Market Overview

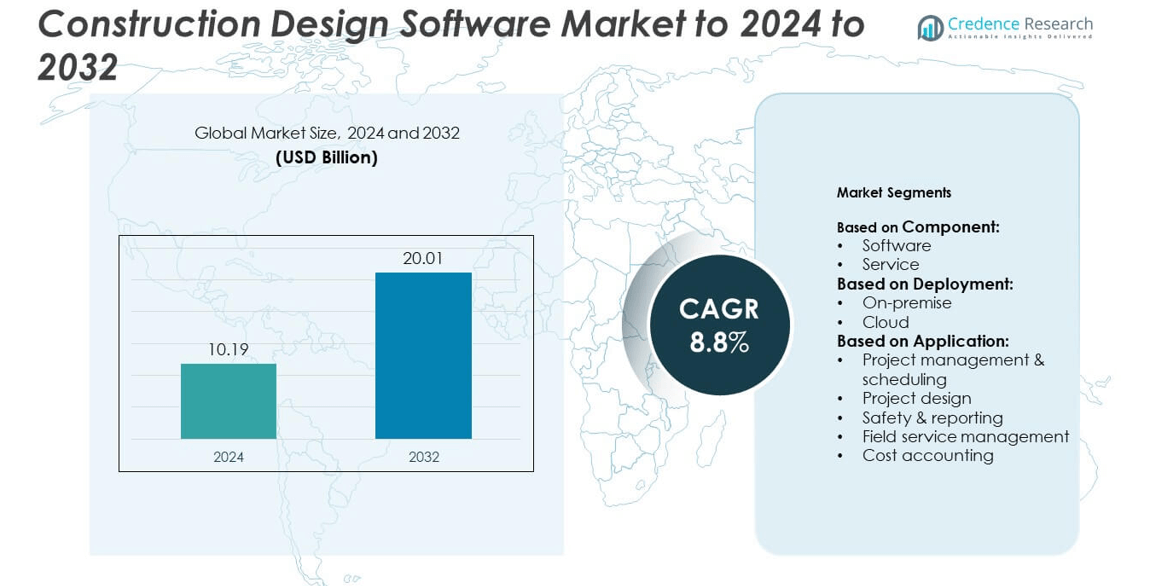

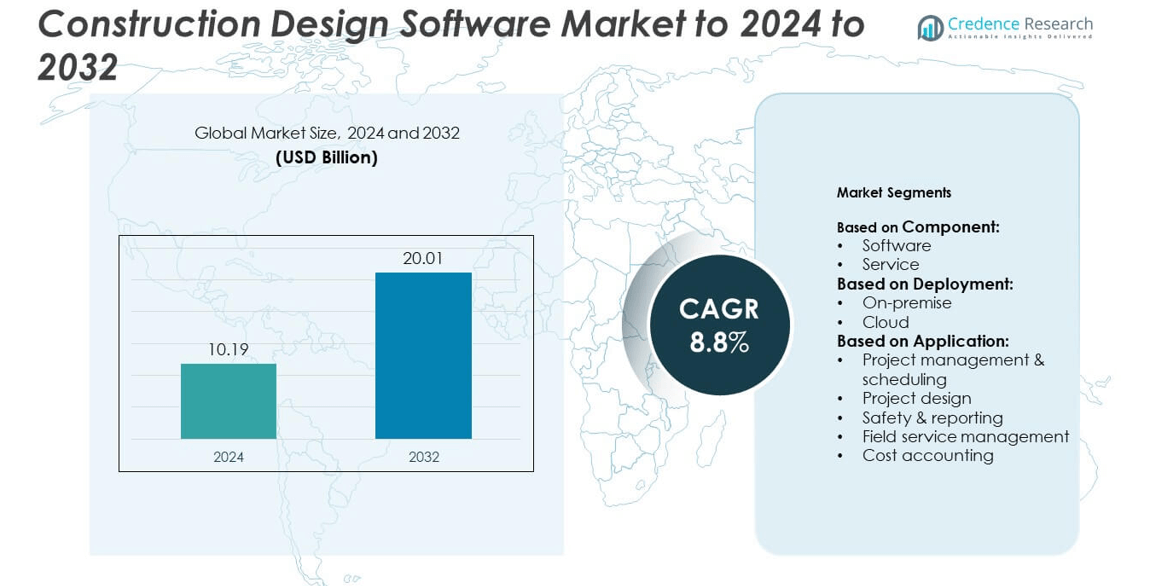

Construction Design Software market size was valued USD 10.19 billion in 2024 and is anticipated to reach USD 20.01 billion by 2032, at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Design Software Market Size 2024 |

USD 10.19 billion |

| Construction Design Software Market, CAGR |

8.8% |

| Construction Design Software Market Size 2032 |

USD 20.01 billion |

The Construction Design Software Market is led by major players such as Trimble, SAP SE, Bentley Systems, Vectorworks, Oracle, Autodesk, RIB Software SE, Sage Group, Microsoft, and Constellation Software. These companies focus on digital transformation through BIM integration, AI-powered design tools, and cloud-based collaboration platforms to enhance efficiency and reduce project delays. Strategic partnerships and product innovations remain key competitive strategies. North America dominated the global market in 2024 with a 36% share, driven by strong adoption of advanced design technologies, robust infrastructure investments, and widespread implementation of digital construction solutions across the region.

Market Insights

- The Construction Design Software Market was valued at USD 10.19 billion in 2024 and is projected to reach USD 20.01 billion by 2032, growing at a CAGR of 8.8%.

- The market growth is driven by increasing adoption of BIM technology, cloud-based design platforms, and demand for efficient project management tools.

- Key trends include the integration of AI and digital twins, enabling real-time design optimization and improved collaboration across project teams.

- The competitive landscape features leading players focusing on innovation, interoperability, and sustainability compliance to strengthen market presence.

- North America led the market with 36% share in 2024, followed by Europe at 30% and Asia-Pacific at 25%, while the software segment dominated by holding around 72% of the total share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The software segment dominated the Construction Design Software Market in 2024, capturing around 72% of the total share. Its leadership stems from widespread adoption of 3D modeling, BIM, and CAD tools that enhance project visualization and precision. Platforms like Autodesk Revit and Bentley MicroStation enable real-time collaboration and clash detection, reducing rework and delays. Increasing demand for integrated design and documentation systems among architects and engineers continues to strengthen the segment. The service segment, focused on implementation, training, and maintenance, is expanding steadily due to growing reliance on cloud integration and technical support.

- For instance, Nemetschek Group reports 7+ million users of its AEC software portfolio.

By Deployment

Cloud-based deployment led the market in 2024, accounting for approximately 64% of the overall share. This dominance is driven by the flexibility, scalability, and cost efficiency of cloud platforms in multi-site construction projects. Firms increasingly use SaaS-based solutions to ensure real-time data sharing and version control across teams. The model supports remote access and seamless integration with IoT-enabled equipment, boosting operational efficiency. On-premise deployment remains relevant for firms prioritizing data control and security, especially in infrastructure and government construction projects with strict compliance standards.

- For instance, Trimble SketchUp surpassed 1,000,000 active subscribers in 2024.

By Application

Project design emerged as the dominant segment in 2024, holding nearly 41% of the total market share. Its strength is supported by growing reliance on advanced BIM and CAD systems for detailed architectural visualization, energy modeling, and structural planning. These tools streamline collaboration among architects, contractors, and engineers, ensuring design accuracy and regulatory compliance. Increasing use of 3D simulation and AI-assisted design optimization further enhances project outcomes. Other key applications, such as cost accounting and safety reporting, are gaining traction as companies adopt digital solutions to improve budget control and risk management efficiency.

Key Growth Drivers

Rising Adoption of Building Information Modeling (BIM)

BIM integration is a key growth driver for the Construction Design Software Market, enabling real-time collaboration and data sharing across project teams. The technology enhances design accuracy, minimizes project delays, and supports sustainability by simulating energy-efficient structures. Increasing global mandates for BIM usage in public infrastructure projects, particularly in the EU and Asia-Pacific, are accelerating adoption. As construction firms prioritize digitalization and error reduction, BIM-driven software remains central to optimizing design workflows and lifecycle management.

- For instance, Procore ended 2024 with 17,088 organic customers and 94% gross retention.

Growing Demand for Cloud-Based Collaboration Tools

Cloud-based construction design platforms are driving market growth by improving flexibility, scalability, and remote access. Construction firms rely on cloud systems for real-time updates, version control, and multi-location project coordination. These solutions enable faster decision-making and cost savings through data centralization. With rising adoption of remote project monitoring and IoT-based site management, cloud-enabled design environments are becoming essential for medium and large enterprises seeking enhanced productivity and mobility across construction operations.

- For instance, Bluebeam, part of the Nemetschek portfolio, reports that its solutions are trusted by over 3 million individuals in more than 160 countries to advance digital collaboration in construction workflows.

Focus on Sustainable and Energy-Efficient Design Solutions

Sustainability trends are significantly influencing the demand for eco-friendly design software. Developers are using advanced modeling tools to assess energy consumption, material efficiency, and environmental impact during early design stages. Governments’ net-zero targets and green building regulations are pushing firms toward software that enables compliance with LEED and BREEAM standards. The emphasis on life-cycle assessment and carbon footprint reduction drives broader adoption of sustainable design platforms in both commercial and residential construction projects.

Key Trends & Opportunities

Integration of Artificial Intelligence and Automation

AI-driven automation is emerging as a major trend in the Construction Design Software Market. Tools that use predictive analytics and machine learning enable error detection, material optimization, and automated design adjustments. These capabilities reduce manual workload and improve accuracy in cost estimation and scheduling. As AI adoption grows, opportunities arise for vendors to offer intelligent design assistants and generative modeling tools that enhance creativity while maintaining structural precision in modern construction design.

- For instance, Laing O’Rourke established an aspirational goal, known as “70:60:30 towards 0,” for its Design for Manufacture and Assembly (DfMA) model.

Expansion of Modular and Prefabricated Construction Design

The shift toward modular and prefabricated construction is creating new opportunities for design software providers. Software tools that support 3D modeling, prefabrication planning, and digital twin integration enable faster project execution and reduced material waste. Prefabrication-friendly design solutions are gaining attention among developers seeking time efficiency and cost reduction. As modular construction expands in urban housing and commercial projects, demand for precise and customizable design platforms continues to strengthen.

- For instance, USGBC (U.S. Green Building Council) confirmed 437 new LEED-certified projects in California in 2024, covering more than 101 million square feet, reinforcing the trend toward energy-efficient and environmentally compliant building design.

Key Challenges

High Implementation and Licensing Costs

The high cost of software licensing, implementation, and customization remains a major challenge for small and mid-sized firms. Many companies struggle to justify investment in advanced BIM or CAD systems due to limited budgets. Subscription-based pricing helps partially, but training and infrastructure costs add further strain. These financial barriers slow digital transformation among smaller construction players, limiting widespread market penetration of advanced design solutions.

Data Security and Integration Complexities

The integration of cloud and connected platforms raises growing concerns over data security and interoperability. Construction projects involve multiple stakeholders, and managing sensitive design data across distributed networks poses risks of breaches or data loss. Compatibility issues between legacy and modern software further hinder seamless collaboration. Vendors must enhance cybersecurity features, encryption standards, and interoperability frameworks to ensure trust and smooth adoption across complex construction ecosystems.

Regional Analysis

North America

North America dominated the Construction Design Software Market in 2024, accounting for 36% of the total share. The region’s growth is driven by rapid adoption of BIM standards, digital twin integration, and advanced project management tools across large-scale infrastructure projects. The United States leads due to high investments in smart city development and strong presence of key players offering cloud-based design platforms. Canada is also expanding its use of sustainable construction design software aligned with energy-efficient building regulations, further supporting regional market expansion.

Europe

Europe held around 30% of the market share in 2024, supported by strict sustainability regulations and growing implementation of BIM mandates across the construction sector. Countries such as the United Kingdom, Germany, and France are investing heavily in digital transformation of building design processes. The EU’s Circular Economy Action Plan and carbon-neutral construction goals encourage adoption of energy modeling and lifecycle assessment tools. Growing infrastructure modernization and cross-border construction collaborations continue to strengthen Europe’s leadership in advanced design software integration.

Asia-Pacific

Asia-Pacific captured nearly 25% of the market share in 2024 and is projected to witness the fastest growth through 2032. Rising urbanization, expanding smart city projects, and government-backed digital construction initiatives are driving adoption of design software in China, Japan, India, and South Korea. Increasing use of cloud-based platforms for large infrastructure and residential projects fuels regional expansion. The region’s growing construction workforce and digital skill development programs further support integration of BIM and AI-driven design technologies across emerging economies.

Latin America

Latin America accounted for approximately 6% of the Construction Design Software Market in 2024. The region is experiencing gradual growth driven by modernization of construction workflows and adoption of digital project design tools in Brazil, Mexico, and Chile. Infrastructure development and public housing programs are promoting the use of CAD and 3D modeling platforms. Limited access to advanced technologies and high software costs remain barriers, but cloud-based and subscription models are increasingly enabling broader market participation among regional firms.

Middle East & Africa

The Middle East & Africa region held a 3% market share in 2024, driven by expanding infrastructure investments and adoption of smart construction technologies. Countries like the UAE and Saudi Arabia are leading with large-scale projects such as NEOM and Dubai’s Smart City initiative, which rely on BIM and 3D design tools for efficient project planning. Africa is gradually embracing digital design solutions through urban infrastructure programs, though challenges in digital readiness and high costs continue to limit widespread software adoption.

Market Segmentations:

By Component:

By Deployment:

By Application:

- Project management & scheduling

- Project design

- Safety & reporting

- Field service management

- Cost accounting

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Construction Design Software Market is highly competitive, with leading players such as Trimble, SAP SE, Bentley Systems, Vectorworks, Oracle, Autodesk, RIB Software SE, Sage Group, Microsoft, and Constellation Software driving innovation and technological advancement. These companies focus on enhancing digital design workflows through cloud-based platforms, BIM integration, and AI-driven modeling solutions. Strategic mergers, product upgrades, and partnerships with construction firms are common to strengthen their global presence. Vendors are prioritizing interoperability, sustainability compliance, and real-time collaboration tools to meet evolving industry demands. The competitive landscape is also shaped by increasing emphasis on subscription-based models and advanced analytics for project efficiency. Growing investments in digital twin technology, automation, and integrated project delivery systems further define the market’s competitive intensity. As construction firms shift toward data-centric and connected design ecosystems, established vendors continue to lead through innovation, while emerging software providers compete by offering cost-effective and specialized design tools.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trimble

- SAP SE

- Bentley Systems

- Vectorworks

- Oracle

- Autodesk

- RIB Software SE

- Sage Group

- Microsoft

- Constellation Software

Recent Developments

- In 2024, Bentley Systems Announced OpenSite+, the first AI-powered civil engineering software for civil site design

- In 2023, Autodesk emphasized the integration of artificial intelligence (AI) and machine learning (ML) to boost analytics and enable more precise and predictive design insights. The company also pushed its cloud-based Autodesk Construction Cloud for streamlined collaboration.

- In 2023, Trimble integrated Azure AI Document Intelligence into its construction management software, Viewpoint Spectrum and Viewpoint Vista. This feature automates the processing of paper and PDF invoices, streamlining a historically manual and time-consuming workflow.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as construction firms adopt digital design and BIM solutions.

- Cloud-based platforms will dominate due to flexibility, scalability, and real-time collaboration benefits.

- Integration of AI and machine learning will improve accuracy and reduce project design errors.

- Demand for sustainable and energy-efficient design software will rise under stricter green building rules.

- Digital twins will gain traction for lifecycle monitoring and predictive maintenance of infrastructure projects.

- Increased investment in smart city projects will boost software adoption across public infrastructure.

- Vendors will focus on interoperability to ensure seamless data exchange between different platforms.

- Mobile and remote-access tools will grow in use to support on-site collaboration and decision-making.

- Emerging markets in Asia-Pacific and Latin America will see accelerated adoption of 3D and BIM tools.

- Subscription-based and SaaS models will become the preferred choice for cost-effective deployment.