Market Overview

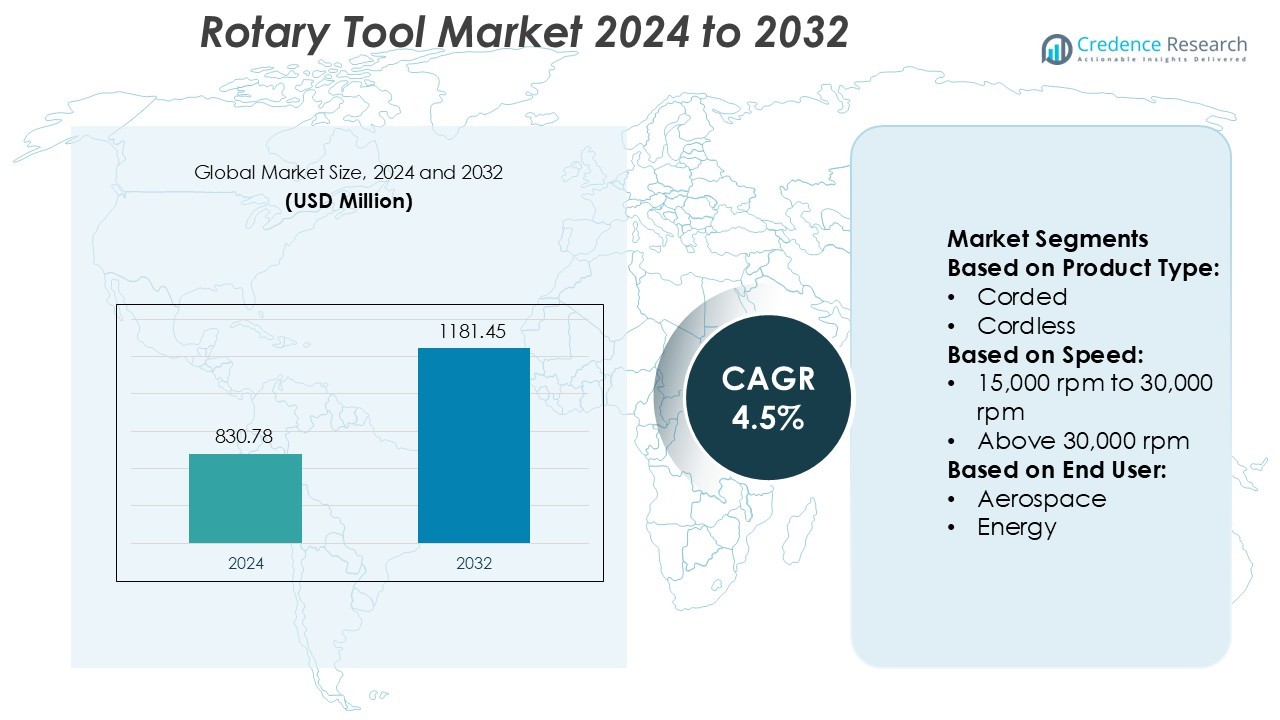

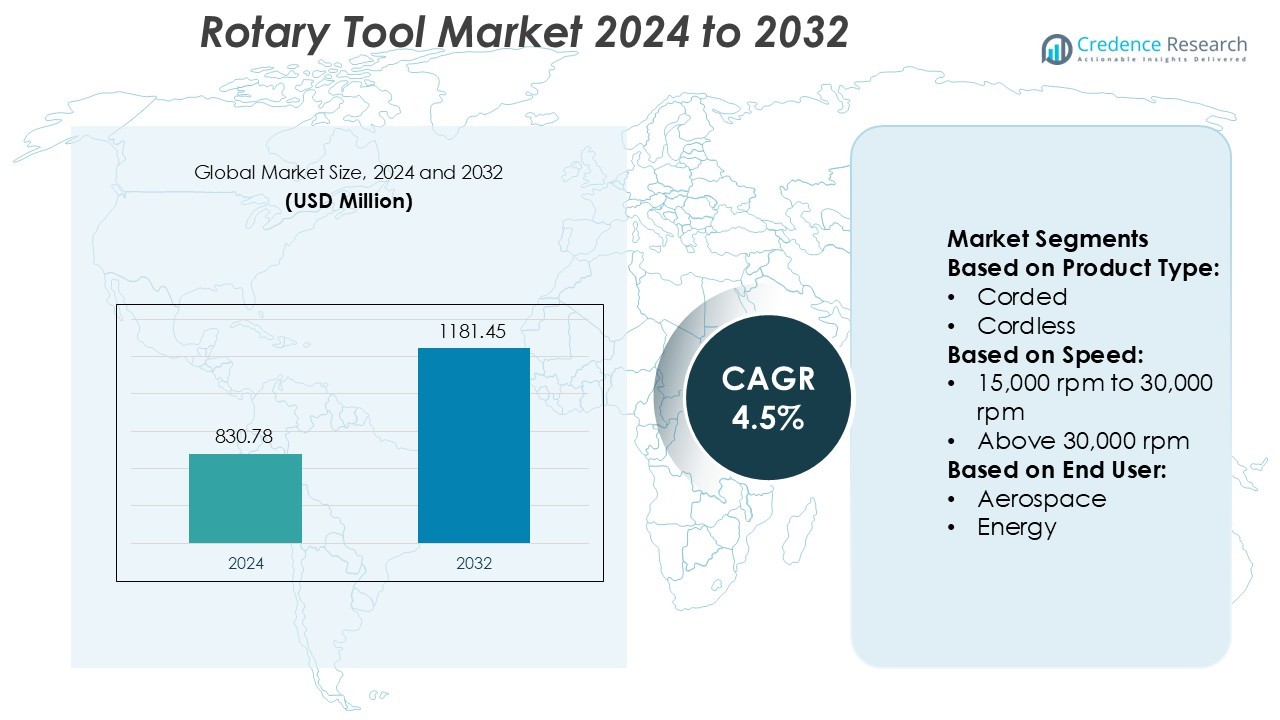

Rotary Tool Market size was valued USD 830.78 million in 2024 and is anticipated to reach USD 1181.45 million by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rotary Tool Market Size 2024 |

USD 830.78 Million |

| Rotary Tool Market, CAGR |

4.5% |

| Rotary Tool Market Size 2032 |

USD 1181.45 Million |

The rotary tool market is led by major players including Makita Corporation, Robert Bosch GmbH, Stanley Black and Decker Inc., Hilti Corporation, Emerson Electric Co., Apex Tool Group, KOKI HOLDINGS Co., Ltd., Husqvarna AB, Snap-on Incorporated, and Zhejiang SALI Abrasive Technology Co., Ltd. These companies focus on innovation in cordless technology, precision control, and ergonomic design to meet rising demand across industrial and consumer applications. North America dominated the global rotary tool market with a 37% share in 2024, driven by strong adoption in DIY projects, professional workshops, and automotive repair. Continuous product innovation and robust distribution networks strengthen the region’s leadership position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rotary Tool Market was valued at USD 830.78 million in 2024 and is expected to reach USD 1181.45 million by 2032, growing at a CAGR of 4.5% during the forecast period.

- Growing demand for DIY and home improvement projects, along with industrial applications in automotive and aerospace, is driving steady market expansion.

- The trend toward cordless and brushless tools, offering higher efficiency and flexibility, is reshaping product development and consumer preference.

- Strong competition among global and regional players leads to continuous innovation, while price sensitivity and safety concerns act as key restraints.

- North America led the market with a 37% share in 2024, supported by high adoption in professional and consumer segments, while the electric rotary tool segment dominated overall product demand.

Market Segmentation Analysis:

By Product Type

The electric rotary tool segment dominated the market with a 63% share in 2024, driven by its versatility, precision, and user-friendly operation. Within this category, the cordless sub-segment is gaining strong momentum due to advancements in lithium-ion batteries that extend runtime and improve portability. Pneumatic rotary tools maintain demand in industrial applications requiring high torque and durability. However, the rapid adoption of cordless electric tools among DIY enthusiasts and professionals, supported by ergonomic designs and brushless motor technology, continues to strengthen this segment’s leadership across global markets.

- For instance, Makita Corporation offers an 18V LXT Cut-Out Tool (Model XOC01Z) that features a 30,000 RPM variable-speed motor. This tool, when paired with an 18V LXT 4.0 Ah lithium-ion battery.

By Speed

The 15,000 rpm to 30,000 rpm segment held the largest share of 52% in 2024, as it balances speed, precision, and power for diverse cutting, polishing, and engraving tasks. This speed range is widely preferred in both professional and home applications for its control and efficiency. The growing use of high-speed rotary tools above 30,000 rpm in precision manufacturing and automotive detailing supports market expansion. Meanwhile, tools operating below 15,000 rpm serve niche uses, such as soft material shaping and small-scale crafting, offering less vibration and energy consumption.

- For instance, Husqvarna AB offers a PG 280 single-disc floor grinder, used for industrial flooring applications. It has a 2.2 kW motor and a grinding width of 280 millimeters.

By End-user

The DIY/home improvement projects segment led the rotary tool market with a 48% share in 2024, driven by rising consumer interest in home renovation and crafting. Affordable cordless models, online tutorials, and e-commerce availability have made rotary tools more accessible to casual users. The industrial/professional segment follows closely, fueled by demand in metalworking, construction, and repair applications. Automotive and aerospace users are also integrating high-precision rotary tools for polishing, grinding, and component finishing tasks, with manufacturers introducing durable, low-vibration models tailored for intensive and repetitive operations.

Key Growth Drivers

- Rising Adoption of DIY and Home Improvement Activities

Growing consumer interest in home renovation and creative crafting projects is a major driver for the rotary tool market. The availability of compact, cordless, and affordable rotary tools has expanded their use among hobbyists and homeowners. Online tutorials and e-commerce platforms have made these tools accessible to a wider audience. Manufacturers are introducing lightweight models with variable speed settings, catering to beginners and professionals alike. This shift toward home-based applications is significantly boosting global demand and market penetration.

- For instance, KOKI HOLDINGS Co., Ltd. (under the HiKOKI brand) offers the GP18DA cordless die grinder, which is equipped with an 18V brushed motor. This tool features a variable speed dial with a maximum no-load speed of 29,000 RPM.

- Expansion of Industrial and Professional Applications

Rotary tools are gaining strong traction in industrial sectors such as metalworking, construction, and electronics. Their versatility in cutting, grinding, polishing, and surface finishing supports various precision-driven operations. The increasing use of these tools in maintenance and repair work enhances operational efficiency and reduces downtime. Continuous product innovations, such as ergonomic designs and brushless motors, are improving tool durability and power output. This industrial expansion, supported by automation and modernization initiatives, drives consistent growth across professional-grade tool segments.

- For instance, Stanley Black and Decker’s DEWALT DWE4887 corded die grinder features a 450 W motor that delivers up to 25,000 RPM. This tool has a compact body weighing approximately 1.6 kg (3.65 lbs) and operates at a single, constant speed.

- Advancements in Battery and Motor Technologies

Technological progress in lithium-ion batteries and brushless motor systems is revolutionizing cordless rotary tools. Extended battery life, faster charging, and higher torque efficiency allow users greater mobility and productivity. These innovations also enhance energy efficiency and reduce maintenance requirements. Manufacturers are focusing on smart features like speed control and overload protection to increase user safety and precision. The shift from corded to cordless designs aligns with broader industrial trends toward portability and sustainability, further accelerating product adoption.

Key Trends & Opportunities

- Integration of Smart and Connected Features

Smart rotary tools with digital controls, RPM monitoring, and Bluetooth connectivity are emerging as key trends. These tools enable users to customize performance parameters, track usage, and optimize tool life through mobile apps. Leading brands are integrating IoT capabilities and sensors for predictive maintenance and performance feedback. This digital integration enhances precision and operational control, especially for professionals handling complex materials. The growing adoption of smart power tools opens new opportunities in connected tool ecosystems and data-driven maintenance systems.

- For instance, Emerson Electric launched its SmartPower™ 701P module which offers up to 10‑year maintenance‑free operation at a one‑minute update rate while weighing just 230 g (0.50 lb) and supporting Bluetooth® and WirelessHART connectivity.

- Growing Focus on Ergonomic and Sustainable Designs

Manufacturers are prioritizing ergonomic designs that reduce user fatigue and improve handling efficiency. The demand for lightweight materials, low-vibration grips, and noise-reducing mechanisms is increasing among both hobbyists and professionals. Additionally, sustainability initiatives are driving the use of recyclable materials and energy-efficient manufacturing. Companies investing in eco-friendly production and reusable packaging gain competitive advantages. This focus on comfort, safety, and sustainability aligns with evolving consumer expectations and regulatory trends favoring green, user-centric innovation in power tools.

- For instance, Bosch’s “GRO 12V‑35” cordless rotary tool runs at a no‑load speed of 5,000 to 35,000 rpm, weighs only 0.62 kg including battery, and functions within the 12.0 V battery category.

- Expanding Penetration in Emerging Economies

Rapid industrialization and rising disposable incomes in Asia-Pacific and Latin America are expanding the rotary tool market. Small workshops and SMEs are adopting affordable, multi-purpose rotary tools for metal fabrication, woodworking, and repair applications. Governments promoting skill development and vocational training further stimulate tool demand. E-commerce platforms enhance accessibility, while localized manufacturing reduces costs. These emerging markets offer strong potential for global players seeking volume growth and regional diversification across industrial and consumer segments.

Key Challenges

- High Competition and Price Pressure

The rotary tool market faces intense competition among global and regional manufacturers, leading to significant price pressure. Companies struggle to balance affordability with quality and innovation. Low-cost imports from Asia often undercut premium brands, affecting margins. This competition compels established players to invest heavily in R&D, branding, and distribution. Maintaining product differentiation through features like noise reduction, energy efficiency, and smart connectivity remains essential to retain market share amid growing commoditization.

- Safety Concerns and Operational Limitations

Improper handling and tool misuse continue to pose safety challenges, particularly among inexperienced users. High-speed rotary tools can cause injuries without proper training or protective equipment. Overheating and vibration also affect tool longevity and operator comfort. Manufacturers are addressing these issues by incorporating safety locks, overload protection, and ergonomic grips. However, limited awareness of safety practices in developing regions restrains wider adoption, emphasizing the need for user education and stricter safety compliance in product design.

Regional Analysis

North America

North America dominated the rotary tool market with a 37% share in 2024, driven by strong demand from DIY users, craftsmen, and industrial professionals. The U.S. leads the region due to a mature power tools market and widespread home renovation culture. High product adoption across automotive repair and metal fabrication industries supports growth. Manufacturers such as Dremel and Milwaukee Tool continue to introduce cordless and brushless innovations to meet consumer preferences. The growing e-commerce penetration and popularity of multipurpose rotary kits further strengthen regional sales momentum.

Europe

Europe held a 28% share in the global rotary tool market in 2024, supported by advanced industrial infrastructure and a strong focus on precision engineering. Germany, France, and the U.K. are key contributors due to their established automotive and manufacturing sectors. The growing trend toward sustainable tool design and ergonomic performance is driving innovation among European brands. Rising investments in professional workshops and DIY projects, coupled with regulatory emphasis on safety and energy efficiency, foster steady market expansion across the continent.

Asia-Pacific

Asia-Pacific accounted for 25% of the rotary tool market in 2024 and is projected to register the fastest growth through 2032. Expanding manufacturing sectors in China, India, and Japan, along with rising disposable incomes, are fueling product demand. Local players offer cost-effective solutions catering to small workshops and individual users. Governments promoting vocational training and smart manufacturing initiatives enhance adoption in industrial applications. The availability of low-cost cordless models through online retail channels strengthens regional penetration and market competitiveness.

Latin America

Latin America captured an 8% market share in 2024, driven by increased construction and automotive repair activities across Brazil, Mexico, and Argentina. The rise in small-scale fabrication units and DIY culture supports rotary tool usage in residential and commercial applications. Economic recovery and infrastructure modernization programs further encourage market growth. Global manufacturers are expanding distribution networks and partnerships to improve product accessibility. The growing preference for affordable cordless rotary tools positions Latin America as an emerging growth hub in the coming years.

Middle East & Africa

The Middle East & Africa region held a 6% share of the rotary tool market in 2024, supported by rising demand from construction, metal fabrication, and automotive maintenance sectors. The UAE and Saudi Arabia lead regional consumption due to infrastructure investments and expanding industrial bases. Africa’s emerging markets, such as South Africa and Nigeria, are witnessing increased adoption of power tools in light manufacturing and household repair activities. Strategic distribution expansion by global brands and localized manufacturing initiatives are enhancing market visibility and future growth potential.

Market Segmentations:

By Product Type:

By Speed:

- 15,000 rpm to 30,000 rpm

- Above 30,000 rpm

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rotary tool market features major players such as Makita Corporation, Husqvarna AB, KOKI HOLDINGS Co., Ltd., Stanley Black and Decker Inc., Emerson Electric Co., Apex Tool Group, Hilti Corporation, Snap-on Incorporated, Zhejiang SALI Abrasive Technology Co., Ltd., and Robert Bosch GmbH. The rotary tool market is highly competitive, driven by continuous innovation, product diversification, and expanding global distribution networks. Manufacturers focus on developing high-performance cordless models with longer battery life and improved motor efficiency to meet evolving consumer and industrial needs. Advanced features such as variable speed control, ergonomic design, and digital connectivity are becoming key differentiators. Companies are also prioritizing sustainable manufacturing practices and lightweight materials to enhance durability and reduce environmental impact. Strategic partnerships, acquisitions, and aftersales service improvements further strengthen market positioning and customer loyalty in both professional and DIY segments.

Key Player Analysis

- Makita Corporation

- Husqvarna AB

- KOKI HOLDINGS Co., Ltd.

- Stanley Black and Decker Inc.

- Emerson Electric Co.

- Apex Tool Group

- Hilti Corporation

- Snap-on Incorporated

- Zhejiang SALI Abrasive Technology Co., Ltd.

- Robert Bosch GmbH.

Recent Developments

- In September 2024, Milwaukee Tool introduced next-generation deep cuts and band saws that deliver better user-cutting performance. The new band saws cut 4-inch black iron pipes 20% faster than old ones.

- In April 2024, California startup ZapBatt developed revolutionary battery technology that acts as a universal adapter for electric devices, including power tools. The innovation achieves 80% charge in under six minutes with a lifespan exceeding 20,000 cycles, utilizing safer SCiB Toshiba lithium titanium oxide (LTO) batteries with no documented thermal runaway cases.

- In February 2024, Makita U.S.A., Inc. launched the 5″ Paddle Switch Angle Grinder with AC/DC Switch (9558HP), offering a versatile solution for professionals in metal fabrication, as well as the electrical, mechanical, and plumbing industries. This compact grinder, weighing just 4.5 lbs, delivers 7.5 AMPs of power and operates at a speed of 10,000 RPM, expanding Makita’s range of high-performance grinding tools.

- In July 2023, DEWALT, a Stanley Black & Decker brand, launched two new seal-headed ratchets. The products protect against automotive solvents and oils and are generally used in the electrical, mechanical, MRO services, and automotive sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Speed, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The rotary tool market will witness steady growth driven by rising DIY and home improvement activities.

- Cordless rotary tools will gain dominance due to advancements in battery and motor technologies.

- Integration of smart and connected features will enhance tool efficiency and precision.

- Demand from industrial sectors such as automotive and aerospace will continue to expand.

- Manufacturers will focus on ergonomic designs to improve comfort and reduce user fatigue.

- Sustainability initiatives will drive the use of recyclable materials and eco-friendly production.

- Emerging economies in Asia-Pacific and Latin America will offer strong growth potential.

- Online retail and e-commerce platforms will boost product accessibility and consumer reach.

- Strategic collaborations and mergers will help companies strengthen market presence globally.

- Innovation in multi-functional and high-speed rotary tools will create new opportunities for professional applications.Top of Form