure remain challenges, but government-led digital security programs are improving awareness. As construction companies embrace cloud-based collaboration platforms, the need for managed security services and compliance-based protection is steadily increasing across the region.

Market Segmentations:

By Component:

- Solution

- Intrusion Detection and Prevention System (IDPS)

- Identity and Access Management (IAM)

- Data Loss Prevention (DLP) & disaster recovery

- Security Information and Event Management (SIEM)

- Risk & compliance management

- Others

- Services

- Professional services

- Managed services

By Deployment Model:

By Enterprise Size:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction cybersecurity market is highly competitive, with major players such as IBM Corporation, Fortinet Inc., Palo Alto Networks, Check Point Software Technologies, Cisco Systems, Trend Micro, CrowdStrike, SentinelOne, Dragos Inc., Trimble Inc., Optiv Security, ManageEngine, and Alcor driving innovation and technological advancement. These companies focus on developing integrated cybersecurity frameworks tailored to the unique needs of the construction sector. They emphasize endpoint protection, cloud security, and real-time threat detection to safeguard digital construction platforms and IoT-enabled systems. The competitive environment is shaped by increasing collaboration between cybersecurity vendors and construction technology providers to deliver scalable, AI-driven solutions. Continuous product upgrades, partnerships, and expansion into developing regions strengthen their market positions. Vendors are also prioritizing managed security services and compliance-focused offerings to meet growing regulatory requirements. Strategic mergers and acquisitions are expected to enhance market consolidation and accelerate the adoption of advanced cybersecurity solutions across construction enterprises.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM Corporation

- Fortinet Inc.

- Palo Alto Networks

- Check Point Software Technologies

- Cisco Systems

- Trend Micro

- CrowdStrike

- SentinelOne

- Dragos Inc.

- Trimble Inc.

- Optiv Security

- ManageEngine

- Alcor

Recent Developments

- In 2024, Cisco launched Hypershield, a security architecture designed to secure any application on any cloud, data center, or edge.

- In 2024, SentinelOne unveiled a revolutionary AI platform (Purple AI) that fuses embedded neural networks and a Large Language Model (LLM)-based natural language interface.

- In 2023, Cisco Redefine its AI Assistant for Security, a significant move to make artificial intelligence (AI) pervasive within its Security Cloudcollaboration, and for Construction Cyber security.

- In 2023, Optiv Security Acquired ClearShark, forming Optiv + ClearShark (OCS), to strengthen its position in providing cybersecurity solutions for the U.S. government, including federal construction projects

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The construction cybersecurity market will expand rapidly with increased adoption of IoT-enabled project management systems.

- Cloud-based security platforms will dominate due to flexibility and real-time threat monitoring.

- AI-driven predictive analytics will become essential for proactive threat detection and risk prevention.

- Integration of cybersecurity into BIM workflows will strengthen data integrity and collaboration security.

- Governments will enforce stricter cybersecurity compliance for infrastructure and smart city projects.

- Demand for managed security services will rise as SMEs seek cost-effective protection solutions.

- Identity and access management tools will remain critical to safeguard project and employee data.

- Partnerships between cybersecurity firms and construction technology providers will increase.

- Training and workforce awareness programs will become a standard part of digital safety strategies.

- Investment in cyber resilience frameworks will drive long-term trust and operational continuity in construction projects.