Market Overview:

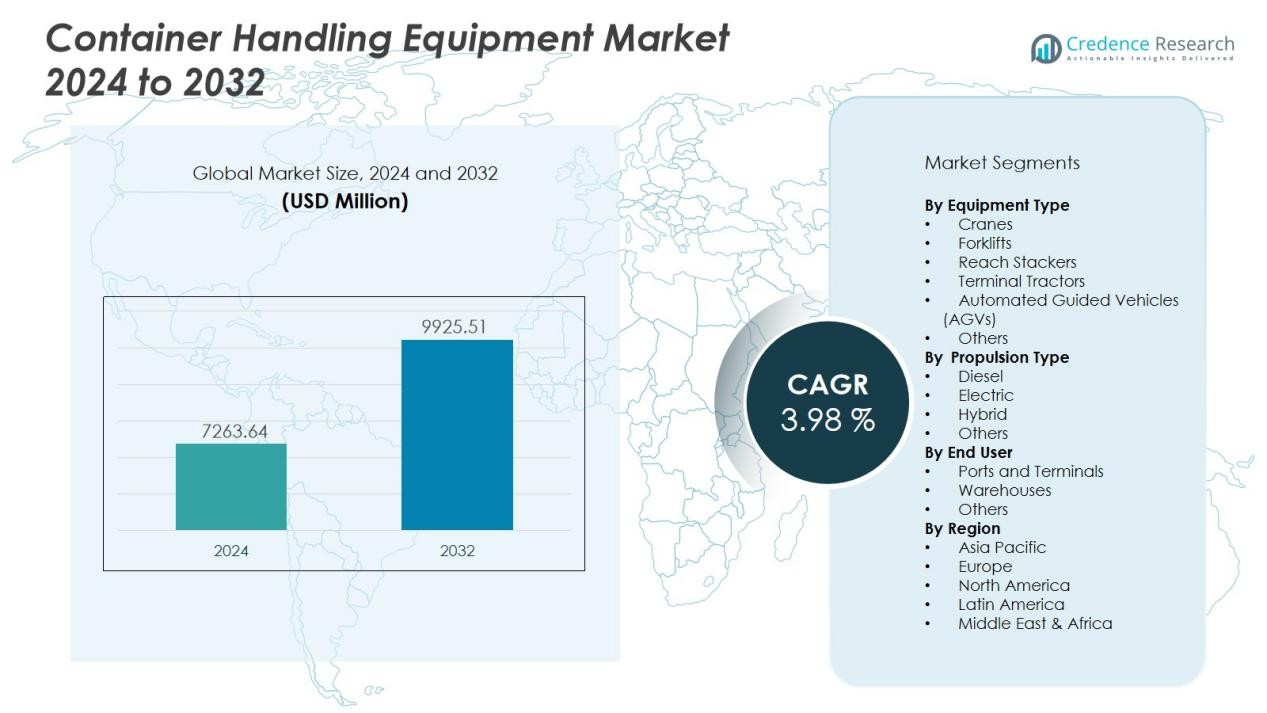

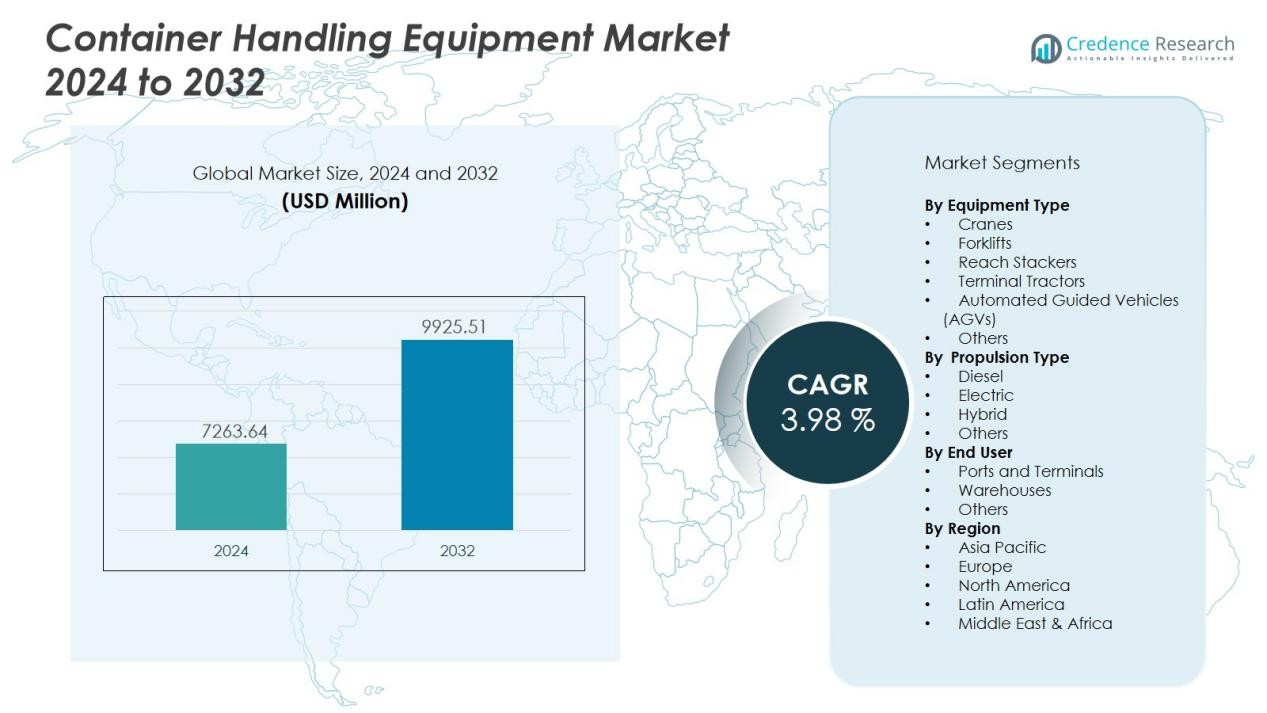

The Container Handling Equipment Market size was valued at USD 7263.64 million in 2024 and is anticipated to reach USD 9925.51 million by 2032, at a CAGR of 3.98 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Container Handling Equipment Market Size 2024 |

USD 7263.64 Million |

| Container Handling Equipment Market, CAGR |

3.98% |

| Container Handling Equipment Market Size 2032 |

USD 9925.51 Million |

Growth in this market is propelled by rising volumes of containerized trade and e-commerce, which increase demand for terminal infrastructure and logistics efficiency. Automation trends, including remote-controlled cranes, automated guided vehicles (AGVs), and electric propulsion systems, are improving operational productivity while reducing labor costs and supporting sustainability targets. The shift toward greener operations and the replacement of older diesel-based handling fleets also fuel equipment modernization.

Regionally, Asia-Pacific dominates the market and is projected to maintain the strongest growth trajectory. Rapid port expansion in China, India, and Southeast Asia, coupled with significant investment in hinterland logistics, underpins this dominance. North America and Europe retain substantial shares, with growth driven more by regulatory compliance, automation upgrades, and port optimization initiatives rather than new infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Container Handling Equipment Market size was valued at USD 7,263.64 million in 2024 and is anticipated to reach USD 9,925.51 million by 2032, growing at a CAGR of 3.98% from 2024 to 2032.

- Asia-Pacific holds the largest market share at 42%, driven by rapid industrialization, port expansion projects, and significant investments in automation and smart ports in China, India, and Southeast Asia.

- North America accounts for 26% of the market share, with steady growth supported by strong logistics networks, port modernization, and the increasing adoption of electrification and emission-reduction technologies.

- Europe holds 21% of the market share, propelled by strong adoption of automation, sustainability efforts, and government policies promoting green technologies in major ports like Germany, the Netherlands, and the UK.

- The fastest-growing region is Asia-Pacific, benefiting from expanding port infrastructure, growing exports, and technological advancements in container handling solutions.

Market Drivers:

Growing Global Trade and Containerization

The Container Handling Equipment Market is driven by expanding global trade and the rising volume of containerized goods. Increasing import-export activities across manufacturing, retail, and e-commerce sectors have elevated the need for efficient port and terminal operations. It supports faster loading, unloading, and intermodal transfer to handle high cargo throughput. This trend continues to strengthen with the ongoing expansion of shipping routes and port infrastructure modernization worldwide.

- For instance, DP World achieved a record throughput of 88.3 million TEU (twenty-foot equivalent units) across its global portfolio of container terminals in 2024, marking an 8.3% growth year-over-year and underscoring high-efficiency container logistics at scale.

Adoption of Automation and Smart Technologies

Automation and digitalization are transforming container handling operations across major ports. The integration of automated stacking cranes, terminal operating systems, and remote-controlled vehicles enhances precision, reduces human error, and improves turnaround times. It enables real-time tracking and operational optimization through data analytics and IoT connectivity. These technologies are helping terminal operators achieve higher productivity and safety standards while reducing overall costs.

- For instance, terminals at the Port of Rotterdam, such as the ECT Delta Terminal and APM Terminals Maasvlakte II, have deployed over 100 Automated Guided Vehicles (AGVs) across their facilities.

Rising Emphasis on Sustainability and Emission Reduction

Environmental regulations and sustainability initiatives are compelling the industry to adopt cleaner and more energy-efficient equipment. Manufacturers are shifting toward electric, hybrid, and hydrogen-powered handling machinery to cut greenhouse gas emissions. It supports global decarbonization efforts and aligns with international emission standards such as IMO and EU directives. This move also attracts investments in research and development for green port equipment solutions.

Infrastructure Expansion and Port Modernization Initiatives

Growing investments in port expansion projects and logistics hubs are fueling market demand. Governments and private operators are prioritizing upgrades to support larger vessels and increased cargo volumes. It stimulates demand for advanced cranes, reach stackers, and terminal tractors capable of managing heavy-duty operations efficiently. The modernization of inland and coastal ports further strengthens the market’s long-term growth prospects.

Market Trends:

Increasing Automation and Digital Integration Across Terminals

Automation has become a defining trend in the Container Handling Equipment Market, with ports adopting advanced control systems and autonomous equipment to improve efficiency. Automated stacking cranes, remote-operated straddle carriers, and AGVs are increasingly deployed to minimize human intervention and enhance precision. It supports faster vessel turnaround and reduces congestion at major terminals. Integration of IoT, AI, and data analytics enables predictive maintenance and optimized fleet management. Digital twins and simulation software are helping operators plan layouts and workflows with greater accuracy. This growing shift toward intelligent automation is setting new standards for operational productivity and safety across global ports.

- For instance, PSA Singapore deployed 80 automated guided vehicles (AGVs) for container transport in its Pasir Panjang Terminal, achieving a 25% reduction in truck turnaround times while maintaining zero safety incidents since rollout.

Shift Toward Electrification and Sustainable Operations

Sustainability is reshaping the direction of container handling technologies, driving the transition from diesel-powered to electric and hybrid machinery. Equipment manufacturers are introducing battery-electric reach stackers, terminal tractors, and cranes to reduce emissions and fuel consumption. It aligns with global efforts to achieve carbon-neutral port operations by 2050. Governments and port authorities are offering incentives to adopt green technologies, accelerating this transition. The rising availability of high-capacity batteries and fast-charging infrastructure further enhances the appeal of electric handling equipment. This trend reflects a broader commitment within the logistics industry to combine operational performance with environmental responsibility.

- For Instance, the Sany SRSC45E5 electric reach stacker is equipped with a 422 kWh lithium iron phosphate battery offering 6-9 hours of continuous operation and over 2,800 full discharge cycles.

Market Challenges Analysis:

High Capital Investment and Maintenance Costs

The Container Handling Equipment Market faces a major challenge due to the high capital cost of advanced machinery. Automated cranes, reach stackers, and electric vehicles require significant upfront investment, which limits adoption among small and medium port operators. It also demands ongoing maintenance, software upgrades, and skilled technicians, adding to operational expenses. The long payback period often discourages investment in newer technologies, especially in developing regions. Fluctuations in raw material prices, such as steel and electronic components, further impact equipment affordability. These financial constraints slow modernization and restrict equipment replacement cycles.

Limited Infrastructure and Integration Barriers

Many ports lack the infrastructure needed to support automated and electric handling systems. Inadequate grid capacity, limited charging stations, and outdated terminal layouts hinder equipment deployment. It creates integration challenges between new digital systems and existing manual operations. Smaller terminals struggle to adopt connected solutions due to low digital maturity. Cybersecurity concerns linked to IoT and automation platforms also raise risks for port authorities. Addressing these infrastructure and security issues remains critical to sustaining market growth.

Market Opportunities:

Expansion of Smart Ports and Digital Logistics Networks

The Container Handling Equipment Market presents strong opportunities through the rise of smart port initiatives worldwide. Governments and private operators are investing in digital transformation to enhance cargo visibility, real-time tracking, and resource optimization. It encourages adoption of connected handling systems equipped with AI, sensors, and automation software. Integration with port management platforms improves coordination between sea, road, and rail logistics. Emerging technologies such as 5G connectivity and edge computing further enhance data-driven decision-making. These developments open avenues for vendors offering intelligent and interoperable handling solutions.

Growing Demand for Green and Energy-Efficient Equipment

The push toward carbon-neutral logistics is creating lucrative opportunities for eco-friendly equipment manufacturers. Ports are shifting to electric, hybrid, and hydrogen-powered cranes, forklifts, and tractors to reduce emissions and comply with environmental standards. It supports long-term sustainability goals and enhances port competitiveness under global ESG frameworks. The availability of government subsidies and green financing programs accelerates fleet electrification. Technological advancements in battery performance and renewable energy integration make zero-emission operations increasingly viable. This transition strengthens the market position of innovators in sustainable container handling technologies.

Market Segmentation Analysis:

By Equipment Type

The Container Handling Equipment Market is segmented by equipment type into cranes, forklifts, reach stackers, terminal tractors, automated guided vehicles (AGVs), and others. Cranes hold the largest share due to their vital role in container loading and unloading operations at ports and terminals. Reach stackers and terminal tractors are gaining traction for their flexibility in yard and intermodal handling. It benefits from automation in large ports where AGVs are increasingly replacing manual vehicles. Forklifts remain important for warehouse and inland logistics operations, supporting smaller container movements efficiently.

- For Instance, Konecranes has delivered hundreds of Rubber-Tired Gantry (RTG) cranes globally, with significant fleets at leading terminals such as the Georgia Ports Authority’s Garden City Terminal, the largest single container terminal in the United States.

By Propulsion Type

By propulsion type, the market includes diesel, electric, hybrid, and others. Diesel-powered equipment continues to dominate due to its reliability and suitability for heavy-duty operations. However, the electric segment is expanding rapidly, supported by stricter emission standards and growing sustainability goals. It gains momentum with advancements in battery efficiency and charging infrastructure. Hybrid systems are also emerging as a transitional choice, offering better fuel economy and lower emissions compared to conventional diesel units.

- For instance, Caterpillar’s 797F mining truck, powered by a diesel engine, can carry up to 400 tons per load and is widely deployed across major mining sites globally.

By End Use

By end use, the market is divided into ports and terminals, warehouses, and others. Ports and terminals represent the dominant segment driven by increasing trade volumes and global containerization trends. It is supported by ongoing infrastructure modernization and automation initiatives. Warehouses and logistics centers are witnessing rising adoption of compact and automated handling solutions to optimize space and workflow efficiency. This diversification strengthens overall market stability across industrial and logistics sectors.

Segmentations:

By Equipment Type

- Cranes

- Forklifts

- Reach Stackers

- Terminal Tractors

- Automated Guided Vehicles (AGVs)

- Others

By Propulsion Type

- Diesel

- Electric

- Hybrid

- Others

By End Use

- Ports and Terminals

- Warehouses

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leading with Expanding Port Infrastructure

Asia-Pacific holds 42% market share in the Container Handling Equipment Market, driven by rapid industrialization and port expansion projects. China, India, South Korea, and Singapore are leading adopters of advanced container handling solutions. It benefits from continuous investments in smart ports and automation programs aimed at increasing throughput capacity. Governments across the region are modernizing coastal and inland ports to handle rising trade volumes. Growing exports in automotive, electronics, and manufacturing sectors fuel further demand for efficient handling systems. The increasing presence of regional equipment manufacturers also strengthens market competitiveness and technological innovation.

North America Demonstrating Steady Growth through Modernization Efforts

North America accounts for 26% market share, supported by robust logistics networks and modernization of existing port infrastructure. The United States and Canada are upgrading terminals with automated cranes and hybrid handling machinery. It is driven by strong trade activity through ports such as Los Angeles, Houston, and Vancouver. Investments in electrification and emission-reduction technologies are creating new opportunities for manufacturers. The integration of IoT-enabled systems and digital tracking platforms enhances operational transparency across logistics chains. Rising focus on safety, efficiency, and sustainability continues to sustain steady growth across this region.

Europe Advancing Toward Sustainable and Automated Operations

Europe holds 21% market share in the global market, led by strong adoption of automation and green handling technologies. Ports in Germany, the Netherlands, and the United Kingdom are deploying electric and hybrid handling fleets. It benefits from the European Union’s policies promoting carbon-neutral logistics and digital transformation in transport. The region’s established port infrastructure supports early implementation of AI-based and remotely operated systems. Continuous R&D investments and collaboration between port authorities and equipment providers encourage technological advancement. Demand for emission-free and energy-efficient solutions keeps Europe at the forefront of sustainable container handling evolution.

Key Player Analysis:

- Cargotec Corporation

- Liebherr Group

- Sany Group

- Konecranes

- Hyster-Yale, Inc.

- Toyota Industries Corporation

- China Communications Construction Company Limited

- PALFINGER AG

- Mi-Jack

- Daifuku Co., Ltd.

Competitive Analysis:

The Container Handling Equipment Market is moderately consolidated, with several global players competing through technological innovation and product diversification. Cargotec Corporation, Liebherr Group, Sany Group, Konecranes, Hyster-Yale, Inc., and Toyota Industries Corporation are among the leading companies shaping industry dynamics. It reflects a competitive balance between established manufacturers and regional suppliers focusing on cost efficiency and service support. Companies are emphasizing automation, electric propulsion, and digital monitoring systems to strengthen their portfolios and align with sustainability goals. Strategic mergers, partnerships, and product upgrades remain central to maintaining market presence. Continuous investments in research and development enable leading firms to deliver high-performance equipment that supports smart port operations and low-emission logistics infrastructure.

Recent Developments:

- In July 2025, Cargotec Corporation completed the sale of its MacGregor business to funds managed by Triton for approximately EUR 480 million, marking a major corporate shift.

- In April 2025, Liebherr Group and Kubota Corporation announced a new long-term partnership targeting wheeled excavator development, launching the A 909 Compact and A 911 Compact models at Bauma 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Equipment Type, Propulsion Type, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Automation will continue to redefine port operations with wider adoption of autonomous cranes and AGVs.

- Electric and hybrid handling equipment will gain strong traction due to stricter emission norms.

- AI-driven predictive maintenance systems will enhance equipment uptime and operational efficiency.

- Integration of IoT and digital twins will improve asset tracking and performance analytics.

- Smart port development programs across Asia-Pacific will create sustained demand for advanced systems.

- Manufacturers will focus on lightweight materials and modular designs to improve equipment mobility.

- Collaborations between technology firms and port authorities will accelerate digital transformation initiatives.

- Growing trade volumes and e-commerce logistics will push expansion of container terminals globally.

- Hydrogen-powered handling equipment will emerge as a promising alternative to diesel and battery units.

- Aftermarket services and retrofitting solutions will offer new revenue streams for equipment providers.